Noticias del mercado

-

21:00

DJIA 17503.30 67.90 0.39%, NASDAQ 4768.08 55.55 1.18%, S&P 500 2052.01 11.97 0.59%

-

18:48

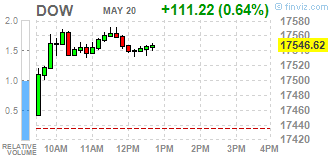

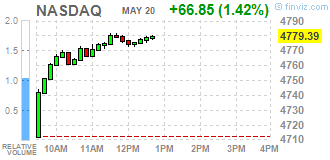

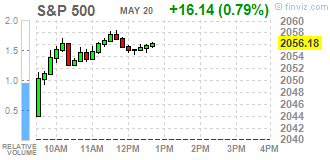

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Friday as technology stocks were lifted by an upbeat forecast from chip industry bellwether Applied Materials, while financial stocks added to gains.

Most of Dow stocks in positive area (22 of 30). Top looser - McDonald's Corp. (MCD, -1,76%). Top gainer - American Express Company (AXP, +2,07%).

Almost all S&P sectors also in positive area. Top looser - Utilities (-0,4%). Top gainer - Technology (+1,3%).

At the moment:

Dow 17516.00 +101.00 +0.58%

S&P 500 2052.50 +13.75 +0.67%

Nasdaq 100 4374.50 +57.25 +1.33%

Oil 48.56 -0.11 -0.23%

Gold 1251.60 -3.20 -0.26%

U.S. 10yr 1.84 -0.00

-

18:04

European stocks close: stocks closed higher, rebounding after yesterday’s drop

Stock closed rebounded after yesterday's drop. Stock markets declined on Thursday on speculation that the Fed may raise its interest rate in June.

Market participants also eyed the economic data from the Eurozone. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €27.3 billion in March from €19.2 billion in February. February's figure was revised up from a surplus of €19.0 billion.

The surplus on goods rose to €31.0 billion in March from €24.2 billion in February.

The surplus on services remained unchanged at €6.9 billion in March.

The primary income surplus increased to €2.3 billion in March from €1.9 billion in February, while the secondary income deficit was down to €12.9 billion from €13.9 billion.

Eurozone's unadjusted current account surplus climbed to €32.3 billion in March from €11.2 billion in February. February's figure was revised up from a surplus of €11.1 billion.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices rose 0.1% in April, missing expectations for a 0.2% rise, after a flat reading in March.

On a yearly basis, German PPI dropped 3.1% in April, missing expectations for a 3.0% decrease, after a 3.1% fall in March.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,156.32 +102.97 +1.70 %

DAX 9,916.02 +120.13 +1.23 %

CAC 40 4,353.9 +71.36 +1.67 %

-

18:00

European stocks closed: FTSE 6156.32 102.97 1.70%, DAX 9916.02 120.13 1.23%, CAC 40 4353.90 71.36 1.67%

-

17:37

WSE: Session Results

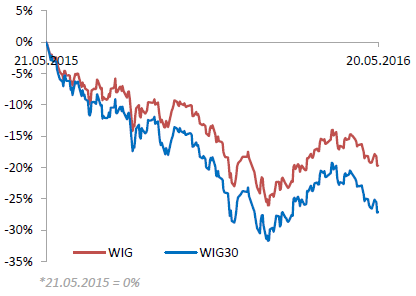

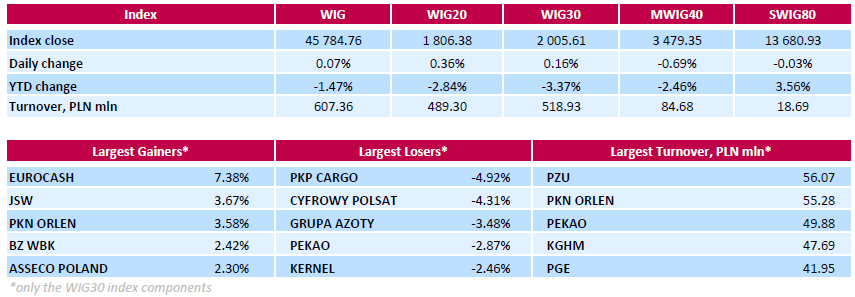

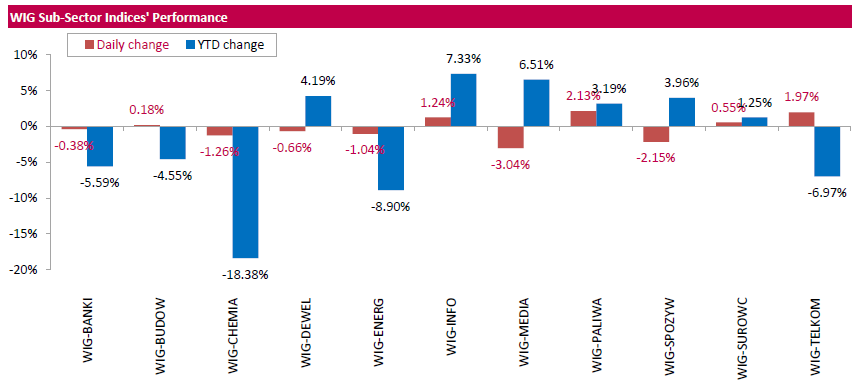

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, inched up 0.07%. Sector performance within the WIG Index was mixed. Oil and gas sector (+2.13%) outperformed, while media sector (-3.04%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.16%. Within the index components, FMCG-wholesaler EUROCASH (WSE: EUR) led the gainers, jumping by 7.38%, supported by an analyst upgrade. It was followed by coking coal miner JSW (WSE: JSW) and oil refiner PKN ORLEN (WSE: PKN), growing by 3.67% and 3.58% respectively. At the same time, the session's most prominent losers were railway freight transport operator PKP CARGO (WSE: PKP), media group CYFROWY POLSAT (WSE: CPS) and chemical producer GRUPA AZOTY (WSE: ATT), which quotations fell by 4.92%, 4.31% and 3.48% respectively. Elsewhere, bank PEKAO (WSE: PEO) declined by 2.87%, dragged down by the announcement that Italy's UniCredit considers selling some of its holding in the bank.

-

17:27

Bank of England's Monetary Policy Committee member Kristin Forbes: uncertainty around the referendum on Britain’s membership in the European Union is weighing on businesses and on investment

The Bank of England's (BoE) Monetary Policy Committee member Kristin Forbes said in an interview with the Belfast Telegraph on Friday that uncertainty around the referendum on Britain's membership in the European Union (EU) was weighing on businesses and on investment.

"We don't have concrete evidence that some of the softening we are seeing now is all referendum-related and uncertainty related, and there is a chance other things are going on," she added.

-

17:15

European Central Bank Governing Council member Jozef Makuch: there is no need in further stimulus measures at the moment

The European Central Bank (ECB) Governing Council member Jozef Makuch said on Friday that there was no need in further stimulus measures at the moment. The recent stimulus measures needed more time to take effect, he added.

Makuch noted that he was confident the stimulus measures would work.

-

17:02

European Central Bank Governing Council member Ardo Hansson: there is no need in further stimulus measures at the moment

The European Central Bank (ECB) Governing Council member Ardo Hansson said on Friday that there was no need in further stimulus measures at the moment.

"Right now we just wait and see," he said.

Hansson hinted that the governments would delay the implementation of reforms.

-

16:38

European Central Bank Executive Board member Benoit Coeure: the ECB has no plans to cut its deposit rate further

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with the Japanese newspaper The Yomiuri Shimbun on Friday that the central bank had no plans to cut its deposit rate further.

"It is in principle possible to cut this rate further, but there is currently no plan to do so," he said.

Coeure noted that the lending to banks was more important than the negative interest rate.

He also said that the ECB's stimulus measures were working.

-

16:28

Greece’s current account narrows to €0.71 billion in March

The Bank of Greece released its current account data on Friday. Greece's current account deficit narrowed to €0.71 billion in March from €1.48 billion in March last year.

The Greek deficit on trade in goods declined to €1.53 billion in March from €1.97 billion in March last year, while the services surplus fell to €343 million from €467 million.

The primary income surplus jumped to €432 million in March from €74 million in March last year, while the deficit on secondary income turned into a surplus of €47 million from a deficit of €52 million last year.

The capital account surplus slid to €57 million in March from €321 million last year.

-

16:15

U.S. existing homes sales climb 1.7% in April

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes climbed 1.7% to a seasonally adjusted annual rate of 5.45 million in April from 5.36 in March. March's figure was revised up from 5.33 million units.

Analysts had expected an increase to 5.40 million units.

"Primarily driven by a convincing jump in the Midwest, where home prices are most affordable, sales activity overall was at a healthy pace last month as very low mortgage rates and modest seasonal inventory gains encouraged more households to search for and close on a home," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 32% in April from 30% in March.

"Looking ahead, with demand holding steady and supply levels still far from sufficient, the market for entry-level and mid-priced homes will likely continue to be the most competitive heading into the summer months," Yun said.

-

15:55

The European Central Bank (ECB) Governing Council member Ewald Nowotny said on Friday that the central bank was closely monitoring how fast inflation in the Eurozone would pick up in the second half of the year

-

15:53

WSE: After start on Wall Street

After opening on Wall Street, we may see a upward pressure from the core markets, as a result, the WIG20 returns to the daily maximum and once again indicates that below 1,800 points the supply side of the market remains weak. Constantly it is difficult to talk about the session solstice in the downward move, which brought the chart from 2,000 points to 1,790 points. Barely PLN 300 mln of turnover indicates that demand also operates in the context of low activity. There can be no doubt that the end of the day above 1,800 points would be a base for attacking from the bulls side in the new week. Everything points a shy attempt to defend the support without confirmation from the volume.

-

15:52

The European Central Bank Governing Council member Erkki Liikanen: inflation in the Eurozone should be above 2% target for a while

The European Central Bank (ECB) Governing Council member Erkki Liikanen said on Friday that inflation in the Eurozone should be above 2% target for a while.

"You can never have average inflation close to 2 percent if you are never above 2; it's arithmetic," he said.

"We must be consistent in both ways," Liikanen added.

-

15:33

U.S. Stocks open: Dow +0.14%, Nasdaq +0.42%, S&P +0.28%

-

15:24

Before the bell: S&P futures +0.28%, NASDAQ futures +0.42%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,736.35 +89.69 +0.54%

Hang Seng 19,852.2 +157.87 +0.80%

Shanghai Composite 2,825.94 +19.03 +0.68%

FTSE 6,134.3 +80.95 +1.34%

CAC 4,331.25 +48.71 +1.14%

DAX 9,886.06 +90.17 +0.92%

Crude $48.04 (-0.25%)

Gold $1257.40 (+0.21%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.21

0.09(0.9868%)

37533

Amazon.com Inc., NASDAQ

AMZN

701.48

2.96(0.4238%)

12366

Apple Inc.

AAPL

94.52

0.32(0.3397%)

93272

AT&T Inc

T

38.59

0.15(0.3902%)

4890

Barrick Gold Corporation, NYSE

ABX

18.37

0.22(1.2121%)

30282

Boeing Co

BA

128.94

0.86(0.6715%)

675

Caterpillar Inc

CAT

69.6

0.17(0.2448%)

1820

Cisco Systems Inc

CSCO

27.74

0.17(0.6166%)

8593

Citigroup Inc., NYSE

C

45.33

0.27(0.5992%)

9679

Deere & Company, NYSE

DE

80.81

-1.44(-1.7508%)

196517

Exxon Mobil Corp

XOM

90.06

-0.05(-0.0555%)

5909

Facebook, Inc.

FB

117.29

0.48(0.4109%)

47455

Ford Motor Co.

F

13.13

0.04(0.3056%)

21487

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.14

0.16(1.4572%)

119182

General Electric Co

GE

29.44

0.08(0.2725%)

12379

General Motors Company, NYSE

GM

30.51

0.19(0.6266%)

3998

Goldman Sachs

GS

155.5

0.80(0.5171%)

3887

Home Depot Inc

HD

131.7

-0.03(-0.0228%)

1174

Intel Corp

INTC

29.83

0.20(0.675%)

3839

Johnson & Johnson

JNJ

112

-0.05(-0.0446%)

5498

JPMorgan Chase and Co

JPM

63.6

0.21(0.3313%)

1837

McDonald's Corp

MCD

124.75

-0.54(-0.431%)

5924

Merck & Co Inc

MRK

54.59

0.01(0.0183%)

200

Microsoft Corp

MSFT

50.45

0.13(0.2583%)

3747

Nike

NKE

57.08

0.04(0.0701%)

12685

Pfizer Inc

PFE

33.38

0.00(0.00%)

552

Starbucks Corporation, NASDAQ

SBUX

54.91

0.36(0.6599%)

7565

Tesla Motors, Inc., NASDAQ

TSLA

215.99

0.78(0.3624%)

395675

The Coca-Cola Co

KO

44.34

0.02(0.0451%)

841

Twitter, Inc., NYSE

TWTR

14.24

0.09(0.636%)

25763

Verizon Communications Inc

VZ

49.8

0.17(0.3425%)

1687

Visa

V

77.33

0.45(0.5853%)

858

Wal-Mart Stores Inc

WMT

69.01

-0.19(-0.2746%)

9550

Yahoo! Inc., NASDAQ

YHOO

35.37

-1.65(-4.4571%)

7568522

Yandex N.V., NASDAQ

YNDX

18.98

-0.01(-0.0527%)

4800

-

14:57

Canadian consumer price inflation rises 0.3% in April

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.3% in April, in line with expectations, after a 0.6% gain in March.

The monthly rise was mainly driven by an increase in prices for transportation, which were up 2.0% in April.

On a yearly basis, the consumer price index climbed to 1.7% in April from 1.3% in March, in line with expectations.

The consumer price index was mainly driven by higher food and shelter prices. Food prices climbed 3.2% year-on-year in April, while shelter prices increased 1.4%.

The index for recreation, education and reading climbed by 2.4% in April from the same month a year earlier, the gasoline prices dropped 5.8%, while clothing and footwear prices declined 0.2%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.2% in April, after a 0.3% rise in March.

On a yearly basis, core consumer price index in Canada climbed to 2.2% in April from 2.1% in March. Analysts had expected the index to drop to 2.0%.

The Bank of Canada's inflation target is 2.0%.

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Johnson & Johnson (JNJ) initiated with a Sell at Standpoint Research; target $94

Wal-Mart (WMT) target raised to $69 from $66 at RBC Capital Mkts

Wal-Mart (WMT) target raised to $71 from $65 at Telsey Advisory Group

-

14:43

Canadian retail sales drop by 1.0% in March

Statistics Canada released retail sales data on Friday. Canadian retail sales dropped by 1.0% in March, missing expectations for a 0.6% fall, after a 0.6% increase in February. February's figure was revised up from a 0.4% rise.

The decrease was driven by drops in 6 of 11 subsectors.

Sales at motor vehicle and parts dealers slid by 2.9% in March, while sales at general merchandise stores increased by 0.4%.

Sales at gasoline stations declined 1.1% in March, while sales at food and beverage stores were down 0.4%.

Sales at building material and garden equipment and supplies dealers decreased 0.7% in March, while sales at furniture and home furnishings stores plunged 3.7%.

Canadian retail sales excluding automobiles fell 0.3% in March, beating expectations for a 0.4% fall, after a 0.3% increase in February. February's figure was revised up from a 0.2% gain.

-

14:32

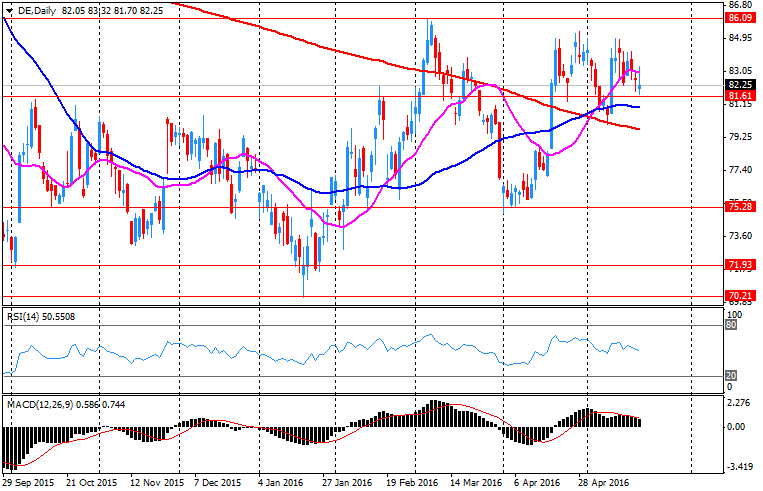

Company News: Deere (DE) Q2 results beat analysts’ expectations

Deere reported Q2 FY 2016 earnings of $1.56 per share (versus $2.03 in Q2 FY 2015), beating analysts' consensus of $1.48.

The company's quarterly revenues amounted to $7.107 bln (-3.9% y/y), beating consensus estimate of $6.660 bln.

Deere issued downside guidance for Q3, projecting revenues of $6.02 bln (-12% y/y) versus analysts' consensus estimate of $6.17 bln.

The company also raised its FY 2016 revenues growth projection to -9% y/y (from -10% y/y) to $23.46 bln (versus analysts' estimate of $23.02 bln), but lowered FY 2016 net income forecasts to $1.2 bln from $1.3 bln.

DE fell to $81.00 (-1.52%) in pre-market trading.

-

14:22

CBI industrial order books balance rises to -8 in May

The Confederation of British Industry (CBI) released its industrial order books balance on Friday. The CBI industrial order books balance rose to -8 in May from -11 in April, beating expectations for a decline to -13.

Total orders increased slightly in May, while exports orders were largely unchanged.

"Conditions in the manufacturing sector seem to be a little better overall, with improving order books compared with a couple of months ago. But domestic and global uncertainty remains high, alongside lacklustre export demand," the CBI director of economics Rain Newton-Smith said.

"Despite recent choppiness in emerging markets, China and India remain significant sources of potential demand," she added.

-

13:38

WSE: Mid session comment

After the first half of the session the market was suspended and delicate balance. After four hours of trading the index value is cosmetically different from yesterday's close and today's opening indicating that the region of 1,800 points is a strong suspension. The whole supports turnover, which hardly comes close to 165 million. Draw in the first half of the session warns that the market does not have many arguments. Surroundings doing better and if US indices do not want to walk north, then from the environment can flow downward impulse and then can no longer defend 1,800 points with a small capital. Another piece of the puzzle is weakening of the zloty, which is just starting to lose again to the euro and the dollar.

-

12:03

European stock markets mid session: stocks traded higher on a rise in oil prices

Stock indices traded higher as oil prices rose. Oil prices increased on falling oil production in the U.S. and on supply disruptions in Nigeria and Venezuela.

Market participants also eyed the economic data from the Eurozone. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €27.3 billion in March from €19.2 billion in February. February's figure was revised up from a surplus of €19.0 billion.

The surplus on goods rose to €31.0 billion in March from €24.2 billion in February.

The surplus on services remained unchanged at €6.9 billion in March.

The primary income surplus increased to €2.3 billion in March from €1.9 billion in February, while the secondary income deficit was down to €12.9 billion from €13.9 billion.

Eurozone's unadjusted current account surplus climbed to €32.3 billion in March from €11.2 billion in February. February's figure was revised up from a surplus of €11.1 billion.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices rose 0.1% in April, missing expectations for a 0.2% rise, after a flat reading in March.

On a yearly basis, German PPI dropped 3.1% in April, missing expectations for a 3.0% decrease, after a 3.1% fall in March.

Current figures:

Name Price Change Change %

FTSE 100 6,135.11 +81.76 +1.35 %

DAX 9,872.17 +76.28 +0.78 %

CAC 40 4,322.33 +39.79 +0.93 %

-

11:22

German producer prices rise 0.1% in April

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices rose 0.1% in April, missing expectations for a 0.2% rise, after a flat reading in March.

On a yearly basis, German PPI dropped 3.1% in April, missing expectations for a 3.0% decrease, after a 3.1% fall in March.

PPI excluding energy sector fell by 1.0% year-on-year in April.

Energy prices were down 8.8% year-on-year in April.

Consumer non-durable goods prices fell 0.4% year-on-year in April, intermediate goods sector prices decreased by 2.6%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.3%.

-

10:58

Eurozone’s current account surplus climbs to a seasonally adjusted €27.3 billion in March

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €27.3 billion in March from €19.2 billion in February. February's figure was revised up from a surplus of €19.0 billion.

The surplus on goods rose to €31.0 billion in March from €24.2 billion in February.

The surplus on services remained unchanged at €6.9 billion in March.

The primary income surplus increased to €2.3 billion in March from €1.9 billion in February, while the secondary income deficit was down to €12.9 billion from €13.9 billion.

Eurozone's unadjusted current account surplus climbed to €32.3 billion in March from €11.2 billion in February. February's figure was revised up from a surplus of €11.1 billion.

-

10:20

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 42.6 in in the week ended May 15

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 42.6 in in the week ended May 15 from 41.7 the prior week.

The increase was mainly driven by a more favourable assessment of the U.S. economy. The measure of views of the economy was up to 32.4 from 30.6, the buying climate index decreased to 38.9 from 39.1, while the personal finances index rose to 56.5 from 55.4.

-

10:07

Bank of England Monetary Policy Committee member Gertjan Vlieghe: more stimulus measures could be needed if the U.K. economy does not recover after the referendum

Bank of England (BoE) Monetary Policy Committee (MPC) member Gertjan Vlieghe said in a speech on Thursday that more stimulus measures could be needed if the U.K. economy does not recover after the referendum on Britain's membership in the European Union (EU). He added that higher inflation target or helicopter money were not options.

Vlieghe pointed out that the economic growth in the U.K. slowed since 2014.

-

09:16

WSE: After opening

The WIG20 futures (WSE: FW20M16) started the day in positive territory, 7 points above yesterday's close. It's a reaction to the somewhat gentler closing of yesterday's session in the US as well as the adjustment to the morning moods in Euroland, where contracts for major European indices rise with a similar extent. Therefore in the morning, the bears have no fuel to continue the decline, which does not mean that this situation will continue in the coming trading hours.

WIG20 index opened at 1800.76 points (+0.05%)*

WIG 45770.12 0.04%

WIG30 2003.33 0.04%

mWIG40 3508.83 0.15%

*/ - change to previous close

The WIG20 begin today's session from return over yesterday affected level of 1,800 points, what may be interpreted as an attempt to rebound. Conducive in such a scenario is the rebound of yesterday's declines in Euroland. Among blue chips the only negative distinction is more than 1 percent decrease of Bank Pekao (WSE: PEO) after the information that UniCredit is considering selling part of its assets, including Bank Pekao, to increase equity.

-

08:26

WSE: Before opening

Thursday's session on Wall Street was dominated by speculation about the June rate hike. When Europe ended its trading the S&P500 index only looked for the bottom of the session and shortly after the close of trading in Frankfurt rebounded, reducing drop by several points. The loss of the S&P500 was barely by 7 points, so the second half of the US session was better and now growing contracts for the DAX and the S&P500 predict an increase in the DAX at the opening. It will not reduce the yesterday's loss in Germany, but a change of mood in the environment will be clear.

On the Warsaw Stock Exchange we are at an important point of the WIG20. Yesterday's drop in Warsaw caused as much by pressure from the environment, as weakening of Polish zloty was translated into not only a strong sell-off, but also a violation by the index of the psychological barrier of 1,800 points.

The potential morning growth in Europe may strengthen the already observed appetites of bulls on defense support in the region of 1,800 points. We also see a slight improvement in trading of the domestic currency, which should help the demand side.

-

06:25

Global Stocks

U.K. stocks moved sharply lower on Thursday after the U.S. Federal Reserve signaled an interest-rate increase in June is still on the table if the economy continues to improve. A crashed EgyptAir plane also hurt sentiment, dragging shares in travel operators and airlines lower.

U.S. stocks recovered some of the early losses but ended lower Thursday on mounting fears that the Federal Reserve's next interest-rate hike could come as early as June. Thursday's moves follow the release of minutes from the Fed's latest meeting, which emphasized the central bank's intent to raise interest rates soon, provided the U.S. economy continues to strengthen.

Asian stocks swung between gains and losses as investors assess what a U.S. interest-rate increase as soon as next month will mean for global economic growth. Minutes of the Federal Reserve's April meeting released this week indicated policy makers may be readying to raise U.S. interest rates as soon as next month. That sent the odds for a June increase to as high as 33 percent from 4 percent on Monday, though has since eased to a 28 percent chance. Traders see a higher probability for an increase by September, with the likelihood seen at 58 percent.

Based on MarketWatch materials

-

04:01

Nikkei 225 16,671.5 +24.84 +0.15 %, Hang Seng 19,846.73 +152.40 +0.77 %, Shanghai Composite 2,795.46 -11.45 -0.41 %

-

01:05

Stocks. Daily history for Sep Apr May 19’2016:

(index / closing price / change items /% change)

Nikkei 225 16,646.66 +1.97 +0.01 %

Hang Seng 19,694.33 -132.08 -0.67 %

S&P/ASX 200 5,323.34 -32.82 -0.61 %

Shanghai Composite 2,807.33 -0.18 -0.01 %

FTSE 100 6,053.35 -112.45 -1.82 %

CAC 40 4,282.54 -36.76 -0.85 %

Xetra DAX 9,795.89 -147.34 -1.48 %

S&P 500 2,040.04 -7.59 -0.37 %

NASDAQ Composite 4,712.53 -26.59 -0.56 %

Dow Jones 17,435.4 -91.22 -0.52 %

-