Noticias del mercado

-

22:09

The main US stock indexes finished trading without a single dynamics

Major US stock indexes ended the session in different directions after US Secretary of Commerce Wilber Ross called China's technological strategy in 2025 a "direct threat" and hinted at actions against Beijing.

A certain pressure on the indices was also provided by the US data. Data for January indicated another solid expansion of business activity in the private sector in the US, supported by the fastest growth in new orders within 5 months. At the same time, production continued to grow much faster than the activity of the service sector. The combined PMI index from IHS Markit for the US was 53.8 in January, compared with 54.1 in December, and showed the least noticeable pace of business expansion since May 2017. Nevertheless, the index for today remains above the threshold level of 50.0 for 23 consecutive months.

Meanwhile, home sales in the US fell more than expected in December, as housing supply in the market fell to a record low, pushing up prices and probably alienating some buyers. The National Association of Realtors (NAR) said that home sales in the secondary market declined in December by 3.6%, to 5.57 million units (seasonally adjusted and in annual terms). Meanwhile, the November sales were revised from 5.81 million to 5.78 million units, which is still the highest since February 2007. Economists predicted that housing sales in December will decrease only to 5.70 million units.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was the shares of The Goldman Sachs Group, Inc. (GS, + 2.05%). Outsider were shares of General Electric Company (GE, -2.22%).

Most sectors of S & P showed an increase. The commodities sector grew most (+ 1.0%). The largest decrease was shown by the sector of conglomerates (-0.6%).

At closing:

DJIA + 0.16% 26.252.19 +41.38

Nasdaq -0.61% 7,415.06 -45.23

S & P -0.05% 2.837.59 -1.54

-

21:02

DJIA +0.20% 26,261.96 +51.15 Nasdaq -0.38% 7,432.19 -28.10 S&P +0.07% 2,840.98 +1.85

-

18:00

European stocks closed: FTSE 100 -88.40 7643.43 -1.14% DAX -144.86 13414.74 -1.07% CAC 40 -40.10 5495.16 -0.72%

-

15:32

U.S. Stocks open: Dow +0.36% Nasdaq +0.15%, S&P +0.25%

-

15:26

Before the bell: S&P futures +-0.33%, NASDAQ futures +0.34%

U.S. stock-index futures rose on Wednesday following as a string of earnings from industrial giants buoyed market sentiment. Particular attention was paid to the financials of General Electric (GE) and United Technologies (UTX).

Global Stocks:

Nikkei 23,940.78 -183.37 -0.76%

Hang Seng 32,958.69 +27.99 +0.08%

Shanghai 3,560.73 +14.23 +0.40%

S&P/ASX 6,054.70 +17.70 +0.29%

FTSE 7,694.04 -37.79 -0.49%

CAC 5,529.79 -5.47 -0.10%

DAX 13,556.78 -2.82 -0.02%

Crude $64.70 (+0.36%)

Gold $1,351.60 (+1.11%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

1,379.05

16.51(1.21%)

98938

American Express Co

AXP

98

0.02(0.02%)

833

Apple Inc.

AAPL

177.83

0.79(0.45%)

196533

AT&T Inc

T

37.29

0.10(0.27%)

8852

Barrick Gold Corporation, NYSE

ABX

15.11

0.28(1.89%)

75191

Boeing Co

BA

337.16

1.57(0.47%)

8251

Caterpillar Inc

CAT

170.3

0.87(0.51%)

14565

Chevron Corp

CVX

131

-0.02(-0.02%)

1646

Cisco Systems Inc

CSCO

42.28

0.18(0.43%)

2839

Citigroup Inc., NYSE

C

79

0.45(0.57%)

16076

Deere & Company, NYSE

DE

169.49

0.83(0.49%)

1002

Exxon Mobil Corp

XOM

88.4

0.10(0.11%)

1996

Facebook, Inc.

FB

190.21

0.86(0.45%)

131884

Ford Motor Co.

F

12.02

0.06(0.50%)

40467

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.85

0.30(1.53%)

20486

General Electric Co

GE

17.78

0.89(5.27%)

5886527

Goldman Sachs

GS

260.22

0.13(0.05%)

4024

Google Inc.

GOOG

1,179.34

9.37(0.80%)

6109

Hewlett-Packard Co.

HPQ

23.93

0.12(0.50%)

2137

Home Depot Inc

HD

205.5

0.60(0.29%)

1785

Intel Corp

INTC

45.85

-0.21(-0.46%)

20097

International Business Machines Co...

IBM

166.7

0.45(0.27%)

8858

Johnson & Johnson

JNJ

142.7

0.87(0.61%)

37732

JPMorgan Chase and Co

JPM

114.79

0.58(0.51%)

18758

Microsoft Corp

MSFT

92.39

0.49(0.53%)

43058

Nike

NKE

67.01

-0.13(-0.19%)

1886

Pfizer Inc

PFE

36.95

0.13(0.35%)

3588

Procter & Gamble Co

PG

89.3

0.25(0.28%)

4460

Starbucks Corporation, NASDAQ

SBUX

61.65

-0.04(-0.06%)

6439

Tesla Motors, Inc., NASDAQ

TSLA

355.55

2.76(0.78%)

24472

Twitter, Inc., NYSE

TWTR

22.86

0.11(0.48%)

73728

United Technologies Corp

UTX

135.3

-0.73(-0.54%)

57819

UnitedHealth Group Inc

UNH

246.02

0.81(0.33%)

195

Verizon Communications Inc

VZ

53.25

0.02(0.04%)

3230

Visa

V

125.15

0.50(0.40%)

8794

Wal-Mart Stores Inc

WMT

106.27

0.37(0.35%)

14491

Walt Disney Co

DIS

110.83

0.42(0.38%)

504

Yandex N.V., NASDAQ

YNDX

38.01

-0.02(-0.05%)

310

-

14:53

Analyst coverage initiations before the market open

Microsoft (MSFT) initiated with a Buy at Nomura; target $102

-

14:52

Target price changes before the market open

Caterpillar (CAT) target raised to $180 from $162 at Barclays

Home Depot (HD) target raised to $222 from $183 at Credit Suisse

Chevron (CVX) target raised to $145 from $130 at Morgan Stanley

Johnson & Johnson (JNJ) target raised to $145 at Stifel

Amazon (AMZN) target raised to $1475 from $1350 at JMP Securities

-

13:15

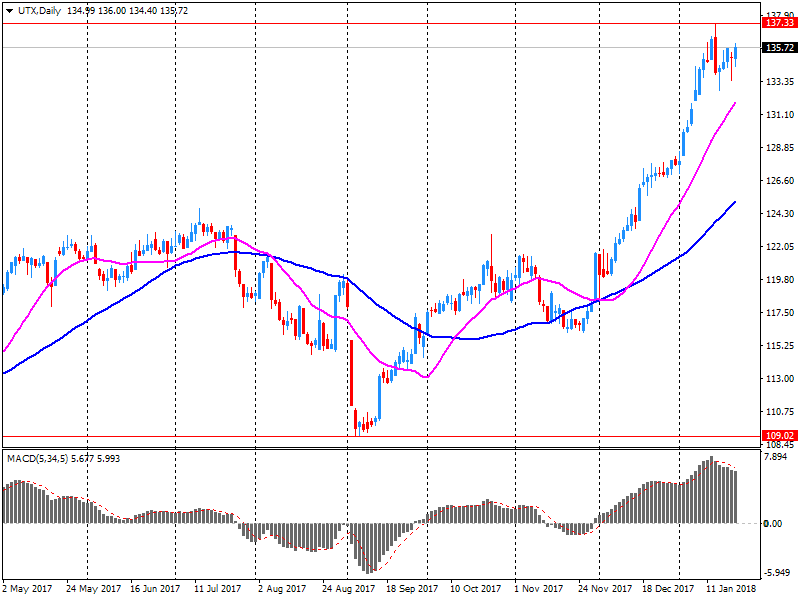

Company News: United Tech (UTX) quarterly results beat analysts’ expectations

United Tech (UTX) reported Q4 FY 2017 earnings of $1.60 per share (versus $1.56 in Q4 FY 2016), beating analysts' consensus estimate of $1.56.

The company's quarterly revenues amounted to $15.680 bln (+7.0% y/y), beating analysts' consensus estimate of $15.344 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $6.85-7.10 (versus analysts' consensus estimate of $6.97) and revenues of $62.5-64.0 bln (versus analysts' consensus estimate of $62.97 bln).

UTX fell to $136.00 (-0.02%) in pre-market trading.

-

13:04

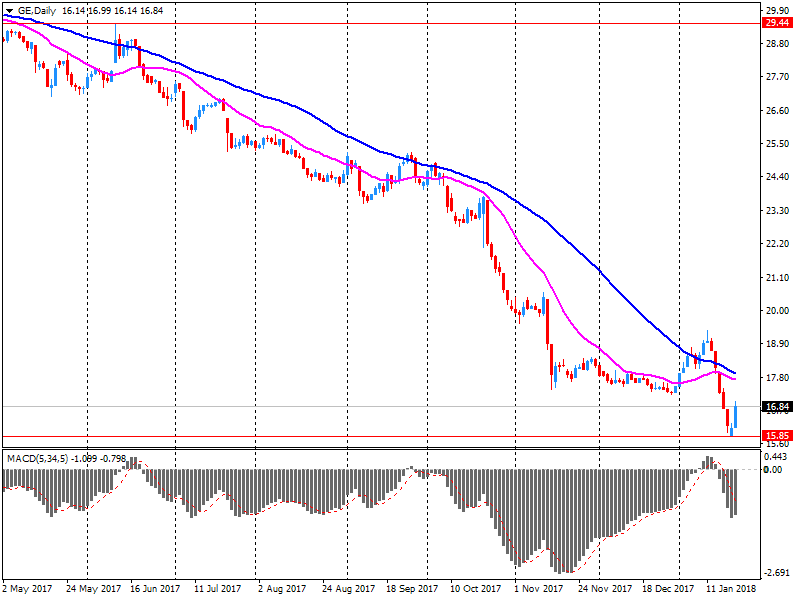

Company News: General Electric (GE) quarterly results miss analysts’ estimates

General Electric (GE) reported Q4 FY 2017 earnings of $0.27 per share (versus $0.46 in Q4 FY 2016), missing analysts' consensus estimate of $0.28.

The company's quarterly revenues amounted to $31.402 bln (-5.1% y/y), missing analysts' consensus estimate of $33.927 bln.

The company reaffirmed guidance for FY 2018, projecting EPS of $1.00-1.07 versus analysts' consensus estimate of $1.01.

GE rose to $17.06 (+1.01%) in pre-market trading.

-

09:30

Major stock exchanges in Europe trading mixed: FTSE 7723.48 -8.35 -0.11%, DAX 13567.19 +7.59 + 0.06%, CAC 5527.61 -7.65 -0.14%

-

08:19

Eurostoxx 50 futures up 0.14 pct, DAX futures up 0.08 pct, CAC 40 futures up 0.10 pct, FTSE futures down 0.03 pct

-

07:34

Global Stocks

Europeans stocks pushed higher Monday, with Spanish and Greek shares gaining in the wake of sovereign ratings upgrades and closing at a 5-month and almost three-year highs, respectively. The Stoxx Europe 600 index SXXP, +0.17% ended up 0.3% at 402.11, closing at its highest since August 2015. Last week, the pan-European gauge rose for a third consecutive week.

U.S. stocks mostly rose on Tuesday, with the S&P 500 and the Nasdaq ending at an all-time highs, a day after a partial shutdown of the government came to an end. The S&P 500 index SPX, +0.22% closed up 0.2% at 2,839, the Nasdaq Composite Index COMP, +0.71% closed up 0.7% at 7,460.

Asia's blazing stock rally took a pause on Wednesday as investors took stock of the best start to a year for the region since 2006. A strengthening yen hit Japanese shares, and a record winning streak for Chinese stocks in Hong Kong was at risk of finally ending.

-

00:36

Stocks. Daily history for Jan 23’2018:

(index / closing price / change items /% change)

Nikkei +307.82 24124.15 +1.29%

TOPIX +19.15 1911.07 +1.01%

Hang Seng +537.29 32930.70 +1.66%

CSI 300 +46.01 4382.61 +1.06%

Euro Stoxx 50 +7.01 3672.29 +0.19%

FTSE 100 +16.39 7731.83 +0.21%

DAX +95.91 13559.60 +0.71%

CAC 40 -6.73 5535.26 -0.12%

DJIA -3.79 26210.81 -0.01%

S&P 500 +6.16 2839.13 +0.22%

NASDAQ +52.26 7460.29 +0.71%

S&P/TSX +9.57 16357.55 +0.06%

-