Noticias del mercado

-

17:41

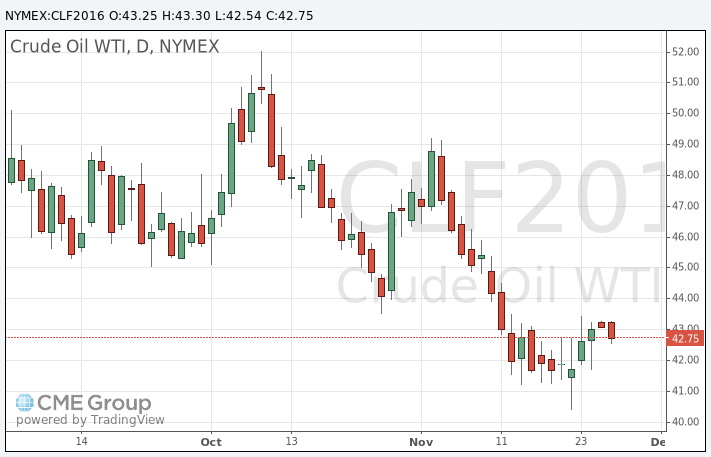

Oil prices decline on concerns over the global oil oversupply

Oil prices were down on concerns over the global oil oversupply. Market participants eyed yesterday's U.S. crude oil inventories data. According to the U.S. Energy Information Administration (EIA) on Wednesday, U.S. crude inventories increased by 0.96 million barrels to 488.2 million in the week to November 20. It was the ninth consecutive increase. Analysts had expected U.S. crude oil inventories to rise by 1.0 million barrels.

The oil driller Baker Hughes reported on Wednesday that the number of active U.S. rigs declined by 9 rigs to 555 this week. It was the lowest level since June 4, 2010.

U.S. markets were closed for a public holiday today.

WTI crude oil for January delivery declined to $42.54 a barrel on the New York Mercantile Exchange (Wednesday's trading session).

Brent crude oil for January fell to $45.45 a barrel on ICE Futures Europe.

-

17:21

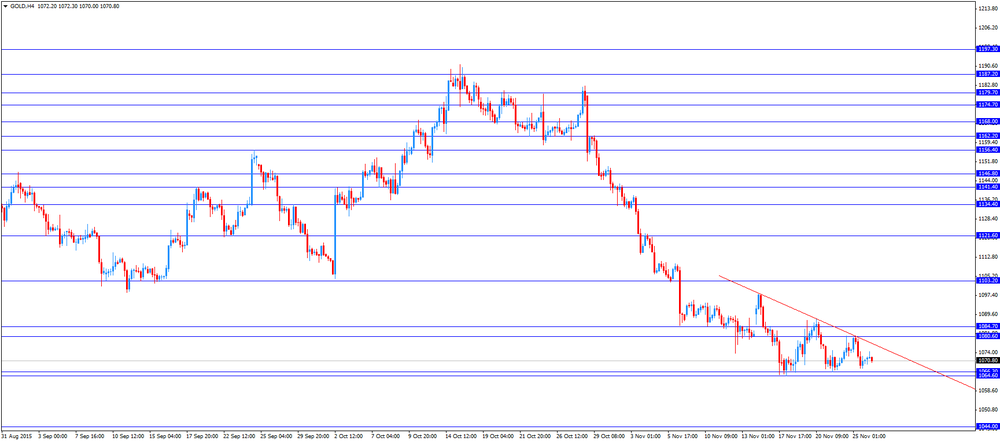

Gold price trade little changed as U.S. markets are closed for a public holiday

Gold price traded little changed as U.S. markets were closed for a public holiday.

The gold price yesterday declined on a stronger U.S. dollar. The greenback rose on a positive U.S. economic data. The number of initial jobless claims in the week ending November 21 in the U.S. fell by 12,000 to 260,000 from 272,000 in the previous week, exceeding expectations for a decline to 270,000. The U.S. durable goods orders climbed 3.0% in October, exceeding expectations for a 1.5% rise, after a 0.8% drop in September. September's figure was revised up from a 1.2% fall. Personal spending rose 0.1% in October, missing expectations for a 0.3% gain, after a 0.1% increase in September.

This U.S. data added to speculation that the Fed will start raising its interest rate next month.

December futures for gold on the COMEX today traded in the range 1069.10 - 1074.20 dollars per ounce.

-

15:02

Fitch Ratings affirms China’s sovereign debt rating at 'A+'

Fitch Ratings affirmed China's sovereign debt rating at 'A+' on Thursday. The outlook is stable.

"China's ratings balance a strong sovereign balance sheet and sustained high GDP growth against high sovereign contingent liabilities and a range of structural weaknesses and risks," the agency said.

Fitch noted that China can handle risks to the country's basic economic and financial stability as it has the administrative and financial resources.

The agency expects general government debt to be 53% of GDP at end-2015, up from 49% at end-2014, and about 54% of GDP in 2016.

China's economy is expected to expand 6.8% in 2015, 6.3% in 2016 and 6% in 2017.

-

11:43

-

09:40

The number of active U.S. rigs falls by 9 rigs to 555 this week

The oil driller Baker Hughes reported on Wednesday that the number of active U.S. rigs declined by 9 rigs to 555 this week. It was the lowest level since June 4, 2010.

Combined oil and gas rigs declined by 4 to 744.

-

08:22

Oil prices little changed

West Texas Intermediate futures for January delivery climbed to $43.14 (+0.23%), while Brent crude is at $46.14 (-0.06%). Concerns over geopolitical tensions eased and investors turned their attention back to fundamentals including the persistent supply glut. The Energy Information Administration said U.S. crude stockpiles rose by 1 million barrels in the week ending November 20 versus a 1.2 million barrels increase expected by economists. The actual buildup was less than analysts had expected, but it still marked the ninth weekly gain. U.S. crude imports rose by 424,000 bpd.

A stronger-than-expected report on U.S. durable goods orders was welcomed by market participants giving WTI some advantage over Brent. Nevertheless trading is thin today due to Thanksgiving Day.

-

07:34

Gold is back to a multi-year low

Gold is currently at $1,071.90 (+0.18%) trading not far from its multi-year low as concerns over geopolitical tensions eased and strong reports on U.S. durable goods orders and activity in the services sector supported expectations of an interest rate hike in December.

Liquidity is likely to be thin today as U.S. markets are on holiday due to Thanksgiving Day. However physical demand picked up in top consumer China. Premiums on the Shanghai Gold Exchange were priced healthy $5-$6 an ounce this morning, up from $3-$4 at the beginning of November.

-

02:31

Commodities. Daily history for Nov 25’2015:

(raw materials / closing price /% change)

Oil 43.08 +0.09%

Gold 1,071.20 +0.11%

-