Noticias del mercado

-

18:42

WSE: Session Results

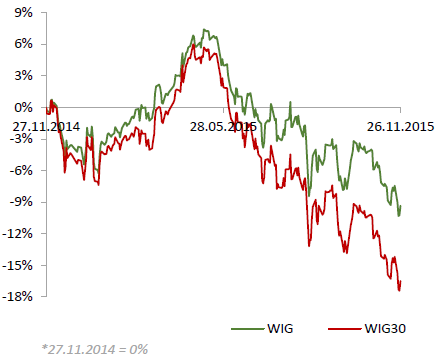

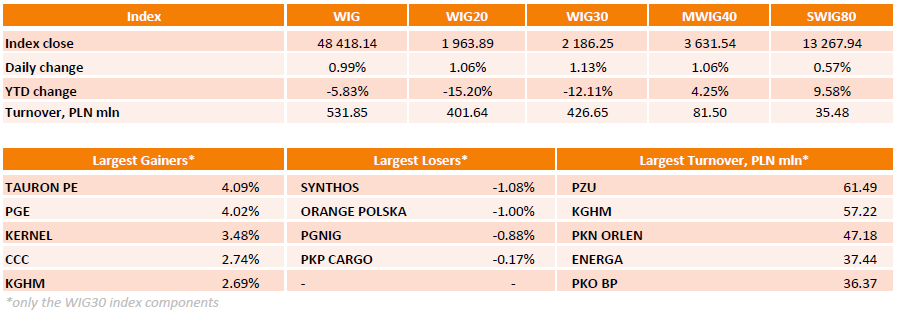

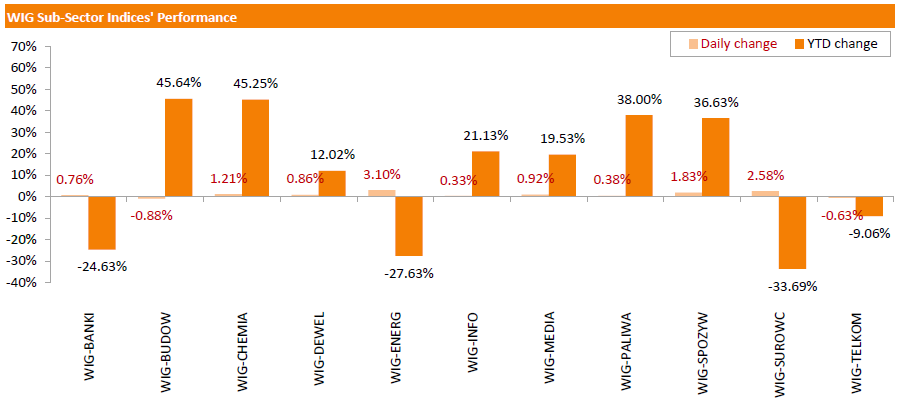

Polish equities rebounded on Thursday. The broad marker measure, the WIG Index, added 0.99%. Sector-wise, construction sector (-0.88%) and telecoms (-0.63%) were the only sectors, which posted negative results. At the same time, utilities (+3.10%) and materials (+2.58%) were the best-performing groups.

Large-cap stocks advanced by 1.13% as measured by the WIG30 Index. Most index constituents posted gains, led by utilities names PGE (WSE: PGE) and TAURON PE (WSE: TPE), which surged by 4.09% and 4.02% respectively. They were followed by agriculture name KERNEL (WSE: KER), which jumped by 3.48%, erasing yesterday's drop. On the other side of the ledger, chemicals name SYNTHOS (WSE: SNS) and telecoms name ORANGE POLSKE (WSE: OPL) led the few decliners, losing 1.08% and 1% respectively.

-

18:00

European stocks close: stocks closed higher on speculation that the European Central Bank will add further stimulus measures

Stock indices closed higher on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB President Mario Draghi said at a press conference after the ECB meeting in October that the central bank will review its stimulus measures at its next meeting in December.

U.S. markets were closed for a public holiday today.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.3% in October from last year, exceeding expectations for a 4.9% gain, after a 4.9 % increase in September.

Loans to the private sector in the Eurozone climbed 1.2% in October from the last year, in line with expectations, after a 1.1% gain in September.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,393.13 +55.49 +0.88 %

DAX 11,320.77 +151.23 +1.35 %

CAC 40 4,946.02 +53.03 +1.08 %

-

18:00

European stocks closed: FTSE 6393.13 55.49 0.88%, DAX 11320.77 151.23 1.35%, CAC 40 4946.02 53.03 1.08%

-

17:17

Swiss industrial production drops 2.8% in the third quarter

The Swiss Federal Statistical Office released its industrial production data for Switzerland on Thursday. Swiss industrial production dropped 2.8% in the third quarter from a year earlier, after a 2.1% fall in the second quarter.

The production in the construction sector was down 4.9% in the third quarter.

-

17:04

Standard & Poor's: the economic growth in the Asia-Pacific region in 2016 and 2017 will be sluggish

Ratings agency Standard & Poor's (S&P) said in its report "Can Asia-Pacific Capitalize On Its New Growth Drivers?" on Wednesday that the economic growth in the Asia-Pacific region in 2016 and 2017 will be sluggish. The agency expects the economy in the region to expand 5.3% in 2016 and 5.2% in 2017.

"Asia-Pacific will need to adapt to changes in the growth drivers to ensure continued relatively strong, balanced, and sustainable growth," Standard & Poor's Asia-Pacific chief economist, Paul Gruenwald, said.

S&P also said that India overtook China as the Asia-Pacific region's growth leader.

Emerging Asia is expected to grow at 6% in 2016 and 2017.

-

16:42

The European Commission expects the European Union’s economy to expand 1.9% in 2015

The European Commission released its annual Annual Growth Survey 2016 and Alert Mechanism Report 2016 on Thursday. The Commission expects the European Union's (EU) economy to expand 1.9% in 2015, 2.0% in 2016 and 2.1% in 2017, according to Annual Growth Survey 2016.

The inflation in the EU is expected to be 0% in 2015, 1.1% in 2016 and to 1.6% in 2017.

The Commission noted in its Alert Mechanism Report that the economies of Italy, France and Belgium are vulnerable to economic shocks due to high debt and low growth.

"The combination of large stocks of public debt and a declining trend in potential growth or competitiveness is a source of concerns in a number of countries despite the absence of external sustainability risks, as it increases the likelihood of unstable debt to-GDP trajectories and the vulnerability to adverse shocks," the Commission said.

-

16:04

The European Central Bank and the People's Bank of China successfully test bilateral currency swap operations

"The ECB and the PBC have successfully completed tests of their existing bilateral currency swap arrangement. From a Eurosystem perspective, the arrangement serves as a backstop facility to address sudden and temporary disruptions in the renminbi market due to liquidity shortages in euro area banks," the central bank said.

The currency swap deal was signed in October 2013 and totalled €45 billion or 350 billion yuan. The central banks conducted tests in April and November this year.

"The ECB regularly conducts tests of its instruments and operations in order to ensure its operational readiness. The scheduling of such tests is not linked to market conditions and should not be seen as signalling any intention of the central banks to request funds from each other to provide counterparties with liquidity in the respective currency," the ECB noted.

-

15:02

Fitch Ratings affirms China’s sovereign debt rating at 'A+'

Fitch Ratings affirmed China's sovereign debt rating at 'A+' on Thursday. The outlook is stable.

"China's ratings balance a strong sovereign balance sheet and sustained high GDP growth against high sovereign contingent liabilities and a range of structural weaknesses and risks," the agency said.

Fitch noted that China can handle risks to the country's basic economic and financial stability as it has the administrative and financial resources.

The agency expects general government debt to be 53% of GDP at end-2015, up from 49% at end-2014, and about 54% of GDP in 2016.

China's economy is expected to expand 6.8% in 2015, 6.3% in 2016 and 6% in 2017.

-

12:00

European stock markets mid session: stocks traded higher on speculation that the European Central Bank will add further stimulus measures

Stock indices traded higher on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB President Mario Draghi said at a press conference after the ECB meeting in October that the central bank will review its stimulus measures at its next meeting in December.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.3% in October from last year, exceeding expectations for a 4.9% gain, after a 4.9 % increase in September.

Loans to the private sector in the Eurozone climbed 1.2% in October from the last year, in line with expectations, after a 1.1% gain in September.

Current figures:

Name Price Change Change %

FTSE 100 6,369.93 +32.29 +0.51 %

DAX 11,315.01 +145.47 +1.30 %

CAC 40 4,934.77 +41.78 +0.85 %

-

11:21

Private capital expenditure in Australia plunges 9.2% in the third quarter

The Australian Bureau of Statistics released its private capital expenditure data on Thursday. Private capital expenditure in Australia dropped 9.2% in the third quarter, missing expectations for a 3.0% decline, after a 4.4% fall in the second quarter.

The second quarter's figure was revised down from a 4.0% decrease.

Capex for buildings and structures plunged 9.8% in the third quarter, while capital spending for equipment, plants and machinery fell 8.2%.

On a yearly basis, private capital expenditure in Australia declined 20.0% in the third quarter.

-

10:52

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 40.9 in in the week ended November 22

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 40.9 in in the week ended November 22 from 41.2 the prior week. The decline was driven by a less favourable assessment of the current economy.

The measure of views of the economy declined to 30.5 from 32.2. It was the highest reading since early May.

The buying climate and the personal finances indexes slightly rose last week.

-

10:29

M3 money supply in the Eurozone rises 5.3% in October from last year

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.3% in October from last year, exceeding expectations for a 4.9% gain, after a 4.9 % increase in September.

Loans to the private sector in the Eurozone climbed 1.2% in October from the last year, in line with expectations, after a 1.1% gain in September.

-

10:08

Spain’s economy expands 0.8% the third quarter

The Spanish statistical office INE released its final gross domestic product (GDP) for Spain. Spain's economy expanded 0.8% the third quarter, in line with the preliminary reading, after a 1.0% growth in the second quarter. It was the ninth consecutive increase.

On a yearly, GDP grew 3.4% in the third quarter, in line with the preliminary reading, after a 3.1% in the second quarter. It was the fastest growth since the fourth quarter of 2007.

Household spending climbed 1% in the third quarter, general government spending rose by 0.9%, while investment increased 1.1%.

Exports were up 2.8% in the third quarter, while imports jumped 4%.

-

09:12

New Zealand’s trade deficit narrows to NZ$963 million in October

Statistics New Zealand released its trade data on late Wednesday evening. New Zealand's trade deficit narrowed to NZ$963 million in October from NZ$1,140 million in September. September's figure was revised up from a deficit of NZ$1,222 million.

Analysts had expected the deficit to decline to NZ$937 million.

Exports dropped 4.5% year-on-year in October, while imports decreased by 2.2%.

"Since annual exports to China fell from their peak in 2014, exports to China and Australia have been around $8.4 billion each. Annual exports to Australia peaked in January 2012 but have been generally falling since, due to lower crude oil exports," Statistics NZ international statistics senior manager Jason Attewell said.

-

07:31

Global Stocks: U.S. stock indices little changed

U.S. stock indices little changed on Wednesday ahead of Thanksgiving Day. Total composite volume was 5.185 billion shares making Wednesday the fifth lowest volume session of 2015.

The Dow Jones Industrial Average climbed 1.20 points, or 0.01%, to 17,813.39. The S&P 500 edged down 0.27 points, or 0.01%, to 2,088.87. The Nasdaq Composite gained 13.34 point, or 0.26%, to 5,116.14.

The U.S. Department of Commerce reported that durable goods orders exceeded analysts' expectations in October driven by higher demand for transportation. Durable goods orders rose by 3.0% in October after a 0.8% decline in September (revised from -1.2%). Economists had expected a 1.5% rise.

Data from Markit Economics showed that the U.S. services sector continued expanding in November outpacing October. The preliminary Services PMI rose to 56.5 compared to October final reading of 54.8. The latest reading was the highest this year. Economists had expected the index to advance to 55.0.

This morning in Asia Hong Kong Hang Seng rose 0.85%, or 190.80, to 22,688.80. China Shanghai Composite Index climbed 0.42%, or 15.20, to 3.663.13. The Nikkei added 0.45%, or 89.21, to 19,936.79.

Asian indices rose. A weaker yen supported Japanese stocks.

However stocks of LCD screens suppliers for Apple fell after Nikkei said Apple plans to introduce organic light-emitting diode displays for iPhones in 2018.

-

03:01

Nikkei 225 19,972.46 +124.88 +0.63 %, Hang Seng 22,730.23 +232.23 +1.03 %, Shanghai Composite 3,659.57 +11.64 +0.32 %

-

02:31

Stocks. Daily history for Sep Nov 25’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,193.68 -32.71 -0.6%

TOPIX 1,594.67 -11.27 -0.7%

SHANGHAI COMP 3,647.85 +31.74 +0.9%

HANG SENG 22,485.6 -102.03 -0.5%

FTSE 100 6,337.64 +60.41 +0.96 %

CAC 40 4,892.99 +72.71 +1.51 %

Xetra DAX 11,169.54 +235.55 +2.15 %

S&P 500 2,088.87 -0.27 -0.01 %

NASDAQ Composite 5,116.14 +13.34 +0.26 %

Dow Jones 17,813.39 +1.20 +0.01 %

-