Noticias del mercado

-

20:19

American focus: the dollar significantly higher against the euro

The Canadian dollar has appreciated sharply against the US dollar, reaching a maximum at the same time July 16, due to a sharp rebound in oil prices and the publication of weak data on US consumer confidence. However, experts note that in general the oil remains in line with the bearish trend, dropping from highs last year, more than $ 60. Recall that the cyclical minimum was recorded in January at $ 43.89 per barrel.

With regard to statistics, the report submitted by the Conference Board, showed that US consumer confidence index fell in July to a level of 90.9 points against 99.8 points in June (revised from 101.4 points). Economists had expected the index was 100.0 points.

The report said that the expectations index fell to 79.9 in July from 92.8 in June, while the current situation index fell to 107.4 points from 110.3 points. The share of consumers who believe that business conditions are "good" decreased to 24.2 percent from 26.1 percent, while the number of reported otherwise remained almost unchanged - at the level of 17.9 percent. As regards the situation in the labor market, the percentage of respondents who reported a sufficient number of jobs fell from 21.3 percent to 20.7 percent, while those who argue the opposite, increased to 26.7 percent from 26.1 percent. The proportion of consumers expecting their incomes rise, decreased from 17.6 percent to 17.0 percent, while the number is expected to decline, rose to 11.2 percent from 10.6 percent. "Consumer confidence fell sharply in July after rising in June. Consumers continue to positively evaluate the current conditions, but their short-term expectations have worsened this month. The less optimistic outlook for the labor market, and perhaps the uncertainty and volatility in the financial markets caused by the situation Greece and China, seems to undermine the confidence of consumers, "- said Lynn Franco, director of economic indicators The Conference Board.

The euro retreated from session low against the dollar, but still continued to show a marked decline. Little support for the European currency had data on US consumer confidence, which were worse than experts' forecasts. Meanwhile, the dollar strengthened after the sell-off in the Chinese stock markets undermined demand for risky assets. On Monday, shares in Shanghai collapsed maximum sessional pace in eight years, and continued to decline on Tuesday, despite expectations of additional stimulus from the government.

Dollar growth expectations also contribute to the outcome of the meeting of the Federal Reserve's monetary policy. Investors hope to get any indication as possible rise in interest rates. Fed Chairman Janet Yellen earlier this month mentioned the possibility of raising interest rates in 2015, the regulator, if the growth will continue unabated. If the Fed's statement to be made on Wednesday, will contain hints at tightening monetary policy, investors will be strengthened in the view that interest rates could be raised in September.

We also add that on Thursday is scheduled publication of US statistics on economic growth for the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The pound rose against the dollar significantly, received major support from the UK GDP data. Also contributed to the growth of the pound weak statistics on the US potrebdoveriyu. Recall, the growth of the UK economy in the 2nd quarter accelerated to improve the prospects for the second half of the year, but the question is how long the Bank of England will keep interest rates at record lows. According to data released on Tuesday the National Bureau of Statistics, the UK GDP in the 2nd quarter increased by 0.7% compared with the previous quarter and by 2.8% compared to the same period of the previous year. These data are preliminary, but they point to the UK's economic recovery after a slowdown in Q1, when GDP growth was only 0.4%. Restoring growth in the UK was due to strong activity in the services sector, which is a little disappointing in the beginning of the year, but now, apparently, will be supported by rising incomes and low inflation.

-

16:00

U.S.: Richmond Fed Manufacturing Index, July 13 (forecast 6)

-

16:00

U.S.: Consumer confidence , July 90.9 (forecast 100)

-

15:45

U.S.: Services PMI, July 55.2 (forecast 55.0)

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E417mn), $1.1000(E417mn), $1.1030-40(E717mn)

USD/JPY: Y122.50($445mn), Y123.00 ($250mn), Y123.40($498mn)

AUD/USD: $0.7300(A$531mn), $0.7325(A$485mn)

USD/CAD: C$1.2940(210mn), C$1.3000($495mn)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, May 4.9% (forecast 5.6%)

-

14:30

Canada: Industrial Product Price Index, y/y, June -0.9%

-

14:30

Canada: Industrial Product Price Index, m/m, June 0.5% (forecast 0.4%)

-

14:30

Canada: Raw Material Price Index, June 0.0%

-

14:15

European session review: the pound rose

The pound rose after the release of UK data on GDP. The growth rate of the UK economy in the 2nd quarter accelerated to improve the prospects for the second half of the year, but the question is how long the Bank of England will keep interest rates at record lows.

According to data released on Tuesday the National Bureau of Statistics, the UK GDP in the 2nd quarter increased by 0.7% compared with the previous quarter and by 2.8% compared to the same period of the previous year. These data are preliminary, but they point to the UK's economic recovery after a slowdown in Q1, when GDP growth was only 0.4%.

Restoring growth in the UK was due to strong activity in the services sector, which is a little disappointing in the beginning of the year, but now, apparently, will be supported by rising incomes and low inflation.

The strong recovery of activity was also observed in the manufacturing sector as the mining industry in the North Sea demonstrates the recovery period after months of very low oil prices. Growth in the mining industry have been the most rapid in more than 25 years, said the ONS, helped by the introduction in March of tax breaks for oil and gas producers.

The US dollar rose against most major currencies, recovering from a fall in the previous session on the eve of the start of the two-day meeting to determine the monetary policy of the Federal Reserve later today. The dollar regained positions, as investors have focused on the upcoming Wednesday statement, the Federal Reserve's monetary policy, expecting to get any indication as possible rise in interest rates. The Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate. On Thursday scheduled publication of US statistics on economic growth for the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The dollar also strengthened after the sell-off in the Chinese stock markets undermined demand for risky assets. On Monday, shares in Shanghai collapsed maximum session pace in eight years, and continued to decline on Tuesday, despite expectations of additional stimulus from the government.

EUR / USD: during the European session the pair fell to $ 1.1021

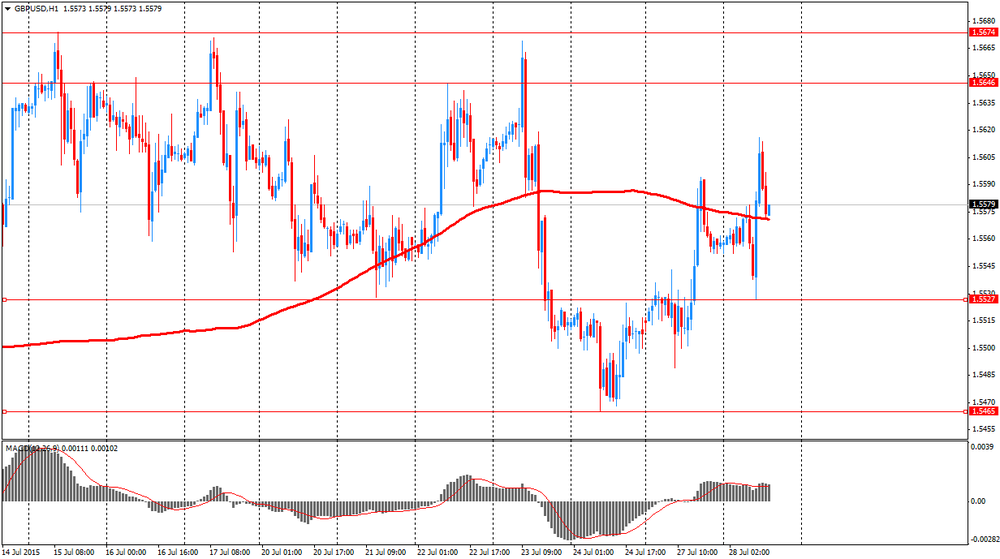

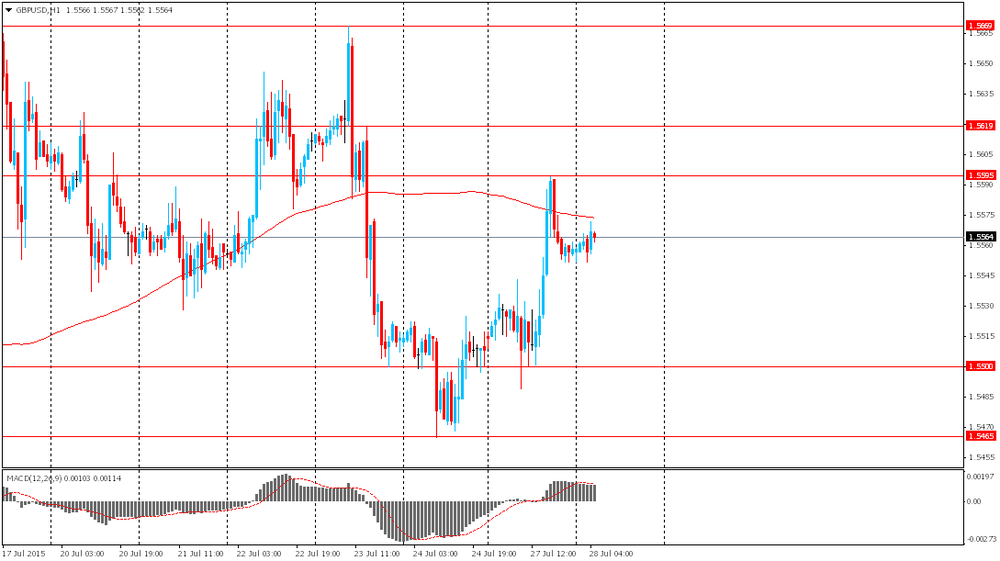

GBP / USD: during the European session the pair rose to $ 1.5616

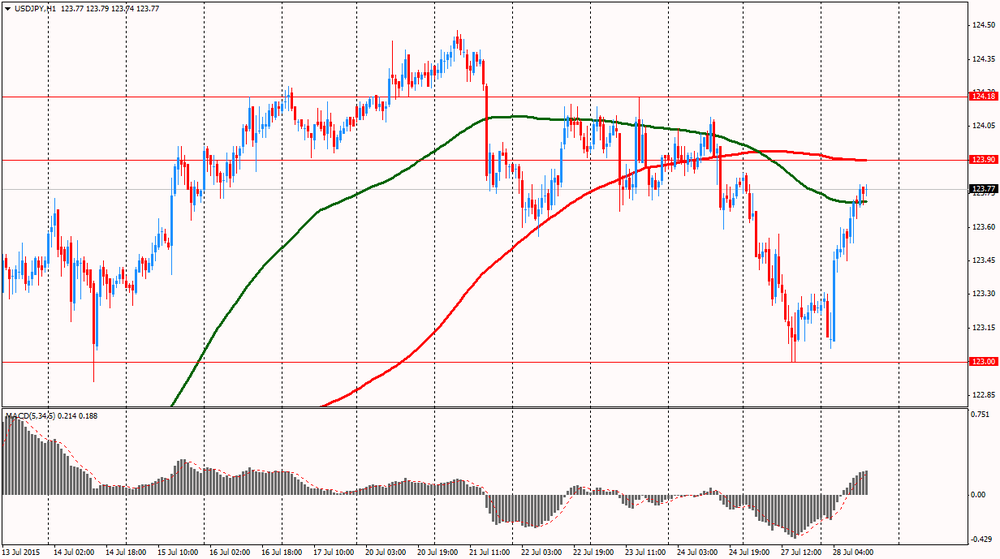

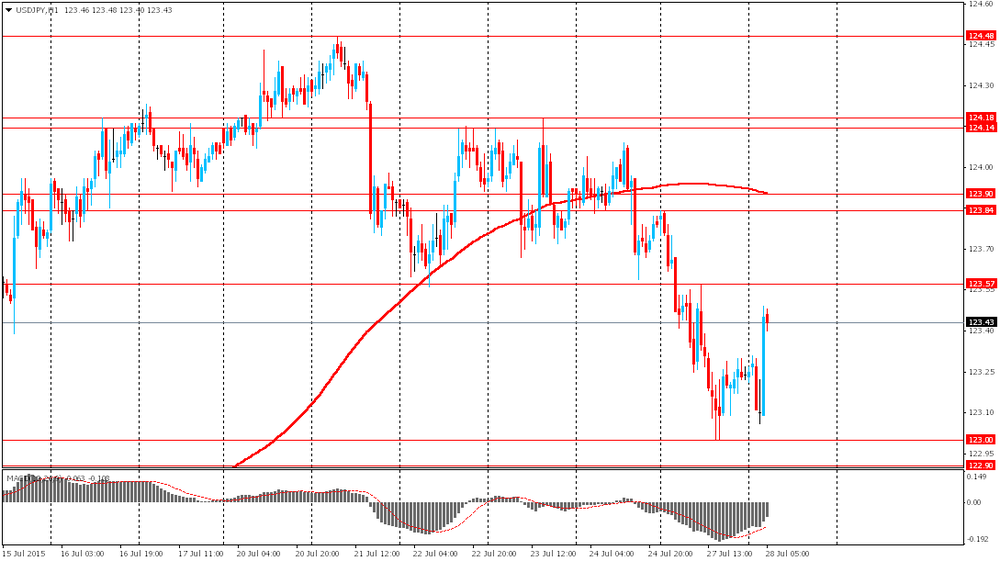

USD / JPY: during the European session the pair rose to Y123.79

В 12:30 GMT Канада представит индекс цен на сырье за июнь. В США в 13:00 GMT выйдет индекс цен на жилье от S&P/Case-Shiller за май, в 13:45 GMT - индекс деловой активности для сферы услуг от Markit за июль, в 14:00 GMT - индикатор уверенности потребителей за июль. Завершит день в 23:50 GMT Япония данными по розничным продажам за июнь.

-

14:00

Orders

EUR/USD

Offers 1.1080-85 1.1100 1.1120 1.1160 1.1185 1.1200 1.1220 1.1250

Bids 1.1050 1.1020 1.1000 1.0980 1.0965 1.0940 1.0900 1.0880 1.0860 1.0820-25 1.0800

GBP/USD

Offers 1.5565 1.5580 1.5600 1.5625 1.5640-50 1.5680 1.5700-10 1.5725-30

Bids 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400 1.5360 1.5330 1.5300

EUR/GBP

Offers 0.7130 0.7150-55 0.7180-85 0.7225-30 0.7260 0.7285 0.7300

Bids 0.7100 0.7085 0.7065 0.7030 0.7000 0.6975-80

EUR/JPY

Offers 137.00 137.30 137.50 137.80 138.00 138.50

Bids 136.50 136.25 136.00 135.80 135.50 135.00

USD/JPY

Offers 123.80-85 124.00 124.25-30 124.50 124.75 125.00

Bids 123.45-50 123.25-30 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7325-30 0.7360 0.7385 0.7400 0.7420-25 0.7450

Bids 0.7280 0.7265 0.7250 0.7230 0.7200 0.7180 0.7150

-

10:52

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E417mn), $1.1000(E417mn), $1.1030-40(E717mn)

USD/JPY: Y122.50($445mn), Y123.00 ($250mn), Y123.40($498mn)

AUD/USD: $0.7300(A$531mn), $0.7325(A$485mn)

USD/CAD: C$1.2940(210mn), C$1.3000($495mn)

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.6% (forecast 2.6%)

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.7% (forecast 0.7%)

-

08:43

Foreign exchange market. Asian session: the yen declined

The yen declined against the U.S. dollar as investors remained cautious ahead of a two-day FOMC meeting, which starts later today. Earlier this month Fed Chair Janet Yellen said that she expected the central bank to start raising rates within 2015. However some market participants believe that recent sharp drops in Chinese stocks will make the Fed very careful.

The euro little changed against the dollar after reaching its two-week high on Monday. Strong euro zone data supported the single currency. IFO reported that German business climate improved to 108.0 from July reading of 107.5. Economists expected the index to come in at 107.5.

The Australian dollar slightly advanced. Data showed that confidence of Australian consumers improved and the corresponding index rose by 0.6% to 112.5 in a week ending July 26. Worries over Greece's debt crisis faded and contributed to this growth. Nevertheless the index is still 3.2% below level seen a year ago.

EUR/USD: the pair fluctuated around $1.1080 in Asian trade

USD/JPY: the pair rose to Y123.50

GBP/USD: the pair traded around $1.5550-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom GDP, y/y (Preliminary) Quarter II 2.9% 2.6%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.4% 0.7%

12:30 Canada Industrial Product Price Index, y/y June -1.3%

12:30 Canada Industrial Product Price Index, m/m June 0.5% 0.4%

12:30 Canada Raw Material Price Index June 4.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y May 4.9% 5.6%

13:45 U.S. Services PMI (Preliminary) July 54.8 55.0

14:00 U.S. Richmond Fed Manufacturing Index July 6 6

14:00 U.S. Consumer confidence July 101.4 100

20:30 U.S. API Crude Oil Inventories July 2.3

23:50 Japan Retail sales, y/y June 3.0% 0.5%

-

08:15

Options levels on tuesday, July 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1223 (2507)

$1.1175 (2514)

$1.1131 (801)

Price at time of writing this review: $1.1064

Support levels (open interest**, contracts):

$1.1008 (3348)

$1.0948 (4377)

$1.0913 (3248)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 55127 contracts, with the maximum number of contracts with strike price $1,1200 (4609);

- Overall open interest on the PUT options with the expiration date August, 7 is 63236 contracts, with the maximum number of contracts with strike price $1,0800 (5928);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from July, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1732)

$1.5704 (1161)

$1.5607 (2157)

Price at time of writing this review: $1.5576

Support levels (open interest**, contracts):

$1.5493 (1464)

$1.5396 (1351)

$1.5298 (1362)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22088 contracts, with the maximum number of contracts with strike price $1,5750 (3212);

- Overall open interest on the PUT options with the expiration date August, 7 is 22661 contracts, with the maximum number of contracts with strike price $1,5250 (2070);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from July, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Currencies. Daily history for Jul 27’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1091 +0,99%

GBP/USD $1,5558 +0,32%

USD/CHF Chf0,9619 -0,07%

USD/JPY Y123,24 -0,45%

EUR/JPY Y136,69 +0,53%

GBP/JPY Y191,74 -0,13%

AUD/USD $0,7265 -0,22%

NZD/USD $0,6601 +0,39%

USD/CAD C$1,3035 -0,08%

-