Noticias del mercado

-

17:27

Bank of England's Monetary Policy Committee member Kristin Forbes: uncertainty around the referendum on Britain’s membership in the European Union is weighing on businesses and on investment

The Bank of England's (BoE) Monetary Policy Committee member Kristin Forbes said in an interview with the Belfast Telegraph on Friday that uncertainty around the referendum on Britain's membership in the European Union (EU) was weighing on businesses and on investment.

"We don't have concrete evidence that some of the softening we are seeing now is all referendum-related and uncertainty related, and there is a chance other things are going on," she added.

-

17:15

European Central Bank Governing Council member Jozef Makuch: there is no need in further stimulus measures at the moment

The European Central Bank (ECB) Governing Council member Jozef Makuch said on Friday that there was no need in further stimulus measures at the moment. The recent stimulus measures needed more time to take effect, he added.

Makuch noted that he was confident the stimulus measures would work.

-

17:02

European Central Bank Governing Council member Ardo Hansson: there is no need in further stimulus measures at the moment

The European Central Bank (ECB) Governing Council member Ardo Hansson said on Friday that there was no need in further stimulus measures at the moment.

"Right now we just wait and see," he said.

Hansson hinted that the governments would delay the implementation of reforms.

-

16:38

European Central Bank Executive Board member Benoit Coeure: the ECB has no plans to cut its deposit rate further

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with the Japanese newspaper The Yomiuri Shimbun on Friday that the central bank had no plans to cut its deposit rate further.

"It is in principle possible to cut this rate further, but there is currently no plan to do so," he said.

Coeure noted that the lending to banks was more important than the negative interest rate.

He also said that the ECB's stimulus measures were working.

-

16:28

Greece’s current account narrows to €0.71 billion in March

The Bank of Greece released its current account data on Friday. Greece's current account deficit narrowed to €0.71 billion in March from €1.48 billion in March last year.

The Greek deficit on trade in goods declined to €1.53 billion in March from €1.97 billion in March last year, while the services surplus fell to €343 million from €467 million.

The primary income surplus jumped to €432 million in March from €74 million in March last year, while the deficit on secondary income turned into a surplus of €47 million from a deficit of €52 million last year.

The capital account surplus slid to €57 million in March from €321 million last year.

-

16:15

U.S. existing homes sales climb 1.7% in April

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes climbed 1.7% to a seasonally adjusted annual rate of 5.45 million in April from 5.36 in March. March's figure was revised up from 5.33 million units.

Analysts had expected an increase to 5.40 million units.

"Primarily driven by a convincing jump in the Midwest, where home prices are most affordable, sales activity overall was at a healthy pace last month as very low mortgage rates and modest seasonal inventory gains encouraged more households to search for and close on a home," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 32% in April from 30% in March.

"Looking ahead, with demand holding steady and supply levels still far from sufficient, the market for entry-level and mid-priced homes will likely continue to be the most competitive heading into the summer months," Yun said.

-

16:00

U.S.: Existing Home Sales , April 5.45 (forecast 5.4)

-

15:55

The European Central Bank (ECB) Governing Council member Ewald Nowotny said on Friday that the central bank was closely monitoring how fast inflation in the Eurozone would pick up in the second half of the year

-

15:52

The European Central Bank Governing Council member Erkki Liikanen: inflation in the Eurozone should be above 2% target for a while

The European Central Bank (ECB) Governing Council member Erkki Liikanen said on Friday that inflation in the Eurozone should be above 2% target for a while.

"You can never have average inflation close to 2 percent if you are never above 2; it's arithmetic," he said.

"We must be consistent in both ways," Liikanen added.

-

15:45

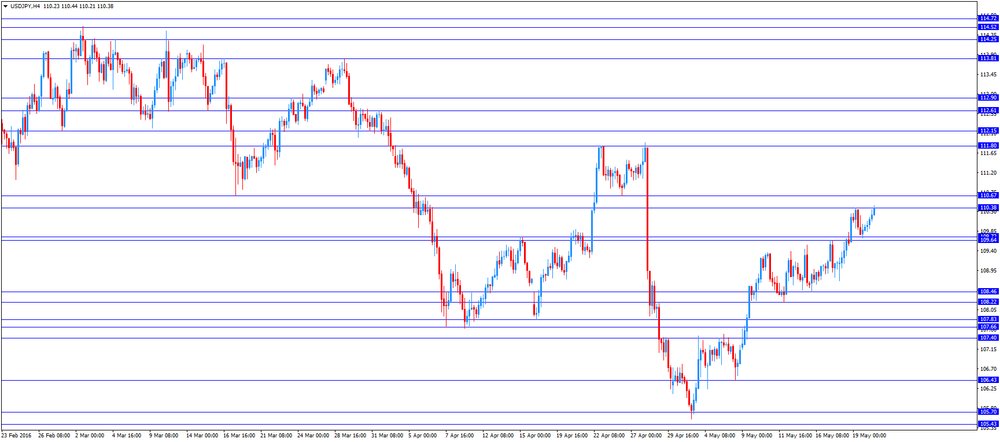

Option expiries for today's 10:00 ET NY cut

USDJPY 108.75-80 (USD 400m) 109.00 (448m) 109.50 (559m) 110.00 250m) 111.00 (285m) 111.55 (600m)

EURUSD: 1.1000 (EUR 622m) 1.1100 (202m) 1.1125 (305m) 1.1135 (475m) 1.1150 (300m) 1.1210 (442m) 1.1245-50 (905m) 1.1300 (380m) 1.1500 (1.07bln)

GBPUSD 1.4600 (GBP 927m)

USDCHF 1.0100 (USD 500m)

EURGBP 0.7745 (EUR 340m)

AUDUSD 0.7075 (AUD 311m) 0.7150 (232m) 0.7200 (497m) 0.7300 (274m) 0.7360 (932m) 0.7400 (334m) 0.7450 (239m) 0.7500 (812m) 0.7500 (1.07bln)

USDCAD 1.2945 (USD 4.52bln) 1.3000-05 (853m)

NZDUSD 0.6750-52 (NZD 519m) 0.6800 (609m) 0.6810 (338m) 0.6850 (271m)

EURJPY 120.00 (EUR 200m) 120.75 (400m) 125.50-53 (1.25bln)

-

14:57

Canadian consumer price inflation rises 0.3% in April

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.3% in April, in line with expectations, after a 0.6% gain in March.

The monthly rise was mainly driven by an increase in prices for transportation, which were up 2.0% in April.

On a yearly basis, the consumer price index climbed to 1.7% in April from 1.3% in March, in line with expectations.

The consumer price index was mainly driven by higher food and shelter prices. Food prices climbed 3.2% year-on-year in April, while shelter prices increased 1.4%.

The index for recreation, education and reading climbed by 2.4% in April from the same month a year earlier, the gasoline prices dropped 5.8%, while clothing and footwear prices declined 0.2%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.2% in April, after a 0.3% rise in March.

On a yearly basis, core consumer price index in Canada climbed to 2.2% in April from 2.1% in March. Analysts had expected the index to drop to 2.0%.

The Bank of Canada's inflation target is 2.0%.

-

14:43

Canadian retail sales drop by 1.0% in March

Statistics Canada released retail sales data on Friday. Canadian retail sales dropped by 1.0% in March, missing expectations for a 0.6% fall, after a 0.6% increase in February. February's figure was revised up from a 0.4% rise.

The decrease was driven by drops in 6 of 11 subsectors.

Sales at motor vehicle and parts dealers slid by 2.9% in March, while sales at general merchandise stores increased by 0.4%.

Sales at gasoline stations declined 1.1% in March, while sales at food and beverage stores were down 0.4%.

Sales at building material and garden equipment and supplies dealers decreased 0.7% in March, while sales at furniture and home furnishings stores plunged 3.7%.

Canadian retail sales excluding automobiles fell 0.3% in March, beating expectations for a 0.4% fall, after a 0.3% increase in February. February's figure was revised up from a 0.2% gain.

-

14:31

Canada: Bank of Canada Consumer Price Index Core, y/y, April 2.2% (forecast 2%)

-

14:30

Canada: Consumer price index, y/y, April 1.7% (forecast 1.7%)

-

14:30

Canada: Retail Sales, m/m, March -1.0% (forecast -0.6%)

-

14:30

Canada: Consumer Price Index m / m, April 0.3% (forecast 0.3%)

-

14:30

Canada: Retail Sales ex Autos, m/m, March -0.3% (forecast -0.4%)

-

14:22

CBI industrial order books balance rises to -8 in May

The Confederation of British Industry (CBI) released its industrial order books balance on Friday. The CBI industrial order books balance rose to -8 in May from -11 in April, beating expectations for a decline to -13.

Total orders increased slightly in May, while exports orders were largely unchanged.

"Conditions in the manufacturing sector seem to be a little better overall, with improving order books compared with a couple of months ago. But domestic and global uncertainty remains high, alongside lacklustre export demand," the CBI director of economics Rain Newton-Smith said.

"Despite recent choppiness in emerging markets, China and India remain significant sources of potential demand," she added.

-

14:13

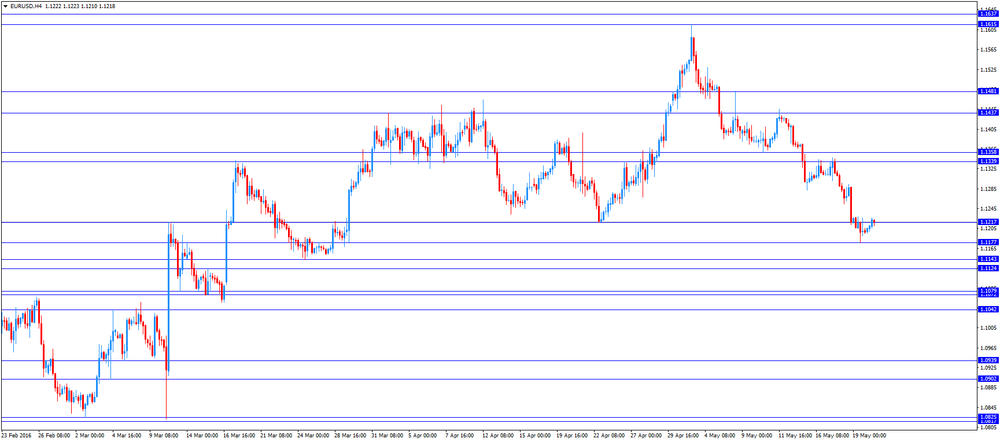

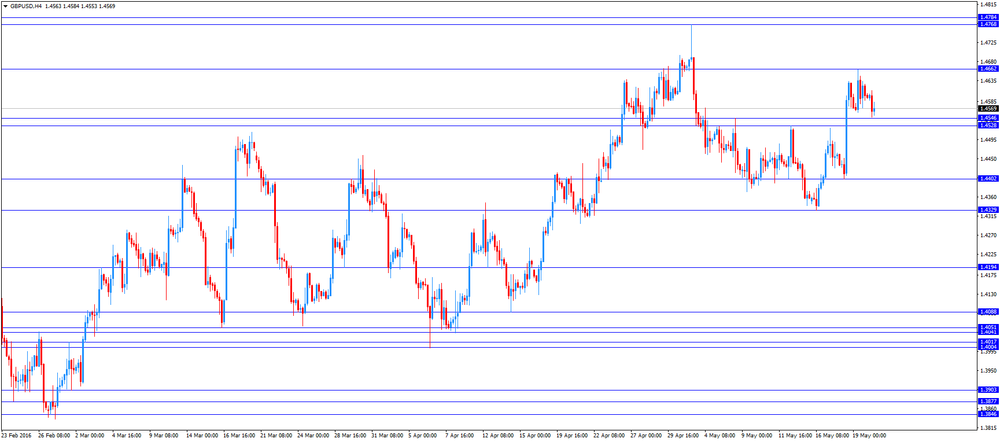

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the current account data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 G7 G7 Meetings

06:00 Germany Producer Price Index (MoM) April 0% 0.2% 0.1%

06:00 Germany Producer Price Index (YoY) April -3.1% -3% -3.1%

08:00 Eurozone Current account, unadjusted, bln March 11.2 Revised From 11.1 32.3

10:00 United Kingdom CBI industrial order books balance May -11 -13 -8

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. home sales data. The existing home sales in the U.S. are expected to rise to 5.40 million units in April from 5.33 million units in March.

The euro traded mixed against the U.S. dollar after the release of the current account data from the Eurozone. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €27.3 billion in March from €19.2 billion in February. February's figure was revised up from a surplus of €19.0 billion.

The surplus on goods rose to €31.0 billion in March from €24.2 billion in February.

The surplus on services remained unchanged at €6.9 billion in March.

The primary income surplus increased to €2.3 billion in March from €1.9 billion in February, while the secondary income deficit was down to €12.9 billion from €13.9 billion.

Eurozone's unadjusted current account surplus climbed to €32.3 billion in March from €11.2 billion in February. February's figure was revised up from a surplus of €11.1 billion.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices rose 0.1% in April, missing expectations for a 0.2% rise, after a flat reading in March.

On a yearly basis, German PPI dropped 3.1% in April, missing expectations for a 3.0% decrease, after a 3.1% fall in March.

The British pound traded mixed against the U.S. dollar. The Confederation of British Industry (CBI) released its industrial order books balance on Friday. The CBI industrial order books balance rose to -8 in May from -11 in April, beating expectations for a decline to -13.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to rise to 1.7% year-on-year in April from 1.3% in March.

The core consumer price index in Canada is expected to fall 2.0% year-on-year in April from 2.1% in March.

Canadian retail sales are expected to decrease 0.6% in March, after a 0.4% rise in February.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y110.38

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m March 0.4% -0.6%

12:30 Canada Retail Sales ex Autos, m/m March 0.2% -0.4%

12:30 Canada Consumer Price Index m / m April 0.6% 0.3%

12:30 Canada Consumer price index, y/y April 1.3% 1.7%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April 2.1% 2%

14:00 U.S. Existing Home Sales April 5.33 5.4

-

14:00

Orders

EUR/USD

Offers 1.1230 1.1250 1.1280-85 1.1300 1.1325 1.1355-60 1.1380 1.1400

Bids1.1200 1.1185 1.1165 1.1150 1.1125-30 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers 1.4600-10 1.4630 1.4650 1.4670 1.4685 1.4700 1.4730 1.4750

Bids 1.4550 1.4520 1.4500 1.4485 1.4470 1.4450 1.4420-25 1.4400

EUR/GBP

Offers 0.7720 0.7735 0.7750 0.7785 0.7800 0.7820 0.7830-35 0.7850

Bids 0.7675-80 0.7650 0.7625-30 0.7600 0.7580 0.7550 0.7530 0.7500

EUR/JPY

Offers 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50

Bids 123.30 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers 110.50 110.65 110.80 111.00 111.30 111.50 111.75-80 112.00

Bids 110.00 109.85 109.70 109.50 109.40 109.00 108.75-80 108.50 108.30 108.20 108.00

AUD/USD

Offers 0.7250 0.7260 0.7280 0.7300 0.7325-30 0.7350 0.7365 0.7380 0.7400

Bids 0.7220 0.7200 0.7180-85 0.7165 0.7150 0.7130 0.7100

-

12:00

United Kingdom: CBI industrial order books balance, May -8 (forecast -13)

-

11:22

German producer prices rise 0.1% in April

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices rose 0.1% in April, missing expectations for a 0.2% rise, after a flat reading in March.

On a yearly basis, German PPI dropped 3.1% in April, missing expectations for a 3.0% decrease, after a 3.1% fall in March.

PPI excluding energy sector fell by 1.0% year-on-year in April.

Energy prices were down 8.8% year-on-year in April.

Consumer non-durable goods prices fell 0.4% year-on-year in April, intermediate goods sector prices decreased by 2.6%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.3%.

-

11:08

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.75-80 (USD 400m) 109.00 (448m) 109.50 (559m) 110.00 250m) 111.00 (285m) 111.55 (600m)

EUR/USD: 1.1000 (EUR 622m) 1.1100 (202m) 1.1125 (305m) 1.1135 (475m) 1.1150 (300m) 1.1210 (442m) 1.1245-50 (905m) 1.1300 (380m) 1.1500 (1.07bln)

GBP/USD 1.4600 (GBP 927m)

USD/CHF 1.0100 (USD 500m)

EUR/GBP 0.7745 (EUR 340m)

AUD/USD 0.7075 (AUD 311m) 0.7150 (232m) 0.7200 (497m) 0.7300 (274m) 0.7360 (932m) 0.7400 (334m) 0.7450 (239m) 0.7500 (812m) 0.7500 (1.07bln)

USD/CAD 1.2945 (USD 4.52bln) 1.3000-05 (853m)

NZD/USD 0.6750-52 (NZD 519m) 0.6800 (609m) 0.6810 (338m) 0.6850 (271m)

EUR/JPY 120.00 (EUR 200m) 120.75 (400m) 125.50-53 (1.25bln)

-

10:58

Eurozone’s current account surplus climbs to a seasonally adjusted €27.3 billion in March

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €27.3 billion in March from €19.2 billion in February. February's figure was revised up from a surplus of €19.0 billion.

The surplus on goods rose to €31.0 billion in March from €24.2 billion in February.

The surplus on services remained unchanged at €6.9 billion in March.

The primary income surplus increased to €2.3 billion in March from €1.9 billion in February, while the secondary income deficit was down to €12.9 billion from €13.9 billion.

Eurozone's unadjusted current account surplus climbed to €32.3 billion in March from €11.2 billion in February. February's figure was revised up from a surplus of €11.1 billion.

-

10:20

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 42.6 in in the week ended May 15

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 42.6 in in the week ended May 15 from 41.7 the prior week.

The increase was mainly driven by a more favourable assessment of the U.S. economy. The measure of views of the economy was up to 32.4 from 30.6, the buying climate index decreased to 38.9 from 39.1, while the personal finances index rose to 56.5 from 55.4.

-

10:07

Bank of England Monetary Policy Committee member Gertjan Vlieghe: more stimulus measures could be needed if the U.K. economy does not recover after the referendum

Bank of England (BoE) Monetary Policy Committee (MPC) member Gertjan Vlieghe said in a speech on Thursday that more stimulus measures could be needed if the U.K. economy does not recover after the referendum on Britain's membership in the European Union (EU). He added that higher inflation target or helicopter money were not options.

Vlieghe pointed out that the economic growth in the U.K. slowed since 2014.

-

10:00

Eurozone: Current account, unadjusted, bln , March 32.3

-

08:38

Options levels on friday, May 20, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1419 (4796)

$1.1342 (2942)

$1.1286 (2887)

Price at time of writing this review: $1.1208

Support levels (open interest**, contracts):

$1.1147 (3367)

$1.1122 (9333)

$1.1092 (5047)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68534 contracts, with the maximum number of contracts with strike price $1,1550 (4932);

- Overall open interest on the PUT options with the expiration date June, 3 is 88952 contracts, with the maximum number of contracts with strike price $1,1200 (9333);

- The ratio of PUT/CALL was 1.30 versus 1.30 from the previous trading day according to data from May, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.4902 (1944)

$1.4804 (1620)

$1.4708 (1858)

Price at time of writing this review: $1.4607

Support levels (open interest**, contracts):

$1.4494 (1278)

$1.4396 (1474)

$1.4298 (2630)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 31589 contracts, with the maximum number of contracts with strike price $1,4600 (2469);

- Overall open interest on the PUT options with the expiration date June, 3 is 34143 contracts, with the maximum number of contracts with strike price $1,4200 (2932);

- The ratio of PUT/CALL was 1.08 versus 1.07 from the previous trading day according to data from May, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Asian session: The dollar held at its highest in nearly two months

The dollar held at its highest in nearly two months against a basket of major currencies early on Friday, on track for a third week of gains as investors awaken to the risk of a hike in U.S. interest rates as early as next month. New York Federal Reserve President William Dudley on Thursday said the U.S. economy could be strong enough to warrant a rate increase in June or July. His comments reinforced surprisingly clear signals of a possibly imminent rate hike in minutes of the Federal Reserve's April policy meeting and underpinned an already-firm greenback.

For potential cues the currency market awaited the G7 meeting of central bankers and finance ministers kicking off on Friday in the northern Japanese city of Sendai, although the event's potential impact may have lessened since the yen's bull run has ended.

The yen's surge to an 18-month high versus the greenback earlier this month had prompted threats of intervention from Japanese authorities. U.S. Treasury Secretary Jack Lew, on the other hand, said that he saw no "disorderly" moves in the market that warrants intervention. A standout performer was sterling, which rose broadly after a robust UK retail sales report diminished chances of an interest rate cut that some investors were factoring in.

EUR/USD: during the Asian session the pair traded in the range of $1.1195-10

GBP/USD: during the Asian session the pair traded in the range of $1.4590-05

USD/JPY: during the Asian session the pair climbed to Y110.10

Based on Reuters materials

-

08:00

Germany: Producer Price Index (MoM), April 0.1% (forecast 0.2%)

-

08:00

Germany: Producer Price Index (YoY), April -3.1% (forecast -3%)

-

01:04

Currencies. Daily history for May 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1197 -0,17%

GBP/USD $1,4600 +0,03%

USD/CHF Chf0,9906 +0,29%

USD/JPY Y109,95 -0,21%

EUR/JPY Y123,11 -0,38%

GBP/JPY Y160,53 -0,17%

AUD/USD $0,7221 -0,01%

NZD/USD $0,6737 +0,03%

USD/CAD C$1,3097 +0,54%

-

00:47

New Zealand: Visitor Arrivals, April 8%

-

00:01

Schedule for today, Friday, May 20’2016:

(time / country / index / period / previous value / forecast)

06:00 Germany Producer Price Index (MoM) April 0% 0.2%

06:00 Germany Producer Price Index (YoY) April -3.1% -3%

08:00 Eurozone Current account, unadjusted, bln March 11.1

10:00 United Kingdom CBI industrial order books balance May -11 -13

12:30 Canada Retail Sales YoY March 5.6%

12:30 Canada Retail Sales, m/m March 0.4% -0.6%

12:30 Canada Retail Sales ex Autos, m/m March 0.2% -0.4%

12:30 Canada Consumer Price Index m / m April 0.6% 0.3%

12:30 Canada Consumer price index, y/y April 1.3% 1.7%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April 2.1% 2%

14:00 U.S. Existing Home Sales April 5.33 5.4

-