Noticias del mercado

-

22:08

The main US stock indexes finished trading in negative territory

The main US stock indexes fell slightly, departing from the next record highs, which was due to the fall in shares of the commodity sector against the backdrop of lower oil prices. Investors also focused on reports from UnitedHealth (UNH) and Citigroup (C).

In addition, the results of research published by the Federal Reserve Bank of New York showed that the region's production index fell in January, while the average forecasts of economists assumed that the index will remain at the same level. According to the data, the production index in the current month fell to +17.7 points compared to +18 points in December. Previous value was not revised. Recall, the index is built on the basis of survey results of top managers. The indicator reflects the situation in the production orders segment and business optimism in the business environment.

Most components of the DOW index recorded a decline (16 out of 30). Outsider were shares of General Electric Company (GE, -3.44%). Leader of the growth were shares of Merck & Co., Inc. (MRK, + 6.12%).

Most S & P sectors ended the session in negative territory. The largest decrease was in the commodity sector (-1.2%). The conglomerate sector grew most (+ 0.4%).

At closing:

DJIA -0.04% 25.792.86 -10.33

Nasdaq -0.51% 7,224.00 -37.00

S & P -0.35% 2,776.44 -9.80

-

21:00

DJIA -0.23% 25,745.03 -58.16 Nasdaq -0.51% 7,224.00 -37.00 S&P -0.41% 2,774.82 -11.42

-

18:00

European stocks closed: FTSE 100 -13.21 7755.93 -0.17% DAX +45.82 13246.33 +0.35% CAC 40 +4.13 5513.82 +0.07%

-

16:23

Euro zone bond yields extend falls, bund yield hits day lows , after ECB's Villeroy says must monitor euro impact on inflation

-

15:34

U.S. Stocks open: Dow +0.84% Nasdaq +0.71%, S&P +0.55%

-

15:28

Before the bell: S&P futures +0.45%, NASDAQ futures +0.55%

U.S. stock-index futures rose on Tuesday, as investors digested fourth-quarter earnings from UnitedHealth (UNH) and Citigroup (C).

Global Stocks:

Nikkei 23,951.81 +236.93 +1.00%

Hang Seng 31,904.75 +565.88 +1.81%

Shanghai 3,437.48 +27.00 +0.79%

S&P/ASX 6,048.60 -28.50 -0.47%

FTSE 7,755.17 -13.97 -0.18%

CAC 5,522.62 +12.93 +0.23%

DAX 13,316.85 +116.34 +0.88%

Crude $64.02 (-0.44%)

Gold $1,334.20 (-0.05%)

-

15:26

ECB's Villeroy says recent euro increase is source of uncertainty, requires monitoring because of its possible downward effects on imported prices. Euro falls to session low but it can be a good opportunity to reload longs

-

The eurozone still needs an accommodative monetary policy, but can gradually reduce intensity of monetary policy support

-

He is confident ECB can manage a smooth exit from ultra-loose monetary policy

-

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

245.91

1.44(0.59%)

2715

ALCOA INC.

AA

56.3

-0.46(-0.81%)

11900

ALTRIA GROUP INC.

MO

69.95

0.34(0.49%)

6534

Amazon.com Inc., NASDAQ

AMZN

1,322.87

17.67(1.35%)

67932

American Express Co

AXP

101.9

0.93(0.92%)

1172

Apple Inc.

AAPL

178.39

1.30(0.73%)

185136

AT&T Inc

T

37.1

0.20(0.54%)

18852

Barrick Gold Corporation, NYSE

ABX

15.29

0.17(1.12%)

234552

Boeing Co

BA

340.1

3.89(1.16%)

50612

Caterpillar Inc

CAT

171.75

1.45(0.85%)

11949

Chevron Corp

CVX

133.86

0.26(0.19%)

3872

Cisco Systems Inc

CSCO

41.18

0.31(0.76%)

17330

Citigroup Inc., NYSE

C

78.83

1.99(2.59%)

701047

Deere & Company, NYSE

DE

170.55

1.25(0.74%)

1512

Exxon Mobil Corp

XOM

87.8

0.28(0.32%)

8085

Facebook, Inc.

FB

181.29

1.92(1.07%)

502978

FedEx Corporation, NYSE

FDX

274

2.15(0.79%)

1327

Ford Motor Co.

F

13.37

0.14(1.06%)

98148

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.65

-0.10(-0.51%)

19200

General Electric Co

GE

18.25

-0.51(-2.72%)

4641529

General Motors Company, NYSE

GM

45.51

1.44(3.27%)

209190

Goldman Sachs

GS

259.79

2.76(1.07%)

10330

Google Inc.

GOOG

1,131.80

9.54(0.85%)

10179

Hewlett-Packard Co.

HPQ

22.97

0.05(0.22%)

5603

Home Depot Inc

HD

197.76

1.34(0.68%)

4533

HONEYWELL INTERNATIONAL INC.

HON

159

-0.07(-0.04%)

2641

Intel Corp

INTC

43.5

0.26(0.60%)

36954

International Business Machines Co...

IBM

165.55

2.41(1.48%)

41153

Johnson & Johnson

JNJ

146.84

1.08(0.74%)

2401

JPMorgan Chase and Co

JPM

112.74

0.07(0.06%)

115009

McDonald's Corp

MCD

174

0.43(0.25%)

3730

Merck & Co Inc

MRK

61.8

3.14(5.35%)

1387871

Microsoft Corp

MSFT

90.2

0.60(0.67%)

44472

Nike

NKE

64.86

0.19(0.29%)

2455

Pfizer Inc

PFE

36.7

0.16(0.44%)

2858

Procter & Gamble Co

PG

90.64

1.03(1.15%)

22023

Starbucks Corporation, NASDAQ

SBUX

60.5

0.10(0.17%)

1594

Tesla Motors, Inc., NASDAQ

TSLA

337.91

1.69(0.50%)

19420

The Coca-Cola Co

KO

46.29

0.14(0.30%)

6070

Travelers Companies Inc

TRV

135.4

0.67(0.50%)

337

Twitter, Inc., NYSE

TWTR

25.8

0.39(1.53%)

166136

United Technologies Corp

UTX

138.2

1.62(1.19%)

1294

UnitedHealth Group Inc

UNH

230.8

2.16(0.94%)

93243

Verizon Communications Inc

VZ

51.78

-0.08(-0.15%)

9785

Visa

V

121.65

1.56(1.30%)

7682

Wal-Mart Stores Inc

WMT

101.42

0.55(0.55%)

8570

Walt Disney Co

DIS

112.99

0.52(0.46%)

5855

Yandex N.V., NASDAQ

YNDX

35.23

0.63(1.82%)

40358

-

14:55

Target price changes before the market open

Boeing (BA) target raised to $415 from $320 at Cowen

-

14:53

Downgrades before the market open

Verizon (VZ) downgraded to Neutral from Buy at MoffettNathanson

-

14:52

Upgrades before the market open

Procter & Gamble (PG) upgraded to Neutral from Sell at Goldman

-

14:40

Business activity continued to grow at a solid clip in New York State

Business activity continued to grow at a solid clip in New York State, according to firms responding to the January 2018 Empire State Manufacturing Survey.

The headline general business conditions index, at 17.7, was little changed from last month's level. The new orders index and the shipments index both showed ongoing growth, although at a slower pace than in December. Unfilled orders and delivery times increased slightly, and inventory levels were higher.

Labor market conditions pointed to a modest increase in employment and steady workweeks. Both input prices and selling prices increased at a faster pace than last month. Firms remained very optimistic about future business conditions and capital spending plans were robust.

-

14:30

U.S.: NY Fed Empire State manufacturing index , January 17.70 (forecast 18)

-

14:18

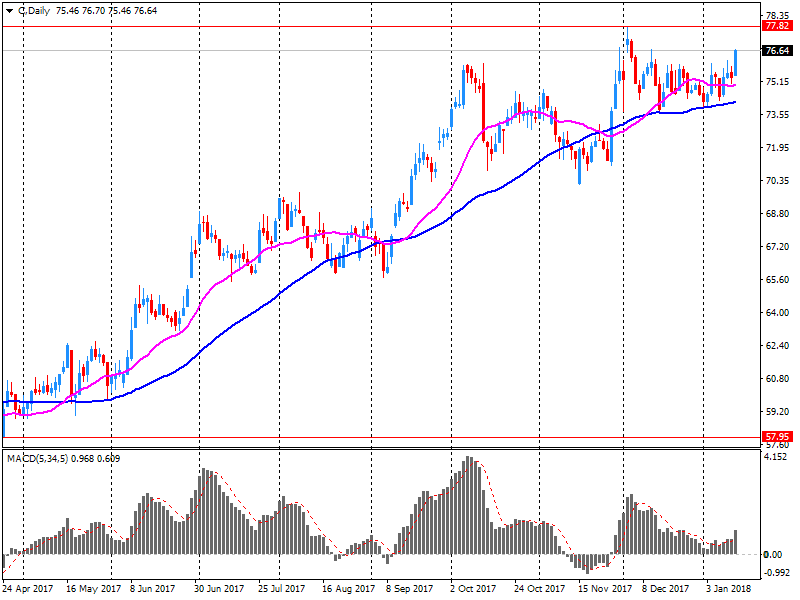

Company News: Citigroup (C) quarterly earnings beat analysts’ expectations

Citigroup (C) reported Q4 FY 2017 earnings of $1.28 per share (versus $1.14 in Q4 FY 2016), beating analysts' consensus estimate of $1.19.

The company's quarterly revenues amounted to $17.255 bln (+1.4% y/y), generally in-line with analysts' consensus estimate of $17.230 bln.

C rose to $78.35 (+1.97%) in pre-market trading.

-

14:17

Romania's president Klaus Iohannis says calls for consultations with political parties to find a PM

-

Wants swift procedure to form a new government to avert political uncertainty and harm the economy

-

Nominates defence minister Mihai Fifor as interim PM

-

-

13:09

German 10-year govt bond yield fall to day's low of 0.49 pct on report ECB unlikely to ditch bond-buying pledge next week

-

13:08

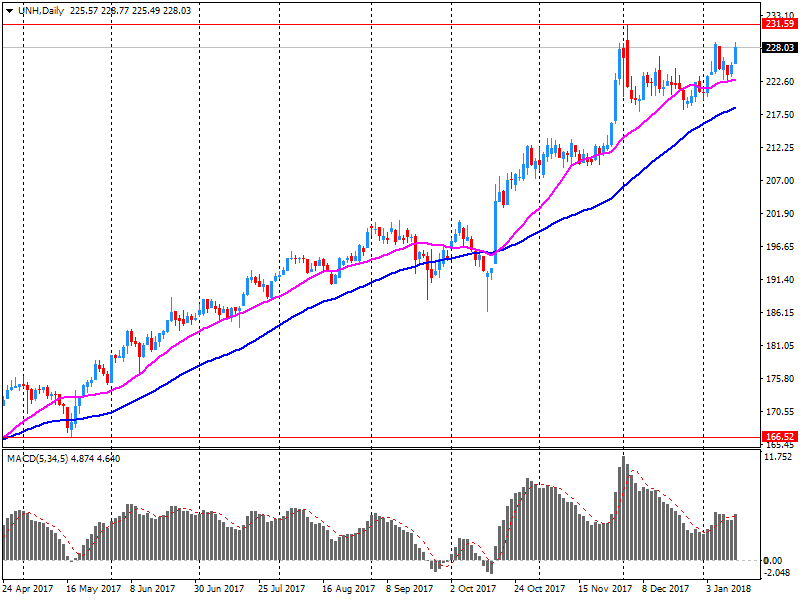

Company News: UnitedHealth (UNH) quarterly earnings miss analysts’ estimate

UnitedHealth (UNH) reported Q4 FY 2017 earnings of $2.44 per share (versus $2.11 in Q4 FY 2016), missing analysts' consensus estimate of $2.52.

The company's quarterly revenues amounted to $52.061 bln (+9.5% y/y), generally in-line with analysts' consensus estimate of $51.570 bln.

The company also issued guidance for FY 2018, projecting EPS of $12.30-12.60, including tax benefits, compared to its previous EPS forecast of $10.55-10.85 and versus analysts' consensus estimate of $11.20.

UNH rose to $234.78 (+2.69%) in pre-market trading.

-

12:29

Bitcoin extends slide to trade down 18 percent on day at $11,191.59 on Bitstamp exchange , on track for biggest one-day fall in three years

-

12:22

USD/JPY Analysis

USD/JPY on the last week fell + 200 pips.

The price since the beginning of this week continues to show signs of a possible continuation of a bearish movement.

If we look at 1 hour time frame chart we can see that the price is forming a upside trend which can be interesting for an entry once the price breaks that trend.

-

12:16

ECB unlikely next week to drop pledge to keep buying bonds until inflation heads to target - Reuters sources

-

10:53

Earnings Season in U.S.: Major Reports of the Week

January 16

Before the Open:

Citigroup (C). Consensus EPS $1.19, Consensus Revenues $17229.88 mln.

UnitedHealth (UNH). Consensus EPS $2.52, Consensus Revenues $51570.43 mln.

January 17

Before the Open:

Bank of America (BAC). Consensus EPS $0.45, Consensus Revenues $21605.10 mln.

Goldman Sachs (GS). Consensus EPS $4.95, Consensus Revenues $7638.28 mln.

After the Close:

Alcoa (AA). Consensus EPS $1.25, Consensus Revenues $3318.11 mln.

January 18

Before the Open:

Morgan Stanley (MS). Consensus EPS $0.78, Consensus Revenues $9248.93 mln.

After the Close:

American Express (AXP). Consensus EPS $1.54, Consensus Revenues $8729.79 mln.

IBM (IBM). Consensus EPS $5.14, Consensus Revenues $22048.59 mln.

-

10:36

UK house prices grew by 5.1% in the year to November

UK house prices grew by 5.1% in the year to November 2017, experiencing a 0.3 percentage point decrease from the previous month.

The Royal Institution of Chartered Surveyors' (RICS) UK Residential Market Survey for November 2017 (PDF, 598KB) reported that their headline near term price expectations series rose to -5% from -10% in October, meaning three month expectations are now more or less flat at the national level. Similarly, the new buyer enquiries series stabilised with a net balance of -5% of respondents noting a decline in demand (as opposed to an increase), up from -19% in October.

-

10:34

UK producer price inflation rose 3.3% on the year to December

The headline rate of inflation for goods leaving the factory gate (output prices) rose 3.3% on the year to December 2017, up from 3.1% in November 2017.

Prices for materials and fuels (input prices) rose 4.9% on the year to December 2017, down from 7.3% in November 2017.

All industries provided upward contributions to output annual inflation; the largest contribution was made by food products.

Prices of imported materials and fuels increased 4.5% on the year to December 2017, down from 6.7% in November 2017.

-

10:32

UK CPI in line with expectations in December

The Consumer Prices Index including owner occupiers' housing costs (CPIH) 12-month inflation rate was 2.7% in December 2017, down from 2.8% in November 2017.

Following a steady increase from late 2015, since April 2017 the CPIH rate has levelled off, ranging between 2.6% and 2.8%.

The downward effect came mainly from air fares, along with a fall in the prices of a range of recreational goods, particularly games and toys.

The downward contributions were partially offset by an increase in tobacco prices, reflecting duty increases that came into effect following the Autumn Budget, along with an increase in petrol and diesel prices.

The Consumer Prices Index (CPI) 12-month rate was 3.0% in December 2017, down from 3.1% in November 2017.

-

10:30

United Kingdom: HICP, Y/Y, December 3% (forecast 3%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, December 2.5% (forecast 2.6%)

-

10:30

United Kingdom: HICP, m/m, December 0.4% (forecast 0.4%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), December 0.4% (forecast 0.3%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , December 3.3% (forecast 2.9%)

-

10:30

United Kingdom: Retail Price Index, m/m, December 0.8% (forecast 0.6%)

-

10:30

United Kingdom: Retail prices, Y/Y, December 4.1% (forecast 3.9%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), December 0.1% (forecast 0.4%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , December 4.9% (forecast 5.4%)

-

10:10

Ukraine's sovereign dollar bonds fall across the curve, 2025 issue down 0.8 cents, after IMF raises concerns over anti-corruption bill

-

09:47

Major European stock exchanges trading in the green zone: FTSE 100 +11.02 7780.16 + 0.14%, DAX +81.89 13282.40 + 0.62%, CAC 40 +14.75 5524.44 + 0.27%

-

09:42

Bitcoin slides 11 percent on day to hit 4-week low of $12,020 on Bitstamp exchange

-

09:09

Romania LEU currency down 0.1 pct vs euro at 4.6444 after prime minister Mihai Tudose resigns

-

08:39

Options levels on tuesday, January 16, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2370 (2966)

$1.2339 (3431)

$1.2313 (4085)

Price at time of writing this review: $1.2228

Support levels (open interest**, contracts):

$1.2139 (352)

$1.2087 (1716)

$1.2054 (2055)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 94394 contracts (according to data from January, 12) with the maximum number of contracts with strike price $1,2100 (5552);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3889 (1793)

$1.3863 (3071)

$1.3841 (3190)

Price at time of writing this review: $1.3780

Support levels (open interest**, contracts):

$1.3651 (84)

$1.3623 (201)

$1.3591 (659)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 30167 contracts, with the maximum number of contracts with strike price $1,3600 (3490);

- Overall open interest on the PUT options with the expiration date February, 9 is 26584 contracts, with the maximum number of contracts with strike price $1,3500 (3246);

- The ratio of PUT/CALL was 0.88 versus 0.92 from the previous trading day according to data from January, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Eurostoxx 50 futures flat, DAX futures up 0.1 pct, CAC 40 futures up 0.2 pct, FTSE futures up 0.2 pct

-

08:21

ECB's Hansson says euro appreciation not a threat to inflation up until now, rise should not be overdramatized - Boersen Zeitung

-

08:14

German wholesale trade rose 1.8% in December

In 2017 the average index of selling prices in wholesale trade was 3.5% higher than the average index of 2016, as reported by the Federal Statistical Office (Destatis).

Compared with December 2016, the index increased by 1.8% in December 2017. In November 2017 the annual rate of change was +3.3% and in October 2017 it was +3.0%, respectively.

Compared with November 2017 the index of wholesale prices fell by 0.3% in December 2017

-

08:12

German SPD rejects coalition talks with Merkel bloc - Spiegel. EUR/USD down 50 pips

-

08:11

Consumer prices in Germany rose by 1.8% on an annual average in 2017

Consumer prices in Germany rose by 1.8% on an annual average in 2017 compared with 2016. The increase was above the relevant levels of the past four years. Between 2014 and 2016, the year-on-year-rates of price increase were even below one percent each. The Federal Statistical Office (Destatis) also reports that the inflation rates as measured by the consumer price index ranged between +1.5% and +2.2% in the individual months of 2017. In December 2017, the inflation rate stood at +1.7%.

The marked increase in the year-on-year rate of price increase in 2017 was mainly due to energy prices. Compared with 2016, energy prices increased by 3.1% in 2017 after they had declined in the previous three years (2016: -5.4%; 2015: -7.0%; 2014: -2.1%). Regarding energy products, especially the prices of heating oil (+16.0%) and motor fuels (+6.0%) were up in 2017 year on year. Declining prices were however recorded for gas (-2.8%) and charges for central and district heating (-1.5%).

-

08:02

Germany: CPI, m/m, December 0.6% (forecast 0.6%)

-

08:02

Germany: CPI, y/y , December 1.8% (forecast 1.7%)

-

07:36

Global Stocks

European stocks finished lower Monday, weighed as the euro continued to march up further into three-year highs, giving a key regional benchmark its third drop in four sessions. Investors were also watching for developments from the U.K., where construction and outsourcing heavyweight Carillion PLC has collapsed.

U.S. equities and bond markets are closed Monday for the Martin Luther King Jr. Day holiday.

Asian equities' best start to a year since 2006 continued Tuesday as most bourses in the region pushed higher. The yen declined amid concern Japanese authorities may want to limit gains that pushed the currency to a four-month high.

-

05:31

Japan: Tertiary Industry Index , November 1.1% (forecast 0.4%)

-

01:31

Australia: New Motor Vehicle Sales (YoY) , December 6.7%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , December 4.5%

-

00:27

Commodities. Daily history for Jan 15’2018:

(raw materials / closing price /% change)

Oil 64.81 +0.79%

Gold 1,340.50 +0.42%

-

00:26

Stocks. Daily history for Jan 15’2018:

(index / closing price / change items /% change)

Nikkei +61.06 23714.88 +0.26%

TOPIX +7.66 1883.90 +0.41%

Hang Seng -73.67 31338.87 -0.23%

CSI 300 +0.24 4225.24 +0.01%

Euro Stoxx 50 -0.80 3611.81 -0.02%

FTSE 100 -9.50 7769.14 -0.12%

DAX -44.52 13200.51 -0.34%

CAC 40 -7.37 5509.69 -0.13%

-

00:25

Currencies. Daily history for Jan 15’2018:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,2265 +1,46%

GBP/USD $1,3794 +0,45%

USD/CHF Chf0,96279 -0,55%

USD/JPY Y110,51 -0,46%

EUR/JPY Y135,54 +0,17%

GBP/JPY Y152,457 0,00%

AUD/USD $0,7963 +0,64%

NZD/USD $0,7297 +0,58%

USD/CAD C$1,24275 -0,34%

-

00:13

Schedule for today, Tuesday, Jan 16’2018 (GMT0)

00:30 Australia New Motor Vehicle Sales (YoY) December 2.1%

00:30 Australia New Motor Vehicle Sales (MoM) December 0.1%

04:30 Japan Tertiary Industry Index November 0.3%

07:00 Germany CPI, y/y (Finally) December 1.8% 1.7%

07:00 Germany CPI, m/m (Finally) December 0.3% 0.6%

09:30 United Kingdom Producer Price Index - Input (YoY) December 7.3% 5.4%

09:30 United Kingdom Producer Price Index - Input (MoM) December 1.8% 0.4%

09:30 United Kingdom Retail Price Index, m/m December 0.2% 0.6%

09:30 United Kingdom Producer Price Index - Output (YoY) December 3.0% 2.9%

09:30 United Kingdom Producer Price Index - Output (MoM) December 0.3% 0.3%

09:30 United Kingdom Retail prices, Y/Y December 3.9% 3.9%

09:30 United Kingdom HICP ex EFAT, Y/Y December 2.7% 2.6%

09:30 United Kingdom HICP, m/m December 0.3% 0.4%

09:30 United Kingdom HICP, Y/Y December 3.1% 3%

13:30 U.S. NY Fed Empire State manufacturing index January 18 18

17:00 Switzerland SNB Chairman Jordan Speaks

23:30 Australia Westpac Consumer Confidence January 103.3

23:50 Japan Core Machinery Orders November 5% -1.4%

23:50 Japan Core Machinery Orders, y/y November 2.3% -0.7%

-