Noticias del mercado

-

21:00

S&P 500 2,105.53 -8.62 -0.41 %, NASDAQ 5,161.66 -10.11 -0.20 %, Dow 17,768.46 -82.58 -0.46 %

-

19:20

European stocks fell for a third day

European stocks fell for a third day as a decline in energy shares outweighed better-than-expected results from Credit Suisse Group AG and Unilever.

Oil-and-gas stocks contributed the most to the Stoxx Europe 600 Index's drop, with BP Plc retreating 1.4 percent. Credit Suisse rose 6.2 percent after quarterly profit beat estimates. Unilever climbed 1.6 percent after the maker of Magnum ice cream reported higher-than-forecast sales growth.

The Stoxx 600 slid 0.5 percent to 398.1 at the close of trading, after earlier rising as much as 0.6 percent. The volume of shares changing hands was 18 percent lower than the 30-day average. Shares had advanced to within 2 percent of their record in a nine-day rally through Monday.

The earnings season is picking up pace in Europe, with more than 200 Stoxx 600 companies scheduled to report through the rest of the month.

Aberdeen Asset Management Plc slid 7.6 percent after posting 9.9 billion pounds ($15.5 billion) of net outflows in the three months to June as investor sentiment toward Asia and emerging markets soured.

Among energy companies, Royal Dutch Shell Plc lost 1.5 percent and Tullow Oil Plc slipped 3.7 percent, as oil approached a bear market.

"It's been such a difficult period for oil-related investments that I believe some investors are throwing in the towel, especially now that apparently the Iran agreements should allow Iran to sell more oil on international markets," said Pierre Mouton, who helps manage $8.3 billion at Notz, Stucki & Cie. in Geneva. "But there's a limit to that and I see relative value today in major oil companies."

Switzerland's benchmark SMI Index jumped 1 percent, for the best performance among western-European markets. Roche Holding AG rose 1.6 percent after the world's biggest maker of cancer drugs reported first-half earnings that exceeded analyst estimates. ABB Ltd. advanced 1.7 percent after also posting better-than-expected profit.

-

18:27

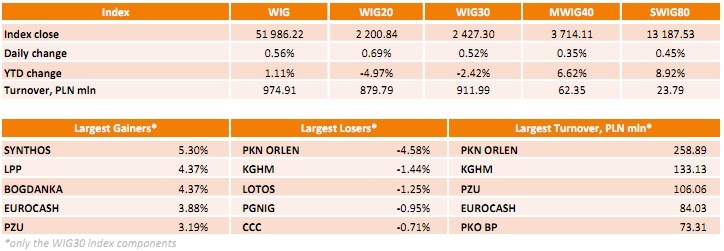

WSE: Session Results

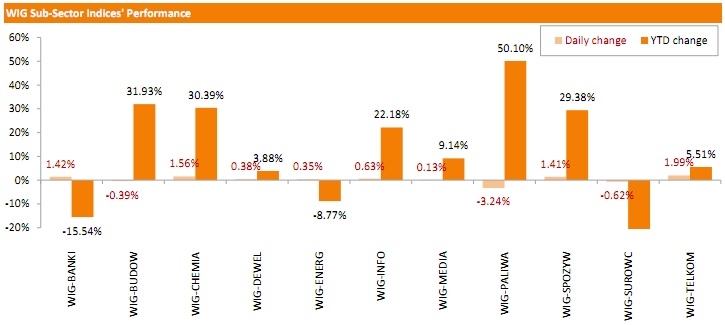

Polish equity market demonstrated growth on Thursday. The broad market measure, the WIG Index, gained 0.56%. Almost all sectors in the WIG generated positive returns. The exception were oil and gas industry (-3.24%), materials (-0.62%) and construction sector (-0.39%).

The large-cap stocks' measure, the WIG30 Index, added 0.52%. Within the WIG30 Index components, SYNTHOS (WSE: SNS) led advancers with a 5.3% gain. BOGDANKA (WSE: LWB), LPP (WSE: LPP) and EUROCASH (WSE: EUR) also demonstrated notable increases, boosting by 4.37%, 4.37% and 3.88% respectively. In the meantime, PKN ORLEN (WSE: PKN) suffered the steepest declines, plunging 4.58% as the company's 2Q15 net profit came in below market expectations due to impairments related to some of its shale gas projects. It was followed by copper miner KGHM (WSE: KGH), as well as two other names from oil and gas sector LOTOS (WSE: LTS) and PGNIG (WSE: PGN), which recorded declines between 0.95% and 1.44%.

-

18:00

European stocks closed: FTSE 100 6,655.01 -12.33 -0.18 %, CAC 40 5,086.74 +4.17 +0.08 %, DAX 11,512.11 -8.56 -0.07 %

-

17:54

Wall Street. Major U.S. stock-indexes fell

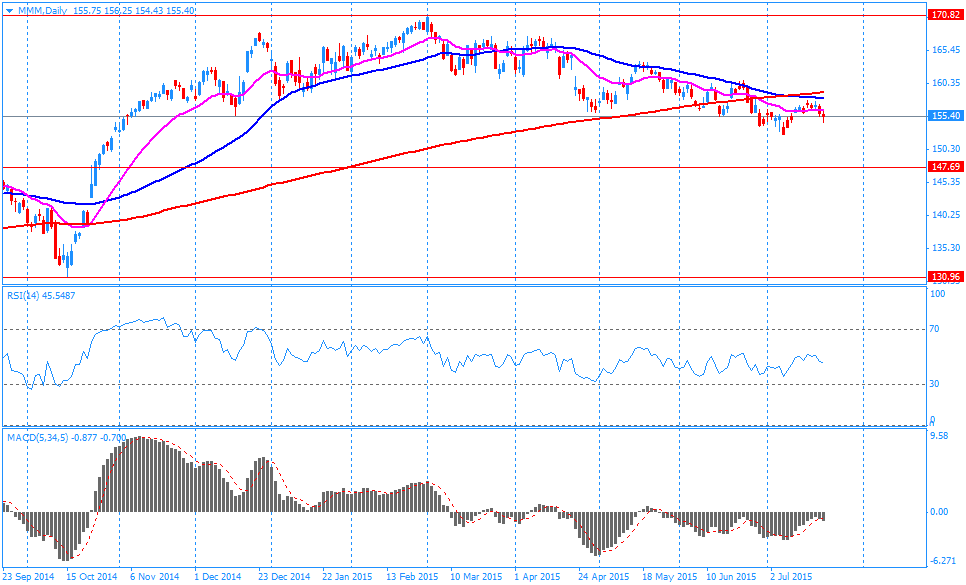

U.S. stock-indexes are little changed after two days of losses, while the Dow Jones industrial average was at a week-low on disappointing results from bellwethers such as 3M (MMM) and Caterpillar (CAT).

Most of Dow stocks in negative area (19 of 30). Top looser - Caterpillar Inc. (CAT, -3.44%). Top gainer - Microsoft Corporation (MSFT, +1.36).

Most of S&P index sectors also in negative area. Top looser - Utilities (-1.3%). Top gainer - Consumer goods (+0.3%).

At the moment:

Dow 17713.00 -72.00 -0.40%

S&P 500 2102.00 -6.00 -0.28%

Nasdaq 100 4616.25 -0.75 -0.02%

10 Year yield 2,31% -0,01

Oil 49.04 -0.15 -0.30%

Gold 1094.00 +2.50 +0.23%

-

15:31

U.S. Stocks open: Dow -0.07%, Nasdaq +0.01%, S&P +0.02%

-

15:27

Before the bell: S&P futures +0.01%, NASDAQ futures +0.02%

U.S. stock-index futures were little changed, as General Motors Co. and SanDisk Corp. rallied on corporate earnings while Caterpillar Inc. slumped.

Global Stocks:

Nikkei 20,683.95 +90.28 +0.44%

Hang Seng 25,398.85 +116.23 +0.46%

Shanghai Composite 4,124.39 +98.34 +2.44%

FTSE 6,672.27 +4.93 +0.07%

CAC 5,084.64 +2.07 +0.04%

DAX 11,529.12 +8.45 +0.07%

Crude oil $49.36 (+0.30%)

Gold $1096.90 (+0.41%)

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yahoo! Inc., NASDAQ

YHOO

39.25

+0.03%

0.2K

Home Depot Inc

HD

114.95

+0.04%

0.1K

AT&T Inc

T

34.30

+0.09%

10.0K

Boeing Co

BA

146.62

+0.10%

129.4K

Facebook, Inc.

FB

97.14

+0.10%

95.6K

Hewlett-Packard Co.

HPQ

30.80

+0.10%

0.5K

Walt Disney Co

DIS

119.50

+0.14%

1.0K

Twitter, Inc., NYSE

TWTR

36.14

+0.14%

10.9K

International Business Machines Co...

IBM

160.59

+0.15%

21.5K

Google Inc.

GOOG

663.30

+0.18%

2.3K

Microsoft Corp

MSFT

45.65

+0.24%

1.1K

Exxon Mobil Corp

XOM

82.00

+0.26%

0.5K

General Electric Co

GE

26.70

+0.26%

4.9K

Intel Corp

INTC

28.68

+0.26%

2.3K

E. I. du Pont de Nemours and Co

DD

59.06

+0.27%

7.0K

UnitedHealth Group Inc

UNH

120.99

+0.32%

0.3K

Starbucks Corporation, NASDAQ

SBUX

56.88

+0.34%

18.8K

Visa

V

72.24

+0.38%

5.4K

Procter & Gamble Co

PG

81.18

+0.43%

0.1K

Chevron Corp

CVX

93.92

+0.44%

0.5K

Apple Inc.

AAPL

125.77

+0.44%

266.9K

Tesla Motors, Inc., NASDAQ

TSLA

269.33

+0.55%

8.8K

ALCOA INC.

AA

10.05

+0.60%

24.7K

Amazon.com Inc., NASDAQ

AMZN

491.53

+0.67%

14.9K

United Technologies Corp

UTX

102.30

+0.74%

0.7K

Cisco Systems Inc

CSCO

27.80

+0.98%

14.4K

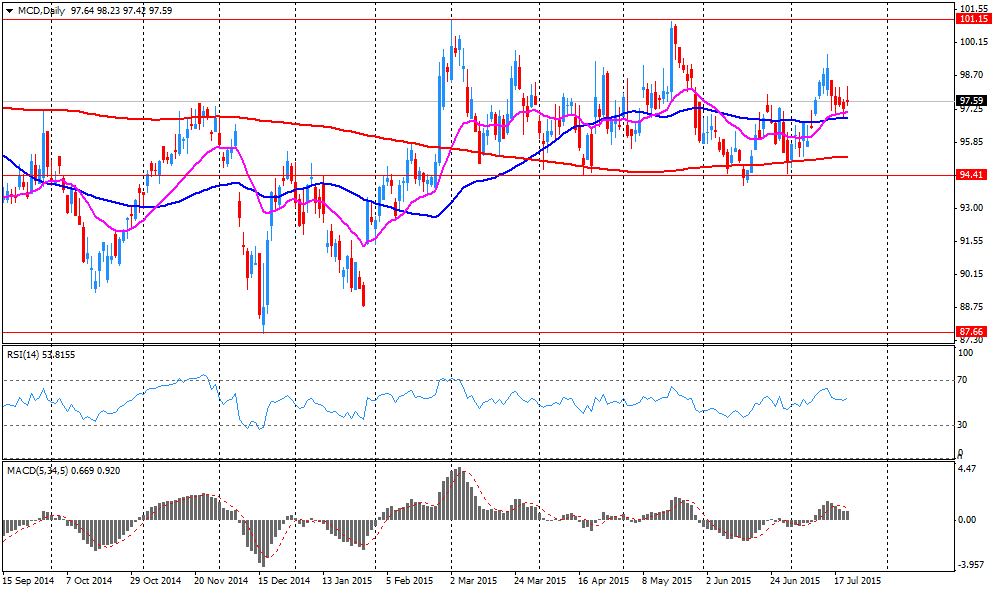

McDonald's Corp

MCD

98.79

+1.24%

21.0K

Barrick Gold Corporation, NYSE

ABX

07.47

+1.49%

50.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.32

+1.73%

56.9K

Ford Motor Co.

F

14.78

+2.50%

199.8K

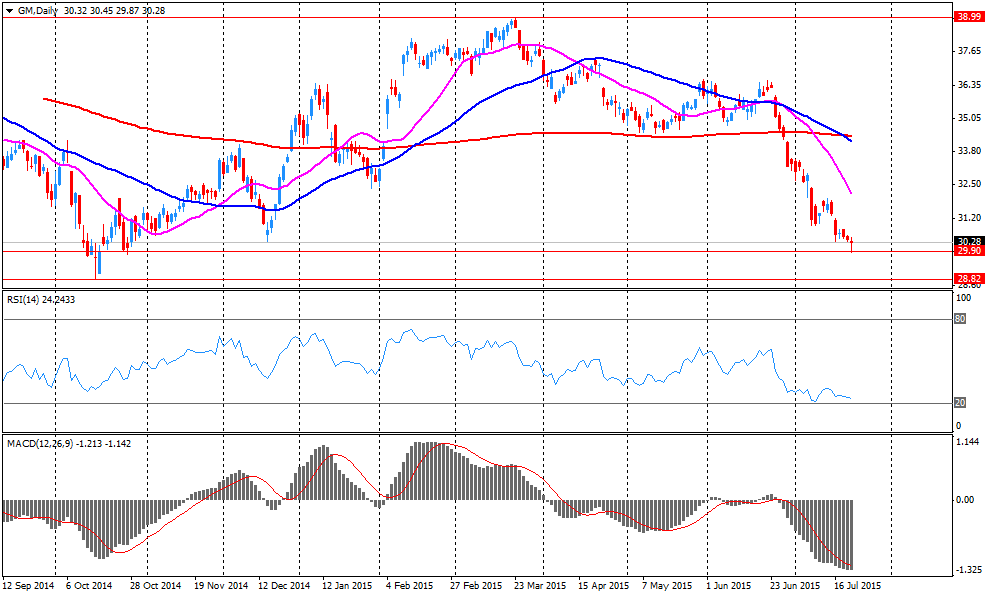

General Motors Company, NYSE

GM

32.44

+7.06%

2.3M

Goldman Sachs

GS

213.25

0.00%

1.0K

The Coca-Cola Co

KO

40.85

-0.12%

0.2K

Citigroup Inc., NYSE

C

60.25

-0.15%

15.9K

JPMorgan Chase and Co

JPM

69.95

-0.19%

8.9K

Verizon Communications Inc

VZ

46.34

-0.24%

4.4K

Yandex N.V., NASDAQ

YNDX

15.10

-0.33%

0.9K

Deere & Company, NYSE

DE

94.03

-0.83%

1.3K

American Express Co

AXP

77.78

-1.53%

0.4K

3M Co

MMM

152.92

-1.60%

3.5K

Caterpillar Inc

CAT

77.75

-2.52%

157.8K

-

15:00

-

14:50

-

14:41

Company News: Caterpillar (CAT) lowered revenue guidance

Company reported Q2 profit of $1.27 per share, as expected. Revenues fell 13.0% year/year to $12.32 bln versus $12.68 bln consensus.

Company sees EPS of $4.70-5.00 for FY15 versus $4.96 consensus. Revenue guidance for FY15 lowered to about $49 bln from about $50 bln versus $49.48 bln consensus.

CAT fell to $77.19 (-3.22%) on the premarket.

-

14:27

-

12:30

Major European stock indexes traded slightly higher

European stock indices show a slight increase, as the negative impact of falling oil prices offset by positive corporate statements of Credit Suisse Group AG and Unilever.

Support index also have news from Greece. Yesterday the Greek parliament voted in favor of the second package of creditors' claims. MPs 230 votes to 63 approved a bill on the measures needed for the final negotiations on a third program of financial aid to Greece of 86 billion euros ($ 93 billion). Approved steps simplify judicial decisions and incorporate into national law of the EU directive on the reorganization of troubled banks. Thirty-six deputies of the ruling party Syriza did not support the position of Tsipras to vote. Against the claims of creditors of the first package approved last week, were 39 representatives of the Party. Tsipras said he would carry out anti-crisis program, but does not consider it correct. He stressed that he would do everything possible to improve the final terms of the agreement.

Pressure had weak data on Britain. The Office for National Statistics said retail sales (including motor fuel) decreased by 0.2 percent compared to the previous month. Recall the end of May sales rose by 0.3 percent (revised from 0.2 percent). It was the first drop in sales for the three months. Experts expect that sales will increase by 0.3 percent. Also, the data showed that, except for the sale of motor fuel sales declined by 0.2 percent, while economists had forecast an increase of 0.4 percent, which would correspond to a change in May. On an annual basis, retail sales growth (including motor fuel) slowed to 4 percent from 4.7 percent in May. Economists had expected sales to rise 4.9 percent. It is worth emphasizing sales increase recorded for 27 consecutive month, which is the longest series since May 2008. Excluding automotive fuel, sales growth slowed to 4.2 percent from 4.5 percent. It expects sales to grow by 5.1 per cent.

Cost of Credit Suisse rose 6.4 percent as the bank returned to profit in the second quarter, and the financial results as a whole exceeded market expectations.

Quotes Unilever - the company selling consumer goods - rose by 2.4 per cent due to revenue growth exceeded forecasts in the second quarter (+ 2.9% vs. + 2.5% expected).

Roche Holding AG's shares rose 1.1 percent after the world's largest manufacturer of cancer drugs said that in the first half revenues exceeded analysts' forecasts.

Cost of ABB Ltd. It rose by 2.2 percent, as the company reported higher profits than expected by experts.

The stock price of Daimler AG - the German manufacturer of cars of a class "lux" - grew by 0.2 percent. Operating profit jumped 54% in the second quarter to 3.78 billion euros. Analysts on average expect its growth to 3.31 billion euros. Quarterly revenue Daimler rose by 19% - to 37.5 billion euros.

Currently:

FTSE 100 6,675.1 +7.76 + 0.12%

CAC 40 5,094.61 +12.04 + 0.24%

DAX 11,549.79 +29.12 + 0.25%

-

08:46

Global Stocks: Asian indices rose despite declines in U.S. stocks

U.S. stock indices declined after earnings reports from various companies, including such tech giants as Apple and Microsoft, missed forecasts.

Microsoft shares lost 3.7% (the company reported a $3.2 billion quarterly loss in its fiscal fourth quarter on Tuesday afternoon). Apple shares fell 4.2% Wednesday as iPhone sales missed some overly optimistic estimates.

The Dow Jones industrial average declined 68.25 points, or 0.4%, to 17851.04. The S&P 500 fell 5.06 points, or 0.2%, 2114.15. The Nasdaq Composite lost 36.35 points, or 0.7%, to 5171.77.

In Asia this morning Hong Kong Hang Seng added 0.64%, or 161.70 points, to 25,444.32. China Shanghai Composite Index rose 1.72%, or 69.39 points, to 4,095.44. The Nikkei rose 0.42%, or 85.56 points, to 20,679.23.

Asian stocks gained amid capital flows from Beijing. Large shareholders, who were blocked by regulators from selling stocks for six months, bought more shares instead of simply holding on to what they already had.

-

04:01

Nikkei 225 20,684.06 +90.39 +0.4 %, Hang Seng 25,399.32 +116.70 +0.5 %, Shanghai Composite 4,034.18 +8.13 0.2 %

-

01:01

Stocks. Daily history for Jul 22’2015:

(index / closing price / change items /% change)

Nikkei 225 20,593.67 -248.30 -1.2 %ф

Hang Seng 25,282.62 -253.81 -1.0 %

S&P/ASX 200 5,614.57 -92.15 -1.6 %

Shanghai Composite 4,026.7 +9.03 +0.2 %

FTSE 100 6,667.34 -101.73 -1.5 %

CAC 40 5,082.57 -24.00 -0.5 %

Xetra DAX 11,520.67 -84.13 -0.7 %

S&P 500 2,114.15 -5.06 -0.2 % 604.85m

NASDAQ Composite 5,171.77 -36.35 -0.7 %

Dow Jones 17,851.04 -68.25 -0.4 %

-