Noticias del mercado

-

21:00

S&P 500 2,131.92 +5.28 +0.25 %, NASDAQ 5,229.84 +19.69 +0.38 %, Dow 18,125.16 +38.71 +0.21 %

-

18:28

WSE: Session Results

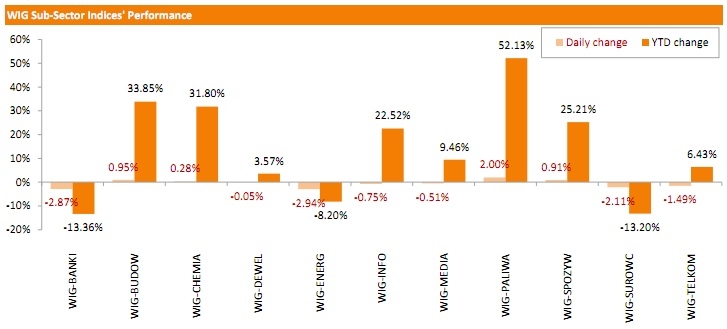

Polish equity market continued to decline on Monday. The broad market measure, the WIG index, lost 1.26%. From a sector perspective, utilities and banks fared the worst, dropping 2.94% and 2.87% respectively. The best-performing group was oil and gas sector, gaining 2%.

The large-cap stocks' measure, the WIG30 Index, declined by 1.51%, dragged down by weak performers of utilities name PGE (WSE: PGE) as well as a number of banking sector stocks, namely PEKAO (WSE: PEO), PKO BP (WSE: PKO), MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which produced losses between 2.57% and 4.27%. On the other side of the ledger, oil and gas name PKN ORLEN (WSE: PKN) recorded the strongest daily performance, soaring by 3.57% on improved analyst outlooks for the company. KERNEL (WSE: KER) emerged as the second best-performing stock in the WIG30, adding 2.81% on reported good operational update. In addition, LOTOS (WSE: LTS) boosted by 1.75%, catching up with its oil and gas sector peers.

-

18:00

European stocks closed: FTSE 100 6,788.69 +13.61 +0.20%, CAC 40 5,142.49 +18.10 +0.35%, DAX 11,735.72 +62.30 +0.53%

-

17:14

Wall Street. Major U.S. stock-indexes little changed

Major Wall Street stock-indexes slightly higher on Monday, with the Nasdaq composite hitting a record for the third straight day, as better-than-expected earnings from big companies boosted investor confidence. On Friday, strong earnings from Google (GOOGL) pushed the tech-heavy Nasdaq to a record close, which gained 4.3% for the week, its largest weekly gain since October while the S&P 500 stopped just short of its record high. Tech earnings will continue to be in focus this week with IBM (IBM) reporting after the close on Monday and other big tech giants such as Apple (AAPL), Yahoo (YHOO) and Microsoft (MSFT) expected to report later this week.

Dow stocks mixed (15 vs 15). Top looser - UnitedHealth Group Incorporated (UNH, -1.22%). Top gainer - Visa Inc. (V, +2.24).

Most of S&P index sectors in negative area. Top looser - Basic Materials (-1.0%). Top gainer - Consumer goods (+0.4%).

At the moment:

Dow 18018.00 +21.00 +0.12%

S&P 500 2120.75 +2.00 +0.09%

Nasdaq 100 4666.50 +16.50 +0.35%

10 Year yield 2,37% +0,02

Oil 50.90 -0.31 -0.61%

Gold 1105.20 -26.70 -2.36%

-

15:34

U.S. Stocks open: Dow +0.13%, Nasdaq +0.20%, S&P +0.09%

-

15:28

Before the bell: S&P futures +0.11%, NASDAQ futures +0.30%

U.S. stock-index futures were little changed as Lockheed Martin (LMT), Morgan Stanley (MS) and Halliburton (HAL) beat analysts' estimates.

Nikkei 20,650.92 +50.80 +0.25%

Hang Seng 25,404.81 -10.46 -0.04%

Shanghai Composite 3,993.44 +36.09 +0.91%

FTSE 6,789.34 +14.26 +0.21%

CAC 5,162.41 +38.02 +0.74%

DAX 11,791.7 +118.28 +1.01%

Crude oil $50.74 (-0.29%)

Gold $1110.10 (-1.91%)

-

15:16

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

82.27

+0.04%

1.3K

American Express Co

AXP

79.27

+0.06%

0.3K

Twitter, Inc., NYSE

TWTR

35.70

+0.08%

10.8K

E. I. du Pont de Nemours and Co

DD

59.73

+0.10%

27.0K

Microsoft Corp

MSFT

46.68

+0.13%

8.7K

Chevron Corp

CVX

93.31

+0.17%

6.3K

Johnson & Johnson

JNJ

100.27

+0.19%

1K

JPMorgan Chase and Co

JPM

69.34

+0.19%

14.5K

Verizon Communications Inc

VZ

47.68

+0.19%

0.9K

Boeing Co

BA

147.16

+0.22%

0.2K

The Coca-Cola Co

KO

41.35

+0.24%

6.1K

Starbucks Corporation, NASDAQ

SBUX

55.84

+0.27%

6.6K

Wal-Mart Stores Inc

WMT

73.60

+0.29%

25.1K

Walt Disney Co

DIS

119.22

+0.30%

1.8K

Merck & Co Inc

MRK

59.00

+0.31%

0.2K

International Business Machines Co...

IBM

173.13

+0.36%

4.5K

Yahoo! Inc., NASDAQ

YHOO

39.85

+0.43%

22.8K

Nike

NKE

113.31

+0.45%

0.8K

Visa

V

71.21

+0.47%

4.5K

Intel Corp

INTC

29.61

+0.48%

15.5K

Ford Motor Co.

F

14.76

+0.48%

1.4K

AT&T Inc

T

35.18

+0.49%

0.1K

General Motors Company, NYSE

GM

30.85

+0.65%

5.2K

Facebook, Inc.

FB

95.69

+0.76%

74.0K

Caterpillar Inc

CAT

84.00

+1.01%

0.8K

United Technologies Corp

UTX

112.22

+1.34%

2.3K

Apple Inc.

AAPL

131.53

+1.47%

590.1K

Amazon.com Inc., NASDAQ

AMZN

491.70

+1.80%

44.5K

Goldman Sachs

GS

212.46

0.00%

1.3K

Cisco Systems Inc

CSCO

28.18

0.00%

1.1K

McDonald's Corp

MCD

97.50

0.00%

0.9K

AMERICAN INTERNATIONAL GROUP

AIG

64.05

0.00%

0.1K

Exxon Mobil Corp

XOM

82.60

-0.01%

1.8K

Tesla Motors, Inc., NASDAQ

TSLA

274.50

-0.06%

18.3K

ALCOA INC.

AA

10.48

-0.10%

5.6K

Citigroup Inc., NYSE

C

58.66

-0.15%

12.8K

General Electric Co

GE

27.18

-0.22%

7.6K

Google Inc.

GOOG

669.00

-0.58%

5.4K

Home Depot Inc

HD

113.50

-0.85%

2.7K

Yandex N.V., NASDAQ

YNDX

15.62

-0.98%

2.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.48

-2.52%

23.0K

Barrick Gold Corporation, NYSE

ABX

08.41

-4.32%

173.1K

-

14:22

Earnings Season in U.S.: Major Reports of the Week

July 20

After the Close:

IBM. Consensus EPS $3.79, Consensus Revenue $20939.23 mln.

July 21

Before the Open:

Verizon (VZ). Consensus EPS $1.00, Consensus Revenue $32468.53 mln.

United Tech (UTX). Consensus EPS $1.72, Consensus Revenue $16517.20 mln.

Travelers (TRV). Consensus EPS $2.12, Consensus Revenue $6016.03 mln.

After the Close:

Apple (AAPL). Consensus EPS $1.80, Consensus Revenue $49339.63 mln.

Microsoft (MSFT). Consensus EPS $0.57, Consensus Revenue $22065.70 mln.

Yahoo! (YHOO). Consensus EPS $0.19, Consensus Revenue $1031.46 mln.

July 22

Before the Open:

Boeing (BA). Consensus EPS $1.92, Consensus Revenue $24253.84 mln.

Coca-Cola (KO). Consensus EPS $0.60, Consensus Revenue $12089.15 mln.

After the Close:

American Express (AXP). Consensus EPS $1.33, Consensus Revenue $8416.26 mln.

July 23

Before the Open:

General Motors (GM). Consensus EPS $1.09, Consensus Revenue $37976.91 mln.

Caterpillar (CAT). Consensus EPS $1.27, Consensus Revenue $12684.99 mln.

3M (MMM). Consensus EPS $1.99, Consensus Revenue $7828.89 mln.

McDonald's (MCD). Consensus EPS $1.24, Consensus Revenue $6447.54 mln.

After the Close:

AT&T (T)). Consensus EPS $0.63, Consensus Revenue $33044.43 mln.

Amazon (AMZN). Consensus EPS $-0.16, Consensus Revenue $22381.57 mln.

Starbucks (SBUX). Consensus EPS $0.41, Consensus Revenue $4866.96 mln.

Visa (V). Consensus EPS $0.58, Consensus Revenue $3362.16 mln.

-

08:50

Global Stocks: Google rules

U.S. stock indices mostly advanced on Friday as investors moved their eyes from Greece, which got a bailout agreement, to quarterly profits reports.

The Dow Jones Industrial Average declined 33.80 points, or 0.2%, to 18,086.45 but still hammered out a 1.8% weekly gain. The S&P 500 added 2.35 points, or 0.1%, to 2,126.64, settling 4 points below its all-time closing high with a weekly gain of 2.4% after three weeks of declines. Nine out of ten components of the index fell with energy companies leading declines amid lower oil prices. The Nasdaq Composite Index rose 44.96 points, or 0.9%, to close at 5,210.14, securing a 4.25% weekly rise.

Google shares jumped 16% to a record close, after the company's quarterly earnings beat analysts' expectations.

In Asia this morning Hong Kong Hang Seng declined 0.24%, or 60.98 points, to 25,354.29. China Shanghai Composite Index climbed 0.04%, or 1.55 point, to 3,958.91. Analysts from Goldlark Investment Consultation believe that investors shouldn't be optimistic about Chinese stocks now as gains are unstable and they are followed by retreats. Japanese stock markets are on holiday.

Asian stock indices traded mixed. Investors put Greece's drama aside and focused on Chinese economy and prospects of Fed rates.

-

04:03

Hang Seng 25,491.22 +75.95 +0.30 %, Shanghai Composite 3,973.58 +16.23 +0.41 %

-

00:58

Stocks. Daily history for Jul 17’2015:

(index / closing price / change items /% change)

Nikkei 225 20,650.92 +50.80 +0.25 %

Hang Seng 25,415.27 +252.49 +1.00 %

Shanghai Composite 3,957.35 +134.18 +3.51 %

FTSE 100 6,775.08 -21.37 -0.31 %

CAC 40 5,124.39 +2.89 +0.06 %

Xetra DAX 11,673.42 -43.34 -0.37 %

S&P 500 2,126.64 +2.35 +0.11 %

NASDAQ Composite 5,210.14 +46.96 +0.91 %

Dow Jones 18,086.45 -33.80 -0.19 %

-