Noticias del mercado

-

17:55

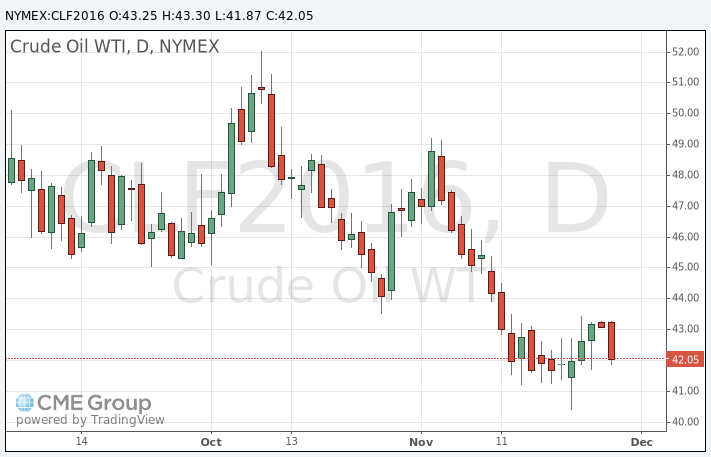

Oil prices decline on a stronger U.S. dollar on concerns over the global oil oversupply

Oil prices traded lower on a stronger U.S. dollar on concerns over the global oil oversupply. Market participants continued to eye this week's U.S. crude oil inventories data. According to the U.S. Energy Information Administration (EIA) on Wednesday, U.S. crude inventories increased by 0.96 million barrels to 488.2 million in the week to November 20. It was the ninth consecutive increase. Analysts had expected U.S. crude oil inventories to rise by 1.0 million barrels.

WTI crude oil for January delivery declined to $41.87 a barrel on the New York Mercantile Exchange.

Brent crude oil for January fell to $45.10 a barrel on ICE Futures Europe.

-

17:51

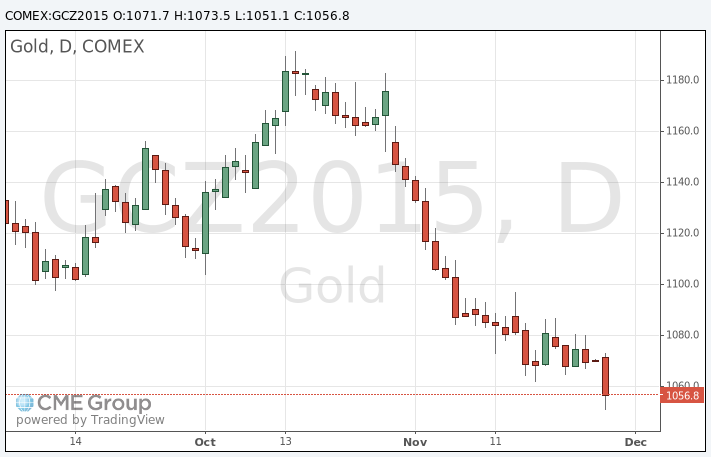

Gold price falls toward 6-year low on a stronger U.S. dollar

Gold price declined toward 6-year low on a stronger U.S. dollar. The greenback rose on speculation that the Fed will start raising its interest rate in December.

The strong U.S. economic data on Wednesday added to this speculation.

December futures for gold on the COMEX today dropped 1051.10 dollars per ounce.

-

16:52

Profits of industrial companies in China drop 4.6% in October

China's National Bureau of Statistics (NBS) said on Friday that profits of industrial companies in China declined 4.6% in October from a year earlier, after a 0.1% fall in September.

For the first ten months of 2015, industrial profits fell 2.0% from a year earlier.

Profits in the mining sector dropped 56.3% in the first ten months of the year from a year earlier, while manufacturing profits rose 3.8%.

-

07:12

Oil prices dropped amid Chinese data

West Texas Intermediate futures for January delivery fell to $42.45 (-1.37%), while Brent crude declined to $45.30 (-0.35%) after disappointing data from China signaled that the world's second-biggest oil consumer was unlikely to boost demand and help defeat the global supply glut.

Chinese industrial profits fell by 4.6% y/y in October marking the fifth consecutive month of declines. These data suggest that China's economy might miss its growth targets.

The recently renewed geopolitical risk did little to support crude. Many analysts believe that these tensions don't threat oil facilities in the Middle East and supplies remain ample.

-

07:09

Gold declined slightly

Gold declined to $1,066.70 (-0.28%) as weak data from top consumer China raised concerns over demand and recent robust data on the U.S. economy reaffirmed expectations for a rate hike in December. Higher rates would harm demand for the non-interest-paying precious metal.

Chinese industrial profits fell by 4.6% y/y in October marking the fifth consecutive month of declines. These data suggest that China's economy might miss its growth targets.

Gold is on track to post a nearly 1% decline this week.

-

02:33

Commodities. Daily history for Nov 26’2015:

(raw materials / closing price /% change)

Oil 42.69 -0.81%

Gold 1,071.50 +0.14%

-