Noticias del mercado

-

20:20

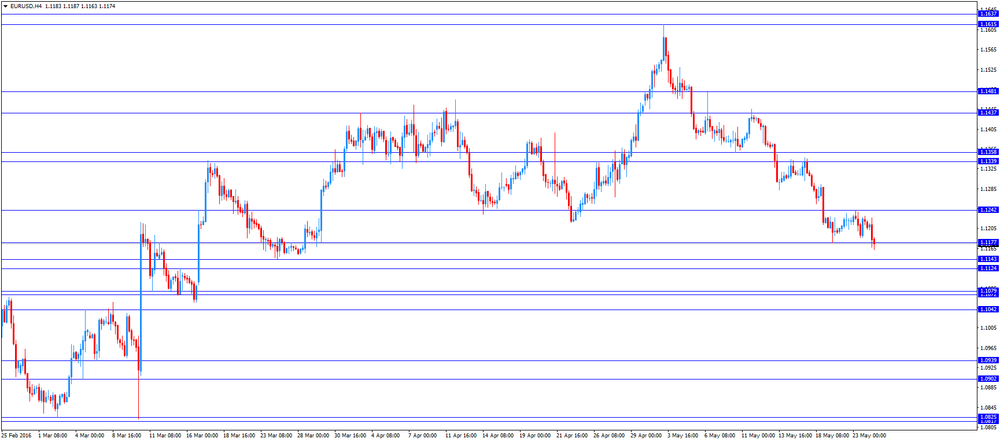

American focus: The US dollar rose significantly against the euro

The US dollar strengthened significantly against the euro, approaching to a maximum of 16 March. Support for the currency continued to recent comments by the Fed regarding the prospects of increasing the Fed's interest rate. Yesterday the head of the Federal Reserve Bank of Philadelphia said Patrick Harper that allows two or three rate hikes before the end of the year provided that the statistical data will point to the strengthening of the US economy. "I can easily imagine two or three rate hikes before the end of the year - he said -. If the new statistical data will not match my vision to strengthen the economy, I am ready to take a break, but in the opposite case, the rise rate in June seems to me to be justified."

President of the Federal Reserve Bank of San - Francisco John Williams also said that predicts two or three rate hikes in 2016. However, he added that a rate hike is still dependent on economic statistics. Today futures on interest rates Fed indicate that the probability of a rate hike in June is 34% versus 4% at the beginning of last week.

The growth of the US currency also contributed to the optimistic data on the US housing market. The Commerce Department reported that in April, sales of new single-family homes rose to a maximum of more than eight years, and prices have reached record highs. According to the data, new home sales jumped 16.6 percent to a seasonally adjusted annual rate reached 619 000 units, the highest level since January 2008. The percentage increase was the largest since January 1992. Sales in March were revised up to 531,000 units from the previously reported 511,000 units. Economists had forecast that sales of new buildings, which accounted for about 10.2 percent of the housing market, reached only 523,000 units last month. The report came after a fairly upbeat data on housing sales in the secondary market and housing construction. He also added factors to the retail sales report and industrial production, suggesting that the economy is gaining momentum after growth almost stalled in the first quarter.

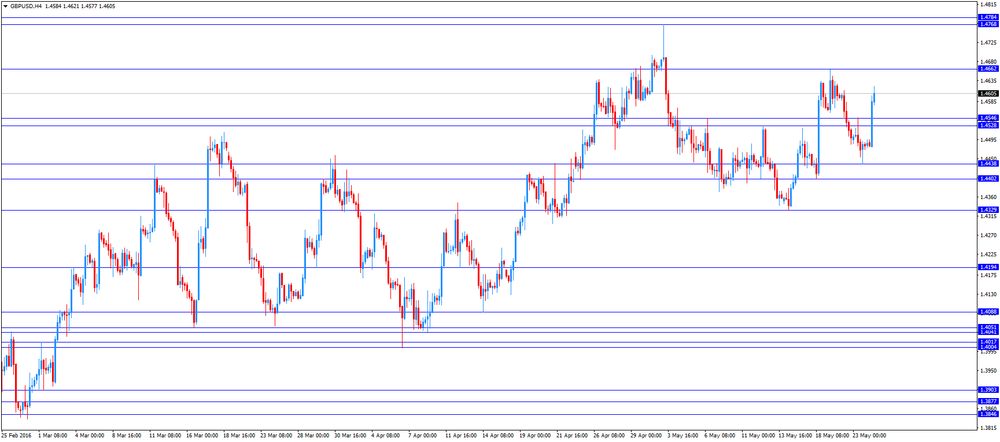

The pound has risen in price by about percent against the dollar, reaching a week high, helped by comments of the Bank of England, Mark Carney, as well as the results of the latest opinion poll on the subject of the referendum. Today, Carney said that the Central Bank will provide stability and order in the markets in anticipation Brekzita, using auctions to provide liquidity. In addition, Carney said that if Britain will remain part of the EU, the next likely step will be the Central Bank interest rate rise

As for the poll, he pointed out that the number of Britons wanting the country to remain in the European Union, sharply higher than the number of opponents. The latest survey published in the Telegraph newspaper on Tuesday showed that the number of followers of "Lost" campaign has a 13 percent advantage over the number of opponents. In favor of the fact that the country remains in the EU, 55% of respondents were in favor, with the support of «Brexit» 42%.

Later this week, investors will be watching the consumer confidence index of the UK, as well as the report on GDP. Given the economic slowdown, the rise of political uncertainty and the decline in the index GfK in the last month, experts predict that the consumer confidence index drops again. Meanwhile, the second estimate of GDP for the 1st quarter, is likely to confirm the early predictions of slowing economic growth. According to expert estimates, GDP grew by 0.4% after rising 0.6% in the 4th quarter of 2015. In annual terms, GDP growth is expected to stabilize at 2.1%.

-

17:45

European Central Bank’s Financial Stability Review: risks to the Eurozone's financial stability increased since November 2015

The European Central Bank (ECB) released its Financial Stability Review on Tuesday. The central bank said that risks to the Eurozone's financial stability increased since November 2015.

"Compared with the November 2015 FSR, most risks have increased. At the same time, all risks are clearly intertwined and would, if they were to materialise, have the potential to be mutually reinforcing. Indeed, all risks could be aggravated by a materialisation of downside risks to economic growth," the report said.

The ECB Vice President Vitor Constancio said in a press conference today that an interest rate hike would not have a negative impact on financial markets in Europe but on emerging economies.

-

17:31

German Chambers of Commerce (DIHK) upgrades its growth forecast for Germany

The German Chambers of Commerce (DIHK) upgraded its growth forecast for Germany on Tuesday. The DIHK expects the German economy to expand 1.5% this year, up from the previous estimate of 1.3%, but lower than the government's forecast of a 1.7% growth. DIHK's managing director Martin Wansleben said on Tuesday that the economy would be driven by construction and consumption, adding that low oil prices and cheap borrowing costs would also support the economic growth.

-

17:18

Bank of England Governor Mark Carney: the BoE is neutral and responsible to warn Britons about risks in case of Britain’s leave from the European Union

Bank of England (BoE) Governor Mark Carney testified before the Treasury Select Committee on Thursday. He said that the BoE was neutral and responsible to warn Britons about risks in case of Britain's leave from the European Union (EU).

Carney pointed out that the central bank would not immediately cut its interest rate in case of Britain's exit from the EU.

-

16:30

Richmond Fed Manufacturing Index drops to -1 in May

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to -1 in May from 14 in April. The decrease was mainly driven by drops in shipments, backlogs and new orders.

Shipments sub-index slid to -8 in May from 14 in April, while new orders sub-index was down to 0 from 18.

The employment sub-index declined to 4 in May from 8 in April, while backlogs fell by 24 points to −13.

"Fifth District manufacturing activity slowed in May, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments and backlogs decreased, and order backlogs flattened this month," the survey said.

-

16:23

New home sales in the U.S. jump 16.6% in April

The U.S. Commerce Department released new home sales data on Tuesday. New home sales jumped 16.6% to a seasonally adjusted annual rate of 619,000 units in April from 531,000 units in March. March's figure was revised up from 511,000 units.

Analysts had expected new home sales to reach 523,000 units.

The decrease was mainly driven lower sales in the West and South region. New home sales in the West region jumped 18.8% in April, while new home sales in the South region climbed 15.8%.

-

16:00

U.S.: Richmond Fed Manufacturing Index, May -8

-

16:00

U.S.: New Home Sales, April 619 (forecast 523)

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00-10 (USD 420m) 109.25 (445m) 109.50 (740m) 110.50 (235m) 110.80 (450m)

EUR/USD: 1.1055 (EUR 461m) 1.1150 (452m) 1.1190 (225m) 1.1250 (569m) 1.1275 (210m) 1.1300 (270m) 1.1380 (873m)

GBP/USD 1.4220 (GBP 295m) 1.4500 (525m) 1.4630 (307m)

USD/CHF 0.9800 (USD 240m) 0.9900 (380m)

EUR/CHF 1.1140 (EUR 201m)

AUD/USD 0.7200 (AUD 619m) 0.7300 (290m)

USD/CAD 1.2855 (USD 430m) 1.3000 (210m) 1.3100 (330m)

-

14:26

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:05 Australia RBA's Governor Glenn Stevens Speech

06:00 Germany GDP (QoQ) (Finally) Quarter I 0.3% 0.7% 0.7%

06:00 Germany GDP (YoY) (Finally) Quarter I 2.1% 1.6% 1.3%

08:30 United Kingdom PSNB, bln April -6.11 Revised From -4.16 -6.2 -6.58

09:00 Eurozone ZEW Economic Sentiment May 21.5 16.8

09:00 Germany ZEW Survey - Economic Sentiment May 11.2 12 6.4

10:00 United Kingdom CBI retail sales volume balance May -13 7 7

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. New home sales in the U.S. are expected to rise to 523,000 units in April from 511,000 units in March.

The euro traded lower against the U.S. dollar after the negative economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased to 6.4 in May from 11.2 in April, missing expectations for a rise to 12.0.

"The strong growth of the German economy in the first quarter of 2016 appears to have surprised the financial market experts. However, they seem not to expect the economic situation to improve at the same pace going forward," ZEW president, Professor Achim Wambach, said.

Eurozone's ZEW economic sentiment index declined to 21.5 in May from 21.5 in April.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.7% in the first quarter, in line with the preliminary reading, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.4% in the first quarter, while government spending increased by 0.5%.

Exports of goods and services were up 1.0% in first quarter, while imports climbed 1.4%.

On a yearly basis, Germany's final GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, in line with the preliminary reading.

The British pound traded higher against the U.S. dollar on the ORB poll. According to the latest ORB poll published by The Telegraph on Tuesday, 55% of respondents would vote for the "Remain" campaign, while 42% would support Britain's exit from the European Union.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The UK public sector net borrowing requirement (PSNB) was £6.58 billion in April, exceeding forecasts of £6.2 billion, up from £6.11 billion in March. March's figure was revised up from £4.16 billion.

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance climbed to 7 in May from -13% in April, in line with expectations. The increase was driven by rises in sectors, such as hardware & DIY, clothing and recreational goods. Sales are expected to decline slightly next month.

EUR/USD: the currency pair fell to $1.1163

GBP/USD: the currency pair climbed to $1.4621

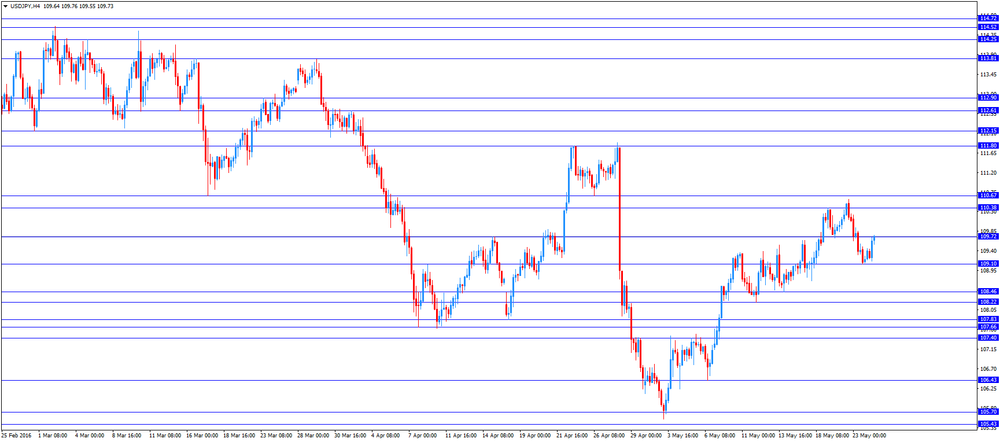

USD/JPY: the currency pair rose to Y109.76

The most important news that are expected (GMT0):

14:00 U.S. Richmond Fed Manufacturing Index May 14

14:00 U.S. New Home Sales April 511 523

22:45 New Zealand Trade Balance, mln April 117 60

-

14:09

CBI retail sales balance climbs to 7 in May

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance climbed to 7 in May from -13% in April, in line with expectations.

The increase was driven by rises in sectors, such as hardware & DIY, clothing and recreational goods.

Sales are expected to decline slightly next month.

"A bit like the start of the British summer, it's been a mixed bag for the retail sector this month. Whilst sales have risen a little, they are expected to fall again next month, and orders have dropped sharply," CBI Director of Economics, Rain Newton-Smith, said.

-

13:48

Orders

EUR/USD

Offers : 1.1200 1.1230 1.1250 1.1280-85 1.1300 1.1325 1.1355-60 1.1380 1.1400

Bids: 1.1160 1.1150 1.1125-30 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers : 1.4525-30 1.4550 1.4575 1.4600-10 1.4630 1.46501.4670 1.46851.4700

Bids: 1.4500 1.4480 1.4465 1.4450 1.4420-25 1.4400 1.4385 1.4350 1.4300-10

EUR/GBP

Offers : 0.7730 0.7755-60 0.7785 0.7800 0.7820 0.7830-35 0.7850

Bids: 0.7695-0.7700 0.7675-80 0.7650 0.7625-30 0.7600 0.7580 0.7550

EUR/JPY

Offers : 122.70 122.85 123.00 123.30 123.60 123.80 124.00 124.30 124.50 124.70-75 125.00

Bids: 122.25 122.00 121.70 121.50 121.20 121.00

USD/JPY

Offers : 109.85 110.00 110.20-35 110.50 110.65 110.80 111.00 111.30 111.50

Bids: 109.50 109.40 109.00 108.75-80 108.50 108.30 108.20 108.00

AUD/USD

Offers : 0.7200 0.7220-25 0.7250 0.7260 0.7280 0.7300 0.7325-30 0.7350

Bids: 0.7165 0.7150 0.7130 0.7100 0.7080 0.7065 0.7050

-

12:00

United Kingdom: CBI retail sales volume balance, May 7 (forecast 7)

-

11:42

German final GDP increases 0.7% in the first quarter

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.7% in the first quarter, in line with the preliminary reading, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.4% in the first quarter, while government spending increased by 0.5%.

Exports of goods and services were up 1.0% in first quarter, while imports climbed 1.4%.

On a yearly basis, Germany's final GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, in line with the preliminary reading.

-

11:37

Public sector net borrowing in the U.K. declines by £0.3 billion in April

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The UK public sector net borrowing requirement (PSNB) was £6.58 billion in April, exceeding forecasts of £6.2 billion, up from £6.11 billion in March. March's figure was revised up from £4.16 billion.

Public sector net borrowing excluding banks declined by £0.3 billion to £7.2 billion in April 2016 compared with April 2015.

The debt-to-gross domestic product ratio rose to 83.3% in April.

-

11:33

Swiss trade surplus widens to CHF2.50 billion in April

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus widened to CHF2.50 billion in April from CHF2.18 billion in the previous month. March's figure was revised up from a surplus of CHF2.16 billion.

On a monthly basis, exports rose 0.3% in April, while imports declined 3.1%.

Exports declined 11.5% year-on-year in April, while imports were up 13.6%.

-

11:26

French manufacturing confidence index falls to 104 in May

The French statistical office Insee released its manufacturing confidence index for France on Tuesday. The French manufacturing confidence index fell to 104 in May from 105 in April. April's figure was revised up from 104.

Past change in production index was up to 12 in May from 10 in April.

Personal production expectations index fell to 8 in May from 9 in April, while general production outlook index rose to 6 from -1.

-

11:22

Germany's ZEW economic sentiment index declines to 6.4 in May

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased to 6.4 in May from 11.2 in April, missing expectations for a rise to 12.0.

The assessment of the current situation in Germany climbed by 5.4 points to 53.1 points.

"The strong growth of the German economy in the first quarter of 2016 appears to have surprised the financial market experts. However, they seem not to expect the economic situation to improve at the same pace going forward," ZEW president, Professor Achim Wambach, said.

Eurozone's ZEW economic sentiment index declined to 21.5 in May from 21.5 in April.

The assessment of the current situation in the Eurozone rose by 2.9 points to -9.2 points.

-

11:15

Reserve Bank of Australia Governor Glenn Stevens: the RBA will not change its inflation target

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said on Tuesday that the central bank would not change its inflation target. He noted that he was confident inflation would rise but it would take more time.

"I think it will work out in time and it will take some time," he said.

-

11:00

Germany: ZEW Survey - Economic Sentiment, May 6.4 (forecast 12)

-

11:00

Eurozone: ZEW Economic Sentiment, May 16.8

-

10:48

The International Monetary Fund upgrades its growth forecast for Italy

The International Monetary Fund (IMF) upgraded its growth forecast for Italy on Monday. The Italian economy is expected to expand 1.1% in 2016, up from its previous forecast of 1.0%, and about 1.25% in 2017-18.

The lender noted that there were downside risks to the outlook. According to the IMF, these risks are financial market volatility, a possible Britain's exit from the European Union, a higher number of refugees, and slowing global trade.

-

10:38

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00-10 (USD 420m) 109.25 (445m) 109.50 (740m) 110.50 (235m) 110.80 (450m)

EUR/USD: 1.1055 (EUR 461m) 1.1150 (452m) 1.1190 (225m) 1.1250 (569m) 1.1275 (210m) 1.1300 (270m) 1.1380 (873m)

GBP/USD 1.4220 (GBP 295m) 1.4500 (525m) 1.4630 (307m)

USD/CHF 0.9800 (USD 240m) 0.9900 (380m)

EUR/CHF 1.1140 (EUR 201m)

AUD/USD 0.7200 (AUD 619m) 0.7300 (290m)

USD/CAD 1.2855 (USD 430m) 1.3000 (210m) 1.3100 (330m)

-

10:36

Philadelphia Fed President Patrick Harker expects the Fed could raise its interest rate two to three times this year

Philadelphia Fed President Patrick Harker said in a speech on Monday that he expected the Fed could raise its interest rate two to three times this year.

"As I said, there will likely be two or perhaps even three rate hikes over the course of the year," he said.

Philadelphia Fed president pointed out that the Fed's interest rate decision will depend on the incoming economic data.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:30

United Kingdom: PSNB, bln, April -6.58 (forecast -6.2)

-

10:19

Japan’s finance minister Taro Aso: Japan has no plans to boost its exports by devaluing its currency

Japan's finance minister Taro Aso said on Tuesday that the country had no plans to boost its exports by devaluing its currency.

"Japan has no intention at all to try to devalue the yen in a consistent manner," he said.

-

10:09

Britain’s finance minister George Osborne: Britain could face a year-long recession in case of the exit from the European Union

Britain's finance minister George Osborne said on Monday that Britain could face a year-long recession in case of the exit from the European Union (EU).

"The British people must ask themselves this question: can we knowingly vote for a recession?" he said.

According to Britain's ministry, if the country leaves the EU and reaches a trade deal with the EU, the economic growth would be 3.6% lower after two years than if the country would remain in the EU.

If the country leaves the EU and deals under World Trade Organisation rules, the economic growth would be 6.0% lower after two years than if the country would remain in the EU.

-

08:29

Options levels on tuesday, May 24, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1415 (5018)

$1.1337 (3443)

$1.1282 (3034)

Price at time of writing this review: $1.1214

Support levels (open interest**, contracts):

$1.1170 (3282)

$1.1144 (8064)

$1.1112 (5038)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 69598 contracts, with the maximum number of contracts with strike price $1,1400 (5018);

- Overall open interest on the PUT options with the expiration date June, 3 is 88581 contracts, with the maximum number of contracts with strike price $1,1200 (8064);

- The ratio of PUT/CALL was 1.27 versus 1.28 from the previous trading day according to data from May, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.4801 (1722)

$1.4703 (1887)

$1.4605 (2476)

Price at time of writing this review: $1.4486

Support levels (open interest**, contracts):

$1.4394 (1601)

$1.4296 (2646)

$1.4198 (2980)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 31951 contracts, with the maximum number of contracts with strike price $1,4600 (2476);

- Overall open interest on the PUT options with the expiration date June, 3 is 34232 contracts, with the maximum number of contracts with strike price $1,4200 (2980);

- The ratio of PUT/CALL was 1.07 versus 1.07 from the previous trading day according to data from May, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

Asian session: The U.S. dollar pared some of its recent losses

The U.S. dollar pared some of its recent losses as investors worried about the likelihood of a U.S. interest rate increase in coming weeks.

A string of comments in recent weeks by Federal Reserve officials and minutes of the last Fed meeting have put a possible rate hike firmly on the table for June or July, reviving the dollar but cooling appetite for riskier assets, even if markets are not totally convinced a tightening will come so soon. Philadelphia Fed President Patrick Harker said on Monday that a hike in June is appropriate unless data weakens, while St. Louis Fed President James Bullard said holding rates too low for too long could cause financial instability.

"The yen gained as risk aversion overcame the Fed officials' hawkish views. Upward pressure on the yen was stronger due to weaker stocks and falling commodities," said Junichi Ishikawa, FX analyst at IG Securities in Tokyo. "That said, the dollar index has stood tall overall amid a significant rise in the two-year U.S. Treasury yield. Trades preparing for a potential Fed rate hike in June are likely to continue." Fed Chair Janet Yellen will appear at a panel at Harvard University on Friday, a day on which investors will also see the second estimate of U.S. first-quarter growth. Markets also await comments from other Fed officials this week, as well as data on new home sales, durable goods orders and consumer sentiment.

EUR / USD: during the Asian session the pair fell to $ 1.1205

GBP / USD: during the Asian session, the pair was trading in the $ 1.4475-00

USD / JPY: during the Asian session, the pair was trading in range Y109.20-40

Based on Reuters materials -

08:00

Germany: GDP (QoQ), Quarter I 0.7% (forecast 0.7%)

-

08:00

Germany: GDP (YoY), Quarter I 1.3% (forecast 1.6%)

-

00:38

Currencies. Daily history for May 23’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1219 -0,02%

GBP/USD $1,4482 -0,12%

USD/CHF Chf0,9894 -0,07%

USD/JPY Y109,21 -0,81%

EUR/JPY Y122,51 -0,90%

GBP/JPY Y158,16 -0,94%

AUD/USD $0,7221 0,00%

NZD/USD $0,6759 -0,06%

USD/CAD C$1,3143 +0,24%

-

00:02

Schedule for today, Tuesday, May 24’2016:

(time / country / index / period / previous value / forecast)

03:05 Australia RBA's Governor Glenn Stevens Speech

06:00 Germany GDP (QoQ) (Finally) Quarter I 0.3% 0.7%

06:00 Germany GDP (YoY) (Finally) Quarter I 2.1% 1.5%

08:30 United Kingdom PSNB, bln April -4.16 -6.2

09:00 Eurozone ZEW Economic Sentiment May 21.5

09:00 Germany ZEW Survey - Economic Sentiment May 11.2 12

10:00 United Kingdom CBI retail sales volume balance May -13 5

14:00 U.S. Richmond Fed Manufacturing Index May 14

22:45 New Zealand Trade Balance, mln April 117 60

-