Noticias del mercado

-

23:58

Schedule for today, Friday, Jul 24’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) July 50.1

01:45 China HSBC Manufacturing PMI (Preliminary) July 49.4 49.7

07:00 France Services PMI (Preliminary) July 54.1 53.8

07:00 France Manufacturing PMI (Preliminary) July 50.7 50.7

07:30 Germany Services PMI (Preliminary) July 53.8 54

07:30 Germany Manufacturing PMI (Preliminary) July 51.9 51.9

08:00 Eurozone Manufacturing PMI (Preliminary) July 52.5 52.5

08:00 Eurozone Services PMI (Preliminary) July 54.4 54.2

08:30 United Kingdom BBA Mortgage Approvals June 42.5

13:00 Belgium Business Climate July -3.9 -4.0

13:45 U.S. Manufacturing PMI (Finally) July 54.0 53.6

14:00 U.S. New Home Sales June 546 545

-

21:00

S&P 500 2,105.53 -8.62 -0.41 %, NASDAQ 5,161.66 -10.11 -0.20 %, Dow 17,768.46 -82.58 -0.46 %

-

20:21

American focus: the dollar fell

The US dollar fell against the euro and the yen, as investors took profits after recent gains of the US currency. A week will be a meeting of the Committee on Open Market Federal Reserve, which will discuss the rise in interest rates and the economy.

The dollar fell as investors booked profits on long-term expectations of strengthening against the dollar. Many analysts and currency managers predict that the US economy will get stronger, which will contribute to the first Fed rate hike in nine years.

The Central Bank may provide more information about its intentions regarding the increase of interest rates in the United States after the two-day meeting, which ended on July 29.

The Fed signaled that interest rates may increase in September, but investors predict that the central bank is likely to take effect at the December meeting. Rising interest rates in the United States will make the dollar more attractive to investors.

If the Fed decides not to raise interest rates in September, the dollar can be traded in the current range against other currencies in a matter of months before the meeting of the central bank in December.

The dollar recovered some lost ground after the publication of the Ministry of Labour that the number of initial claims for unemployment benefits in the US for the week July 12-18 has decreased by 26,000, taking into account the correction for seasonal fluctuations amounted to 255 000. The number of initial claims for benefit Unemployment reached its lowest level since 18-24 November 1973. Economists had forecast that the number of applications for unemployment benefits will be 280,000.

The euro earlier rose sharply against the US currency, approaching the maximum of 15 July. Experts point out that the reason for this growth can be called normal operation stops with the optimism caused by the result of the vote in the Greek parliament. Yesterday the Greek parliament voted in favor of the second package of creditors' claims. MPs 230 votes to 63 approved a bill on the measures needed for the final negotiations on the 3rd program of financial aid to Greece of 86 billion euros ($ 93 billion). Approved steps simplify judicial decisions and incorporate into national law of the EU directive on the reorganization of troubled banks. Thirty-six deputies of the ruling party Syriza did not support the position of Tsipras to vote. Against the claims of creditors of the first package approved last week, were 39 representatives of the Party. Tsipras said he would carry out anti-crisis program, but does not consider it correct. He stressed that he would do everything possible to improve the final terms of the agreement.

The pound dropped significantly against the US dollar, which was caused by the publication of weak data on sales in Britain. According to the report of the Office of National Statistics, retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Experts expect that sales will increase by 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent. It is worth emphasizing sales increase recorded for 27 consecutive month, which is the longest series since May 2008. Excluding automotive fuel, sales growth slowed to 4.2 percent from 4.5 percent. It expects sales to grow by 5.1 per cent. In the second quarter sales rose 0.7 percent compared with an increase of 0.9 percent in the three months to March. Last growth rate was the lowest since the third quarter of 2014. Without adjusting for falling prices, retail spending in the second quarter rose 1.3 percent, recording a minimum pace since the first quarter of 2013.

The yen was moderately higher against the dollar, updating yesterday's high. Traders noted that the dollar seems to be resumed decline, marked the beginning of the week. The decision of the Greek Parliament was the driver of demand for risky assets and a weaker dollar.

Little impact on the yen also provided data on the trade balance of Japan. As it became known, in May, Japan's trade deficit in June amounted to - ¥ 69 billion against a deficit of - ¥ 217,2 Bln. This figure was lower than the forecast of analysts ¥ 5.4 billion. Exports from Japan grew at the fastest pace in five months. It is a sign that foreign demand has supported the restoration of the Japanese economy. According to the Ministry of Finance of Japan, exports in June rose by 9.5% compared with the same period of the previous year due to demand for automobiles and semiconductors from abroad. In May, the annual growth of exports by 2.4%. Export growth was partly due to the weakening of the Japanese yen over the past 12 months. Exports to China grew by 5.9%, while exports to the US jumped by 17.6%. Imports declined by 2.9% in June, the decline observed the sixth consecutive month.

-

19:20

European stocks fell for a third day

European stocks fell for a third day as a decline in energy shares outweighed better-than-expected results from Credit Suisse Group AG and Unilever.

Oil-and-gas stocks contributed the most to the Stoxx Europe 600 Index's drop, with BP Plc retreating 1.4 percent. Credit Suisse rose 6.2 percent after quarterly profit beat estimates. Unilever climbed 1.6 percent after the maker of Magnum ice cream reported higher-than-forecast sales growth.

The Stoxx 600 slid 0.5 percent to 398.1 at the close of trading, after earlier rising as much as 0.6 percent. The volume of shares changing hands was 18 percent lower than the 30-day average. Shares had advanced to within 2 percent of their record in a nine-day rally through Monday.

The earnings season is picking up pace in Europe, with more than 200 Stoxx 600 companies scheduled to report through the rest of the month.

Aberdeen Asset Management Plc slid 7.6 percent after posting 9.9 billion pounds ($15.5 billion) of net outflows in the three months to June as investor sentiment toward Asia and emerging markets soured.

Among energy companies, Royal Dutch Shell Plc lost 1.5 percent and Tullow Oil Plc slipped 3.7 percent, as oil approached a bear market.

"It's been such a difficult period for oil-related investments that I believe some investors are throwing in the towel, especially now that apparently the Iran agreements should allow Iran to sell more oil on international markets," said Pierre Mouton, who helps manage $8.3 billion at Notz, Stucki & Cie. in Geneva. "But there's a limit to that and I see relative value today in major oil companies."

Switzerland's benchmark SMI Index jumped 1 percent, for the best performance among western-European markets. Roche Holding AG rose 1.6 percent after the world's biggest maker of cancer drugs reported first-half earnings that exceeded analyst estimates. ABB Ltd. advanced 1.7 percent after also posting better-than-expected profit.

-

18:27

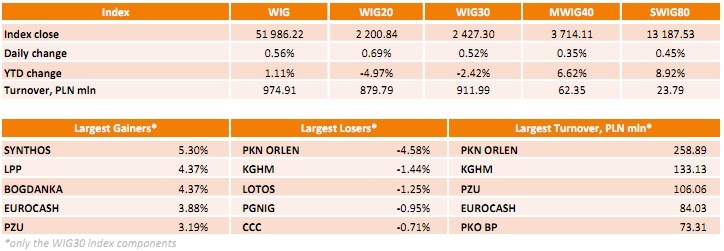

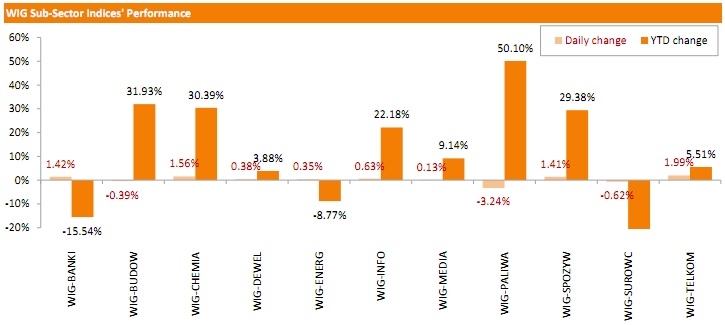

WSE: Session Results

Polish equity market demonstrated growth on Thursday. The broad market measure, the WIG Index, gained 0.56%. Almost all sectors in the WIG generated positive returns. The exception were oil and gas industry (-3.24%), materials (-0.62%) and construction sector (-0.39%).

The large-cap stocks' measure, the WIG30 Index, added 0.52%. Within the WIG30 Index components, SYNTHOS (WSE: SNS) led advancers with a 5.3% gain. BOGDANKA (WSE: LWB), LPP (WSE: LPP) and EUROCASH (WSE: EUR) also demonstrated notable increases, boosting by 4.37%, 4.37% and 3.88% respectively. In the meantime, PKN ORLEN (WSE: PKN) suffered the steepest declines, plunging 4.58% as the company's 2Q15 net profit came in below market expectations due to impairments related to some of its shale gas projects. It was followed by copper miner KGHM (WSE: KGH), as well as two other names from oil and gas sector LOTOS (WSE: LTS) and PGNIG (WSE: PGN), which recorded declines between 0.95% and 1.44%.

-

18:00

European stocks closed: FTSE 100 6,655.01 -12.33 -0.18 %, CAC 40 5,086.74 +4.17 +0.08 %, DAX 11,512.11 -8.56 -0.07 %

-

17:54

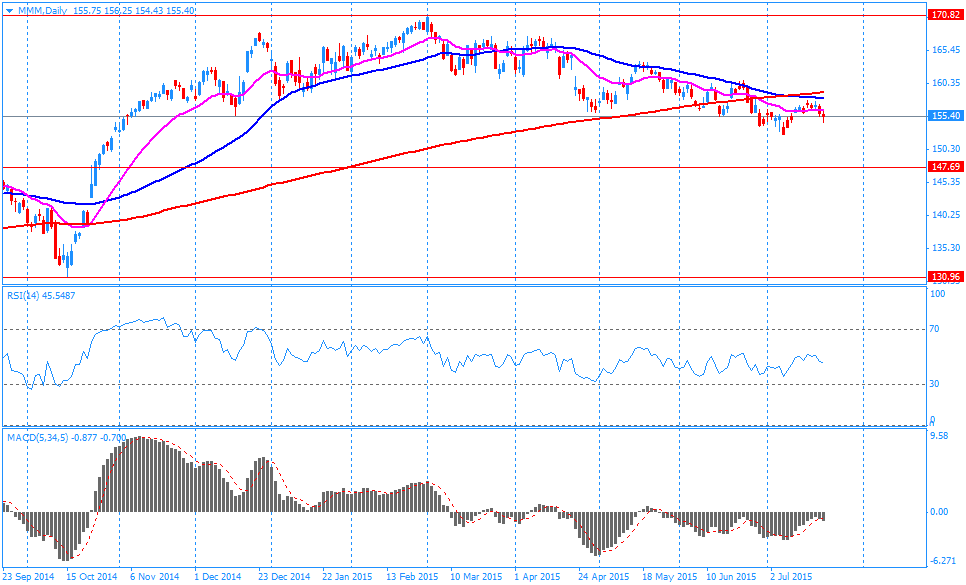

Wall Street. Major U.S. stock-indexes fell

U.S. stock-indexes are little changed after two days of losses, while the Dow Jones industrial average was at a week-low on disappointing results from bellwethers such as 3M (MMM) and Caterpillar (CAT).

Most of Dow stocks in negative area (19 of 30). Top looser - Caterpillar Inc. (CAT, -3.44%). Top gainer - Microsoft Corporation (MSFT, +1.36).

Most of S&P index sectors also in negative area. Top looser - Utilities (-1.3%). Top gainer - Consumer goods (+0.3%).

At the moment:

Dow 17713.00 -72.00 -0.40%

S&P 500 2102.00 -6.00 -0.28%

Nasdaq 100 4616.25 -0.75 -0.02%

10 Year yield 2,31% -0,01

Oil 49.04 -0.15 -0.30%

Gold 1094.00 +2.50 +0.23%

-

16:01

Eurozone: Consumer Confidence, July -7.1 (forecast -5.68)

-

16:00

U.S.: Leading Indicators , June 0.6% (forecast 0.2%)

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0845-50(E760mn), $1.0900(E1.9bn), $1.0915(E500mn), $1.1000(1.9bn)

USD/JPY: Y123.00($1.08bn), Y123.90-124.00($360mn), Y125.00($1.11bn)

GBP/USD: $1.5525(Gbp404mn)

AUD/USD: $0.7200(A$1.61bn), $0.7350(A$458mn), $0.7470(A$260mn), $0.7550(A$400mn)

NZD/USD: $0.6600(NZ$423mn), $0.6900(NZ$391mn)

-

15:31

U.S. Stocks open: Dow -0.07%, Nasdaq +0.01%, S&P +0.02%

-

15:27

Before the bell: S&P futures +0.01%, NASDAQ futures +0.02%

U.S. stock-index futures were little changed, as General Motors Co. and SanDisk Corp. rallied on corporate earnings while Caterpillar Inc. slumped.

Global Stocks:

Nikkei 20,683.95 +90.28 +0.44%

Hang Seng 25,398.85 +116.23 +0.46%

Shanghai Composite 4,124.39 +98.34 +2.44%

FTSE 6,672.27 +4.93 +0.07%

CAC 5,084.64 +2.07 +0.04%

DAX 11,529.12 +8.45 +0.07%

Crude oil $49.36 (+0.30%)

Gold $1096.90 (+0.41%)

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yahoo! Inc., NASDAQ

YHOO

39.25

+0.03%

0.2K

Home Depot Inc

HD

114.95

+0.04%

0.1K

AT&T Inc

T

34.30

+0.09%

10.0K

Boeing Co

BA

146.62

+0.10%

129.4K

Facebook, Inc.

FB

97.14

+0.10%

95.6K

Hewlett-Packard Co.

HPQ

30.80

+0.10%

0.5K

Walt Disney Co

DIS

119.50

+0.14%

1.0K

Twitter, Inc., NYSE

TWTR

36.14

+0.14%

10.9K

International Business Machines Co...

IBM

160.59

+0.15%

21.5K

Google Inc.

GOOG

663.30

+0.18%

2.3K

Microsoft Corp

MSFT

45.65

+0.24%

1.1K

Exxon Mobil Corp

XOM

82.00

+0.26%

0.5K

General Electric Co

GE

26.70

+0.26%

4.9K

Intel Corp

INTC

28.68

+0.26%

2.3K

E. I. du Pont de Nemours and Co

DD

59.06

+0.27%

7.0K

UnitedHealth Group Inc

UNH

120.99

+0.32%

0.3K

Starbucks Corporation, NASDAQ

SBUX

56.88

+0.34%

18.8K

Visa

V

72.24

+0.38%

5.4K

Procter & Gamble Co

PG

81.18

+0.43%

0.1K

Chevron Corp

CVX

93.92

+0.44%

0.5K

Apple Inc.

AAPL

125.77

+0.44%

266.9K

Tesla Motors, Inc., NASDAQ

TSLA

269.33

+0.55%

8.8K

ALCOA INC.

AA

10.05

+0.60%

24.7K

Amazon.com Inc., NASDAQ

AMZN

491.53

+0.67%

14.9K

United Technologies Corp

UTX

102.30

+0.74%

0.7K

Cisco Systems Inc

CSCO

27.80

+0.98%

14.4K

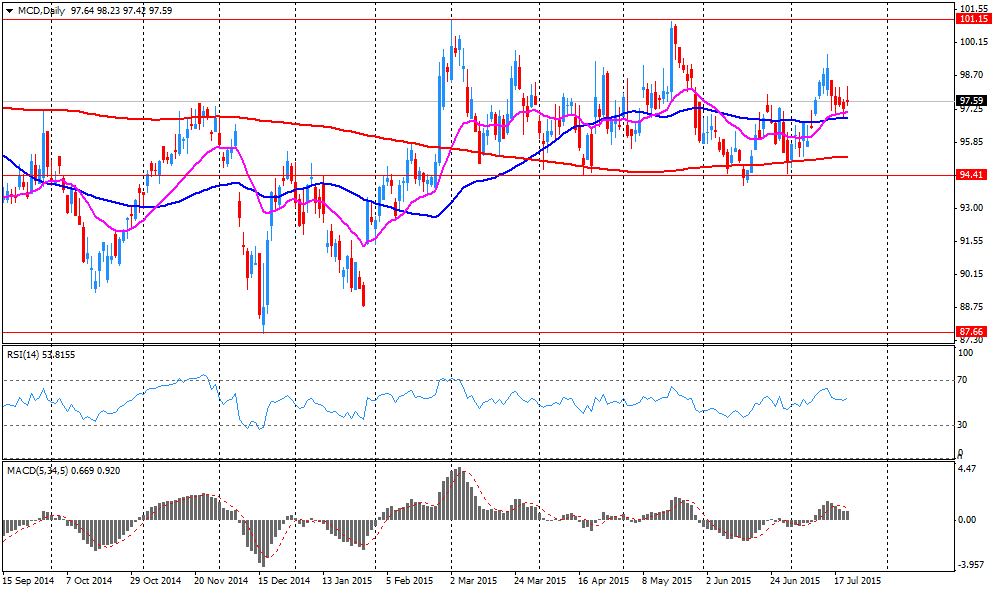

McDonald's Corp

MCD

98.79

+1.24%

21.0K

Barrick Gold Corporation, NYSE

ABX

07.47

+1.49%

50.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.32

+1.73%

56.9K

Ford Motor Co.

F

14.78

+2.50%

199.8K

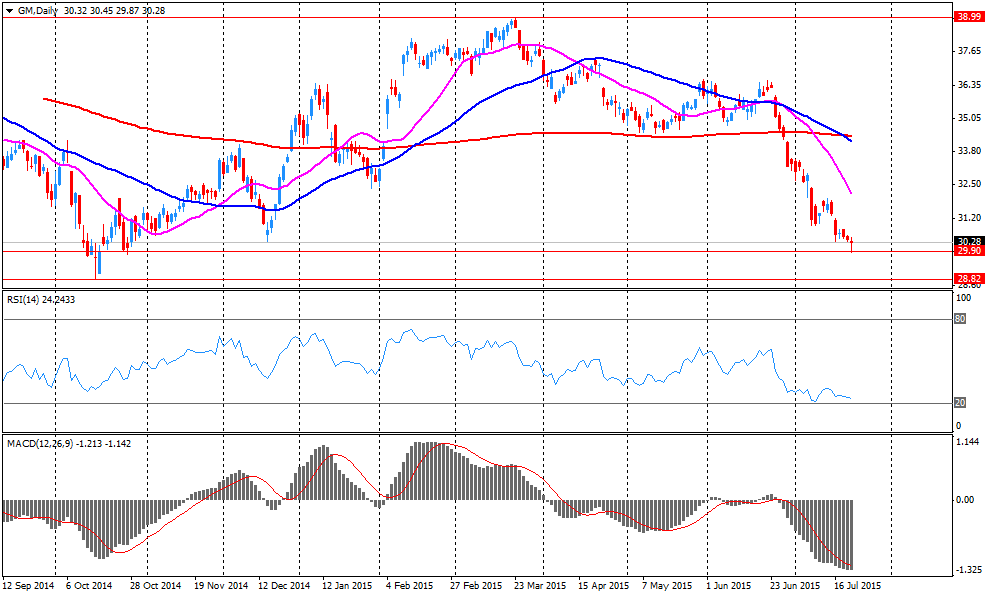

General Motors Company, NYSE

GM

32.44

+7.06%

2.3M

Goldman Sachs

GS

213.25

0.00%

1.0K

The Coca-Cola Co

KO

40.85

-0.12%

0.2K

Citigroup Inc., NYSE

C

60.25

-0.15%

15.9K

JPMorgan Chase and Co

JPM

69.95

-0.19%

8.9K

Verizon Communications Inc

VZ

46.34

-0.24%

4.4K

Yandex N.V., NASDAQ

YNDX

15.10

-0.33%

0.9K

Deere & Company, NYSE

DE

94.03

-0.83%

1.3K

American Express Co

AXP

77.78

-1.53%

0.4K

3M Co

MMM

152.92

-1.60%

3.5K

Caterpillar Inc

CAT

77.75

-2.52%

157.8K

-

15:00

-

14:50

-

14:41

Company News: Caterpillar (CAT) lowered revenue guidance

Company reported Q2 profit of $1.27 per share, as expected. Revenues fell 13.0% year/year to $12.32 bln versus $12.68 bln consensus.

Company sees EPS of $4.70-5.00 for FY15 versus $4.96 consensus. Revenue guidance for FY15 lowered to about $49 bln from about $50 bln versus $49.48 bln consensus.

CAT fell to $77.19 (-3.22%) on the premarket.

-

14:30

Canada: Retail Sales, m/m, May 1.0% (forecast 0.5%)

-

14:30

U.S.: Initial Jobless Claims, July 255 (forecast 280)

-

14:30

U.S.: Continuing Jobless Claims, 2207 (forecast 2225)

-

14:30

Canada: Retail Sales ex Autos, m/m, May 0.9% (forecast 0.8%)

-

14:30

Canada: Retail Sales YoY, May 2.7%

-

14:27

-

14:16

European session review: the pound fell sharply against the US dollar

Data

8:30 UK Retail Sales m / m in June 0.3% Revised to 0.2% 0.3% -0.2%

8:30 UK Retail sales, y / y in June to 4.7% from 4.6% Revised 4.9% 4.0%

The euro rose sharply against the US currency, approaching to a maximum of 15 of July. Experts point out that the reason for this growth can be called normal operation stops with the optimism caused by the result of the vote in the Greek parliament. Yesterday the Greek parliament voted in favor of the second package of creditors' claims. MPs 230 votes to 63 approved a bill on the measures needed for the final negotiations on the 3rd program of financial aid to Greece of 86 billion euros ($ 93 billion). Approved steps simplify judicial decisions and incorporate into national law of the EU directive on the reorganization of troubled banks. Thirty-six deputies of the ruling party Syriza did not support the position of Tsipras to vote. Against the claims of creditors of the first package approved last week, were 39 representatives of the Party. Tsipras said he would carry out anti-crisis program, but does not consider it correct. He stressed that he would do everything possible to improve the final terms of the agreement.

In the course of trade is also affected by expectations the publication of data on the US and the eurozone. Today at 12:30 GMT the United States will report on the number of initial applications for unemployment benefits. According to forecasts, the number of applications increased by 280 thousand. Against 281 thousand. By the end of the previous week. Recall, this indicator can serve as a kind of benchmark in order to determine what will be the main data on the US labor market (the unemployment rate and the number of new jobs created in non-agricultural sectors of the US economy).

With regard to statistics for the euro area, at 14:00 GMT will be presented to the index of consumer confidence for July. It is expected that the index worsened to -5.68 to -5.6.

The pound dropped significantly against the US dollar, which was caused by the publication of weak data on sales in Britain. According to the report of the Office of National Statistics, retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Experts expect that sales will increase by 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent. It is worth emphasizing sales increase recorded for 27 consecutive month, which is the longest series since May 2008. Excluding automotive fuel, sales growth slowed to 4.2 percent from 4.5 percent. It expects sales to grow by 5.1 per cent. In the second quarter sales rose 0.7 percent compared with an increase of 0.9 percent in the three months to March. Last growth rate was the lowest since the third quarter of 2014. Without adjusting for falling prices, retail spending in the second quarter rose 1.3 percent, recording a minimum pace since the first quarter of 2013.

The yen was moderately higher against the dollar, approaching to yesterday's high. Traders noted that the dollar seems to be resumed decline, marked the beginning of the week. The decision of the Greek Parliament was the driver of demand for risky assets and a weaker dollar.

Little impact on the yen also provided data on the trade balance of Japan. As it became known, in May, Japan's trade deficit in June amounted to - ¥ 69 billion against a deficit of - ¥ 217,2 Bln. This figure was lower than the forecast of analysts ¥ 5.4 billion. Exports from Japan grew at the fastest pace in five months. It is a sign that foreign demand has supported the restoration of the Japanese economy. According to the Ministry of Finance of Japan, exports in June rose by 9.5% compared with the same period of the previous year due to demand for automobiles and semiconductors from abroad. In May, the annual growth of exports by 2.4%. Export growth was partly due to the weakening of the Japanese yen over the past 12 months. Exports to China grew by 5.9%, while exports to the US jumped by 17.6%. Imports declined by 2.9% in June, the decline observed the sixth consecutive month.

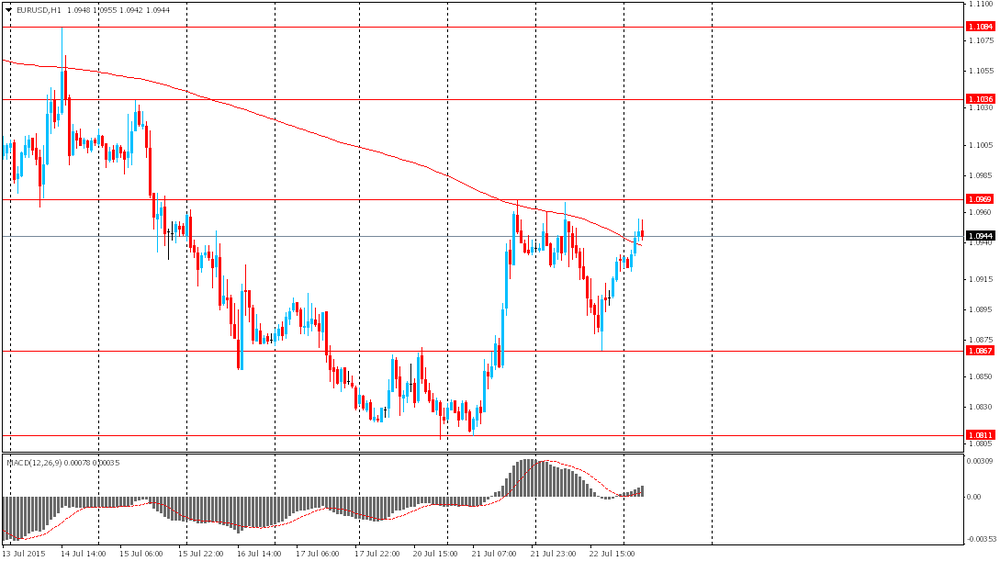

EUR / USD: during the European session, the pair rose to $ 1.1003

GBP / USD: during the European session the pair fell to $ 1.5584

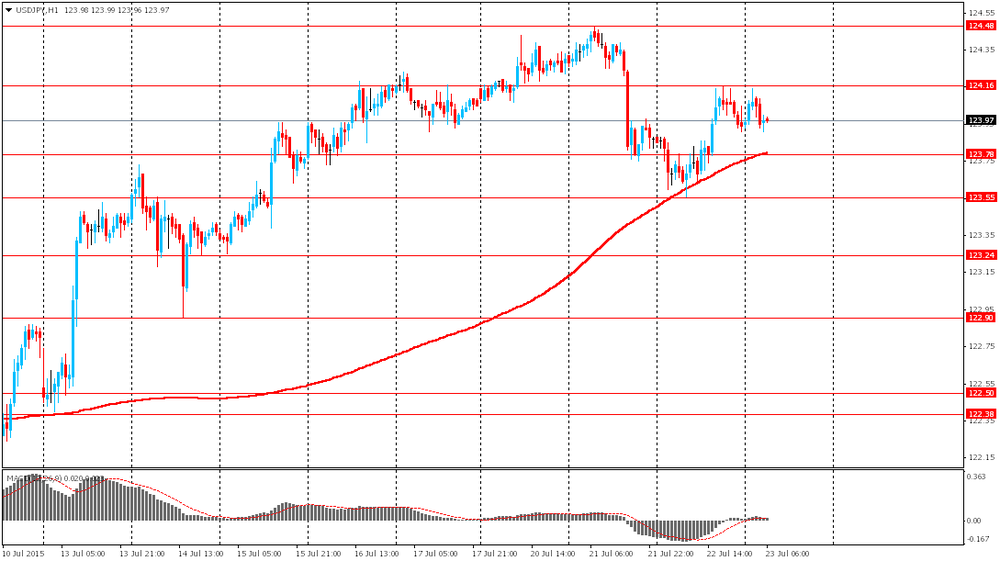

USD / JPY: during the European session the pair fell to Y123.67

At 12:30 GMT, Canada will publish data on retail sales for May. Also at this time, will the traditional American report on the number of initial applications for unemployment benefits. At 14:00 GMT the euro zone will present the consumer confidence index for July and the US - the index of leading indicators for June. At 22:45 GMT New Zealand declares the trade balance for June.

-

14:00

Orders

EUR/USD

Orders 1.1000 1.1050 1.1080 1.1100

Bids 1.0920 1.0900 1.0875 1.0850 1.0800 1.0785 1.0750

GBP/USD

Orders 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5580 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Orders 0.7060 0.7085 0.7100 0.7120-25 0.7150

Bids 0.6975 0.6950 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Orders 136.50 137.00

Bids 135.00 134.40 134.00 133.80 133.50

USD/JPY

Orders 124.15 124.50 124.75 125.00 125.30 125.50

Bids 123.50-55 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Orders 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7370 0.7330 0.7300 0.7285 0.7250 0.7200

-

12:30

Major European stock indexes traded slightly higher

European stock indices show a slight increase, as the negative impact of falling oil prices offset by positive corporate statements of Credit Suisse Group AG and Unilever.

Support index also have news from Greece. Yesterday the Greek parliament voted in favor of the second package of creditors' claims. MPs 230 votes to 63 approved a bill on the measures needed for the final negotiations on a third program of financial aid to Greece of 86 billion euros ($ 93 billion). Approved steps simplify judicial decisions and incorporate into national law of the EU directive on the reorganization of troubled banks. Thirty-six deputies of the ruling party Syriza did not support the position of Tsipras to vote. Against the claims of creditors of the first package approved last week, were 39 representatives of the Party. Tsipras said he would carry out anti-crisis program, but does not consider it correct. He stressed that he would do everything possible to improve the final terms of the agreement.

Pressure had weak data on Britain. The Office for National Statistics said retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Experts expect that sales will increase by 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent. It is worth emphasizing sales increase recorded for 27 consecutive month, which is the longest series since May 2008. Excluding automotive fuel, sales growth slowed to 4.2 percent from 4.5 percent. It expects sales to grow by 5.1 per cent.

Cost of Credit Suisse rose 6.4 percent as the bank returned to profit in the second quarter, and the financial results as a whole exceeded market expectations.

Quotes Unilever - the company selling consumer goods - rose by 2.4 per cent due to revenue growth exceeded forecasts in the second quarter (+ 2.9% vs. + 2.5% expected).

Roche Holding AG's shares rose 1.1 percent after the world's largest manufacturer of cancer drugs said that in the first half revenues exceeded analysts' forecasts.

Cost of ABB Ltd. It rose by 2.2 percent, as the company reported higher profits than expected by experts.

The stock price of Daimler AG - the German manufacturer of cars of a class "lux" - grew by 0.2 percent. Operating profit jumped 54% in the second quarter to 3.78 billion euros. Analysts on average expect its growth to 3.31 billion euros. Quarterly revenue Daimler rose by 19% - to 37.5 billion euros.

Currently:

FTSE 100 6,675.1 +7.76 + 0.12%

CAC 40 5,094.61 +12.04 + 0.24%

DAX 11,549.79 +29.12 + 0.25%

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0845-50(E760mn), $1.0900(E1.9bn), $1.0915(E500mn), $1.1000(1.9bn)

USD/JPY: Y123.00($1.08bn), Y123.90-124.00($360mn), Y125.00($1.11bn)

GBP/USD: $1.5525(Gbp404mn)

AUD/USD: $0.7200(A$1.61bn), $0.7350(A$458mn), $0.7470(A$260mn), $0.7550(A$400mn)

NZD/USD: $0.6600(NZ$423mn), $0.6900(NZ$391mn)

-

10:30

United Kingdom: Retail Sales (MoM), June -0.2% (forecast 0.3%)

-

10:30

United Kingdom: Retail Sales (YoY) , June 4.0% (forecast 4.9%)

-

08:53

Oil: WTI fell below $50

West Texas Intermediate futures for September delivery is currently at $49.26 (+0.14%). On Wednesday prices reached their lowest level since April. Brent crude slid to $56.07 (-0.11%).

Data by the U.S. Energy Information Administration showed Wednesday that commercial crude-oil stockpiles unexpectedly rose by 2.5 million barrels to 463.9 million barrels. Gasoline stockpiles fell by 1.7 million barrels. Distillate stocks, which include heating oil and diesel fuel, rose by 200,000 barrels.

However, some analysts noted that demand grew significantly in the first half of the year and the World Bank raised its 2015 forecast for crude prices to $57 per barrel from $53. At the same time large inventories and rising output from OPEC members are likely to keep prices weak in the medium-term.

-

08:48

Gold rebounded slightly

Gold slightly rebounded to $1,097.20 (+0.52%) an ounce as the dollar took a breath in its rally. The US dollar index, an indicator of greenback's strength, trades -0.10% lower at 97.53.

However most forecasts still suggest that bullion may tumble more. Analysts from Morgan Stanley said that prices may tumble significantly if China's stock markets see another correction and central banks sell their reserves. An imminent rate hike by the Federal Reserve also weighs on gold.

Physical demand remained sluggish.

-

08:46

Global Stocks: Asian indices rose despite declines in U.S. stocks

U.S. stock indices declined after earnings reports from various companies, including such tech giants as Apple and Microsoft, missed forecasts.

Microsoft shares lost 3.7% (the company reported a $3.2 billion quarterly loss in its fiscal fourth quarter on Tuesday afternoon). Apple shares fell 4.2% Wednesday as iPhone sales missed some overly optimistic estimates.

The Dow Jones industrial average declined 68.25 points, or 0.4%, to 17851.04. The S&P 500 fell 5.06 points, or 0.2%, 2114.15. The Nasdaq Composite lost 36.35 points, or 0.7%, to 5171.77.

In Asia this morning Hong Kong Hang Seng added 0.64%, or 161.70 points, to 25,444.32. China Shanghai Composite Index rose 1.72%, or 69.39 points, to 4,095.44. The Nikkei rose 0.42%, or 85.56 points, to 20,679.23.

Asian stocks gained amid capital flows from Beijing. Large shareholders, who were blocked by regulators from selling stocks for six months, bought more shares instead of simply holding on to what they already had.

-

08:42

Foreign exchange market. Asian session: the New Zealand dollar gained

The euro advanced slightly against the U.S. dollar after Greece's parliament approved the second pack of reforms in order to receive financial aid. Lawmakers voted 230-63 in favor of changes to judiciary and banking systems. Greek finance minister Euclid Tsakalotos earlier told parliament the vote would clear the way for negotiations on the new €86 billion bailout to begin on Friday with the target of completing a deal by August 18-20.

The New Zealand dollar advanced despite a 25 basis point rate cut. The central bank did not say that the exchange rate was unjustified, and this persuaded investors to buy the NZD. The bank also said that monetary policy might ease further. Economists expect the RBNZ to continue lowering rates in the coming months to help stimulate inflation and support the economy amid sharp declines in dairy product prices (New Zealand's key exports).

EUR/USD: the pair rose to $1.0955 in Asian trade

USD/JPY: the pair traded around Y123.90-15

GBP/USD: the pair traded around $1.5615

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals June 42.5

08:30 United Kingdom Retail Sales (MoM) June 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) June 4.6% 4.9%

12:30 Canada Retail Sales, m/m May -0.1% 0.5%

12:30 Canada Retail Sales YoY May 1.7%

12:30 Canada Retail Sales ex Autos, m/m May -0.6% 0.8%

12:30 U.S. Continuing Jobless Claims 2215 2225

12:30 U.S. Initial Jobless Claims July 281 280

14:00 Eurozone Consumer Confidence (Preliminary) July -5.6 -5.68

14:00 U.S. Leading Indicators June 0.7% 0.2%

14:15 Eurozone ECB's Jens Weidmann Speaks

22:45 New Zealand Trade Balance, mln June 350 100

-

08:13

Options levels on thursday, July 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1098 (1886)

$1.1034 (1087)

$1.0986 (297)

Price at time of writing this review: $1.0931

Support levels (open interest**, contracts):

$1.0877 (3138)

$1.0848 (4030)

$1.0804 (5859)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 52620 contracts, with the maximum number of contracts with strike price $1,1200 (3341);

- Overall open interest on the PUT options with the expiration date August, 7 is 62205 contracts, with the maximum number of contracts with strike price $1,0800 (6387);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from July, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1177)

$1.5804 (1849)

$1.5706 (1096)

Price at time of writing this review: $1.5612

Support levels (open interest**, contracts):

$1.5493 (1430)

$1.5396 (1339)

$1.5298 (1433)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 21703 contracts, with the maximum number of contracts with strike price $1,5750 (3212);

- Overall open interest on the PUT options with the expiration date August, 7 is 22739 contracts, with the maximum number of contracts with strike price $1,5250 (2080);

- The ratio of PUT/CALL was 1.05 versus 1.09 from the previous trading day according to data from July, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:01

Nikkei 225 20,684.06 +90.39 +0.4 %, Hang Seng 25,399.32 +116.70 +0.5 %, Shanghai Composite 4,034.18 +8.13 0.2 %

-

01:52

Japan: Trade Balance Total, bln, June -69 (forecast 5.4)

-

01:04

Commodities. Daily history for Jul 22’2015:

(raw materials / closing price /% change)

Oil 49.20 +0.02%

Gold 1,093.00 +0.14%

-

01:01

Stocks. Daily history for Jul 22’2015:

(index / closing price / change items /% change)

Nikkei 225 20,593.67 -248.30 -1.2 %ф

Hang Seng 25,282.62 -253.81 -1.0 %

S&P/ASX 200 5,614.57 -92.15 -1.6 %

Shanghai Composite 4,026.7 +9.03 +0.2 %

FTSE 100 6,667.34 -101.73 -1.5 %

CAC 40 5,082.57 -24.00 -0.5 %

Xetra DAX 11,520.67 -84.13 -0.7 %

S&P 500 2,114.15 -5.06 -0.2 % 604.85m

NASDAQ Composite 5,171.77 -36.35 -0.7 %

Dow Jones 17,851.04 -68.25 -0.4 %

-

00:59

Currencies. Daily history for Jul 22’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0928 -0,08%

GBP/USD $1,5612 +0,35%

USD/CHF Chf0,9596 +0,11%

USD/JPY Y123,94 +0,06%

EUR/JPY Y135,43 -0,04%

GBP/JPY Y193,47 +0,40%

AUD/USD $0,7381 -0,53%

NZD/USD $0,6635 +0,20%

USD/CAD C$1,3028 +0,62%

-