Noticias del mercado

-

22:05

Major US stock indexes finished trading above zero

Major stock indexes on Wall Street rose on Wednesday, buoyed by corporate reports and the outcome of the Fed meeting. Recall, the Fed has completed a two-day meeting on monetary policy and decided to leave its key interest rate near zero. The meeting, scheduled for September 16-17, the leadership of the central bank will have to make a difficult decision. Today, the Fed pointed to progress in the US labor market. It is a sign that the central bank aims to raise interest rates in September or later in the year. However, at the same time, the Fed signaled the concern of relatively low inflation, which could convince the leadership of the central bank to delay raising interest rates.

Among the companies reporting that for the last quarter will be published on Wednesday - Facebook Inc. and Whole Foods Market Inc. Gains of 75% of the companies of the index S & P 500, has already made public its quarterly reports, exceeded market expectations.

In addition, it was reported that after five consecutive months of growth of the sale of unfinished housing fell in June, but remained close to May's level, which was the highest in nine years, according to data of the National Association of Realtors. Modest gains in the Northeast and West were offset by a large decline in the Midwest and South. The index of pending home sales (PHSI), the forecast indicator on the basis of signed contracts fell by 1.8% to 110.3 in June, but was still 8.2% higher than in June 2014 (101.9). Despite the decline in the last month, the index finished third in 2015 and is currently growing at annualized for ten consecutive months.

Oil prices rose sharply, which was associated with the publication of a weekly report on petroleum inventories in the United States, which eased concerns about excess supply in the market. US Department of Energy reported that in the week ended July 24, commercial oil reserves in the country (excluding the strategic reserve), decreased by 4.2 million barrels to 459.7 million barrels. Analysts expected reduction of stocks for the week by 1 million barrels per day.

Almost all components of the index DOW finished trading in positive territory (26 of 30). Outsider shares were EI du Pont de Nemours and Company (DD, -0.64%). Most remaining shares rose Microsoft Corporation (MSFT, + 2.13%).

All sectors of the index S & P closed in the positive zone. Leaders of growth were the basic materials sector (+ 1.7%).

At the close:

Dow + 0.69% 17,751.19 +120.92

Nasdaq + 0.44% 5,111.73 +22.52

S & P + 0.73% 2,108.46 +15.21

-

21:00

Dow +0.80% 17,770.87 +140.60 Nasdaq +0.52% 5,115.57 +26.36 S&P +0.81% 2,110.16 +16.91

-

19:00

European stock markets closed higher

European stocks closed in positive territory, registering with the largest increase in two days for two weeks. Support index was upbeat corporate reports, as well as increased activity in mergers and acquisitions (M & A).

Growth also contributed to published statistics. German consumer confidence index stabilized in August, data showed on research group GfK on Wednesday. The forecast consumer sentiment index was 10.1 points, remaining unchanged from July. Evaluation coincided with expectations. The economic expectations index fell by 6.5 points to 18.4 in July. As a result, indicator lost almost 20 points in two months. Meanwhile, income expectations rose 1.4 points to 58.6. Earnings expectations in Germany were completely indifferent to international crises and events concerning Greece. At the same time, the sub-index measuring willingness to buy dropped to 55.4 in July 57 June.

A little influenced by the news that on Thursday, the stock market in Greece is not to trade, and the resumption of work on Friday is unlikely in view of the technical problems associated with the imposition of restrictions on local investors. This was reported by Reuters with reference to the Speaker of the Athens Stock Exchange.

It also became known that the European Central Bank on Wednesday upheld the scope of the program of emergency lending to Greek banks, as the Bank of Greece did not ask the ECB to increase it. Told informed source. During the previous two weeks, the ECB has increased the volume of emergency lending program to 900 million euros (995.6 million US dollars). It supports Greek banks afloat, which since early February effectively cut off from regular monetary operations of the ECB. The total volume of lending programs after last week's increase exceeded 90 billion euros.

A further increase in the index held back pending the outcome of the meeting of the US Federal Reserve. As expected, the Central Bank will not now make adjustments to the current monetary policy, but traders will be interested in the text of the statements contained therein and hints of further steps of the Central Bank. Add, Fed Chairman Janet Yellen will not hold a press conference following the meeting, also scheduled update of economic forecasts.

FTSE 100 6,631 +75.72 + 1.16% CAC 40 5,017.44 +40.12 + 0.81% DAX 11,211.85 +37.94 + 0.34%

Quotes Bayer AG and PSA Peugeot Citroen rose by more than 4% on good reporting. As it became known, the net profit of the German pharmaceutical group Bayer AG rose in April-June by 21% - to 1.15 billion euros, in line with analysts' expectations. Meanwhile, French carmaker PSA Peugeot Citroen said that in the first half of the year returned to a profitable level for the first time since 2011 due to higher prices, favorable changes in foreign exchange rates, and improve production efficiency.

Cost GlaxoSmithKline Plc rose 3.6% after the largest pharmaceutical UK reported a smaller reduction of the profit for the second quarter than analysts had expected.

Shares of Barclays Plc rose 1.9%, while Numericable-SFR SAS - by 3.2 percent, aided by positive corporate reports.

Italcementi SpA's share price soared by 49%. The fourth cement producer in the world of HeidelbergCement AG paid 1.67 billion euros for a 45% stake in the fifth-largest industry Italcementi.

Cost of Volkswagen AG fell by 2.3%, as the company lowered its global sales forecast against the background of a slowdown in China and the difficult situation in Russia and South America.

Quotes Man Group Plc rose 7% after the world's largest public hedge fund, said that by the end of the first half year profit exceeded analysts' expectations.

-

18:12

WSE: Session Results

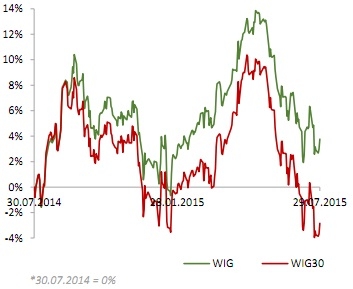

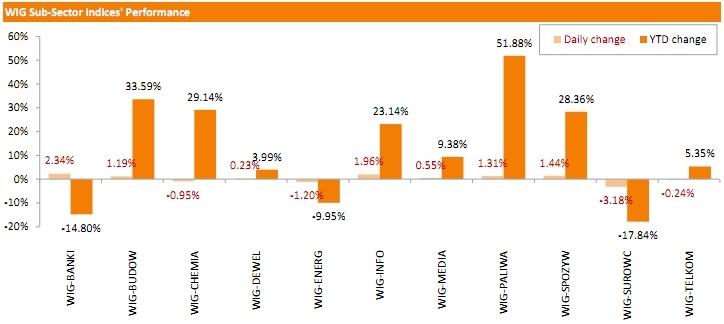

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, surged by 0.73%. Sector performance in the WIG Index was mixed. Banking stocks (+2.34%) recorded the biggest gain in response to the rumors that a new tax on bank assets might be introduced in 2017 rather than next year, as some investors had expected. At the same time, materials (-3.18%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, rose by 0.87%. The best-performing banking names, including HANDLOWY (WSE: BHW), PEKAO (WSE: PEO), BZWBK (WSE: BZW), ING BSK (WSE: ING), MBANK (WSE: MBK) and ALIOR (WSE: ALR), returned gains of 2.20%-5.19%. ASSECO POLAND (WSE: ACP) and PKN ORLEN (WSE: PKN) also demonstrated strong performance, growing by 4.19% and 2.60% respectively. On the other side of the ledger, KGHM (WSE: KGH), TAURON PE (WSE: TPE), EUROCASH (WSE: EUR) and GRUPA AZOTY (WSE: ATT) were the poorest performers, losing 2.38%-3.85%.

-

18:00

European stocks closed: FTSE 100 6,631 +75.72 +1.16% CAC 40 5,017.44 +40.12 +0.81% DAX 11,211.85 +37.94 +0.34%

-

17:56

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday as investors assessed earning ahead of a statement from the U.S. Federal Reserve that could give clues regarding the timing of a rate hike. Investors are focused on the outcome of the Fed's two-day policy meeting with markets divided on whether it will take a hawkish or dovish stance. No move on rates is expected this week. Contracts to buy previously owned U.S. homes unexpectedly fell in June after five straight months of increase, suggesting some cooling in sales activity after recent gains. Recent concerns surrounding the Greek debt crisis and the rout in Chinese markets have prompted some investors to bet that the Fed may hold off raising rates until the end of the year.

Almost all of Dow stocks in positive area (26 of 30). Top looser - Caterpillar Inc. (CAT, -0.62%). Top gainer - Merck & Co. Inc. (MRK, +1.67).

Almost all of S&P index sectors also in positive area. Top looser - Utilities (-0.1%). Top gainer - Basic Materials (+1.5%).

At the moment:

Dow 17665.00 +119.00 +0.68%

S&P 500 2098.75 +11.50 +0.55%

Nasdaq 100 4565.75 +9.75 +0.21%

10 Year yield 2,29% +0,04

Oil 49.21 +1.23 +2.56%

Gold 1095.60 -0.60 -0.05%

-

15:34

U.S. Stocks open: Dow +0.16%, Nasdaq +0.23%, S&P +0.17%

-

15:25

Before the bell: S&P futures -0.02%, NASDAQ futures +0.01%

U.S. stock-index futures fluctuated as investors assessed earnings from Twitter Inc. to Gilead Sciences Inc. before the Federal Reserve's decision on monetary policy.

Global Stocks:

Nikkei 20,302.91 -25.98 -0.13%

Hang Seng 24,619.45 +115.51 +0.47%

Shanghai Composite 3,790.26 +127.26 +3.47%

FTSE 6,587.54 +32.26 +0.49%

CAC 4,975.09 -2.23 -0.04%

DAX 11,156.53 -17.38 -0.16%

Crude oil $47.53 (-0.93%)

Gold $1094.60 (-0.15%)

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Tesla Motors, Inc., NASDAQ

TSLA

264.84

+0.01%

1.5K

Cisco Systems Inc

CSCO

28.22

+0.04%

16.7K

E. I. du Pont de Nemours and Co

DD

55.92

+0.04%

87.7K

Yandex N.V., NASDAQ

YNDX

14.90

+0.07%

0.4K

Google Inc.

GOOG

628.51

+0.08%

0.3K

International Business Machines Co...

IBM

160.20

+0.09%

1.1K

Procter & Gamble Co

PG

80.30

+0.09%

0.3K

Nike

NKE

113.58

+0.10%

0.1K

Chevron Corp

CVX

92.50

+0.11%

0.1K

General Electric Co

GE

26.13

+0.11%

7.0K

Travelers Companies Inc

TRV

106.07

+0.12%

0.6K

Starbucks Corporation, NASDAQ

SBUX

57.21

+0.12%

0.9K

Goldman Sachs

GS

206.51

+0.13%

4.5K

Verizon Communications Inc

VZ

45.95

+0.13%

11.5K

Home Depot Inc

HD

115.00

+0.14%

0.7K

Citigroup Inc., NYSE

C

58.45

+0.14%

43.3K

JPMorgan Chase and Co

JPM

68.15

+0.15%

33.6K

Hewlett-Packard Co.

HPQ

30.33

+0.20%

1.6K

McDonald's Corp

MCD

97.55

+0.23%

1.2K

Wal-Mart Stores Inc

WMT

72.27

+0.24%

0.8K

Johnson & Johnson

JNJ

99.28

+0.26%

0.6K

AT&T Inc

T

34.44

+0.32%

5.8K

Boeing Co

BA

142.26

+0.32%

1.6K

Microsoft Corp

MSFT

45.49

+0.33%

12.0K

Yahoo! Inc., NASDAQ

YHOO

37.85

+0.34%

3.1K

ALCOA INC.

AA

9.91

+0.41%

0.9K

Facebook, Inc.

FB

95.81

+0.55%

406.8K

General Motors Company, NYSE

GM

31.50

+0.57%

1.1K

Intel Corp

INTC

29.13

+0.59%

24.0K

Ford Motor Co.

F

14.78

+0.68%

52.6K

Amazon.com Inc., NASDAQ

AMZN

530.26

+0.80%

66.1K

Barrick Gold Corporation, NYSE

ABX

06.95

+0.87%

83.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

дек.44

+0.89%

24.7K

ALTRIA GROUP INC.

MO

55.77

+0.94%

6.3K

International Paper Company

IP

49.72

+2.03%

0.2K

Walt Disney Co

DIS

118.46

0.00%

0.4K

The Coca-Cola Co

KO

40.54

-0.02%

2.2K

Pfizer Inc

PFE

35.30

-0.14%

3.3K

Merck & Co Inc

MRK

57.42

-0.17%

1.5K

Exxon Mobil Corp

XOM

82.27

-0.25%

5.4K

American Express Co

AXP

74.91

-0.27%

1.7K

Apple Inc.

AAPL

123.04

-0.28%

88.9K

Caterpillar Inc

CAT

77.54

-0.31%

2.3K

Visa

V

74.50

-0.32%

5.1K

United Technologies Corp

UTX

98.61

-0.36%

2.6K

Twitter, Inc., NYSE

TWTR

32.37

-11.41%

1.8M

-

15:01

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded to Buy from Hold at Stifel, target $700

Downgrades:

Other:

Twitter (TWTR) reiterated at Buy at Canaccord Genuity, target lowered from $52 to $45

Twitter (TWTR) reiterated at Sector Perform at RBC Capital Mkts, target lowered from $47 to $41

DuPont (DD) reiterated at Sector Perform at RBC Capital Mkts, target lowered from $64 to $58

-

12:30

Europe trades higher amid earnings onslaught

European opened higher on Wednesday on what is a bumper day of earnings, as choppy trade in Chinese stocks continues and investors look to the outcome of a two-day policy meeting of the U.S. Federal Reserve.

The pan-European Stoxx 600 was trading over 0.5 percent higher by mid-morning.

Britain's FTSE 100 and the French CAC were both around 0.5 percent higher at the open while the German DAX saw a 0.4 percent pop.

Asian stocks turned mixed early Wednesday, as volatile trade in China offset the positive lead from Wall Street overnight. However, the stabilization of commodity prices gave a slight boost to resource-dependent markets such as Australia.

One of the biggest names reporting today, Barclays, said adjusted pre-tax profit was up 11 percent to £3.7 billion in the first half of the year, sending shares up around 2 percent by mid-morning.

Total said second quarter revenue fell 29 percent year-on-year to $44.7 billion, while adjusted net profit fell 2 percent to $3.085 billion as the low oil price continues to bite. Despite this, shares in the firm were trading around 1.4 percent higher.

Tullow Oil also continued to feel the heat and reported a $10 million pre-tax loss in the first half of the year and a 35 percent plunge in revenue. The company also said that it would suspend its dividend. Shares were over 3.4 percent higher at the open but reversed gains to trade slightly lower by mid-morning.

French carmaker Peugeot said its net profit for the first half of the year came in at 571 million euros ($630.5 million) after booking a 114 million euro loss a year earlier. Peugeot saw a 5 percent pop as a result.

In the pharmaceutical space, Bayer reported a 20.9 percent rise in net profit in the second quarter to 1.15 billion euros ($1.27 billion) from 953 million euros in the same period last year, sending shares over 4.7 percent higher.

Cement maker Holcim saw second-quarter net profit plunge 35.2 percent year-on-year to 263 million Swiss francs in its last earnings as a separate company before it begins reporting as a group after its merger with Lafarge. The new group, LafargeHolcim, also released a "roadmap" for the second half of the year. In a press release on Wednesday, the company said that its dividend will stand at 1.30 Swiss francs per share for the 2015 financial year. Shares in LafargeHolcim plunged over 5.8 percent.

Dutch publishing company Wolters Kluwer reported better-than-expected revenues, up 17 percent in the first half of the year compared to the same period in 2014. Shares in the firm surged over 5 percent.

European pay-TV group Sky said revenues rose 5 percent year-on-year to £11.3 billion ($17.6 billion) for the 12 months ending June 30, sending the company's stock price up 2 percent.

Oil and gas company Saipem announced thousands of job cuts on Tuesday and revised down its outlook for the rest of the year. Shares in the Italian firm plunged over 8.8 percent as a result but was trading around 6.3 percent lower by mid-morning.

British American Tobacco said revenues fell in the first half of the year due to currency fluctuations but shares in the company were trading around 2.6 percent higher.

-

08:44

Global Stocks: declines in Chinese stocks slowed down

U.S. stock indices rose on Tuesday. Declines in Chinese stocks slowed down after the China Securities Regulatory Commission said on Monday that the local government will raise purchases of stocks in order to support the equity market after the biggest drop in eight years.

Preliminary data by Markit Economics showed that the U.S. Services PMI rose to 55.2 in July due to improvements in employment and new business. Economists expected the index to rise to 55 from 54.8 reported previously.

The Dow Jones Industrial Average rose 189.68 points, or 1.1%, to 17630.27. The S&P 500 gained 25.61 points, or 1.2%, to 2093.25. The Nasdaq Composite climbed 49.43 points, or 1%, to 5089.21.

In Asia this morning Hong Kong Hang Seng gained 0.01%, or 2.49 points, to 24,506.43. China Shanghai Composite Index fell 0.45%, or 16.57 points, to 3,646.43. The Nikkei declined 0.23%, or 47.45 points, to 20,281.44.

The China Securities Regulatory Commission said late Tuesday it was investigating share dumping incidents that occurred on Monday.

Investors are also cautious ahead of the end of this month's two-day Fed meeting waiting for clues on the timing of a U.S. rate increase.

-

04:00

Nikkei 225 20,242.71 -86.18 -0.42 %, Hang Seng 24,633.4 +129.46 +0.53 %, Shanghai Composite 3,689.82 +26.82 +0.73 %

-

00:31

Stocks. Daily history for Jul 28’2015:

(index / closing price / change items /% change)

Nikkei 225 20,328.89 -21.21 -0.10 %

Hang Seng 24,503.94 +151.98 +0.62 %

S&P/ASX 200 5,584.69 -5.20 -0.09 %

Shanghai Composite 3,662.82 -62.74 -1.68 %

FTSE 100 6,555.28 +50.15 +0.77 %

CAC 40 4,977.32 +49.72 +1.01 %

Xetra DAX 11,173.91 +117.51 +1.06 %

S&P 500 2,093.25 +25.61 +1.24 %

NASDAQ Composite 5,089.21 +49.43 +0.98 %

Dow Jones 17,630.27 +189.68 +1.09 %

-