Noticias del mercado

-

22:20

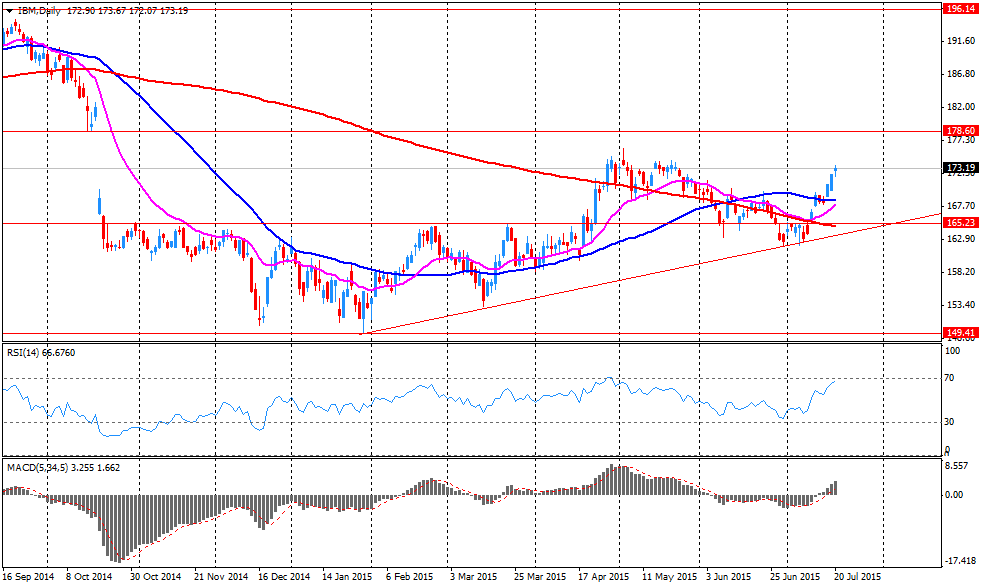

U.S. stocks fell

U.S. stocks fell as IBM Corp. sank on earnings, while European equities ended the best rally since 2011. Treasuries advanced and the dollar's rally versus the euro paused.

The Standard & Poor's 500 Index lost 0.4 percent at 4 p.m. in New York. International Business Machines Corp. slid the most since October, sending the Dow Jones Industrial Average down 1 percent. The Stoxx Europe 600 fell after nine days of gains. The dollar retreated for the first time in five days, and Treasury 10-year note yields slipped three basis points.

In the absence of U.S. economic data, attention is turning to earnings as investors look for clues on the strength of American companies with the Federal Reserve poised to raise interest rates this year. About a quarter of S&P 500 members disclose results this week, including Apple Inc. after today's close. The Bloomberg Commodity Index rebounded from a 2002 low.

Today's weakness in equity markets bolstered the appeal of U.S. government debt. Treasuries rose, sending two-year note yields down from the highest in almost a month, as appetite for riskier assets waned.

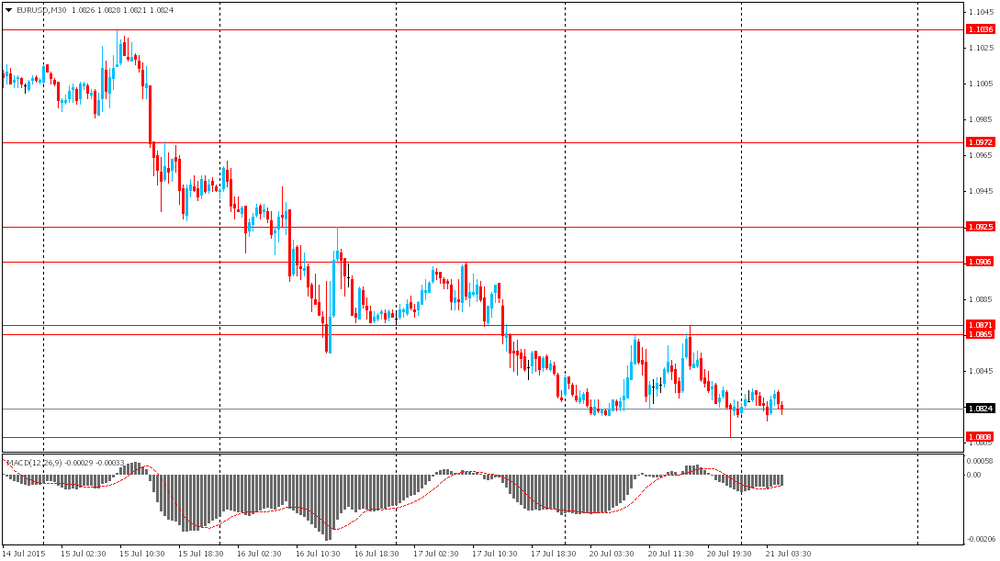

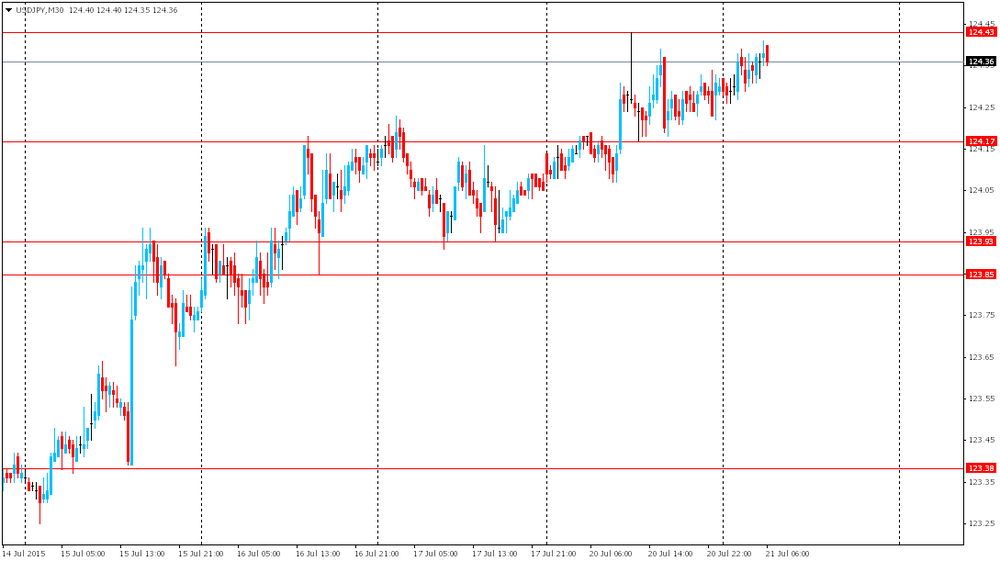

The dollar weakened on Tuesday versus the euro, and an index of the U.S. currency retreated from a three-month high. The euro added 1.1 percent to $1.0942 and the yen gained 0.3 percent to 123.95 per dollar.

Those declines look set to reverse as the Fed meets next week to consider raising interest rates, diverging from central banks in much of the world.

IBM tumbled 6.4 percent after sales fell for a 13th quarter. United Technologies Corp. slid 7.8 percent after cutting its 2015 profit forecast. Novartis AG dropped 2.1 percent after reporting lower sales, while Remy Cointreau SA slipped 2.5 percent after posting revenue that missed analyst estimates.

-

21:00

S&P 500 2,119.36 -8.92 -0.42 %, NASDAQ 5,209.12 -9.74 -0.19 %, Dow 17,894.03 -206.38 -1.14 %

-

20:20

American focus: the dollar fell sharply

The US dollar fell against other major currencies, as investors took profits after a period of strong growth in the US currency.

Against the background of the lack of economic news, investors are taking profits, obtained in last week as the dollar grew on expectations as to what the Federal Reserve may raise interest rates in the next few months. Rising interest rates will support the dollar, making it more attractive to investors.

Last Wednesday, Fed Chairman Janet Yellen said the US central bank aims to raise interest rates this year against the backdrop of rapid economic recovery. Her comments supported the dollar and the dollar index from July 10 to July 20 rose more than 1%.

The euro rose against the dollar significantly updating the 4-day high. The ratio of the market against the euro improved after Greece made payments on the debt, and the IMF and the ECB opened its banks. Yesterday the Greek banks have resumed work after a three-week break, and today the government has submitted to parliament a bill that would require lenders to start negotiations on a new program of financial aid. Parliament must adopt the bills on Wednesday. The most controversial proposal of creditors concerning early retirement pension and citizens to improve the taxation of farmers who raise serious objections from the left wing of the ruling party, SYRIZA, and many representatives of the opposition, were removed from the bill, which greatly increases the chances that it will be approved by the Greek parliament majority.

The focus also remains a divergence in monetary policy of the ECB and the Fed. Meanwhile, traders are waiting for preliminary data on the euro zone PMI, scheduled for Friday, and the FOMC meeting next week, especially after the last performance Yellen and favorable US reports. Also recall that yesterday the Fed Bullard said a 50% probability of a rate hike in September, while supporting the US dollar.

The pound fell against the dollar by updating yesterday's low, but then went back to the opening level. Traders continue to analyze the report on the state finances of Britain, and are waiting for the publication of the minutes of the Bank of England, especially after the Central Bank head Carney hinted at prospects for a rate hike at the end of 2015 or early 2016. As previously reported, the British government borrowing fell in June, but slightly less than predicted by experts. However, the last value was the lowest for the month for the past seven years. According to the data, net borrowing state. sector (excluding public sector banks) decreased to 9.4 billion. pounds in June from 10.2 billion. pounds a year earlier, compared with economists' forecasts at -8.5 billion. lbs. For the first three months of fiscal year 2015/16, net borrowing of the public sector amounted to 25.1 billion. Pounds, which is almost 20 percent lower than in April-June last year. We also add the last value was the lowest since the April-June 2008/09 financial year. The ONS said that tax revenues in June increased by 0.3 billion. To 11.5 billion pounds. Pounds, its highest level since the start of statistics (1997). Income taxes increased by almost 14 percent, to 1.7 billion. Pounds, which is also the maximum value for all the time.

-

19:20

European stocks declined

European stocks declined, snapping a nine-day winning streak, amid mixed earnings reports.

Novartis AG fell 2.1 percent after reporting lower sales, dragging a measure of health-related companies to the second-worst performance of the 19 industry groups on the Stoxx Europe 600 Index. French distiller Remy Cointreau SA slipped 2.5 percent after posting sales that missed analyst estimates.

The Stoxx 600 retreated 1 percent to 402.66 at the close of trading, after earlier rising as much as 0.3 percent. Shares extended losses in late-afternoon trading, as U.S. stocks declined amid disappointing results from IBM Corp. and United Technologies. The volume of shares changing hands on the Stoxx 600 was 19 percent lower than the 30-day average.

"The earnings season is in focus for now and there's a consolidation after the big rally post Greece -- people are taking profits," said Konstantin Giantiroglou, head of investment advisory and research at Neue Aargauer Bank AG in Brugg, Switzerland. "Some investors are a bit more cautious today seeing the markets have gone up a lot."

A nine-day winning streak pushed the Stoxx 600 to within 2 percent of its record as Greece and its creditors reached an agreement paving the way for a new bailout and the European Central Bank increased emergency liquidity assistance. The nation reopened its banks on Monday after a three-week shutdown. The Athens Stock Exchange remains closed.

Zalando SE lost 5.2 percent after the German online fashion retailer indicated that second-quarter earnings may have declined because of higher costs. Tele2 AB dropped 6.8 percent after profit fell short of projections.

EasyJet Plc slipped 3.2 percent after Commerzbank AG reiterated its sell recommendation on the carrier, while also downgrading shares of some European peers amid increasing capacity and falling demand.

Stora Enso Oyj tumbled 8.3 percent, the most in three years. The Finnish papermaker posted operating profit that missed analyst estimates amid production problems in board mills, investments in new facilities and lower harvesting in China.

Faurecia SA added 1.7 percent after people familiar with the matter said Europe's biggest maker of car interiors is exploring a sale of its bumpers business.

-

18:13

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower in late morning trading on Tuesday as revenue at IBM and United Technologies weighed on the Dow and the S&P 500 and investors awaited results from tech giants including Apple and Microsoft. IBM's shares fell as much as 5.5%, a day after the company's revenue fell for the 13th consecutive quarter. United Technologies fell as much as 7.9% and was the biggest loser on the Dow, after the company cut its full-year profit outlook.

Most of Dow stocks in negative area (22 of 30). Top looser - United Technologies Corporation (UTX, -7.68%). Top gainer - Chevron Corporation (CVX, +1.03).

Most of S&P index sectors also in negative area. Top looser - Industrial Goods (-1.1%). Top gainer - Basic Materials (+0.8%).

At the moment:

Dow 17816.00 -187.00 -1.04%

S&P 500 2112.75 -9.25 -0.44%

Nasdaq 100 4665.75 -5.50 -0.12%

10 Year yield 2,36% -0,02

Oil 50.69 +0.25 +0.50%

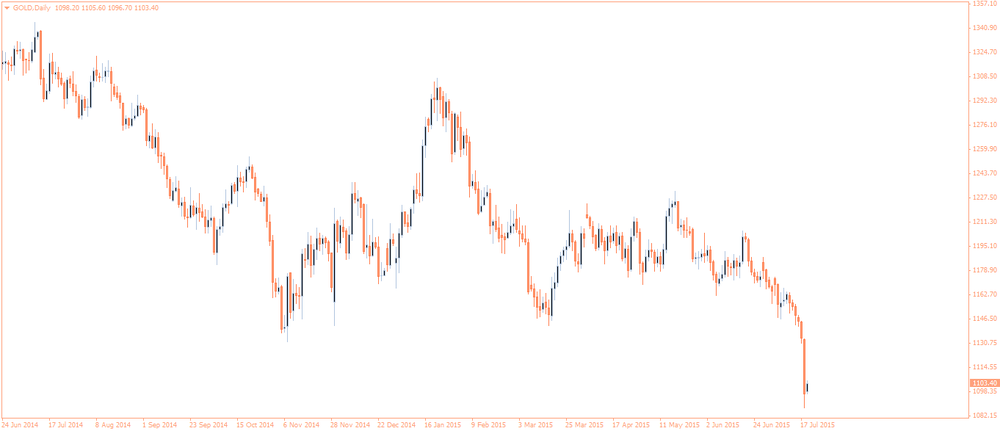

Gold 1105.10 -1.70 -0.15%

-

18:05

WSE: Session Results

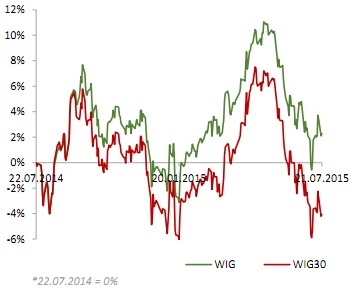

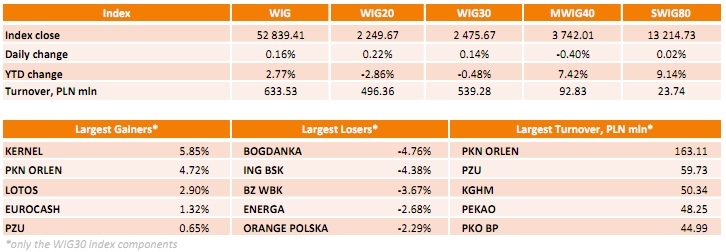

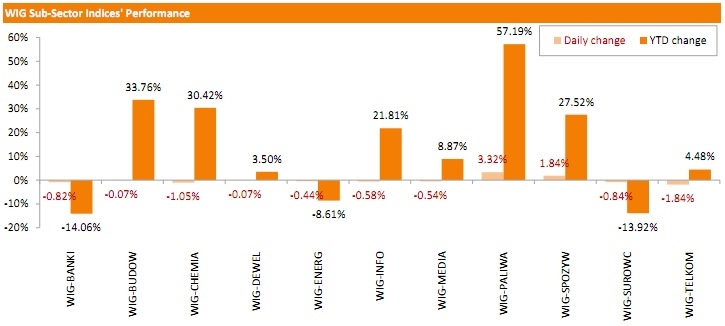

Polish equities were higher on Tuesday, with the broad-market measure, the WIG index, edging up 0.16%. Sector performance was mainly negative as nine sectors recorded losses, with telecommunication sector (-1.84%) lagging behind.

The large-cap stocks' measure, the WIG30 Index rose 0.14%. Within the index components, KERNEL (WSE: KER) and PKN ORLEN (WSE: PKN) topped the list of advancers, climbing by 5.85% and 4.72% respectively. They were followed by LOTOS (WSE: LTS) and EUROCASH (WSE: EUR), adding 2.9% and 1.32% respectively. On the contrary, BOGDANKA (WSE: LWB) was the worst performer, losing 4.76%. ING BSK (WSE: ING), BZ WBK (WSE: BZW), ENERGA (WSE: ENG), ORANGE POLSKA (WSE: OPL), MBANK (WSE: MBK) and HANDLOWY (WSE: BHW) also posted notable declines, dropping 2.06%-4.38%.

-

18:00

European stocks closed: FTSE 100 6,769.07 -19.62 -0.29 %, CAC 40 5,106.57 -35.92 -0.70 %, DAX 11,604.8 -130.92 -1.12 %

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0850(E1.2bn), $1.0900(E1.0bn)

USD/JPY: Y122.00($1.3bn), Y122.60($344mn), Y123.00($380mn)

EUR/JPY: Y134.00(E390mn), Y134.50(E550mn), Y136.00(E240mn)

GBP/USD: $1.5400(Gbp322mn)

AUD/USD: $0.7350(A$611mn), $0.7600(A$634mn)

USD/CAD: C$1.2850($1.0bn), C$1.3030($375mn), C$1.3100($1.25bn)

-

15:33

U.S. Stocks open: Dow -0.62%, Nasdaq -0.05%, S&P -0.12%

-

15:24

Before the bell: S&P futures -0.14%, NASDAQ futures -0.02%

U.S. stock-index futures were little changed before Apple Inc. and Microsoft Corp. report quarterly earnings.

Global Stocks:

Nikkei 20,841.97 +191.05 +0.93%

Hang Seng 25,536.43 +131.62 +0.52%

Shanghai Composite 4,018.62 +26.51 +0.66%

FTSE 6,777.95 -10.74 -0.16%

CAC 5,133.28 -9.21 -0.18%

DAX 11,693.34 -42.38 -0.36%

Crude oil $50.24 (+0.26%)

Gold $1102.40 (-2.60%)

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

119.62

+0.03%

3.2K

3M Co

MMM

157.25

+0.08%

0.1K

American Express Co

AXP

79.36

+0.08%

0.6K

Amazon.com Inc., NASDAQ

AMZN

488.67

+0.12%

10.5K

McDonald's Corp

MCD

97.64

+0.15%

0.1K

Procter & Gamble Co

PG

82.31

+0.15%

5.7K

Starbucks Corporation, NASDAQ

SBUX

56.30

+0.16%

0.3K

ALTRIA GROUP INC.

MO

53.80

+0.17%

1.1K

Visa

V

72.84

+0.19%

19.5K

Nike

NKE

113.37

+0.21%

0.3K

Ford Motor Co.

F

14.60

+0.21%

1.6K

Home Depot Inc

HD

113.66

+0.22%

0.7K

Yandex N.V., NASDAQ

YNDX

15.52

+0.26%

2.3K

ALCOA INC.

AA

10.23

+0.29%

7.2K

Chevron Corp

CVX

93.31

+0.40%

0.2K

HONEYWELL INTERNATIONAL INC.

HON

106.80

+0.40%

0.1K

Wal-Mart Stores Inc

WMT

73.41

+0.42%

0.1K

Merck & Co Inc

MRK

59.26

+0.44%

0.2K

General Motors Company, NYSE

GM

30.67

+0.56%

0.8K

Yahoo! Inc., NASDAQ

YHOO

39.77

+0.58%

11.5K

Johnson & Johnson

JNJ

101.00

+0.63%

2.6K

Apple Inc.

AAPL

132.93

+0.65%

517.8K

Facebook, Inc.

FB

98.80

+0.91%

613.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.25

+1.35%

73.3K

Travelers Companies Inc

TRV

104.75

+2.09%

2.7K

Barrick Gold Corporation, NYSE

ABX

07.66

+3.37%

289.9K

Hewlett-Packard Co.

HPQ

30.45

0.00%

0.1K

Boeing Co

BA

146.70

-0.01%

2.0K

Intel Corp

INTC

29.10

-0.01%

7.7K

Exxon Mobil Corp

XOM

81.72

-0.05%

4.1K

JPMorgan Chase and Co

JPM

69.19

-0.10%

22.8K

Microsoft Corp

MSFT

46.87

-0.11%

39.2K

Caterpillar Inc

CAT

82.15

-0.12%

2.3K

Citigroup Inc., NYSE

C

58.78

-0.12%

1.5K

Cisco Systems Inc

CSCO

27.99

-0.14%

1.0K

Twitter, Inc., NYSE

TWTR

35.76

-0.14%

9.9K

General Electric Co

GE

27.08

-0.22%

51.8K

Goldman Sachs

GS

211.91

-0.23%

1.5K

The Coca-Cola Co

KO

41.25

-0.31%

2.2K

Google Inc.

GOOG

660.00

-0.46%

3.8K

AT&T Inc

T

34.62

-0.80%

37.5K

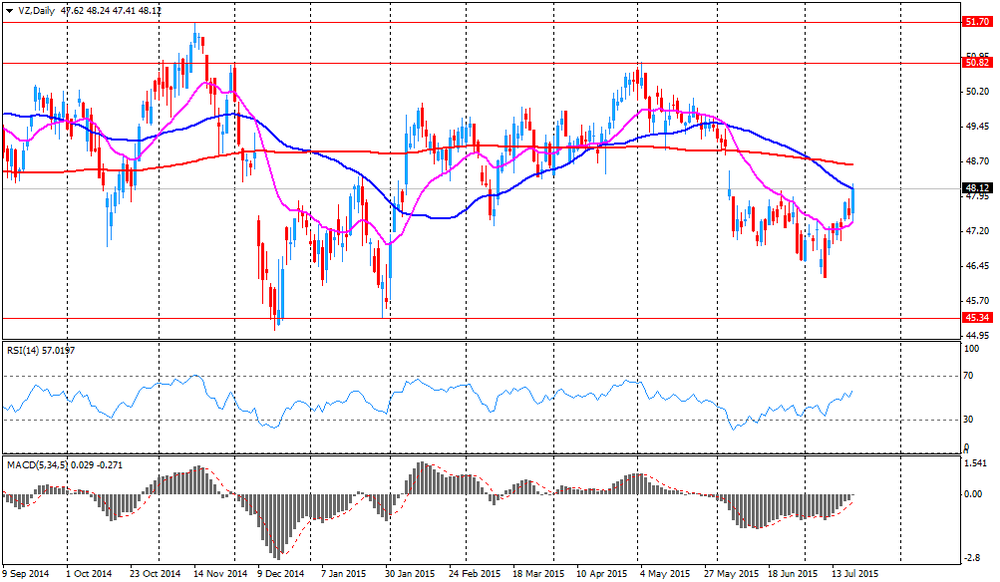

Verizon Communications Inc

VZ

46.94

-2.41%

283.8K

Tesla Motors, Inc., NASDAQ

TSLA

271.00

-3.99%

152.1K

United Technologies Corp

UTX

105.00

-4.96%

3.8K

International Business Machines Co...

IBM

164.14

-5.24%

72.8K

-

14:50

Company News: Travelers (TRV) reported better than expected EPS and revenue

Company reported Q2 profit of $2.52 per share versus $2.11 consensus. Revenues rose 0.1% year/year to $6.17 bln versus $6.02 bln consensus.

Company reported: book value per share increased 3% from the prior year quarter end and 1% from year-end 2014 to $77.51; adjusted book value per share increased 5% and 3% respectively to $73.09.

TRV rose to $104.80 (+2.13%) on the premarket.

-

14:38

Company News: United Technologies Corp (UTX) lowered EPS and revenues guidance

Company reported Q2 profit of $1.81 per share versus $1.72 consensus. Revenues fell 5.0% year/year to $16.33 bln versus $16.52 bln consensus.

Company lowered EPS guidance for FY15 to $6.45-6.60 from $6.55-6.85 versus $6.82 consensus. Revenue guidence lowered to $57-58 bln from prior $58-59 bln versus $64.72 bln consensus.

UTX fell to $106.00 (-4.06%) on the premarket.

-

14:27

-

14:18

-

14:15

European session review: the pound fell sharply against the US dollar

Data:

01:30 Australia RBA Meeting's Minutes

06:00 Switzerland Trade Balance June 3.409 Revised From 3.43 3.578

08:30 United Kingdom PSNB, bln June -8.35 Revised From -9.35 -8.6 -8.58

The pound fell sharply against the dollar, updating yesterday's low. Traders continue to analyze the report on the state finances of Britain, and are waiting for the publication of the minutes of the Bank of England, especially after the Central Bank head Carney hinted at prospects for a rate hike at the end of 2015 or early 2016. As previously reported, the British government borrowing fell in June, but slightly less than predicted by experts. However, the last value was the lowest for the month for the past seven years. According to the data, net borrowing state. sector (excluding public sector banks) decreased to 9.4 billion. pounds in June from 10.2 billion. pounds a year earlier, compared with economists' forecasts at -8.5 billion. lbs. For the first three months of fiscal year 2015/16, net borrowing of the public sector amounted to 25.1 billion. Pounds, which is almost 20 percent lower than in April-June last year. We also add the last value was the lowest since the April-June 2008/09 financial year. The ONS said that tax revenues in June increased by 0.3 billion. To 11.5 billion pounds. Pounds, its highest level since the start of statistics (1997). Income taxes increased by almost 14 percent, to 1.7 billion. Pounds, which is also the maximum value for all the time.

The euro rose against the dollar significantly, approaching to yesterday's high. Experts point out that there are no releases or significant events in Europe and the US market's attention is directed to the dynamics of interest in risky assets. The ratio of the market against the euro also improved after Greece made payments on the debt, and the IMF and the ECB opened its banks. Yesterday the Greek banks have resumed work after a three-week break, and today the government has submitted to parliament a bill that would require lenders to start negotiations on a new program of financial aid. Parliament must adopt the bills on Wednesday. The most controversial proposal of creditors concerning early retirement pension and citizens to improve the taxation of farmers who raise serious objections from the left wing of the ruling party, SYRIZA, and many representatives of the opposition, were removed from the bill, which greatly increases the chances that it will be approved by the Greek parliament majority.

The focus also remains a divergence in monetary policy of the ECB and the Fed. Meanwhile, traders are waiting for preliminary data on the euro zone PMI, scheduled for Friday, and the FOMC meeting next week, especially after the last performance Yellen and favorable US reports. Also recall that yesterday the Fed Bullard said a 50% probability of a rate hike in September, while supporting the US dollar.

Ian shows a slight decline against the US dollar, while remaining close to the monthly minimum. In the course of trading influenced the July report of the Government of Japan. Recall, the government lowered its estimate of industrial production and identify potential risks associated with the slowdown of the Chinese economy. Overall assessment of the economic situation in Japan was left unchanged. "The growth rate of China's economy is slowing down a bit. Though it had no apparent effect on Japan's economy, should closely monitor the pace of economic activity in China," - said the representative of the government at a press conference. The representative of the Government of Japan said that the weakness of the production of small cars and parts for smart phones has a negative impact on industrial production in Japan as a whole. Restoration of activity so far not observed in all sectors of the economy, especially behind the regional small and medium enterprises.

EUR / USD: during the European session, the pair rose to $ 1.0877

GBP / USD: during the European session, the pair has risen traded in the range of $ 1.5590- $ 1.5527

USD / JPY: during the European session the pair fell to Y124.24

At 20:30 GMT the United States will declare the change of volume of crude oil reserves (according to API),

-

14:00

Orders

EUR/USD

Offers 1.0880 1.0900 1.0925-30 1.0950 1.0975 1.1000 1.1050 1.1080 1.1100

Bids 1.0800 1.0785 1.0750 1.0725 1.0700

GBP/USD

Offers 1.5640-50 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7000 0.7020 0.7060 0.7085 0.7100 0.7120-25 0.7150

Bids 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Offers 135.25 135.50 135.80 136.00 136.50

Bids 134.40 134.00 133.80 133.50 133.30 133.00

USD/JPY

Offers 124.50 124.75 125.00 125.30 125.50

Bids 124.00 123.85 123.123.50 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7330 0.7300 0.7285 0.7250 0.7200

-

12:30

Major stock indexes in Europe are mixed

European stocks traded in different directions, but with only a slight change, which is associated with the publication of mixed earnings reports.

"Greece no longer has a significant impact on the market, the investors have paid attention to economic statistics and company reports. After closing all waiting for quarterly reports of Apple and Microsoft", - the analyst said Peregrine & Black Markus Huber.

Yesterday the Greek banks have resumed work after a three-week break, and today the government has submitted to parliament a bill that would require lenders to start negotiations on a new program of financial aid. Parliament must adopt the bills on Wednesday. The most controversial proposal of creditors concerning early retirement pension and citizens to improve the taxation of farmers who raise serious objections from the left wing of the ruling party, SYRIZA, and many representatives of the opposition, were removed from the bill, which greatly increases the chances that it will be approved by the Greek parliament majority.

A little influenced by data on Britain. It is learned that the British government borrowing fell in June, but less than predicted by experts. However, the last value was the lowest for the month for the past seven years. This was reported to the Office for National Statistics. According to the data, net borrowing state. sector (excluding banks state. sector) fell to 9.4 bln. pounds in June from 10.2 billion. pounds a year earlier, compared with economists' forecasts at -8.5 billion. lbs. For the first three months of fiscal year 2015/16, net borrowing of the public sector amounted to 25.1 billion. Pounds, which is almost 20 percent lower than in April-June last year. We also add the last value was the lowest since the April-June 2008/09 financial year. The ONS said that tax revenues in June increased by 0.3 billion. To 11.5 billion pounds. Pounds, its highest level since the start of statistics (1997). Income taxes increased by almost 14 percent, to 1.7 billion. Pounds, which is also the maximum value for all the time.

Sensor shares of pharmaceutical companies shows the largest decline among the 19 industry groups Stoxx Europe 600. The cost of Novartis AG - the world's largest pharmaceutical companies in terms of revenue - fell by 2.4% due to lower revenues in the 2nd quarter by 7%. Shares of Swiss farmkontserna Actelion Ltd. fell 0.8%, as its core earnings in the 1st half of the year was worse than expected.

Quotes Remy Cointreau SA - the second largest producer of alcoholic beverages in France - were down 2.3% on the back of weak data on revenue for the first fiscal quarter.

Cost Norsk Hydro has grown by 1.5% since the base of EBIT in April-June rose to 2.67 billion Norwegian kroner against the forecast of 2.34 billion euros.

Paper Zalando SE fell 2.6% after the company reported that second-quarter earnings may have declined because of the high costs.

The cost of Tele2 AB fell 3.2%, as the amount of profit was lower than forecast.

Quotes Royal Mail Plc - British postal operatora- fell 0.4% as revenue in the 1st finkvartale not changed.

EasyJet Plc's shares fell 1.4% after analysts at Commerzbank AG confirmed the rating on the stock at "sell."

Currently:

FTSE 100 6,787.28 -1.41 -0.02%

CAC 40 5,145.64 +3.15 + 0.06%

DAX 11,736.09 +0.37 0.00%

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0850(E1.2bn), $1.0900(E1.0bn)

USD/JPY: Y122.00($1.3bn), Y122.60($344mn), Y123.00($380mn)

EUR/JPY: Y134.00(E390mn), Y134.50(E550mn), Y136.00(E240mn)

GBP/USD: $1.5400(Gbp322mn)

AUD/USD: $0.7350(A$611mn), $0.7600(A$634mn)

USD/CAD: C$1.2850($1.0bn), C$1.3030($375mn), C$1.3100($1.25bn)

-

10:30

United Kingdom: PSNB, bln, June -8.58 (forecast -8.6)

-

08:49

Oil prices continue declining

West Texas Intermediate futures for August delivery, which expires today, declined to $50.22 (-0.44%); Brent crude fell to $56.55 (-0.18%) amid the dollar's strength and concerns of imminent additional supplies to an already oversupplied market from Iran.

Strong dollar makes crude more expensive for holders of other currencies.

Meanwhile many analysts say that Iran cannot increase its exports significantly in the near future. "Pessimism about oil prices because of the Iran nuclear deal and economic concern about China and Europe are overblown," analysts at PIRA Energy said forecasting Iranian output rising from around 3 million barrels per day to full capacity of 3.5 million bpd by the end of 2016.

The American Petroleum Institute and the US Energy Information Administration will publish inventory reports on Tuesday and Wednesday respectively.

-

08:47

Gold stabilized above a five-year low

Gold is currently at $1,103.00 (-0.34%) an ounce. After yesterday's sharp drop the metal has stabilized just above its five-year low and an important support level $1,100. Many analysts say that today's stabilization does not mean that the down trend is reversed.

An imminent rate hike in the U.S., progress in Greece's situation and weak demand in top consumers China and India undermine gold's safe-haven appeal. However bullion price is unlikely to fall as dramatically as yesterday, because yesterday's plunge happened in a few minutes unlike for example a fall of 13% over two consecutive trading days in April 2013.

-

08:45

Global Stocks: U.S. indices advanced and helped boost Asian stocks

U.S. stock indices slightly advanced on Friday amid several strong earnings reports, although shares of mining companies fell because of declines in commodity prices.

The Dow Jones Industrial Average climbed 13.96 points, or 0.1%, to close at 18100.41. The S&P 500 gained 1.64 points, or 0.1%, to 2128.28. The Nasdaq Composite rose 8.72 points, or 0.2%, 5218.86.

Goldman Sachs is skeptical looking ahead as U.S. stocks have historically underperformed in the twelve months after the Fed's first rate hike. For example, Goldman expects the U.S. benchmark S&P 500 returning negative-0.7%, negative-0.2% and a positive-3.2%, on a three-month, six-month and 12-month basis, respectively.

In Asia this morning Hong Kong Hang Seng rose 0.36%, or 91.54 points, to 25,496.35. China Shanghai Composite Index climbed 0.52%, or 20.91 point, to 4,013.02. The Nikkei rose 0.67%, or 138.53 points, to 20,789.45.

Japanese stocks advanced amid a weaker yen and gains in U.S. equities.

-

08:41

Foreign exchange market. Asian session: the euro remains under pressure despite debt payments from Greece

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:45 New Zealand Visitor Arrivals June 9.5% 9.2%

01:50 Japan Monetary Policy Meeting Minutes

03:30 Australia RBA Meeting's Minutes

The euro remained under pressure despite positive news from Athens. Sources reported that the European Central Bank and the International Monetary Fund had confirmed that they received payments from Greece. Yesterday Greece transferred €4.2 and over €2 billion to the ECB and the IMF respectively. Greece has also returned a loan of €500 million to its own central bank. Greece's banks reopened boosting risk appetite.

The New Zealand dollar rose against the U.S. dollar after New Zealand Prime Minister said that the New Zealand dollar's 25% decline to $0.6500 in the last twelve months was faster than expected. However growth of the NZD/USD pair is limited by low prices of dairy products and expectations of a 25 basis points rate cut by the RBNZ this week.

EUR/USD: the pair traded around $1.0815-35 in Asian trade

USD/JPY: the pair rose to Y124.40

GBP/USD: the pair traded around $1.5555-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland Trade Balance June 3.43

10:30 United Kingdom PSNB, bln June -9.35 -8.6

22:30 U.S. API Crude Oil Inventories July -0.95

-

08:31

Switzerland: Trade Balance, June 3.578

-

08:23

Options levels on tuesday, July 21, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1037 (1616)

$1.0970 (870)

$1.0919 (294)

Price at time of writing this review: $1.0820

Support levels (open interest**, contracts):

$1.0785 (2543)

$1.0745 (2997)

$1.0718 (6095)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 50150 contracts, with the maximum number of contracts with strike price $1,1400 (3252);

- Overall open interest on the PUT options with the expiration date August, 7 is 60834 contracts, with the maximum number of contracts with strike price $1,0800 (6095);

- The ratio of PUT/CALL was 1.21 versus 1.24 from the previous trading day according to data from July, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5803 (1939)

$1.5706 (850)

$1.5609 (1873)

Price at time of writing this review: $1.5571

Support levels (open interest**, contracts):

$1.5491 (1455)

$1.5395 (1376)

$1.5297 (1416)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20882 contracts, with the maximum number of contracts with strike price $1,5750 (3009);

- Overall open interest on the PUT options with the expiration date August, 7 is 22903 contracts, with the maximum number of contracts with strike price $1,5250 (2054);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from July, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:04

Nikkei 225 20,729.54 +78.62 +0.38 %, Hang Seng 25,470 +65.19 +0.26 %, Shanghai Composite 3,968.47 -23.64 -0.59 %

-

00:47

New Zealand: Visitor Arrivals, June 9.2%

-

00:35

Commodities. Daily history for Jul 20’2015:

(raw materials / closing price /% change)

Oil 49.94 -0.42%

Gold 1,096.70 -0.91%

-

00:34

Stocks. Daily history for Jul 20’2015:

(index / closing price / change items /% change)

Hang Seng 25,404.81 -10.46 -0.04%

S&P/ASX 200 5,686.89 +16.78 +0.30%

Shanghai Composite 3,993.44 +36.09 +0.91%

FTSE 100 6,788.69 +13.61 +0.20%

CAC 40 5,142.49 +18.10 +0.35%

Xetra DAX 11,735.72 +62.30 +0.53%

S&P 500 2,128.28 +1.64 +0.08%

NASDAQ Composite 5,218.86 +8.72 +0.17%

Dow Jones 18,100.41 +13.96 +0.08%

-

00:29

Currencies. Daily history for Jul 20’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0821 -0,07%

GBP/USD $1,5557 -0,29%

USD/CHF Chf0,9641 +0,30%

USD/JPY Y124,30 +0,20%

EUR/JPY Y134,51 +0,13%

GBP/JPY Y193,38 -0,12%

AUD/USD $0,7367 -0,04%

NZD/USD $0,6558 +0,67%

USD/CAD C$1,2997 +0,21%

-

00:01

Schedule for today, Tuesday, Jul 21’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

06:00 Switzerland Trade Balance June 3.43

08:30 United Kingdom PSNB, bln June -9.35 -8.6

20:30 U.S. API Crude Oil Inventories July -0.95

-