Noticias del mercado

-

20:20

American focus: The US dollar lost ground against the previously-earned euros

The euro rose against the dollar mildly, returning to the level of opening of the session, which was caused by the publication of weak US data. The Markit Economics reported that the preliminary manufacturing PMI fell to 50.5 in May from 50.8 in April, giving way to increasing expectations to 51.0. It was the lowest level since September 2009. The decrease was due to lower production and weaker growth in new orders. "PMI manufacturing data cast doubt on the ability of the US economy to rebound from a disappointing start of the year in the second quarter," - said the chief economist at Markit Chris Williamson.

In the course of trading and continued to influence mixed indicators on business activity in the euro area. Preliminary results of a survey by Markit showed that private sector growth in the euro zone eased to 16-month low in May. Composite PMI fell unexpectedly to 52.9 in May from 53 in April. According to forecasts, the index is expected to grow to 53.2. Managers' Index for the service sector purchases remained at 53.1, while experts waited increasing to 53.3. The manufacturing PMI fell to 51.5 from 51.7 in April. Economists had expected the index to improve to 51.9. Chris Williamson, chief economist at Markit, said: "The disappointing PMI data for May suggest that robust economic growth, which saw in the first quarter, will be temporary PMI index indicates a GDP growth of only 0.3 percent in the second quarter." . In addition, it became known that the French private sector growth improved to 7-month high in May. The composite output index rose to 51.1 in May, a 7-month high, from 50.2 in April. in the service sector Purchasing Managers Index rose to 51.8, while, according to forecasts, it was to remain at 50.6, as it was registered in April. The manufacturing PMI reached 48.3 against 48 in April. It was below the expected reading of 48.8. Another report showed that Germany's private sector activity grew at a faster pace in May. The composite output index rose to a 5-month high of 54.7 in May from 53.6 in April. Manufacturers and service providers reported higher growth rates, which some respondents attributed to the processes of work in progress and the increase in new orders.

The pound rebounded against the dollar, reaching the opening level. Since today, Britain has not published any reports on the course of trading influenced speculation about Brexit. According to the latest information agency TNS, the results of the online survey showed that output supporters of EU staff ahead of opponents Brexit: 41% in favor of withdrawal from the EU, 38% - against Brexit, and 21% - difficult to answer. Later this week, investors will be watching the consumer confidence index of the UK, as well as the report on GDP. Given the economic slowdown, the rise of political uncertainty and the decline in the index GfK in the last month, experts predict that the consumer confidence index drops again. Meanwhile, the second estimate of GDP for the 1st quarter, is likely to confirm the early predictions of slowing economic growth. According to expert estimates, GDP grew by 0.4% after rising 0.6% in the 4th quarter of 2015. In annual terms, GDP growth is expected to stabilize at 2.1%.

-

17:40

San Francisco Fed President John Williams: the Fed could raise its interest rate in June or in July

San Francisco Fed President John Williams said on Monday that the Fed could raise its interest rate in June or in July. He added that the referendum on Britain's membership in the European Union (EU) would be taken into account in June.

San Francisco Fed president expects two or three interest rate hikes this year.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:31

Australia’s leading economic index rises 0.1% in March

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) rose 0.1% in March, after a 0.3% decline in February.

The coincident index increased 0.3% in March, after a 0.2% rise in February.

-

17:01

St. Louis Federal Reserve President James Bullard: low interest rates for a longer period could lead to financial instability in future

St. Louis Federal Reserve President James Bullard said on Monday that low interest rates for a longer period could lead to financial instability in future.

"I do worry that keeping rates too low for too long could feed into future financial instability even if it doesn't look like we're in that situation today," he said.

St. Louis Federal Reserve president noted that interest rate hikes would depend on the economic data.

He pointed out that the referendum on Britain's membership in the European Union (EU) would not weigh on the Fed's interest rate decision in June.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:55

European Central Bank purchases €16.19 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €16.19 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €907 million of covered bonds, and €142 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:13

Eurozone’s preliminary consumer confidence index rises to -7 in May

The European Commission released its preliminary consumer confidence figures for the Eurozone on Monday. Eurozone's preliminary consumer confidence index rose to -7 in May from -9.3 in April. Analysts had expected the index to increase to -9.0.

European Union's consumer confidence index increased by 1.1 points to 5.7 in May.

-

16:00

Eurozone: Consumer Confidence, May -7 (forecast -9)

-

15:52

U.S. preliminary manufacturing purchasing managers' index declines to 50.5 in May, the lowest level since September 2009

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 50.5 in May from 50.8 in April, missing expectations for an increase to 51.0. It was the lowest level since September 2009.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a fall in output and a softer pace of expansion in new business.

"The weak manufacturing PMI data cast doubt on the ability of the US economy to rebound from its disappointing start to the year in the second quarter," Markit Chief Economist Chris Williamson said.

"The survey is signalling that manufacturing will act as a drag on economic growth in the second quarter, leaving the economy once again dependent on the service sector, and consumers in particular, to sustain growth," he added.

-

15:45

U.S.: Manufacturing PMI, May 50.5

-

15:38

Japan's final leading index increases to 99.3 in March

Japan's Cabinet Office released its final leading index data on Monday. The leading index increased to 99.3 in March from 98.9 in February, up from the preliminary estimate of 98.4.

Japan's coincident index was up to 111.1 in March from 110.7 in February, down from the preliminary reading of 111.2.

-

15:30

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 689m) 110.00 (588m) 111.00 (220m) 11195-112.00 (413m)

EUR/USD: 1.1055-75 (EUR 809m) 1.1200 (834 m) 1.1250-55 (385m) 1.1275 (214m) 1.1300-05 (506m) 1.1350 (208m)

USD/CHF 0.9800 (USD 240m) 0.9900 (380m)

AUD/USD 0.7150 (AUD 403m) 0.7300 (801m)

NZD/USD 0.6725 (NZD 282m) 0.6840 (230m)

-

14:34

Japan’s all industry activity index rises 0.1% in March

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Monday. The index rose 0.1% in March, missing expectations for a 0.7% gain, after a 0.9% drop in February. February's figure was revised down from a 1.2% decrease.

Construction industry activity index fell 1.6% in March, industrial production index jumped 3.8%, while tertiary industry activity decreased 0.7%.

-

14:12

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the PMI data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 Japan Manufacturing PMI (Preliminary) May 48.2 47.6

04:30 Japan All Industry Activity Index, m/m March -0.9% Revised From -1.2% 0.7% 0.1%

05:00 Japan Leading Economic Index (Finally) March 96.8 98.4 93.3

05:00 Japan Coincident Index (Finally) March 110.7 111.2 111.1

07:00 France Manufacturing PMI (Preliminary) May 48 48.8 48.3

07:00 France Services PMI (Preliminary) May 50.6 50.6 51.8

07:30 Germany Manufacturing PMI (Preliminary) May 51.8 52 52.4

07:30 Germany Services PMI (Preliminary) May 54.5 54.6 55.2

08:00 Eurozone Services PMI (Preliminary) May 53.1 53.3 53.1

08:00 Eurozone Manufacturing PMI (Preliminary) May 51.7 51.9 51.5

09:30 U.S. FOMC Member James Bullard Speaks

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to rise to 51.0 in May from 50.8 in April.

The euro traded lower against the U.S. dollar after the release of the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0. Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6. The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8. The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6. The services index was driven by rises in new orders, employment and input prices.

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

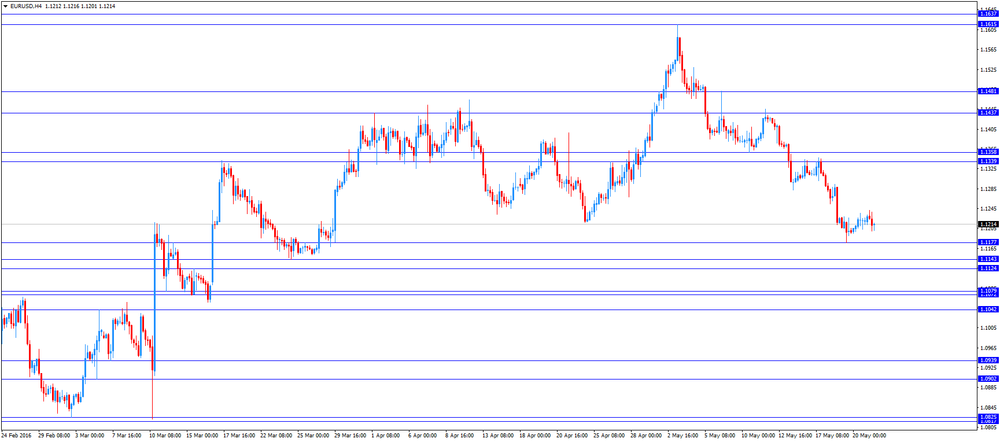

EUR/USD: the currency pair fell to $1.1200

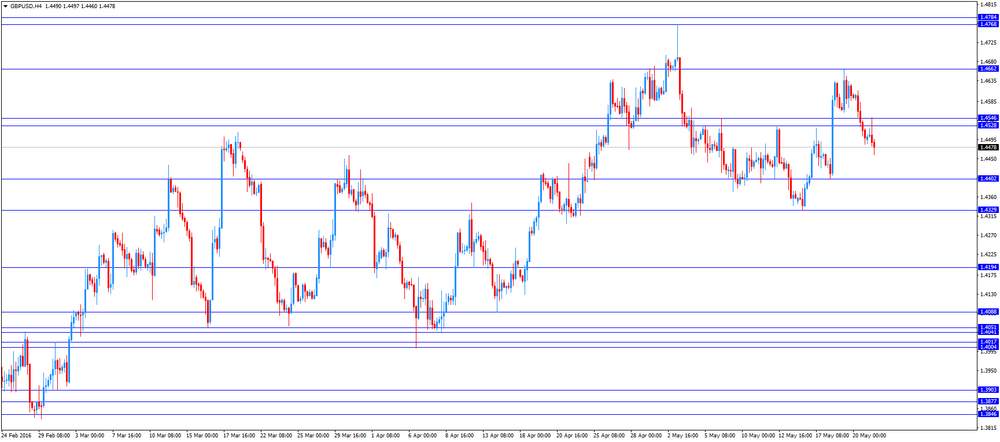

GBP/USD: the currency pair declined to $1.4460

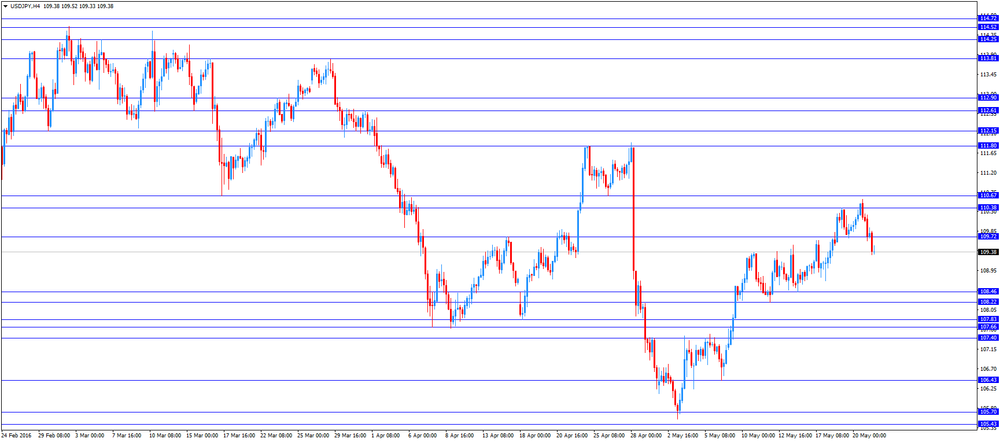

USD/JPY: the currency pair dropped to Y109.31

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Preliminary) May 50.8

14:00 Eurozone Consumer Confidence (Preliminary) May -9.3 -9

-

13:48

Orders

EUR/USD

Offers : 1.1250 1.1280-85 1.1300 1.1325 1.1355-60 1.1380 1.1400

Bids: 1.1200 1.1185 1.1165 1.1150 1.1125-30 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers : 1.4525-30 1.4550 1.4575 1.4600-10 1.4630 1.4650 1.4670 1.4685 1.4700

Bids: 1.4480 1.4465 1.4450 1.4420-25 1.4400 1.4385 1.4350

EUR/GBP

Offers : 0.7755-60 0.7785 0.7800 0.7820 0.7830-35 0.7850

Bids: 0.7725 0.7700 0.7675-80 0.7650 0.7625-30 0.7600 0.7580 0.7550

EUR/JPY

Offers : 123.60 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50

Bids: 123.20 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers : 109.85 110.00 110.20-35 110.50 110.65 110.80 111.00 111.30 111.50

Bids: 109.50 109.40 109.00 108.75-80 108.50 108.30 108.20 108.00

AUD/USD

Offers : 0.7260 0.7280 0.73000.7325-30 0.7350 0.7365 0.7380 0.7400

Bids: 0.7235 0.7220 0.7200 0.7180-85 0.7165 0.7150 0.7130 0.7100

-

11:47

European Central Bank chief economist Peter Praet: the ECB could cut its interest rates further but it would depend on conditions

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

"Interest rates are still in the tool box. The question is of course the conditions under which we would decide to use that instrument, because it is clear that the negative rates at some point have also side effects that start to become more important, namely on the profitability of banks," he said.

Praet noted that the ECB was independent.

"I don't think the Governing Council changes in any way its capacity to decide because of political debates. We do what we have to do as good central bankers," the ECB chief economist said.

-

11:36

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 47.6 in May

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 47.6 in May from 48.2 in April. It was the lowest level since December 2012.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was mainly driven by drop in output and new orders.

"Manufacturing conditions deteriorated at a faster rate mid-way through the second quarter of 2016, suggesting the aftermath of the earthquakes were still weighing heavily on goods producers. Both production and new orders declined sharply and at the quickest rates in 25 and 41 months respectively," economist at Markit, Amy Brownbill, said.

-

11:20

France's preliminary manufacturing and services PMIs increase in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8.

The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6.

The services index was driven by rises in new orders, employment and input prices.

"First-quarter GDP data showed a surprisingly punchy 0.5% expansion, but the PMIs continue to point to a more subdued trend in private sector activity midway through the second quarter," the Senior Economist at Markit Jack Kennedy said.

-

11:13

Germany's preliminary manufacturing and services PMIs rise in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0.

Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6.

The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

"A first look at today's survey results is encouraging, as output growth accelerated for the first time in 2016 so far. However, we should not be too complacent about these numbers and should instead view them with some caution," Markit's economist Oliver Kolodseike noted.

-

11:04

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 689m) 110.00 (588m) 111.00 (220m) 11195-112.00 (413m)

EUR/USD: 1.1055-75 (EUR 809m) 1.1200 (834 m) 1.1250-55 (385m) 1.1275 (214m) 1.1300-05 (506m) 1.1350 (208m)

USD/CHF 0.9800 (USD 240m) 0.9900 (380m)

AUD/USD 0.7150 (AUD 403m) 0.7300 (801m)

NZD/USD 0.6725 (NZD 282m) 0.6840 (230m)

-

11:03

Eurozone's preliminary manufacturing PMI falls in May, while services PMIs remains unchanged

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

-

10:37

Japanese Finance Minister Taro Aso: Japan will not devaluate its currency

Japanese Finance Minister Taro Aso said on Friday that the country would not devaluate its currency.

"Japan is committed to refraining from competitive devaluation," he said.

Aso noted that "excessive volatility" would have a negative impact on the economy.

-

10:12

Preliminary real GDP in the OECD area climbs 0.4% in the first quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Thursday. Real GDP of 34 OECD member countries rose 0.4% in the first quarter, after a 0.4% gain in the fourth quarter.

Real GDP of the United States was down to 0.1% from 0.3%, real GDP of Germany rose to 0.7% from 0.3%, while Britain's economy decreased to 0.4% from 0.6%.

GDP of France increased to 0.5% from 0.3%, Italy's economy was up to 0.3% from 0.2%, while Japan's GDP climbed to 0.4% from -0.4%.

Eurozone's economy expanded at 0.5% in the first quarter, after a 0.3% rise in the fourth quarter.

On a yearly basis, GDP of 34 OECD member countries was down 1.8% in the first quarter, after a 2.0% gain in the previous quarter.

-

10:01

Japan's trade surplus widens to ¥824 billion in April

The Ministry of Finance released its trade data for Japan on the late Sunday evening. Japan's trade surplus rose to ¥824 billion in April from ¥755 billion in March. Analysts had expected a surplus of ¥492.8 billion.

Exports fell 10.1% year-on-year in April, while imports dropped 23.3%.

Exports to Asia declined by 11.1% year-on-year in April, exports to the United States decreased by 11.8%, while exports to the European Union climbed by 9.9%.

Imports from Asia plunged by 19.2% year-on-year in April, imports from the United States slid by 18.1%, while imports from the European Union declined by 8.4%.

-

10:00

Eurozone: Manufacturing PMI, May 51.5 (forecast 51.9)

-

10:00

Eurozone: Services PMI, May 53.1 (forecast 53.3)

-

09:30

Germany: Manufacturing PMI, May 52.4 (forecast 52)

-

09:30

Germany: Services PMI, May 55.2 (forecast 54.6)

-

09:00

France: Manufacturing PMI, May 48.3 (forecast 48.8)

-

09:00

France: Services PMI, May 51.8 (forecast 50.6)

-

08:24

Asian session: The dollar fell versus the yen

The dollar fell versus the yen on Monday, dragged lower by sliding Tokyo stocks and data showing Japan logged a much larger-than-expected trade surplus in April. If a country's exports exceed its imports, as in Japan's recent case, there is in theory a high demand for its goods and therefore for its currency. A Group of 7 finance ministers' meeting concluded on Saturday with the United States warning Japan against intervening to weaken the yen, displaying a well known rift between the two countries on currency intervention.

The U.S. currency got off to a steady start to the week against other major peers, with the dollar index remaining within striking distance of a two-month peak after markets last week moved to price in a greater chance of an imminent hike in U.S. interest rates. Emboldening dollar bulls, recent comments from Federal Reserve officials as well as minutes of the Fed's April meeting have convinced many analysts and investors that a rate hike in June or July is a real possibility.

The resurgent dollar has taken a heavy toll on commodity currencies, none more so than the Australian dollar which was further weighed by expectations of cuts in interest rates at home.

EUR/USD: during the Asian session the pair rose to $1.1240

GBP/USD: during the Asian session the pair rose to $1.4520

USD/JPY: during the Asian session the pair dropped to Y109.60

Based on Reuters materials

-

07:08

Options levels on monday, May 23, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1417 (4795)

$1.1340 (3192)

$1.1286 (2965)

Price at time of writing this review: $1.1225

Support levels (open interest**, contracts):

$1.1166 (3304)

$1.1140 (8240)

$1.1108 (5056)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68803 contracts, with the maximum number of contracts with strike price $1,1550 (4893);

- Overall open interest on the PUT options with the expiration date June, 3 is 88094 contracts, with the maximum number of contracts with strike price $1,1200 (8240);

- The ratio of PUT/CALL was 1.28 versus 1.30 from the previous trading day according to data from May, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.4802 (1719)

$1.4703 (1868)

$1.4606 (2470)

Price at time of writing this review: $1.4514

Support levels (open interest**, contracts):

$1.4394 (1497)

$1.4296 (2646)

$1.4198 (2968)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 31903 contracts, with the maximum number of contracts with strike price $1,4600 (2470);

- Overall open interest on the PUT options with the expiration date June, 3 is 34139 contracts, with the maximum number of contracts with strike price $1,4200 (2968);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from May, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:02

Japan: Leading Economic Index , March 93.3 (forecast 98.4)

-

07:02

Japan: Coincident Index, March 111.2 (forecast 111.2)

-

06:46

Japan: All Industry Activity Index, m/m, March 0.1% (forecast 0.7%)

-

04:01

Japan: Manufacturing PMI, May 47.6

-

01:50

Japan: Trade Balance Total, bln, April 824 (forecast 492.8)

-

00:40

Currencies. Daily history for May 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1221 +0,21%

GBP/USD $1,4500 -0,69%

USD/CHF Chf0,9901 -0,05%

USD/JPY Y110,10 +0,14%

EUR/JPY Y123,61 +0,40%

GBP/JPY Y159,64 -0,56%

AUD/USD $0,7221 0,00%

NZD/USD $0,6763 +0,38%

USD/CAD C$1,3111 +0,11%

-

00:01

Schedule for today, Monday, May 23’2016:

(time / country / index / period / previous value / forecast)

02:00 Japan Manufacturing PMI (Preliminary) May 48.2

04:30 Japan All Industry Activity Index, m/m March -1.2% 0.7%

05:00 Japan Leading Economic Index (Finally) March 96.8 98.4

05:00 Japan Coincident Index (Finally) March 110.7 111.2

07:00 France Manufacturing PMI (Preliminary) May 48 48.8

07:00 France Services PMI (Preliminary) May 50.6 50.6

07:30 Germany Manufacturing PMI (Preliminary) May 51.8 52

07:30 Germany Services PMI (Preliminary) May 54.5 54.6

08:00 Eurozone Services PMI (Preliminary) May 53.1 53.3

08:00 Eurozone Manufacturing PMI (Preliminary) May 51.7 51.9

09:30 U.S. FOMC Member James Bullard Speaks

13:45 U.S. Manufacturing PMI (Preliminary) May 50.8

14:00 Eurozone Consumer Confidence (Preliminary) May -9.3 -9

-