Noticias del mercado

-

21:00

Dow +0.17% 17,530.05 +29.11 Nasdaq +0.17% 4,777.90 +8.34 S&P +0.01% 2,052.46 +0.14

-

20:20

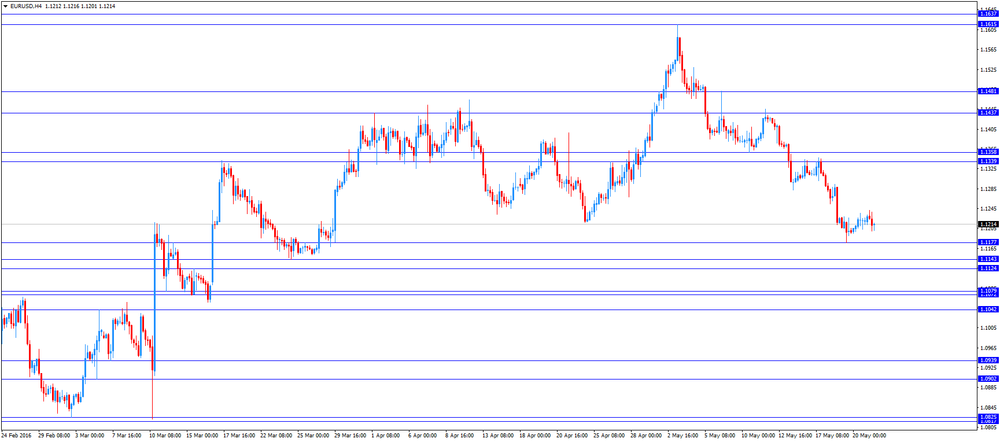

American focus: The US dollar lost ground against the previously-earned euros

The euro rose against the dollar mildly, returning to the level of opening of the session, which was caused by the publication of weak US data. The Markit Economics reported that the preliminary manufacturing PMI fell to 50.5 in May from 50.8 in April, giving way to increasing expectations to 51.0. It was the lowest level since September 2009. The decrease was due to lower production and weaker growth in new orders. "PMI manufacturing data cast doubt on the ability of the US economy to rebound from a disappointing start of the year in the second quarter," - said the chief economist at Markit Chris Williamson.

In the course of trading and continued to influence mixed indicators on business activity in the euro area. Preliminary results of a survey by Markit showed that private sector growth in the euro zone eased to 16-month low in May. Composite PMI fell unexpectedly to 52.9 in May from 53 in April. According to forecasts, the index is expected to grow to 53.2. Managers' Index for the service sector purchases remained at 53.1, while experts waited increasing to 53.3. The manufacturing PMI fell to 51.5 from 51.7 in April. Economists had expected the index to improve to 51.9. Chris Williamson, chief economist at Markit, said: "The disappointing PMI data for May suggest that robust economic growth, which saw in the first quarter, will be temporary PMI index indicates a GDP growth of only 0.3 percent in the second quarter." . In addition, it became known that the French private sector growth improved to 7-month high in May. The composite output index rose to 51.1 in May, a 7-month high, from 50.2 in April. in the service sector Purchasing Managers Index rose to 51.8, while, according to forecasts, it was to remain at 50.6, as it was registered in April. The manufacturing PMI reached 48.3 against 48 in April. It was below the expected reading of 48.8. Another report showed that Germany's private sector activity grew at a faster pace in May. The composite output index rose to a 5-month high of 54.7 in May from 53.6 in April. Manufacturers and service providers reported higher growth rates, which some respondents attributed to the processes of work in progress and the increase in new orders.

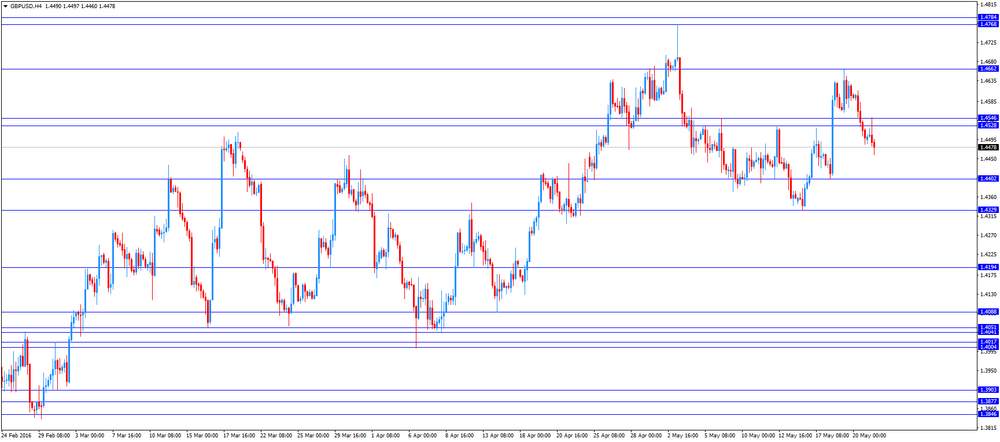

The pound rebounded against the dollar, reaching the opening level. Since today, Britain has not published any reports on the course of trading influenced speculation about Brexit. According to the latest information agency TNS, the results of the online survey showed that output supporters of EU staff ahead of opponents Brexit: 41% in favor of withdrawal from the EU, 38% - against Brexit, and 21% - difficult to answer. Later this week, investors will be watching the consumer confidence index of the UK, as well as the report on GDP. Given the economic slowdown, the rise of political uncertainty and the decline in the index GfK in the last month, experts predict that the consumer confidence index drops again. Meanwhile, the second estimate of GDP for the 1st quarter, is likely to confirm the early predictions of slowing economic growth. According to expert estimates, GDP grew by 0.4% after rising 0.6% in the 4th quarter of 2015. In annual terms, GDP growth is expected to stabilize at 2.1%.

-

19:39

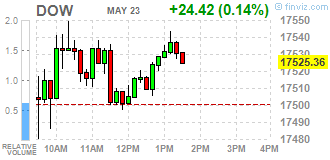

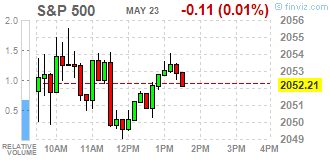

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes slightly rose on Monday, while a bounce in Apple's stock kept the Nasdaq in positive territory. However, oil slid as Iran vowed to ramp up output and rig reductions paused in the United States. Investors are awaiting speeches by several U.S. Federal Reserve officials this week for further clues on the trajectory of rate hikes, with Fed Chair Janet Yellen set to speak on Friday.

Most of Dow stocks in positive area (19 of 30). Top looser - Verizon Communications Inc. (VZ, -0,89%). Top gainer - Apple Inc. (AAPL, +1,69%).

S&P sectors mixed. Top looser - Utilities (-0,5%). Top gainer - Consumer goods (+0,2%).

At the moment:

Dow 17508.00 +26.00 +0.15%

S&P 500 2050.00 0.00 0.00%

Nasdaq 100 4369.50 +7.25 +0.17%

Oil 47.96 -0.45 -0.93%

Gold 1251.30 -1.60 -0.13%

U.S. 10yr 1.84 -0.01

-

18:00

European stocks closed: FTSE 100 6,147.53 -8.79 -0.14% CAC 40 4,325.1 -28.80 -0.66% DAX 9,842.29 -73.73 -0.74%

-

18:00

European stocks close: stocks closed lower on the PMI data from the Eurozone and on falling oil prices

Stock closed lower on the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0. Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6. The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8. The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6. The services index was driven by rises in new orders, employment and input prices.

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

Falling oil prices also weighed on stock markets. News that Iran has no plans to freeze its oil production also weighed on oil prices. Iran's Deputy Oil Minister Rokneddin Javadi said on Sunday that the country was not ready to freeze its oil output as it has not reached pre-sanctions levels. He noted that Iran's crude oil exports, excluding gas condensates, reached 2 million barrels a day, adding that the country's crude oil export capacity was expected to reach 2.2 million barrels a day by the middle of summer.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,147.53 -8.79 -0.14 %

DAX 9,842.29 -73.73 -0.74 %

CAC 40 4,325.1 -28.80 -0.66 %

-

17:43

WSE: Session Results

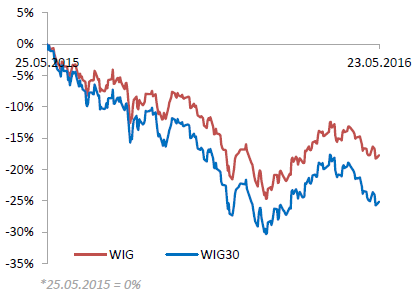

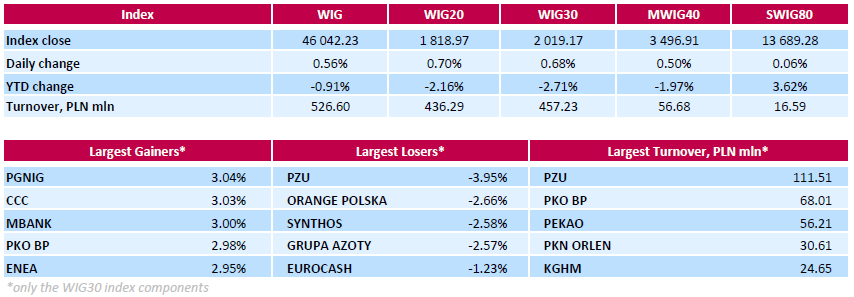

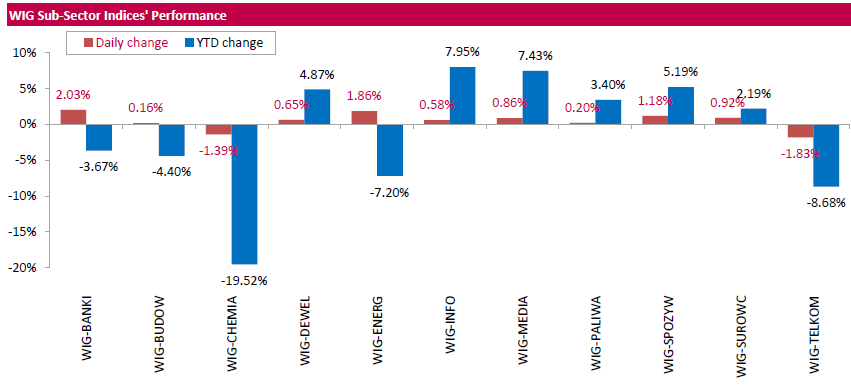

Polish equity market closed higher on Monday, with the broad market measure, the WIG index, adding 0.56%. Except for chemicals (-1.39%) and telecoms (-1.83%), every sector in the WIG Index rose, with banking sector (+2.03%) outperforming.

The large-cap stocks' benchmark, the WIG30 Index, advanced 0.68%. In the index basket, the day's strongest performers were oil and gas producer PGNIG (WSE: PGN), footwear retailer CCC (WSE: CCC), genco ENEA (WSE: ENA) and two banking sector names MBANK (WSE: MBK) and PKO BP (WSE: PKO), which gained between 2.95% and 3.04%. At the same time, insurer PZU (WSE: PZU) was hit the hardest, down 3.95%, as investors were frustrated by the announcement the company plans to pay out lower-than-expected FY 2015 dividend of PLN 2.08 per share (div. yield 6% based on Friday's closing price), which however is in-line with its policy of handing out 50-100 pct of profit. Other major laggards were telecommunication services provider ORANGE POLSKA (WSE: OPL) and two chemicals names SYNTHOS (WSE: SNS) and GRUPA AZOTY (WSE: ATT), declining by 2.66%, 2.58% and 2.57% respectively.

-

17:42

Oil quotes continue to fall

The cost of oil futures fell nearly percent, as investors focus again shifted to the excess of world supply of oil.

On Sunday, Iran's deputy oil minister Rukneddin Javadi said Iran does not intend to freeze the oil, as the country does not increase the export of oil to dosanktsionnogo level until the second half of the year. "Iran exports oil to reach 2.2 million barrels a day by mid-summer before oil exports reached this indicator before the sanctions against the country for more than four years ago, have been introduced -. Javadi said -. The Government has no plans at the moment to freeze or interrupt the growth of oil production and exports. " In April, Javadi said that oil exports will reach 2 million barrels per day within the next month, and dosanktsionny country level will be released in June. Experts note that comments Javadi reduce the likelihood of coordination of frozen oil production by OPEC at a meeting of the group, which will be held in Vienna on 2 June.

Pressure on the quotes also have Friday's data from Baker Hughes, showing that for the first time this year, the number of oil rigs in the United States has not changed. The Baker Hughes reported that the total number of drilling rigs in the United States by the end of the working week was reduced by 2 units which ended May 20, up to 404 units. In annual terms, a decline of 481 units or 54.4%. The number of oil rigs in the past week remained at a level of 318 units. The number of gas-producing plants has decreased by two units, or 2.3%, amounting to 85 pieces.

Latest news outweighed fears of unplanned supply disruptions of oil worldwide. Since production is recovering, especially in Nigeria and Canada, experts expect a decline in prices in the next few weeks.

Meanwhile, today Goldman Sachs analysts raised the forecast of oil prices for the current year, but decreased - in 2017. The Bank expects that the average WTI crude price in 2016 will be $ 45 per barrel as compared to the previously forecasted $ 38 per barrel next year - $ 53 per barrel compared to $ 58 per barrel. at 2018 rank remains unchanged - $ 60 per barrel. The forecast for Brent crude oil for the year increased to $ 45 per barrel to $ 39 per barrel, and the next year - reduced to $ 55 per barrel to $ 60 per barrel. The long-term rating has been maintained at $ 53-63 per barrel in the background of productivity growth in the US shale industry and increasing the supply of OPEC.

WTI for delivery in July fell to $48.18 a barrel. Brent for July fell to $48.07 a barrel.

-

17:40

San Francisco Fed President John Williams: the Fed could raise its interest rate in June or in July

San Francisco Fed President John Williams said on Monday that the Fed could raise its interest rate in June or in July. He added that the referendum on Britain's membership in the European Union (EU) would be taken into account in June.

San Francisco Fed president expects two or three interest rate hikes this year.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:31

Australia’s leading economic index rises 0.1% in March

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) rose 0.1% in March, after a 0.3% decline in February.

The coincident index increased 0.3% in March, after a 0.2% rise in February.

-

17:22

Gold prices are down

Gold prices declined moderately by updating the 3.5-week low. Pressure on prices has had a stronger dollar and increasing the likelihood that the Fed will raise interest rates in June.

Precious metals began to fall in price after the Fed last week published the minutes of its April meeting, which showed that the US economy may be ready to increase interest rates next month. Recall, higher interest rates have a downward pressure on the price of gold, which brings its holders to interest income and that is difficult to compete with the assets, bringing that income against the background of increasing interest rates. Since the beginning of the year gold has risen in price by almost 18% due to the reduction of the dollar, an increase in demand for safe-haven assets and the Fed signals that interest rates this year will be increased gradually.

"Minutes of the Fed meeting were clearly more hawkish than expected, and this has led to some changes in the mood now increased the likelihood that the Fed will raise interest rates in June or July.", - Says the analyst of ABN Amro Georgette Boele. Meanwhile, today the president of the Federal Reserve Bank of St. Louis James Bullard said he sees more factors in favor of the slow rate hikes, which in favor of the absence of further tightening of monetary policy. Meanwhile, the president of the Federal Reserve Bank of San Francisco John Williams said he expects two or three short-term increases in interest rates by the central bank this year. Williams added that rate hikes will depend on the exact timing of the data. Today futures on interest rates Fed indicate that the probability of a rate hike in June is 26% versus 4% at the beginning of last week. In addition, traders increased the estimate of the probability of a July rate hike to 53%

"Despite the fact that most traders do not believe the Fed will raise rates in June, investors are trying to reduce risks from open positions in anticipation of the next meeting", - said analyst Bob Haberkorn RJO Futures.

In addition, it became known that the gold reserves in the largest gold ETF-fund SPDR Gold Trust rose on Friday to 1 percent, to 869.26 tonnes, the highest level since November 2013.

The cost of the June gold futures on the COMEX fell to $ 1248.8 per ounce.

-

17:01

St. Louis Federal Reserve President James Bullard: low interest rates for a longer period could lead to financial instability in future

St. Louis Federal Reserve President James Bullard said on Monday that low interest rates for a longer period could lead to financial instability in future.

"I do worry that keeping rates too low for too long could feed into future financial instability even if it doesn't look like we're in that situation today," he said.

St. Louis Federal Reserve president noted that interest rate hikes would depend on the economic data.

He pointed out that the referendum on Britain's membership in the European Union (EU) would not weigh on the Fed's interest rate decision in June.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:55

European Central Bank purchases €16.19 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €16.19 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €907 million of covered bonds, and €142 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:13

Eurozone’s preliminary consumer confidence index rises to -7 in May

The European Commission released its preliminary consumer confidence figures for the Eurozone on Monday. Eurozone's preliminary consumer confidence index rose to -7 in May from -9.3 in April. Analysts had expected the index to increase to -9.0.

European Union's consumer confidence index increased by 1.1 points to 5.7 in May.

-

16:00

Eurozone: Consumer Confidence, May -7 (forecast -9)

-

15:52

U.S. preliminary manufacturing purchasing managers' index declines to 50.5 in May, the lowest level since September 2009

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 50.5 in May from 50.8 in April, missing expectations for an increase to 51.0. It was the lowest level since September 2009.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a fall in output and a softer pace of expansion in new business.

"The weak manufacturing PMI data cast doubt on the ability of the US economy to rebound from its disappointing start to the year in the second quarter," Markit Chief Economist Chris Williamson said.

"The survey is signalling that manufacturing will act as a drag on economic growth in the second quarter, leaving the economy once again dependent on the service sector, and consumers in particular, to sustain growth," he added.

-

15:47

WSE: After start on Wall Street

The market in the United States opened at neutral level and more importantly, over the support level. Currently the April lows is a key reference point. Last week was an opportunity to go down at the bottom, but it did not. Now that the bulls have their chance for a recovery and subsequent days will show whether they manage to overcome the support line.

On the Warsaw market puts a shadow of weakening of the zloty. The reason is a retreat from the assets of emerging countries as a result of a possible rate hike in the United States and the conflict between Poland-EU. There are also concerns that zloty may continue its downward movement.

-

15:45

U.S.: Manufacturing PMI, May 50.5

-

15:38

Japan's final leading index increases to 99.3 in March

Japan's Cabinet Office released its final leading index data on Monday. The leading index increased to 99.3 in March from 98.9 in February, up from the preliminary estimate of 98.4.

Japan's coincident index was up to 111.1 in March from 110.7 in February, down from the preliminary reading of 111.2.

-

15:33

U.S. Stocks open: Dow -0.08%, Nasdaq +0.05%, S&P -0.05%

-

15:30

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 689m) 110.00 (588m) 111.00 (220m) 11195-112.00 (413m)

EUR/USD: 1.1055-75 (EUR 809m) 1.1200 (834 m) 1.1250-55 (385m) 1.1275 (214m) 1.1300-05 (506m) 1.1350 (208m)

USD/CHF 0.9800 (USD 240m) 0.9900 (380m)

AUD/USD 0.7150 (AUD 403m) 0.7300 (801m)

NZD/USD 0.6725 (NZD 282m) 0.6840 (230m)

-

15:24

Before the bell: S&P futures -0.04%, NASDAQ futures +0.08%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,654.6 -81.75 -0.49%

Hang Seng 19,809.03 -43.17 -0.22%

Shanghai Composite 2,844.02 +18.53 +0.66%

FTSE 6,138.2 -18.12 -0.29%

CAC 4,321.79 -32.11 -0.74%

DAX 9,846.04 -69.98 -0.71%

Crude $47.59 (-1.69%)

Gold $1247.50 (-0.43%)

-

14:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.24

0.13(1.427%)

187882

Amazon.com Inc., NASDAQ

AMZN

703.71

0.91(0.1295%)

7477

Apple Inc.

AAPL

95.8

0.58(0.6091%)

263407

AT&T Inc

T

38.5

0.05(0.13%)

2481

Barrick Gold Corporation, NYSE

ABX

17.86

-0.34(-1.8681%)

52417

Boeing Co

BA

127.61

0.22(0.1727%)

10644

Caterpillar Inc

CAT

69.87

0.00(0.00%)

1038

Cisco Systems Inc

CSCO

27.93

-0.04(-0.143%)

3023

Citigroup Inc., NYSE

C

44.91

0.01(0.0223%)

115

Deere & Company, NYSE

DE

77.5

-0.24(-0.3087%)

995

Exxon Mobil Corp

XOM

89.25

-0.49(-0.546%)

2861

Facebook, Inc.

FB

117.53

0.18(0.1534%)

22466

Ford Motor Co.

F

13.2

0.01(0.0758%)

3609

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.84

-0.24(-2.1661%)

121986

General Electric Co

GE

29.52

-0.04(-0.1353%)

4338

General Motors Company, NYSE

GM

30.53

-0.04(-0.1308%)

873

Goldman Sachs

GS

154.7

0.19(0.123%)

1394

Google Inc.

GOOG

707.53

-2.21(-0.3114%)

877

Hewlett-Packard Co.

HPQ

11.65

-0.01(-0.0858%)

116

Home Depot Inc

HD

131.98

0.13(0.0986%)

2014

Intel Corp

INTC

30.21

0.06(0.199%)

2277

Johnson & Johnson

JNJ

112.64

-0.00(-0.00%)

409

Merck & Co Inc

MRK

55.07

-0.04(-0.0726%)

265

Microsoft Corp

MSFT

50.63

0.01(0.0198%)

2183

Nike

NKE

56.61

0.13(0.2302%)

3226

Pfizer Inc

PFE

33.7

-0.04(-0.1186%)

349

Procter & Gamble Co

PG

79.99

-0.03(-0.0375%)

472

Starbucks Corporation, NASDAQ

SBUX

54.67

0.05(0.0915%)

1949

Tesla Motors, Inc., NASDAQ

TSLA

220.5

0.22(0.0999%)

24305

The Coca-Cola Co

KO

44

0.05(0.1138%)

679

Twitter, Inc., NYSE

TWTR

14.48

0.05(0.3465%)

17356

United Technologies Corp

UTX

99.21

0.11(0.111%)

107

Visa

V

78.23

0.56(0.721%)

6292

Wal-Mart Stores Inc

WMT

69.67

-0.19(-0.272%)

5552

Walt Disney Co

DIS

99.74

-0.04(-0.0401%)

384

Yahoo! Inc., NASDAQ

YHOO

36.42

-0.08(-0.2192%)

1845

Yandex N.V., NASDAQ

YNDX

19.22

-0.00(-0.00%)

1000

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Alcoa (AA) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Other:

-

14:34

Japan’s all industry activity index rises 0.1% in March

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Monday. The index rose 0.1% in March, missing expectations for a 0.7% gain, after a 0.9% drop in February. February's figure was revised down from a 1.2% decrease.

Construction industry activity index fell 1.6% in March, industrial production index jumped 3.8%, while tertiary industry activity decreased 0.7%.

-

14:12

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the PMI data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 Japan Manufacturing PMI (Preliminary) May 48.2 47.6

04:30 Japan All Industry Activity Index, m/m March -0.9% Revised From -1.2% 0.7% 0.1%

05:00 Japan Leading Economic Index (Finally) March 96.8 98.4 93.3

05:00 Japan Coincident Index (Finally) March 110.7 111.2 111.1

07:00 France Manufacturing PMI (Preliminary) May 48 48.8 48.3

07:00 France Services PMI (Preliminary) May 50.6 50.6 51.8

07:30 Germany Manufacturing PMI (Preliminary) May 51.8 52 52.4

07:30 Germany Services PMI (Preliminary) May 54.5 54.6 55.2

08:00 Eurozone Services PMI (Preliminary) May 53.1 53.3 53.1

08:00 Eurozone Manufacturing PMI (Preliminary) May 51.7 51.9 51.5

09:30 U.S. FOMC Member James Bullard Speaks

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to rise to 51.0 in May from 50.8 in April.

The euro traded lower against the U.S. dollar after the release of the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0. Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6. The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8. The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6. The services index was driven by rises in new orders, employment and input prices.

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

EUR/USD: the currency pair fell to $1.1200

GBP/USD: the currency pair declined to $1.4460

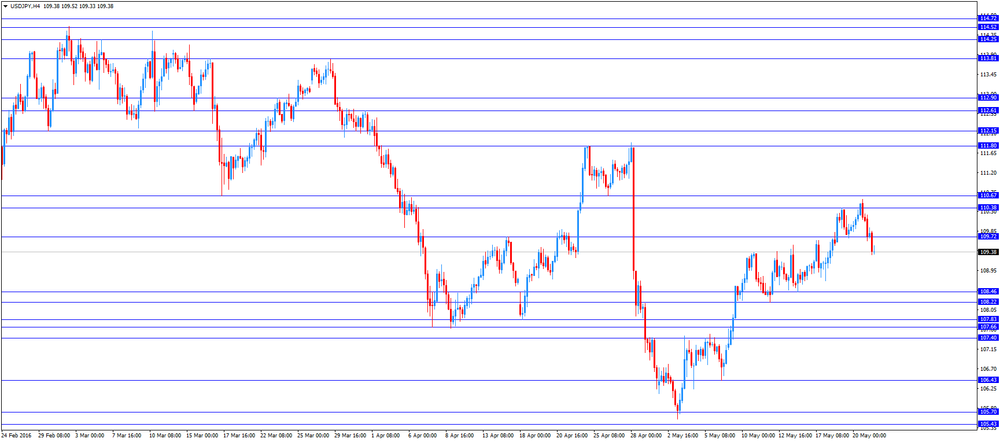

USD/JPY: the currency pair dropped to Y109.31

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Preliminary) May 50.8

14:00 Eurozone Consumer Confidence (Preliminary) May -9.3 -9

-

13:48

Orders

EUR/USD

Offers : 1.1250 1.1280-85 1.1300 1.1325 1.1355-60 1.1380 1.1400

Bids: 1.1200 1.1185 1.1165 1.1150 1.1125-30 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers : 1.4525-30 1.4550 1.4575 1.4600-10 1.4630 1.4650 1.4670 1.4685 1.4700

Bids: 1.4480 1.4465 1.4450 1.4420-25 1.4400 1.4385 1.4350

EUR/GBP

Offers : 0.7755-60 0.7785 0.7800 0.7820 0.7830-35 0.7850

Bids: 0.7725 0.7700 0.7675-80 0.7650 0.7625-30 0.7600 0.7580 0.7550

EUR/JPY

Offers : 123.60 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50

Bids: 123.20 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers : 109.85 110.00 110.20-35 110.50 110.65 110.80 111.00 111.30 111.50

Bids: 109.50 109.40 109.00 108.75-80 108.50 108.30 108.20 108.00

AUD/USD

Offers : 0.7260 0.7280 0.73000.7325-30 0.7350 0.7365 0.7380 0.7400

Bids: 0.7235 0.7220 0.7200 0.7180-85 0.7165 0.7150 0.7130 0.7100

-

13:25

WSE: Mid session comment

In the first half of the session noticeably weakened the zloty, which in relation to the euro is weaker than in the week before the message from Moody's. Today the European Commission is to submit its opinion on the state of the rule of law in Poland, which adversely affects the national assets. The WSE also weakened and the WIG20 index set new daily lows below the level of 1,800 points. In the southern phase of the session there was a rebound and the situation was saved by the banking sector.

Published at 10:00 (Warsaw time) European macroeconomic publications (PMI) presented a negative image, and currently we see a return to session lows with a loss of the order of 0.9% in Germany and 1% in France.

-

12:00

European stock markets mid session: stocks traded mixed on the PMI data from the Eurozone

Stock indices traded mixed on the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0. Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6. The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8. The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6. The services index was driven by rises in new orders, employment and input prices.

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

Current figures:

Name Price Change Change %

FTSE 100 6,153.58 -2.74 -0.04 %

DAX 9,916.14 +0.12 0.00%

CAC 40 4,341.04 -12.86 -0.30 %

-

11:47

European Central Bank chief economist Peter Praet: the ECB could cut its interest rates further but it would depend on conditions

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

"Interest rates are still in the tool box. The question is of course the conditions under which we would decide to use that instrument, because it is clear that the negative rates at some point have also side effects that start to become more important, namely on the profitability of banks," he said.

Praet noted that the ECB was independent.

"I don't think the Governing Council changes in any way its capacity to decide because of political debates. We do what we have to do as good central bankers," the ECB chief economist said.

-

11:36

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 47.6 in May

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 47.6 in May from 48.2 in April. It was the lowest level since December 2012.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was mainly driven by drop in output and new orders.

"Manufacturing conditions deteriorated at a faster rate mid-way through the second quarter of 2016, suggesting the aftermath of the earthquakes were still weighing heavily on goods producers. Both production and new orders declined sharply and at the quickest rates in 25 and 41 months respectively," economist at Markit, Amy Brownbill, said.

-

11:20

France's preliminary manufacturing and services PMIs increase in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8.

The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6.

The services index was driven by rises in new orders, employment and input prices.

"First-quarter GDP data showed a surprisingly punchy 0.5% expansion, but the PMIs continue to point to a more subdued trend in private sector activity midway through the second quarter," the Senior Economist at Markit Jack Kennedy said.

-

11:13

Germany's preliminary manufacturing and services PMIs rise in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0.

Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6.

The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

"A first look at today's survey results is encouraging, as output growth accelerated for the first time in 2016 so far. However, we should not be too complacent about these numbers and should instead view them with some caution," Markit's economist Oliver Kolodseike noted.

-

11:04

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 689m) 110.00 (588m) 111.00 (220m) 11195-112.00 (413m)

EUR/USD: 1.1055-75 (EUR 809m) 1.1200 (834 m) 1.1250-55 (385m) 1.1275 (214m) 1.1300-05 (506m) 1.1350 (208m)

USD/CHF 0.9800 (USD 240m) 0.9900 (380m)

AUD/USD 0.7150 (AUD 403m) 0.7300 (801m)

NZD/USD 0.6725 (NZD 282m) 0.6840 (230m)

-

11:03

Eurozone's preliminary manufacturing PMI falls in May, while services PMIs remains unchanged

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

-

10:49

Iran’s Deputy Oil Minister Rokneddin Javadi: Iran is not ready to freeze its oil output

Iran's Deputy Oil Minister Rokneddin Javadi said on Sunday that the country was not ready to freeze its oil output as it has not reached pre-sanctions levels. He noted that Iran's crude oil exports, excluding gas condensates, reached 2 million barrels a day, adding that the country's crude oil export capacity was expected to reach 2.2 million barrels a day by the middle of summer.

-

10:37

Japanese Finance Minister Taro Aso: Japan will not devaluate its currency

Japanese Finance Minister Taro Aso said on Friday that the country would not devaluate its currency.

"Japan is committed to refraining from competitive devaluation," he said.

Aso noted that "excessive volatility" would have a negative impact on the economy.

-

10:23

The number of active U.S. oil rigs remains unchanged at 318 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. oil rigs remained unchanged at 318 last week.

The number of gas rigs declined by 2 to 85.

Combined oil and gas rigs decreased by 2 to 404.

-

10:12

Preliminary real GDP in the OECD area climbs 0.4% in the first quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Thursday. Real GDP of 34 OECD member countries rose 0.4% in the first quarter, after a 0.4% gain in the fourth quarter.

Real GDP of the United States was down to 0.1% from 0.3%, real GDP of Germany rose to 0.7% from 0.3%, while Britain's economy decreased to 0.4% from 0.6%.

GDP of France increased to 0.5% from 0.3%, Italy's economy was up to 0.3% from 0.2%, while Japan's GDP climbed to 0.4% from -0.4%.

Eurozone's economy expanded at 0.5% in the first quarter, after a 0.3% rise in the fourth quarter.

On a yearly basis, GDP of 34 OECD member countries was down 1.8% in the first quarter, after a 2.0% gain in the previous quarter.

-

10:01

Japan's trade surplus widens to ¥824 billion in April

The Ministry of Finance released its trade data for Japan on the late Sunday evening. Japan's trade surplus rose to ¥824 billion in April from ¥755 billion in March. Analysts had expected a surplus of ¥492.8 billion.

Exports fell 10.1% year-on-year in April, while imports dropped 23.3%.

Exports to Asia declined by 11.1% year-on-year in April, exports to the United States decreased by 11.8%, while exports to the European Union climbed by 9.9%.

Imports from Asia plunged by 19.2% year-on-year in April, imports from the United States slid by 18.1%, while imports from the European Union declined by 8.4%.

-

10:00

Eurozone: Manufacturing PMI, May 51.5 (forecast 51.9)

-

10:00

Eurozone: Services PMI, May 53.1 (forecast 53.3)

-

09:30

Germany: Manufacturing PMI, May 52.4 (forecast 52)

-

09:30

Germany: Services PMI, May 55.2 (forecast 54.6)

-

09:13

WSE: After opening

The futures market (WSE: FW20M16) began the week from decline by 0.22% to 1,811 points.

WIG20 index opened at 1805.88 points (-0.03%)*

WIG 45801.86 0.04%

WIG30 2005.90 0.01%

mWIG40 3483.47 0.12%

*/ - change to previous close

The cash market opens at neutral level with low turnover and a distinction of PZU (WSE: PZU), which shares went down after information on the recommended dividend payment. Surrounded DAX drops significantly, which is a change, because until the opening seemed that the behavior of the market in Frankfurt should be neutral.

-

09:00

France: Manufacturing PMI, May 48.3 (forecast 48.8)

-

09:00

France: Services PMI, May 51.8 (forecast 50.6)

-

08:24

Asian session: The dollar fell versus the yen

The dollar fell versus the yen on Monday, dragged lower by sliding Tokyo stocks and data showing Japan logged a much larger-than-expected trade surplus in April. If a country's exports exceed its imports, as in Japan's recent case, there is in theory a high demand for its goods and therefore for its currency. A Group of 7 finance ministers' meeting concluded on Saturday with the United States warning Japan against intervening to weaken the yen, displaying a well known rift between the two countries on currency intervention.

The U.S. currency got off to a steady start to the week against other major peers, with the dollar index remaining within striking distance of a two-month peak after markets last week moved to price in a greater chance of an imminent hike in U.S. interest rates. Emboldening dollar bulls, recent comments from Federal Reserve officials as well as minutes of the Fed's April meeting have convinced many analysts and investors that a rate hike in June or July is a real possibility.

The resurgent dollar has taken a heavy toll on commodity currencies, none more so than the Australian dollar which was further weighed by expectations of cuts in interest rates at home.

EUR/USD: during the Asian session the pair rose to $1.1240

GBP/USD: during the Asian session the pair rose to $1.4520

USD/JPY: during the Asian session the pair dropped to Y109.60

Based on Reuters materials

-

08:22

WSE: Before opening

Today's morning moods are tend to be neutral. Asian's markets were dominated by modest increases, except Japan, where, however, discount is not large. Listing of contracts in the United States do not differ much from the levels of Friday's closing session.

On the Warsaw Stock Exchange on Friday we had a slight increase, helped by better preserve of the environment and the words of Adam Glapiński (candidate to head of the National Bank of Poland) who said, during the hearing in front of the Public Finance Committee, that the reduction of interest rates would endanger the stability of banks and it is not known whether the solution to the issue of loans mortgage will be connected with the currency conversion. It was support for the banks, for which the potential rate cut would be prejudicial, and the issue of foreign currency lending remains a significant unknown. The WIG20 index closed above the 1,800 pts. and there is no clear argument this morning that it does not persist. Surroundings maintains its support, which means that the supply side could not get a clear advantage, even though the growing expectations of an imminent interest rate hike in the US.

-

07:08

Options levels on monday, May 23, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1417 (4795)

$1.1340 (3192)

$1.1286 (2965)

Price at time of writing this review: $1.1225

Support levels (open interest**, contracts):

$1.1166 (3304)

$1.1140 (8240)

$1.1108 (5056)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68803 contracts, with the maximum number of contracts with strike price $1,1550 (4893);

- Overall open interest on the PUT options with the expiration date June, 3 is 88094 contracts, with the maximum number of contracts with strike price $1,1200 (8240);

- The ratio of PUT/CALL was 1.28 versus 1.30 from the previous trading day according to data from May, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.4802 (1719)

$1.4703 (1868)

$1.4606 (2470)

Price at time of writing this review: $1.4514

Support levels (open interest**, contracts):

$1.4394 (1497)

$1.4296 (2646)

$1.4198 (2968)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 31903 contracts, with the maximum number of contracts with strike price $1,4600 (2470);

- Overall open interest on the PUT options with the expiration date June, 3 is 34139 contracts, with the maximum number of contracts with strike price $1,4200 (2968);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from May, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:02

Japan: Leading Economic Index , March 93.3 (forecast 98.4)

-

07:02

Japan: Coincident Index, March 111.2 (forecast 111.2)

-

06:57

Global Stocks

European stocks rallied Friday, recording their second consecutive weekly gain, as investors' appetite for risk returned after a selloff spurred by concerns about the next U.S. interest-rate hike.

U.S. stocks closed higher on Friday as fears of an interest-rate hike ebbed with the S&P 500 and the Nasdaq posting weekly gains, but the Dow Jones Industrial Average extended its losing streak for a fourth week. Friday's gains follow a day of losses on Thursday, when worries that the Fed could hike interest rates in June sent markets lower in both the U.S. and Europe.

Asia's benchmark stock index swung between gains and losses as Japanese shares fell as the yen advanced, offsetting gains in Chinese and Taiwanese shares. The biggest source of tension at the G-7 meeting over the weekend, held in northern Japan, was the strong yen, with Japanese officials concerned about the currency's impact on exports. Finance Minister Taro Aso signaled a willingness to take action against "disorderly" moves.

Based on MarketWatch materials

-

06:46

Japan: All Industry Activity Index, m/m, March 0.1% (forecast 0.7%)

-

04:05

Nikkei 225 16,485.76 -250.59 -1.50 %, Hang Seng 19,902.15 +49.95 +0.25 %, Shanghai Composite 2,834.55 +9.07 +0.32 %

-

04:01

Japan: Manufacturing PMI, May 47.6

-

01:50

Japan: Trade Balance Total, bln, April 824 (forecast 492.8)

-

00:43

Commodities. Daily history for May 20’2016:

(raw materials / closing price /% change)

Oil 48.48 +0.14%

Gold 1,252.90 0.00%

-

00:42

Stocks. Daily history for Sep Apr May 20’2016:

(index / closing price / change items /% change)

Nikkei 225 16,736.35 +89.69 +0.54 %

Hang Seng 19,852.2 +157.87 +0.80 %

S&P/ASX 200 5,351.31 +27.96 +0.53 %

Shanghai Composite 2,825.94 +19.03 +0.68 %

FTSE 100 6,156.32 +102.97 +1.70 %

CAC 40 4,353.9 +71.36 +1.67 %

Xetra DAX 9,916.02 +120.13 +1.23 %

S&P 500 2,052.32 +12.28 +0.60 %

NASDAQ Composite 4,769.56 +57.02 +1.21 %

Dow Jones 17,500.94 +65.54 +0.38 %

-

00:40

Currencies. Daily history for May 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1221 +0,21%

GBP/USD $1,4500 -0,69%

USD/CHF Chf0,9901 -0,05%

USD/JPY Y110,10 +0,14%

EUR/JPY Y123,61 +0,40%

GBP/JPY Y159,64 -0,56%

AUD/USD $0,7221 0,00%

NZD/USD $0,6763 +0,38%

USD/CAD C$1,3111 +0,11%

-

00:01

Schedule for today, Monday, May 23’2016:

(time / country / index / period / previous value / forecast)

02:00 Japan Manufacturing PMI (Preliminary) May 48.2

04:30 Japan All Industry Activity Index, m/m March -1.2% 0.7%

05:00 Japan Leading Economic Index (Finally) March 96.8 98.4

05:00 Japan Coincident Index (Finally) March 110.7 111.2

07:00 France Manufacturing PMI (Preliminary) May 48 48.8

07:00 France Services PMI (Preliminary) May 50.6 50.6

07:30 Germany Manufacturing PMI (Preliminary) May 51.8 52

07:30 Germany Services PMI (Preliminary) May 54.5 54.6

08:00 Eurozone Services PMI (Preliminary) May 53.1 53.3

08:00 Eurozone Manufacturing PMI (Preliminary) May 51.7 51.9

09:30 U.S. FOMC Member James Bullard Speaks

13:45 U.S. Manufacturing PMI (Preliminary) May 50.8

14:00 Eurozone Consumer Confidence (Preliminary) May -9.3 -9

-