Noticias del mercado

-

21:00

S&P 500 2,079.59 -22.56 -1.1 %, NASDAQ 5,093.62 -52.79 -1.0 %, Dow 17,569.03 -162.89 -0.9 %

-

19:20

European stocks fell

European stocks fell with miners and auto-related shares, extending their first weekly drop in three, as data around the world signaled worsening economic conditions.

Antofagasta Plc and Glencore Plc slipped at least 4.5 percent as commodity producers extended a rout. Volkswagen AG slid 2.7 percent, pacing losses among carmakers, after Manager Magazin said a drop in its Chinese deliveries could hurt earnings by more than 1 billion euros ($1.1 billion). BASF SE declined 4.6 percent after its earnings trailed projections.

The Stoxx Europe 600 Index dropped 0.9 percent to 394.64 at the close of trading, reversing intraday gains of 0.5 percent. A report showed U.S. new-home sales unexpectedly fell in June. Data earlier showed a surprise weakening in Chinese manufacturing, while euro-area output missed projections.

"The news flow has been on the downside," said Ralf Zimmerman, a strategist at Bankhaus Lampe KG in Dusseldorf, Germany. "We had weak Chinese PMIs and declining PMIs in Europe, soft figures on the corporate front. We need more positive global news or else the downwards move in market will persist."

The Stoxx 600 fell for a fourth day, taking its weekly retreat to 2.7 percent. Commodity producers fell the most among industry groups during the period.

Among other shares moving on corporate news, Aggreko Plc tumbled 12 percent after saying it expects full-year profit to fall short of estimates.

Lonmin Plc slumped 17 percent on concern it will need to raise funds after saying it may cut as many as 6,000 jobs. Diageo Plc dropped 2.5 percent after saying the U.S. Securities and Exchange Commission is looking into its distribution practices there.

Vodafone Group Plc climbed 2.8 percent after service revenue increased more than projected. Thales SA surged to the highest price since 1998 after first-half sales beat estimates.

-

18:56

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Friday for the fourth straight day after a mixed bag of earnings from big companies and the downward spiral of commodities. Metal prices hit multi-year lows as weaker-than-expected data from China and the euro zone raised concerns about global growth while oil prices neared four-month lows. The three major indexes were poised to end the week in the red after disappointing corporate results and forecasts added to concerns about the U.S. profit outlook. Data on Friday showed new U.S. single-family home sales fell in June to their lowest level in seven months and May's sales were revised sharply lower. Other data showed manufacturing activity nudged up in July after slowing for three straight months.

Almost all of Dow stocks in negative area (27 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -2.45%). Top gainer - Visa Inc. (V, +4.46).

Almost all of S&P index sectors also in negative area. Top looser - Basic Materials (-1.6%). Top gainer - Services (+0.2%).

At the moment:

Dow 17551.00 -125.00 -0.71%

S&P 500 2083.50 -15.00 -0.71%

Nasdaq 100 4585.25 -34.75 -0.75%

10 Year yield 2,27% -0,01

Oil 47.99 -0.46 -0.95%

Gold 1085.00 -9.10 -0.83%

-

18:00

European stocks closed: FTSE 100 6,579.81 -75.20 -1.1 %, CAC 40 5,057.36 -29.38 -0.6 %, DAX 11,347.45 -164.66 -1.4 %

-

17:51

WSE: Session Results

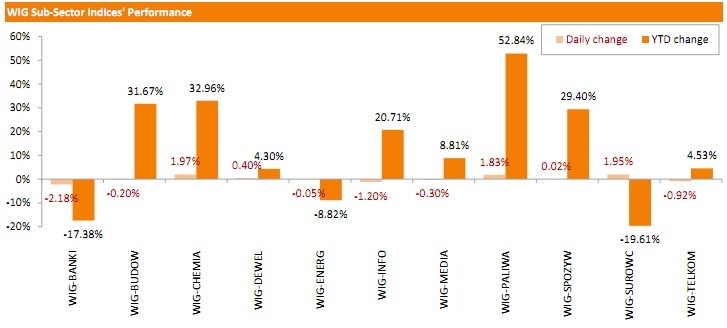

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, slid down 0.24%. Sector performance within the WIG Index was mixed. Banks (-2.18%) and informational technologies (-1.20%) recorded the most notable declines, while chemicals (+1.97%), materials (+1.95%) and oil and gas names (+1.83%) fared the best.

The large-cap stocks' measure, the WIG30 Index lost 0.32%. Within the Index components, PEKAO (WSE: PEO), BZ WBK (WSE: BZW) and PKO BP (WSE: PKO) were the weakest performers, returning losses of 2.68%-3%. On the other side of the ledger, PKN ORLEN (WSE: PKN) led the advancers pack with a 2.83% growth, bouncing back after yesterday's sharp decline. It was followed by BOGDANKA (WSE: LWB) and GRUPA AZOTY (WSE: ATT), gaining 2.69% and 2.06% respectively.

-

15:32

U.S. Stocks open: Dow +0.09%, Nasdaq +0.28%, S&P +0.09%

-

15:23

Before the bell: S&P futures -0.10%, NASDAQ futures +0.07%

U.S. stock-index futures were little changed, as a rally in Amazon.com Inc. and Visa Inc. after better-than-expected results .

Global Stocks:

Nikkei 20,544.53 -139.42 -0.7%

Hang Seng 25,128.51 -270.34 -1.1%

Shanghai Composite 4,070.83 -53.09 -1.3%

FTSE 6,643.38 -11.63 -0.2%

CAC 5,089.54 +2.80 +0.1%

DAX 11,466.32 -45.79 -0.4%

Crude oil $48.94 (+1.03%)

Gold $1082.60 (-1.05%)

-

15:17

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

146.13

+0.01%

1.4K

Tesla Motors, Inc., NASDAQ

TSLA

267.22

+0.01%

6.0K

UnitedHealth Group Inc

UNH

119.38

+0.04%

1.4K

Exxon Mobil Corp

XOM

81.20

+0.07%

4.3K

Goldman Sachs

GS

211.23

+0.09%

0.3K

ALTRIA GROUP INC.

MO

53.87

+0.09%

0.4K

McDonald's Corp

MCD

97.24

+0.15%

0.2K

Nike

NKE

114.18

+0.16%

0.8K

Chevron Corp

CVX

93.10

+0.17%

3.5K

Apple Inc.

AAPL

125.40

+0.19%

198.0K

Ford Motor Co.

F

14.64

+0.21%

16.4K

Hewlett-Packard Co.

HPQ

31.30

+0.22%

1.0K

E. I. du Pont de Nemours and Co

DD

58.62

+0.24%

0.6K

Verizon Communications Inc

VZ

46.46

+0.24%

1.8K

Home Depot Inc

HD

114.88

+0.25%

0.3K

General Electric Co

GE

26.34

+0.30%

5.1K

American Express Co

AXP

77.25

+0.31%

2.4K

Caterpillar Inc

CAT

77.13

+0.33%

10.9K

Google Inc.

GOOG

646.76

+0.38%

3.7K

ALCOA INC.

AA

10.01

+0.50%

7.7K

Walt Disney Co

DIS

119.41

+0.51%

6.3K

Twitter, Inc., NYSE

TWTR

36.46

+0.75%

35.3K

General Motors Company, NYSE

GM

31.80

+0.95%

14.7K

Yahoo! Inc., NASDAQ

YHOO

39.65

+1.12%

10.8K

Cisco Systems Inc

CSCO

28.42

+1.46%

43.0K

Facebook, Inc.

FB

97.48

+2.14%

330.4K

AT&T Inc

T

34.80

+2.56%

815.6K

Amazon.com Inc., NASDAQ

AMZN

584.00

+21.12%

682.3K

Starbucks Corporation, NASDAQ

SBUX

59.35

+4.93%

77.6K

Visa

V

76.69

+6.89%

123.0K

JPMorgan Chase and Co

JPM

69.64

0.00%

0.7K

The Coca-Cola Co

KO

40.84

0.00%

1.0K

Citigroup Inc., NYSE

C

59.85

-0.03%

13.8K

Johnson & Johnson

JNJ

100.12

-0.08%

0.1K

Procter & Gamble Co

PG

80.61

-0.11%

0.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.62

-0.15%

74.5K

3M Co

MMM

149.00

-0.33%

1.7K

Intel Corp

INTC

28.50

-0.33%

10.3K

Yandex N.V., NASDAQ

YNDX

15.20

-0.39%

0.4K

United Technologies Corp

UTX

100.74

-0.40%

2.2K

Microsoft Corp

MSFT

45.80

-0.67%

6.5K

International Business Machines Co...

IBM

160.40

-0.82%

3.8K

Barrick Gold Corporation, NYSE

ABX

7.00

-0.99%

124.3K

-

15:12

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded to Buy from Neutral at B. Riley & Co., target $646

Walt Disney (DIS) upgraded from Hold to Buy at Topeka Capital Markets, target raised from $105 to $138

General Motors (GM) upgraded to Neutral from Underperform at Credit Suisse

Downgrades:

Other:

AT&T (T) reiterated at Mkt Perform at FBR Capital, target raised from $36 to $38

Amazon (AMZN) target raised:

to $700 from $500 at Nomura;

to $550 from $475 at Sun Trust Rbsn Humphrey;

to $650 from $460 at Citigroup;

to $650 from $520 at Piper Jaffray;

to $700 from $565 at Cowen;

to $650 from $550 at UBS;

to $700 from $480 at Credit Suisse;

to $650 from $500 at RBC Capital Mkts;

to $670 from $460 at Cantor Fitzgerald.

Visa (V) target raised:

to $82 from $79 at RBC Capital Mkts;

to $70 from $66 at Topeka Capital Markets;

to $80 from $70 at FBR Capital.

Starbucks (SBUX) reiterated at Outperform, target raised from $60 to $64 at RBC Capital Mkts

3M (MMM) target lowered to $148 from $150 at RBC Capital Mkts

Caterpillar (CAT) target lowered to $92 from $94 at Stifel

-

08:38

Global Stocks: U.S. indices weighed by earnings reports

U.S. stock indices declined for the third straight day after Caterpillar, 3M and American Express posted weak reports.

Meanwhile an index of economic activity in the U.S. rose substantially in the previous month due to improvements in output and employment. The Conference Board reported that the index of leading indicators, which measures economic conditions in the next three to six months, rose 0.6% after a 0.8% increase in May.

The Dow Jones industrial average declined 119.09 points, or 0.7%, to 17,731.92 (the index turned negative for the year). The S&P 500 fell 12 points, or 0.6%, to 2,102.15 (all of its 10 sectors traded lower). The Nasdaq Composite lost 25.36 points, or 0.5%, to 5,146.41.

In Asia this morning Hong Kong Hang Seng fell 0.86%, or 218.90 points, to 25,179.95. China Shanghai Composite Index rose 1.09%, or 44.89 points, to 4,168.82. The Nikkei lost 0.58%, or 119.85 points, to 20,564.10.

Asian stocks outside China fell amid declines in U.S. equities. Chinese stocks rose on regulators' support ignoring a preliminary report from Markit Economics, which showed that China Manufacturing PMI fell to 48.2 in July from 49.4 reported previously. This is the index's fifth contraction in a row.

-

04:01

Nikkei 225 20,605.6 -78.35 -0.38 %, Hang Seng 25,129.83 -269.02 -1.06 %, Shanghai Composite 4,119.05 -4.88 -0.12 %

-

00:31

Stocks. Daily history for Jul 23’2015:

(index / closing price / change items /% change)

Nikkei 225 20,683.95 +90.28 +0.44 %

Hang Seng 25,398.85 +116.23 +0.46 %

S&P/ASX 200 5,590.29 -24.28 -0.43 %

Shanghai Composite 4,124.39 +98.34 +2.44 %

FTSE 100 6,655.01 -12.33 -0.18 %

CAC 40 5,086.74 +4.17 +0.08 %

Xetra DAX 11,512.11 -8.56 -0.07 %

S&P 500 2,102.15 -12.00 -0.57 %

NASDAQ Composite 5,146.41 -25.36 -0.49 %

Dow Jones 17,731.92 -119.12 -0.67 %

-