Noticias del mercado

-

16:01

U.S.: New Home Sales, June 482 (forecast 546)

-

15:45

U.S.: Manufacturing PMI, July 53.8 (forecast 53.6)

-

15:40

Option expiries for today's 10:00 ET NY cut

USDJPY 122.50 (1.16bn) 123.00, 123.20, 123.25, 123.50 124.00 (1.12bn), 124.10, 124.50, 124.85 125.00 (960m), 125.50, 126.00

EURUSD 1.0725, 1.0790 1.0800 (2.03bn), 1.0840, 1.0850 (1bn), 1.0890 1.0900 (1.2bn), 1.0945 (511m), 1.0960 1.1000 (1.39bn) 1.1100 (595m), 1.1130 (503m)

GBPUSD 1.5420 1.5500, 1.5550 1.5700

USDCAD 1.2900/05

AUDUSD 0.7100 (500m) 0.7325, 0.7360, 0.7375 0.7450/55 0.7525 (504m)

AUDNZD 1.0850 1.0900 1.1050 1.1100 (908m)

USDCHF 0.9525 0.9600 (1.39bn) 0.9700 0.9800 (1bn)

-

15:18

Belgium: Business Climate, July -4.1 (forecast -4.0)

-

14:20

European session review: the US dollar rose significantly against the euro

Data

01:35 Japan Manufacturing PMI (Preliminary) July 50.1 51.4

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) July 49.4 49.7 48.2

07:00 France Services PMI (Preliminary) July 54.1 53.8 52

07:00 France Manufacturing PMI (Preliminary) July 50.7 50.7 49.6

07:30 Germany Services PMI (Preliminary) July 53.8 53.9 53.7

07:30 Germany Manufacturing PMI (Preliminary) July 51.9 51.9 51.5

08:00 Eurozone Manufacturing PMI (Preliminary) July 52.5 52.5 52.2

08:00 Eurozone Services PMI (Preliminary) July 54.4 54.2 53.8

08:30 United Kingdom BBA Mortgage Approvals June 42.9 Revised From 42.5 44.5

The euro fell sharply against the dollar, approaching to yesterday's low. The EUR / USD has come under selling pressure after German PMI figures reflected the weakness of the euro zone and the region's economy. Preliminary results of the research, published by Markit Economics, showed: the private sector in Germany continued to expand in July, but at a slower pace than last month. Preliminary composite index of business activity, which covers the manufacturing sector and services sector fell in July to 53.4 points against 53.7 in June. Recall index value above 50 indicates expansion in the sector. PMI index for the services sector was 53.7 in July, compared to 53.8 points in June. It was expected that the figure will reach 53.9 points. Meanwhile, the manufacturing PMI fell to 51.5 in July from 51.9 in June. Experts predicted that the index would remain unchanged.

Meanwhile, another report showed that economic growth in the euro area slowed down in July, but the pace of expansion remained one of the largest in the last four years. According to the data, the composite Purchasing Managers' Index, which assesses changes in the manufacturing sector and the service sector, fell in July to 53,7punkta compared to 54.2 points in June (maximum four years). Despite the decline, the index remains slightly above its average over the first half of the year. It was expected that the index will be 54. The last reading was the sixth largest since mid-2011. The report also stated that the PMI index in the services sector declined in July, more than expected - to 53.8 points against 54.4 in June, and forecasts at the level of 54.2 points. At the same time, the manufacturing PMI index fell to 52.2 from 52.5 in June. Economists had forecast that the index would remain unchanged.

The pound fell against the dollar moderately updating yesterday's low and fixed below the level of $ 1.5500. The market continues to analyze the weak data on UK retail sales. Recall, retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Economists had expected an increase of 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent.

In addition, investors expect the data on new home sales in the US in June. Analysts predict that the index remained unchanged compared with the May level of 546 thousand., Became the highest since 2008, to 548 thousand. Homes based on annual rates.

EUR / USD: during the European session the pair fell to $ 1.0922

GBP / USD: during the European session the pair fell to $ 1.5465

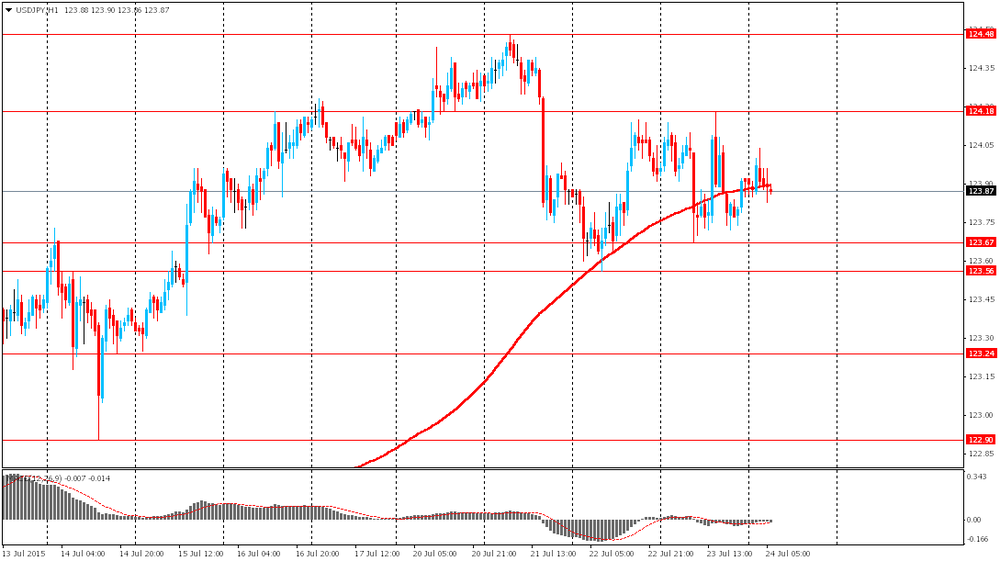

USD / JPY: during the European session, the pair was trading in the range of Y123.82-Y124.04

At 13:00 GMT Belgium will present the index business sentiment in June. At 13:45 GMT the United States will release the index of business activity in the manufacturing sector in July, and at 14:00 GMT will declare the amount of new home sales for June.

-

14:00

EUR/USD

Offers 1.1000 1.1050 1.1080 1.1100

Bids 1.0920 1.0900 1.0875 1.0850 1.0800 1.0785 1.0750

GBP/USD

Offers 1.5530 1.5585 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5450 1.5425-30 1.5400 1.5330

EUR/GBP

Offers 0.7100 0.7120-25 0.7150

Bids 0.7045 0.6975 0.6950 0.6925 0.6900 0.6885 0.6850 0.6830 0.6800

EUR/JPY

Offers 136.00 136.50 137.00

Bids 135.00 134.40 134.00 133.80 133.50

USD/JPY

Offers 124.15 124.50 124.75 125.00 125.30 125.50

Bids 123.50-55 123.20-25 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7325 0.7400 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7265 0.7250 0.7200

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.78bn), $1.0850(E1.0bn), $1.0900(E1.2bn), $1.1000(E1.4bn)

USD/JPY: Y122.50($1.16bn), Y124.00 ($1.12bn), Y125.00($960mn)

AUD/USD: $0.7320(A$200mn), $0.7525(A$505mn)

USD/SGD: Sgd1.3700($797mn)

-

10:30

United Kingdom: BBA Mortgage Approvals, June 44.5

-

10:00

Eurozone: Services PMI, July 53.8 (forecast 54.2)

-

10:00

Eurozone: Manufacturing PMI, July 52.2 (forecast 52.5)

-

09:30

Germany: Manufacturing PMI, July 51.5 (forecast 51.9)

-

09:30

Germany: Services PMI, July 53.7 (forecast 53.9)

-

09:00

France: Services PMI, July 52 (forecast 53.8)

-

09:00

France: Manufacturing PMI, July 49.6 (forecast 50.7)

-

08:35

Foreign exchange market. Asian session: the euro slid ahead of PMI data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) July 50.1 51.4

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) July 49.4 49.7 48.2

The euro slightly declined ahead of manufacturing and services PMI data for the euro zone and its member-states.

The Australian dollar fell after Markit Economics published weak preliminary Manufacturing PMI data for China. The index contracted to 48.2 in July compared to June final reading of 49.7. Analysts expected the index to come in at 49.7. Any reading below 50 points to contraction. China is Australia's major trading partner.

Standard&Poor's agency put additional pressure on the AUD saying that it will cut the country's rating if it does not fix its budget issues. That's why economists expect the Reserve Bank of Australia to lower its benchmark rate further.

The greenback advanced after favorable employment data intensified expectations of a rate hike in the U.S.

EUR/USD: the pair fell to $1.0965 in Asian trade

USD/JPY: the pair traded around Y123.85-05

GBP/USD: the pair fell to $1.5500

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 France Services PMI (Preliminary) July 54.1 53.8

07:00 France Manufacturing PMI (Preliminary) July 50.7 50.7

07:30 Germany Services PMI (Preliminary) July 53.8 53.9

07:30 Germany Manufacturing PMI (Preliminary) July 51.9 51.9

08:00 Eurozone Manufacturing PMI (Preliminary) July 52.5 52.5

08:00 Eurozone Services PMI (Preliminary) July 54.4 54.2

08:30 United Kingdom BBA Mortgage Approvals June 42.5

13:00 Belgium Business Climate July -3.9 -4.0

13:45 U.S. Manufacturing PMI (Finally) July 54.0 53.6

14:00 U.S. New Home Sales June 546 546

-

08:13

Options levels on friday, July 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1105 (2212)

$1.1064 (834)

$1.1037 (380)

Price at time of writing this review: $1.0965

Support levels (open interest**, contracts):

$1.0925 (1696)

$1.0901 (4161)

$1.0873 (3051)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 53184 contracts, with the maximum number of contracts with strike price $1,1200 (3548);

- Overall open interest on the PUT options with the expiration date August, 7 is 62313 contracts, with the maximum number of contracts with strike price $1,0800 (6045);

- The ratio of PUT/CALL was 1.17 versus 1.18 from the previous trading day according to data from July, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1799)

$1.5704 (1136)

$1.5606 (2158)

Price at time of writing this review: $1.5512

Support levels (open interest**, contracts):

$1.5394 (1326)

$1.5297 (1370)

$1.5198 (1358)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 21936 contracts, with the maximum number of contracts with strike price $1,5750 (3212);

- Overall open interest on the PUT options with the expiration date August, 7 is 22669 contracts, with the maximum number of contracts with strike price $1,5250 (2083);

- The ratio of PUT/CALL was 1.03 versus 1.05 from the previous trading day according to data from July, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:46

Japan: Manufacturing PMI, July 51.4

-

03:45

China: HSBC Manufacturing PMI, July 48.2 (forecast 49.7)

-

00:45

New Zealand: Trade Balance, mln, June -60 (forecast 100)

-

00:30

Currencies. Daily history for Jul 23’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0983 +0,50%

GBP/USD $1,5514 -0,63%

USD/CHF Chf0,9596 0,00%

USD/JPY Y123,91 -0,02%

EUR/JPY Y136,09 +0,48%

GBP/JPY Y192,24 -0,64%

AUD/USD $0,7351 -0,41%

NZD/USD $0,6699 +0,96%

USD/CAD C$1,3039 +0,08%

-