Noticias del mercado

-

21:00

S&P 500 2,131.92 +5.28 +0.25 %, NASDAQ 5,229.84 +19.69 +0.38 %, Dow 18,125.16 +38.71 +0.21 %

-

20:21

American focus: the dollar rose

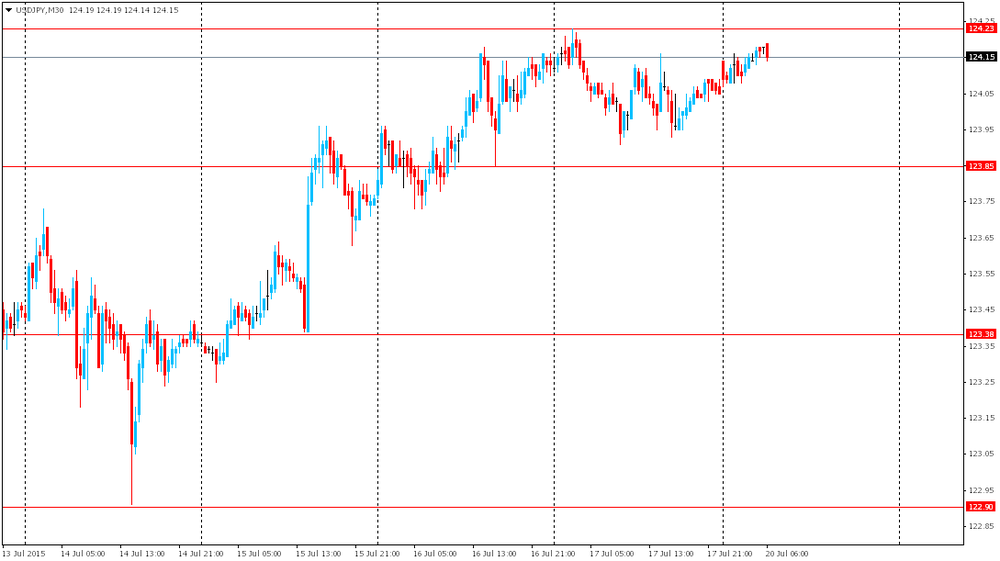

The US dollar rose to a fresh one-month highs against the yen, as the demand for the dollar is supported by expectations for a rate hike in the US before the end of this year.

The dollar was supported after data on Friday showing that the consumer price index in the US rose in June by 0.3%, while the annualized consumer price index rose 0.1% last month.

A separate report showed that housing starts rose in June by 9.8% to 1.174 million units, more than the expected increase of 6.2%.

The volume of building permits rose 7.4% to 1.343 million units last month, confounding forecasts, falling by 11.8%.

The data came after the Federal Reserve Janet Yellen said in a speech before the Committee on Financial Services of the House of Representatives that the Fed is likely to raise rates "at some point this year." She also added that the situation on the US labor market has become healthier, but "some weakness" is still there.

Demand for the yen as a safe haven eased since Monday Greek banks once again began its work after the compulsory three-week suspension, but the restrictions on cash withdrawals still remain. On Saturday, the Greek government has ordered to save the daily cash withdrawal limit of € 60 and set a weekly limit on the level of 420 euros.

The decree came into force on the same day that a new coalition government was sworn in Greece after reshuffling the cabinet. Five opponents of the agreement with the creditors of the party SYRIZA, including the leader of the left wing of the party, had left his post.

On Friday, Germany voted in favor of opening the discussions on the third package of aid to Greece and the European Union approved a bridge loan in the amount of 7.16 billion euros to help Greece make payments on debt to the European Central Bank on Monday.

On Wednesday, the Greek parliament must continue to vote for austerity measures.

The euro rose to session highs after the International Monetary Fund on Monday confirmed that Greece had paid its debt, which paved the way to fund the program resumed assistance to the country.

"The Fund is ready to continue to assist Greece in its attempts to return to financial stability and economic growth," - said IMF spokesman Gerry Rice.

Representatives of the European authorities last week approved a temporary loan for Greece, which allowed Athens to pay debts to the European Central Bank and the IMF. Failure to repay the ECB could plunge the country into financial chaos, as the central bank would close the last funding to support the banking system.

Payment on the IMF loan allowed the Fund to resume formal negotiations on a program of assistance to Athens.

Today it became known that the German producer prices in June fell 0.1% compared to May and by 1.4% per annum. This indicates that producer prices did not exert upward pressure on consumer prices. Excluding volatile energy prices, producer prices Europe's largest economy rose by 0.1% compared with the previous month and fell by 0.2% compared to June of the previous year. Energy prices in Germany in June fell by 0.4% compared to May and by 4.4% compared to the same period of the previous year.

Meanwhile, the data provided by the European Central Bank, have shown that the seasonally adjusted current account surplus decreased the eurozone in May to the level of 18.0 billion. Euros against 24.0 billion. Euro in the previous month (revised from 22.3 billion. euros). The surplus in trade in goods amounted to 23.9 billion. Euros, while the surplus in trade in services was at the level of 6.3 bln. Euro. The balance of the primary income account was 1.1 bln. Euro, which was partly offset by a deficit in the amount of secondary income 13.3 billion. Euro. In unadjusted basis, the current account surplus narrowed to 3.4 billion. Euros from 22.0 billion euros in April (revised from 20.4 billion. Euros).

Small effect has also a monthly report of the Central Bank of Germany. It was reported that the pace of growth in Germany in the 2nd quarter is likely to accelerate. "The growth of economic activity in Germany is likely to become stronger in the 2nd quarter," - the report says the Bundesbank. The central bank said that the positive impetus comes from the consumer sector, which provides support for a good situation on the labor market and a significant increase in wages. "In addition, German exports greatly revived," - said the Central Bank.

The pound fell against the dollar, updating the at least Friday because of the anticipation of the publication of important statistics. Experts point out that tomorrow's data are likely to be indicative of a decrease in the needs of the UK government borrowing, with increased tax revenues, economists say. "Given the acceleration in wage growth and increasing employment, tax revenues start to increase. The low inflation rate contribute to reduce costs", - said James Pomeroy, an economist at HSBC.

Meanwhile, retail sales data, which will be released on Thursday, will shed more light on the state of the UK economy. According to forecasts, sales rose by 0.3% compared to May and by 4.9% per annum.

Focus will also be minutes of the meeting of the Bank of England, which are likely to be indicative of the fact that all members of the board unanimously voted to keep interest rates at the current record low of 0.5%. Governor of the Bank of England Governor Mark Carney and other executives of the bank has recently signaled that the time for the Central Bank rate hikes are coming, but economists think unlikely to tighten policy until 2016.

-

18:28

WSE: Session Results

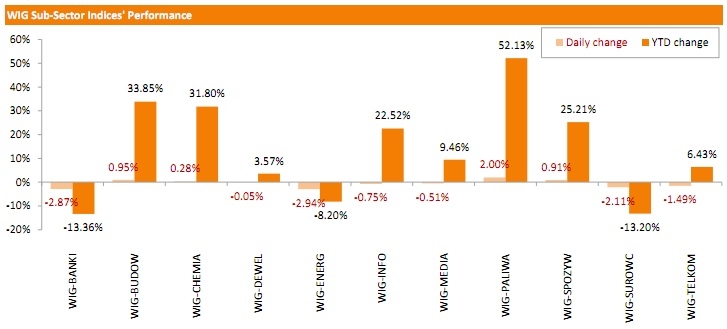

Polish equity market continued to decline on Monday. The broad market measure, the WIG index, lost 1.26%. From a sector perspective, utilities and banks fared the worst, dropping 2.94% and 2.87% respectively. The best-performing group was oil and gas sector, gaining 2%.

The large-cap stocks' measure, the WIG30 Index, declined by 1.51%, dragged down by weak performers of utilities name PGE (WSE: PGE) as well as a number of banking sector stocks, namely PEKAO (WSE: PEO), PKO BP (WSE: PKO), MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which produced losses between 2.57% and 4.27%. On the other side of the ledger, oil and gas name PKN ORLEN (WSE: PKN) recorded the strongest daily performance, soaring by 3.57% on improved analyst outlooks for the company. KERNEL (WSE: KER) emerged as the second best-performing stock in the WIG30, adding 2.81% on reported good operational update. In addition, LOTOS (WSE: LTS) boosted by 1.75%, catching up with its oil and gas sector peers.

-

18:00

European stocks closed: FTSE 100 6,788.69 +13.61 +0.20%, CAC 40 5,142.49 +18.10 +0.35%, DAX 11,735.72 +62.30 +0.53%

-

17:14

Wall Street. Major U.S. stock-indexes little changed

Major Wall Street stock-indexes slightly higher on Monday, with the Nasdaq composite hitting a record for the third straight day, as better-than-expected earnings from big companies boosted investor confidence. On Friday, strong earnings from Google (GOOGL) pushed the tech-heavy Nasdaq to a record close, which gained 4.3% for the week, its largest weekly gain since October while the S&P 500 stopped just short of its record high. Tech earnings will continue to be in focus this week with IBM (IBM) reporting after the close on Monday and other big tech giants such as Apple (AAPL), Yahoo (YHOO) and Microsoft (MSFT) expected to report later this week.

Dow stocks mixed (15 vs 15). Top looser - UnitedHealth Group Incorporated (UNH, -1.22%). Top gainer - Visa Inc. (V, +2.24).

Most of S&P index sectors in negative area. Top looser - Basic Materials (-1.0%). Top gainer - Consumer goods (+0.4%).

At the moment:

Dow 18018.00 +21.00 +0.12%

S&P 500 2120.75 +2.00 +0.09%

Nasdaq 100 4666.50 +16.50 +0.35%

10 Year yield 2,37% +0,02

Oil 50.90 -0.31 -0.61%

Gold 1105.20 -26.70 -2.36%

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E992mn), $1.0900(E753mn), $1.1000(E751mn)

USD/JPY: Y122.00($2.3bn), Y122.50($600mn), Y123.00($765mn), Y123.85($500mn)

GBP/USD: $1.5535(Gbp268mn), $1.5600(Gbp170mn)

EUR/GBP: Gbp0.7100(E208mn)

USD/CHF: Chf0.9700(270mn)

AUD/NZD: NZ$1.1210-20(A$621mn)

-

15:34

U.S. Stocks open: Dow +0.13%, Nasdaq +0.20%, S&P +0.09%

-

15:28

Before the bell: S&P futures +0.11%, NASDAQ futures +0.30%

U.S. stock-index futures were little changed as Lockheed Martin (LMT), Morgan Stanley (MS) and Halliburton (HAL) beat analysts' estimates.

Nikkei 20,650.92 +50.80 +0.25%

Hang Seng 25,404.81 -10.46 -0.04%

Shanghai Composite 3,993.44 +36.09 +0.91%

FTSE 6,789.34 +14.26 +0.21%

CAC 5,162.41 +38.02 +0.74%

DAX 11,791.7 +118.28 +1.01%

Crude oil $50.74 (-0.29%)

Gold $1110.10 (-1.91%)

-

15:16

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

82.27

+0.04%

1.3K

American Express Co

AXP

79.27

+0.06%

0.3K

Twitter, Inc., NYSE

TWTR

35.70

+0.08%

10.8K

E. I. du Pont de Nemours and Co

DD

59.73

+0.10%

27.0K

Microsoft Corp

MSFT

46.68

+0.13%

8.7K

Chevron Corp

CVX

93.31

+0.17%

6.3K

Johnson & Johnson

JNJ

100.27

+0.19%

1K

JPMorgan Chase and Co

JPM

69.34

+0.19%

14.5K

Verizon Communications Inc

VZ

47.68

+0.19%

0.9K

Boeing Co

BA

147.16

+0.22%

0.2K

The Coca-Cola Co

KO

41.35

+0.24%

6.1K

Starbucks Corporation, NASDAQ

SBUX

55.84

+0.27%

6.6K

Wal-Mart Stores Inc

WMT

73.60

+0.29%

25.1K

Walt Disney Co

DIS

119.22

+0.30%

1.8K

Merck & Co Inc

MRK

59.00

+0.31%

0.2K

International Business Machines Co...

IBM

173.13

+0.36%

4.5K

Yahoo! Inc., NASDAQ

YHOO

39.85

+0.43%

22.8K

Nike

NKE

113.31

+0.45%

0.8K

Visa

V

71.21

+0.47%

4.5K

Intel Corp

INTC

29.61

+0.48%

15.5K

Ford Motor Co.

F

14.76

+0.48%

1.4K

AT&T Inc

T

35.18

+0.49%

0.1K

General Motors Company, NYSE

GM

30.85

+0.65%

5.2K

Facebook, Inc.

FB

95.69

+0.76%

74.0K

Caterpillar Inc

CAT

84.00

+1.01%

0.8K

United Technologies Corp

UTX

112.22

+1.34%

2.3K

Apple Inc.

AAPL

131.53

+1.47%

590.1K

Amazon.com Inc., NASDAQ

AMZN

491.70

+1.80%

44.5K

Goldman Sachs

GS

212.46

0.00%

1.3K

Cisco Systems Inc

CSCO

28.18

0.00%

1.1K

McDonald's Corp

MCD

97.50

0.00%

0.9K

AMERICAN INTERNATIONAL GROUP

AIG

64.05

0.00%

0.1K

Exxon Mobil Corp

XOM

82.60

-0.01%

1.8K

Tesla Motors, Inc., NASDAQ

TSLA

274.50

-0.06%

18.3K

ALCOA INC.

AA

10.48

-0.10%

5.6K

Citigroup Inc., NYSE

C

58.66

-0.15%

12.8K

General Electric Co

GE

27.18

-0.22%

7.6K

Google Inc.

GOOG

669.00

-0.58%

5.4K

Home Depot Inc

HD

113.50

-0.85%

2.7K

Yandex N.V., NASDAQ

YNDX

15.62

-0.98%

2.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.48

-2.52%

23.0K

Barrick Gold Corporation, NYSE

ABX

08.41

-4.32%

173.1K

-

14:30

Canada: Wholesale Sales, m/m, May -1.0% (forecast 0.0%)

-

14:22

Earnings Season in U.S.: Major Reports of the Week

July 20

After the Close:

IBM. Consensus EPS $3.79, Consensus Revenue $20939.23 mln.

July 21

Before the Open:

Verizon (VZ). Consensus EPS $1.00, Consensus Revenue $32468.53 mln.

United Tech (UTX). Consensus EPS $1.72, Consensus Revenue $16517.20 mln.

Travelers (TRV). Consensus EPS $2.12, Consensus Revenue $6016.03 mln.

After the Close:

Apple (AAPL). Consensus EPS $1.80, Consensus Revenue $49339.63 mln.

Microsoft (MSFT). Consensus EPS $0.57, Consensus Revenue $22065.70 mln.

Yahoo! (YHOO). Consensus EPS $0.19, Consensus Revenue $1031.46 mln.

July 22

Before the Open:

Boeing (BA). Consensus EPS $1.92, Consensus Revenue $24253.84 mln.

Coca-Cola (KO). Consensus EPS $0.60, Consensus Revenue $12089.15 mln.

After the Close:

American Express (AXP). Consensus EPS $1.33, Consensus Revenue $8416.26 mln.

July 23

Before the Open:

General Motors (GM). Consensus EPS $1.09, Consensus Revenue $37976.91 mln.

Caterpillar (CAT). Consensus EPS $1.27, Consensus Revenue $12684.99 mln.

3M (MMM). Consensus EPS $1.99, Consensus Revenue $7828.89 mln.

McDonald's (MCD). Consensus EPS $1.24, Consensus Revenue $6447.54 mln.

After the Close:

AT&T (T)). Consensus EPS $0.63, Consensus Revenue $33044.43 mln.

Amazon (AMZN). Consensus EPS $-0.16, Consensus Revenue $22381.57 mln.

Starbucks (SBUX). Consensus EPS $0.41, Consensus Revenue $4866.96 mln.

Visa (V). Consensus EPS $0.58, Consensus Revenue $3362.16 mln.

-

14:00

Orders

EUR/USD

Offers 1.0880 1.0900 1.0925-30 1.0950 1.0975 1.1000 1.1050 1.1080 1.1100

Bids 1.0820-25 1.0800 1.0785 1.0750 1.0725 1.0700

GBP/USD

Offers 1.5640-50 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5600 1.5580-85 1.5550 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.6975-80 0.7000 0.7020 0.7060 0.7085 0.7100 0.7120-25 0.7150

Bids 0.6940 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Offers 135.00 135.25 135.50 135.80 136.00 136.50

Bids 134.40 134.00 133.80 133.50 133.30 133.00

USD/JPY

Offers 124.25-30 124.50 124.75 125.00 125.30 125.50

Bids 124.00 123.85 123.123.50 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7350 0.7330 0.7300 0.7285 0.7250 0.7200

-

11:03

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E992mn), $1.0900(E753mn), $1.1000(E751mn)

USD/JPY: Y122.00($2.3bn), Y122.50($600mn), Y123.00($765mn), Y123.85($500mn)

GBP/USD: $1.5535(Gbp268mn), $1.5600(Gbp170mn)

EUR/GBP: Gbp0.7100(E208mn)

USD/CHF: Chf0.9700(270mn)

AUD/NZD: NZ$1.1210-20(A$621mn)

-

10:01

Eurozone: Current account, unadjusted, bln , May 3.4 (forecast 23.2)

-

08:55

Oil prices posted moderate declines

West Texas Intermediate futures for August delivery declined to $51.12 (+0.75%); Brent crude fell to $57.02 (-0.14%) after sources reported that Saudi exports fell to a five-month low of 6.935 million barrels a day despite record high output of over 10 million bpd. In April the Kingdom shipped 7.737 million bpd.

Meanwhile Baker Hughes Inc. said that U.S. producers cut seven oil drilling rigs last week.

Russian Energy Minister Alexander Novak and OPEC Secretary-General Abdullah al-Badri will meet in Moscow on July 30 to discuss oil markets and Iranian situation.

-

08:53

Gold dropped to a five-year low

Gold is currently at $1,106.30 (-2.26%) an ounce. The metal dropped to a five-year low after positive economic data from the U.S. intensified expectations of an imminent rate hike by the Federal Reserve.

Some analysts believe that this sharp decline is a sign that some funds are pessimistic about the metal's outlook. "This kind of sharp drop during early Asian hours is a strong indication that a big fund is selling their holdings of gold," noted Gnanasekar Thiagarajan, director of Commtrendz Risk Management.

Some other analysts also say that this sharp drop couldn't be driven by fundamentals, because the dollar was stable the moment gold plunged.

-

08:50

Global Stocks: Google rules

U.S. stock indices mostly advanced on Friday as investors moved their eyes from Greece, which got a bailout agreement, to quarterly profits reports.

The Dow Jones Industrial Average declined 33.80 points, or 0.2%, to 18,086.45 but still hammered out a 1.8% weekly gain. The S&P 500 added 2.35 points, or 0.1%, to 2,126.64, settling 4 points below its all-time closing high with a weekly gain of 2.4% after three weeks of declines. Nine out of ten components of the index fell with energy companies leading declines amid lower oil prices. The Nasdaq Composite Index rose 44.96 points, or 0.9%, to close at 5,210.14, securing a 4.25% weekly rise.

Google shares jumped 16% to a record close, after the company's quarterly earnings beat analysts' expectations.

In Asia this morning Hong Kong Hang Seng declined 0.24%, or 60.98 points, to 25,354.29. China Shanghai Composite Index climbed 0.04%, or 1.55 point, to 3,958.91. Analysts from Goldlark Investment Consultation believe that investors shouldn't be optimistic about Chinese stocks now as gains are unstable and they are followed by retreats. Japanese stock markets are on holiday.

Asian stock indices traded mixed. Investors put Greece's drama aside and focused on Chinese economy and prospects of Fed rates.

-

08:47

Foreign exchange market. Asian session: the euro remains under pressure

The euro remained under pressure despite positive news from Athens. German Parliament approved Greece's bailout program and euro zone officials constructed a plan, which allows Greece to receive €7 billion to make a payment to the European Central Bank on Monday. Earlier the Eurogroup agreed with the European Commission's proposal to use the European Financial Stability Mechanism for Greece's bridge financing. This week investors will be focused on negotiations between Greece and its international lenders.

The Australian dollar fell amid significant declines in commodity prices and cuts in forecasts of iron ore and coal prices. The AUD also got affected by China's housing price index, which rose to -4.9% from -5.7% reported previously.

Japanese markets are closed due to Marine Day.

EUR/USD: the pair declined to $1.0820 in Asian trade

USD/JPY: the pair advanced to Y124.20

GBP/USD: the pair fell to $1.5580

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Germany Producer Price Index (MoM) June 0.0% 0.0%

08:00 Germany Producer Price Index (YoY) June -1.3% -1.3%

10:00 Eurozone Current account, unadjusted, bln May 20.4 23.2

12:00 Germany Bundesbank Monthly Report

14:30 Canada Wholesale Sales, m/m May 1.9% 0.0%

-

08:10

Options levels on monday, July 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1050 (1561)

$1.0987 (721)

$1.0939 (276)

Price at time of writing this review: $1.0829

Support levels (open interest**, contracts):

$1.0791 (2529)

$1.0746 (3018)

$1.0718 (6015)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 49114 contracts, with the maximum number of contracts with strike price $1,1400 (3152);

- Overall open interest on the PUT options with the expiration date August, 7 is 60921 contracts, with the maximum number of contracts with strike price $1,0800 (6015);

- The ratio of PUT/CALL was 1.24 versus 1.30 from the previous trading day according to data from July, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1162)

$1.5804 (1975)

$1.5707 (924)

Price at time of writing this review: $1.5592

Support levels (open interest**, contracts):

$1.5493 (1376)

$1.5396 (1349)

$1.5298 (1416)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20844 contracts, with the maximum number of contracts with strike price $1,5750 (3000);

- Overall open interest on the PUT options with the expiration date August, 7 is 22715 contracts, with the maximum number of contracts with strike price $1,5250 (2054);

- The ratio of PUT/CALL was 1.09 versus 1.10 from the previous trading day according to data from July, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Producer Price Index (YoY), June 1.4% (forecast -1.3%)

-

08:00

Germany: Producer Price Index (MoM), June -0.1% (forecast 0.0%)

-

04:03

Hang Seng 25,491.22 +75.95 +0.30 %, Shanghai Composite 3,973.58 +16.23 +0.41 %

-

01:00

Commodities. Daily history for Jul 17’2015:

(raw materials / closing price /% change)

Oil 50.78 -0.22%

Gold 1,132.30 +0.04%

-

00:58

Stocks. Daily history for Jul 17’2015:

(index / closing price / change items /% change)

Nikkei 225 20,650.92 +50.80 +0.25 %

Hang Seng 25,415.27 +252.49 +1.00 %

Shanghai Composite 3,957.35 +134.18 +3.51 %

FTSE 100 6,775.08 -21.37 -0.31 %

CAC 40 5,124.39 +2.89 +0.06 %

Xetra DAX 11,673.42 -43.34 -0.37 %

S&P 500 2,126.64 +2.35 +0.11 %

NASDAQ Composite 5,210.14 +46.96 +0.91 %

Dow Jones 18,086.45 -33.80 -0.19 %

-

00:54

Currencies. Daily history for Jul 17’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0829 -0,42%

GBP/USD $1,5602 -0,01%

USD/CHF Chf0,9612 +0,40%

USD/JPY Y124,05 -0,06%

EUR/JPY Y134,34 -0,48%

GBP/JPY Y193,61 -0,04%

AUD/USD $0,7370 -0,46%

NZD/USD $0,6514 +0,06%

USD/CAD C$1,2970 +0,10%

-