Noticias del mercado

-

22:13

The main US stock indexes finished trading mostly in positive territory

The main US stock indexes mostly rose on Tuesday, as optimistic results from Netflix (NFLX) stimulated the growth of the technology sector, while Dow was under pressure from the decline in shares of Johnson & Johnson (JNJ) and Procter & Gamble (PG).

In addition, a review by the Federal Reserve Bank of Richmond showed that activity of manufacturing firms in the Fifth Circuit slowed in January, despite the fact that each of the indicators remained positive. The composite index of business activity fell from 20 to 14. This decline was caused by a fall in the indicators of supply and employment. The third component, new orders, kept steadily. However, manufacturing firms were faced with an increase in unfulfilled orders in January, after a decline in December, as the index rose from -4 to 5.

Quotes of oil increased by more than 1.5% on Tuesday, supported by favorable prospects for world economic growth and expectations of further oil production constraints on the part of OPEC, Russia and their allies.

Most components of the DOW index finished trading in positive territory (17 out of 30). The leader of growth was the shares of The Travelers Companies, Inc. (TRV, + 4.66%). Outsider were shares of Johnson & Johnson (JNJ, -4.31%).

Almost all S & P sectors showed an increase. The conglomerate sector grew most (+ 0.9%). Nil change was recorded in the commodities sector, the health sector, and the consumer goods sector.

At closing:

DJIA -0.01% 26,210.81 -3.79

Nasdaq + 0.71% 7.460.29 +52.26

S & P + 0.22% 2.839.15 +6.18

-

21:00

DJIA +0.02% 26,219.66 +5.06 Nasdaq +0.68% 7,458.75 +50.72 S&P +0.26% 2,840.30 +7.33

-

18:00

European stocks closed: FTSE 100 +16.39 7731.83 +0.21% DAX +95.91 13559.60 +0.71% CAC 40 -6.73 5535.26 -0.12%

-

15:33

U.S. Stocks open: Dow -0.08% Nasdaq +0.26%, S&P +0.05%

-

15:28

Before the bell: S&P futures -0.05%, NASDAQ futures +0.08%

U.S. stock-index futures were flat on Tuesday,following Monday's rally, which lifted stocks to new records.

Global Stocks:

текущий момент демонстрируют рост.

Nikkei 24,124.15 +307.82 +1.29%

Hang Seng 32,930.70 +537.29 +1.66%

Shanghai 3,546.98 +45.62 +1.30%

S&P/ASX 6,037.00 +45.10 +0.75%

FTSE 7,742.86 +27.42 +0.36%

CAC 5,545.51 +3.52 +0.06%

DAX 13,565.74 +102.05 +0.76%

Crude $64.16 (+0.93%)

Gold $1,336.30 (+0.33%)

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

248

0.70(0.28%)

221

ALCOA INC.

AA

52.5

-0.44(-0.83%)

5328

Amazon.com Inc., NASDAQ

AMZN

1,335.20

7.89(0.59%)

34519

Apple Inc.

AAPL

177.61

0.61(0.34%)

139879

AT&T Inc

T

38.25

0.38(1.00%)

37072

Barrick Gold Corporation, NYSE

ABX

14.55

0.04(0.28%)

8250

Boeing Co

BA

338.49

0.49(0.15%)

11909

Caterpillar Inc

CAT

172

1.11(0.65%)

13599

Chevron Corp

CVX

132.84

0.28(0.21%)

383

Cisco Systems Inc

CSCO

41.65

-0.01(-0.02%)

10015

Citigroup Inc., NYSE

C

78.4

-0.19(-0.24%)

19915

Deere & Company, NYSE

DE

169.88

-0.50(-0.29%)

203

Facebook, Inc.

FB

186.51

1.14(0.62%)

124808

Ford Motor Co.

F

12.03

0.01(0.08%)

34287

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.62

-0.37(-1.85%)

63817

General Electric Co

GE

16.31

0.14(0.87%)

334801

General Motors Company, NYSE

GM

43.12

-0.17(-0.39%)

1195

Goldman Sachs

GS

259.25

-2.27(-0.87%)

9871

Google Inc.

GOOG

1,159.00

3.19(0.28%)

6791

Hewlett-Packard Co.

HPQ

23.56

-0.29(-1.22%)

3971

Home Depot Inc

HD

204.89

0.43(0.21%)

437

HONEYWELL INTERNATIONAL INC.

HON

158.55

0.01(0.01%)

721

Intel Corp

INTC

45.97

0.22(0.48%)

29328

International Business Machines Co...

IBM

162.73

0.13(0.08%)

6304

Johnson & Johnson

JNJ

148.86

0.72(0.49%)

73819

JPMorgan Chase and Co

JPM

114

-0.33(-0.29%)

6122

McDonald's Corp

MCD

175.7

-0.51(-0.29%)

6752

Merck & Co Inc

MRK

61.38

0.13(0.21%)

778

Microsoft Corp

MSFT

91.8

0.19(0.21%)

43031

Nike

NKE

66.11

-0.28(-0.42%)

564

Pfizer Inc

PFE

36.96

0.03(0.08%)

7797

Procter & Gamble Co

PG

90.65

-1.24(-1.35%)

69667

Starbucks Corporation, NASDAQ

SBUX

61.3

-0.11(-0.18%)

3479

Tesla Motors, Inc., NASDAQ

TSLA

359.63

8.07(2.30%)

91282

Travelers Companies Inc

TRV

141.5

2.15(1.54%)

11455

Twitter, Inc., NYSE

TWTR

23.39

0.07(0.30%)

33801

United Technologies Corp

UTX

135.9

0.69(0.51%)

1904

Verizon Communications Inc

VZ

54.86

1.40(2.62%)

1814900

Visa

V

124.89

0.56(0.45%)

3827

Wal-Mart Stores Inc

WMT

106

0.55(0.52%)

2436

Walt Disney Co

DIS

111.3

0.20(0.18%)

6605

Yandex N.V., NASDAQ

YNDX

37.59

-0.38(-1.00%)

6200

-

14:43

Analyst coverage initiations before the market open

Honeywell (HON) initiated with a Buy at UBS

3M (MMM) initiated with a Neutral at UBS

General Electric (GE) initiated with a Neutral at UBS

-

14:43

Target price changes before the market open

Microsoft (MSFT) target raised to $92 at Stifel

-

14:42

Downgrades before the market open

HP (HPQ) downgraded to Equal-Weight from Overweight at Morgan Stanley

-

14:41

Upgrades before the market open

Caterpillar (CAT) upgraded to Buy from Neutral at Seaport Global Securities

-

14:11

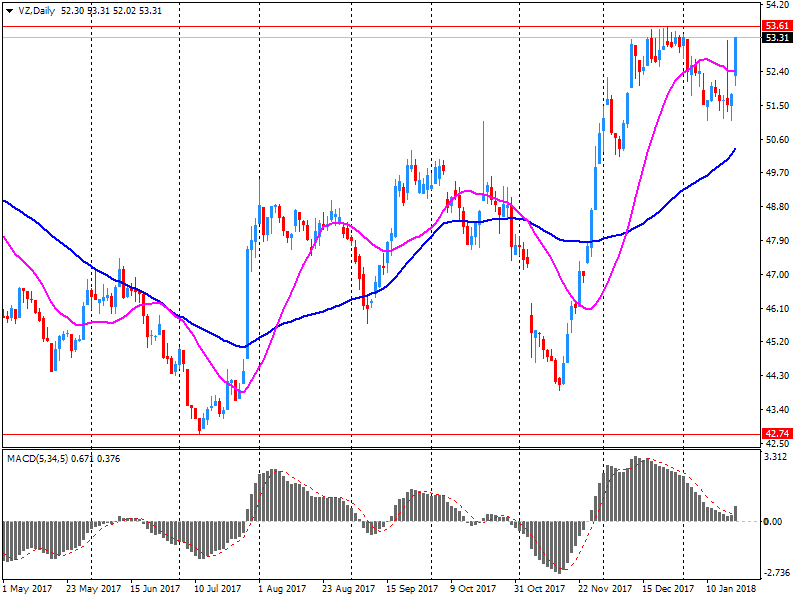

Company News: Verizon (VZ) quarterly earnings miss analysts’ estimate

Verizon (VZ) reported Q4 FY 2017 earnings of $0.86 per share (versus $0.86 in Q4 FY 2016), missing analysts' consensus estimate of $0.88.

The company's quarterly revenues amounted to $33.955 bln (+2.2% y/y), beating analysts' consensus estimate of $33.198 bln.

The company also announced it expected its 2018 EPS and sales would grow at low-single-digit percentage rates.

VZ rose to $53.95 (+0.92%) in pre-market trading.

-

13:57

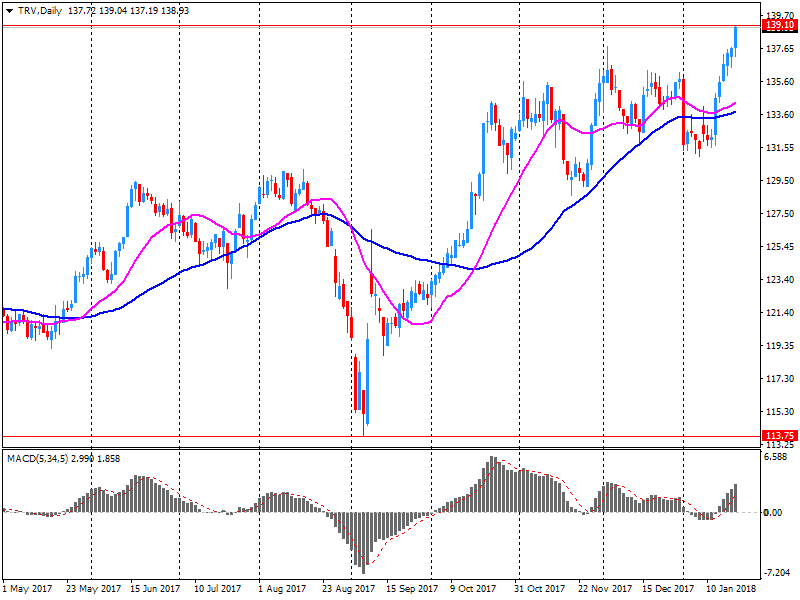

Company News: Travelers (TRV) quarterly results beat analysts’ forecasts

Travelers (TRV) reported Q4 FY 2017 earnings of $2.28 per share (versus $3.20 in Q4 FY 2016), beating analysts' consensus estimate of $1.42.

The company's quarterly revenues amounted to $7.451 bln (+3.6% y/y), beating analysts' consensus estimate of $6.466 bln.

TRV rose to $140.75 (+1.00%) in pre-market trading.

-

13:51

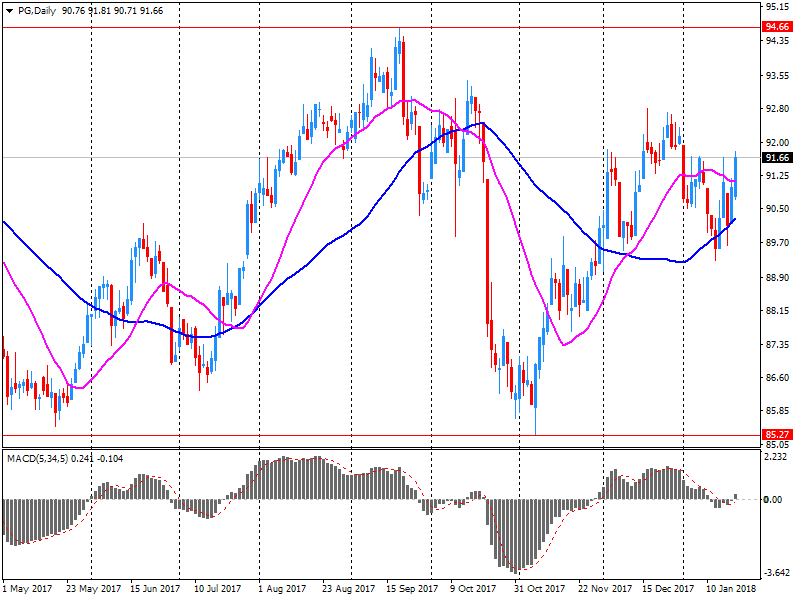

Company News: Procter & Gamble (PG) quarterly earnings beat analysts’ expectations

Procter & Gamble (PG) reported Q4 FY 2017 earnings of $1.19 per share (versus $1.08 in Q4 FY 2016), beating analysts' consensus estimate of $1.14.

The company's quarterly revenues amounted to $17.395 bln (+3.2% y/y), in-line with analysts' consensus estimate of $17.390 bln.

The company also announced it expected its 2018 EPS to increase by 5-8% y/y to ~$4.12-4.23 compared to earlier forecast growth of 5-7% y/y and analysts' consensus estimate of $4.17. At the same time, the 2018 revenues guidance was reaffirmed $67.0 bln (+3% y/y) versus analysts' consensus estimate of $67.12 bln.

PG fell to $90.45 (-1.57%) in pre-market trading.

-

13:34

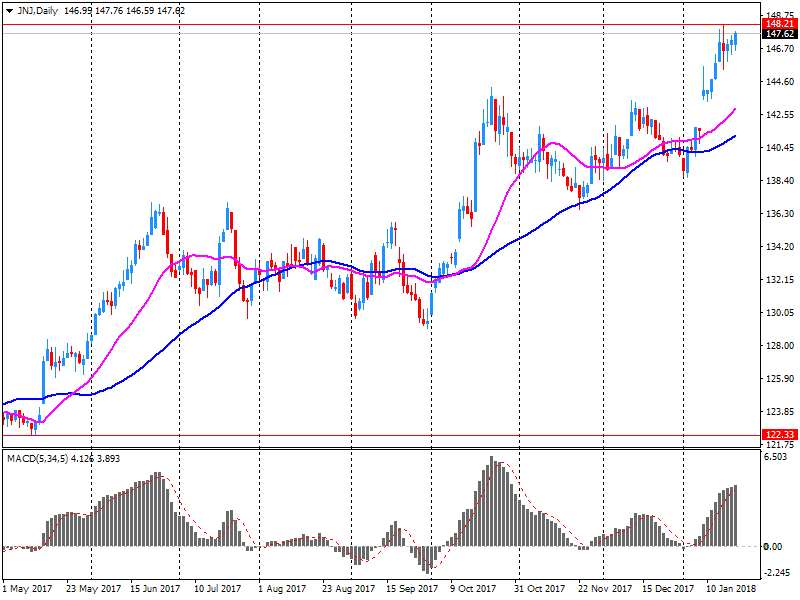

Company News: Johnson & Johnson (JNJ) quarterly earnings beat analysts’ estimate

Johnson & Johnson (JNJ) reported Q4 FY 2017 earnings of $1.74 per share (versus $1.58 in Q4 FY 2016), beating analysts' consensus estimate of $1.72.

The company's quarterly revenues amounted to $20.195 bln (+11.5% y/y), generally in-line with analysts' consensus estimate of $20.080 bln.

The company also issued guidance for FY 2018, projecting EPS of $8.00-8.20 (versus analysts' consensus estimate of $7.87) and revenues of $80.6-81.4 bln (versus analysts' consensus estimate of $80.71 bln).

JNJ rose to $149.50 (+0.92%) in pre-market trading.

-

09:44

Major European stock exchanges started trading in the green zone: FTSE 7724.68 +9.24 + 0.12%, DAX 13589.61 +125.92 + 0.94%, CAC 5563.58 +21.59 + 0.39%

-

08:30

Eurostoxx 50 futures up 0.6 pct, DAX futures up 0.8 pct, CAC 40 futures up 0.6 pct, FTSE futures up 0.4 pct, IBEX futures up 0.5 pct

-

07:33

Global Stocks

Europeans stocks pushed higher Monday, with Spanish and Greek shares gaining in the wake of sovereign ratings upgrades and closing at a 5-month and almost three-year highs, respectively. The Stoxx Europe 600 index SXXP, +0.31% ended up 0.3% at 402.11, closing at its highest since August 2015. Last week, the pan-European gauge rose for a third consecutive week.

U.S. stock-market indexes closed at records on Monday after the Senate approved a procedural bill that would allow the government to end a multiday shutdown. The S&P 500 SPX, +0.81% rose 22.67 points, or 0.8%, to 2,832.97. The tech-heavy Nasdaq Composite index COMP, +0.98% advanced 71.65 points, or 1%, to 7,408.03, largely fueled by gains in biotech shares.

Most Asian stock markets rose further Tuesday morning, with strong U.S. earnings lifting investor confidence. Major stock indexes in Japan, Hong Kong and South Korea SEU, +0.98% rose as much as 1% by midday after the U.S. Congress voted to end a government shutdown.

-

00:33

Stocks. Daily history for Jan 22’2018:

(index / closing price / change items /% change)

Nikkei +8.27 23816.33 +0.03%

TOPIX +2.18 1891.92 +0.12%

Hang Seng +138.52 32393.41 +0.43%

CSI 300 +51.20 4336.60 +1.19%

Euro Stoxx 50 +16.21 3665.28 +0.44%

FTSE 100 -15.35 7715.44 -0.20%

DAX +29.24 13463.69 +0.22%

CAC 40 +15.48 5541.99 +0.28%

DJIA +142.88 26214.60 +0.55%

S&P 500 +22.67 2832.97 +0.81%

NASDAQ +71.65 7408.03 +0.98%

S&P/TSX -5.48 16347.98 -0.03%

-