Noticias del mercado

-

22:16

The main US stock indexes finished trading with a confident increase

Major US stock indices rose strongly, while the DJIA index closed for the first time above 26,000, helped by a rise in the price of shares of technological and industrial companies. Meanwhile, further increases were limited to losses of General Electric Company and The Goldman Sachs Group.

The focus was also on the United States. The Fed said industrial production rose 0.9 percent in December, helped by sustained growth in the mining industry following a revised 0.1 percent decline in November. Economists predicted that industrial production will grow by 0.3 percent after a 0.2 percent growth was registered in November. Industrial production grew at an annualized rate of 8.2 percent in the fourth quarter, which was the largest increase since the second quarter of 2010. For the whole of 2017, the volume of industrial production grew by 1.8 percent, which is the first and largest increase since 2014. The growth of the industrial sector is facilitated by the strengthening of the global economy and the weakening of the dollar, which helps make US exports more competitive than the country's main trading partners.

Meanwhile, the confidence of builders in the market of newly built houses for a single family fell by 2 points to a level of 72 in January, showed the housing market index (HMI) from the National Association of Housing Owners / Wells Fargo. "The builders are confident that changes in the tax code will promote the development of small businesses and lead to wider economic growth," said NAHB chairman Randy Noel. - Our participants are very happy about what awaits them ahead. However, they still face rising prices for materials and a shortage of labor and plots.

Almost all components of the DOW index finished trading in positive territory (25 out of 30). The leader of growth was the shares of The Boeing Company (BA, 4.85%). Outsider were shares of General Electric Company (GE, -4.91%).

All sectors of the S & P index recorded an increase. The technological sector grew most (+ 1.2%).

At closing:

DJIA + 1.25% 26,115.65 +322.79

Nasdaq + 1.03% 7,298.28 +74.59

S & P + 0.94% 2,802.56 +26.14

-

21:00

DJIA +1.12% 26,081.84 +288.98 Nasdaq +1.07% 7,300.77 +77.09 S&P +1.02% 2,804.66 +28.24

-

18:00

European stocks closed: FTSE 100 -30.50 7725.43 -0.39% DAX -62.37 13183.96 -0.47% CAC 40 -19.83 5493.99 -0.36%

-

15:31

U.S. Stocks open: Dow +0.59% Nasdaq +0.46%, S&P +0.32%

-

15:08

Before the bell: S&P futures +0.35%, NASDAQ futures +0.41%

U.S. stock-index futures rose on Wednesday as investors assessed fourth-quarter earnings from Bank of America (BAC) and Goldman Sachs (GS).

Global Stocks:

Nikkei 23,868.34 -83.47 -0.35%

Hang Seng 31,983.41 +78.66 +0.25%

Shanghai 3,445.36 +8.76 +0.26%

S&P/ASX 6,015.80 -32.80 -0.54%

FTSE 7,738.09 -17.84 -0.23%

CAC 5,507.33 -6.49 -0.12%

DAX 13,209.47 -36.86 -0.28%

Crude $63.66 (-0.11%)

Gold $1,336.60 (-0.04%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

245.73

0.99(0.40%)

1583

ALCOA INC.

AA

55.85

-0.39(-0.69%)

1134

ALTRIA GROUP INC.

MO

69

0.08(0.12%)

410

Amazon.com Inc., NASDAQ

AMZN

1,315.40

10.54(0.81%)

74889

American Express Co

AXP

101.45

1.11(1.11%)

1816

AMERICAN INTERNATIONAL GROUP

AIG

61.2

0.14(0.23%)

313

Apple Inc.

AAPL

176.04

-0.15(-0.09%)

275180

AT&T Inc

T

36.75

0.03(0.08%)

9597

Barrick Gold Corporation, NYSE

ABX

15.16

-0.04(-0.26%)

7575

Boeing Co

BA

337.8

2.64(0.79%)

43177

Caterpillar Inc

CAT

170.4

1.09(0.64%)

15316

Chevron Corp

CVX

132.5

0.49(0.37%)

4134

Cisco Systems Inc

CSCO

40.87

0.33(0.81%)

17030

Citigroup Inc., NYSE

C

76.94

-0.17(-0.22%)

30457

Deere & Company, NYSE

DE

168.98

1.44(0.86%)

300

Exxon Mobil Corp

XOM

87.32

0.35(0.40%)

3148

Facebook, Inc.

FB

178.99

0.60(0.34%)

93203

FedEx Corporation, NYSE

FDX

269

-0.58(-0.22%)

811

Ford Motor Co.

F

12.63

-0.47(-3.59%)

539327

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.4

0.08(0.41%)

5100

General Electric Co

GE

17.82

-0.39(-2.14%)

1081619

General Motors Company, NYSE

GM

44.4

0.21(0.48%)

9204

Goldman Sachs

GS

256.53

-1.93(-0.75%)

144517

Google Inc.

GOOG

1,131.36

9.60(0.86%)

7753

Hewlett-Packard Co.

HPQ

22.65

-0.23(-1.01%)

1912

Home Depot Inc

HD

197.37

1.06(0.54%)

2899

Intel Corp

INTC

43.4

0.26(0.60%)

14322

International Business Machines Co...

IBM

166.79

2.94(1.79%)

74959

Johnson & Johnson

JNJ

147.65

0.79(0.54%)

2226

JPMorgan Chase and Co

JPM

111.97

-0.30(-0.27%)

36437

McDonald's Corp

MCD

174.1

0.42(0.24%)

2278

Merck & Co Inc

MRK

61.99

-0.08(-0.13%)

41665

Microsoft Corp

MSFT

88.87

0.52(0.59%)

28647

Nike

NKE

63.96

0.54(0.85%)

3037

Pfizer Inc

PFE

36.74

0.14(0.38%)

3275

Procter & Gamble Co

PG

90.47

0.25(0.28%)

3390

Starbucks Corporation, NASDAQ

SBUX

61.08

0.52(0.86%)

4719

Tesla Motors, Inc., NASDAQ

TSLA

341.47

1.41(0.41%)

11761

The Coca-Cola Co

KO

46.7

0.17(0.37%)

2985

Travelers Companies Inc

TRV

136.33

0.81(0.60%)

550

Twitter, Inc., NYSE

TWTR

24.8

0.14(0.57%)

51284

United Technologies Corp

UTX

134.82

0.85(0.63%)

1810

UnitedHealth Group Inc

UNH

234.85

1.95(0.84%)

3316

Verizon Communications Inc

VZ

51.9

0.24(0.46%)

2426

Visa

V

121.2

0.81(0.67%)

10642

Wal-Mart Stores Inc

WMT

101.29

0.60(0.60%)

7356

Walt Disney Co

DIS

111.4

0.71(0.64%)

3721

Yandex N.V., NASDAQ

YNDX

35.12

-0.06(-0.17%)

1050

-

14:43

Target price changes before the market open

Deere (DE) target raised to $184 from $161 at Stifel

UnitedHealth (UNH) target raised to $268 from $235 at Citigroup

Merck (MRK) target raised to $72 from $68 at BMO Capital Markets

-

14:42

Downgrades before the market open

Apple (AAPL) downgraded to Neutral from Buy at Longbow

HP (HPQ) downgraded to Equal Weight at Barclays

Citigroup (C) downgraded to Mkt Perform from Outperform at Keefe Bruyette

-

14:41

Upgrades before the market open

IBM(IBM) upgraded to Overweight at Barclays

Wal-Mart (WMT) added to US Focus List at Citigroup; Buy, target $117

-

13:59

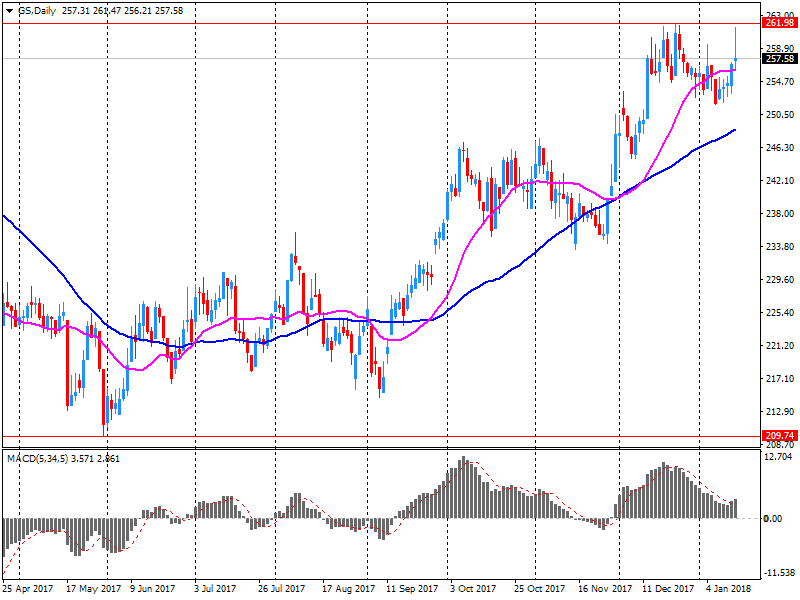

Company News: Goldman Sachs (GS) quarterly results beat analysts’ expectations

Goldman Sachs (GS) reported Q4 FY 2017 earnings of $5.68 per share (versus $5.08 in Q4 FY 2016), beating analysts' consensus estimate of $4.95.

The company's quarterly revenues amounted to $7.830 bln (-4.2% y/y), beating analysts' consensus estimate of $7.638 bln.

GS fell to $256.10 (-0.91%) in pre-market trading.

-

13:31

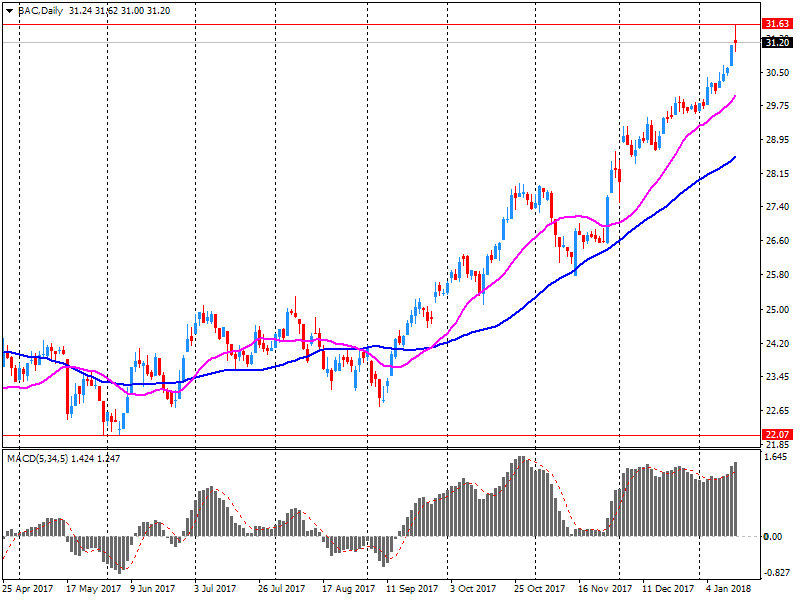

Company News: Bank of America (BAC) quarterly earnings beat analysts’ estimate

Bank of America (BAC) reported Q4 FY 2017 earnings of $0.47 per share (versus $0.40 in Q4 FY 2016), beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $20.687 bln (+3.5% y/y), missing analysts' consensus estimate of $21.605 bln.

BAC rose to $31.36 (+0.38%) in pre-market trading.

-

09:25

Major stock exchanges in Europe trading in the red zone: FTSE 7739.86 -16.07 -0.21%, DAX 13205.25 -41.08 -0.31%, CAC 5491.53 -22.29 -0.40%

-

08:28

Eurostoxx 50 futures down 0.33 pct, CAC 40 futures down 0.42 pct, DAX futures down 0.32 pct, german bund futures open 1 ticks higher at 160.78, FTSE futures down 0.22 pct

-

07:30

Global Stocks

British blue-chip stocks finished lower Tuesday, pulled down in part by a fall in shares of BP PLC after the energy heavyweight said it will take a $1.7 billion charge related to the Deepwater Horizon disaster. A selloff for miners also weighed on the main equity benchmark.

The Dow Jones Industrial Average closed marginally lower on Tuesday after the blue-chip index relinquished all its early gains in the sharpest daily reversal in nearly two years, according to FactSet. In early trade, Dow industrials were up more than 1% and set an intraday all-time high above 26,000.

Asian stocks were mostly lower Wednesday following a late selloff in U.S. equities and after some markets logged fresh highs Tuesday. Hong Kong's Hang Seng Index topped 2007's record-high close on Tuesday while Singapore's main stock index breached 2015's high, getting to levels last seen in 2007.

-

00:26

Stocks. Daily history for Jan 16’2018:

(index / closing price / change items /% change)

Nikkei +236.93 23951.81 +1.00%

TOPIX +10.35 1894.25 +0.55%

Hang Seng +565.88 31904.75 +1.81%

CSI 300 +33.23 4258.47 +0.79%

Euro Stoxx 50 +10.20 3622.01 +0.28%

FTSE 100 -13.21 7755.93 -0.17%

DAX +45.82 13246.33 +0.35%

CAC 40 +4.13 5513.82 +0.07%

DJIA -10.33 25792.86 -0.04%

S&P 500 -9.82 2776.42 -0.35%

NASDAQ -37.37 7223.69 -0.51%

S&P/TSX -72.93 16298.88 -0.45%

-