Noticias del mercado

-

22:06

Major US stock indexes completed the session in different directions

Major US stock indices showed mixed dynamics on Wednesday, as the growth of shares in the health sector was countered by the fall in quotations of the main materials sector.

In addition, as it became known, in May, home sales in the secondary market in the US unexpectedly rose to the third highest monthly level in a decade, and the chronic shortage of stocks pushed the median price of housing to a record level. The National Association of Realtors said that home sales in the secondary market grew by 1.1% to 5.62 million units, taking into account seasonal fluctuations last month. Economists predicted that sales would fall to 5.55 million.

Oil prices fell by more than 2%, the reason for which were the continuing concerns about the oversaturation of the market. Since the beginning of this year, oil futures have lost about 20% of their value, which is the worst result for the first six months of the year since 1997. Compliance with the agreement between OPEC and other producers to reduce production by 1.8 million barrels per day reached the highest level in May since the signing of this pact, namely 106%. This means that they cut production more than necessary. Compliance with the agreement by OPEC members was 108%, and among non-OPEC countries, it was 100%. Nevertheless, the global reserves of crude oil and petroleum products remain significantly higher than their long-term average values.

Most components of the DOW index recorded a decline (18 out of 30). Most fell shares of Caterpillar Inc. (CAT, -3.46%). Leader of the growth were shares of NIKE, Inc. (NKE, + 1.80%).

Most sectors of the S & P index showed a decline. Most of all fell the sector of basic materials (-1.1%). The leader of growth was the healthcare sector (+ 1.3%).

At closing:

DJIA -0.24% 21.415.23 -51.91

Nasdaq + 0.74% 6.233.95 +45.92

S & P -0.06% 2.435.66 -1.37

-

21:00

DJIA -0.21% 21,422.93 -44.21 Nasdaq +0.71% 6,232.26 +44.23 S&P -0.03% 2,436.32 -0.71

-

18:00

European stocks closed: FTSE 100 -24.92 7447.79 -0.33% DAX -40.53 12774.26 -0.32% CAC 40 -19.39 5274.26 -0.37%

-

15:34

U.S. Stocks open: Dow +0.08%, Nasdaq +0.29%, S&P +0.12%

-

15:26

Before the bell: S&P futures -0.03%, NASDAQ futures +0.10%

U.S. stock-index futures were flat as investors decided to take a breath after the market was on a roller coaster ride earlier this week.

Stocks:

Nikkei 20,138.79 -91.62 -0.45%

Hang Seng 25,694.58 -148.46 -0.57%

Shanghai 3,156.38 +16.36 +0.52%

S&P/ASX 5,665.72 -91.53 -1.59%

FTSE 7,436.36 -36.35 -0.49%

CAC 5,263.50 -30.15 -0.57%

DAX 12,770.38 -44.41 -0.35%

Crude $43.72 (+0.48%)

Gold $1,244.70 (+0.10%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

77.3

-0.03(-0.04%)

5035

Amazon.com Inc., NASDAQ

AMZN

996.04

3.45(0.35%)

18108

American Express Co

AXP

82.7

0.19(0.23%)

675

Apple Inc.

AAPL

145.38

0.37(0.26%)

57936

AT&T Inc

T

38.9

0.24(0.62%)

759

Barrick Gold Corporation, NYSE

ABX

15.65

0.07(0.45%)

36168

Boeing Co

BA

198.6

0.27(0.14%)

800

Caterpillar Inc

CAT

106.8

-0.24(-0.22%)

6485

Chevron Corp

CVX

105.9

-0.58(-0.54%)

18543

Cisco Systems Inc

CSCO

31.86

0.01(0.03%)

3557

Citigroup Inc., NYSE

C

64.03

0.12(0.19%)

11432

Facebook, Inc.

FB

152.37

0.12(0.08%)

14494

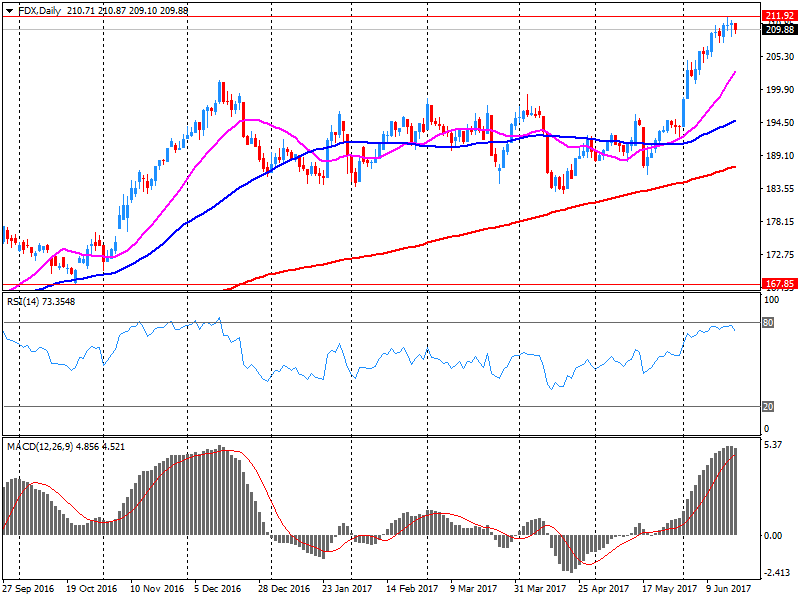

FedEx Corporation, NYSE

FDX

206.55

-2.40(-1.15%)

71457

Ford Motor Co.

F

11.17

0.05(0.45%)

16734

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.38

0.14(1.25%)

31306

General Electric Co

GE

28.15

0.02(0.07%)

4965

Goldman Sachs

GS

224.7

-0.40(-0.18%)

2663

Intel Corp

INTC

34.35

-0.51(-1.46%)

536031

JPMorgan Chase and Co

JPM

87.56

0.04(0.05%)

2939

McDonald's Corp

MCD

154.5

0.43(0.28%)

1005

Microsoft Corp

MSFT

70.1

0.19(0.27%)

8469

Nike

NKE

52.14

0.58(1.12%)

56348

Procter & Gamble Co

PG

89.5

-0.13(-0.15%)

7736

Tesla Motors, Inc., NASDAQ

TSLA

374.5

2.26(0.61%)

51053

Twitter, Inc., NYSE

TWTR

16.93

0.02(0.12%)

25284

Verizon Communications Inc

VZ

45.99

0.05(0.11%)

560

Visa

V

94.74

0.36(0.38%)

1357

Walt Disney Co

DIS

104

0.06(0.06%)

2227

Yandex N.V., NASDAQ

YNDX

26.31

0.06(0.23%)

4100

-

14:40

Analyst coverage initiations before the market open

General Motors (GM) initiated with a Neutral at Guggenheim

Ford Motor Co. (F) initiated with a Neutral at Guggenheim

-

14:39

Downgrades before the market open

Intel (INTC) downgraded to Neutral from Buy at BofA/Merrill

Chevron (CVX) downgraded to Neutral from Outperform at Macquarie

-

13:59

Company News: FedEx (FDX) Q4 EPS beat analysts’ estimate

FedEx (FDX) reported Q4 FY 2017 earnings of $4.25 per share (versus $3.30 in Q4 FY 2016), beating analysts' consensus estimate of $3.88.

The company's quarterly revenues amounted to $15.700 bln (+21% y/y), generally in line with analysts' consensus estimate of $15.560 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $13.20-14.00 versus analysts' consensus estimate of $13.58. Its CapEx is expected to amount to $5.9 bln in FY 2018, in line with analysts' expectations.

FDX fell to $208.30 (-0.31%) in pre-market trading.

-

09:31

Major European stock markets trading in the red zone: FTSE 7461.31 -11.40 -0.15%, DAX 12753.83 -60.96 -0.48%, CAC 5248.86 -44.79 -0.85%

-

07:33

Global Stocks

European stocks ended lower Tuesday, reversing gains as oil prices sank toward bear-market territory, taking energy-related shares with them. The Stoxx Europe 600 Oil and Gas Index SXEP, -2.18% was shoved 2.2% lower, losing the most since November as West Texas Intermediate oil futures CLN7, -1.95% and Brent crude futures LCOQ7, -0.17% swung lower by about 3%.

U.S. stocks finished lower Tuesday as investors dumped energy shares after crude-oil prices sank into bear-market territory. The S&P 500 SPX, -0.67% dropped 16.43 points, or 0.7%, to close at 2,437.03, with nine of the 11 main sectors trading lower. The energy sector was down 1.3%, topping the losers.

Stocks were lower across the Asia-Pacific region early Wednesday, as global price declines for oil hurt energy companies, though mainland markets were resilient after MSCI Inc. said it would include Chinese stocks in its emerging-markets index. Oil prices returned to bear-market territory overnight and the U.S. benchmark has fallen 20% from its last high point, with cuts by the Organization of the Petroleum Exporting Countries offset by increasing production elsewhere.

-

00:32

Stocks. Daily history for Jun 20’2017:

(index / closing price / change items /% change)

Nikkei +162.66 20230.41 +0.81%

TOPIX +11.18 1617.25 +0.70%

Hang Seng -81.51 25843.04 -0.31%

CSI 300 -7.18 3546.49 -0.20%

Euro Stoxx 50 -18.92 3560.66 -0.53%

FTSE 100 -51.10 7472.71 -0.68%

DAX -74.16 12814.79 -0.58%

CAC 40 -17.07 5293.65 -0.32%

DJIA -61.85 21467.14 -0.29

S&P 500 -16.43 2437.03 -0.67

NASDAQ -50.98 6188.03 -0.82

S&P/TSX -116.44 15149.60 -0.76

-