Noticias del mercado

-

22:22

U.S. stocks closed

Most U.S. stocks rose in light trading, while bonds fluctuated as signs Russia won't escalate tensions after the downing of its warplane saw investors to shift their attention to evidence the American economy is robust enough to withstand higher interest rates.

The Russell 2000 Index of small-cap equities led gains, while the Standard & Poor's 500 Index meandered amid below-average volumes ahead of Thursday's Thanksgiving holiday in the U.S. The dollar strengthened as orders data added to the picture of a stabilization in manufacturing, even as consumer spending climbed less than was forecast. The euro slipped to a seven-month low on bets regional policy makers will bolster stimulus, while crude oil rose above $43 a barrel. Brazilian assets tumbled as a graft scandal widened.

U.S. and German leaders called for an easing of tensions a day after Turkey's downing of the Russian jet threatened to escalate the conflict in Syria, unsettling financial markets. In the U.S., the biggest part of the economy is off to a slow start to the holiday season, adding an element of doubt as to the strength of the economic recovery even as goods orders pick up. Speculation is mounting that the Federal Reserve will boost interest rates before the year is out, just as the European Central Bank increases stimulus.

The S&P 500 fell less than 0.1 percent to 2,088.87 as of 4 p.m. in New York, capping its third straight move of less than 0.2 percent following its best weekly advance this year. Trading in S&P 500 stocks was 31 percent below the 30-day average. The Russell 200 jumped 0.8 percent to its highest level since Nov. 6.

Energy shares trimmed earlier declines after U.S. government data showed crude-oil stockpiles rose less than analysts forecast. Pfizer Inc. climbed 2.8 percent to lead health-care companies' advance. Macy's Inc. gained 1.9 percent and travel-related companies rebounded to pace an increase among consumer discretionary companies.

-

21:00

DJIA 17836.91 24.72 0.14%, NASDAQ 5120.73 17.92 0.35%, S&P 500 2091.47 2.33 0.11%

-

18:16

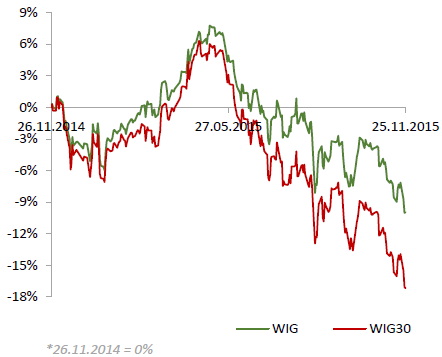

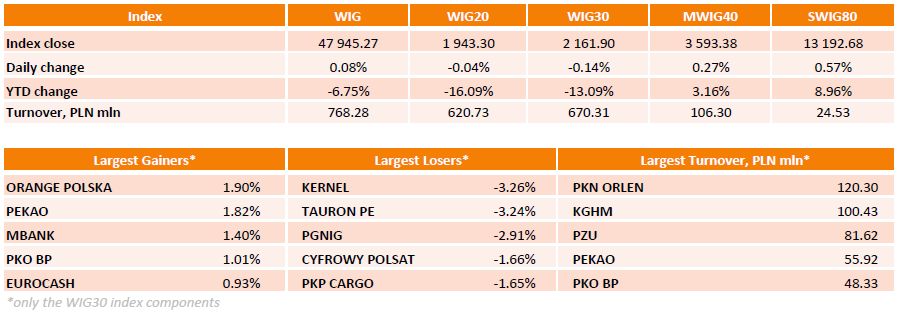

WSE: Session Results

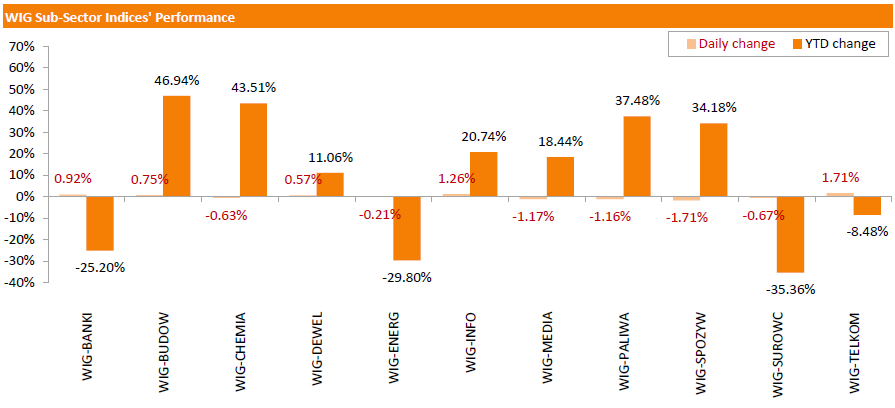

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index, edged up 0.08%. Sector performance in the WIG Index was mixed. Telecommunication sector (+1.71%) was best performer, while food sector (-1.71%) recorded the worst result.

The large-cap stocks fell by 0.14%, as measured by the WIG30 Index. Within the index components, Ukrainian agricultural producer KERNEL (WSE: KER) led the decliners, tumbling by 3.26% on the back of weak Q1 FY2016 financials. The company reported quarterly revenue of $377.7 mln (-35% y/y), EBITDA of $55.1 mln (-32% y/y) and net profit of $23.9 mln (+2% y/y). The other biggest losers were utilities name TAURON PE (WSE: TPE) and oil and gas sector stock PGNIG (WSE: PGN), plunging by 3.24% and 2.91% respectively. On the other side of the ledger, telecoms name ORANGE POLSKE (WSE: OPL) led the gainers with a 1.9% advance, followed by banking sector stocks PEKAO (WSE: PEO), MBANK (WSE: MBK) and PKO BP (WSE: PKO), adding 1.82, 1.4% and 1.01% respectively.

-

18:10

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly higher in quiet trading on Wednesday morning, led by healthcare and consumer stocks after a flood of data that suggested that the U.S. economy was growing modestly. The data left intact expectations that the Federal Reserve will raise interest rates for the first time since 2006 when it meets for the last time this year on Dec. 15-16.

Data showed claims for jobless benefits fell more than expected to 260,000 last week, while durable goods orders for October, excluding aircraft, increased 1.3%, far more than the 0.4% expected.

Dow stocks mixed (16 in positive area, 14 in negative). Top looser - International Business Machines Corporation (IBM, -0.80%). Top gainer - Pfizer Inc. (PFE. +3.17%).

S&P index sectors also mixed. Top looser - Utilities (-1.2%). Top gainer - Healthcare (+1,2%).

At the moment:

Dow 17798.00 +33.00 +0.19%

S&P 500 2088.50 +3.75 +0.18%

Nasdaq 100 4679.25 +13.25 +0.28%

Oil 42.41 -0.46 -1.07%

Gold 1071.30 -2.50 -0.23%

U.S. 10yr 2.23 -0.01

-

18:00

European stocks close: stocks closed higher on a weaker euro and company news

Stock indices closed higher on a weaker euro and company news. The euro fell against the U.S. dollar as the greenback was supported by speculation that the Fed will start raising its interest rates next month and on the positive U.S. economic data.

The U.K. Office for Budget Responsibility (OBR) released its Autumn Forecasts on Wednesday. The U.K. economy is expected to expand 2.4% in 2015, remained unchanged, and 2.4% in 2016, up from its previous forecast of 2.3% growth.

The U.K. economy is expected to grow at 2.5% in 2017, up from its previous forecast of 2.4%, at 2.4% in 2018, at 2.3% in 2019 and 2020.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 45,437 in October from 44,825 in September. September's figure was revised down from 44,489.

"These statistics show that housing market activity remained strong in October. Consumers remain confident and their incomes are growing. Mortgage rates are at multi-year lows and people are snapping up the very competitive deals being offered by banks," the chief economist at the BBA, Richard Woolhouse, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,337.64 +60.41 +0.96 %

DAX 11,169.54 +235.55 +2.15 %

CAC 40 4,892.99 +72.71 +1.51 %

-

18:00

European stocks closed: FTSE 6337.64 60.41 0.96%, DAX 11169.54 235.55 2.15%, CAC 40 4892.99 72.71 1.51%

-

17:44

European Central Bank will pause its asset-buying programme between December 22 and January 1

The European Central Bank (ECB) will pause its asset-buying programme between December 22 and January 1. The central bank will resume its purchases on January 04.

"Purchases during the period 27 November to 21 December will be somewhat frontloaded to take advantage of the relatively better market conditions expected during the early part of the month," the ECB said.

The central bank will review its stimulus measures at its next meeting in December.

-

17:23

Bank of Japan board member Sayuri Shirai: there is no need for further stimulus measures

The Bank of Japan (BoJ) board member Sayuri Shirai said in a speech on Wednesday that there is no need for further stimulus measures.

"At present, further monetary policy action is unnecessary. A risk of returning to deflation is considered low given that prices of a wide range of consumption items, excluding energy, have been rising," she said.

Shirai forecasted the core inflation in Japan to rise to around 1.7% - 1.8% over the January-June period of 2017.

She pointed out that the low core inflation is temporary.

-

17:14

Autumn Forecasts: 2016 U.K. GDP growth is upgraded

The U.K. Office for Budget Responsibility (OBR) released its Autumn Forecasts on Wednesday. The U.K. economy is expected to expand 2.4% in 2015, remained unchanged, and 2.4% in 2016, up from its previous forecast of 2.3% growth.

The U.K. economy is expected to grow at 2.5% in 2017, up from its previous forecast of 2.4%, at 2.4% in 2018, at 2.3% in 2019 and 2020.

The debt ratio for this year was downgraded to 82.5% of GDP from July forecast of 83.6%. The debt ratio is expected to be 79.9% in 2017-18, and 71.3% in 2020-21.

The U.K. budget deficit is expected to be 3.9% of GDP in 2015, 2.5% in 2016, 1.2% in 2017-18, declining to 0.2% in the year after, and turning into a surplus of 0.5% in 2019-20, while increasing to 0.6% in the following year.

The U.K. Chancellor George Osborne said in the Autumn Statement on Wednesday that global growth and global trade outlook were revised down.

"I can tell the House that in today's forecast, the expectations for world growth and world trade have been revised down again. The weakness of the euro zone remains a persistent problem; there are rising concerns about debt in emerging economies," he said.

Osborne noted that the government's debt will decline.

"We promised to bring our debts down. Today, the forecast I present shows that after the longest period of rising debt in our modern history, this year our debt will fall and keep falling in every year that follows," he said.

-

16:43

Thomson Reuters/University of Michigan final consumer sentiment index rises to 91.3 in November

The Thomson Reuters/University of Michigan final consumer sentiment index increased to 91.3 in November from 90.0 in October, down from the preliminary estimate of 93.1.

"The data indicate that consumers have become increasingly aware of economic cross currents in the domestic as well as the global economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index rose to 104.3 in November 102.3 in October, down from a preliminary reading of 104.8.

The index of consumer expectations was up to 82.9 in November from 82.1 in October, down from a preliminary reading of 85.6.

The inflation expectations for the next year remained unchanged at 2.7% in November, up from a preliminary reading of 2.5%.

-

16:29

New home sales in the U.S. jump 10.7% in October

The U.S. Commerce Department released new home sales data on Wednesday. New home sales increased 10.7% to a seasonally adjusted annual rate of 495,000 units in October from 447,000 units in September. September's figure was revised down from 468,000 units.

Analysts had expected new home sales to reach 500,000 units.

The increase was mainly driven by higher sales in the Northeast. New home sales in the Northeast soared 135.3% in October.

-

16:22

U.S. preliminary services purchasing managers' index rises to 56.5 in November

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary services purchasing managers' index (PMI) climbed to 56.5 in November from 54.8 in October. It was the highest level since April.

Analysts had expected the index to rise to 55.0.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a new business growth.

"The US economy is showing further robust economic growth in the fourth quarter, with the pace of expansion picking up in November. The upturn in the flash PMI brings the surveys up to a level indicative of 2.3% annualised GDP growth in November, up from 1.8% in October," Markit Chief Economist Chris Williamson.

-

15:35

U.S. Stocks open: Dow +0.09%, Nasdaq +0.12%, S&P +0.04%

-

15:27

U.S. house price index rise 0.8% in September

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Wednesday. The U.S. house price index rose 0.8% on a seasonally adjusted basis in September, exceeding expectations for a 0.5% increase, after a 0.3% gain in August.

On a quarterly basis, U.S. house prices climbed 1.3% in the third quarter.

"The long-anticipated slowdown in home price appreciation did not occur in the third quarter. The factors that have contributed to extraordinary price growth over the last few years-low interest rates, tight inventories, strong buyer confidence, and improving income growth-continued to drive prices upward in much of the country. However, as prices continue to rise, reduced affordability will be a stronger market headwind," FHFA Principal Economist Andrew Leventis said.

-

15:26

Before the bell: S&P futures +0.20%, NASDAQ futures +0.25%

U.S. stock-index futures advanced .

Global Stocks:

Nikkei 19,847.58 -77.31 -0.39%

Hang Seng 22,498 -89.63 -0.40%

Shanghai Composite 3,647.85 +31.74 +0.88%

FTSE 6,337.67 +60.44 +0.96%

CAC 4,890.65 +70.37 +1.46%

DAX 11,134.4 +200.41 +1.83%

Crude oil $42.04 (-1.94%)

Gold $1069.50 (-0.40%)

-

15:18

U.S. personal spending climbs 0.1% in October

The U.S. Commerce Department released personal spending and income figures on Wednesday. Personal spending rose 0.1% in October, missing expectations for a 0.3% gain, after a 0.1% increase in September.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 3.0% in the third quarter, after a 3.6% increase in the second quarter.

This data suggests that American consumers were cautious.

Spending on durable goods was flat in October, while spending on services increased by 0.1%.

The saving rate climbed was 5.6% in October, the highest level since December 2012, up from 5.3% in September.

Personal income increased 0.4% in October, in line with expectations, after a 0.2% gain in September. September's figure was revised up from a 0.1% increase.

Wages and salaries were up 0.6% in October.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in October, missing forecasts of a 0.1% increase, after a 0.2% gain in September. September's figure was revised up from a 0.1% rise.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.3% in October, in line with expectations.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Deere & Company, NYSE

DE

80.00

4.79%

32.5K

Yandex N.V., NASDAQ

YNDX

17.40

1.81%

0.1K

Pfizer Inc

PFE

32.27

0.94%

12.6K

Tesla Motors, Inc., NASDAQ

TSLA

220.15

0.87%

8.3K

Twitter, Inc., NYSE

TWTR

25.73

0.82%

7.8K

Caterpillar Inc

CAT

71.85

0.63%

1.1K

Amazon.com Inc., NASDAQ

AMZN

674.70

0.53%

14.0K

Facebook, Inc.

FB

106.19

0.43%

58.0K

Nike

NKE

133.05

0.41%

5.4K

Google Inc.

GOOG

750.89

0.35%

0.6K

AT&T Inc

T

33.50

0.33%

0.4K

Wal-Mart Stores Inc

WMT

60.10

0.30%

1.0K

JPMorgan Chase and Co

JPM

66.95

0.25%

39.0K

Citigroup Inc., NYSE

C

54.30

0.22%

45.0K

Procter & Gamble Co

PG

76.60

0.20%

1.5K

International Business Machines Co...

IBM

138.85

0.18%

0.4K

Walt Disney Co

DIS

118.11

0.14%

99.3K

AMERICAN INTERNATIONAL GROUP

AIG

63.20

0.13%

0.1K

ALCOA INC.

AA

9.10

0.11%

8.2K

Visa

V

79.85

0.08%

0.8K

Home Depot Inc

HD

133.70

0.07%

2.4K

Apple Inc.

AAPL

118.96

0.07%

85.1K

Johnson & Johnson

JNJ

102.10

0.06%

0.7K

Microsoft Corp

MSFT

54.28

0.06%

8.6K

Starbucks Corporation, NASDAQ

SBUX

62.00

0.06%

0.1K

The Coca-Cola Co

KO

43.36

0.00%

0.7K

Ford Motor Co.

F

14.55

0.00%

7.8K

Cisco Systems Inc

CSCO

27.25

-0.07%

0.5K

American Express Co

AXP

71.52

-0.15%

0.1K

General Electric Co

GE

30.59

-0.23%

5.9K

Exxon Mobil Corp

XOM

81.50

-0.46%

2.3K

Intel Corp

INTC

34.20

-0.47%

0.2K

Yahoo! Inc., NASDAQ

YHOO

32.75

-0.64%

1.8K

Barrick Gold Corporation, NYSE

ABX

7.26

-1.63%

10.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.13

-2.05%

39.4K

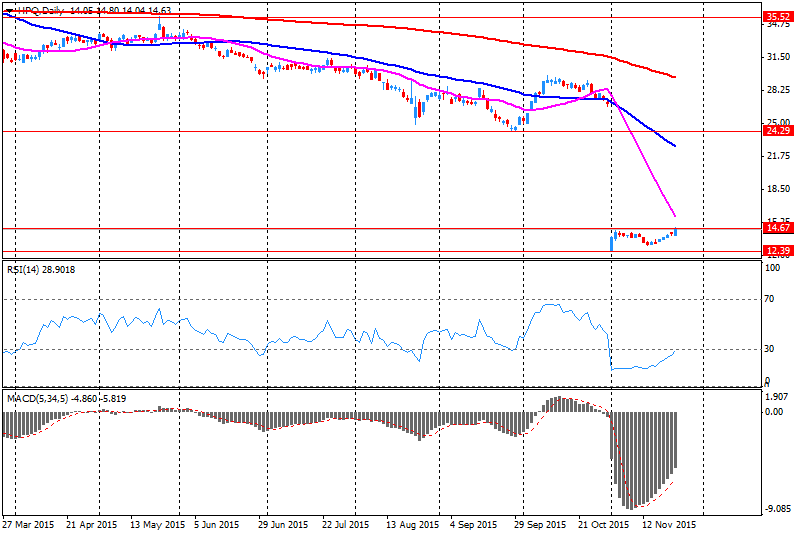

Hewlett-Packard Co.

HPQ

13.33

-8.95%

9.5K

-

14:59

U.S. durable goods orders climb 3.0% in October

The U.S. Commerce Department released durable goods orders data on Wednesday. The U.S. durable goods orders climbed 3.0% in October, exceeding expectations for a 1.5% rise, after a 0.8% drop in September. September's figure was revised up from a 1.2% fall.

The rise was partly driven by a strong demand for transportation equipment, which soared by 8.0% in October.

The U.S. durable goods orders excluding transportation increased 0.5% in October, beating expectations for a 0.3% gain, after a 0.1% decrease in September. September's figure was revised up from a 0.4% drop.

The U.S. durable goods orders excluding defence jumped 3.2 % in October, after a 1.6% decline in September. September's figure was revised up from a 2.0% decrease.

-

14:50

Initial jobless claims decline to 260,000 in the week ending November 21

The U.S. Labor Department released its jobless claims figures on Wednesday. The number of initial jobless claims in the week ending November 21 in the U.S. fell by 12,000 to 260,000 from 272,000 in the previous week, exceeding expectations for a decline to 270,000. The previous week's figure was revised up from 271,000.

Jobless claims remained below 300,000 the 38th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 34,000 to 2,207,000 in the week ended November 14.

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Pfizer (PFE) upgraded to Neutral from Reduce at Sun Trust Rbsn Humphrey

Downgrades:

HP (HPQ) downgraded to Hold from Buy at Needham

Other:

American Express (AXP) initiated with a Neutral at Piper Jaffray

-

14:39

Industrial turnover in Italy drops at a seasonally adjusted rate of 0.1% in September

The Italian statistical office Istat released its industrial orders data for Italy on Wednesday. Industrial turnover in Italy dropped at a seasonally adjusted rate of 0.1% in September, after a 1.6% decrease in August.

Domestic market orders plunged 1.0% in September, while demand from non-domestic markets fell by 3.2%.

On a yearly basis, the seasonally adjusted industrial turnover in Italy slid 0.9% in September, after a 2.5% drop in August. August's figure was revised down from a 2.4% fall.

The seasonally adjusted industrial new orders index dropped by 2.0% month-on-month in September, after a 5.2% fall in August.

-

14:39

-

14:27

Company News: Hewlett Packard Enterprise Co. (HPE) Q4 revenue beats expectations

Hewlett Packard Enterprise Co. posted FY 2015 revenues of $14.100 bln, beating analysts' consensus of $13.489 bln.

The company also reported FY 2015 earnings of $1.84 versus consensus estimate of $. $1.86.

Hewlett Packard Enterprise Co. reaffirmed EPS FY16 outlook of $1.85-1.95 (versus consensus of $1.91).

HPE rose to $14.06 (+2.70%) in pre-market trading.

-

14:25

Company News: HP Inc. (HPQ) Posts Worse-than-Expected Quarterly Results

HP Inc. reported Q4 earnings of $0.93 per share (versus $1.06 per share in the corresponding period of the previous year), missing analysts' consensus of $0.97.

The company's revenues amounted to $25.714 bln (-9.5%), missing consensus estimate of $26.718 bln.

HP Inc. issued downside guidance for Q1 FY 2016, projecting EPS of $0.33-0.38 versus consensus of $0.42. For FY 2016, the company forecasted EPS of $1.59-1.69 versus prior guidance of $1.67-1.77 and analysts' estimate of $1.71.

HPQ fell to $13.39 (-8.54%) in pre-market trading.

-

14:22

Italian retail sales decline by 0.1% in September

The Italian statistical office Istat released its retail sales data for Italy on Wednesday. Italian retail sales declined by 0.1% in September, after a 0.2% increase in August. July's figure was revised down from a 0.3% rise.

Sales of food products were down 0.1% in September, while sales of non-food products fell by 0.1%.

On a yearly basis, retail sales in Italy increased 1.5% in September, after a 1.3% rise in August.

-

12:06

European stock markets mid session: stocks traded higher as concerns over the situation in the Middle East eased

Stock indices traded higher as concerns over the situation in the Middle East eased. Turkey shot down the Russian jet near the Syria's border on Tuesday. The jet should have violated Turkish airspace.

Russia's defence ministry said the jet did not violate Turkish airspace. Russian President Vladimir Putin said that Turkey's action was a "stab in the back by the terrorists' accomplices" and that this action would have serious consequences.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 45,437 in October from 44,825 in September. September's figure was revised down from 44,489.

"These statistics show that housing market activity remained strong in October. Consumers remain confident and their incomes are growing. Mortgage rates are at multi-year lows and people are snapping up the very competitive deals being offered by banks," the chief economist at the BBA, Richard Woolhouse, said.

Current figures:

Name Price Change Change %

FTSE 100 6,335.25 +58.02 +0.93 %

DAX 11,094.64 +160.65 +1.46 %

CAC 40 4,890.49 +70.21 +1.49 %

-

12:00

European Central Bank’s Financial Stability Review: the impact on the Eurozone’s financial stability from interest rates hikes abroad is limited

The European Central Bank (ECB) released its Financial Stability Review on Wednesday. The central bank said that the impact on the Eurozone's financial stability from interest rates hikes abroad is limited.

"Highly indebted foreign-currency borrowers may be vulnerable to a prospective normalisation of financial conditions in the United States and other advanced economies. Euro area banks have limited direct exposure to emerging market economies outside Europe," the report said.

But there are risks from a faster-than-expected interest rate hikes in the U.S.

"Risks to the growth outlook remain slightly on the downside and relate to a faster than expected normalisation of interest rates and a further appreciation of the US dollar," the report say.

The ECB Vice President Vitor Constancio said in a press conference today that a level of systemic risk in the Eurozone is low.

He noted that the ECB has not made a decision regarding further stimulus measures.

-

11:41

Number of mortgage approvals in the U.K. rises to 45,437 in October

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 45,437 in October from 44,825 in September. September's figure was revised down from 44,489.

"These statistics show that housing market activity remained strong in October. Consumers remain confident and their incomes are growing. Mortgage rates are at multi-year lows and people are snapping up the very competitive deals being offered by banks," the chief economist at the BBA, Richard Woolhouse, said.

-

11:34

Spanish producer prices decline 0.7% in October

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Wednesday. The Spanish producer prices dropped 0.7% in October, after a 0.9% fall in September.

On a yearly basis, producer price inflation in Spain fell 3.5% in October, after a 3.6% decline in September. Producer prices have been declining since July 2014.

Producer prices excluding energy were flat year-on-year in October, after a 0.3% rise in September.

Energy prices slid 13.2% year-on-year in October.

-

11:24

UBS consumption index rises to 1.60 in October

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.60 in October from 1.56 in September. September's figure was revised down from 1.65.

The increase was driven by a slight improvement in consumer confidence and expected business activity in the retail sector.

"Despite consumers' gloomy labour market expectations, this was outweighed slightly by the prospect of an economic upturn. At the same time, business activity in the retail sector seems to have improved recently," the bank said.

-

11:12

French consumer confidence index remains unchanged at 96 in November

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index remained unchanged at 96 in November.

The index of the outlook on consumers' saving capacity rose to -4 in November from -5 in October.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -24 in October.

The index of the outlook on consumers' financial situation for next twelve months decreased to -11 in November from -10 in October.

The index of the outlook on unemployment rising in coming months dropped to 36 in November from 60 in October.

The index for future inflation expectations was up to -41 in November from -42 in October.

The Insee noted that the most responses were registered before the terrorist attacks of 13 November.

-

10:50

Bank of Japan’s October 30 monetary policy meeting minutes: a slow improvement in the output gap is one of reasons why the central bank will miss its inflation target

The Bank of Japan (BoJ) released its October 30 monetary policy meeting minutes on late Wednesday evening. According to minutes, a few board members noted that a slow improvement in the output gap is one of reasons why the central bank will miss its inflation target.

"A few members added that the projected delay in the timing of reaching 2 percent had also been partly attributable to a somewhat slow improvement in the output gap," the minutes said.

Many board members said that the delay of reaching 2% inflation targets was driven by low oil prices.

The BoJ decided to keep unchanged its monetary policy at its October meeting.

-

10:37

Moody's Japan K.K.: weak domestic and global GDP growth will support stable earnings for non-financial corporates in Japan in 2016

Moody's Japan K.K. said on Wednesday that weak domestic and global GDP growth will support stable earnings for non-financial corporates in Japan in 2016.

"Japan's corporates remain cautious under subdued domestic and global conditions, and will broadly focus on cutting costs, reducing leverage and maintaining credit quality and ratings," a Moody's Vice President and Senior Analyst, Masako Kuwahara, said.

The agency expects the Japanese economy to expand 0.5%-1.5% in 2016.

Moody's noted that it expects limited direct impact on Japanese corporates from the slowdown in the Chinese economy.

-

10:27

The European Commission proposes a euro-area wide insurance scheme for bank deposits

The European Commission proposed a euro-area wide insurance scheme for bank deposits on Tuesday. The scheme's name is the European Deposit Insurance Scheme (EDIS). This scheme should strengthen the Banking Union.

There will be 3 steps in implementing this scheme. The first step is a re-insurance approach which would last for 3 years until 2020. The second step is a progressively mutualised system ("co-insurance") in 2020. The third step is fully insure national Deposit Guarantee Schemes (DGS) as of 2024.

-

10:16

German Finance Minister Wolfgang Schaeuble: the government’s target is still a balanced budget next year

German Finance Minister Wolfgang Schaeuble said on Tuesday that the government's target is still a balanced budget next year, adding that the migration crisis is top priority.

"We can master this task next year without new debt, if possible," he said.

-

07:21

Global Stocks: U.S. stock indices edged up

U.S. stock indices edged up on Tuesday as energy stocks rose after Turkey downed a Russian military plane on the Syrian border.

The Dow Jones Industrial Average rose 19.51 points, or 0.1%, to 17812.19. The S&P 500 climbed 2.55 points, or 0.1%, to 2089.14 (its energy sector rose 2.2%). The Nasdaq Composite gained 0.33 point, or less than 0.1%, to 5102.81.

Data showed on Wednesday that the U.S. economy expanded at a faster pace in the third quarter than a preliminary report had shown. The country's gross domestic product rose by 2.1% vs +1.5% reported earlier. Experts had expected the index to grow by 2.0%. Despite this revision the growth pace was much more modest than the 3.9% expansion in the third quarter.

A report from the Conference Board showed that the U.S. consumer confidence index fell to 90.4 points in November from 99.1 in October (revised from 97.6). Analysts had expected the index to come in at 99.5 points. The expectations index declined to 78.6 from 88.7, while the current assessment index fell to 108.1 from 114.6.

This morning in Asia Hong Kong Hang Seng declined 0.14%, or 32.02, to 22,555.61. China Shanghai Composite Index climbed 0.56%, or 20.30, to 3.636.41. The Nikkei lost 0.29%, or 56.99, to 19,867.90.

Asian indices traded mixed amid escalating geopolitical tensions. Airlines' shares fell. A stronger yen weighed on Japanese exporters. Meanwhile stocks of Chinese producers of military aircrafts rose.

-

03:29

Nikkei 225 19,831.71 -93.18 -0.47 %, Hang Seng 22,462.32 -125.31 -0.55 %, Shanghai Composite 3,613.77 -2.34 -0.06 %

-

00:30

Stocks. Daily history for Sep Nov 24’2015:

(index / closing price / change items /% change)

Nikkei 225 19,924.89 +45.08 +0.23 %

Hang Seng 22,587.63 -78.27 -0.35 %

Shanghai Composite 3,615.82 +5.50 +0.15 %

FTSE 100 6,277.23 -28.26 -0.45 %

CAC 40 4,820.28 -68.84 -1.41 %

Xetra DAX 10,933.99 -158.32 -1.43 %

S&P 500 2,089.14 +2.55 +0.12 %

NASDAQ Composite 5,102.81 +0.33 +0.01 %

Dow Jones 17,812.19 +19.51 +0.11 %

-