Noticias del mercado

-

22:11

The main US stock indexes finished trading in negative territory

Major stock markets in the US recorded a slight decline, as the fall in the shares of the utilities sector and basic resources halted the rally, which had previously led to the Dow Jones index's maximum increase of 1000 points.

Investors also acted out ambiguous data for the United States. The US Department of Commerce said that the growth rate of housing construction in the US weakened more than expected in December, recording the biggest recession slightly more than a year, amid a sharp decline in the construction of single-family housing units after a two-month growth. The laying of new homes fell 8.2% to a seasonally adjusted level of 1.192 million units. The November sales were revised to 1,299 million units from previously announced 1,297 million units. The December percentage decline was the largest since November 2016. Economists predicted that the bookmarks will drop to 1.275 million units. The construction permit decreased by 0.1% to 1.302 million units in December. Construction permits increased by 4.7% to 1.263 million units in 2017, which is also the highest level since 2007.

Meanwhile, the Ministry of Labor reported that the number of Americans applying for unemployment benefits fell more than expected last week, to the lowest level in 45 years, but the decline was likely to overstate the health of the labor market, as the data in the several states. Initial applications for state unemployment benefits fell by 41,000 to 220,000, seasonally adjusted for the week ending January 13, the lowest level since February 1973. The appeals for the previous week were not revised. Economists predicted that bids would fall to 250,000.

Most components of the DOW index finished trading in positive territory (16 out of 30). The leader of growth was UnitedHealth Group Incorporated (UNH, + 2.07%). Outsider were shares of General Electric Company (GE, -3.00%).

Most S & P sectors recorded a decline. The largest drop was shown by the utilities sector (-0.7%). The technological sector grew most (+ 0.2%).

At closing:

DJIA -0.37% 26.017.81 -97.84

Nasdaq -0.03% 7.296.05 -2.23

S & P -0.16% 2,798.03 -4.53

-

21:01

DJIA -0.20% 26,064.37 -51.28 Nasdaq +0.17% 7,310.46 +12.18 S&P +0.03% 2,803.40 +0.84

-

18:00

European stocks closed: FTSE 100 -24.47 7700.96 -0.32% DAX +97.47 13281.43 +0.74% CAC 40 +0.84 5494.83 +0.02%

-

15:50

-

15:33

U.S. Stocks open: Dow +0.02% Nasdaq -0.08%, S&P -0.08%

-

15:22

Before the bell: S&P futures -0.06%, NASDAQ futures -0.25%

U.S. stock-index futures fell slightly on Thursday, as investors were cautious after Wall Street rocketed to new records the day before. The focus was on quarterly results of Morgan Stanley (MS) as well as a batch of economic data.

Global Stocks:

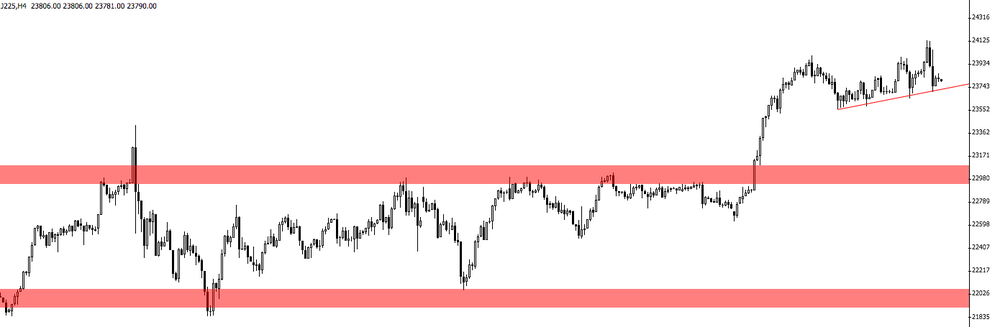

Nikkei 23,763.37 -104.97 -0.44%

Hang Seng 32,121.94 +138.53 +0.43%

Shanghai 3,475.91 +31.24 +0.91%

S&P/ASX 6,014.60 -1.20 -0.02%

FTSE 7,695.57 -29.86 -0.39%

CAC 5,490.02 -3.97 -0.07%

DAX 13,241.16 +57.20 +0.43%

Crude $63.78 (-0.30%)

Gold $1,330.40 (-0.66%)

-

14:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

52.23

-4.76(-8.35%)

225869

ALTRIA GROUP INC.

MO

70.2

0.05(0.07%)

509

Amazon.com Inc., NASDAQ

AMZN

1,293.80

-1.20(-0.09%)

23160

American Express Co

AXP

100.9

0.14(0.14%)

7071

AMERICAN INTERNATIONAL GROUP

AIG

61.5

0.08(0.13%)

353

Apple Inc.

AAPL

178.92

-0.18(-0.10%)

197689

AT&T Inc

T

36.87

0.02(0.05%)

11097

Barrick Gold Corporation, NYSE

ABX

14.7

0.08(0.55%)

25287

Boeing Co

BA

351.45

0.44(0.13%)

38693

Caterpillar Inc

CAT

169

0.50(0.30%)

6616

Chevron Corp

CVX

133

0.64(0.48%)

497

Cisco Systems Inc

CSCO

41.11

-0.09(-0.22%)

9439

Citigroup Inc., NYSE

C

77.85

0.38(0.49%)

14055

Exxon Mobil Corp

XOM

88.28

0.28(0.32%)

789

Ford Motor Co.

F

12.25

0.07(0.57%)

84520

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.78

0.01(0.05%)

4763

General Electric Co

GE

17.39

0.04(0.23%)

1113160

General Motors Company, NYSE

GM

44

-0.03(-0.07%)

2235

Goldman Sachs

GS

254

0.35(0.14%)

4037

Google Inc.

GOOG

1,133.37

1.39(0.12%)

1241

Hewlett-Packard Co.

HPQ

23.6

0.14(0.60%)

310

Home Depot Inc

HD

200

0.18(0.09%)

1045

Intel Corp

INTC

44.38

-0.01(-0.02%)

30700

International Business Machines Co...

IBM

170.22

1.57(0.93%)

51070

JPMorgan Chase and Co

JPM

113.15

0.16(0.14%)

14523

Merck & Co Inc

MRK

61.79

-0.24(-0.39%)

1865

Microsoft Corp

MSFT

90.1

-0.04(-0.04%)

16838

Procter & Gamble Co

PG

90.45

-0.06(-0.07%)

2745

Starbucks Corporation, NASDAQ

SBUX

61.25

0.59(0.97%)

27558

Tesla Motors, Inc., NASDAQ

TSLA

346.5

-0.66(-0.19%)

6582

Twitter, Inc., NYSE

TWTR

24.59

0.03(0.12%)

41109

United Technologies Corp

UTX

134.75

0.33(0.25%)

629

UnitedHealth Group Inc

UNH

239.4

0.97(0.41%)

4263

Verizon Communications Inc

VZ

51.9

0.18(0.35%)

2213

Visa

V

122

0.02(0.02%)

2758

Wal-Mart Stores Inc

WMT

104.75

2.05(2.00%)

49594

-

14:45

Analyst coverage initiations before the market open

Caterpillar (CAT) initiated with a Buy at Berenberg; target $200

-

14:44

Target price changes before the market open

Freeport-McMoRan (FCX) target raised to $18 from $16 at B. Riley FBR

-

14:43

Downgrades before the market open

Chevron (CVX) downgraded to Hold from Buy at HSBC Securities

-

14:43

Upgrades before the market open

Wal-Mart (WMT) added to Conviction Buy List at Goldman

-

14:02

Company News: Morgan Stanley (MS) quarterly results beat analysts’ expectations

Morgan Stanley (MS) reported Q4 FY 2017 earnings of $0.84 per share (versus $0.81 in Q4 FY 2016), beating analysts' consensus estimate of $0.78. (! Q4 results excluded a net discrete tax provision of $0.990 bln or a loss of $0.55 per share).

The company's quarterly revenues amounted to $9.500 bln (+5.3% y/y), beating analysts' consensus estimate of $9.249 bln.

MS rose to $56.25 (+1.63%) in pre-market trading.

-

13:34

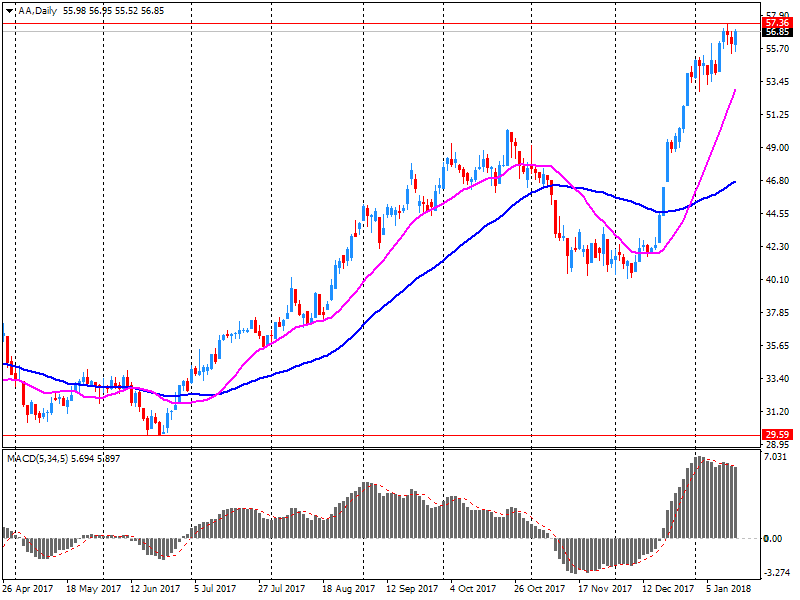

Company News: Alcoa (AA) quarterly results miss analysts’ estimates

Alcoa (AA) reported Q4 FY 2017 earnings of $1.04 per share (versus $0.14 in Q4 FY 2016), missing analysts' consensus estimate of $1.23.

The company's quarterly revenues amounted to $3.174 bln (+25.1% y/y), missing analysts' consensus estimate of $3.285 bln.

AA fell to $53.20 (-6.65%) in pre-market trading.

-

09:45

Major European stock exchanges trading in the green zone: FTSE 7729.37 +3.94 + 0.05%, DAX 13221.73 +37.77 + 0.29%, CAC 5503.48 +9.49 + 0.17%

-

08:12

Eurostoxx 50 futures up 0.4 pct, DAX futures up 0.5 pct, CAC 40 futures up 0.4 pct, FTSE futures up 0.1 pct

-

07:37

Global Stocks

European stocks finished in the red Wednesday, as a round of corporate financial updates failed to lift an investing mood dimmed by losses on U.S. stock markets. A disappointing sales report from fashion house Burberry Group PLC and a warning of layoffs at Swedish construction company Skanska AB dragged on shares of those companies.

The Dow industrials on Wednesday staged a late rally to end above 26,000 for the first time ever, knocking out another round-number milestone at a history-setting pace for blue chips, with all the main equity indexes finishing at all-time highs. An upbeat gauge of conditions at the Federal Reserve's business districts contributed to the buying sentiment.

Asia-Pacific stocks were higher Thursday, aided by strength in Chinese banks and regional tech companies, after equities hit fresh record highs on Wall Street overnight. Hong Kong stocks HSI, +0.12% were 0.4% higher and benchmarks on the mainland logged similar gains. Bank stocks in China rose after data showed housing prices rose last month in 57 of 70 cities measured by the National Bureau of Statistics.

-

00:29

Stocks. Daily history for Jan 17’2018:

(index / closing price / change items /% change)

Nikkei -83.47 23868.34 -0.35%

TOPIX -3.43 1890.82 -0.18%

Hang Seng +78.66 31983.41 +0.25%

CSI 300 -10.35 4248.12 -0.24%

Euro Stoxx 50 -9.23 3612.78 -0.25%

FTSE 100 -30.50 7725.43 -0.39%

DAX -62.37 13183.96 -0.47%

CAC 40 -19.83 5493.99 -0.36%

DJIA +322.79 26115.65 +1.25%

S&P 500 +26.14 2802.56 +0.94%

NASDAQ +74.60 7298.28 +1.03%

S&P/TSX +27.82 16326.70 +0.17%

-