Noticias del mercado

-

23:59

Schedule for today, Thursday, Jul 23’2015:

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals June 42.5

08:30 United Kingdom Retail Sales (MoM) June 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) June 4.6% 4.9%

12:30 Canada Retail Sales, m/m May -0.1% 0.5%

12:30 Canada Retail Sales YoY May 1.7%

12:30 Canada Retail Sales ex Autos, m/m May -0.6% 0.8%

12:30 U.S. Continuing Jobless Claims 2215 2225

12:30 U.S. Initial Jobless Claims July 281 280

14:00 Eurozone Consumer Confidence (Preliminary) July -5.6 -5.68

14:00 U.S. Leading Indicators June 0.7% 0.2%

14:15 Eurozone ECB's Jens Weidmann Speaks

22:45 New Zealand Trade Balance, mln June 350

-

23:00

New Zealand: RBNZ Interest Rate Decision, 3% (forecast 3.13%)

-

22:16

US stocks fell

Technology shares are closing solidly lower after Apple and Microsoft turned in disappointing results.

Apple fell 4.3 percent Wednesday. The company gave a cautious outlook for the current quarter and didn't provide much detail on how its new smartwatch was doing.

Microsoft fell 3.7 percent after booking a huge loss related to its purchase of Nokia.

The Dow Jones industrial average gave up 68 points, or 0.4 percent, to 17,851.

The Standard & Poor's 500 index fell five points, or 0.3 percent, to 2,114. The Nasdaq composite declined 36 points, or 0.7 percent, to 5,171.

Bond prices didn't move much. The yield on the 10-year Treasury note held steady at 2.33 percent.

-

21:00

S&P 500 2,114.86 -4.35 -0.21 %, NASDAQ 5,175.17 -32.95 -0.63 %, Dow 17,837.91 -81.38 -0.45 %

-

20:20

American focus: the dollar rose

The US dollar rose against most major currencies as investors again began to predict the strengthening US currency, when the Federal Reserve will raise interest rates. Investors expect that the improvement in US economic data will force the Fed to raise interest rates from zero to the end of this year, possibly in September.

Sales of new buildings rose sharply by the end of June, while reaching the highest level since February 2007, indicating that the acceleration of the pace of recovery of the housing market.

According to the report the Ministry of Trade, seasonally adjusted new home sales rose in June by 3.2%, to 5.49 million. Units (in annual terms). Economists had expected the growth rate to 5.4 million. We also add the figure for May was revised down - to 5.32 million. 5.35 million. Compared with the same period last year, new home sales rose 9.6%.

Also, today's data showed that the average price of new homes sold in June was $ 236,400, which is 6.5% more than last year. Meanwhile, the ratio of reserves to the level of sales of houses in June was 5.0 months versus 5.1 months in May.

Economists expect growth in sales this summer will be partially supported by customers seeking to enter the market before mortgage rates and housing prices continue to rise further. But they warn that there are still "weak spots", including a lack of buyers in the primary market and the decline of housing starts.

The pound rose against the dollar significantly, approaching to the maximum from July 17, which was associated with the publication of minutes of meeting the expectations of the Central Bank of England. As previously reported, the minutes of the meeting showed that all members of the MPC of the Bank of England voted unanimously for keeping the old policy in July. Despite the drop in inflation to zero in June, the Bank of England Carney said the rate may be increased at the end of the year. The protocol also showed that the decision to raise rates or leave them in the same place, it becomes more balanced for some members of the MPC. Also noted in the report that the recent appreciation of the pound is a factor that can have a direct impact on inflation. Finally, the Greek crisis dissuade some members of the Committee of the need to raise rates in the near vremya..Na Last week, Bank of England Governor Mark Carney hinted following the Central Bank's plans, saying that the decision to raise interest rates from record lows will be seen more closely around the end of 2015 year. Most market players expect the Bank of England will start to raise interest rates gradually from mid-2016.

-

19:21

European stocks fell

European stocks fell after Apple Inc.'s worse-than-forecast results dragged semiconductor companies lower and commodity producers deepened declines.

Apple chip suppliers Dialog Semiconductor Plc and Infineon Technologies AG lost at least 5.2 percent. ARM Holdings Plc, whose technology is used in iPhones, tumbled 6.6 percent. The company's quarterly revenue also missed estimates. BHP Billiton Ltd. slid 5.7 percent, leading a drop in miners, after saying petroleum, copper and coal output will drop in fiscal 2016.

The Stoxx Europe 600 Index slipped 0.6 percent to 400.28 at the close of trading. It briefly pared a drop of as much as 0.8 percent after data showed U.S. existing-home sales climbed to an eight-year high in June, before resuming a decline.

Apple's "supply chain clearly has ramifications for companies across the world," said Daniel Murray, London-based head of research at EFG Asset Management. "I would interpret the recent commodities selloff as partly a reflection of stronger dollar sentiment, as well as fears about China. None of that looks like it's going to change anytime soon."

A fourth day of declines in commodity stocks sent the U.K.'s FTSE 100 Index 1.5 percent lower, the worst drop in western-European markets.

The earnings season is picking up pace in Europe, with more than 230 Stoxx 600 companies scheduled to report through the rest of the month.

Telenor ASA fell 2.8 percent after the Nordic region's largest phone company reported profit that fell short of analysts' estimates. TalkTalk Telecom Group Plc tumbled 8.9 percent after saying full-year earnings will be more weighted toward the second half than in previous years.

Danske Bank A/S climbed 3.3 percent after saying quarterly profit increased and raising its full-year forecast. EasyJet Plc rose 4.9 percent after saying annual pretax profit will increase amid a recovery in sales in the summer.

The Stoxx 600 fell for the first time in 10 days yesterday amid mixed earnings reports. Before that, fading fears over Greece pushed the gauge to its fastest rally in 3 1/2 years, taking it closer to strategists' year-end forecasts.

-

19:19

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes declined on Wednesday, with the tech-heavy Nasdaq composite falling more than 1 percent after disappointing results from technology giants including Apple, the world's largest publicly traded company.

Most of Dow stocks in negative area (20 of 30). Top looser - Apple Inc. (AAPL, -4.63%). Top gainer - JPMorgan Chase & Co. (JPM, +1.03).

Most of S&P index sectors also in negative area. Top looser - Conglomerates (-2.1%). Top gainer - Utilities (+0.1%).

At the moment:

Dow 17761.00 -105.00 -0.59%

S&P 500 2106.00 -8.50 -0.40%

Nasdaq 100 4617.25 -49.25 -1.06%

10 Year yield 2,32% -0,02

Oil 49.88 -0.98 -1.93%

Gold 1092.50 -11.00 -1.00%

-

18:34

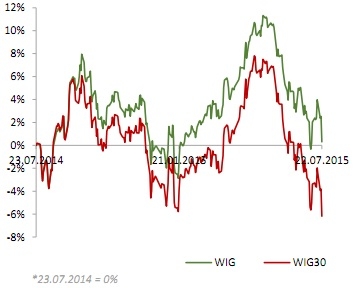

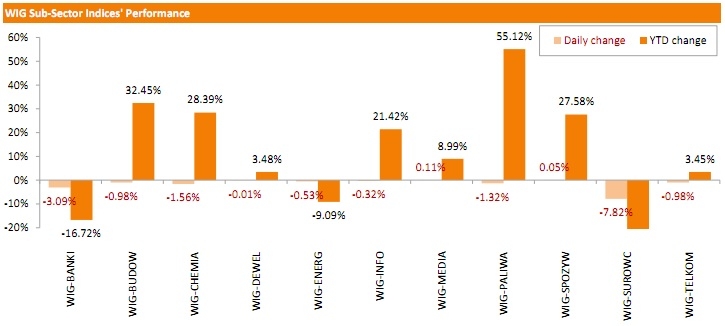

WSE: Session Results

Polish equities were lower on Wednesday. The broad market measure, the WIG Index, declined 2.16%. Media stocks (+0.11%) and food names (+0.05%) were the only groups, which posted positive results. At the same time, materials (-7.82%) was the worst-performing sector, followed by banks (-3.09%).

Large-cap stocks measure, the WIG30 Index, underperformed the broad market, recording a 2.46% drop. Copper miner KGHM (WSE: KGH) was the sharpest decliner among the indicator's constituents with its shares' quotations being beaten down 8.79% as copper prices slide. Additional pressure came from news the company, along with PGE (WSE: PGE; -0.29%) and GRUPA AZOTY (WSE: ATT; -0.93%), offered to contribute to a state-run fund which will be used to bail out troubled coal miners. Other biggest laggards were PZU (WSE: PZU), PKO BP (WSE: PKO) and SYNTHOS (WSE: SNS), tumbling 5.70%, 4.09% and 4.03% respectively. On the other side of the ledger, EUROCASH (WSE: EUR) and KERNEL (WSE: KER) were recorded as the biggest gainers, advancing 3.67% and 2.53% respectively.

-

18:00

European stocks closed: FTSE 100 6,667.34 -101.73 -1.50 %, CAC 40 5,082.57 -24.00 -0.47 %, DAX 11,520.67 -84.13 -0.72 %

-

16:30

U.S.: Crude Oil Inventories, July 2.468 (forecast -2.0)

-

16:00

U.S.: Existing Home Sales , June 5.49 (forecast 5.4)

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0820-25(E400mn), $1.0900(E759mn), $1.1000(E306mn)

USD/JPY: Y123.00-10($486mn), Y123.70-80($350mn), Y124.80($1.0bn)

AUD/USD: $0.7400(A$328mn)

USD/CAD: C$1.2850($483mn), C$1.3000($356mn)

-

15:33

U.S. Stocks open: Dow -0.23%, Nasdaq -0.98%, S&P -0.34%

-

15:30

Before the bell: S&P futures -0.47%, NASDAQ futures -1.41%

U.S. stocks were poised for a lower open Wednesday after disappointing results from technology heavyweights Apple Inc. and Microsoft Corp.

Global Stocks:

Nikkei 20,593.67 -248.30 -1.19%

Hang Seng 25,282.62 -253.81 -0.99%

Shanghai Composite 4,026.7 +9.03 +0.23%

FTSE 6,660.97 -108.10 -1.60%

CAC 5,078.45 -28.12 -0.55%

DAX 11,498.4 -106.40 -0.92%

Crude oil $50.20 (-1.30%)

Gold $1089.70 (-1.25%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Starbucks Corporation, NASDAQ

SBUX

56.24

+0.07%

9.8K

Home Depot Inc

HD

114.03

+0.15%

3.5K

Exxon Mobil Corp

XOM

82.04

+0.47%

71.7K

International Paper Company

IP

48.32

+0.48%

0.8K

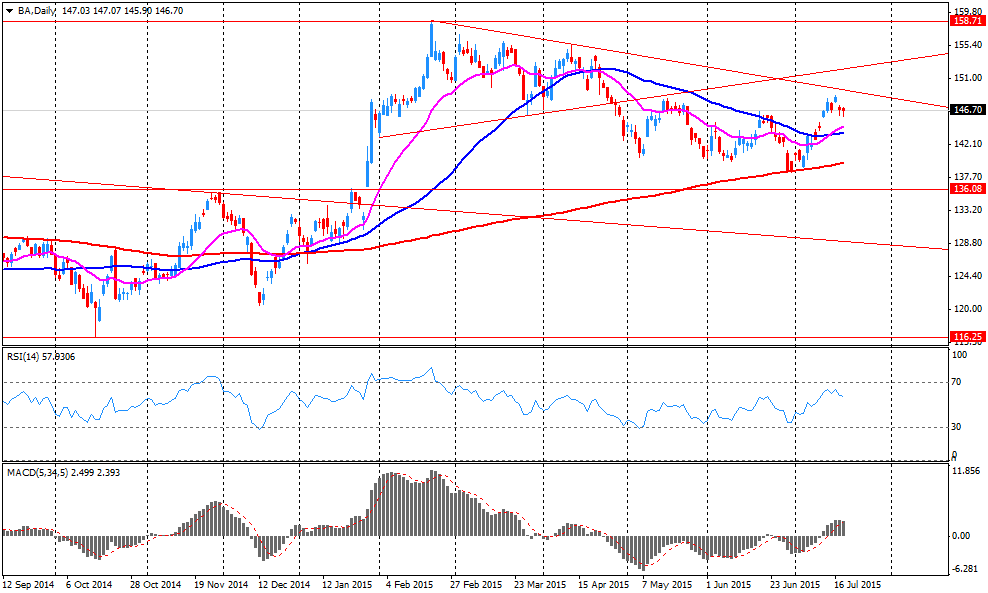

Boeing Co

BA

147.75

+1.90%

73.9K

E. I. du Pont de Nemours and Co

DD

59.27

-0.02%

3.2K

Wal-Mart Stores Inc

WMT

72.71

-0.04%

2.8K

McDonald's Corp

MCD

97.20

-0.12%

1.9K

Amazon.com Inc., NASDAQ

AMZN

487.38

-0.13%

21.0K

Procter & Gamble Co

PG

80.83

-0.17%

3.0K

Verizon Communications Inc

VZ

46.89

-0.17%

0.1K

UnitedHealth Group Inc

UNH

120.64

-0.18%

4.0K

3M Co

MMM

155.45

-0.20%

2.3K

Johnson & Johnson

JNJ

100.14

-0.20%

4.1K

Ford Motor Co.

F

14.48

-0.21%

9.9K

Google Inc.

GOOG

660.67

-0.25%

7.9K

Travelers Companies Inc

TRV

104.21

-0.26%

9.9K

Walt Disney Co

DIS

119.00

-0.26%

1.6K

Nike

NKE

112.69

-0.27%

0.4K

Pfizer Inc

PFE

35.04

-0.28%

1.2K

American Express Co

AXP

78.72

-0.29%

1.8K

JPMorgan Chase and Co

JPM

68.90

-0.29%

2.0K

Caterpillar Inc

CAT

81.97

-0.30%

0.7K

Intel Corp

INTC

28.63

-0.31%

31.7K

Merck & Co Inc

MRK

58.48

-0.32%

0.3K

The Coca-Cola Co

KO

41.05

-0.34%

95.2K

Visa

V

71.76

-0.36%

5.3K

Cisco Systems Inc

CSCO

27.74

-0.36%

81.2K

Goldman Sachs

GS

210.72

-0.37%

6.9K

United Technologies Corp

UTX

102.30

-0.40%

7.6K

General Electric Co

GE

26.74

-0.41%

13.8K

Citigroup Inc., NYSE

C

58.81

-0.49%

6.6K

HONEYWELL INTERNATIONAL INC.

HON

104.86

-0.51%

0.1K

Hewlett-Packard Co.

HPQ

30.50

-0.52%

0.4K

Chevron Corp

CVX

93.39

-0.54%

3.3K

International Business Machines Co...

IBM

161.70

-0.84%

12.3K

ALCOA INC.

AA

окт.14

-0.88%

13.9K

Twitter, Inc., NYSE

TWTR

36.19

-1.20%

41.5K

AT&T Inc

T

34.14

-1.24%

376.9K

Barrick Gold Corporation, NYSE

ABX

07.38

-1.60%

175.4K

Facebook, Inc.

FB

96.82

-1.60%

223.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.45

-1.72%

10.2K

Tesla Motors, Inc., NASDAQ

TSLA

262.00

-1.79%

32.6K

Yahoo! Inc., NASDAQ

YHOO

38.70

-2.59%

32.5K

Microsoft Corp

MSFT

45.66

-3.42%

173.8K

Apple Inc.

AAPL

121.26

-7.26%

3.1M

-

15:05

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded from Mkt Perform to Mkt Outperform at JMP Securities, target $575

Downgrades:

United Tech (UTX) downgraded from Overweight to Neutral at Atlantic Equities

Apple (AAPL) downgraded from Outperform to Market Perform at Cowen, target lowered from $140 to $130

Other:

Apple (AAPL) reiterated at Buy at Canaccord Genuity, target lowered from $160 to $155

Apple (AAPL) reiterated at Outperform at FBR Capital, target lowered from $185 to $175

United Tech (UTX) reiterated at Outperform at RBC Capital Mkts, target lowered from $141 to $114

Travelers (TRV) reiterated at Outperform at RBC Capital Mkts, target lowered from $117 to $115

Exxon Mobil (XOM) added to Conviction Buy List at Goldman

-

15:00

U.S.: Housing Price Index, m/m, May 0.4%

-

14:48

-

14:33

Company News: Boeing (BA) beated expectation, revenue rose 11%

Company reported Q2 profit of $1.62 per share versus $1.38 consensus. Revenues rose 11.3% year/year to $24.54 bln versus $24.27 bln consensus.

Company issueed guidance for FY15, EPS expected at $7.70-7.90 versus $7.90 consensus. Revenue expected at $94.5-96.5 bln versus $94.85 bln consensus. Company reaffirmed commercial airplane deliveries 750-755.

BA rose to $147.23 (+1.54%) on the premarket.

-

14:20

European session review: the pound rose significantly against the US dollar

Data:

00:30 Australia Leading Index June -0.1% 0.0%

01:30 Australia CPI, q/q Quarter II 0.2% 0.8% 0.7%

01:30 Australia CPI, y/y Quarter II 1.3% 1.7% 1.5%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.7% Revised From 0.6% 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter II 2.3% 2.2% 2.2%

03:05 Australia RBA's Governor Glenn Stevens Speech

04:30 Japan All Industry Activity Index, m/m May 0.1% -0.5%

08:30 United Kingdom Bank of England Minutes

11:00 U.S. MBA Mortgage Applications July -1.9% 0.1%

The euro depreciated moderately against the dollar, retreating from a weekly high, due to the expectations of the vote in Greece relative to the second package of measures proposed by the creditors. Later on Wednesday, the Greek parliament will continue to vote on the second package of reforms needed to ensure agreement on the financial rescue of the country. If lawmakers approve the financial and judicial reform, Greece will continue to base negotiations on a new program of assistance from the lenders of $ 86 billion. Euro. Recall on August 20, Greece must make the next payment to the ECB's large size 3.2 bln. Euro, and then, in September, the IMF was obliged to pay 1.5 billion. Euros.

Meanwhile, investors are watching the situation on the stock markets and reports on corporate profits. Experts say the pair may continue to fall, given the divergence of monetary policy of the ECB and the Fed and reports Bloomberg that China can start to get rid of euros in exchange for dollars. "Traders should remain cautious when buying dollars because it is unclear whether the Fed will raise rates already at the September meeting, - the analyst Sumitomo Mitsui Banking Corp. Masato Yanagi. - We do not have data on how quickly the Fed is going to raise the rate. I I think for the dollar activated closer to September. " Recall, the Fed chief Janet Yellen last week confirmed that the Fed still plans to raise the benchmark interest rate this year.

Also, market participants are waiting for the publication of statistics on the US housing market. According to forecasts, sales in the secondary market rose in June to 5.4 million. Units against 5.35 million. Units in the previous month.

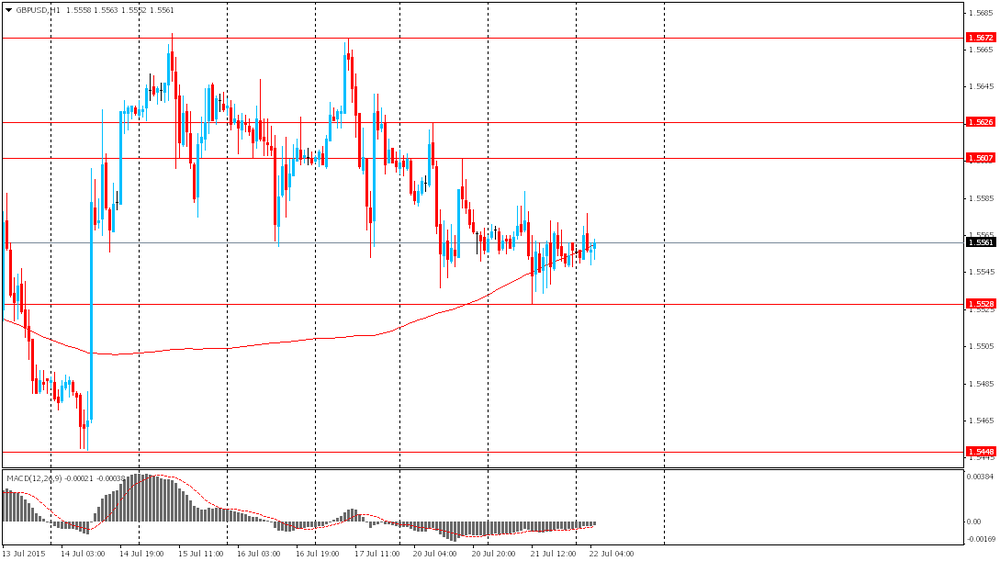

The pound rose against the dollar significantly, approaching to the maximum from July 17, which was associated with the publication of minutes of meeting the expectations of the Central Bank of England. As previously reported, the minutes of the meeting showed that all members of the MPC of the Bank of England voted unanimously for keeping the old policy in July. Despite the drop in inflation to zero in June, the Bank of England Carney said the rate may be increased at the end of the year. The protocol also showed that the decision to raise rates or leave them in the same place, it becomes more balanced for some members of the MPC. Also noted in the report that the recent appreciation of the pound is a factor that can have a direct impact on inflation. Finally, the Greek crisis dissuade some members of the Committee of the need to raise rates in the near vremya..Na Last week, Bank of England Governor Mark Carney hinted following the Central Bank's plans, saying that the decision to raise interest rates from record lows will be seen more closely around the end of 2015 year. Most market players expect the Bank of England will start to raise interest rates gradually from mid-2016.

Yen shows little change against the dollar amid a lack of fundamental catalysts that could contribute to its growth. The market was waiting for the vote in Greece on the second package of reforms and report on home sales in the United States. In addition, the markets continue to analyze yesterday's hawkish comments of the Bank of Japan Kuroda, who continue to support the Japanese currency against the dollar, as well as the minutes of the last meeting of the Bank of Japan. Minutes of the meeting held on 18 and 19 June showed that some of the nine members of the board of the central bank said that the impact of the policy of the Bank of Japan may be reduced, taking into account the increase in long-term interest rates, among other factors.

EUR / USD: during the European session the pair fell to $ 1.0903

GBP / USD: during the European session, the pair rose to $ 1.5647

USD / JPY: during the European session the pair fell to Y123,54

At 14:00 GMT the United States will report the volume of home sales in the secondary market in June. The main attention will be focused on the RBNZ announcement of the decision on the basic interest rate (at 21:00 GMT). At the same time, it will cover the RBNZ statement. Then, 23:50 GMT Japan announced changes the balance of foreign trade in goods in June.

-

14:00

Orders

EUR/USD

Offers 1.0975 1.1000 1.1050 1.1080 1.1100

Bids 1.0875 1.0850 1.0800 1.0785 1.0750 1.0725 1.0700

GBP/USD

Offers 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7020 0.7060 0.7085 0.7100 0.7120-25 0.7150

Bids 0.6975 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Offers 135.50 135.80 136.00 136.50

Bids 135.00 134.40 134.00 133.80 133.50 133.30 133.00

USD/JPY

Offers 124.10 124.50 124.75 125.00 125.30 125.50

Bids 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7370 0.7330 0.7300 0.7285 0.7250 0.7200

-

13:00

U.S.: MBA Mortgage Applications, July 0.1%

-

10:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0820-25(E400mn), $1.0900(E759mn), $1.1000(E306mn)

USD/JPY: Y123.00-10($486mn), Y123.70-80($350mn), Y124.80($1.0bn)

AUD/USD: $0.7400(A$328mn)

USD/CAD: C$1.2850($483mn), C$1.3000($356mn)

-

09:04

Oil prices continue declining

West Texas Intermediate futures for September delivery fell to $50.24 (-1.22%); Brent crude declined to $56.58 (-0.81%) after late Tuesday data from the American Petroleum Institute surprised with a 2.3-million-barrel increase in U.S. crude inventories. A report from the U.S. Energy Information Administration is due today at 14:30 GMT, and analysts forecast a 1.6 million-barrels decline in stockpiles. Meanwhile a poll by Reuters showed that eight analysts expect U.S. commercial crude oil stocks to have risen by 2.3 million barrels on average in the week ended July 17.

"Any indication of rising oil inventories in this week's EIA weekly report is likely to weaken oil prices further," ANZ analysts said.

-

09:01

Gold remained under pressure

Gold fell to $1,092.80 (-0.97%) an ounce suggesting that downward pressure on the metal persisted even after the 4% decline on Monday (the most dramatic drop in almost two years). Holdings in top gold fund SPDR Gold Trust declined to their lowest since 2008 and many analysts forecast bullion prices to fall further.

"We can't see any bullish factor. Inflation is well contained and we don't see a systemic crisis that might push people to buy gold," Wing Fung Financial Group's head of research, Mark To, said.

Gold top consumers India and China did not increase demand despite prices holding near a five-year low.

Meanwhile mine closures are not expected to happen in the near future despite ongoing pressure on prices as operators instead try to reduce costs to keep operations going.

-

08:59

Global Stocks: U.S. indices declined and weighed on Asian stocks

U.S. stock indices declined amid weak earnings reports from various companies.

The Dow Jones Industrial Average dropped 204.51 points, or 1.13%, to 17,895.9. The S&P 500 fell 9.58 points, or 0.45%, to 2,118.7. The Nasdaq Composite lost 9.25 points, or 0.18%, to 5,209.61.

Shares of Dow components IBM and United Technologies fell by 6.2% to $162.42 and by 7.6% to $102.06 respectively. IBM's profits dropped for the 13th consecutive quarter and missed analyst's expectations. So far, 70% of companies have reported earnings above analyst expectations.

In Asia this morning Hong Kong Hang Seng fell 1.15%, or 294.82 points, to 25,241.61. China Shanghai Composite Index declined 0.42%, or 16.89 point, to 4,000.79. The Nikkei dropped 1.03%, or 213.68 points, to 20,628.29.

Asian stocks declined after shares of several U.S. companies dropped amid lower-than-expected revenues.

Toshiba shares fell 1.7% after their 6% rise the day earlier when the details of an accounting scandal showed that an independent investigation had found the company overstating its earnings by a total of 151.8 billion yen ($1.22 billion) over the past six years.

-

08:55

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Leading Index June -0.1% 0.0%

01:30 Australia CPI, q/q Quarter II 0.2% 0.8% 0.7%

01:30 Australia CPI, y/y Quarter II 1.3% 1.7% 1.5%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.7% Revised From 0.6% 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter II 2.3% 2.2% 2.2%

03:05 Australia RBA's Governor Glenn Stevens Speech

04:30 Japan All Industry Activity Index, m/m May 0.1% -0.5%

The New Zealand dollar declined ahead of tomorrow's Reserve Bank of New Zealand meeting. Most economists expect the central bank to cut its benchmark rate to 3.0% because of the weakness of dairy trade.

The euro was muted after S&P rating agency raised Greece's rating to "CCC+" with stable outlook.

The Australian dollar declined after inflation data, which showed that the consumer price index rose by 0.7% in the second quarter, while economists had expected a +0.8% reading. The index rose by 0.2% in the first quarter. On an annualized basis inflation rose by 1.5% compared to 1.3% a year ago. Analysts expected a 1.7% increase. RBA's target inflation range is 2%-3%. Nevertheless the AUD advanced moderately after RBA Governor Glenn Stevens expressed optimism about the Australian economy.

EUR/USD: the pair traded around $1.0920-60 in Asian trade

USD/JPY: the pair fell to Y123.60

GBP/USD: the pair traded around $1.5550-75

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

05:00 Japan Coincident Index (Finally) May 111 109.2

05:00 Japan Leading Economic Index (Finally) May 106.4 106.2

08:30 United Kingdom Bank of England Minutes

11:00 U.S. MBA Mortgage Applications July -1.9%

13:00 U.S. Housing Price Index, m/m May 0.3%

14:00 U.S. Existing Home Sales June 5.35 5.4

14:30 U.S. Crude Oil Inventories July -4.346 -2.0

21:00 New Zealand RBNZ Interest Rate Decision 3.25% 3.13%

21:00 New Zealand RBNZ Rate Statement

23:50 Japan Trade Balance Total, bln June -216.0 5.4

-

08:15

Options levels on wednesday, July 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1078 (2190)

$1.1028 (899)

$1.0994 (355)

Price at time of writing this review: $1.0942

Support levels (open interest**, contracts):

$1.0906 (3140)

$1.0872 (3956)

$1.0822 (5856)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 51942 contracts, with the maximum number of contracts with strike price $1,1400 (3255);

- Overall open interest on the PUT options with the expiration date August, 7 is 60807 contracts, with the maximum number of contracts with strike price $1,0900 (5856);

- The ratio of PUT/CALL was 1.17 versus 1.21 from the previous trading day according to data from July, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1144)

$1.5803 (1860)

$1.5705 (965)

Price at time of writing this review: $1.5610

Support levels (open interest**, contracts):

$1.5491 (1441)

$1.5395 (1355)

$1.5297 (1413)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 21005 contracts, with the maximum number of contracts with strike price $1,5750 (3002);

- Overall open interest on the PUT options with the expiration date August, 7 is 22872 contracts, with the maximum number of contracts with strike price $1,5250 (2052);

- The ratio of PUT/CALL was 1.09 versus 1.10 from the previous trading day according to data from July, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:32

Japan: All Industry Activity Index, m/m, May -0.5%

-

04:03

Nikkei 225 20,597.85 -244.12 -1.17 %, Hang Seng 25,287.2 -249.23 -0.98 %, Shanghai Composite 4,027.42 +9.74 +0.24 %

-

03:34

Australia: Trimmed Mean CPI q/q, Quarter II 0.6%

-

03:30

Australia: CPI, q/q, Quarter II 0.7% (forecast 0.8%)

-

03:30

Australia: CPI, y/y, Quarter II 1.5% (forecast 1.7%)

-

03:30

Australia: Trimmed Mean CPI y/y, Quarter II 2.2% (forecast 2.2%)

-

02:31

Australia: Leading Index, June 0.0%

-

00:31

Commodities. Daily history for Jul 21’2015:

(raw materials / closing price /% change)

Oil 50.59 +0.46%

Gold 1,100.00 -0.32%

-

00:30

Stocks. Daily history for Jul 21’2015:

(index / closing price / change items /% change)

Hang Seng 25,536.43 +131.62 +0.5 %

S&P/ASX 200 5,706.72 +19.82 +0.3 %

Shanghai Composite 4,018.62 +26.51 +0.7 %

Topix 1,673.88 +10.94 +0.7 %

FTSE 100 6,769.07 -19.62 -0.3 %

CAC 40 5,106.57 -35.92 -0.7 %

Xetra DAX 11,604.8 -130.92 -1.1 %

S&P 500 2,119.21 -9.07 -0.4 %

NASDAQ Composite 5,208.12 -10.74 -0.2 %

Dow Jones 17,919.29 -181.12 -1.0 %

-

00:28

Currencies. Daily history for Jul 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,0937 +1,06%

GBP/USD $1,5557 0,00%

USD/CHF Chf0,9585 -0,58%

USD/JPY Y123,87 -0,35%

EUR/JPY Y135,48 +0,72%

GBP/JPY Y192,69 -0,36%

AUD/USD $0,7420 +0,71%

NZD/USD $0,6622 +0,97%

USD/CAD C$1,2947 -0,39%

-

00:01

Schedule for today, Wednesday, Jul 22’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index June -0.1%

01:30 Australia CPI, q/q Quarter II 0.2% 0.8%

01:30 Australia CPI, y/y Quarter II 1.3% 1.7%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter II 2.3% 2.2%

03:05 Australia RBA's Governor Glenn Stevens Speech

04:30 Japan All Industry Activity Index, m/m May 0.1%

05:00 Japan Coincident Index (Finally) May 111 109.2

05:00 Japan Leading Economic Index (Finally) May 106.4 106.2

08:30 United Kingdom Bank of England Minutes

11:00 U.S. MBA Mortgage Applications July -1.9%

13:00 U.S. Housing Price Index, m/m May 0.3%

14:00 U.S. Existing Home Sales June 5.35 5.4

14:30 U.S. Crude Oil Inventories July -4.346

21:00 New Zealand RBNZ Interest Rate Decision 3.25% 3.13%

21:00 New Zealand RBNZ Rate Statement

23:50 Japan Trade Balance Total, bln June -216.0 5.4

-