Noticias del mercado

-

23:58

Schedule for today, Friday, Jul 24’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) July 50.1

01:45 China HSBC Manufacturing PMI (Preliminary) July 49.4 49.7

07:00 France Services PMI (Preliminary) July 54.1 53.8

07:00 France Manufacturing PMI (Preliminary) July 50.7 50.7

07:30 Germany Services PMI (Preliminary) July 53.8 54

07:30 Germany Manufacturing PMI (Preliminary) July 51.9 51.9

08:00 Eurozone Manufacturing PMI (Preliminary) July 52.5 52.5

08:00 Eurozone Services PMI (Preliminary) July 54.4 54.2

08:30 United Kingdom BBA Mortgage Approvals June 42.5

13:00 Belgium Business Climate July -3.9 -4.0

13:45 U.S. Manufacturing PMI (Finally) July 54.0 53.6

14:00 U.S. New Home Sales June 546 545

-

20:21

American focus: the dollar fell

The US dollar fell against the euro and the yen, as investors took profits after recent gains of the US currency. A week will be a meeting of the Committee on Open Market Federal Reserve, which will discuss the rise in interest rates and the economy.

The dollar fell as investors booked profits on long-term expectations of strengthening against the dollar. Many analysts and currency managers predict that the US economy will get stronger, which will contribute to the first Fed rate hike in nine years.

The Central Bank may provide more information about its intentions regarding the increase of interest rates in the United States after the two-day meeting, which ended on July 29.

The Fed signaled that interest rates may increase in September, but investors predict that the central bank is likely to take effect at the December meeting. Rising interest rates in the United States will make the dollar more attractive to investors.

If the Fed decides not to raise interest rates in September, the dollar can be traded in the current range against other currencies in a matter of months before the meeting of the central bank in December.

The dollar recovered some lost ground after the publication of the Ministry of Labour that the number of initial claims for unemployment benefits in the US for the week July 12-18 has decreased by 26,000, taking into account the correction for seasonal fluctuations amounted to 255 000. The number of initial claims for benefit Unemployment reached its lowest level since 18-24 November 1973. Economists had forecast that the number of applications for unemployment benefits will be 280,000.

The euro earlier rose sharply against the US currency, approaching the maximum of 15 July. Experts point out that the reason for this growth can be called normal operation stops with the optimism caused by the result of the vote in the Greek parliament. Yesterday the Greek parliament voted in favor of the second package of creditors' claims. MPs 230 votes to 63 approved a bill on the measures needed for the final negotiations on the 3rd program of financial aid to Greece of 86 billion euros ($ 93 billion). Approved steps simplify judicial decisions and incorporate into national law of the EU directive on the reorganization of troubled banks. Thirty-six deputies of the ruling party Syriza did not support the position of Tsipras to vote. Against the claims of creditors of the first package approved last week, were 39 representatives of the Party. Tsipras said he would carry out anti-crisis program, but does not consider it correct. He stressed that he would do everything possible to improve the final terms of the agreement.

The pound dropped significantly against the US dollar, which was caused by the publication of weak data on sales in Britain. According to the report of the Office of National Statistics, retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Experts expect that sales will increase by 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent. It is worth emphasizing sales increase recorded for 27 consecutive month, which is the longest series since May 2008. Excluding automotive fuel, sales growth slowed to 4.2 percent from 4.5 percent. It expects sales to grow by 5.1 per cent. In the second quarter sales rose 0.7 percent compared with an increase of 0.9 percent in the three months to March. Last growth rate was the lowest since the third quarter of 2014. Without adjusting for falling prices, retail spending in the second quarter rose 1.3 percent, recording a minimum pace since the first quarter of 2013.

The yen was moderately higher against the dollar, updating yesterday's high. Traders noted that the dollar seems to be resumed decline, marked the beginning of the week. The decision of the Greek Parliament was the driver of demand for risky assets and a weaker dollar.

Little impact on the yen also provided data on the trade balance of Japan. As it became known, in May, Japan's trade deficit in June amounted to - ¥ 69 billion against a deficit of - ¥ 217,2 Bln. This figure was lower than the forecast of analysts ¥ 5.4 billion. Exports from Japan grew at the fastest pace in five months. It is a sign that foreign demand has supported the restoration of the Japanese economy. According to the Ministry of Finance of Japan, exports in June rose by 9.5% compared with the same period of the previous year due to demand for automobiles and semiconductors from abroad. In May, the annual growth of exports by 2.4%. Export growth was partly due to the weakening of the Japanese yen over the past 12 months. Exports to China grew by 5.9%, while exports to the US jumped by 17.6%. Imports declined by 2.9% in June, the decline observed the sixth consecutive month.

-

16:01

Eurozone: Consumer Confidence, July -7.1 (forecast -5.68)

-

16:00

U.S.: Leading Indicators , June 0.6% (forecast 0.2%)

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0845-50(E760mn), $1.0900(E1.9bn), $1.0915(E500mn), $1.1000(1.9bn)

USD/JPY: Y123.00($1.08bn), Y123.90-124.00($360mn), Y125.00($1.11bn)

GBP/USD: $1.5525(Gbp404mn)

AUD/USD: $0.7200(A$1.61bn), $0.7350(A$458mn), $0.7470(A$260mn), $0.7550(A$400mn)

NZD/USD: $0.6600(NZ$423mn), $0.6900(NZ$391mn)

-

14:30

Canada: Retail Sales, m/m, May 1.0% (forecast 0.5%)

-

14:30

U.S.: Initial Jobless Claims, July 255 (forecast 280)

-

14:30

U.S.: Continuing Jobless Claims, 2207 (forecast 2225)

-

14:30

Canada: Retail Sales ex Autos, m/m, May 0.9% (forecast 0.8%)

-

14:30

Canada: Retail Sales YoY, May 2.7%

-

14:16

European session review: the pound fell sharply against the US dollar

Data

8:30 UK Retail Sales m / m in June 0.3% Revised to 0.2% 0.3% -0.2%

8:30 UK Retail sales, y / y in June to 4.7% from 4.6% Revised 4.9% 4.0%

The euro rose sharply against the US currency, approaching to a maximum of 15 of July. Experts point out that the reason for this growth can be called normal operation stops with the optimism caused by the result of the vote in the Greek parliament. Yesterday the Greek parliament voted in favor of the second package of creditors' claims. MPs 230 votes to 63 approved a bill on the measures needed for the final negotiations on the 3rd program of financial aid to Greece of 86 billion euros ($ 93 billion). Approved steps simplify judicial decisions and incorporate into national law of the EU directive on the reorganization of troubled banks. Thirty-six deputies of the ruling party Syriza did not support the position of Tsipras to vote. Against the claims of creditors of the first package approved last week, were 39 representatives of the Party. Tsipras said he would carry out anti-crisis program, but does not consider it correct. He stressed that he would do everything possible to improve the final terms of the agreement.

In the course of trade is also affected by expectations the publication of data on the US and the eurozone. Today at 12:30 GMT the United States will report on the number of initial applications for unemployment benefits. According to forecasts, the number of applications increased by 280 thousand. Against 281 thousand. By the end of the previous week. Recall, this indicator can serve as a kind of benchmark in order to determine what will be the main data on the US labor market (the unemployment rate and the number of new jobs created in non-agricultural sectors of the US economy).

With regard to statistics for the euro area, at 14:00 GMT will be presented to the index of consumer confidence for July. It is expected that the index worsened to -5.68 to -5.6.

The pound dropped significantly against the US dollar, which was caused by the publication of weak data on sales in Britain. According to the report of the Office of National Statistics, retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Experts expect that sales will increase by 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent. It is worth emphasizing sales increase recorded for 27 consecutive month, which is the longest series since May 2008. Excluding automotive fuel, sales growth slowed to 4.2 percent from 4.5 percent. It expects sales to grow by 5.1 per cent. In the second quarter sales rose 0.7 percent compared with an increase of 0.9 percent in the three months to March. Last growth rate was the lowest since the third quarter of 2014. Without adjusting for falling prices, retail spending in the second quarter rose 1.3 percent, recording a minimum pace since the first quarter of 2013.

The yen was moderately higher against the dollar, approaching to yesterday's high. Traders noted that the dollar seems to be resumed decline, marked the beginning of the week. The decision of the Greek Parliament was the driver of demand for risky assets and a weaker dollar.

Little impact on the yen also provided data on the trade balance of Japan. As it became known, in May, Japan's trade deficit in June amounted to - ¥ 69 billion against a deficit of - ¥ 217,2 Bln. This figure was lower than the forecast of analysts ¥ 5.4 billion. Exports from Japan grew at the fastest pace in five months. It is a sign that foreign demand has supported the restoration of the Japanese economy. According to the Ministry of Finance of Japan, exports in June rose by 9.5% compared with the same period of the previous year due to demand for automobiles and semiconductors from abroad. In May, the annual growth of exports by 2.4%. Export growth was partly due to the weakening of the Japanese yen over the past 12 months. Exports to China grew by 5.9%, while exports to the US jumped by 17.6%. Imports declined by 2.9% in June, the decline observed the sixth consecutive month.

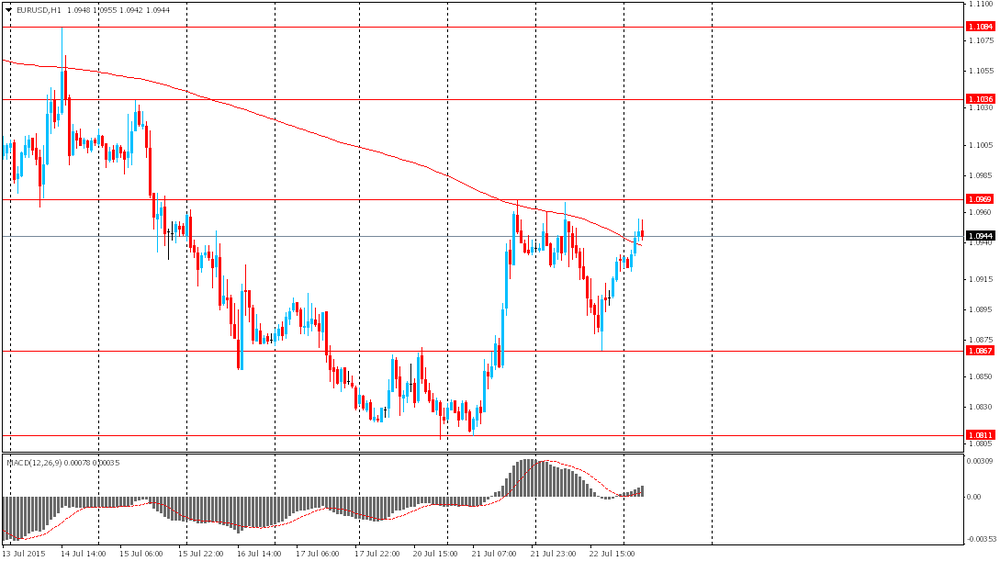

EUR / USD: during the European session, the pair rose to $ 1.1003

GBP / USD: during the European session the pair fell to $ 1.5584

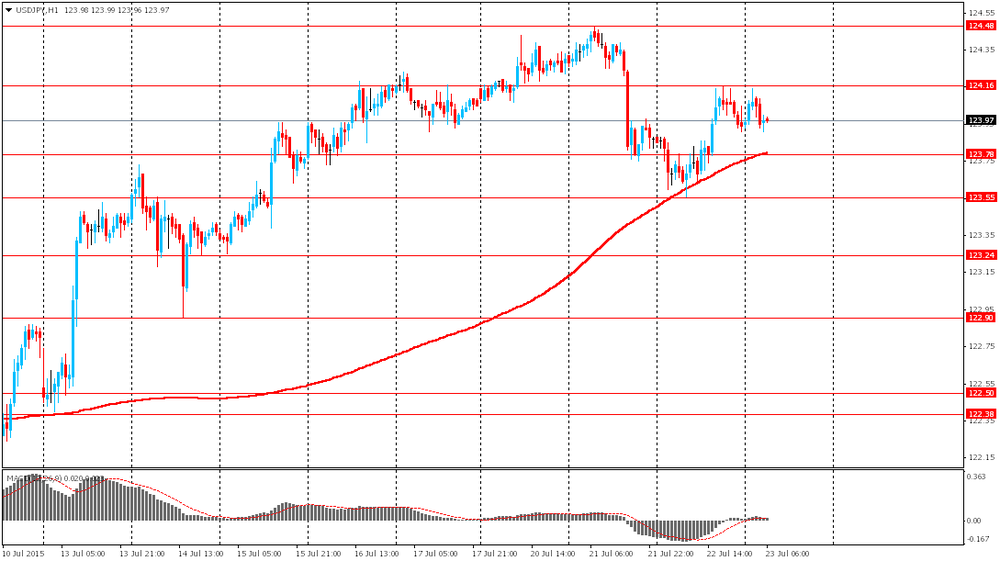

USD / JPY: during the European session the pair fell to Y123.67

At 12:30 GMT, Canada will publish data on retail sales for May. Also at this time, will the traditional American report on the number of initial applications for unemployment benefits. At 14:00 GMT the euro zone will present the consumer confidence index for July and the US - the index of leading indicators for June. At 22:45 GMT New Zealand declares the trade balance for June.

-

14:00

Orders

EUR/USD

Orders 1.1000 1.1050 1.1080 1.1100

Bids 1.0920 1.0900 1.0875 1.0850 1.0800 1.0785 1.0750

GBP/USD

Orders 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5580 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Orders 0.7060 0.7085 0.7100 0.7120-25 0.7150

Bids 0.6975 0.6950 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Orders 136.50 137.00

Bids 135.00 134.40 134.00 133.80 133.50

USD/JPY

Orders 124.15 124.50 124.75 125.00 125.30 125.50

Bids 123.50-55 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Orders 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7370 0.7330 0.7300 0.7285 0.7250 0.7200

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.7bn), $1.0845-50(E760mn), $1.0900(E1.9bn), $1.0915(E500mn), $1.1000(1.9bn)

USD/JPY: Y123.00($1.08bn), Y123.90-124.00($360mn), Y125.00($1.11bn)

GBP/USD: $1.5525(Gbp404mn)

AUD/USD: $0.7200(A$1.61bn), $0.7350(A$458mn), $0.7470(A$260mn), $0.7550(A$400mn)

NZD/USD: $0.6600(NZ$423mn), $0.6900(NZ$391mn)

-

10:30

United Kingdom: Retail Sales (MoM), June -0.2% (forecast 0.3%)

-

10:30

United Kingdom: Retail Sales (YoY) , June 4.0% (forecast 4.9%)

-

08:42

Foreign exchange market. Asian session: the New Zealand dollar gained

The euro advanced slightly against the U.S. dollar after Greece's parliament approved the second pack of reforms in order to receive financial aid. Lawmakers voted 230-63 in favor of changes to judiciary and banking systems. Greek finance minister Euclid Tsakalotos earlier told parliament the vote would clear the way for negotiations on the new €86 billion bailout to begin on Friday with the target of completing a deal by August 18-20.

The New Zealand dollar advanced despite a 25 basis point rate cut. The central bank did not say that the exchange rate was unjustified, and this persuaded investors to buy the NZD. The bank also said that monetary policy might ease further. Economists expect the RBNZ to continue lowering rates in the coming months to help stimulate inflation and support the economy amid sharp declines in dairy product prices (New Zealand's key exports).

EUR/USD: the pair rose to $1.0955 in Asian trade

USD/JPY: the pair traded around Y123.90-15

GBP/USD: the pair traded around $1.5615

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals June 42.5

08:30 United Kingdom Retail Sales (MoM) June 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) June 4.6% 4.9%

12:30 Canada Retail Sales, m/m May -0.1% 0.5%

12:30 Canada Retail Sales YoY May 1.7%

12:30 Canada Retail Sales ex Autos, m/m May -0.6% 0.8%

12:30 U.S. Continuing Jobless Claims 2215 2225

12:30 U.S. Initial Jobless Claims July 281 280

14:00 Eurozone Consumer Confidence (Preliminary) July -5.6 -5.68

14:00 U.S. Leading Indicators June 0.7% 0.2%

14:15 Eurozone ECB's Jens Weidmann Speaks

22:45 New Zealand Trade Balance, mln June 350 100

-

08:13

Options levels on thursday, July 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1098 (1886)

$1.1034 (1087)

$1.0986 (297)

Price at time of writing this review: $1.0931

Support levels (open interest**, contracts):

$1.0877 (3138)

$1.0848 (4030)

$1.0804 (5859)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 52620 contracts, with the maximum number of contracts with strike price $1,1200 (3341);

- Overall open interest on the PUT options with the expiration date August, 7 is 62205 contracts, with the maximum number of contracts with strike price $1,0800 (6387);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from July, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1177)

$1.5804 (1849)

$1.5706 (1096)

Price at time of writing this review: $1.5612

Support levels (open interest**, contracts):

$1.5493 (1430)

$1.5396 (1339)

$1.5298 (1433)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 21703 contracts, with the maximum number of contracts with strike price $1,5750 (3212);

- Overall open interest on the PUT options with the expiration date August, 7 is 22739 contracts, with the maximum number of contracts with strike price $1,5250 (2080);

- The ratio of PUT/CALL was 1.05 versus 1.09 from the previous trading day according to data from July, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:52

Japan: Trade Balance Total, bln, June -69 (forecast 5.4)

-

00:59

Currencies. Daily history for Jul 22’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0928 -0,08%

GBP/USD $1,5612 +0,35%

USD/CHF Chf0,9596 +0,11%

USD/JPY Y123,94 +0,06%

EUR/JPY Y135,43 -0,04%

GBP/JPY Y193,47 +0,40%

AUD/USD $0,7381 -0,53%

NZD/USD $0,6635 +0,20%

USD/CAD C$1,3028 +0,62%

-