Noticias del mercado

-

22:05

Major US stock indexes finished trading above zero

Major US stock indexes rose on Tuesday, ending a five-day decline in this case. Fall of Chinese indexes slowed due to the fact that the regulator China Securities said on Monday that will buy shares to stabilize the market, after the biggest decline in the market for eight years.

As it became known today, the US service sector grew at a faster pace in July than in June, as employment and new business accelerated. As shown by the report financial firm Markit, its preliminary purchasing managers' index for the services sector rose to 55.2 in July from 54.8 last reading in June, slightly ahead of the 55 level expected by economists. Recall that the value of more than 50 indicates expansion of economic activity.

In addition, the report submitted by the Conference Board, showed that the index of US consumer confidence fell in July to a level of 90.9 points against 99.8 points in June (revised from 101.4 points). Economists had expected the index was 100.0 points. The report said that the expectations index fell to 79.9 in July from 92.8 in June, while the current situation index fell to 107.4 points from 110.3 points.

Oil prices also rose in today's trading, but still near four-month low against a background of excess reserves in the US and concerns about demand in China.

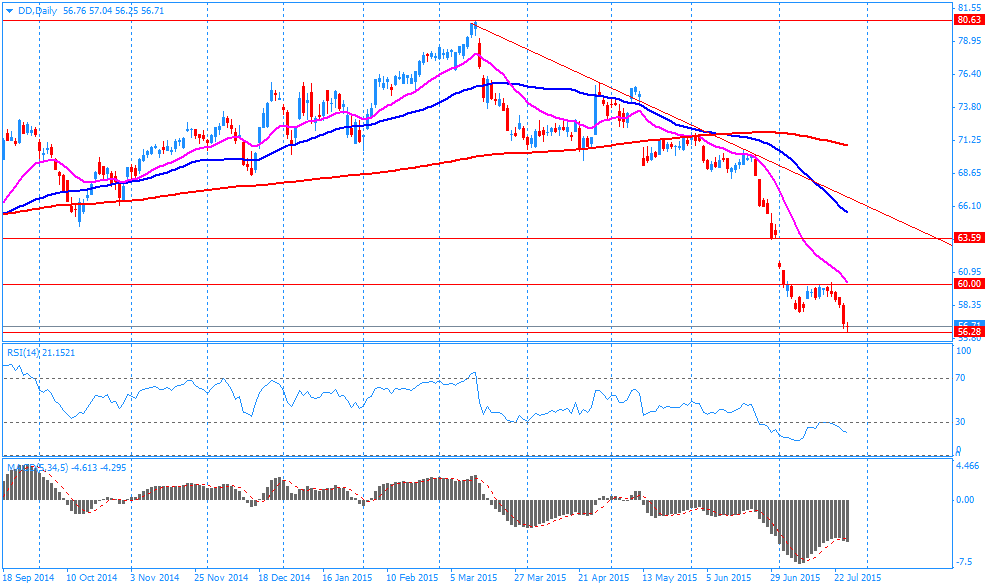

Almost all components of the index DOW closed in positive territory (29 of 30). Most remaining shares rose Exxon Mobil Corporation (XOM, + 4.19%). Only shares fell EI du Pont de Nemours and Company (DD, -1.49%).

All sectors of the index S & P ended the session in positive zone. Leaders of growth were the basic materials sector (+ 2.7%).

At the close:

Dow + 1.09% 17,630.47 +189.88

Nasdaq + 0.98% 5,089.21 +49.43

S & P + 1.24% 2,093.26 +25.62

-

21:00

Dow +1.15% 17,641.96 +201.37 Nasdaq +1.02% 5,091.17 +51.39 S&P +1.29% 2,094.28 +26.64

-

20:19

American focus: the dollar significantly higher against the euro

The Canadian dollar has appreciated sharply against the US dollar, reaching a maximum at the same time July 16, due to a sharp rebound in oil prices and the publication of weak data on US consumer confidence. However, experts note that in general the oil remains in line with the bearish trend, dropping from highs last year, more than $ 60. Recall that the cyclical minimum was recorded in January at $ 43.89 per barrel.

With regard to statistics, the report submitted by the Conference Board, showed that US consumer confidence index fell in July to a level of 90.9 points against 99.8 points in June (revised from 101.4 points). Economists had expected the index was 100.0 points.

The report said that the expectations index fell to 79.9 in July from 92.8 in June, while the current situation index fell to 107.4 points from 110.3 points. The share of consumers who believe that business conditions are "good" decreased to 24.2 percent from 26.1 percent, while the number of reported otherwise remained almost unchanged - at the level of 17.9 percent. As regards the situation in the labor market, the percentage of respondents who reported a sufficient number of jobs fell from 21.3 percent to 20.7 percent, while those who argue the opposite, increased to 26.7 percent from 26.1 percent. The proportion of consumers expecting their incomes rise, decreased from 17.6 percent to 17.0 percent, while the number is expected to decline, rose to 11.2 percent from 10.6 percent. "Consumer confidence fell sharply in July after rising in June. Consumers continue to positively evaluate the current conditions, but their short-term expectations have worsened this month. The less optimistic outlook for the labor market, and perhaps the uncertainty and volatility in the financial markets caused by the situation Greece and China, seems to undermine the confidence of consumers, "- said Lynn Franco, director of economic indicators The Conference Board.

The euro retreated from session low against the dollar, but still continued to show a marked decline. Little support for the European currency had data on US consumer confidence, which were worse than experts' forecasts. Meanwhile, the dollar strengthened after the sell-off in the Chinese stock markets undermined demand for risky assets. On Monday, shares in Shanghai collapsed maximum sessional pace in eight years, and continued to decline on Tuesday, despite expectations of additional stimulus from the government.

Dollar growth expectations also contribute to the outcome of the meeting of the Federal Reserve's monetary policy. Investors hope to get any indication as possible rise in interest rates. Fed Chairman Janet Yellen earlier this month mentioned the possibility of raising interest rates in 2015, the regulator, if the growth will continue unabated. If the Fed's statement to be made on Wednesday, will contain hints at tightening monetary policy, investors will be strengthened in the view that interest rates could be raised in September.

We also add that on Thursday is scheduled publication of US statistics on economic growth for the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The pound rose against the dollar significantly, received major support from the UK GDP data. Also contributed to the growth of the pound weak statistics on the US potrebdoveriyu. Recall, the growth of the UK economy in the 2nd quarter accelerated to improve the prospects for the second half of the year, but the question is how long the Bank of England will keep interest rates at record lows. According to data released on Tuesday the National Bureau of Statistics, the UK GDP in the 2nd quarter increased by 0.7% compared with the previous quarter and by 2.8% compared to the same period of the previous year. These data are preliminary, but they point to the UK's economic recovery after a slowdown in Q1, when GDP growth was only 0.4%. Restoring growth in the UK was due to strong activity in the services sector, which is a little disappointing in the beginning of the year, but now, apparently, will be supported by rising incomes and low inflation.

-

19:00

European stock markets closed higher

European stock indexes finished trading in positive territory today, breaking with the five-day fall, which is associated with increased activity in mergers and acquisitions, as well as the publication of positive quarterly reports.

Meanwhile, many investors perceive a relatively calm the turbulence in the Chinese stock market, believing that other regions of relatively isolated from this volatility. It is worth emphasizing, since the start of the week China's Shanghai Composite lost 10%.

"In the last couple of days the market was concerned about the instability in the market in China, but today these fears receded into the background, and give support to the quotations and financial results of the companies active in the field of mergers," - said the expert Baader Bank Gerhard Schwarz.

In the course of trade is also affected by waiting for a decision of the Federal Reserve System. Analysts say that by the July meeting any changes in monetary policy are not expected. Recall Fed rate steady at 0-0.25% since the end of 2008 against the backdrop of slow economic recovery after the crisis. Earlier, the Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate. According to analysts surveyed by Bloomberg, the July meeting of the Fed may be the last, which should not expect any dramatic statements. Most experts do not expect a change in the base interest rate, and some are still waiting for its increase in September.

The focus was also on US statistics. US service sector grew at a faster pace in July than in June, as employment and new business accelerated, the report showed Markit. Preliminary PMI for the services sector rose to 55.2 in July from 54.8 last reading in June, slightly ahead of the 55 level expected by economists. The sub-index measuring the volume of new business in the service companies, rose to 56.8, its highest level since April, from 56.3 in June. Employment component also rose in June.

Meanwhile, the report submitted by the Conference Board, showed that US consumer confidence index fell in July to a level of 90.9 points against 99.8 points in June (revised from 101.4 points). Economists had expected the index was 100.0 points. The report said that the expectations index fell to 79.9 in July from 92.8 in June, while the current situation index fell to 107.4 points from 110.3 points.

FTSE 100 6,555.28 +50.15 + 0.77% CAC 40 4,977.32 +49.72 + 1.01% DAX 11,173.91 +117.51 + 1.06%

The price of securities Melrose Industries Plc rose 9.8% on the announcement of the sale of a provider of energy accounting Elster American Honeywell International Inc. for $ 5.1 billion.

The cost of Hikma Pharmaceuticals Plc increased by 12%. The company said it agreed to buy the business Roxane pharmaceutical company Boehringer Ingelheim GmbH for $ 2.65 billion.

Shares of British insurer RSA Insurance Group Plc jumped 19% as the Zurich Insurance Group AG is considering buying it.

Capitalization Kering SA and Drax Group Plc rose 5.5 percent after reports that the amount of profit for the first half of the year exceeded the forecasts of experts.

The cost of the British manufacturer of components for the automotive and aerospace industry GKNPlc increased by 7.5% on the news of the purchase of the Dutch Fokker Technologies BV for 706 million euros.

Shares of Gerresheimer AG rose 12% after agreement of purchase Centor US Holding Inc. the company Nemera Development SA.

Quotes Michelin have fallen by 6.4%. The largest producer of tires in Europe reported that operating profit for the first half was below analysts' estimates.

Luxottica Group SpA shares rose 1.6% after the world's largest manufacturer of glasses reported record revenues and earnings for the second quarter.

-

18:21

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday and were on track to break a five-day losing streak as a selloff in Chinese stocks eased. China's top securities regulator said on Monday Beijing would keep buying shares to stabilize the market, after the steepest decline in Chinese stocks in eight years.

Almost all of Dow stocks in positive area (20 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -1.16%). Top gainer - Caterpillar Inc. (CAT, +3.16).

All of S&P index sectors also in positive area. Top gainer - Basic Materials (+2.2%).

At the moment:

Dow 17480.00 +84.00 +0.48%

S&P 500 2078.00 +13.50 +0.65%

Nasdaq 100 4532.75 +10.25 +0.23%

10 Year yield 2,24% +0,01

Oil 48.10 +0.71 +1.50%

Gold 1093.90 -2.50 -0.23%

-

18:03

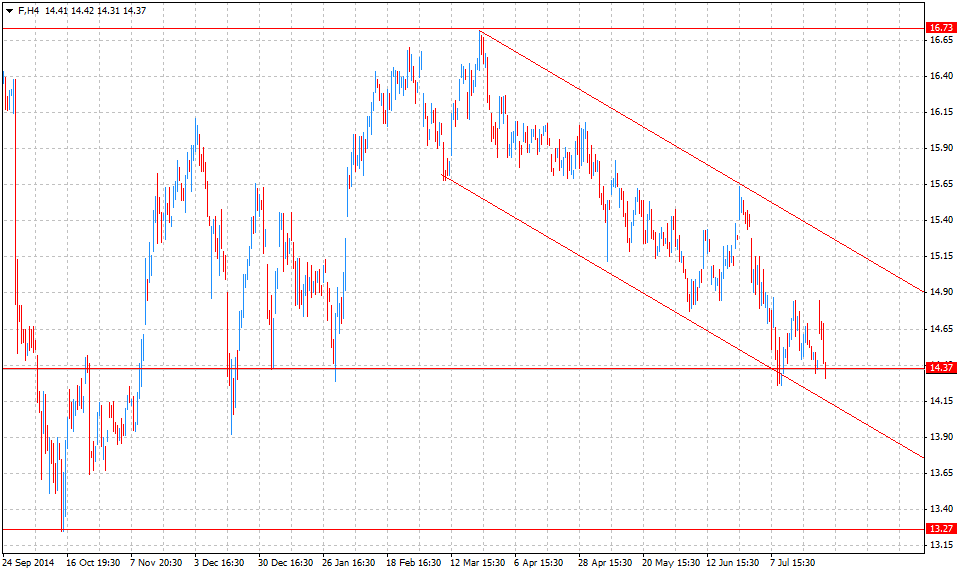

WSE: Session Results

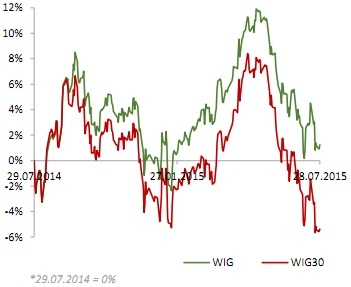

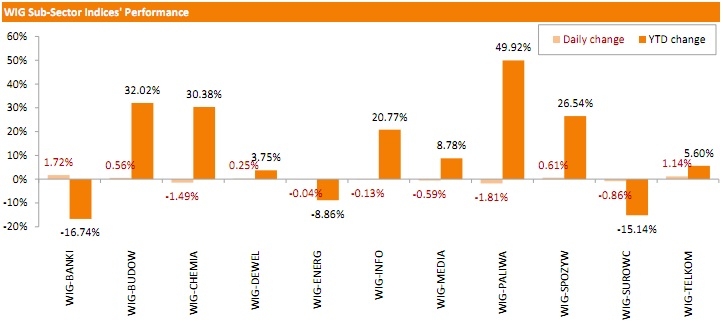

Polish equity market edged higher on Tuesday. The broad market measure, the WIG Index, advanced 0.32%. Sector-wise, oil and gas industry (-1.81%), chemicals (-1.49%) and materials (-0.86%) produced the biggest losses. At the same time, banking sector (+1.72%) fared the best, followed by telecommunications (+1.14%) and food sector (+0.61%).

The large-cap companies' indicator, the WIG30 Index, added 0.19%. Within the index components, BZ WBK (WSE: BZW), ING BSK (WSE: ING) and PZU (WSE: PZU) topped the gainers, rebounding by a respective 3.93%, 3.83% and 2.11%. They were followed by ORANGE POLSKA (WSE: OPL), which surged 1.99% as the company's 2Q15 profit beat the analysts' estimates. On the contrary, SYNTHOS (WSE: SNS) lagged with a 3% drop. ENEA (WSE: ENA) and PKN ORLEN (WSE: PKN) also posted notable declines, sliding down 2.75% and 2.03% respectively.

-

18:00

European stocks closed: FTSE 100 6,555.28 +50.15 +0.77% CAC 40 4,977.32 +49.72 +1.01% DAX 11,173.91 +117.51 +1.06%

-

16:00

U.S.: Richmond Fed Manufacturing Index, July 13 (forecast 6)

-

16:00

U.S.: Consumer confidence , July 90.9 (forecast 100)

-

15:45

U.S.: Services PMI, July 55.2 (forecast 55.0)

-

15:31

U.S. Stocks open: Dow +0.31%, Nasdaq +0.47%, S&P +0.37%

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E417mn), $1.1000(E417mn), $1.1030-40(E717mn)

USD/JPY: Y122.50($445mn), Y123.00 ($250mn), Y123.40($498mn)

AUD/USD: $0.7300(A$531mn), $0.7325(A$485mn)

USD/CAD: C$1.2940(210mn), C$1.3000($495mn)

-

15:28

Before the bell: S&P futures +0.40%, NASDAQ futures +0.28%

U.S. stock-index futures rose amid better-than-forecast earnings and as Chinese equities pulled back from a selloff.

Global Stocks:

Nikkei 20,328.89 -21.21 -0.10%

Hang Seng 24,503.94 +151.98 +0.62%

Shanghai Composite 3,662.82 -62.74 -1.68%

FTSE 6,553.43 +48.30 +0.74%

CAC 4,981.97 +54.37 +1.10%

DAX 11,202.28 +145.88 +1.32%

Crude oil $46.45 (+0.13%)

Gold $1093.00 (-0.32%)

-

15:20

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Merck & Co Inc

MRK

57.00

+0.02%

4.4K

Nike

NKE

112.02

+0.26%

0.8K

International Business Machines Co...

IBM

159.65

+0.36%

0.1K

Exxon Mobil Corp

XOM

79.55

+0.37%

24.0K

Verizon Communications Inc

VZ

46.00

+0.37%

9.5K

AT&T Inc

T

34.45

+0.38%

2.6K

Chevron Corp

CVX

89.50

+0.40%

13.6K

Johnson & Johnson

JNJ

98.67

+0.40%

1.1K

The Coca-Cola Co

KO

40.71

+0.42%

0.5K

McDonald's Corp

MCD

96.45

+0.43%

2.4K

Cisco Systems Inc

CSCO

28.34

+0.46%

0.9K

Home Depot Inc

HD

113.60

+0.47%

0.5K

Visa

V

74.25

+0.53%

0.1K

Yandex N.V., NASDAQ

YNDX

14.61

+0.55%

3.5K

Starbucks Corporation, NASDAQ

SBUX

57.30

+0.56%

9.1K

UnitedHealth Group Inc

UNH

118.56

+0.58%

1.4K

Boeing Co

BA

141.86

+0.59%

0.1K

Facebook, Inc.

FB

94.72

+0.59%

151.0K

Intel Corp

INTC

28.52

+0.60%

5.7K

Microsoft Corp

MSFT

45.62

+0.60%

13.6K

General Electric Co

GE

26.11

+0.62%

6.1K

Travelers Companies Inc

TRV

106.24

+0.62%

2.5K

Google Inc.

GOOG

631.27

+0.64%

2.2K

ALTRIA GROUP INC.

MO

54.30

+0.65%

0.3K

Goldman Sachs

GS

206.50

+0.72%

1.3K

Deere & Company, NYSE

DE

91.91

+0.72%

1.9K

Apple Inc.

AAPL

123.71

+0.76%

187.2K

Citigroup Inc., NYSE

C

58.40

+0.76%

7.3K

American Express Co

AXP

75.52

+0.80%

1K

Walt Disney Co

DIS

119.25

+0.85%

5.3K

JPMorgan Chase and Co

JPM

68.60

+0.87%

17.7K

Caterpillar Inc

CAT

76.10

+1.04%

28.5K

ALCOA INC.

AA

09.72

+1.04%

18.8K

Tesla Motors, Inc., NASDAQ

TSLA

255.85

+1.12%

6.0K

General Motors Company, NYSE

GM

31.40

+1.13%

7.1K

Procter & Gamble Co

PG

80.90

+1.16%

2.5K

Amazon.com Inc., NASDAQ

AMZN

538.50

+1.33%

15.5K

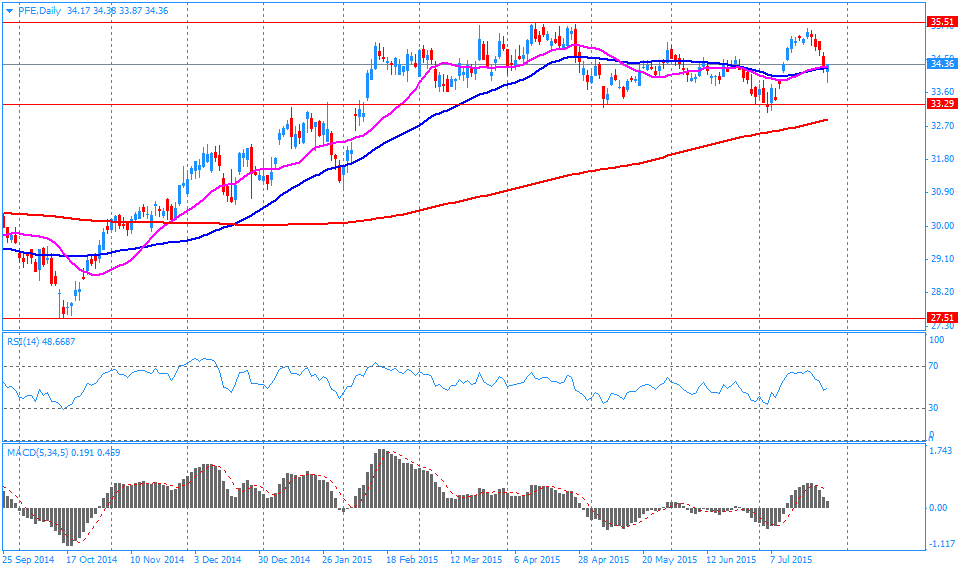

Pfizer Inc

PFE

34.80

+1.34%

29.8K

FedEx Corporation, NYSE

FDX

167.00

+1.37%

0.2K

Barrick Gold Corporation, NYSE

ABX

7.00

+1.45%

51.5K

Ford Motor Co.

F

14.92

+2.54%

217.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.70

+2.90%

58.5K

Twitter, Inc., NYSE

TWTR

34.65

-0.14%

34.5K

Yahoo! Inc., NASDAQ

YHOO

37.63

-0.54%

27.7K

E. I. du Pont de Nemours and Co

DD

55.36

-2.41%

2.0K

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, May 4.9% (forecast 5.6%)

-

15:00

-

14:45

Company News: Merck (MRK) issued FY15 EPS guidance above consensus

Company reported Q2 profit of $0.86 per share versus $0.81 consensus. Revenues fell 10.5% year/year to $9.79 bln versus $9.80 bln consensus.

Company issued guidance for FY15, sees EPS of $3.45-3.55 versus $3.44 consensus and revenues of $38.6-39.8 bln verdus $39.7 bln consensus.

MRK fell to $56.80 (-0.33%) on the premarket.

-

14:36

Company News: Pfizer (PFE) reported better than expected EPS and revenue

Company reported Q2 profit of $0.56 per share versus $0.52 consensus. Revenues fell 7.2% year/year to $11.85 bln versus $11.42 bln consensus.

Company raised EPS guidance for FY15 to $2.01-2.07 from $1.95-2.05 versus $2.06 consensus. Revenue guidance raised to $45-46 bln from $44-46 bln versus $45.96 bln consensus.

PFE rose to $35.03 (+2.01%) on the premarket.

-

14:30

Canada: Industrial Product Price Index, y/y, June -0.9%

-

14:30

Canada: Industrial Product Price Index, m/m, June 0.5% (forecast 0.4%)

-

14:30

Canada: Raw Material Price Index, June 0.0%

-

14:26

-

14:15

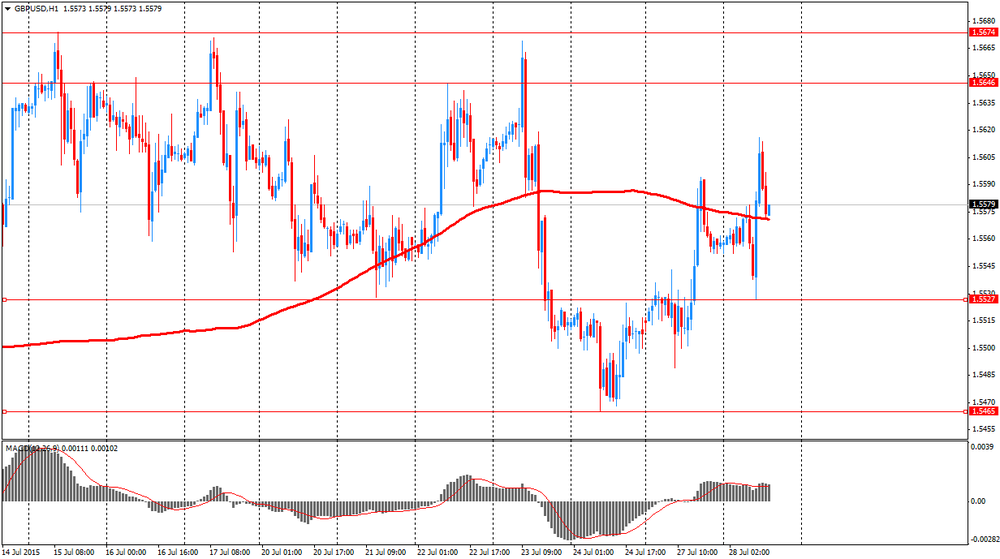

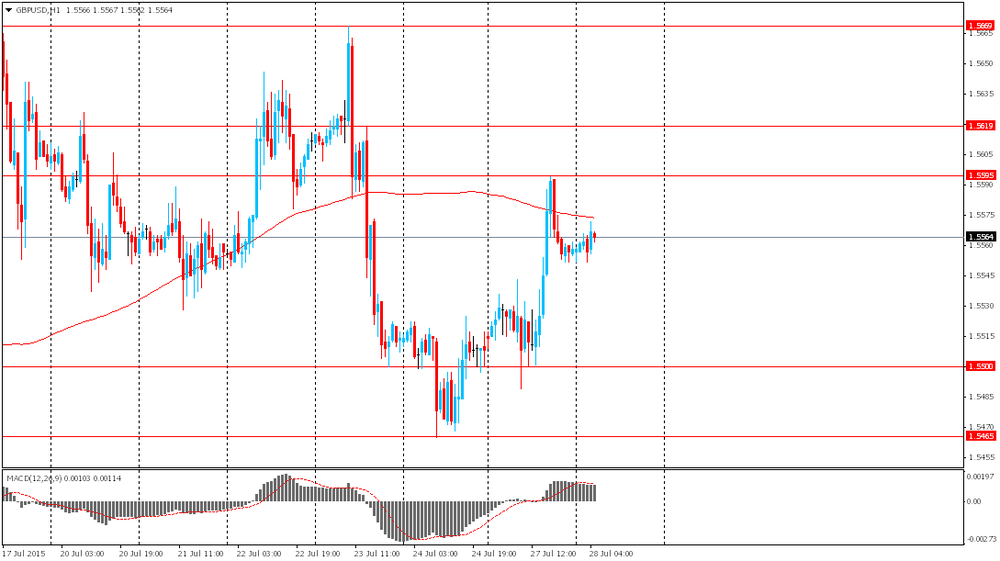

European session review: the pound rose

The pound rose after the release of UK data on GDP. The growth rate of the UK economy in the 2nd quarter accelerated to improve the prospects for the second half of the year, but the question is how long the Bank of England will keep interest rates at record lows.

According to data released on Tuesday the National Bureau of Statistics, the UK GDP in the 2nd quarter increased by 0.7% compared with the previous quarter and by 2.8% compared to the same period of the previous year. These data are preliminary, but they point to the UK's economic recovery after a slowdown in Q1, when GDP growth was only 0.4%.

Restoring growth in the UK was due to strong activity in the services sector, which is a little disappointing in the beginning of the year, but now, apparently, will be supported by rising incomes and low inflation.

The strong recovery of activity was also observed in the manufacturing sector as the mining industry in the North Sea demonstrates the recovery period after months of very low oil prices. Growth in the mining industry have been the most rapid in more than 25 years, said the ONS, helped by the introduction in March of tax breaks for oil and gas producers.

The US dollar rose against most major currencies, recovering from a fall in the previous session on the eve of the start of the two-day meeting to determine the monetary policy of the Federal Reserve later today. The dollar regained positions, as investors have focused on the upcoming Wednesday statement, the Federal Reserve's monetary policy, expecting to get any indication as possible rise in interest rates. The Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate. On Thursday scheduled publication of US statistics on economic growth for the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The dollar also strengthened after the sell-off in the Chinese stock markets undermined demand for risky assets. On Monday, shares in Shanghai collapsed maximum session pace in eight years, and continued to decline on Tuesday, despite expectations of additional stimulus from the government.

EUR / USD: during the European session the pair fell to $ 1.1021

GBP / USD: during the European session the pair rose to $ 1.5616

USD / JPY: during the European session the pair rose to Y123.79

В 12:30 GMT Канада представит индекс цен на сырье за июнь. В США в 13:00 GMT выйдет индекс цен на жилье от S&P/Case-Shiller за май, в 13:45 GMT - индекс деловой активности для сферы услуг от Markit за июль, в 14:00 GMT - индикатор уверенности потребителей за июль. Завершит день в 23:50 GMT Япония данными по розничным продажам за июнь.

-

14:00

Orders

EUR/USD

Offers 1.1080-85 1.1100 1.1120 1.1160 1.1185 1.1200 1.1220 1.1250

Bids 1.1050 1.1020 1.1000 1.0980 1.0965 1.0940 1.0900 1.0880 1.0860 1.0820-25 1.0800

GBP/USD

Offers 1.5565 1.5580 1.5600 1.5625 1.5640-50 1.5680 1.5700-10 1.5725-30

Bids 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400 1.5360 1.5330 1.5300

EUR/GBP

Offers 0.7130 0.7150-55 0.7180-85 0.7225-30 0.7260 0.7285 0.7300

Bids 0.7100 0.7085 0.7065 0.7030 0.7000 0.6975-80

EUR/JPY

Offers 137.00 137.30 137.50 137.80 138.00 138.50

Bids 136.50 136.25 136.00 135.80 135.50 135.00

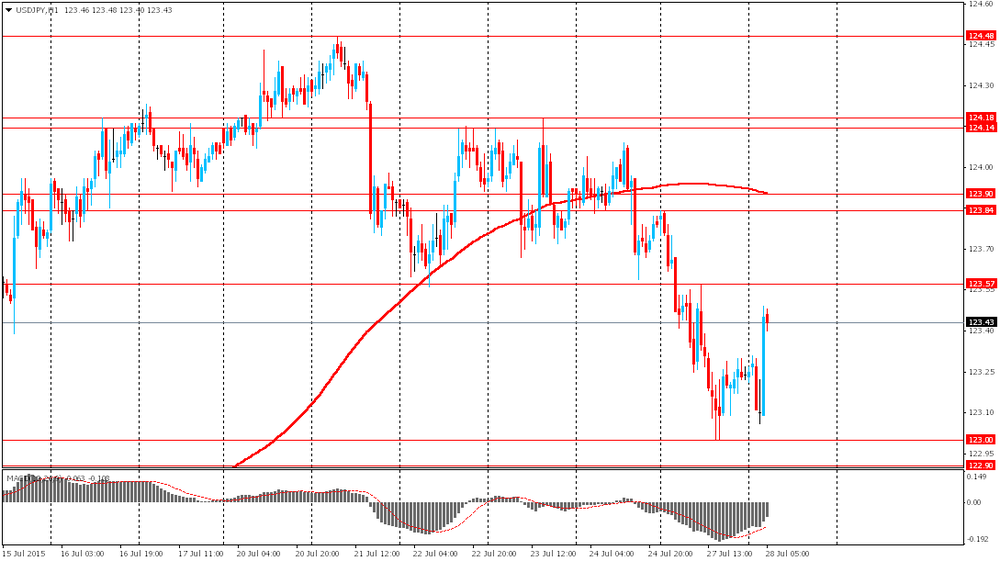

USD/JPY

Offers 123.80-85 124.00 124.25-30 124.50 124.75 125.00

Bids 123.45-50 123.25-30 123.00 122.80 122.50-60 122.00

AUD/USD

Offers 0.7325-30 0.7360 0.7385 0.7400 0.7420-25 0.7450

Bids 0.7280 0.7265 0.7250 0.7230 0.7200 0.7180 0.7150

-

12:30

European equities were trading higher

European equities were trading higher Tuesday, with investors around the world watching how Chinese stocks are trading after a sharp drop on Monday and volatile trade in the current session.

The pan-European Stoxx 600 index was trading 0.4 percent higher Tuesday.

In Asia overnight, stocks mostly narrowed their early declines near mid-day, taking their cues from the mainland, where the benchmark Shanghai Composite index recouped some losses after trading down as much as 5.1 percent early Tuesday. The China Securities regulator announced Tuesday that it was investigating whether share-dumping was behind Monday's sell-off, Reuters reported.

Shares of Zurich Insurance were trading 2.5 percent lower on Tuesday after the company said it was weighing up a bid for British rival RSA Insurance Group.

Diageo shares were down 0.2 percent on news that the global drinks maker is planning to restructure its South African and Namibian operations and sell equity stakes in its joint ventures in the region to Heineken.

in other news, the U.K.'s gross domestic product (GDP) grew by 0.7 percent in the second quarter of 2015, according to preliminary official data, meeting expectations.

Earnings are also in focus for markets on Tuesday. French tire maker Michelin posted solid gains in first-half sales and profit on Tuesday, holding firm to its full-year goals. Shares of the company were trading 5.14 percent lower on Tuesday, however.

Elsewhere, Norwegian oil major Statoil posted better-than-forecast second-quarter profit on Tuesday despite taking a hit due to lower oil prices. Shares of the oil company were trading 3 percent higher Tuesday.

BP, one of the world's biggest oil companies, announced a second-quarter replacement cost loss of $6.3 billion Tuesday, and warned that low oil prices are here to stay. Its shares were trading lower by 0.8 percent Tuesday.

Focus in Asia and Europe is also on the fall in commodity prices. Spot gold was trading at its weakest level since early 2010 on Tuesday at $1,093.45 an ounce and U.S. crude futures were trading around $47 a barrel.

In other news, discussions to complete a third bailout program between Greece and its creditors will start on Tuesday, a week later than planned. The pressure is mounting on Prime Minister Alexis Tsipras to maintain unity in his Syriza party as the more leftist members oppose the bailout package, which demands deeper austerity measures in Greece.

-

10:52

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E417mn), $1.1000(E417mn), $1.1030-40(E717mn)

USD/JPY: Y122.50($445mn), Y123.00 ($250mn), Y123.40($498mn)

AUD/USD: $0.7300(A$531mn), $0.7325(A$485mn)

USD/CAD: C$1.2940(210mn), C$1.3000($495mn)

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.6% (forecast 2.6%)

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.7% (forecast 0.7%)

-

08:50

Oil declined further

West Texas Intermediate futures for September delivery slid to $47.20 (-0.40%), while Brent crude fell to $53.13 (-0.64%). Prices approached four-month lows as renewed declines in Chinese stocks intensified investors' concerns over prospects of global economic growth and demand for oil.

Some analysts believe that crude prices will edge up by the end of the current year, although they will still be quite low.

Investors are waiting for weekly data on U.S. inventories.

-

08:48

Gold stayed low

Gold is currently at $1,094.30 (-0.19%) fluctuating around a 5 year-low as investors expect a hike in U.S. interest rates in the near future. Higher rates would be harmful for the non-interest-paying bullion.

The Federal Reserve begins a closely-watched two-day policy meeting later today. Absence of a significant support from Greek debt crisis and dramatic declines in Chinese stocks underline the importance of prospects of Fed rates.

Physical demand in top consumer China remained sluggish. China's net gold imports from Hong Kong dropped to a 10-month low in June.

-

08:46

Global Stocks: U.S. indices declined

U.S. stock indices followed declines in Asian stock markets. China Shanghai Composite Index fell 8.5% on Monday, renewing investors' concerns about equities.

The Dow Jones Industrial Average fell 127.94 points, or 0.7%, to close at 17440.59, its lowest close in almost six months. The S&P 500 index declined 12.01 points, or 0.6%, to 2067.64. The Nasdaq Composite Index lost 48.85, or 1%, to 5039.78.

In Asia this morning Hong Kong Hang Seng rose 1.43%, or 347.48 points, to 24,699.44. China Shanghai Composite Index fell 0.86%, or 32.08 points, to 3,693.48. The Nikkei climbed 0.13%, or 26.37 points, to 20,376.47.

Sharp declines made investors avoid stocks and turn to such safe-haven assets as the Japanese yen. Investors were also cautious ahead of a two-day U.S. Federal Reserve meeting, which starts later today.

The China Securities Regulatory Commission said late Monday night that the local government will raise purchases of stocks in order to support the equity market.

-

08:43

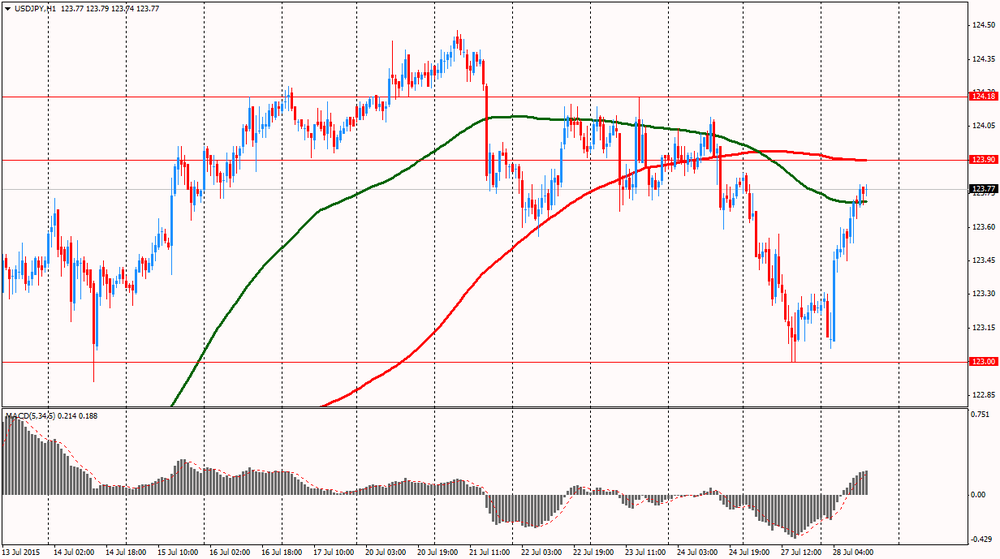

Foreign exchange market. Asian session: the yen declined

The yen declined against the U.S. dollar as investors remained cautious ahead of a two-day FOMC meeting, which starts later today. Earlier this month Fed Chair Janet Yellen said that she expected the central bank to start raising rates within 2015. However some market participants believe that recent sharp drops in Chinese stocks will make the Fed very careful.

The euro little changed against the dollar after reaching its two-week high on Monday. Strong euro zone data supported the single currency. IFO reported that German business climate improved to 108.0 from July reading of 107.5. Economists expected the index to come in at 107.5.

The Australian dollar slightly advanced. Data showed that confidence of Australian consumers improved and the corresponding index rose by 0.6% to 112.5 in a week ending July 26. Worries over Greece's debt crisis faded and contributed to this growth. Nevertheless the index is still 3.2% below level seen a year ago.

EUR/USD: the pair fluctuated around $1.1080 in Asian trade

USD/JPY: the pair rose to Y123.50

GBP/USD: the pair traded around $1.5550-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom GDP, y/y (Preliminary) Quarter II 2.9% 2.6%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.4% 0.7%

12:30 Canada Industrial Product Price Index, y/y June -1.3%

12:30 Canada Industrial Product Price Index, m/m June 0.5% 0.4%

12:30 Canada Raw Material Price Index June 4.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y May 4.9% 5.6%

13:45 U.S. Services PMI (Preliminary) July 54.8 55.0

14:00 U.S. Richmond Fed Manufacturing Index July 6 6

14:00 U.S. Consumer confidence July 101.4 100

20:30 U.S. API Crude Oil Inventories July 2.3

23:50 Japan Retail sales, y/y June 3.0% 0.5%

-

08:15

Options levels on tuesday, July 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1223 (2507)

$1.1175 (2514)

$1.1131 (801)

Price at time of writing this review: $1.1064

Support levels (open interest**, contracts):

$1.1008 (3348)

$1.0948 (4377)

$1.0913 (3248)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 55127 contracts, with the maximum number of contracts with strike price $1,1200 (4609);

- Overall open interest on the PUT options with the expiration date August, 7 is 63236 contracts, with the maximum number of contracts with strike price $1,0800 (5928);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from July, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1732)

$1.5704 (1161)

$1.5607 (2157)

Price at time of writing this review: $1.5576

Support levels (open interest**, contracts):

$1.5493 (1464)

$1.5396 (1351)

$1.5298 (1362)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22088 contracts, with the maximum number of contracts with strike price $1,5750 (3212);

- Overall open interest on the PUT options with the expiration date August, 7 is 22661 contracts, with the maximum number of contracts with strike price $1,5250 (2070);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from July, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:02

Nikkei 225 20,160.99 -189.11 -0.93 %, Hang Seng 24,304.54 -47.42 -0.19 %, Shanghai Composite 3,589.09 -136.47 -3.66 %

-

00:33

Commodities. Daily history for Jul 27’2015:

(raw materials / closing price /% change)

Oil 46.98 -0.87%

Gold 1,093.50 -0.26%

-

00:32

Stocks. Daily history for Jul 27’2015:

(index / closing price / change items /% change)

Topix 1,637.9 -17.96 -1.08 %

Hang Seng 24,351.96 -776.55 -3.09 %

S&P/ASX 200 5,589.89 +23.78 +0.43 %

Shanghai Composite 3,725.56 -345.35 -8.48 %

FTSE 100 6,505.13 -74.68 -1.13 %

CAC 40 -129.76 -2.57 %

Xetra DAX 11,056.4 -291.05 -2.56 %

S&P 500 2,067.64 -12.01 -0.58 %

NASDAQ Composite 5,039.78 -48.85 -0.96 %

Dow Jones 17,440.59 -127.94 -0.73 %

-

00:31

Currencies. Daily history for Jul 27’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1091 +0,99%

GBP/USD $1,5558 +0,32%

USD/CHF Chf0,9619 -0,07%

USD/JPY Y123,24 -0,45%

EUR/JPY Y136,69 +0,53%

GBP/JPY Y191,74 -0,13%

AUD/USD $0,7265 -0,22%

NZD/USD $0,6601 +0,39%

USD/CAD C$1,3035 -0,08%

-