Noticias del mercado

-

22:16

US stocks fell

Technology shares are closing solidly lower after Apple and Microsoft turned in disappointing results.

Apple fell 4.3 percent Wednesday. The company gave a cautious outlook for the current quarter and didn't provide much detail on how its new smartwatch was doing.

Microsoft fell 3.7 percent after booking a huge loss related to its purchase of Nokia.

The Dow Jones industrial average gave up 68 points, or 0.4 percent, to 17,851.

The Standard & Poor's 500 index fell five points, or 0.3 percent, to 2,114. The Nasdaq composite declined 36 points, or 0.7 percent, to 5,171.

Bond prices didn't move much. The yield on the 10-year Treasury note held steady at 2.33 percent.

-

21:00

S&P 500 2,114.86 -4.35 -0.21 %, NASDAQ 5,175.17 -32.95 -0.63 %, Dow 17,837.91 -81.38 -0.45 %

-

19:21

European stocks fell

European stocks fell after Apple Inc.'s worse-than-forecast results dragged semiconductor companies lower and commodity producers deepened declines.

Apple chip suppliers Dialog Semiconductor Plc and Infineon Technologies AG lost at least 5.2 percent. ARM Holdings Plc, whose technology is used in iPhones, tumbled 6.6 percent. The company's quarterly revenue also missed estimates. BHP Billiton Ltd. slid 5.7 percent, leading a drop in miners, after saying petroleum, copper and coal output will drop in fiscal 2016.

The Stoxx Europe 600 Index slipped 0.6 percent to 400.28 at the close of trading. It briefly pared a drop of as much as 0.8 percent after data showed U.S. existing-home sales climbed to an eight-year high in June, before resuming a decline.

Apple's "supply chain clearly has ramifications for companies across the world," said Daniel Murray, London-based head of research at EFG Asset Management. "I would interpret the recent commodities selloff as partly a reflection of stronger dollar sentiment, as well as fears about China. None of that looks like it's going to change anytime soon."

A fourth day of declines in commodity stocks sent the U.K.'s FTSE 100 Index 1.5 percent lower, the worst drop in western-European markets.

The earnings season is picking up pace in Europe, with more than 230 Stoxx 600 companies scheduled to report through the rest of the month.

Telenor ASA fell 2.8 percent after the Nordic region's largest phone company reported profit that fell short of analysts' estimates. TalkTalk Telecom Group Plc tumbled 8.9 percent after saying full-year earnings will be more weighted toward the second half than in previous years.

Danske Bank A/S climbed 3.3 percent after saying quarterly profit increased and raising its full-year forecast. EasyJet Plc rose 4.9 percent after saying annual pretax profit will increase amid a recovery in sales in the summer.

The Stoxx 600 fell for the first time in 10 days yesterday amid mixed earnings reports. Before that, fading fears over Greece pushed the gauge to its fastest rally in 3 1/2 years, taking it closer to strategists' year-end forecasts.

-

19:19

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes declined on Wednesday, with the tech-heavy Nasdaq composite falling more than 1 percent after disappointing results from technology giants including Apple, the world's largest publicly traded company.

Most of Dow stocks in negative area (20 of 30). Top looser - Apple Inc. (AAPL, -4.63%). Top gainer - JPMorgan Chase & Co. (JPM, +1.03).

Most of S&P index sectors also in negative area. Top looser - Conglomerates (-2.1%). Top gainer - Utilities (+0.1%).

At the moment:

Dow 17761.00 -105.00 -0.59%

S&P 500 2106.00 -8.50 -0.40%

Nasdaq 100 4617.25 -49.25 -1.06%

10 Year yield 2,32% -0,02

Oil 49.88 -0.98 -1.93%

Gold 1092.50 -11.00 -1.00%

-

18:34

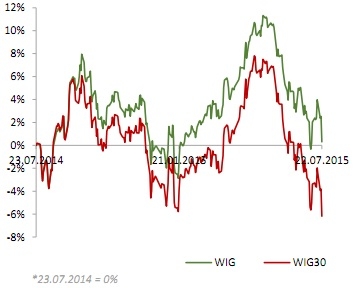

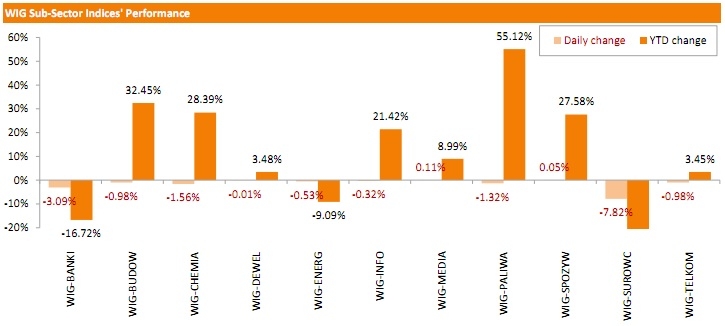

WSE: Session Results

Polish equities were lower on Wednesday. The broad market measure, the WIG Index, declined 2.16%. Media stocks (+0.11%) and food names (+0.05%) were the only groups, which posted positive results. At the same time, materials (-7.82%) was the worst-performing sector, followed by banks (-3.09%).

Large-cap stocks measure, the WIG30 Index, underperformed the broad market, recording a 2.46% drop. Copper miner KGHM (WSE: KGH) was the sharpest decliner among the indicator's constituents with its shares' quotations being beaten down 8.79% as copper prices slide. Additional pressure came from news the company, along with PGE (WSE: PGE; -0.29%) and GRUPA AZOTY (WSE: ATT; -0.93%), offered to contribute to a state-run fund which will be used to bail out troubled coal miners. Other biggest laggards were PZU (WSE: PZU), PKO BP (WSE: PKO) and SYNTHOS (WSE: SNS), tumbling 5.70%, 4.09% and 4.03% respectively. On the other side of the ledger, EUROCASH (WSE: EUR) and KERNEL (WSE: KER) were recorded as the biggest gainers, advancing 3.67% and 2.53% respectively.

-

18:00

European stocks closed: FTSE 100 6,667.34 -101.73 -1.50 %, CAC 40 5,082.57 -24.00 -0.47 %, DAX 11,520.67 -84.13 -0.72 %

-

15:33

U.S. Stocks open: Dow -0.23%, Nasdaq -0.98%, S&P -0.34%

-

15:30

Before the bell: S&P futures -0.47%, NASDAQ futures -1.41%

U.S. stocks were poised for a lower open Wednesday after disappointing results from technology heavyweights Apple Inc. and Microsoft Corp.

Global Stocks:

Nikkei 20,593.67 -248.30 -1.19%

Hang Seng 25,282.62 -253.81 -0.99%

Shanghai Composite 4,026.7 +9.03 +0.23%

FTSE 6,660.97 -108.10 -1.60%

CAC 5,078.45 -28.12 -0.55%

DAX 11,498.4 -106.40 -0.92%

Crude oil $50.20 (-1.30%)

Gold $1089.70 (-1.25%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Starbucks Corporation, NASDAQ

SBUX

56.24

+0.07%

9.8K

Home Depot Inc

HD

114.03

+0.15%

3.5K

Exxon Mobil Corp

XOM

82.04

+0.47%

71.7K

International Paper Company

IP

48.32

+0.48%

0.8K

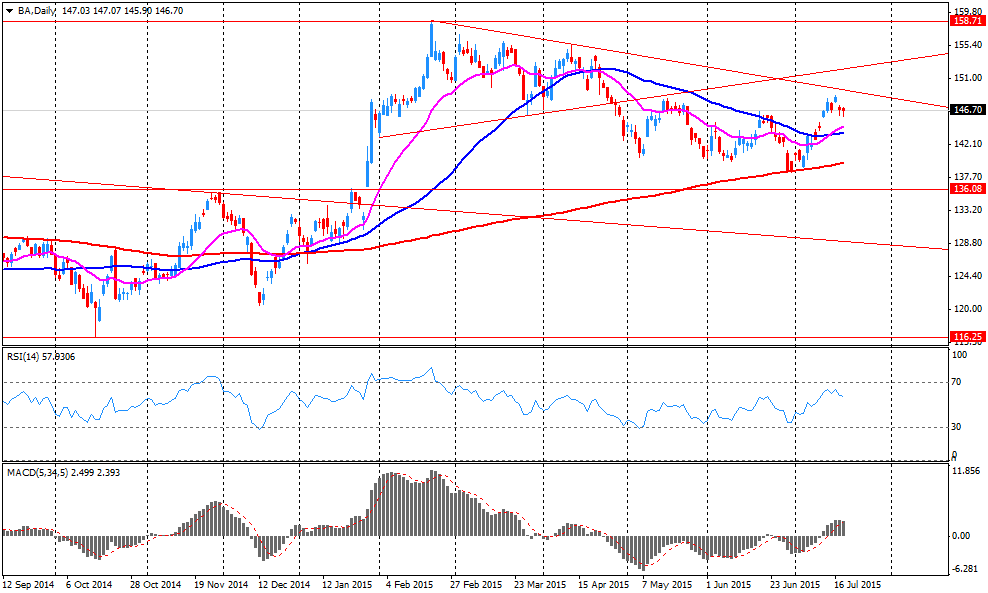

Boeing Co

BA

147.75

+1.90%

73.9K

E. I. du Pont de Nemours and Co

DD

59.27

-0.02%

3.2K

Wal-Mart Stores Inc

WMT

72.71

-0.04%

2.8K

McDonald's Corp

MCD

97.20

-0.12%

1.9K

Amazon.com Inc., NASDAQ

AMZN

487.38

-0.13%

21.0K

Procter & Gamble Co

PG

80.83

-0.17%

3.0K

Verizon Communications Inc

VZ

46.89

-0.17%

0.1K

UnitedHealth Group Inc

UNH

120.64

-0.18%

4.0K

3M Co

MMM

155.45

-0.20%

2.3K

Johnson & Johnson

JNJ

100.14

-0.20%

4.1K

Ford Motor Co.

F

14.48

-0.21%

9.9K

Google Inc.

GOOG

660.67

-0.25%

7.9K

Travelers Companies Inc

TRV

104.21

-0.26%

9.9K

Walt Disney Co

DIS

119.00

-0.26%

1.6K

Nike

NKE

112.69

-0.27%

0.4K

Pfizer Inc

PFE

35.04

-0.28%

1.2K

American Express Co

AXP

78.72

-0.29%

1.8K

JPMorgan Chase and Co

JPM

68.90

-0.29%

2.0K

Caterpillar Inc

CAT

81.97

-0.30%

0.7K

Intel Corp

INTC

28.63

-0.31%

31.7K

Merck & Co Inc

MRK

58.48

-0.32%

0.3K

The Coca-Cola Co

KO

41.05

-0.34%

95.2K

Visa

V

71.76

-0.36%

5.3K

Cisco Systems Inc

CSCO

27.74

-0.36%

81.2K

Goldman Sachs

GS

210.72

-0.37%

6.9K

United Technologies Corp

UTX

102.30

-0.40%

7.6K

General Electric Co

GE

26.74

-0.41%

13.8K

Citigroup Inc., NYSE

C

58.81

-0.49%

6.6K

HONEYWELL INTERNATIONAL INC.

HON

104.86

-0.51%

0.1K

Hewlett-Packard Co.

HPQ

30.50

-0.52%

0.4K

Chevron Corp

CVX

93.39

-0.54%

3.3K

International Business Machines Co...

IBM

161.70

-0.84%

12.3K

ALCOA INC.

AA

окт.14

-0.88%

13.9K

Twitter, Inc., NYSE

TWTR

36.19

-1.20%

41.5K

AT&T Inc

T

34.14

-1.24%

376.9K

Barrick Gold Corporation, NYSE

ABX

07.38

-1.60%

175.4K

Facebook, Inc.

FB

96.82

-1.60%

223.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.45

-1.72%

10.2K

Tesla Motors, Inc., NASDAQ

TSLA

262.00

-1.79%

32.6K

Yahoo! Inc., NASDAQ

YHOO

38.70

-2.59%

32.5K

Microsoft Corp

MSFT

45.66

-3.42%

173.8K

Apple Inc.

AAPL

121.26

-7.26%

3.1M

-

15:05

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded from Mkt Perform to Mkt Outperform at JMP Securities, target $575

Downgrades:

United Tech (UTX) downgraded from Overweight to Neutral at Atlantic Equities

Apple (AAPL) downgraded from Outperform to Market Perform at Cowen, target lowered from $140 to $130

Other:

Apple (AAPL) reiterated at Buy at Canaccord Genuity, target lowered from $160 to $155

Apple (AAPL) reiterated at Outperform at FBR Capital, target lowered from $185 to $175

United Tech (UTX) reiterated at Outperform at RBC Capital Mkts, target lowered from $141 to $114

Travelers (TRV) reiterated at Outperform at RBC Capital Mkts, target lowered from $117 to $115

Exxon Mobil (XOM) added to Conviction Buy List at Goldman

-

14:48

-

14:33

Company News: Boeing (BA) beated expectation, revenue rose 11%

Company reported Q2 profit of $1.62 per share versus $1.38 consensus. Revenues rose 11.3% year/year to $24.54 bln versus $24.27 bln consensus.

Company issueed guidance for FY15, EPS expected at $7.70-7.90 versus $7.90 consensus. Revenue expected at $94.5-96.5 bln versus $94.85 bln consensus. Company reaffirmed commercial airplane deliveries 750-755.

BA rose to $147.23 (+1.54%) on the premarket.

-

08:59

Global Stocks: U.S. indices declined and weighed on Asian stocks

U.S. stock indices declined amid weak earnings reports from various companies.

The Dow Jones Industrial Average dropped 204.51 points, or 1.13%, to 17,895.9. The S&P 500 fell 9.58 points, or 0.45%, to 2,118.7. The Nasdaq Composite lost 9.25 points, or 0.18%, to 5,209.61.

Shares of Dow components IBM and United Technologies fell by 6.2% to $162.42 and by 7.6% to $102.06 respectively. IBM's profits dropped for the 13th consecutive quarter and missed analyst's expectations. So far, 70% of companies have reported earnings above analyst expectations.

In Asia this morning Hong Kong Hang Seng fell 1.15%, or 294.82 points, to 25,241.61. China Shanghai Composite Index declined 0.42%, or 16.89 point, to 4,000.79. The Nikkei dropped 1.03%, or 213.68 points, to 20,628.29.

Asian stocks declined after shares of several U.S. companies dropped amid lower-than-expected revenues.

Toshiba shares fell 1.7% after their 6% rise the day earlier when the details of an accounting scandal showed that an independent investigation had found the company overstating its earnings by a total of 151.8 billion yen ($1.22 billion) over the past six years.

-

04:03

Nikkei 225 20,597.85 -244.12 -1.17 %, Hang Seng 25,287.2 -249.23 -0.98 %, Shanghai Composite 4,027.42 +9.74 +0.24 %

-

00:30

Stocks. Daily history for Jul 21’2015:

(index / closing price / change items /% change)

Hang Seng 25,536.43 +131.62 +0.5 %

S&P/ASX 200 5,706.72 +19.82 +0.3 %

Shanghai Composite 4,018.62 +26.51 +0.7 %

Topix 1,673.88 +10.94 +0.7 %

FTSE 100 6,769.07 -19.62 -0.3 %

CAC 40 5,106.57 -35.92 -0.7 %

Xetra DAX 11,604.8 -130.92 -1.1 %

S&P 500 2,119.21 -9.07 -0.4 %

NASDAQ Composite 5,208.12 -10.74 -0.2 %

Dow Jones 17,919.29 -181.12 -1.0 %

-

00:01

Schedule for today, Wednesday, Jul 22’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index June -0.1%

01:30 Australia CPI, q/q Quarter II 0.2% 0.8%

01:30 Australia CPI, y/y Quarter II 1.3% 1.7%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter II 2.3% 2.2%

03:05 Australia RBA's Governor Glenn Stevens Speech

04:30 Japan All Industry Activity Index, m/m May 0.1%

05:00 Japan Coincident Index (Finally) May 111 109.2

05:00 Japan Leading Economic Index (Finally) May 106.4 106.2

08:30 United Kingdom Bank of England Minutes

11:00 U.S. MBA Mortgage Applications July -1.9%

13:00 U.S. Housing Price Index, m/m May 0.3%

14:00 U.S. Existing Home Sales June 5.35 5.4

14:30 U.S. Crude Oil Inventories July -4.346

21:00 New Zealand RBNZ Interest Rate Decision 3.25% 3.13%

21:00 New Zealand RBNZ Rate Statement

23:50 Japan Trade Balance Total, bln June -216.0 5.4

-