Noticias del mercado

-

21:00

Dow +1.26% 17,712.49 +219.56 Nasdaq +1.95% 4,858.88 +93.10 +1.36% S&P 2,075.94 +27.90

-

18:00

European stocks closed: FTSE 100 6,219.26 +82.83 +1.35% CAC 40 4,431.52 +106.42 +2.46% DAX 10,057.31 +215.02 +2.18%

-

18:00

European stocks close: stocks closed higher on rising oil prices and on a weaker euro

Stock closed higher on rising oil prices and on a weaker euro. The euro declined on the negative economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased to 6.4 in May from 11.2 in April, missing expectations for a rise to 12.0.

"The strong growth of the German economy in the first quarter of 2016 appears to have surprised the financial market experts. However, they seem not to expect the economic situation to improve at the same pace going forward," ZEW president, Professor Achim Wambach, said.

Eurozone's ZEW economic sentiment index declined to 21.5 in May from 21.5 in April.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.7% in the first quarter, in line with the preliminary reading, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.4% in the first quarter, while government spending increased by 0.5%.

Exports of goods and services were up 1.0% in first quarter, while imports climbed 1.4%.

On a yearly basis, Germany's final GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, in line with the preliminary reading.

According to the latest ORB poll published by The Telegraph on Tuesday, 55% of respondents would vote for the "Remain" campaign, while 42% would support Britain's exit from the European Union.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The UK public sector net borrowing requirement (PSNB) was £6.58 billion in April, exceeding forecasts of £6.2 billion, up from £6.11 billion in March. March's figure was revised up from £4.16 billion.

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance climbed to 7 in May from -13% in April, in line with expectations. The increase was driven by rises in sectors, such as hardware & DIY, clothing and recreational goods. Sales are expected to decline slightly next month.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,219.26 +82.83 +1.35 %

DAX 10,057.31 +215.02 +2.18 %

CAC 40 4,431.52 +106.42 +2.46 %

-

17:45

European Central Bank’s Financial Stability Review: risks to the Eurozone's financial stability increased since November 2015

The European Central Bank (ECB) released its Financial Stability Review on Tuesday. The central bank said that risks to the Eurozone's financial stability increased since November 2015.

"Compared with the November 2015 FSR, most risks have increased. At the same time, all risks are clearly intertwined and would, if they were to materialise, have the potential to be mutually reinforcing. Indeed, all risks could be aggravated by a materialisation of downside risks to economic growth," the report said.

The ECB Vice President Vitor Constancio said in a press conference today that an interest rate hike would not have a negative impact on financial markets in Europe but on emerging economies.

-

17:45

WSE: Session Results

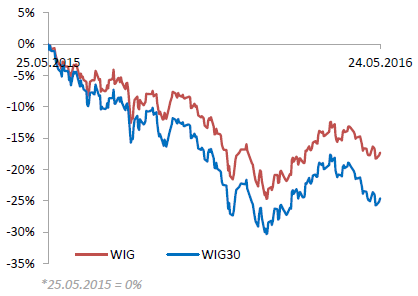

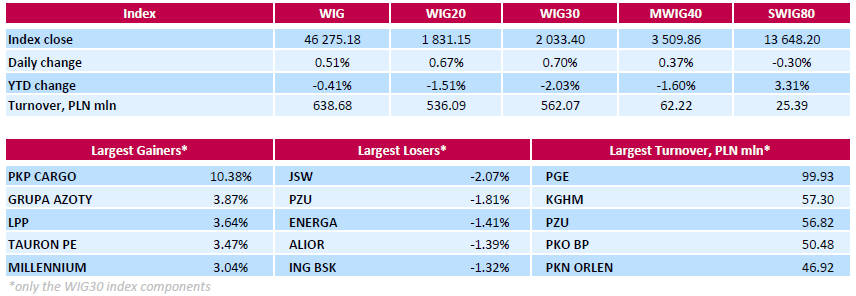

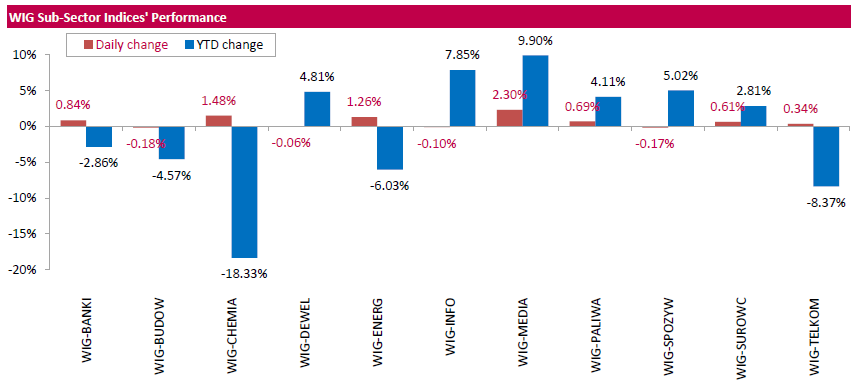

Polish equity market closed higher on Tuesday. The broad measure, the WIG index, added 0.51%. Sector-wise, media sector (+2.30%) outperformed, while construction (-0.18%) recorded the worst result.

The large-cap benchmark, the WIG30 Index, grew by 0.7%. In the index basket, railway freight transport operator PKP CARGO (WSE: PKP) led the advancers, climbing by 10.38% after four consecutive sessions of declines, supported by the announcement that Czech billionaire Pavel Tykač wants to buy OKD, which is the main client of Czech AWT, a company owned by PKP CARGO. It was followed by chemical producer GRUPA AZOTY (WSE: ATT), clothing retailer LPP (WSE: LPP) and genco TAURON PE (WSE: TPE), surging by 3.87%, 3.64% and 3.47% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) and insurer PZU (WSE: PZU) were the weakest performers, tumbling by 2.07% and 1.81% respectively.

-

17:31

German Chambers of Commerce (DIHK) upgrades its growth forecast for Germany

The German Chambers of Commerce (DIHK) upgraded its growth forecast for Germany on Tuesday. The DIHK expects the German economy to expand 1.5% this year, up from the previous estimate of 1.3%, but lower than the government's forecast of a 1.7% growth. DIHK's managing director Martin Wansleben said on Tuesday that the economy would be driven by construction and consumption, adding that low oil prices and cheap borrowing costs would also support the economic growth.

-

17:18

Bank of England Governor Mark Carney: the BoE is neutral and responsible to warn Britons about risks in case of Britain’s leave from the European Union

Bank of England (BoE) Governor Mark Carney testified before the Treasury Select Committee on Thursday. He said that the BoE was neutral and responsible to warn Britons about risks in case of Britain's leave from the European Union (EU).

Carney pointed out that the central bank would not immediately cut its interest rate in case of Britain's exit from the EU.

-

16:58

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday, recouping Monday's losses, with banks among the biggest gainers as investors speculated on the possibility of a June interest rate hike. Minutes of the Federal Reserve's April meeting suggested a June rate hike had not been ruled out, surprising investors who had thought the Fed would stand pat until the end of the year.

Almost of Dow stocks in positive area (29 of 30). Top looser - The Boeing Company (BA, -0,02%). Top gainer - Visa Inc. (V, +2,55%).

All S&P sectors mixed. Top gainer - Financial (+1,7%).

At the moment:

Dow 17677.00 +207.00 +1.18%

S&P 500 2070.00 +24.75 +1.21%

Nasdaq 100 4422.50 +70.00 +1.61%

Oil 48.88 +0.80 +1.66%

Gold 1237.10 -14.40 -1.15%

U.S. 10yr 1.88 +0.04

-

16:30

Richmond Fed Manufacturing Index drops to -1 in May

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to -1 in May from 14 in April. The decrease was mainly driven by drops in shipments, backlogs and new orders.

Shipments sub-index slid to -8 in May from 14 in April, while new orders sub-index was down to 0 from 18.

The employment sub-index declined to 4 in May from 8 in April, while backlogs fell by 24 points to −13.

"Fifth District manufacturing activity slowed in May, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments and backlogs decreased, and order backlogs flattened this month," the survey said.

-

16:23

New home sales in the U.S. jump 16.6% in April

The U.S. Commerce Department released new home sales data on Tuesday. New home sales jumped 16.6% to a seasonally adjusted annual rate of 619,000 units in April from 531,000 units in March. March's figure was revised up from 511,000 units.

Analysts had expected new home sales to reach 523,000 units.

The decrease was mainly driven lower sales in the West and South region. New home sales in the West region jumped 18.8% in April, while new home sales in the South region climbed 15.8%.

-

15:49

WSE: After start on Wall Street

The market in the US starts trading from increases and the attack on the exponential average of 21 sessions. This all happens with very good behavior of European exchanges. Thus, we observe the continuation of the defense support. Futures market in the US efficiently goes to session highs, which further improves the already positive sentiment in Western Europe. However in this environment the Warsaw Stock Exchange is not benefiting and today's session already bears the hallmarks of the upcoming long May weekend.

-

15:34

U.S. Stocks open: Dow +0.62%, Nasdaq +0.57%, S&P +0.56%

-

15:14

Before the bell: S&P futures +0.59%, NASDAQ futures +0.66%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,498.76 -155.84 -0.94%

Hang Seng 19,830.43 +21.40 +0.11%

Shanghai Composite 2,822.04 -21.60 -0.76%

FTSE 6,195.21 +58.78 +0.96%

CAC 4,398.3 +73.20 +1.69%

DAX 9,984.45 +142.16 +1.44%

Crude $48.42 (+0.71%)

Gold $1238.90 (-1.01%)

-

14:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

167.01

0.90(0.5418%)

300

ALCOA INC.

AA

9.38

0.10(1.0776%)

25086

ALTRIA GROUP INC.

MO

63.14

-0.10(-0.1581%)

100

Amazon.com Inc., NASDAQ

AMZN

700.32

3.57(0.5124%)

14146

American Express Co

AXP

63.91

0.32(0.5032%)

110

Apple Inc.

AAPL

97.06

0.63(0.6533%)

154375

Barrick Gold Corporation, NYSE

ABX

17.53

-0.38(-2.1217%)

104315

Boeing Co

BA

128.3

0.72(0.5644%)

3505

Caterpillar Inc

CAT

71

0.60(0.8523%)

1000

Cisco Systems Inc

CSCO

28.06

0.12(0.4295%)

7099

Citigroup Inc., NYSE

C

45.5

0.39(0.8646%)

28135

Deere & Company, NYSE

DE

78.86

0.98(1.2583%)

4452

Exxon Mobil Corp

XOM

89.9

0.30(0.3348%)

1372

Facebook, Inc.

FB

116.65

0.68(0.5864%)

105029

Ford Motor Co.

F

13.2

0.07(0.5331%)

24606

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.55

0.17(1.4939%)

102630

General Electric Co

GE

29.6

0.11(0.373%)

11359

General Motors Company, NYSE

GM

30.67

0.08(0.2615%)

106

Goldman Sachs

GS

156.45

1.00(0.6433%)

1732

Google Inc.

GOOG

707.75

3.51(0.4984%)

2392

Home Depot Inc

HD

132.06

0.64(0.487%)

1258

Intel Corp

INTC

30.32

0.09(0.2977%)

17600

JPMorgan Chase and Co

JPM

63.9

0.44(0.6934%)

16325

McDonald's Corp

MCD

123.3

0.49(0.399%)

1969

Microsoft Corp

MSFT

50.5

0.47(0.9394%)

102637

Pfizer Inc

PFE

33.83

0.16(0.4752%)

1220

Procter & Gamble Co

PG

80.35

0.15(0.187%)

286

Starbucks Corporation, NASDAQ

SBUX

54.84

0.24(0.4396%)

2840

Tesla Motors, Inc., NASDAQ

TSLA

217.73

1.51(0.6984%)

10549

The Coca-Cola Co

KO

43.9

-0.07(-0.1592%)

150

Twitter, Inc., NYSE

TWTR

14.36

-0.05(-0.347%)

133115

UnitedHealth Group Inc

UNH

131

0.58(0.4447%)

400

Verizon Communications Inc

VZ

49.28

0.14(0.2849%)

800

Visa

V

77.55

0.34(0.4404%)

617

Wal-Mart Stores Inc

WMT

69.5

0.00(0.00%)

1903

Yahoo! Inc., NASDAQ

YHOO

36.88

0.22(0.6001%)

2067

Yandex N.V., NASDAQ

YNDX

19.22

0.06(0.3131%)

3200

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Microsoft (MSFT) upgraded to Outperform from Market Perform at Cowen

Deere (DE) upgraded to Outperform from Market Perform at BMO Capital; target $96

Downgrades:Twitter (TWTR) downgraded to Sell from Neutral at Moffettnathanson

Other:Twitter (TWTR) target lowered to $18 from $22 at Monness Crespi & Hardt

Home Depot (HD) initiated with a Buy at Topeka Capital Mkts; target $158 -

14:09

CBI retail sales balance climbs to 7 in May

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance climbed to 7 in May from -13% in April, in line with expectations.

The increase was driven by rises in sectors, such as hardware & DIY, clothing and recreational goods.

Sales are expected to decline slightly next month.

"A bit like the start of the British summer, it's been a mixed bag for the retail sector this month. Whilst sales have risen a little, they are expected to fall again next month, and orders have dropped sharply," CBI Director of Economics, Rain Newton-Smith, said.

-

13:29

WSE: Mid session comment

After the morning approach the situation on the Warsaw Stock Exchange stabilized with growth of 0.5% on the WIG20 index. This time it is the weaker stance compare the environment, where both the CAC40 and the DAX overlook the session highs gaining 1.5% and 1%. The WSE stood out yesterday, so today's calm behavior to a certain extent can be explained. The turnover is still not so impressive and in the middle of the southern phase of trade have barely PLN 250 mln on the entire market. Noteworthy is worse attitude of smaller companies, where the sWIG80 index lost 0.4% and set session lows.

-

12:03

European stock markets mid session: stocks traded higher on a rise in shares in the finance sector

Stock indices traded higher on a rise in shares in the finance sector.

Market participants also eyed the economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased to 6.4 in May from 11.2 in April, missing expectations for a rise to 12.0.

"The strong growth of the German economy in the first quarter of 2016 appears to have surprised the financial market experts. However, they seem not to expect the economic situation to improve at the same pace going forward," ZEW president, Professor Achim Wambach, said.

Eurozone's ZEW economic sentiment index declined to 21.5 in May from 21.5 in April.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.7% in the first quarter, in line with the preliminary reading, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.4% in the first quarter, while government spending increased by 0.5%.

Exports of goods and services were up 1.0% in first quarter, while imports climbed 1.4%.

On a yearly basis, Germany's final GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, in line with the preliminary reading.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The UK public sector net borrowing requirement (PSNB) was £6.58 billion in April, exceeding forecasts of £6.2 billion, up from £6.11 billion in March. March's figure was revised up from £4.16 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,180.66 +44.23 +0.72 %

DAX 9,923.82 +81.53 +0.83 %

CAC 40 4,384.95 +59.85 +1.38 %

-

11:42

German final GDP increases 0.7% in the first quarter

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.7% in the first quarter, in line with the preliminary reading, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.4% in the first quarter, while government spending increased by 0.5%.

Exports of goods and services were up 1.0% in first quarter, while imports climbed 1.4%.

On a yearly basis, Germany's final GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, in line with the preliminary reading.

-

11:37

Public sector net borrowing in the U.K. declines by £0.3 billion in April

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The UK public sector net borrowing requirement (PSNB) was £6.58 billion in April, exceeding forecasts of £6.2 billion, up from £6.11 billion in March. March's figure was revised up from £4.16 billion.

Public sector net borrowing excluding banks declined by £0.3 billion to £7.2 billion in April 2016 compared with April 2015.

The debt-to-gross domestic product ratio rose to 83.3% in April.

-

11:33

Swiss trade surplus widens to CHF2.50 billion in April

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus widened to CHF2.50 billion in April from CHF2.18 billion in the previous month. March's figure was revised up from a surplus of CHF2.16 billion.

On a monthly basis, exports rose 0.3% in April, while imports declined 3.1%.

Exports declined 11.5% year-on-year in April, while imports were up 13.6%.

-

11:26

French manufacturing confidence index falls to 104 in May

The French statistical office Insee released its manufacturing confidence index for France on Tuesday. The French manufacturing confidence index fell to 104 in May from 105 in April. April's figure was revised up from 104.

Past change in production index was up to 12 in May from 10 in April.

Personal production expectations index fell to 8 in May from 9 in April, while general production outlook index rose to 6 from -1.

-

11:22

Germany's ZEW economic sentiment index declines to 6.4 in May

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased to 6.4 in May from 11.2 in April, missing expectations for a rise to 12.0.

The assessment of the current situation in Germany climbed by 5.4 points to 53.1 points.

"The strong growth of the German economy in the first quarter of 2016 appears to have surprised the financial market experts. However, they seem not to expect the economic situation to improve at the same pace going forward," ZEW president, Professor Achim Wambach, said.

Eurozone's ZEW economic sentiment index declined to 21.5 in May from 21.5 in April.

The assessment of the current situation in the Eurozone rose by 2.9 points to -9.2 points.

-

11:15

Reserve Bank of Australia Governor Glenn Stevens: the RBA will not change its inflation target

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said on Tuesday that the central bank would not change its inflation target. He noted that he was confident inflation would rise but it would take more time.

"I think it will work out in time and it will take some time," he said.

-

10:48

The International Monetary Fund upgrades its growth forecast for Italy

The International Monetary Fund (IMF) upgraded its growth forecast for Italy on Monday. The Italian economy is expected to expand 1.1% in 2016, up from its previous forecast of 1.0%, and about 1.25% in 2017-18.

The lender noted that there were downside risks to the outlook. According to the IMF, these risks are financial market volatility, a possible Britain's exit from the European Union, a higher number of refugees, and slowing global trade.

-

10:36

Philadelphia Fed President Patrick Harker expects the Fed could raise its interest rate two to three times this year

Philadelphia Fed President Patrick Harker said in a speech on Monday that he expected the Fed could raise its interest rate two to three times this year.

"As I said, there will likely be two or perhaps even three rate hikes over the course of the year," he said.

Philadelphia Fed president pointed out that the Fed's interest rate decision will depend on the incoming economic data.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:19

Japan’s finance minister Taro Aso: Japan has no plans to boost its exports by devaluing its currency

Japan's finance minister Taro Aso said on Tuesday that the country had no plans to boost its exports by devaluing its currency.

"Japan has no intention at all to try to devalue the yen in a consistent manner," he said.

-

10:09

Britain’s finance minister George Osborne: Britain could face a year-long recession in case of the exit from the European Union

Britain's finance minister George Osborne said on Monday that Britain could face a year-long recession in case of the exit from the European Union (EU).

"The British people must ask themselves this question: can we knowingly vote for a recession?" he said.

According to Britain's ministry, if the country leaves the EU and reaches a trade deal with the EU, the economic growth would be 3.6% lower after two years than if the country would remain in the EU.

If the country leaves the EU and deals under World Trade Organisation rules, the economic growth would be 6.0% lower after two years than if the country would remain in the EU.

-

09:14

WSE: After opening

The futures market (WSE: FW20M16) began the trading with a decline of 0.55% to 1,813 points.

WIG20 index opened at 1817.47 points (-0.08%)*

WIG 45968.72 -0.16%

WIG30 2014.51 -0.23%

mWIG40 3495.01 -0.05%

*/ - change to previous close

The cash market opened in a more balanced way, with a modest decline of 0.08% to 1,817 points and at low turnover. Worse is the German market, where the opening of the cash market is clearly downward and discounts of the DAX reach 0.5%, which actually begins to be threaten as the breaking out the bottom of the consolidation.

While today our market completely ignored the behavior of Euroland, we need to be aware that indefinitely such a play will not succeed, and if there a slump in the German market will appear, sooner or later a rebound in the form of deterioration in sentiment should hit us.

-

08:26

WSE: Before opening

Wall Street's main index ended yesterday's session with decline of 0.2% and it was a daily minimum. This is a signal of the lack of power to undermine indices from area of support levels. So slowly the supply side of the market should gain an advantage.

An important will be Friday speech of Janet Yellen, which should confirm the high probability of imminent changes in interest rates. So far, investors have quite calmly react to such a possibility, although it does not help for market sentiment. In practice there is no strong arguments for buying the shares, which was also helped yesterday's preliminary PMI readings. Europe and the United States are therefore again in the area of support levels.

In Asia, the mood is cautious and the parquets are dominated by the red color. In Japan and China drops reached 1% and this will not help the Warsaw Stock Exchange in the morning.

However our market yesterday could behave in an individual way and defend support at level of 1,800 points on the WIG20, although with the still unsatisfactory turnover and strong pressure from PZU, which shares have accumulated the greatest activity.

It must be remembered that the short-term trend remains downward, and yesterday's session did not do too much in terms of its changes.

-

06:24

Global Stocks

European stocks closed lower Monday as shares in Bayer AG and Fiat Chrysler Automobiles NV struggled and Deutsche Bank sounded downbeat on the market. Euro strength can make prices for European exports more expensive for holders of other currencies to buy.

U.S. stocks finished lower Monday, giving up early gains as the prospect that interest rates might rise as soon as next month weighed on utilities shares. The utilities sector was the worst-performing of the index, sliding 1% as the prospect of higher interest rates diminished demand for dividend-paying stocks.

Asian stocks fell for the first time in three days, as a stronger yen weighed on exporters in Japan and speculation mounted the U.S. is closer to raising interest rates. Federal Reserve Bank of St. Louis President James Bullard said he doesn't expect a U.K. vote on European Union membership to influence the U.S. central bank's decision.

Based on MarketWatch materials

-

04:03

Nikkei 225 16,548.61 -105.99 -0.64 %, Hang Seng 19,776.61 -32.42 -0.16 %, Shanghai Composite 2,830.24 -13.40 -0.47 %

-

00:44

Stocks. Daily history for Sep Apr May 23’2016:

(index / closing price / change items /% change)

Nikkei 225 16,654.6 -81.75 -0.49 %

Hang Seng 19,809.03 -43.17 -0.22 %

S&P/ASX 200 5,318.94 -32.36 -0.60 %

Shanghai Composite 2,844.02 +18.53 +0.66 %

FTSE 100 6,136.43 -19.89 -0.32 %

CAC 40 4,325.1 -28.80 -0.66 %

Xetra DAX 9,842.29 -73.73 -0.74 %

S&P 500 2,048.04 -4.28 -0.21 %

NASDAQ Composite 4,765.78 -3.78 -0.08 %

Dow Jones 17,492.93 -8.01 -0.05 %

-