Noticias del mercado

-

23:55

Schedule for today, Thursday, Jan 18’2018 (GMT0)

00:00 Australia Consumer Inflation Expectation January 3.7%

00:30 Australia Changing the number of employed December 61.6 9

00:30 Australia Unemployment rate December 5.4% 5.4%

04:30 Japan Industrial Production (YoY) (Finally) November 5.9% 3.7%

04:30 Japan Industrial Production (MoM) (Finally) November 0.5% 0.6%

07:00 China NBS Press Conference

07:00 China Fixed Asset Investment December 7.2% 7.1%

07:00 China Retail Sales y/y December 10.2% 10.1%

07:00 China Industrial Production y/y December 6.1% 6%

07:00 China GDP y/y Quarter IV 6.8% 6.7%

08:00 Germany German Buba President Weidmann Speaks

13:30 U.S. Continuing Jobless Claims January 1867 1900

13:30 U.S. Housing Starts December 1.297 1.275

13:30 U.S. Building Permits December 1.298 1.29

13:30 U.S. Philadelphia Fed Manufacturing Survey January 26.2 25.0

13:30 U.S. Initial Jobless Claims January 261 250

14:30 Eurozone ECB's Benoit Coeure Speaks

16:00 U.S. Crude Oil Inventories January -4.948 -3.588

21:30 New Zealand Business NZ PMI December 57.7

-

22:16

The main US stock indexes finished trading with a confident increase

Major US stock indices rose strongly, while the DJIA index closed for the first time above 26,000, helped by a rise in the price of shares of technological and industrial companies. Meanwhile, further increases were limited to losses of General Electric Company and The Goldman Sachs Group.

The focus was also on the United States. The Fed said industrial production rose 0.9 percent in December, helped by sustained growth in the mining industry following a revised 0.1 percent decline in November. Economists predicted that industrial production will grow by 0.3 percent after a 0.2 percent growth was registered in November. Industrial production grew at an annualized rate of 8.2 percent in the fourth quarter, which was the largest increase since the second quarter of 2010. For the whole of 2017, the volume of industrial production grew by 1.8 percent, which is the first and largest increase since 2014. The growth of the industrial sector is facilitated by the strengthening of the global economy and the weakening of the dollar, which helps make US exports more competitive than the country's main trading partners.

Meanwhile, the confidence of builders in the market of newly built houses for a single family fell by 2 points to a level of 72 in January, showed the housing market index (HMI) from the National Association of Housing Owners / Wells Fargo. "The builders are confident that changes in the tax code will promote the development of small businesses and lead to wider economic growth," said NAHB chairman Randy Noel. - Our participants are very happy about what awaits them ahead. However, they still face rising prices for materials and a shortage of labor and plots.

Almost all components of the DOW index finished trading in positive territory (25 out of 30). The leader of growth was the shares of The Boeing Company (BA, 4.85%). Outsider were shares of General Electric Company (GE, -4.91%).

All sectors of the S & P index recorded an increase. The technological sector grew most (+ 1.2%).

At closing:

DJIA + 1.25% 26,115.65 +322.79

Nasdaq + 1.03% 7,298.28 +74.59

S & P + 0.94% 2,802.56 +26.14

-

22:00

U.S.: Total Net TIC Flows, November 33.8 (forecast 31.3)

-

22:00

U.S.: Net Long-term TIC Flows , November 57.5 (forecast 36.5)

-

21:00

DJIA +1.12% 26,081.84 +288.98 Nasdaq +1.07% 7,300.77 +77.09 S&P +1.02% 2,804.66 +28.24

-

18:00

European stocks closed: FTSE 100 -30.50 7725.43 -0.39% DAX -62.37 13183.96 -0.47% CAC 40 -19.83 5493.99 -0.36%

-

16:13

BoC says will "remain cautious in considering future policy adjustments", guided by incoming data

-

Consumption, residential investment have been stronger than anticipated; expected to contribute less to growth going forward

-

Benefits of higher commodity prices being diluted by wider spreads between benchmark world, canadian oil prices

-

Core inflation measures have edged up, consistent with diminishing slack in economy

-

Labor market slack being absorbed more quickly than anticipated; wages still rising by less than typical

-

Raises 2018 average annual inflation forecast to 2.0 pct from 1.7 pct, holds 2019 at 2.1 pct

-

Holds q4 growth forecast at 2.5 pct, sees q1 growth 2.5 pct; raises 2018 to 2.2 pct from 2.1 pct, 2019 to 1.6 pct from 1.5 pct

-

Uncertainty about future of NAFTA "weighing increasingly" on the outlook; trade-policy uncertainty to reduce level of business investment by 2 pct by end-2019

-

BoC sees small benefit to Canada from stronger U.S. demand due to recent tax changes

-

-

16:09

Canadian dollar turns lower having strengthened initally after the Bank of Canada raises interest rates, touches c$1.2480 to the U.S. dollar, or 80.13 U.S. cents

-

16:02

The Bank of Canada today increased its target for the overnight rate to 1 1/4 per cent

"The Bank of Canada today increased its target for the overnight rate to 1 1/4 per cent. The Bank Rate is correspondingly 1 1/2 per cent and the deposit rate is 1 per cent. Recent data have been strong, inflation is close to target, and the economy is operating roughly at capacity. However, uncertainty surrounding the future of the North American Free Trade Agreement (NAFTA) is clouding the economic outlook.

The global economy continues to strengthen, with growth expected to average 3 1/2 per cent over the projection horizon. Growth in advanced economies is projected to be stronger than in the Bank's October Monetary Policy Report (MPR). In particular, there are signs of increasing momentum in the US economy, which will be boosted further by recent tax changes. Global commodity prices are higher, although the benefits to Canada are being diluted by wider spreads between benchmark world and Canadian oil prices.

In Canada, real GDP growth is expected to slow to 2.2 per cent in 2018 and 1.6 per cent in 2019, following an estimated 3.0 per cent in 2017. Growth is expected to remain above potential through the first quarter of 2018 and then slow to a rate close to potential for the rest of the projection horizon."

-

16:00

U.S.: NAHB Housing Market Index, January 72 (forecast 72)

-

16:00

Canada: Bank of Canada Rate, 1.25% (forecast 1.25%)

-

15:36

U.S industrial production rose 0.9 percent in December even though manufacturing output only edged up 0.1%

Revisions to mining and utilities altered the pattern of growth for October and November, but the level of the overall index in November was little changed. For the fourth quarter as a whole, total industrial production jumped 8.2 percent at an annual rate after being held down in the third quarter by Hurricanes Harvey and Irma. At 107.5 percent of its 2012 average, the index has increased 3.6 percent since December 2016 for its largest calendar-year gain since 2010.

The gain in manufacturing output in December was its fourth consecutive monthly increase. The output of utilities advanced 5.6 percent for the month, while the index for mining moved up 1.6 percent. Capacity utilization for the industrial sector was 77.9 percent, a rate that is 2.0 percentage points below its long-run (1972-2016) average.

-

15:31

U.S. Stocks open: Dow +0.59% Nasdaq +0.46%, S&P +0.32%

-

15:15

U.S.: Industrial Production YoY , December 3.6%

-

15:15

U.S.: Industrial Production (MoM), December 0.9% (forecast 0.3%)

-

15:15

U.S.: Capacity Utilization, December 77.9% (forecast 77.3%)

-

15:08

Before the bell: S&P futures +0.35%, NASDAQ futures +0.41%

U.S. stock-index futures rose on Wednesday as investors assessed fourth-quarter earnings from Bank of America (BAC) and Goldman Sachs (GS).

Global Stocks:

Nikkei 23,868.34 -83.47 -0.35%

Hang Seng 31,983.41 +78.66 +0.25%

Shanghai 3,445.36 +8.76 +0.26%

S&P/ASX 6,015.80 -32.80 -0.54%

FTSE 7,738.09 -17.84 -0.23%

CAC 5,507.33 -6.49 -0.12%

DAX 13,209.47 -36.86 -0.28%

Crude $63.66 (-0.11%)

Gold $1,336.60 (-0.04%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

245.73

0.99(0.40%)

1583

ALCOA INC.

AA

55.85

-0.39(-0.69%)

1134

ALTRIA GROUP INC.

MO

69

0.08(0.12%)

410

Amazon.com Inc., NASDAQ

AMZN

1,315.40

10.54(0.81%)

74889

American Express Co

AXP

101.45

1.11(1.11%)

1816

AMERICAN INTERNATIONAL GROUP

AIG

61.2

0.14(0.23%)

313

Apple Inc.

AAPL

176.04

-0.15(-0.09%)

275180

AT&T Inc

T

36.75

0.03(0.08%)

9597

Barrick Gold Corporation, NYSE

ABX

15.16

-0.04(-0.26%)

7575

Boeing Co

BA

337.8

2.64(0.79%)

43177

Caterpillar Inc

CAT

170.4

1.09(0.64%)

15316

Chevron Corp

CVX

132.5

0.49(0.37%)

4134

Cisco Systems Inc

CSCO

40.87

0.33(0.81%)

17030

Citigroup Inc., NYSE

C

76.94

-0.17(-0.22%)

30457

Deere & Company, NYSE

DE

168.98

1.44(0.86%)

300

Exxon Mobil Corp

XOM

87.32

0.35(0.40%)

3148

Facebook, Inc.

FB

178.99

0.60(0.34%)

93203

FedEx Corporation, NYSE

FDX

269

-0.58(-0.22%)

811

Ford Motor Co.

F

12.63

-0.47(-3.59%)

539327

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.4

0.08(0.41%)

5100

General Electric Co

GE

17.82

-0.39(-2.14%)

1081619

General Motors Company, NYSE

GM

44.4

0.21(0.48%)

9204

Goldman Sachs

GS

256.53

-1.93(-0.75%)

144517

Google Inc.

GOOG

1,131.36

9.60(0.86%)

7753

Hewlett-Packard Co.

HPQ

22.65

-0.23(-1.01%)

1912

Home Depot Inc

HD

197.37

1.06(0.54%)

2899

Intel Corp

INTC

43.4

0.26(0.60%)

14322

International Business Machines Co...

IBM

166.79

2.94(1.79%)

74959

Johnson & Johnson

JNJ

147.65

0.79(0.54%)

2226

JPMorgan Chase and Co

JPM

111.97

-0.30(-0.27%)

36437

McDonald's Corp

MCD

174.1

0.42(0.24%)

2278

Merck & Co Inc

MRK

61.99

-0.08(-0.13%)

41665

Microsoft Corp

MSFT

88.87

0.52(0.59%)

28647

Nike

NKE

63.96

0.54(0.85%)

3037

Pfizer Inc

PFE

36.74

0.14(0.38%)

3275

Procter & Gamble Co

PG

90.47

0.25(0.28%)

3390

Starbucks Corporation, NASDAQ

SBUX

61.08

0.52(0.86%)

4719

Tesla Motors, Inc., NASDAQ

TSLA

341.47

1.41(0.41%)

11761

The Coca-Cola Co

KO

46.7

0.17(0.37%)

2985

Travelers Companies Inc

TRV

136.33

0.81(0.60%)

550

Twitter, Inc., NYSE

TWTR

24.8

0.14(0.57%)

51284

United Technologies Corp

UTX

134.82

0.85(0.63%)

1810

UnitedHealth Group Inc

UNH

234.85

1.95(0.84%)

3316

Verizon Communications Inc

VZ

51.9

0.24(0.46%)

2426

Visa

V

121.2

0.81(0.67%)

10642

Wal-Mart Stores Inc

WMT

101.29

0.60(0.60%)

7356

Walt Disney Co

DIS

111.4

0.71(0.64%)

3721

Yandex N.V., NASDAQ

YNDX

35.12

-0.06(-0.17%)

1050

-

14:43

Target price changes before the market open

Deere (DE) target raised to $184 from $161 at Stifel

UnitedHealth (UNH) target raised to $268 from $235 at Citigroup

Merck (MRK) target raised to $72 from $68 at BMO Capital Markets

-

14:42

Downgrades before the market open

Apple (AAPL) downgraded to Neutral from Buy at Longbow

HP (HPQ) downgraded to Equal Weight at Barclays

Citigroup (C) downgraded to Mkt Perform from Outperform at Keefe Bruyette

-

14:41

Upgrades before the market open

IBM(IBM) upgraded to Overweight at Barclays

Wal-Mart (WMT) added to US Focus List at Citigroup; Buy, target $117

-

14:23

Bank of Canada monetary policy report the main event of the day. Interest rate hike of 0.25% to 1.25% expected, volatility on the rise

-

13:59

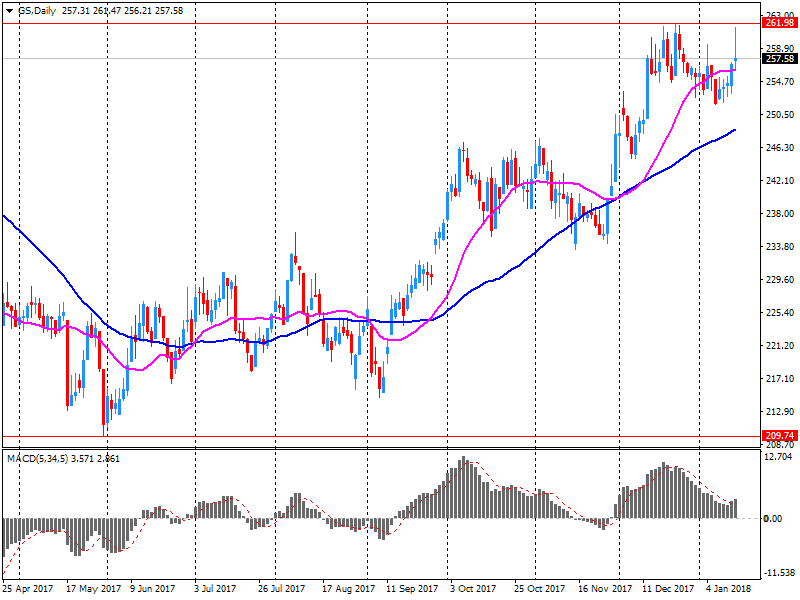

Company News: Goldman Sachs (GS) quarterly results beat analysts’ expectations

Goldman Sachs (GS) reported Q4 FY 2017 earnings of $5.68 per share (versus $5.08 in Q4 FY 2016), beating analysts' consensus estimate of $4.95.

The company's quarterly revenues amounted to $7.830 bln (-4.2% y/y), beating analysts' consensus estimate of $7.638 bln.

GS fell to $256.10 (-0.91%) in pre-market trading.

-

13:31

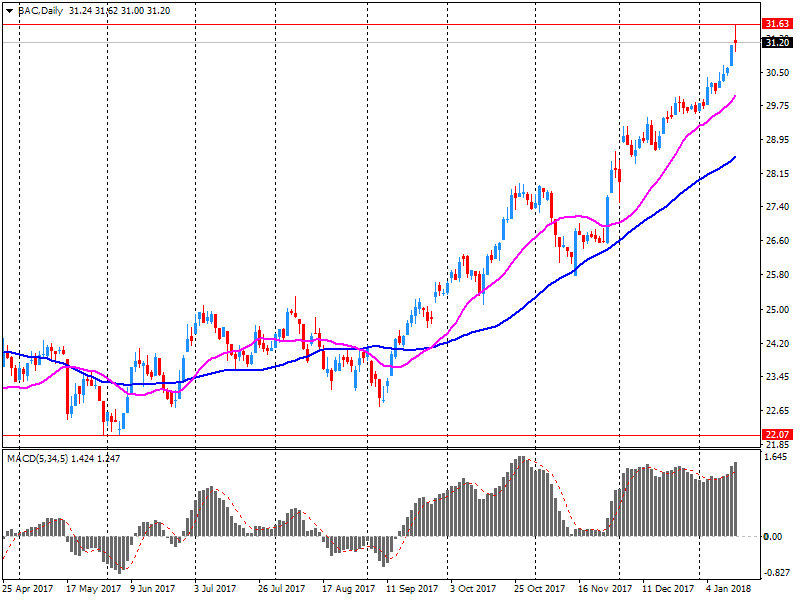

Company News: Bank of America (BAC) quarterly earnings beat analysts’ estimate

Bank of America (BAC) reported Q4 FY 2017 earnings of $0.47 per share (versus $0.40 in Q4 FY 2016), beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $20.687 bln (+3.5% y/y), missing analysts' consensus estimate of $21.605 bln.

BAC rose to $31.36 (+0.38%) in pre-market trading.

-

12:19

AUD/JPY Daily time frame chart

AUD/JPY on daily time frame chart we can see that the price has broken a downside trend line and a resistance level which the price has already shown some difficulty in breakthrough that zone.

After the breakout of the trend line and the resistance level the price starts a new bullish movement.

Therefore, our bias on this pair remains - long

-

11:31

EU's Juncker says willing to facilitate Britain rejoining EU after Brexit

-

11:29

Bank of England says have seen some evidence UK lenders tightened consumer credit underwriting standards in 2017

-

Some lenders' boards do not receive enough information to judge consumer lending quality is worsening

-

Says will consider following up adequacy of lenders' credit risk monitoring in late 2018

-

UK motor finance lenders have adopted a "reasonably prudent" approach to future value of 2nd-hand cars

-

-

11:06

Eurozone: Harmonized CPI, Y/Y, December 1.4% (forecast 1.4%)

-

11:02

Euro area annual inflation was 1.4% in December, unchanged

Euro area annual inflation was 1.4% in December 2017, down from 1.5% in November. In December 2016, the rate was 1.1%. European Union annual inflation was 1.7% in December 2017, down from 1.8% in November. A year earlier the rate was 1.2%. These figures come from Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in Cyprus (-0.4%), Ireland and Finland (both 0.5%) and Denmark (0.8%). The highest annual rates were recorded in Lithuania and Estonia (both 3.8%) and the United Kingdom (3.0%). Compared with November 2017, annual inflation fell in twenty-three Member States, remained stable in four and rose in one.

The largest upward impacts to the euro area annual inflation came from fuels for transport (+0.11 percentage points), tobacco (+0.06 pp) and milk, cheese & eggs (+0.05 pp), while telecommunication (-0.10 pp), garments and vegetables (-0.05 pp each) had the biggest downward impacts.

-

11:00

Eurozone: Construction Output, y/y, November 2.7%

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, December 0.9% (forecast 0.9%)

-

11:00

Eurozone: Harmonized CPI, December 0.4% (forecast 0.4%)

-

10:18

ECB's Nowotny says euro exchange rate must be observed

-

09:25

Major stock exchanges in Europe trading in the red zone: FTSE 7739.86 -16.07 -0.21%, DAX 13205.25 -41.08 -0.31%, CAC 5491.53 -22.29 -0.40%

-

09:18

Norway's finance minister sees mainland economic growth above trend, employment to expand faster than population growth

-

08:47

Options levels on wednesday, January 17, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2362 (4074)

$1.2338 (5553)

$1.2320 (3098)

Price at time of writing this review: $1.2231

Support levels (open interest**, contracts):

$1.2154 (1392)

$1.2118 (1752)

$1.2078 (2052)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 102999 contracts (according to data from January, 16) with the maximum number of contracts with strike price $1,2100 (5553);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3893 (3003)

$1.3863 (2366)

$1.3844 (2053)

Price at time of writing this review: $1.3773

Support levels (open interest**, contracts):

$1.3677 (494)

$1.3644 (208)

$1.3608 (700)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 31794 contracts, with the maximum number of contracts with strike price $1,3600 (3488);

- Overall open interest on the PUT options with the expiration date February, 9 is 27202 contracts, with the maximum number of contracts with strike price $1,3500 (3040);

- The ratio of PUT/CALL was 0.86 versus 0.88 from the previous trading day according to data from January, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:32

EUR/USD touched 3 year high of 1.2322 on the asian session

-

08:31

Tillerson says it is time to talk to North Korea but they need first to take the step to say they want to talk

-

There are no differences between U.S. and South Korea over how to deal with North Korea

-

-

08:29

Bitcoin falls more than 7 percent on Bitstamp exchange

-

08:29

10-year U.S. treasury yield at 2.549 percent vs U.S. close of 2.544 percent on tuesday

-

08:28

Eurostoxx 50 futures down 0.33 pct, CAC 40 futures down 0.42 pct, DAX futures down 0.32 pct, german bund futures open 1 ticks higher at 160.78, FTSE futures down 0.22 pct

-

08:23

ECB's Constancio says does not rule out that monetary policy will continue to be 'very accommodating' for a long time

-

Would keep ESM as it is, no reasons to modify institutional situation and create a new entity, reducing role of commission

-

Not heard convincing arguments in favour of transforming ESM into so-called european monetary fund

-

-

07:30

Global Stocks

British blue-chip stocks finished lower Tuesday, pulled down in part by a fall in shares of BP PLC after the energy heavyweight said it will take a $1.7 billion charge related to the Deepwater Horizon disaster. A selloff for miners also weighed on the main equity benchmark.

The Dow Jones Industrial Average closed marginally lower on Tuesday after the blue-chip index relinquished all its early gains in the sharpest daily reversal in nearly two years, according to FactSet. In early trade, Dow industrials were up more than 1% and set an intraday all-time high above 26,000.

Asian stocks were mostly lower Wednesday following a late selloff in U.S. equities and after some markets logged fresh highs Tuesday. Hong Kong's Hang Seng Index topped 2007's record-high close on Tuesday while Singapore's main stock index breached 2015's high, getting to levels last seen in 2007.

-

01:30

Australia: Home Loans , November 2.1% (forecast -0.2%)

-

00:50

Japan: Core Machinery Orders, y/y, November 4.1% (forecast -0.7%)

-

00:50

Japan: Core Machinery Orders, November 5.7% (forecast -1.4%)

-

00:26

Commodities. Daily history for Jan 16’2018:

(raw materials / closing price /% change)

Oil 63.88 -0.65%

Gold 1,338.80 +0.29%

-

00:26

Stocks. Daily history for Jan 16’2018:

(index / closing price / change items /% change)

Nikkei +236.93 23951.81 +1.00%

TOPIX +10.35 1894.25 +0.55%

Hang Seng +565.88 31904.75 +1.81%

CSI 300 +33.23 4258.47 +0.79%

Euro Stoxx 50 +10.20 3622.01 +0.28%

FTSE 100 -13.21 7755.93 -0.17%

DAX +45.82 13246.33 +0.35%

CAC 40 +4.13 5513.82 +0.07%

DJIA -10.33 25792.86 -0.04%

S&P 500 -9.82 2776.42 -0.35%

NASDAQ -37.37 7223.69 -0.51%

S&P/TSX -72.93 16298.88 -0.45%

-

00:25

Currencies. Daily history for Jan 16’2018:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,2260 -0,04%

GBP/USD $1,3790 -0,03%

USD/CHF Chf0,95941 -0,35%

USD/JPY Y110,46 -0,05%

EUR/JPY Y135,43 -0,08%

GBP/JPY Y152,336 -0,08%

AUD/USD $0,7960 -0,04%

NZD/USD $0,7265 -0,44%

USD/CAD C$1,24343 +0,05%

-

00:01

Schedule for today, Wednesday, Jan 17’2018 (GMT0)

0:30 Australia Home Loans November -0.6% -0.2%

10:00 Eurozone Construction Output, y/y November 2.0%

10:00 Eurozone Harmonized CPI December 0.1% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December 0.9% 0.9%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December 1.5% 1.4%

11:45 United Kingdom MPC Member Saunders Speaks

14:15 U.S. Capacity Utilization December 77.1% 77.3%

14:15 U.S. Industrial Production YoY December 3.4%

14:15 U.S. Industrial Production (MoM) December 0.2% 0.4%

15:00 Canada Bank of Canada Monetary Policy Report

15:00 Canada Bank of Canada Rate 1% 1.25%

15:00 Canada BOC Rate Statement

15:00 U.S. NAHB Housing Market Index January 74 72

16:15 Canada BOC Press Conference

19:00 U.S. Fed's Beige Book

20:00 U.S. FOMC Member Charles Evans Speaks

20:15 U.S. FOMC Member Kaplan Speak

21:00 U.S. Net Long-term TIC Flows November 23.2

21:00 U.S. Total Net TIC Flows November 151.2

21:30 U.S. FOMC Member Mester Speaks

-