Noticias del mercado

-

21:00

DJIA 17436.72 -131.81 -0.75%, S&P 500 2069.18 -10.47 -0.50%, NASDAQ 5043.92 -44.71 -0.88%

-

19:20

Europe stocks close 2% down after China rout

European stock closed lower on Monday, after a sharp selloff in Asian shares highlighted concerns about Chinese market volatility and slowing growth.

The pan-European FTSEurofirst 300 provisionally closed 2.1 percent lower, while the Germany's DAX and France's CAC closed respectively 2.4 percent and 2.5 percent lower.

The U.K.'s benchmark FTSE outperformed its euro zone peers, but still closed unofficially down 1.0 percent.

Stocks across Europe, the U.S. and Asia tumbled after China's Shanghai Composite tanked to close 8.5 percent down at a three-week low. This added to the sharp losses seen by the index in recent weeks as the fall in commodity prices saps risk appetite.

Declines in the Shanghai Composite quadrupled during its afternoon session, as official data showed China's industrial profits declined 0.3 percent year-on-year in June, after rising in April and May.

Earnings season continued in Europe, with some companies warning of the impact of the slowing Chinese economy. These included French autos supplier Valeo on Monday, which closed 5.4 percent down at the bottom of the CAC after releasing its first-half earnings.

The FTSE's weakest performers were Pearson and Merlin Entertainments.

The former closed down 4.8 percent after confirming it was in talks to sell its 50 percent stake in The Economist, having announced the sale of the Financial Times Group to Nikkei last week.

Merlin Entertainments shares, meanwhile, closed down 4.3 percent after a profit warning was released. Its shares tumbled as much as 7.8 percent in early trading, its worst ever one-day drop.

Better news came from Swiss banking giant, UBS, which reported better-than-expected earnings. However, shares in the bank closed down around 1.6 percent. UBS results came a day earlier than expected, following a report in Swiss paper Sonntagszeitung.

-

18:29

WSE: Session Results

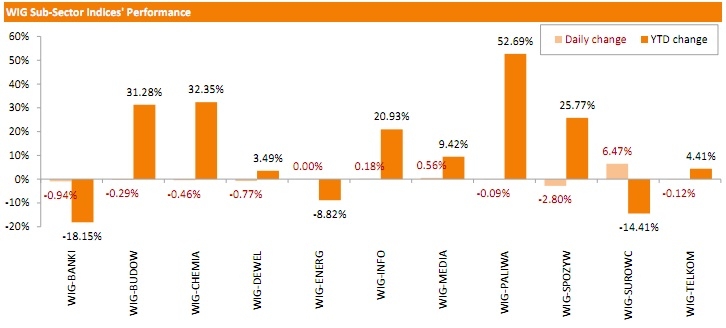

Polish equity market continued to slide on Monday. The broad market measure, the WIG Index, lost 0.23%. Sector-wise, materials (+6.47 %) fared the best, while food sector names (-2.80%) lagged behind.

The large-cap stocks fell by 0.1%. Within the index components, KERNEL (WSE: KER) recorded the biggest drop, down 4.89%. It was followed by banking names HANDLOWY (WSE: BHW) and ING BSK (WSE: ING), plunging by 3.95% and 2.86% respectively. On the other side of the ledger, KGHM (WSE: KGH) became the session's best performer, as its quotations skyrocketed by 8.05%, buoyed by announcement the opposition Law and Justice Party motioned to abolish a mining tax for cooper and silver producers. PGNIG (WSE: PGN), BORYSZEW (WSE: BRS), TAURON PE (WSE: TPE), CYFROWY POLSAT (WSE: CPS) and MBANK (WSE: MBK) did well too, posting 1%-2% gains.

-

18:24

Wall Street. Major U.S. stock-indexes fell

Wall Street fell on Monday and fell sharply on concerns about China's slowing growth in the wake of the biggest drop in Shanghai shares in eight years. The Dow Jones industrial average fell to its lowest level in over five months while the Nasdaq composite was at a four-week low and the S&P 500 touched its lowest in more than two weeks. Chinese shares tumbled more than 8% as an unprecedented government rescue plan to prop up valuations abruptly ran out of steam, raising doubts about the viability of Beijing's efforts to stave off a deeper crash.

Almost all of Dow stocks in negative area (24 of 30). Top looser - The Boeing Company (BA, -1.78%). Top gainer - Intel Corporation (INTC, +0.92).

Almost all of S&P index sectors also in negative area. Top looser - Conglomerates (-1.6%). Top gainer - Utilities (+1.1%).

At the moment:

Dow 17363.00 -160.00 -0.91%

S&P 500 2062.75 -14.75 -0.71%

Nasdaq 100 4519.25 -42.50 -0.93%

10 Year yield 2,24% -0,03

Oil 47.60 -0.54 -1.12%

Gold 1095.50 +10.00 +0.92%

-

18:00

European stocks closed: FTSE 100 6,505.13 -74.68 -1.13 %, CAC 40 4,927.60 -129.76 -2.57 %, DAX 11,056.40 -291.05 -2.56 %

-

15:40

U.S. Stocks open: Dow -0.81%, Nasdaq -1.04%, S&P -0.67%

-

15:29

U.S. stock-index futures fell after the biggest slump in eight years for Chinese equities amid concern over the nation’s economic growth.

Global Stocks:

Nikkei 20,350.1 -194.43 -0.95%

Hang Seng 24,351.96 -776.55 -3.09%

Shanghai Composite 3,725.56 -345.35 -8.48%

FTSE 6,534.28 -45.53 -0.69%

CAC 4,960.44 -96.92 -1.92%

DAX 11,138.09 -209.36 -1.84%

Crude oil $47.34 (-1.66%)

Gold $1090.10 (+0.42%)

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Microsoft Corp

MSFT

46.05

+0.24%

20.2K

Deere & Company, NYSE

DE

92.75

+0.36%

2.2K

UnitedHealth Group Inc

UNH

117.94

0.00%

0.3K

Merck & Co Inc

MRK

57.41

0.00%

0.3K

McDonald's Corp

MCD

96.01

-0.09%

1.2K

Intel Corp

INTC

28.02

-0.14%

3.9K

Amazon.com Inc., NASDAQ

AMZN

528.70

-0.14%

60.6K

AT&T Inc

T

34.23

-0.18%

56.1K

General Motors Company, NYSE

GM

31.00

-0.19%

10.0K

Johnson & Johnson

JNJ

98.95

-0.20%

0.6K

The Coca-Cola Co

KO

40.34

-0.25%

1.4K

Walt Disney Co

DIS

118.60

-0.26%

8.7K

Nike

NKE

112.69

-0.27%

1.6K

Procter & Gamble Co

PG

80.05

-0.30%

1.7K

United Technologies Corp

UTX

98.98

-0.33%

5.0K

International Business Machines Co...

IBM

159.15

-0.38%

3.9K

3M Co

MMM

148.75

-0.39%

0.2K

Cisco Systems Inc

CSCO

28.29

-0.39%

1.7K

Verizon Communications Inc

VZ

45.86

-0.39%

12.7K

Google Inc.

GOOG

621.13

-0.39%

10.9K

E. I. du Pont de Nemours and Co

DD

56.71

-0.40%

1.5K

Starbucks Corporation, NASDAQ

SBUX

57.06

-0.40%

15.7K

American Express Co

AXP

75.55

-0.46%

2.4K

Pfizer Inc

PFE

34.10

-0.47%

1.0K

Home Depot Inc

HD

113.00

-0.52%

0.1K

ALTRIA GROUP INC.

MO

53.50

-0.54%

0.4K

Boeing Co

BA

143.18

-0.61%

1.9K

Twitter, Inc., NYSE

TWTR

35.19

-0.65%

5.1K

Wal-Mart Stores Inc

WMT

71.11

-0.66%

0.2K

Goldman Sachs

GS

205.93

-0.68%

1.0K

Travelers Companies Inc

TRV

104.54

-0.69%

0.2K

Ford Motor Co.

F

14.29

-0.69%

37.9K

Facebook, Inc.

FB

96.27

-0.70%

74.2K

HONEYWELL INTERNATIONAL INC.

HON

102.04

-0.71%

0.1K

Exxon Mobil Corp

XOM

79.30

-0.80%

8.7K

JPMorgan Chase and Co

JPM

68.36

-0.80%

4.2K

ALCOA INC.

AA

09.73

-0.82%

17.4K

Chevron Corp

CVX

89.85

-0.83%

12.9K

General Electric Co

GE

25.54

-0.83%

13.5K

Visa

V

74.17

-0.84%

6.8K

AMERICAN INTERNATIONAL GROUP

AIG

63.00

-1.01%

0.1K

Citigroup Inc., NYSE

C

58.11

-1.01%

4.0K

Barrick Gold Corporation, NYSE

ABX

07.17

-1.10%

58.9K

Apple Inc.

AAPL

123.10

-1.12%

446.2K

Caterpillar Inc

CAT

75.11

-1.30%

5.1K

Tesla Motors, Inc., NASDAQ

TSLA

261.21

-1.58%

9.5K

Yahoo! Inc., NASDAQ

YHOO

38.18

-1.72%

61.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.03

-2.12%

14.5K

Yandex N.V., NASDAQ

YNDX

14.48

-2.43%

4.0K

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded from Sell to Neutral at Goldman, target raised from $78 to $94

Downgrades:

Other:

AT&T (T) reiterated at Hold at Canaccord Genuity, target raised from $34 to $35

-

14:32

Earnings Season in U.S.: Major Reports of the Week

July 28

Before the Open:

Ford Motor (F). Consensus EPS $0.37, Consensus Revenue $35435.25 mln.

UPS (UPS). Consensus EPS $1.27, Consensus Revenue $14501.55 mln.

Pfizer (PFE). Consensus EPS $0.52, Consensus Revenue $11418.05 mln.

Merck (MRK). Consensus EPS $0.81, Consensus Revenue $9797.65 mln.

DuPont (DD). Consensus EPS $1.22, Consensus Revenue $8982.75 mln.

After the Close:

Twitter (TWTR). Consensus EPS $0.04, Consensus Revenue $481.24 mln.

July 29

After the Close:

Facebook (FB). Consensus EPS $0.47, Consensus Revenue $3985.62 mln.

July 30

Before the Open:

Procter & Gamble (PG). Consensus EPS $0.95, Consensus Revenue $17952.32 mln.

Yandex N.V. (YNDX). Consensus EPS $7.96, Consensus Revenue $13567.68 mln.

July 31

Before the Open:

Exxon Mobil (XOM). Consensus EPS $1.11, Consensus Revenue $77862.33 mln.

Chevron (CVX). Consensus EPS $1.15, Consensus Revenue $30270.89 mln.

-

12:30

Major stock indexes in Europe show a negative trend

European stocks traded in negative territory, approaching its fifth consecutive sessional fall. In the course of trading influence news from the Asia-Pacific region, as well as corporate reports.

"The fall is mainly due to China. I think that many investors expect that the growth of the Chinese economy will continue to slow down, and this slowdown is not yet fully reflected in the quotations of European shares," - said the expert Peregrine & Black Markus Huber. Recall Chinese stocks fell today by 8.5%. In addition, the data showed that the profits of Chinese industrial companies in June decreased by 0.3% per year, after rising 0.6% in May.

Meanwhile, the market was supported by the German statistics. These Munich institute IFO, showed that the index of business sentiment in Germany rose unexpectedly in July, recording the first increase since April. According to the report, the July business climate index rose to a level of 108.0 compared with 107.5 in June (revised from 107.4). The latter value was the highest since May this year. Analysts had expected the index to fall to 107.2 points. The current conditions index from the IFO rose in July by 0.8 points, to 113.9 points, while the expectations index jumped to 102.4 points from 102.1 (revised from 102.0). It forecasts a decline of data rate to 113 and 101.8, respectively. "Business expectations were somewhat more optimistic, after declining for three consecutive months. The recent easing concerns about Greece helped to improve sentiment on the German economy," - said in a press release IFO.

Shares of Swiss bank UBS AG fell 1.2 percent, despite the unexpectedly high quarterly profit. Meanwhile, analysts Citigroup Inc. They noted that a higher than expected amount of profit is likely to be a one-off.

The gauge of banks' shares shows the largest decline among the 19 industry groups. Quotes of German Deutsche Bank and Commerzbank fell 1.7 percent and 2.3 percent, respectively.

The cost of Ryanair Holdings Plc - Europe's largest budget airline - decreased by 0.9 percent since the company announced that the surplus of transport capacity could put pressure on the price of tickets. In the last quarter of the average cost of a ticket on the routes Ryanair declined by 4%.

Paper Merlin Entertainments Plc fell 3.8 percent, which was associated with a decrease in earnings forecast for the current year.

Capitalization of Royal Philips NV - the manufacturer of consumer electronics - increased by 5.0 percent due to higher profit than analysts had expected.

The cost of Reckitt Benckiser Group Plc rose 2.2 percent. The company said that the increase in revenues in the second quarter exceeded the forecasts of experts.

Currently:

FTSE 100 6,568.95 -10.86 -0.17%

CAC 40 4,985.68 -71.68 -1.42%

DAX 11,195.84 -151.61 -1.34%

-

08:49

Global Stocks: U.S. indices weighed on Asian stocks

U.S. stock indices fell on Friday with biotechnology companies leading declines this time.

Biogen dropped 22% on weak sales outlook.

The Dow Jones Industrial Average fell 163.39 points, or 0.9%, to 17568.53 Friday. The S&P 500 declined 22.50 points, or 1.1%, to 2079.65, and the Nasdaq Composite lost 57.78 points, or 1.1%, to 5088.63.

For the week, the Dow Jones lost 2.9%, while the S&P 500 tumbled 2.2%.

In Asia this morning Hong Kong Hang Seng fell 2.67%, or 671.42 points, to 24,457.09. China Shanghai Composite Index fell 3.09%, or 125.63 points, to 3,945.28. The Nikkei lost 1.19%, or 244.77 points, to 20,299.76.

Stocks fell across Asia amid declines in U.S. indices, which were caused by corporate earnings reports. Chinese stocks were also influenced by concerns over activity in the industrial sector of the country's economy. Official data showed that revenues of Chinese industrial companies fell by 0.7% in the first half of the current year compared to last year.

-

04:08

Nikkei 225 20,424.69 -119.84 -0.58 %, Hang Sengт24,716.31ь-412.20 -1.64 %, Shanghai Composite 4,004.26 -66.64 -1.64 %

-

00:55

Stocks. Daily history for Jul 24’2015:

(index / closing price / change items /% change)

Nikkei 225 20,544.53 -139.42 -0.67 %

Hang Seng -270.34 -1.06 %

S&P/ASX 200 5,566.1 -24.18 -0.43 %

Shanghai Composite 4,070.83 -53.09 -1.29 %

FTSE 100 6,579.81 -75.20 -1.13 %

CAC 40 5,057.36 -29.38 -0.58 %

Xetra DAX 11,347.45 -164.66 -1.43 %

S&P 500 2,079.65 -22.50 -1.07 %

NASDAQ Composite 5,088.63 -57.78 -1.12 %

Dow Jones 17,568.53 -163.39 -0.92 %

-