Noticias del mercado

-

22:08

The main US stock indexes finished trading in negative territory

The main US stock indexes fell slightly, departing from the next record highs, which was due to the fall in shares of the commodity sector against the backdrop of lower oil prices. Investors also focused on reports from UnitedHealth (UNH) and Citigroup (C).

In addition, the results of research published by the Federal Reserve Bank of New York showed that the region's production index fell in January, while the average forecasts of economists assumed that the index will remain at the same level. According to the data, the production index in the current month fell to +17.7 points compared to +18 points in December. Previous value was not revised. Recall, the index is built on the basis of survey results of top managers. The indicator reflects the situation in the production orders segment and business optimism in the business environment.

Most components of the DOW index recorded a decline (16 out of 30). Outsider were shares of General Electric Company (GE, -3.44%). Leader of the growth were shares of Merck & Co., Inc. (MRK, + 6.12%).

Most S & P sectors ended the session in negative territory. The largest decrease was in the commodity sector (-1.2%). The conglomerate sector grew most (+ 0.4%).

At closing:

DJIA -0.04% 25.792.86 -10.33

Nasdaq -0.51% 7,224.00 -37.00

S & P -0.35% 2,776.44 -9.80

-

21:00

DJIA -0.23% 25,745.03 -58.16 Nasdaq -0.51% 7,224.00 -37.00 S&P -0.41% 2,774.82 -11.42

-

18:00

European stocks closed: FTSE 100 -13.21 7755.93 -0.17% DAX +45.82 13246.33 +0.35% CAC 40 +4.13 5513.82 +0.07%

-

15:34

U.S. Stocks open: Dow +0.84% Nasdaq +0.71%, S&P +0.55%

-

15:28

Before the bell: S&P futures +0.45%, NASDAQ futures +0.55%

U.S. stock-index futures rose on Tuesday, as investors digested fourth-quarter earnings from UnitedHealth (UNH) and Citigroup (C).

Global Stocks:

Nikkei 23,951.81 +236.93 +1.00%

Hang Seng 31,904.75 +565.88 +1.81%

Shanghai 3,437.48 +27.00 +0.79%

S&P/ASX 6,048.60 -28.50 -0.47%

FTSE 7,755.17 -13.97 -0.18%

CAC 5,522.62 +12.93 +0.23%

DAX 13,316.85 +116.34 +0.88%

Crude $64.02 (-0.44%)

Gold $1,334.20 (-0.05%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

245.91

1.44(0.59%)

2715

ALCOA INC.

AA

56.3

-0.46(-0.81%)

11900

ALTRIA GROUP INC.

MO

69.95

0.34(0.49%)

6534

Amazon.com Inc., NASDAQ

AMZN

1,322.87

17.67(1.35%)

67932

American Express Co

AXP

101.9

0.93(0.92%)

1172

Apple Inc.

AAPL

178.39

1.30(0.73%)

185136

AT&T Inc

T

37.1

0.20(0.54%)

18852

Barrick Gold Corporation, NYSE

ABX

15.29

0.17(1.12%)

234552

Boeing Co

BA

340.1

3.89(1.16%)

50612

Caterpillar Inc

CAT

171.75

1.45(0.85%)

11949

Chevron Corp

CVX

133.86

0.26(0.19%)

3872

Cisco Systems Inc

CSCO

41.18

0.31(0.76%)

17330

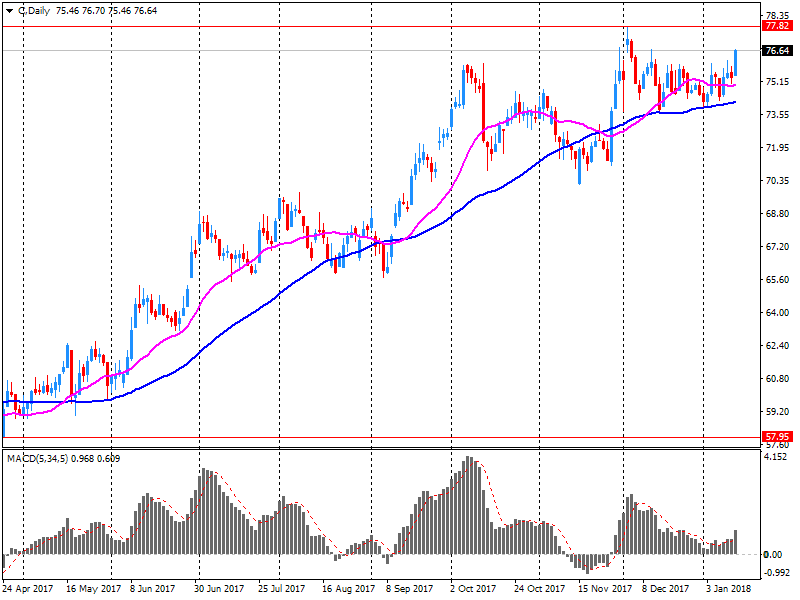

Citigroup Inc., NYSE

C

78.83

1.99(2.59%)

701047

Deere & Company, NYSE

DE

170.55

1.25(0.74%)

1512

Exxon Mobil Corp

XOM

87.8

0.28(0.32%)

8085

Facebook, Inc.

FB

181.29

1.92(1.07%)

502978

FedEx Corporation, NYSE

FDX

274

2.15(0.79%)

1327

Ford Motor Co.

F

13.37

0.14(1.06%)

98148

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.65

-0.10(-0.51%)

19200

General Electric Co

GE

18.25

-0.51(-2.72%)

4641529

General Motors Company, NYSE

GM

45.51

1.44(3.27%)

209190

Goldman Sachs

GS

259.79

2.76(1.07%)

10330

Google Inc.

GOOG

1,131.80

9.54(0.85%)

10179

Hewlett-Packard Co.

HPQ

22.97

0.05(0.22%)

5603

Home Depot Inc

HD

197.76

1.34(0.68%)

4533

HONEYWELL INTERNATIONAL INC.

HON

159

-0.07(-0.04%)

2641

Intel Corp

INTC

43.5

0.26(0.60%)

36954

International Business Machines Co...

IBM

165.55

2.41(1.48%)

41153

Johnson & Johnson

JNJ

146.84

1.08(0.74%)

2401

JPMorgan Chase and Co

JPM

112.74

0.07(0.06%)

115009

McDonald's Corp

MCD

174

0.43(0.25%)

3730

Merck & Co Inc

MRK

61.8

3.14(5.35%)

1387871

Microsoft Corp

MSFT

90.2

0.60(0.67%)

44472

Nike

NKE

64.86

0.19(0.29%)

2455

Pfizer Inc

PFE

36.7

0.16(0.44%)

2858

Procter & Gamble Co

PG

90.64

1.03(1.15%)

22023

Starbucks Corporation, NASDAQ

SBUX

60.5

0.10(0.17%)

1594

Tesla Motors, Inc., NASDAQ

TSLA

337.91

1.69(0.50%)

19420

The Coca-Cola Co

KO

46.29

0.14(0.30%)

6070

Travelers Companies Inc

TRV

135.4

0.67(0.50%)

337

Twitter, Inc., NYSE

TWTR

25.8

0.39(1.53%)

166136

United Technologies Corp

UTX

138.2

1.62(1.19%)

1294

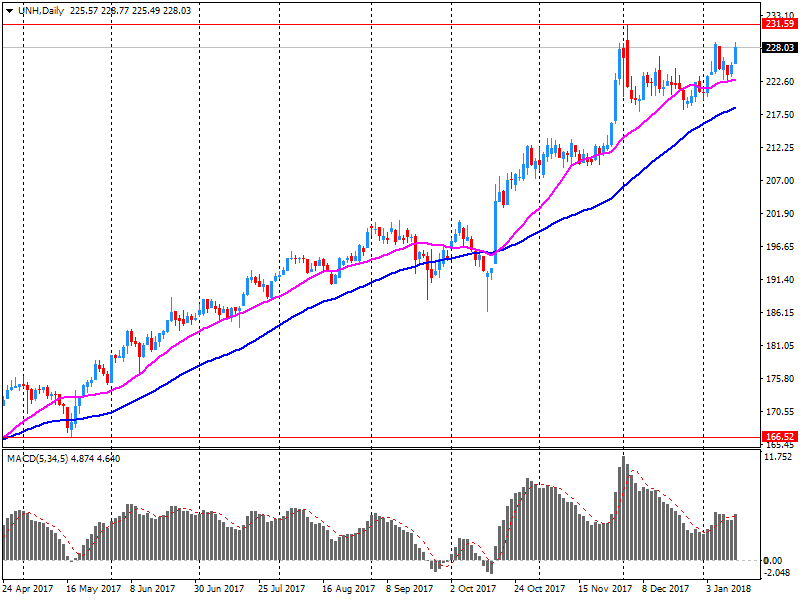

UnitedHealth Group Inc

UNH

230.8

2.16(0.94%)

93243

Verizon Communications Inc

VZ

51.78

-0.08(-0.15%)

9785

Visa

V

121.65

1.56(1.30%)

7682

Wal-Mart Stores Inc

WMT

101.42

0.55(0.55%)

8570

Walt Disney Co

DIS

112.99

0.52(0.46%)

5855

Yandex N.V., NASDAQ

YNDX

35.23

0.63(1.82%)

40358

-

14:55

Target price changes before the market open

Boeing (BA) target raised to $415 from $320 at Cowen

-

14:53

Downgrades before the market open

Verizon (VZ) downgraded to Neutral from Buy at MoffettNathanson

-

14:52

Upgrades before the market open

Procter & Gamble (PG) upgraded to Neutral from Sell at Goldman

-

14:18

Company News: Citigroup (C) quarterly earnings beat analysts’ expectations

Citigroup (C) reported Q4 FY 2017 earnings of $1.28 per share (versus $1.14 in Q4 FY 2016), beating analysts' consensus estimate of $1.19.

The company's quarterly revenues amounted to $17.255 bln (+1.4% y/y), generally in-line with analysts' consensus estimate of $17.230 bln.

C rose to $78.35 (+1.97%) in pre-market trading.

-

13:08

Company News: UnitedHealth (UNH) quarterly earnings miss analysts’ estimate

UnitedHealth (UNH) reported Q4 FY 2017 earnings of $2.44 per share (versus $2.11 in Q4 FY 2016), missing analysts' consensus estimate of $2.52.

The company's quarterly revenues amounted to $52.061 bln (+9.5% y/y), generally in-line with analysts' consensus estimate of $51.570 bln.

The company also issued guidance for FY 2018, projecting EPS of $12.30-12.60, including tax benefits, compared to its previous EPS forecast of $10.55-10.85 and versus analysts' consensus estimate of $11.20.

UNH rose to $234.78 (+2.69%) in pre-market trading.

-

10:53

Earnings Season in U.S.: Major Reports of the Week

January 16

Before the Open:

Citigroup (C). Consensus EPS $1.19, Consensus Revenues $17229.88 mln.

UnitedHealth (UNH). Consensus EPS $2.52, Consensus Revenues $51570.43 mln.

January 17

Before the Open:

Bank of America (BAC). Consensus EPS $0.45, Consensus Revenues $21605.10 mln.

Goldman Sachs (GS). Consensus EPS $4.95, Consensus Revenues $7638.28 mln.

After the Close:

Alcoa (AA). Consensus EPS $1.25, Consensus Revenues $3318.11 mln.

January 18

Before the Open:

Morgan Stanley (MS). Consensus EPS $0.78, Consensus Revenues $9248.93 mln.

After the Close:

American Express (AXP). Consensus EPS $1.54, Consensus Revenues $8729.79 mln.

IBM (IBM). Consensus EPS $5.14, Consensus Revenues $22048.59 mln.

-

09:47

Major European stock exchanges trading in the green zone: FTSE 100 +11.02 7780.16 + 0.14%, DAX +81.89 13282.40 + 0.62%, CAC 40 +14.75 5524.44 + 0.27%

-

08:22

Eurostoxx 50 futures flat, DAX futures up 0.1 pct, CAC 40 futures up 0.2 pct, FTSE futures up 0.2 pct

-

07:36

Global Stocks

European stocks finished lower Monday, weighed as the euro continued to march up further into three-year highs, giving a key regional benchmark its third drop in four sessions. Investors were also watching for developments from the U.K., where construction and outsourcing heavyweight Carillion PLC has collapsed.

U.S. equities and bond markets are closed Monday for the Martin Luther King Jr. Day holiday.

Asian equities' best start to a year since 2006 continued Tuesday as most bourses in the region pushed higher. The yen declined amid concern Japanese authorities may want to limit gains that pushed the currency to a four-month high.

-

00:26

Stocks. Daily history for Jan 15’2018:

(index / closing price / change items /% change)

Nikkei +61.06 23714.88 +0.26%

TOPIX +7.66 1883.90 +0.41%

Hang Seng -73.67 31338.87 -0.23%

CSI 300 +0.24 4225.24 +0.01%

Euro Stoxx 50 -0.80 3611.81 -0.02%

FTSE 100 -9.50 7769.14 -0.12%

DAX -44.52 13200.51 -0.34%

CAC 40 -7.37 5509.69 -0.13%

-