Noticias del mercado

-

18:40

American focus: the US dollar rose sharply

The US dollar rose significantly against other major currencies amid growing expectations for a rate hike in December in the US, while trade volumes are expected to remain weakened in holiday trading. Dollar feels the support after upbeat US data published during the week reinforced expectations that the Federal Reserve will raise interest rates at its meeting in December.

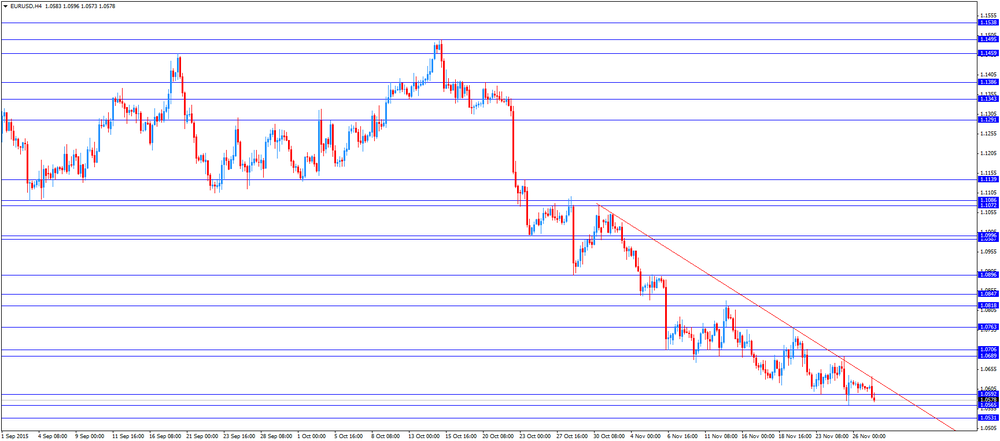

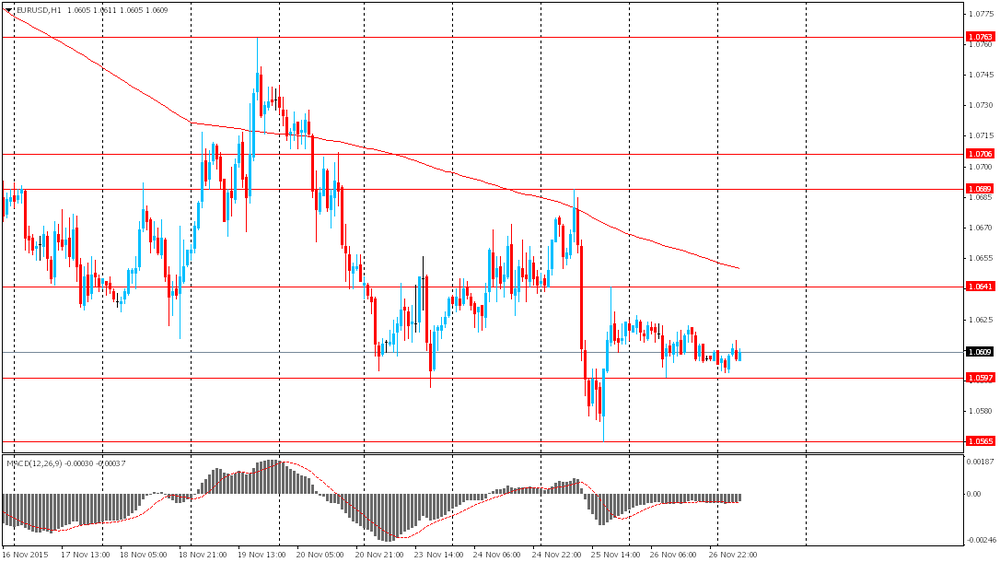

The euro fell sharply against the dollar, dropping back below $ 1.0600 and approaching the minimum on 25 November. Experts point out that the reason for such dynamics was the growth of interest in buying the dollar and the mixed data for the euro area. The European Commission said that economic sentiment in the euro zone remained stable in November, as the improvement in confidence among consumers was offset by a decrease in sentiment among manufacturers, but inflation expectations increased in both sectors. The overall index of economic sentiment in November was 106.1 points. The indicator for October was revised up to 106.1 points from 105.9 points. Economists had forecast the index to be 105.9 points. Meanwhile, the business climate indicator, which points to the phase of the business cycle, fell more than expected - to 0.36 from 0.44 in October. Projections indicate an increase to 0.45. The report also stated that economic sentiment in the euro zone improved mainly in the construction sector - the corresponding index rose to -17.8 against -20.7 in October. Consumer confidence also rose - up to -5.9 from -7.5. Meanwhile, the index of sentiment in the services sector rose to 12.8 from 12.3 in October. Sentiment indicator in industry fell to 3.2 against -2.0 in October, and the figure for the retail sector fell to 5.8 from 6.4.

Pressure on the euro also have expectations of the December meeting of the ECB in the course of which can be taken new measures easing (quantitative easing program increase and / or decrease in interest rates on deposits) in an attempt to accelerate the growth of inflation and the economy. If the ECB does soften the policy, the market may act according to the rule "buy the rumor, sell the fact", and then the pair will rise above $ 1.0700.

The pound has dropped significantly against the dollar, reaching a minimum of 6 November, which was associated with the publication of GDP data for the UK and the widespread strengthening of the US currency. As previously reported, the rate of economic growth in Britain slowed somewhat in the three months to September, but in line with preliminary estimates and expectations of experts. According to the data in the third quarter gross domestic product grew by 0.5 percent, which was slightly slower growth of 0.7 percent, which was recorded in the period from April to June. Last Modified confirmed analysts' forecasts. In annual terms, the economy expanded by 2.3 percent compared with 2.4 percent in the second quarter. Recall that last year, GDP grew by 2.9 percent, ahead while the other major advanced economies. Slow recovery in Britain reflects the slowdown in the global economic environment emerging markets, led by China. UK exporters also faced difficulties due to the strengthening of the pound this year.

The Swiss franc fell nearly 100 points against the dollar, five-year updating the maximum. According to analysts, the weakening of the franc due to the intervention of the Swiss Central Bank, which has intensified in anticipation of action by the ECB next week. Yesterday the head of the SNB Thomas Jordan said the bank is ready to use its balance sheet to keep the exchange rate, but does not consider the introduction of an upper limit for the franc to the number of possible options. "Our policy is very clear - said Jordan. - It is based on two pillars: negative interest rates and a willingness, if necessary, to intervene in the foreign exchange market." The next meeting of the Swiss National Bank, devoted to monetary policy, on 10 December. According to Jordan, the bank does not set any limits on the expansion of its balance sheet to weaken the franc.

-

16:52

Profits of industrial companies in China drop 4.6% in October

China's National Bureau of Statistics (NBS) said on Friday that profits of industrial companies in China declined 4.6% in October from a year earlier, after a 0.1% fall in September.

For the first ten months of 2015, industrial profits fell 2.0% from a year earlier.

Profits in the mining sector dropped 56.3% in the first ten months of the year from a year earlier, while manufacturing profits rose 3.8%.

-

16:41

Greek revised GDP falls at a seasonally-and-calendar adjusted 0.9% in the third quarter

The Hellenic Statistical Authority released its revised gross domestic product (GDP) data for Greece on Friday. The Greek revised GDP fall at a seasonally-and-calendar adjusted 0.9% rate in the third quarter, down from the preliminary reading of a 0.5% decline, after a 0.3% growth in the second quarter.

The second quarter's figure was revised down to a 0.4% rise.

On a yearly unadjusted basis, Greek final GDP slid 0.9% rate in the third quarter, down from the preliminary reading of a 0.1% decrease, after a 1.3% increase in the second quarter.

Total consumption expenditure dropped 1.0% year-on-year in the third quarter.

Exports dropped 7.1% in the third quarter, while imports declined 16.9%.

-

16:26

Preliminary consumer price inflation in Spain rises 0.3% in November

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.3% in November, after a 0.6% rise in October.

On a yearly basis, consumer prices fell by 0.3% in November, after a 0.7% decrease in October.

The annual decline was mainly driven by the decline in the prices of fuels and lubricants (gas and diesel oil).

-

16:12

Nationwide: UK house prices rise 0.1% in November

The Nationwide Building Society released its house prices data for the U.K. on Friday. UK house prices were up 0.1% in November, missing expectations for a 0.5% rise, after a 0.5% increase in October. October's figure was revised down from a 0.6% gain.

On a yearly basis, house prices fell to 3.7% in November from 3.9% in October. Analysts had expected house prices to rise by 4.2%.

"While this bodes well for a sustainable increase in housing market activity in the period ahead, much will depend on whether building activity can keep pace with increasing demand," Nationwide's chief economist, Robert Gardner, said.

-

15:38

Italian consumer confidence index climbs to 118.4 in November

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. The Italian consumer confidence index climbed to 118.4 in November from 117.0 in October. October's figure was revised up from 116.9.

The increase was driven by rises in all components: economic, personal, current and future.

The business confidence index fell to 104.6 in November from 105.7 in October. October's figure was revised down from 105.9.

-

15:22

GfK’s U.K. consumer confidence index declines to 1 in November

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index fell to 1 in November from 2 in October. Analysts had expected the index to remain unchanged at 2.

3 of 5 measures decreased, 1 rose and 1 was unchanged.

"Overall, despite the good news agenda of rock-bottom inflation, falling fuel prices and higher wage growth boosting spending power, confidence appears to be depressed by a combination of wider economic, political and social events. However, one area that continues to hold up is our expectation for our personal financial situation for the next 12 months," Joe Staton, Head of Market Dynamics at GfK, said.

-

15:00

Greek producer prices decrease 0.6% in October

The Hellenic Statistical Authority released its producer price index (PPI) data on Friday. Greek producer prices decreased 0.6% in October.

Domestic market prices fell by 0.5% in October, while foreign market prices slid 0.6%.

On a yearly basis, Greek PPI plunged 9.6% in October, after a 10.4% drop in September.

Domestic market prices slid 8.1% year-on-year in October, while foreign market prices dropped 14.1%.

Energy prices plunged 23.0% year-on-year in October, while non-durable consumer goods industrial prices were up 0.3% year-on-year.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 872m) 123.60 (1.1bln)

EUR/USD 1.0500 (EUR 1.6bln) 1.0575 (1bln) 1.0640-50 (1bln) 1.0700 (1.7bln)

GBP/USD 1.5100 (GBP 168m)

USD/CHF 1.0200 (USD 355m)

USD/CAD 1.3300 (USD 777m) 1.3475 (530m)

AUD/USD 0.7145-50 (AUD 512m)

NZD/USD 0.6590 (NZD 376m)

EUR/JPY 129.00 (EUR 388m) 132.00 (341m)

-

14:43

Canadian industrial product prices decline in October, while raw materials prices climb

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) fell 0.5% in October, missing forecasts for a 0.1% drop, after a 0.4% decline in September. September's figure was revised down from 0.3% decrease.

The decrease was mainly driven by lower prices for motorized and recreational vehicles, which slid 1.1% in October.

2 of the 21 commodity groups increased, 18 declined and 1 was unchanged.

The Raw Materials Price Index (RMPI) climbed 0.4% in October, after a 2.4% gain in September. September's figure was revised down from a 3.0% rise.

The rise was driven by higher prices for crude energy products. Crude energy products rose by 2.4% in September.

3 of the 6 commodity groups rose and 3 decreased.

-

14:30

Canada: Industrial Product Price Index, y/y, October -0.4%

-

14:30

Canada: Industrial Product Price Index, m/m, October -0.5% (forecast -0.1%)

-

14:29

German Gfk consumer confidence index declines to 9.3 in December

Market research group GfK released its consumer confidence index for Germany on Friday. German Gfk consumer confidence index fell to 9.3 in December from 9.4 in November, beating expectations for a drop to 9.2.

The decrease was driven by declines in 2 of 3 indicators.

The economic expectations index plunged by 2.4 points to -5.3 points in November, while the willingness to buy index increased 3.0 points to 48.9.

The income expectations index fell by 3.3 points to 44.4 in November.

"German consumer confidence is continuing to wane, while economic expectations are maintaining their downward trend. The persistently high influx of asylum seekers has seen economic optimism fall further, and has also had a detrimental effect on the income expectations indicator, which has also experienced losses. In contrast, the propensity to consume is currently bucking this trend and, despite the general economic downturn, actually increased this month," Gfk noted.

-

14:18

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies on speculation that the Fed will start raising its interest rate next month

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence November 2 2 1

07:00 United Kingdom Nationwide house price index, y/y November 3.9% 4.2% 3.7%

07:00 United Kingdom Nationwide house price index November 0.5% Revised From 0.6% 0.5% 0.1%

09:30 United Kingdom Business Investment, q/q Quarter III 1.6% 1.5% 2.2%

09:30 United Kingdom Business Investment, y/y Quarter III 3.1% 6.6%

09:30 United Kingdom GDP, y/y (Revised) Quarter III 2.4% 2.3% 2.3%

09:30 United Kingdom GDP, q/q (Revised) Quarter III 0.7% 0.5% 0.5%

10:00 Eurozone Consumer Confidence (Finally) November -7.5 Revised From -7.6 -7.7 -5.9

10:00 Eurozone Business climate indicator November 0.44 0.45 0.36

10:00 Eurozone Industrial confidence November -2 -2.1 -3.2

10:00 Eurozone Economic sentiment index November 106.1 Revised From 105.9 105.9 106.1

12:00 Germany Gfk Consumer Confidence Survey December 9.4 9.2 9.3

The U.S. dollar traded mixed to higher against the most major currencies on speculation that the Fed will start raising its interest rate next month.

The euro traded lower against the U.S. dollar on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB President Mario Draghi said at a press conference after the ECB meeting in October that the central bank will review its stimulus measures at its next meeting in December.

Meanwhile, the economic data from the Eurozone was mixed. The European Commission released its economic sentiment index for the Eurozone on Friday. The index remained unchanged at 106.1 in November. October's figure was revised up from 105.9. Analysts had expected the index to decline to 105.9.

The increase was driven by stronger confidence among consumers.

The industrial confidence index dropped to -3.2 in November from -2.0 in October, missing expectations for a decline to -2.1.

The final consumer confidence index was up to -5.9 in November from -7.5 in October, beating expectations for a fall to -7.7. October's figure was revised up from -7.6.

The business climate index decreased to 0.36 in November from 0.44 in October. Analysts had expected the index to rise to 0.45.

German Gfk consumer confidence index fell to 9.3 in December from 9.4 in November, beating expectations for a drop to 9.2.

The British pound traded lower against the U.S. dollar after the release of the revised U.K. GDP data. The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Friday. The revised U.K. GDP expanded at 0.5% in the third quarter, in line with the preliminary reading, after a 0.7% rise in the second quarter.

The growth was driven by a rise in household spending. Household spending rose 0.8% in the third quarter, after a 0.7% increase in the second quarter.

Exports climbed 0.9% in the third quarter, while imports were up 5.5%.

Business investment jumped 2.2% in the third quarter.

The service sector climbed 0.7% in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.3% in the third quarter, in line with the preliminary reading, after a 2.4% gain in the second quarter.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of Canadian Industrial Product Price Index, which is expected to decline 0.1% in October, after a 0.3% fall in September.

EUR/USD: the currency pair declined to $1.0573

GBP/USD: the currency pair fell to $1.5030

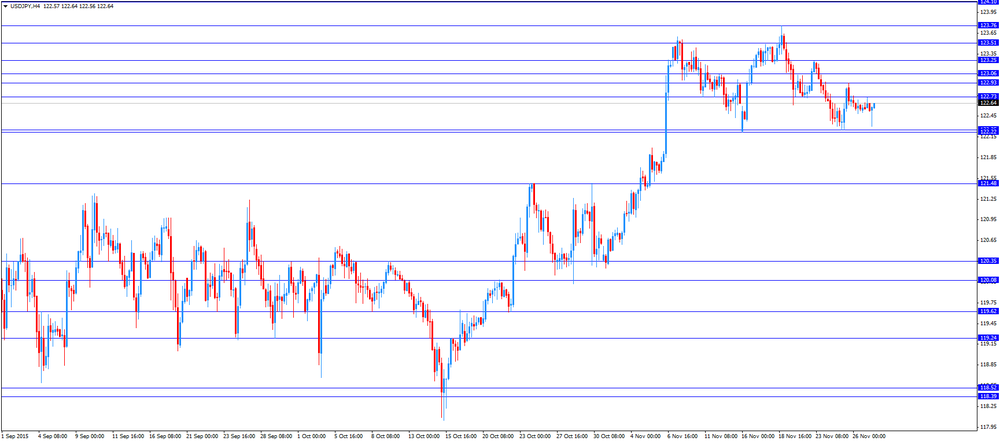

USD/JPY: the currency pair increased to Y122.64

The most important news that are expected (GMT0):

13:30 Canada Industrial Product Price Index, m/m October -0.3% -0.1%

13:30 Canada Industrial Product Price Index, y/y October -0.4%

-

14:00

Orders

EUR/USD

Offers 1.0630-35 1.0650 1.0665 1.0685-90 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0580-85 1.0550 1.0525-30 1.0500 1.0485 1.0465 1.0450 1.0425-30 1.0400

GBP/USD

Offers 1.5100 1.5120-25 1.5135 1.5150-55 1.5170 1.5180-85 1.5200 1.5300

Bids 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7050 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7025 0.7010-15 0.7000 0.6980-85 0.6965 0.6950

EUR/JPY

Offers 130.20-25 130.50 130.80 131.00131.20 131.50 131.85 132.00

Bids 129.65 129.50 129.35 129.00 128.80 128.50

USD/JPY

Offers 122.65-70 122.85 123.00 123.20-25 123.35 123.50

Bids 122.20-25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7235 0.7250 0.7265 0.7280-85 0.7300 0.7325-30 0.7350

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100-05

-

13:00

Germany: Gfk Consumer Confidence Survey, December 9.3 (forecast 9.2)

-

11:46

Eurozone’s economic sentiment index remains unchanged at 106.1 in November

The European Commission released its economic sentiment index for the Eurozone on Friday. The index remained unchanged at 106.1 in November. October's figure was revised up from 105.9. Analysts had expected the index to decline to 105.9.

The increase was driven by stronger confidence among consumers.

The industrial confidence index dropped to -3.2 in November from -2.0 in October, missing expectations for a decline to -2.1.

The final consumer confidence index was up to -5.9 in November from -7.5 in October, beating expectations for a fall to -7.7. October's figure was revised up from -7.6.

The business climate index decreased to 0.36 in November from 0.44 in October. Analysts had expected the index to rise to 0.45.

-

11:32

Revised U.K. GDP grows at 0.5% in the third quarter

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Friday. The revised U.K. GDP expanded at 0.5% in the third quarter, in line with the preliminary reading, after a 0.7% rise in the second quarter.

The growth was driven by a rise in household spending. Household spending rose 0.8% in the third quarter, after a 0.7% increase in the second quarter.

Exports climbed 0.9% in the third quarter, while imports were up 5.5%.

Business investment jumped 2.2% in the third quarter.

The service sector climbed 0.7% in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.3% in the third quarter, in line with the preliminary reading, after a 2.4% gain in the second quarter.

-

11:22

French producer prices increase 0.2% in October

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.2% in October, after a 0.1% rise in September.

The increase was driven a rise in prices for mining and quarrying products, energy and water, which were up 1.9% in October.

On a yearly basis, French PPI fell 2.5% in October, after a 2.6% drop in September.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 32.0 year-on-year in October.

Import prices decreased 0.4% in October, after a 0.6% fall in September.

-

11:15

French consumer spending drops 0.7% in October

French statistical office INSEE released its consumer spending data on Friday. French consumer spending slid 0.7% in October, after a 0.1% gain in September. It was the first drop since March.

The drop was mainly driven by a decline in purchases of durable goods. Spending on durable goods plunged by 1.8% in October, driven by lower car purchases.

Spending on food was flat in October, while spending on energy fell 1.1%.

On a yearly basis, consumer spending climbed 2.1% in October.

-

11:02

German import prices decline 0.3% in October

Destatis released its import prices data for Germany on Friday. German import prices declined by 4.1% in October from last year, after a 4.0% fall in September.

The decline was driven by a drop in energy prices, which plunged 30.0% year-on-year in October.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.3% in October, after a 0.7% fall in September.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 0.5% in October.

Export prices increased 0.2% year-on-year in October, after a 0.3% rise in September.

On a monthly base, export prices were down 0.2% in October.

-

11:01

Eurozone: Consumer Confidence, November -5.7 (forecast -7.7)

-

11:00

Eurozone: Industrial confidence, November -3.2 (forecast -2.1)

-

11:00

Eurozone: Business climate indicator , November 0.36 (forecast 0.45)

-

11:00

Eurozone: Economic sentiment index , November 106.1 (forecast 105.9)

-

10:52

Japan's national CPI rises to an annual rate of 0.3% in October

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) rose to an annual rate of 0.3% in October from 0.0% in September. Analysts had expected the index to remain unchanged at 0.0%.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of -0.1% in October, in line with expectations.

The decline was mainly driven by low energy prices.

Household spending in Japan fell 2.4% year-on-year in October, after a 0.4% decline in September, missing expectations of a 0.1% gain.

The unemployment rate dropped to 3.1% in October from 3.4% in September. Analysts had expected the index to remain unchanged at 3.4%.

The Bank of Japan released its own inflation figures. Japan's core national CPI climbed an annual rate of 1.2% in October. The central bank's calculation does not include fresh food products and energy, but it includes prices for imported food products.

-

10:42

The number of registered job seekers without any employment activity in France rises 1.2% in October

The French labour ministry said on Thursday that the number of registered job seekers without any employment activity rose 1.2% in October, after a 0.7% decline in September.

The total number of fully unemployed was 3.589 million people. It was the highest level since April 2013.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012. The French government is struggling to bring down unemployment.

-

10:30

United Kingdom: GDP, y/y, Quarter III 2.3% (forecast 2.3%)

-

10:30

United Kingdom: GDP, q/q, Quarter III 0.5% (forecast 0.5%)

-

10:30

United Kingdom: Business Investment, q/q, Quarter III 2.2% (forecast 1.5%)

-

10:30

United Kingdom: Business Investment, y/y, Quarter III 6.6%

-

10:20

The Swiss National Bank President Thomas Jordan: the central bank closely monitors the exchange rate of the Swiss currency

The Swiss National Bank (SNB) President Thomas Jordan said in an interview with Swiss newspaper Handelszeitung on Thursday that the central bank closely monitors the exchange rate of the Swiss currency.

"Our monetary policy is clear. It is based on two pillars: the negative interest rates and the willingness to intervene in the currency market if necessary," he said.

Jordan added that there was no limit to how much the central bank could increase its balance sheet.

-

10:09

French Finance Minister Michel Sapin: the country plans to meet its budget deficit targets next year

French Finance Minister Michel Sapin said on Thursday that the country plans to meet its budget deficit targets next year, despite the additional spending for the security after the terrorist attacks in Paris.

"I won't put any budgetary hurdles in the way of assuring the internal or external security of the French people, but France will not abandon this necessary goal of reducing our deficit," he said.

-

08:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 872m) 123.60 (1.1bln)

EUR/USD 1.0500 (EUR 1.6bln) 1.0575 (1bln) 1.0640-50 (1bln) 1.0700 (1.7bln)

GBP/USD 1.5100 (GBP 168m)

USD/CHF 1.0200 (USD 355m)

USD/CAD 1.3300 (USD 777m) 1.3475 (530m)

AUD/USD 0.7145-50 (AUD 512m)

NZD/USD 0.6590 (NZD 376m)

EUR/JPY 129.00 (EUR 388m) 132.00 (341m)

-

08:02

Foreign exchange market. Asian session: the yen advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence November 2 2 1

07:00 United Kingdom Nationwide house price index, y/y November 3.9% 4.2% 3.7%

07:00 United Kingdom Nationwide house price index November 0.6% 0.5% 0.1%

The yen advanced against the U.S. dollar after the release of mixed macroeconomic data from Japan. The core consumer price index declined by 0.1% y/y in line with expectations (mostly because of lower energy costs). This is the third months of declines in a row. The unemployment rate came in at 3.1% in October compared to 3.4% in September. Economists had expected the index to remain unchanged.

Meanwhile household spending fell by 2.4% y/y in October as consumers spent less on clothing, health care and education. Economists expect consumption to remain weak as employers are not ready to raise wages significantly. Earlier the Bank of Japan said that higher wages were needed to accelerate inflation in the country.

Japanese Economy Minister Akira Amari told reporters on Friday that the unexpected decline in household spending shows that many consumers lack confidence.

EUR/USD: the pair fluctuated within $1.0600-15 in Asian trade

USD/JPY: the pair traded within Y122.50-75

GBP/USD: the pair traded within $1.5085-05

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Business Investment, q/q Quarter III 1.6% 1.5%

09:30 United Kingdom Business Investment, y/y Quarter III 3.1%

09:30 United Kingdom GDP, y/y (Revised) Quarter III 2.4% 2.3%

09:30 United Kingdom GDP, q/q (Revised) Quarter III 0.7% 0.5%

10:00 Eurozone Consumer Confidence (Finally) November -7.6 -7.7

10:00 Eurozone Business climate indicator November 0.44 0.45

10:00 Eurozone Industrial confidence November -2 -2.1

10:00 Eurozone Economic sentiment index November 105.9 105.9

12:00 Germany Gfk Consumer Confidence Survey December 9.4 9.2

13:30 Canada Industrial Product Price Index, m/m October -0.3% -0.1%

13:30 Canada Industrial Product Price Index, y/y October -0.4%

-

08:01

United Kingdom: Nationwide house price index , November 0.1% (forecast 0.5%)

-

08:01

United Kingdom: Nationwide house price index, y/y, November 3.7% (forecast 4.2%)

-

07:05

Options levels on friday, November 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0742 (1122)

$1.0716 (1482)

$1.0675 (740)

Price at time of writing this review: $1.0611

Support levels (open interest**, contracts):

$1.0577 (5203)

$1.0547 (7439)

$1.0503 (6094)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 96864 contracts, with the maximum number of contracts with strike price $1,1100 (6091);

- Overall open interest on the PUT options with the expiration date December, 4 is 122018 contracts, with the maximum number of contracts with strike price $1,0500 (10669);

- The ratio of PUT/CALL was 1.26 versus 1.26 from the previous trading day according to data from November, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (1907)

$1.5302 (2549)

$1.5204 (1078)

Price at time of writing this review: $1.5087

Support levels (open interest**, contracts):

$1.4997 (2659)

$1.4899 (2660)

$1.4799 (650)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28291 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 32325 contracts, with the maximum number of contracts with strike price $1,5050 (4945);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from November, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:32

Currencies. Daily history for Nov 26’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0609 -0,14%

GBP/USD $1,5100 -0,19%

USD/CHF Chf1,0236 +0,20%

USD/JPY Y122,55 -0,11%

EUR/JPY Y130,05 -0,22%

GBP/JPY Y185,06 -0,35%

AUD/USD $0,7224 -0,35%

NZD/USD $0,6569 -0,12%

USD/CAD C$1,3293 +0,05%

-

02:00

Schedule for today, Friday, Nov 27’2015:

(time / country / index / period / previous value / forecast)

00:05 United Kingdom Gfk Consumer Confidence November 2 2 1

07:00 United Kingdom Nationwide house price index, y/y November 3.9% 4.2%

07:00 United Kingdom Nationwide house price index November 0.6% 0.5%

09:30 United Kingdom Business Investment, q/q Quarter III 1.6% 1.5%

09:30 United Kingdom Business Investment, y/y Quarter III 3.1%

09:30 United Kingdom GDP, y/y (Revised) Quarter III 2.4% 2.3%

09:30 United Kingdom GDP, q/q (Revised) Quarter III 0.7% 0.5%

10:00 Eurozone Consumer Confidence (Finally) November -7.6 -7.7

10:00 Eurozone Business climate indicator November 0.44 0.45

10:00 Eurozone Industrial confidence November -2 -2.1

10:00 Eurozone Economic sentiment index November 105.9 105.9

12:00 Germany Gfk Consumer Confidence Survey December 9.4 9.2

13:30 Canada Industrial Product Price Index, m/m October -0.3% -0.1%

13:30 Canada Industrial Product Price Index, y/y October -0.4%

-

00:32

Japan: Tokyo CPI ex Fresh Food, y/y, November 0% (forecast -0.1%)

-

00:32

Japan: National Consumer Price Index, y/y, October 0.3% (forecast 0%)

-

00:32

Japan: National CPI Ex-Fresh Food, y/y, October -0.1% (forecast -0.1%)

-

00:31

Japan: Household spending Y/Y, October -2.4% (forecast 0.1%)

-

00:31

Japan: Tokyo Consumer Price Index, y/y, November 0.2% (forecast 0.2%)

-

00:31

Japan: Unemployment Rate, October 3.1% (forecast 3.4%)

-