Noticias del mercado

-

22:07

The main US stock indexes completed the session in a positive territory

The main US stock indexes showed a moderate increase, which was supported by strong reports of companies in the retail sector.

The sentiment of investors also gained momentum after the minutes of the last meeting of the Federal Reserve showed that politicians expect the economy to pick up momentum and raise interest rates sooner rather than later.

In addition, as it became known, the number of Americans applying for unemployment benefits last week grew less than expected, and the four-week moving average fell to a 44-year low, which suggests a further tightening of the labor market situation. Initial claims for unemployment benefits rose by 1,000 and, taking into account seasonal fluctuations, reached 234,000 for the week of May 20. This growth followed three weeks of decline.

At the same time, the deficit of international trade in April was 67.6 billion, which is 2.5 billion more than in March, when the deficit reached 65.1 billion. The export of goods for April amounted to 125.9 billion, which is 1.1 Billion less than in March. Imports of goods for April amounted to 193.4 billion, which is 1.4 billion more than in March.

Oil prices fell by about 5% on Thursday after OPEC approved the extension of the current agreement to reduce oil production for nine months, until March 2018, but refused to consider a possibility of a more significant decline in production.

Most components of the DOW index recorded a rise (22 out of 30). The leader of growth was shares UnitedHealth Group Incorporated (UNH, + 1.62%). The shares of E.I. du Pont de Nemours and Company fell more than others (DD, -1.25%).

Most sectors of the S & P index finished trading in positive territory. The leader of growth was the service sector (+ 1.0%). Most of all fell the sector of basic materials (-1.2%).

At closing:

DJIA + 0.33% 21,082.61 +70.19

Nasdaq + 0.69% 6.205.26 +42.24

S & P + 0.44% 2.415.04 +10.65

-

21:00

DJIA +0.38% 21,092.41 +79.99 Nasdaq +0.85% 6,215.34 +52.32 S&P +0.51% 2,416.75 +12.36

-

18:00

European stocks closed: FTSE 100 +2.81 7517.71 +0.04% DAX -21.15 12621.72 -0.17% CAC 40 -4.18 5337.16 -0.08%

-

15:34

U.S. Stocks open: Dow +0.23%, Nasdaq +0.31%, S&P +0.19%

-

15:26

Before the bell: S&P futures +0.24%, NASDAQ futures +0.39%

U.S. stock-index futures rose as the minutes of the Fed's May meeting signaled that the U.S. central bank's officials had good confidence in the economic outlook and expected to raise interest rates soon.

Stocks:

Nikkei 19,813.13 +70.15 +0.36%

Hang Seng 25,630.78 +202.28 +0.80%

Shanghai 3,107.87 +43.80 +1.43%

S&P/ASX 5,789.63 +20.65 +0.36%

FTSE 7,509.25 -5.65 -0.08%

CAC 5,344.53 +3.19 +0.06%

DAX 12,628.69 -14.18 -0.11%

Crude $50.75 (-1.19%)

Gold $1,256.60 (-0.28%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

73.58

0.73(1.00%)

310

Amazon.com Inc., NASDAQ

AMZN

984.4

4.05(0.41%)

34070

Apple Inc.

AAPL

153.86

0.52(0.34%)

96223

AT&T Inc

T

38.25

0.10(0.26%)

528

Barrick Gold Corporation, NYSE

ABX

16.59

-0.12(-0.72%)

18725

Caterpillar Inc

CAT

104.01

0.06(0.06%)

1879

Chevron Corp

CVX

105.94

-0.28(-0.26%)

1280

Cisco Systems Inc

CSCO

31.54

0.05(0.16%)

860

Citigroup Inc., NYSE

C

62.5

0.23(0.37%)

4932

Exxon Mobil Corp

XOM

82.09

-0.20(-0.24%)

7283

Facebook, Inc.

FB

150.31

0.27(0.18%)

55131

Ford Motor Co.

F

10.98

0.02(0.18%)

4407

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.95

0.05(0.42%)

785

General Electric Co

GE

27.84

0.01(0.04%)

18512

Goldman Sachs

GS

224.55

0.72(0.32%)

2649

Google Inc.

GOOG

958.65

3.69(0.39%)

4664

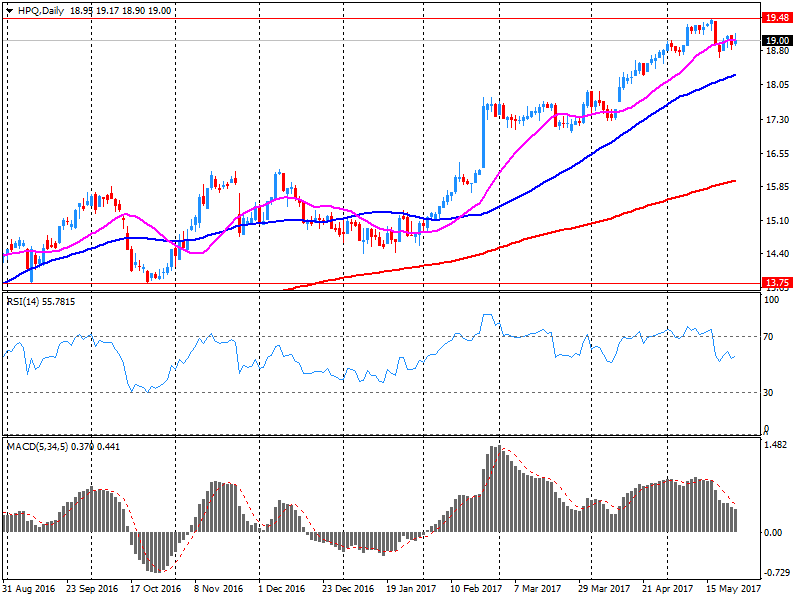

Hewlett-Packard Co.

HPQ

19.69

0.68(3.58%)

19805

Home Depot Inc

HD

155.62

0.62(0.40%)

2509

Intel Corp

INTC

36.18

0.06(0.17%)

161520

Johnson & Johnson

JNJ

127.46

0.79(0.62%)

218

JPMorgan Chase and Co

JPM

85.93

0.22(0.26%)

8083

Merck & Co Inc

MRK

64.99

0.06(0.09%)

131

Microsoft Corp

MSFT

69

0.23(0.33%)

8534

Nike

NKE

52.2

0.19(0.37%)

1126

Procter & Gamble Co

PG

86.74

0.24(0.28%)

621

Starbucks Corporation, NASDAQ

SBUX

62.1

0.21(0.34%)

2118

Tesla Motors, Inc., NASDAQ

TSLA

311.07

0.85(0.27%)

21767

The Coca-Cola Co

KO

44.93

-0.10(-0.22%)

3076

Twitter, Inc., NYSE

TWTR

18.05

0.07(0.39%)

25542

Verizon Communications Inc

VZ

45.1

0.06(0.13%)

3058

Visa

V

95.3

0.49(0.52%)

1401

Walt Disney Co

DIS

107.99

0.28(0.26%)

359

Yandex N.V., NASDAQ

YNDX

28.7

0.23(0.81%)

585

-

14:41

Analyst coverage initiations before the market open

Altria (MO) initiated with an Overweight at Piper Jaffray

-

14:41

Target price changes before the market open

McDonald's (MCD) target raised to $170 from $160 at Bernstein

-

13:51

Company News: HP Inc. (HPQ) quarterly results beat analysts’ estimates

HP Inc. (HPQ) reported Q2 FY 2017 earnings of $0.40 per share (versus $0.41 in Q2 FY 2016), beating analysts' consensus estimate of $0.39.

The company's quarterly revenues amounted to $12.400 bln (+7% y/y), beating analysts' consensus estimate of $11.933 bln.

The company raised guidance for FY 2017, projecting EPS of $1.59-1.66 versus analysts' consensus estimate of $1.62.

HPQ rose to $19.60 (+3.10%) in pre-market trading.

-

10:16

Major European stock exchanges trading in the green zone: FTSE 7522.59 +7.69 + 0.10%, DAX 12662.43 +19.56 + 0.15%, CAC 5362.40 +21.06 + 0.39%

-

07:36

Global Stocks

Most major European stock markets closed out a choppy session slightly lower, with investors staying on the sidelines ahead of the Federal Reserve minutes due later in the day. Dovish comments from European Central Bank President Mario Draghi did little to pull markets out of their narrow trading ranges.

The S&P 500 gained ground for a fifth consecutive session Wednesday to close at a record as minutes of the Federal Reserve's latest policy meeting showed broad agreement on plans to begin shrinking the central bank's balance sheet and also pointed to a likely rate increase next month, as widely expected.

Chinese stocks closed higher Wednesday, shaking off losses as initial concerns wore off from Moody's Investors Service's decision to lower the country's credit rating for the first time since 1989. Equities fell more than 1% in early trading in both Shanghai and Shenzhen, with the downgrade reminding investors of China's continued growth in outstanding borrowings-especially among companies.

-

00:31

Stocks. Daily history for May 24’2017:

(index / closing price / change items /% change)

Nikkei +129.70 19742.98 +0.66%

TOPIX +9.89 1575.11 +0.63%

Hang Seng +25.35 25428.50 +0.10%

CSI 300 -0.02 3424.17 +0.00%

Euro Stoxx 50 -8.41 3586.62 -0.23%

FTSE 100 +29.61 7514.90 +0.40%

DAX -16.28 12642.87 -0.13%

CAC 40 -6.82 5341.34 -0.13%

DJIA +74.51 21012.42 +0.36%

S&P 500 +5.97 2404.39 +0.25%

NASDAQ +24.31 6163.02 +0.40%

S&P/TSX -57.45 15419.49 -0.37%

-