Noticias del mercado

-

20:20

American focus: the dollar fell sharply

The US dollar fell against other major currencies, as investors took profits after a period of strong growth in the US currency.

Against the background of the lack of economic news, investors are taking profits, obtained in last week as the dollar grew on expectations as to what the Federal Reserve may raise interest rates in the next few months. Rising interest rates will support the dollar, making it more attractive to investors.

Last Wednesday, Fed Chairman Janet Yellen said the US central bank aims to raise interest rates this year against the backdrop of rapid economic recovery. Her comments supported the dollar and the dollar index from July 10 to July 20 rose more than 1%.

The euro rose against the dollar significantly updating the 4-day high. The ratio of the market against the euro improved after Greece made payments on the debt, and the IMF and the ECB opened its banks. Yesterday the Greek banks have resumed work after a three-week break, and today the government has submitted to parliament a bill that would require lenders to start negotiations on a new program of financial aid. Parliament must adopt the bills on Wednesday. The most controversial proposal of creditors concerning early retirement pension and citizens to improve the taxation of farmers who raise serious objections from the left wing of the ruling party, SYRIZA, and many representatives of the opposition, were removed from the bill, which greatly increases the chances that it will be approved by the Greek parliament majority.

The focus also remains a divergence in monetary policy of the ECB and the Fed. Meanwhile, traders are waiting for preliminary data on the euro zone PMI, scheduled for Friday, and the FOMC meeting next week, especially after the last performance Yellen and favorable US reports. Also recall that yesterday the Fed Bullard said a 50% probability of a rate hike in September, while supporting the US dollar.

The pound fell against the dollar by updating yesterday's low, but then went back to the opening level. Traders continue to analyze the report on the state finances of Britain, and are waiting for the publication of the minutes of the Bank of England, especially after the Central Bank head Carney hinted at prospects for a rate hike at the end of 2015 or early 2016. As previously reported, the British government borrowing fell in June, but slightly less than predicted by experts. However, the last value was the lowest for the month for the past seven years. According to the data, net borrowing state. sector (excluding public sector banks) decreased to 9.4 billion. pounds in June from 10.2 billion. pounds a year earlier, compared with economists' forecasts at -8.5 billion. lbs. For the first three months of fiscal year 2015/16, net borrowing of the public sector amounted to 25.1 billion. Pounds, which is almost 20 percent lower than in April-June last year. We also add the last value was the lowest since the April-June 2008/09 financial year. The ONS said that tax revenues in June increased by 0.3 billion. To 11.5 billion pounds. Pounds, its highest level since the start of statistics (1997). Income taxes increased by almost 14 percent, to 1.7 billion. Pounds, which is also the maximum value for all the time.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0850(E1.2bn), $1.0900(E1.0bn)

USD/JPY: Y122.00($1.3bn), Y122.60($344mn), Y123.00($380mn)

EUR/JPY: Y134.00(E390mn), Y134.50(E550mn), Y136.00(E240mn)

GBP/USD: $1.5400(Gbp322mn)

AUD/USD: $0.7350(A$611mn), $0.7600(A$634mn)

USD/CAD: C$1.2850($1.0bn), C$1.3030($375mn), C$1.3100($1.25bn)

-

14:15

European session review: the pound fell sharply against the US dollar

Data:

01:30 Australia RBA Meeting's Minutes

06:00 Switzerland Trade Balance June 3.409 Revised From 3.43 3.578

08:30 United Kingdom PSNB, bln June -8.35 Revised From -9.35 -8.6 -8.58

The pound fell sharply against the dollar, updating yesterday's low. Traders continue to analyze the report on the state finances of Britain, and are waiting for the publication of the minutes of the Bank of England, especially after the Central Bank head Carney hinted at prospects for a rate hike at the end of 2015 or early 2016. As previously reported, the British government borrowing fell in June, but slightly less than predicted by experts. However, the last value was the lowest for the month for the past seven years. According to the data, net borrowing state. sector (excluding public sector banks) decreased to 9.4 billion. pounds in June from 10.2 billion. pounds a year earlier, compared with economists' forecasts at -8.5 billion. lbs. For the first three months of fiscal year 2015/16, net borrowing of the public sector amounted to 25.1 billion. Pounds, which is almost 20 percent lower than in April-June last year. We also add the last value was the lowest since the April-June 2008/09 financial year. The ONS said that tax revenues in June increased by 0.3 billion. To 11.5 billion pounds. Pounds, its highest level since the start of statistics (1997). Income taxes increased by almost 14 percent, to 1.7 billion. Pounds, which is also the maximum value for all the time.

The euro rose against the dollar significantly, approaching to yesterday's high. Experts point out that there are no releases or significant events in Europe and the US market's attention is directed to the dynamics of interest in risky assets. The ratio of the market against the euro also improved after Greece made payments on the debt, and the IMF and the ECB opened its banks. Yesterday the Greek banks have resumed work after a three-week break, and today the government has submitted to parliament a bill that would require lenders to start negotiations on a new program of financial aid. Parliament must adopt the bills on Wednesday. The most controversial proposal of creditors concerning early retirement pension and citizens to improve the taxation of farmers who raise serious objections from the left wing of the ruling party, SYRIZA, and many representatives of the opposition, were removed from the bill, which greatly increases the chances that it will be approved by the Greek parliament majority.

The focus also remains a divergence in monetary policy of the ECB and the Fed. Meanwhile, traders are waiting for preliminary data on the euro zone PMI, scheduled for Friday, and the FOMC meeting next week, especially after the last performance Yellen and favorable US reports. Also recall that yesterday the Fed Bullard said a 50% probability of a rate hike in September, while supporting the US dollar.

Ian shows a slight decline against the US dollar, while remaining close to the monthly minimum. In the course of trading influenced the July report of the Government of Japan. Recall, the government lowered its estimate of industrial production and identify potential risks associated with the slowdown of the Chinese economy. Overall assessment of the economic situation in Japan was left unchanged. "The growth rate of China's economy is slowing down a bit. Though it had no apparent effect on Japan's economy, should closely monitor the pace of economic activity in China," - said the representative of the government at a press conference. The representative of the Government of Japan said that the weakness of the production of small cars and parts for smart phones has a negative impact on industrial production in Japan as a whole. Restoration of activity so far not observed in all sectors of the economy, especially behind the regional small and medium enterprises.

EUR / USD: during the European session, the pair rose to $ 1.0877

GBP / USD: during the European session, the pair has risen traded in the range of $ 1.5590- $ 1.5527

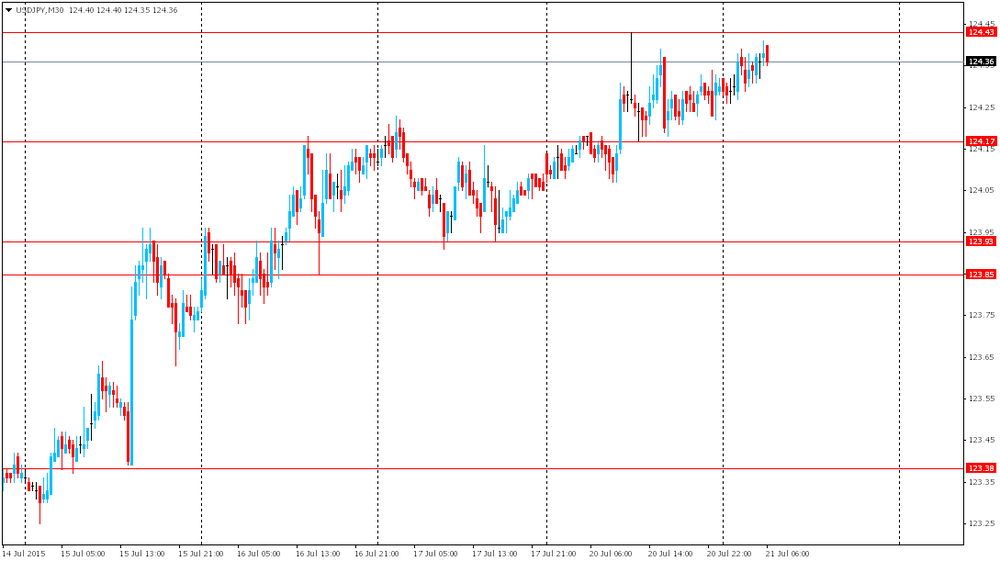

USD / JPY: during the European session the pair fell to Y124.24

At 20:30 GMT the United States will declare the change of volume of crude oil reserves (according to API),

-

14:00

Orders

EUR/USD

Offers 1.0880 1.0900 1.0925-30 1.0950 1.0975 1.1000 1.1050 1.1080 1.1100

Bids 1.0800 1.0785 1.0750 1.0725 1.0700

GBP/USD

Offers 1.5640-50 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7000 0.7020 0.7060 0.7085 0.7100 0.7120-25 0.7150

Bids 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Offers 135.25 135.50 135.80 136.00 136.50

Bids 134.40 134.00 133.80 133.50 133.30 133.00

USD/JPY

Offers 124.50 124.75 125.00 125.30 125.50

Bids 124.00 123.85 123.123.50 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7330 0.7300 0.7285 0.7250 0.7200

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0850(E1.2bn), $1.0900(E1.0bn)

USD/JPY: Y122.00($1.3bn), Y122.60($344mn), Y123.00($380mn)

EUR/JPY: Y134.00(E390mn), Y134.50(E550mn), Y136.00(E240mn)

GBP/USD: $1.5400(Gbp322mn)

AUD/USD: $0.7350(A$611mn), $0.7600(A$634mn)

USD/CAD: C$1.2850($1.0bn), C$1.3030($375mn), C$1.3100($1.25bn)

-

10:30

United Kingdom: PSNB, bln, June -8.58 (forecast -8.6)

-

08:41

Foreign exchange market. Asian session: the euro remains under pressure despite debt payments from Greece

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:45 New Zealand Visitor Arrivals June 9.5% 9.2%

01:50 Japan Monetary Policy Meeting Minutes

03:30 Australia RBA Meeting's Minutes

The euro remained under pressure despite positive news from Athens. Sources reported that the European Central Bank and the International Monetary Fund had confirmed that they received payments from Greece. Yesterday Greece transferred €4.2 and over €2 billion to the ECB and the IMF respectively. Greece has also returned a loan of €500 million to its own central bank. Greece's banks reopened boosting risk appetite.

The New Zealand dollar rose against the U.S. dollar after New Zealand Prime Minister said that the New Zealand dollar's 25% decline to $0.6500 in the last twelve months was faster than expected. However growth of the NZD/USD pair is limited by low prices of dairy products and expectations of a 25 basis points rate cut by the RBNZ this week.

EUR/USD: the pair traded around $1.0815-35 in Asian trade

USD/JPY: the pair rose to Y124.40

GBP/USD: the pair traded around $1.5555-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland Trade Balance June 3.43

10:30 United Kingdom PSNB, bln June -9.35 -8.6

22:30 U.S. API Crude Oil Inventories July -0.95

-

08:31

Switzerland: Trade Balance, June 3.578

-

08:23

Options levels on tuesday, July 21, 2015:

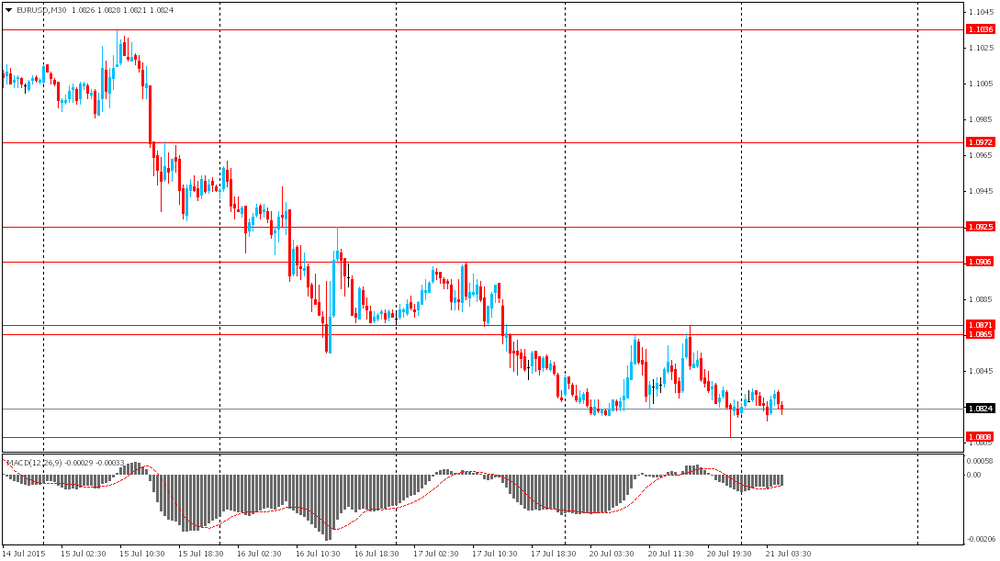

EUR / USD

Resistance levels (open interest**, contracts)

$1.1037 (1616)

$1.0970 (870)

$1.0919 (294)

Price at time of writing this review: $1.0820

Support levels (open interest**, contracts):

$1.0785 (2543)

$1.0745 (2997)

$1.0718 (6095)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 50150 contracts, with the maximum number of contracts with strike price $1,1400 (3252);

- Overall open interest on the PUT options with the expiration date August, 7 is 60834 contracts, with the maximum number of contracts with strike price $1,0800 (6095);

- The ratio of PUT/CALL was 1.21 versus 1.24 from the previous trading day according to data from July, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5803 (1939)

$1.5706 (850)

$1.5609 (1873)

Price at time of writing this review: $1.5571

Support levels (open interest**, contracts):

$1.5491 (1455)

$1.5395 (1376)

$1.5297 (1416)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20882 contracts, with the maximum number of contracts with strike price $1,5750 (3009);

- Overall open interest on the PUT options with the expiration date August, 7 is 22903 contracts, with the maximum number of contracts with strike price $1,5250 (2054);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from July, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:47

New Zealand: Visitor Arrivals, June 9.2%

-

00:29

Currencies. Daily history for Jul 20’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0821 -0,07%

GBP/USD $1,5557 -0,29%

USD/CHF Chf0,9641 +0,30%

USD/JPY Y124,30 +0,20%

EUR/JPY Y134,51 +0,13%

GBP/JPY Y193,38 -0,12%

AUD/USD $0,7367 -0,04%

NZD/USD $0,6558 +0,67%

USD/CAD C$1,2997 +0,21%

-

00:01

Schedule for today, Tuesday, Jul 21’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

06:00 Switzerland Trade Balance June 3.43

08:30 United Kingdom PSNB, bln June -9.35 -8.6

20:30 U.S. API Crude Oil Inventories July -0.95

-