Noticias del mercado

-

23:59

Schedule for today, Tuesday, Jul 28’2015:

(time / country / index / period / previous value / forecast)

08:30United Kingdom GDP, y/y (Preliminary) Quarter II 2.9% 2.6%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.4% 0.7%

12:30 Canada Industrial Product Price Index, y/y June -1.3%

12:30 Canada Industrial Product Price Index, m/m June 0.5% 0.4%

12:30 Canada Raw Material Price Index June 4.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y May 4.9% 5.6%

13:45 U.S. Services PMI (Preliminary) July 54.8 55.0

14:00 U.S. Richmond Fed Manufacturing Index July 6

14:00 U.S. Consumer confidence July 101.4 100

20:30 U.S. API Crude Oil Inventories July 2.3

23:50 Japan Retail sales, y/y June 3.0% 0.5%

-

20:20

American focus: the dollar fell

The US dollar fell against the euro and the yen, as investors took profits after recent gains amid fears that China's stock market volatility may deter the Federal Reserve from raising interest rates in the United States in the coming months.

The Chinese stock market on Monday suffered the biggest losses since 2007. Stock indexes have fallen by 8.5% on concerns that the government will postpone the implementation of measures to support the market. Some investors believe that the instability of the stock market in China will make the Fed more cautious when it comes to the matter of tightening monetary policy. This prompted them to sell dollars and buy euros and yen. The prospect of a rate hike in September to support the dollar in recent weeks, as the higher cost of borrowing makes the dollar more attractive to investors seeking to return.

Investors are waiting for the completion of the Fed meeting on Wednesday, as they look for new clues about the timing of rate increases. Fed Chairman Janet Yellen, speaking in Congress earlier this month, stressed that it expects the central bank will raise the fed funds rate at some point before the end of the year.

Little support for the dollar during trading had strong data on orders for durable goods. The volume of orders for durable goods increased significantly in June, offsetting with the fall in the previous two months. This was reported in the statement of the Ministry of Commerce.

According to data seasonally adjusted new orders for durable goods rose in June by 3.4% compared with a decrease of 2.2% in the previous month (revised from -1.8%). Economists had expected orders to increase by 3.0%.

Recall data on orders for durable goods are highly volatile and often revised, making them difficult to analyze. However, other recent reports indicate that the manufacturing sector improves.

The Ministry of Commerce said that the June change partly reflects the increase in demand for airplanes. Orders for non-military aircraft and parts rose 66.1% in June. Separately, Boeing Corporation announced that it has received 161 orders for the aircraft in June to 11 in May.

Excluding the transportation sector, orders rose by 0.8%, recording the largest increase since August 2014. Meanwhile, with the exception of the defense sector, orders rose 3.8%.

A key indicator of business investment also improved in June - orders for non-military capital goods excluding aircraft rose 0.9% after falling 0.4% in May.

Today's report adds to signs that US manufacturers can overcome the difficulties of the strong dollar, harsh winter weather and a drop in oil prices. However, the data also showed that in the first half of 2015, new orders were down 2% compared to the same period in 2014.

Meanwhile, support for the euro has had a report on Germany. The research results presented by the Munich institute IFO, have shown that the index of business sentiment in Germany rose unexpectedly in July, recording the first increase since April. According to the data, the July business climate index rose to 108.0 level against 107.5 in June (revised from 107.4). The latter value was the highest since May this year. Analysts had expected the index to fall to 107.2 points. The current conditions index from the IFO rose in July by 0.8 points, to 113.9 points, while the expectations index jumped to 102.4 points from 102.1 (revised from 102.0). It forecasts a decline of data rate to 113 and 101.8, respectively. "Business expectations were somewhat more optimistic, after declining for three consecutive months. The recent easing concerns about Greece helped to improve sentiment," - said in a press release IFO.

Focus has also proved statistics for the euro area. A report published by the ECB showed that the growth rate of the monetary aggregate M3 remained in June at 5.0%. Experts expect that this figure will increase by 5.2%. In the period from April to June, the average annual growth rate of M3 was 5.1%. Regarding the main components of M3, the growth rate of M1 increased to 11.8% in June from 11.2% in May. The growth rate of short-term deposits other than overnight deposits (M2-M1) amounted to -4.3% in June, against -4.2% in the previous month. We also learned that the annual growth rate of deposits placed by households stood at 3.0% in June compared with 2.9% in the previous month, while the annual growth rate of deposits placed by non-financial corporations slowed to 4.2% from 4.3% in May. Meanwhile, the ECB reported that the growth rate of credit to the government accelerated to 5.3% from 4.1% in May, while the pace of lending to the private sector slowed to 0.1% from 0.2%.

-

15:50

Сегодня в 14:00 GMT истекает срок действия следующих опционов:

EUR/USD: $1.0800(E2.0bn), $1.0850(E1.0bn), $1.0900(E1.2bn), $1.0925(E754mn), $1.1000(E1.19bn)

USD/JPY: Y122.50($550mn), Y124.00 ($321mn), Y125.00($300mn)

GBP/USD: $1.5750(Gbp240mn)

NZD/USD: $0.6660(NZ$270mn)

USD/CAD: C$1.3100(250mn), C$1.3200($450mn)

-

14:30

U.S.: Durable Goods Orders , June 3.4% (forecast 3%)

-

14:30

U.S.: Durable goods orders ex defense, 3.8%

-

14:30

U.S.: Durable Goods Orders ex Transportation , June 0.8% (forecast 0.5%)

-

14:15

European session review: the US dollar fell against most major currencies

Data

8:00 Eurozone Change in volume of private sector credit, y / y in June 0.5% 0.6% 0.6%

8:00 Eurozone M3 money supply, y / y in June 5.0% 5.2% 5.0%

8:00 Germany IFO business climate index in July 107.5 107.2 108

8:00 Germany IFO current conditions index in July 113.1 113 113.9

8:00 Germany IFO expectations index July 102.1 101.8 102.4

10:00 UK Balance industrial orders Confederation of British Industry in July -7 -10

The euro rose sharply against the US currency, updating the maximum of 14 in July and briefly breaking the mark of $ 1.1100, which is mainly explained by the fall in the dollar Friday on weak data on home sales in the United States. Meanwhile, support for the euro has had a report on Germany. The research results presented by the Munich institute IFO, have shown that the index of business sentiment in Germany rose unexpectedly in July, recording the first increase since April. According to the data, the July business climate index rose to 108.0 level against 107.5 in June (revised from 107.4). The latter value was the highest since May this year. Analysts had expected the index to fall to 107.2 points. The current conditions index from the IFO rose in July by 0.8 points, to 113.9 points, while the expectations index jumped to 102.4 points from 102.1 (revised from 102.0). It forecasts a decline of data rate to 113 and 101.8, respectively. "Business expectations were somewhat more optimistic, after declining for three consecutive months. The recent easing concerns about Greece helped to improve sentiment," - said in a press release IFO.

Focus has also proved statistics for the euro area. A report published by the ECB showed that the growth rate of the monetary aggregate M3 remained in June at 5.0%. Experts expect that this figure will increase by 5.2%. In the period from April to June, the average annual growth rate of M3 was 5.1%. Regarding the main components of M3, the growth rate of M1 increased to 11.8% in June from 11.2% in May. The growth rate of short-term deposits other than overnight deposits (M2-M1) amounted to -4.3% in June, against -4.2% in the previous month. We also learned that the annual growth rate of deposits placed by households stood at 3.0% in June compared with 2.9% in the previous month, while the annual growth rate of deposits placed by non-financial corporations slowed to 4.2% from 4.3% in May. Meanwhile, the ECB reported that the growth rate of credit to the government accelerated to 5.3% from 4.1% in May, while the pace of lending to the private sector slowed to 0.1% from 0.2%.

The yen appreciated strongly against the dollar, reaching the highest level since July 15 as the drop in the Chinese stock markets increased the attractiveness of the yen as a currency of refuge. In addition, the decline has intensified due to the reduction in price of the dollar. Also, investors are waiting for the meeting of the US Federal Reserve and the publication of US GDP data. Tomorrow begins a two-day meeting of the Committee on Open Market Federal Reserve, which will discuss the rise in interest rates and the economy. The Central Bank of the United States can provide more information about its intentions regarding the increase in US interest rates. The Fed signaled that interest rates may increase in September, but investors predict that the central bank is likely to take effect at the December meeting. Rising interest rates in the United States will make the dollar more attractive to investors.

The pound has stabilized near the opening levels against the dollar, as investors take a wait and see stance ahead of the release of tomorrow's GDP report Britain. According to economists, the UK economy is likely to grow much more rapidly in the 2nd quarter after a slight delay in the start of the year. According to the forecast, the UK GDP in the 2nd quarter grew by 0.7% against growth of 0.4% in the 1st quarter.

A slight pressure is applied to the data from the CBI, which showed that the expectations of new orders in the industrial sector in Britain fell unexpectedly in July, reaching a minimum value in the past two years, mainly due to the effect of strengthening the pound on export performance. According to the balance of industrial orders fell this month to a level of -10 compared to -7 in July. The last reading was the lowest since July 2013. Economists had expected the balance slightly improved - to -5. However, the rate is still above the long-term average at -15. Quarterly Review of CBI pointed to the gloomy prospects for the manufacturers. Expectations regarding the volume of export orders in the next three months fell to the lowest level since October 2011.

EUR / USD: during the European session, the pair rose to $ 1.1115

GBP / USD: during the European session, the pair has updated the maximum and minimum, and then stabilized near the opening level

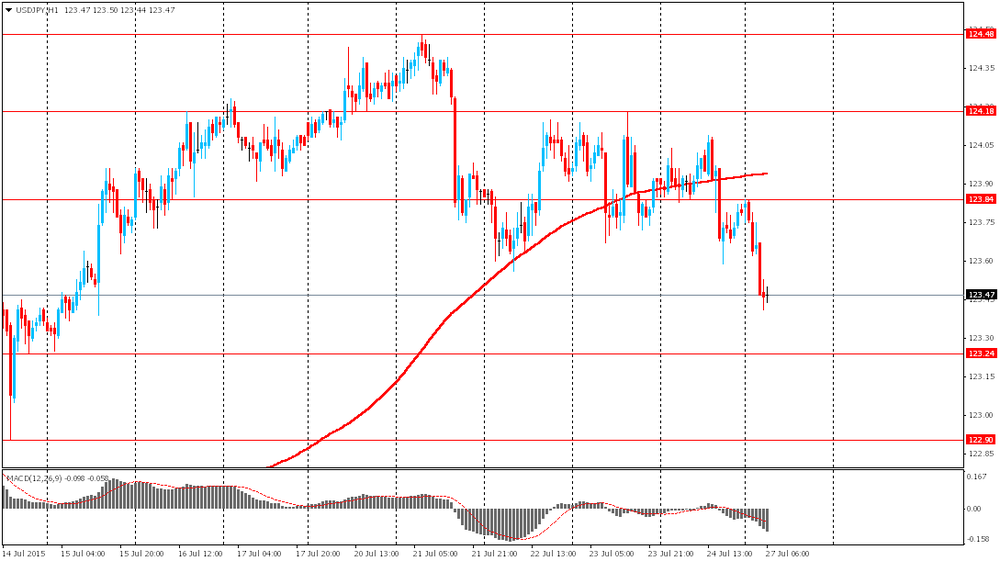

USD / JPY: during the European session the pair fell to Y123.15

At 12:30 GMT the United States will report on orders for durable goods, including excl rd transport in June.

-

14:00

Orders

EUR/USD

Offers 1.1120 1.1160 1.1185 1.1200

Bids 1.1000 1.0980 1.0965 1.0940 1.0900 1.0880 1.0860 1.081.0820-25 1.0800 1.0785 1.0750

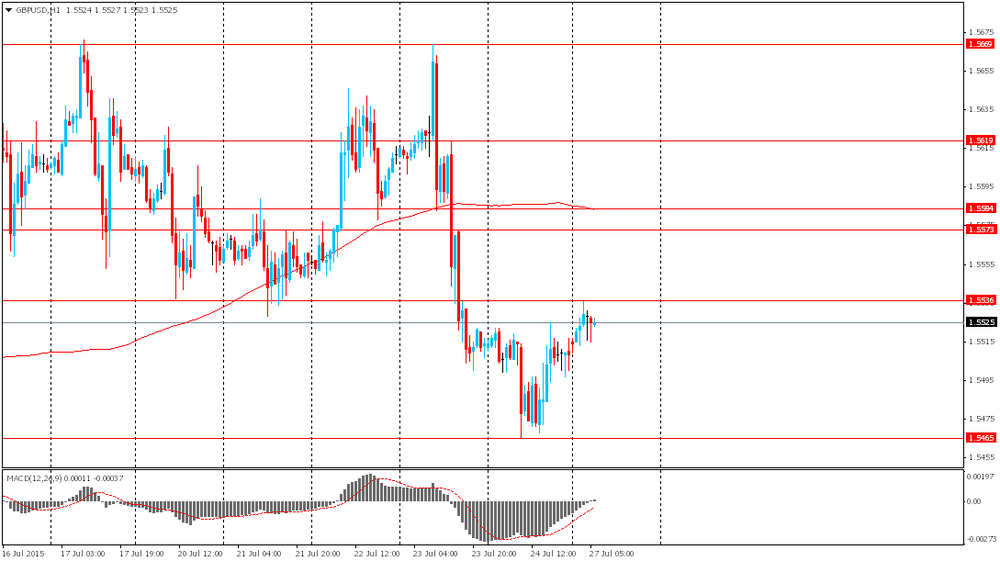

GBP/USD

Offers 1.5520-25 1.5550 1.5580 1.5600 1.5625 1.5640-50 1.5680 1.5700-10

Bids 1.5485 1.5450 1.5425-30 1.5400 1.5360 1.5330 1.5300

EUR/GBP

Offers 0.7150-55 0.7180-85 0.7225-30 0.7260 0.7285 0.7300

Bids 0.7120 0.7100 0.7085 0.7065 0.7030 0.7000 0.6975-80

EUR/JPY

Offers 136.85 137.00 137.30 137.50 137.80 138.00

Bids 136.25 136.00 135.80 135.50 135.00 134.85 134.40 134.00

USD/JPY

Offers 123.50-55 123.85 124.00 124.25-30 124.50 124.75 125.00

Bids 123.25-30 123.00 122.80 122.50-60 122.00 121.75 121.50

AUD/USD

Offers 0.7300 0.7325 0.7360 0.7385 0.7400 0.7420-25 0.7450

Bids 0.7265 0.7250 0.7230 0.7200 0.7180 0.7150

-

12:00

United Kingdom: CBI industrial order books balance, July -10

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.0bn), $1.0850(E1.0bn), $1.0900(E1.2bn), $1.0925(E754mn), $1.1000(E1.19bn)

USD/JPY: Y122.50($550mn), Y124.00 ($321mn), Y125.00($300mn)

GBP/USD: $1.5750(Gbp240mn)

NZD/USD: $0.6660(NZ$270mn)

USD/CAD: C$1.3100(250mn), C$1.3200($450mn)

-

10:00

Germany: IFO - Business Climate, July 108 (forecast 107.2)

-

10:00

Eurozone: M3 money supply, adjusted y/y, June 5.0% (forecast 5.2%)

-

10:00

Germany: IFO - Current Assessment , July 113.9 (forecast 113)

-

10:00

Germany: IFO - Expectations , July 102.4 (forecast 101.8)

-

10:00

Eurozone: Private Loans, Y/Y, June 0.6% (forecast 0.6%)

-

08:46

Foreign exchange market. Asian session: the euro gained

The euro advanced against the dollar ahead of German business climate data by IFO. Economists expect the index to come in at 107.2 in July. The index is based on results of survey of 7000 business executives. A reading above 100 suggests that economic growth improves amid business optimism.

The yen rose against the dollar amid declines in Asian stocks and growing demand for this safe-haven currency. Investors are waiting for the Federal Reserve meeting and U.S. GDP data.

A two-day Federal Open Markets Committee meeting starts tomorrow. The central bank of the U.S. may provide more information on its intension regarding the future of interest rates. The Fed signaled that it may raise rates in September, but investors are convinced that the Fed will take this step in December. Higher rates in the U.S. would make the greenback more attractive for investors.

EUR/USD: the pair rose to $1.1015 in Asian trade

USD/JPY: the pair fell to Y123.40

GBP/USD: the pair traded around $1.5515-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Private Loans, Y/Y June 0.5% 0.6%

08:00 Eurozone M3 money supply, adjusted y/y June 5.0% 5.2%

08:00 Germany IFO - Business Climate July 107.4 107.2

08:00 Germany IFO - Current Assessment July 113.1 113

08:00 Germany IFO - Expectations July 102.0 101.8

10:00 United Kingdom CBI industrial order books balance July -7

12:30 U.S. Durable goods orders ex defense -2.1%

12:30 U.S. Durable Goods Orders June -1.8% 3%

12:30 U.S. Durable Goods Orders ex Transportation June 0.5% 0.5%

-

07:01

Options levels on monday, July 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1119 (2454)

$1.1068 (1120)

$1.1033 (433)

Price at time of writing this review: $1.1003

Support levels (open interest**, contracts):

$1.0920 (1696)

$1.0871 (3088)

$1.0840 (5713)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 54217 contracts, with the maximum number of contracts with strike price $1,1200 (4082);

- Overall open interest on the PUT options with the expiration date August, 7 is 62849 contracts, with the maximum number of contracts with strike price $1,0800 (5835);

- The ratio of PUT/CALL was 1.16 versus 1.17 from the previous trading day according to data from July, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1805)

$1.5703 (1138)

$1.5606 (2159)

Price at time of writing this review: $1.5527

Support levels (open interest**, contracts):

$1.5394 (1338)

$1.5297 (1373)

$1.5198 (1338)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22218 contracts, with the maximum number of contracts with strike price $1,5750 (3212);

- Overall open interest on the PUT options with the expiration date August, 7 is 22651 contracts, with the maximum number of contracts with strike price $1,5250 (2086);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from July, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:54

Currencies. Daily history for Jul 24’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0981 -0,02%

GBP/USD 1,5508 -0,04%

USD/CHF Chf0,9626 +0,31%

USD/JPY Y123,79 -0,10%

EUR/JPY Y135,97 -0,09%

GBP/JPY Y191,99 -0,13%

AUD/USD $0,7281 -0,96%

NZD/USD $0,6575 -1,89%

USD/CAD C$1,3045 +0,05%

-