Noticias del mercado

-

22:05

Major US stock indexes finished trading above zero

Major US stock indexes rose on Tuesday, ending a five-day decline in this case. Fall of Chinese indexes slowed due to the fact that the regulator China Securities said on Monday that will buy shares to stabilize the market, after the biggest decline in the market for eight years.

As it became known today, the US service sector grew at a faster pace in July than in June, as employment and new business accelerated. As shown by the report financial firm Markit, its preliminary purchasing managers' index for the services sector rose to 55.2 in July from 54.8 last reading in June, slightly ahead of the 55 level expected by economists. Recall that the value of more than 50 indicates expansion of economic activity.

In addition, the report submitted by the Conference Board, showed that the index of US consumer confidence fell in July to a level of 90.9 points against 99.8 points in June (revised from 101.4 points). Economists had expected the index was 100.0 points. The report said that the expectations index fell to 79.9 in July from 92.8 in June, while the current situation index fell to 107.4 points from 110.3 points.

Oil prices also rose in today's trading, but still near four-month low against a background of excess reserves in the US and concerns about demand in China.

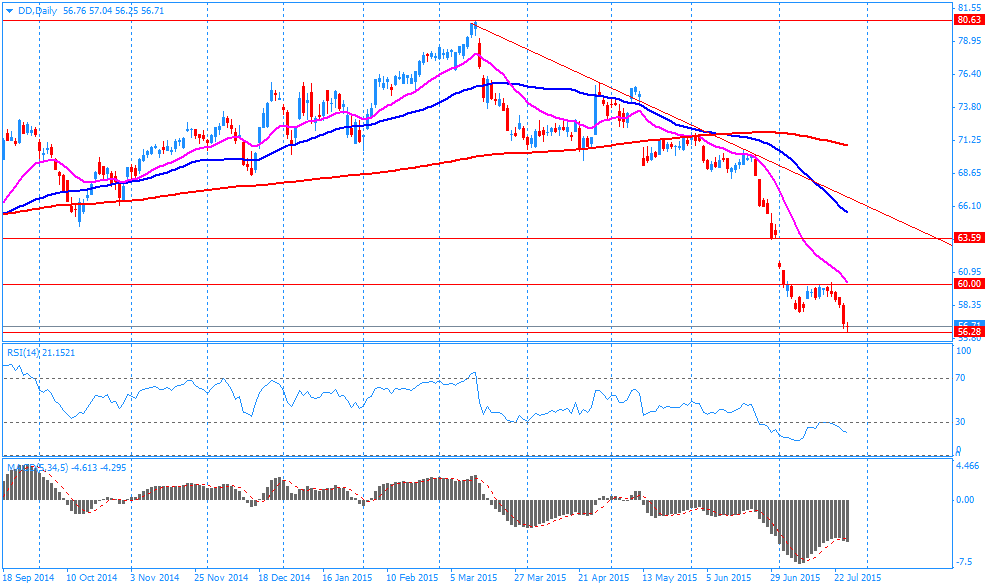

Almost all components of the index DOW closed in positive territory (29 of 30). Most remaining shares rose Exxon Mobil Corporation (XOM, + 4.19%). Only shares fell EI du Pont de Nemours and Company (DD, -1.49%).

All sectors of the index S & P ended the session in positive zone. Leaders of growth were the basic materials sector (+ 2.7%).

At the close:

Dow + 1.09% 17,630.47 +189.88

Nasdaq + 0.98% 5,089.21 +49.43

S & P + 1.24% 2,093.26 +25.62

-

21:00

Dow +1.15% 17,641.96 +201.37 Nasdaq +1.02% 5,091.17 +51.39 S&P +1.29% 2,094.28 +26.64

-

19:00

European stock markets closed higher

European stock indexes finished trading in positive territory today, breaking with the five-day fall, which is associated with increased activity in mergers and acquisitions, as well as the publication of positive quarterly reports.

Meanwhile, many investors perceive a relatively calm the turbulence in the Chinese stock market, believing that other regions of relatively isolated from this volatility. It is worth emphasizing, since the start of the week China's Shanghai Composite lost 10%.

"In the last couple of days the market was concerned about the instability in the market in China, but today these fears receded into the background, and give support to the quotations and financial results of the companies active in the field of mergers," - said the expert Baader Bank Gerhard Schwarz.

In the course of trade is also affected by waiting for a decision of the Federal Reserve System. Analysts say that by the July meeting any changes in monetary policy are not expected. Recall Fed rate steady at 0-0.25% since the end of 2008 against the backdrop of slow economic recovery after the crisis. Earlier, the Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate. According to analysts surveyed by Bloomberg, the July meeting of the Fed may be the last, which should not expect any dramatic statements. Most experts do not expect a change in the base interest rate, and some are still waiting for its increase in September.

The focus was also on US statistics. US service sector grew at a faster pace in July than in June, as employment and new business accelerated, the report showed Markit. Preliminary PMI for the services sector rose to 55.2 in July from 54.8 last reading in June, slightly ahead of the 55 level expected by economists. The sub-index measuring the volume of new business in the service companies, rose to 56.8, its highest level since April, from 56.3 in June. Employment component also rose in June.

Meanwhile, the report submitted by the Conference Board, showed that US consumer confidence index fell in July to a level of 90.9 points against 99.8 points in June (revised from 101.4 points). Economists had expected the index was 100.0 points. The report said that the expectations index fell to 79.9 in July from 92.8 in June, while the current situation index fell to 107.4 points from 110.3 points.

FTSE 100 6,555.28 +50.15 + 0.77% CAC 40 4,977.32 +49.72 + 1.01% DAX 11,173.91 +117.51 + 1.06%

The price of securities Melrose Industries Plc rose 9.8% on the announcement of the sale of a provider of energy accounting Elster American Honeywell International Inc. for $ 5.1 billion.

The cost of Hikma Pharmaceuticals Plc increased by 12%. The company said it agreed to buy the business Roxane pharmaceutical company Boehringer Ingelheim GmbH for $ 2.65 billion.

Shares of British insurer RSA Insurance Group Plc jumped 19% as the Zurich Insurance Group AG is considering buying it.

Capitalization Kering SA and Drax Group Plc rose 5.5 percent after reports that the amount of profit for the first half of the year exceeded the forecasts of experts.

The cost of the British manufacturer of components for the automotive and aerospace industry GKNPlc increased by 7.5% on the news of the purchase of the Dutch Fokker Technologies BV for 706 million euros.

Shares of Gerresheimer AG rose 12% after agreement of purchase Centor US Holding Inc. the company Nemera Development SA.

Quotes Michelin have fallen by 6.4%. The largest producer of tires in Europe reported that operating profit for the first half was below analysts' estimates.

Luxottica Group SpA shares rose 1.6% after the world's largest manufacturer of glasses reported record revenues and earnings for the second quarter.

-

18:21

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday and were on track to break a five-day losing streak as a selloff in Chinese stocks eased. China's top securities regulator said on Monday Beijing would keep buying shares to stabilize the market, after the steepest decline in Chinese stocks in eight years.

Almost all of Dow stocks in positive area (20 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -1.16%). Top gainer - Caterpillar Inc. (CAT, +3.16).

All of S&P index sectors also in positive area. Top gainer - Basic Materials (+2.2%).

At the moment:

Dow 17480.00 +84.00 +0.48%

S&P 500 2078.00 +13.50 +0.65%

Nasdaq 100 4532.75 +10.25 +0.23%

10 Year yield 2,24% +0,01

Oil 48.10 +0.71 +1.50%

Gold 1093.90 -2.50 -0.23%

-

18:03

WSE: Session Results

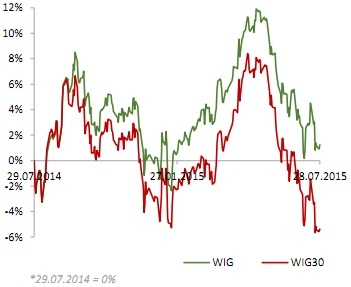

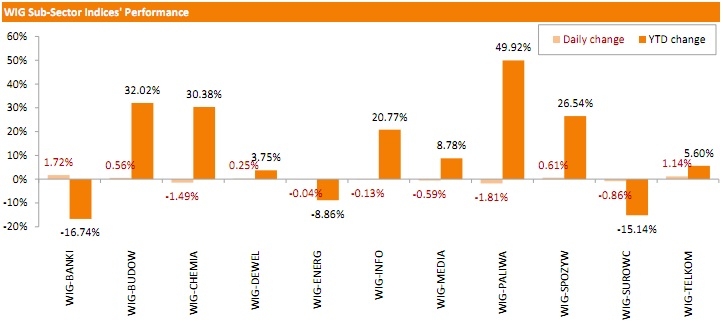

Polish equity market edged higher on Tuesday. The broad market measure, the WIG Index, advanced 0.32%. Sector-wise, oil and gas industry (-1.81%), chemicals (-1.49%) and materials (-0.86%) produced the biggest losses. At the same time, banking sector (+1.72%) fared the best, followed by telecommunications (+1.14%) and food sector (+0.61%).

The large-cap companies' indicator, the WIG30 Index, added 0.19%. Within the index components, BZ WBK (WSE: BZW), ING BSK (WSE: ING) and PZU (WSE: PZU) topped the gainers, rebounding by a respective 3.93%, 3.83% and 2.11%. They were followed by ORANGE POLSKA (WSE: OPL), which surged 1.99% as the company's 2Q15 profit beat the analysts' estimates. On the contrary, SYNTHOS (WSE: SNS) lagged with a 3% drop. ENEA (WSE: ENA) and PKN ORLEN (WSE: PKN) also posted notable declines, sliding down 2.75% and 2.03% respectively.

-

18:00

European stocks closed: FTSE 100 6,555.28 +50.15 +0.77% CAC 40 4,977.32 +49.72 +1.01% DAX 11,173.91 +117.51 +1.06%

-

15:31

U.S. Stocks open: Dow +0.31%, Nasdaq +0.47%, S&P +0.37%

-

15:28

Before the bell: S&P futures +0.40%, NASDAQ futures +0.28%

U.S. stock-index futures rose amid better-than-forecast earnings and as Chinese equities pulled back from a selloff.

Global Stocks:

Nikkei 20,328.89 -21.21 -0.10%

Hang Seng 24,503.94 +151.98 +0.62%

Shanghai Composite 3,662.82 -62.74 -1.68%

FTSE 6,553.43 +48.30 +0.74%

CAC 4,981.97 +54.37 +1.10%

DAX 11,202.28 +145.88 +1.32%

Crude oil $46.45 (+0.13%)

Gold $1093.00 (-0.32%)

-

15:20

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Merck & Co Inc

MRK

57.00

+0.02%

4.4K

Nike

NKE

112.02

+0.26%

0.8K

International Business Machines Co...

IBM

159.65

+0.36%

0.1K

Exxon Mobil Corp

XOM

79.55

+0.37%

24.0K

Verizon Communications Inc

VZ

46.00

+0.37%

9.5K

AT&T Inc

T

34.45

+0.38%

2.6K

Chevron Corp

CVX

89.50

+0.40%

13.6K

Johnson & Johnson

JNJ

98.67

+0.40%

1.1K

The Coca-Cola Co

KO

40.71

+0.42%

0.5K

McDonald's Corp

MCD

96.45

+0.43%

2.4K

Cisco Systems Inc

CSCO

28.34

+0.46%

0.9K

Home Depot Inc

HD

113.60

+0.47%

0.5K

Visa

V

74.25

+0.53%

0.1K

Yandex N.V., NASDAQ

YNDX

14.61

+0.55%

3.5K

Starbucks Corporation, NASDAQ

SBUX

57.30

+0.56%

9.1K

UnitedHealth Group Inc

UNH

118.56

+0.58%

1.4K

Boeing Co

BA

141.86

+0.59%

0.1K

Facebook, Inc.

FB

94.72

+0.59%

151.0K

Intel Corp

INTC

28.52

+0.60%

5.7K

Microsoft Corp

MSFT

45.62

+0.60%

13.6K

General Electric Co

GE

26.11

+0.62%

6.1K

Travelers Companies Inc

TRV

106.24

+0.62%

2.5K

Google Inc.

GOOG

631.27

+0.64%

2.2K

ALTRIA GROUP INC.

MO

54.30

+0.65%

0.3K

Goldman Sachs

GS

206.50

+0.72%

1.3K

Deere & Company, NYSE

DE

91.91

+0.72%

1.9K

Apple Inc.

AAPL

123.71

+0.76%

187.2K

Citigroup Inc., NYSE

C

58.40

+0.76%

7.3K

American Express Co

AXP

75.52

+0.80%

1K

Walt Disney Co

DIS

119.25

+0.85%

5.3K

JPMorgan Chase and Co

JPM

68.60

+0.87%

17.7K

Caterpillar Inc

CAT

76.10

+1.04%

28.5K

ALCOA INC.

AA

09.72

+1.04%

18.8K

Tesla Motors, Inc., NASDAQ

TSLA

255.85

+1.12%

6.0K

General Motors Company, NYSE

GM

31.40

+1.13%

7.1K

Procter & Gamble Co

PG

80.90

+1.16%

2.5K

Amazon.com Inc., NASDAQ

AMZN

538.50

+1.33%

15.5K

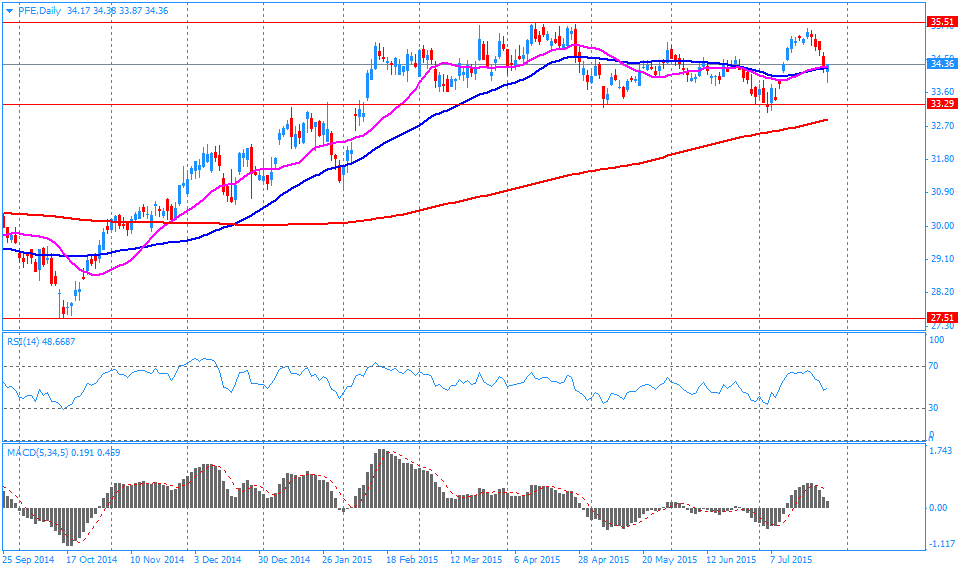

Pfizer Inc

PFE

34.80

+1.34%

29.8K

FedEx Corporation, NYSE

FDX

167.00

+1.37%

0.2K

Barrick Gold Corporation, NYSE

ABX

7.00

+1.45%

51.5K

Ford Motor Co.

F

14.92

+2.54%

217.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.70

+2.90%

58.5K

Twitter, Inc., NYSE

TWTR

34.65

-0.14%

34.5K

Yahoo! Inc., NASDAQ

YHOO

37.63

-0.54%

27.7K

E. I. du Pont de Nemours and Co

DD

55.36

-2.41%

2.0K

-

15:00

-

14:45

Company News: Merck (MRK) issued FY15 EPS guidance above consensus

Company reported Q2 profit of $0.86 per share versus $0.81 consensus. Revenues fell 10.5% year/year to $9.79 bln versus $9.80 bln consensus.

Company issued guidance for FY15, sees EPS of $3.45-3.55 versus $3.44 consensus and revenues of $38.6-39.8 bln verdus $39.7 bln consensus.

MRK fell to $56.80 (-0.33%) on the premarket.

-

14:36

Company News: Pfizer (PFE) reported better than expected EPS and revenue

Company reported Q2 profit of $0.56 per share versus $0.52 consensus. Revenues fell 7.2% year/year to $11.85 bln versus $11.42 bln consensus.

Company raised EPS guidance for FY15 to $2.01-2.07 from $1.95-2.05 versus $2.06 consensus. Revenue guidance raised to $45-46 bln from $44-46 bln versus $45.96 bln consensus.

PFE rose to $35.03 (+2.01%) on the premarket.

-

14:26

-

12:30

European equities were trading higher

European equities were trading higher Tuesday, with investors around the world watching how Chinese stocks are trading after a sharp drop on Monday and volatile trade in the current session.

The pan-European Stoxx 600 index was trading 0.4 percent higher Tuesday.

In Asia overnight, stocks mostly narrowed their early declines near mid-day, taking their cues from the mainland, where the benchmark Shanghai Composite index recouped some losses after trading down as much as 5.1 percent early Tuesday. The China Securities regulator announced Tuesday that it was investigating whether share-dumping was behind Monday's sell-off, Reuters reported.

Shares of Zurich Insurance were trading 2.5 percent lower on Tuesday after the company said it was weighing up a bid for British rival RSA Insurance Group.

Diageo shares were down 0.2 percent on news that the global drinks maker is planning to restructure its South African and Namibian operations and sell equity stakes in its joint ventures in the region to Heineken.

in other news, the U.K.'s gross domestic product (GDP) grew by 0.7 percent in the second quarter of 2015, according to preliminary official data, meeting expectations.

Earnings are also in focus for markets on Tuesday. French tire maker Michelin posted solid gains in first-half sales and profit on Tuesday, holding firm to its full-year goals. Shares of the company were trading 5.14 percent lower on Tuesday, however.

Elsewhere, Norwegian oil major Statoil posted better-than-forecast second-quarter profit on Tuesday despite taking a hit due to lower oil prices. Shares of the oil company were trading 3 percent higher Tuesday.

BP, one of the world's biggest oil companies, announced a second-quarter replacement cost loss of $6.3 billion Tuesday, and warned that low oil prices are here to stay. Its shares were trading lower by 0.8 percent Tuesday.

Focus in Asia and Europe is also on the fall in commodity prices. Spot gold was trading at its weakest level since early 2010 on Tuesday at $1,093.45 an ounce and U.S. crude futures were trading around $47 a barrel.

In other news, discussions to complete a third bailout program between Greece and its creditors will start on Tuesday, a week later than planned. The pressure is mounting on Prime Minister Alexis Tsipras to maintain unity in his Syriza party as the more leftist members oppose the bailout package, which demands deeper austerity measures in Greece.

-

08:46

Global Stocks: U.S. indices declined

U.S. stock indices followed declines in Asian stock markets. China Shanghai Composite Index fell 8.5% on Monday, renewing investors' concerns about equities.

The Dow Jones Industrial Average fell 127.94 points, or 0.7%, to close at 17440.59, its lowest close in almost six months. The S&P 500 index declined 12.01 points, or 0.6%, to 2067.64. The Nasdaq Composite Index lost 48.85, or 1%, to 5039.78.

In Asia this morning Hong Kong Hang Seng rose 1.43%, or 347.48 points, to 24,699.44. China Shanghai Composite Index fell 0.86%, or 32.08 points, to 3,693.48. The Nikkei climbed 0.13%, or 26.37 points, to 20,376.47.

Sharp declines made investors avoid stocks and turn to such safe-haven assets as the Japanese yen. Investors were also cautious ahead of a two-day U.S. Federal Reserve meeting, which starts later today.

The China Securities Regulatory Commission said late Monday night that the local government will raise purchases of stocks in order to support the equity market.

-

04:02

Nikkei 225 20,160.99 -189.11 -0.93 %, Hang Seng 24,304.54 -47.42 -0.19 %, Shanghai Composite 3,589.09 -136.47 -3.66 %

-

00:32

Stocks. Daily history for Jul 27’2015:

(index / closing price / change items /% change)

Topix 1,637.9 -17.96 -1.08 %

Hang Seng 24,351.96 -776.55 -3.09 %

S&P/ASX 200 5,589.89 +23.78 +0.43 %

Shanghai Composite 3,725.56 -345.35 -8.48 %

FTSE 100 6,505.13 -74.68 -1.13 %

CAC 40 -129.76 -2.57 %

Xetra DAX 11,056.4 -291.05 -2.56 %

S&P 500 2,067.64 -12.01 -0.58 %

NASDAQ Composite 5,039.78 -48.85 -0.96 %

Dow Jones 17,440.59 -127.94 -0.73 %

-