Noticias del mercado

-

17:17

Swiss industrial production drops 2.8% in the third quarter

The Swiss Federal Statistical Office released its industrial production data for Switzerland on Thursday. Swiss industrial production dropped 2.8% in the third quarter from a year earlier, after a 2.1% fall in the second quarter.

The production in the construction sector was down 4.9% in the third quarter.

-

17:04

Standard & Poor's: the economic growth in the Asia-Pacific region in 2016 and 2017 will be sluggish

Ratings agency Standard & Poor's (S&P) said in its report "Can Asia-Pacific Capitalize On Its New Growth Drivers?" on Wednesday that the economic growth in the Asia-Pacific region in 2016 and 2017 will be sluggish. The agency expects the economy in the region to expand 5.3% in 2016 and 5.2% in 2017.

"Asia-Pacific will need to adapt to changes in the growth drivers to ensure continued relatively strong, balanced, and sustainable growth," Standard & Poor's Asia-Pacific chief economist, Paul Gruenwald, said.

S&P also said that India overtook China as the Asia-Pacific region's growth leader.

Emerging Asia is expected to grow at 6% in 2016 and 2017.

-

16:42

The European Commission expects the European Union’s economy to expand 1.9% in 2015

The European Commission released its annual Annual Growth Survey 2016 and Alert Mechanism Report 2016 on Thursday. The Commission expects the European Union's (EU) economy to expand 1.9% in 2015, 2.0% in 2016 and 2.1% in 2017, according to Annual Growth Survey 2016.

The inflation in the EU is expected to be 0% in 2015, 1.1% in 2016 and to 1.6% in 2017.

The Commission noted in its Alert Mechanism Report that the economies of Italy, France and Belgium are vulnerable to economic shocks due to high debt and low growth.

"The combination of large stocks of public debt and a declining trend in potential growth or competitiveness is a source of concerns in a number of countries despite the absence of external sustainability risks, as it increases the likelihood of unstable debt to-GDP trajectories and the vulnerability to adverse shocks," the Commission said.

-

16:04

The European Central Bank and the People's Bank of China successfully test bilateral currency swap operations

"The ECB and the PBC have successfully completed tests of their existing bilateral currency swap arrangement. From a Eurosystem perspective, the arrangement serves as a backstop facility to address sudden and temporary disruptions in the renminbi market due to liquidity shortages in euro area banks," the central bank said.

The currency swap deal was signed in October 2013 and totalled €45 billion or 350 billion yuan. The central banks conducted tests in April and November this year.

"The ECB regularly conducts tests of its instruments and operations in order to ensure its operational readiness. The scheduling of such tests is not linked to market conditions and should not be seen as signalling any intention of the central banks to request funds from each other to provide counterparties with liquidity in the respective currency," the ECB noted.

-

15:02

Fitch Ratings affirms China’s sovereign debt rating at 'A+'

Fitch Ratings affirmed China's sovereign debt rating at 'A+' on Thursday. The outlook is stable.

"China's ratings balance a strong sovereign balance sheet and sustained high GDP growth against high sovereign contingent liabilities and a range of structural weaknesses and risks," the agency said.

Fitch noted that China can handle risks to the country's basic economic and financial stability as it has the administrative and financial resources.

The agency expects general government debt to be 53% of GDP at end-2015, up from 49% at end-2014, and about 54% of GDP in 2016.

China's economy is expected to expand 6.8% in 2015, 6.3% in 2016 and 6% in 2017.

-

14:40

Option expiries for today's 10:00 ET NY cut

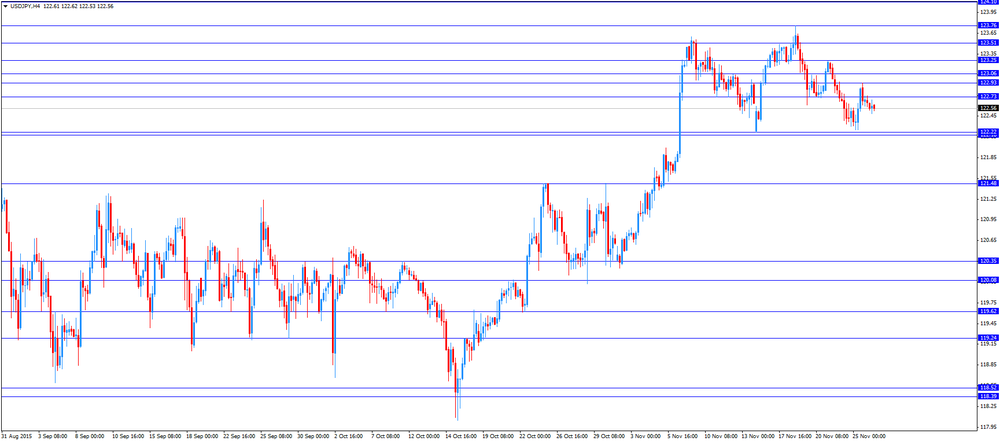

USD/JPY 122.65 (USD 436m) 123.00 (213m)

EUR/USD 1.0500 (EUR 1.3bln) 1.0590-1.0600 (558m) 1.0690-1.0700 (2bln)

GBP/USD 1.5090 (GBP 193m)

AUD/USD 0.7110 (AUD 329m) 0.7150 (339m) 0.7300 (255m)

-

14:35

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on speculation that the European Central Bank will add further stimulus measures

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Private Capital Expenditure Quarter III -4.4% Revised From -4.0% -3% -9.2%

09:00 Eurozone Private Loans, Y/Y October 1.1% 1.2% 1.2%

09:00 Eurozone M3 money supply, adjusted y/y October 4.9% 4.9% 5.3%

13:00 Canada Bank holiday

13:00 U.S. Bank holiday

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports from the U.S. U.S. markets are closed for a public holiday.

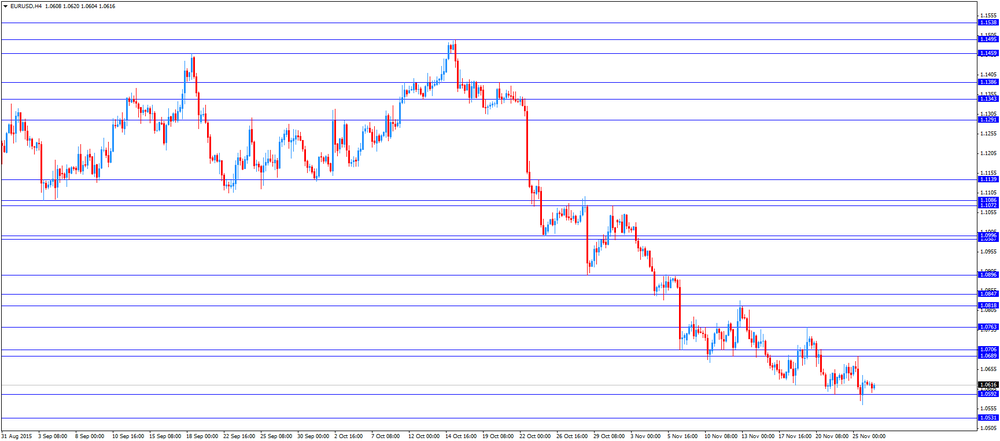

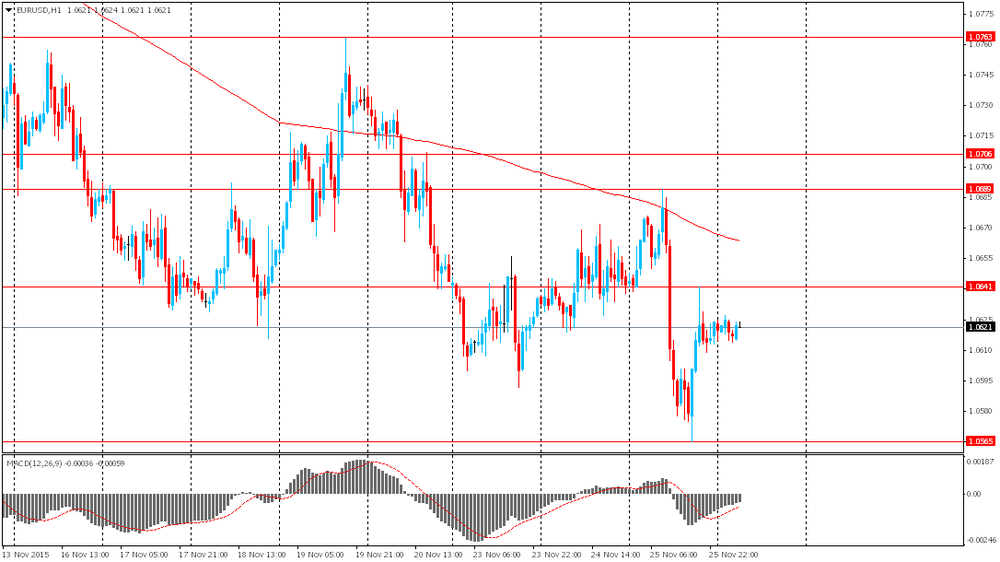

The euro traded lower against the U.S. dollar on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB President Mario Draghi said at a press conference after the ECB meeting in October that the central bank will review its stimulus measures at its next meeting in December.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.3% in October from last year, exceeding expectations for a 4.9% gain, after a 4.9 % increase in September.

Loans to the private sector in the Eurozone climbed 1.2% in October from the last year, in line with expectations, after a 1.1% gain in September.

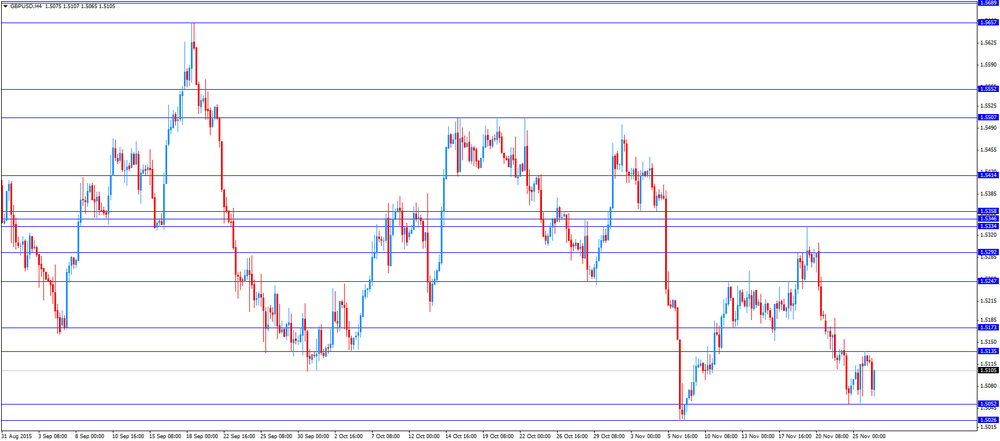

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair traded mixed

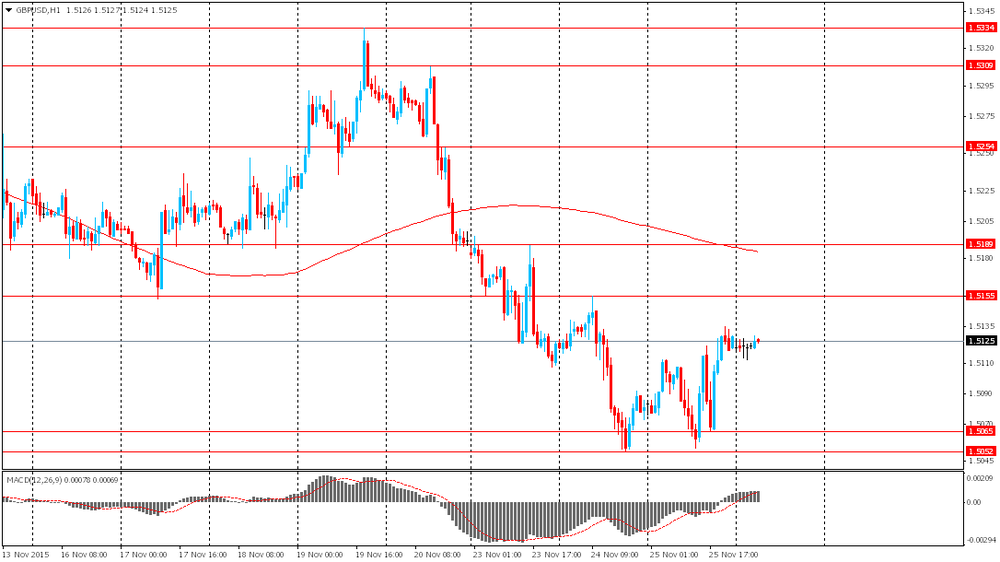

GBP/USD: the currency pair fell to $1.5065

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

23:30 Japan Unemployment Rate October 3.4% 3.4%

23:30 Japan Household spending Y/Y October -0.4% 0.1%

23:30 Japan Tokyo Consumer Price Index, y/y November 0.1% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November -0.2% -0.1%

23:30 Japan National Consumer Price Index, y/y October 0.0% 0%

23:30 Japan National CPI Ex-Fresh Food, y/y October -0.1% -0.1%

-

14:00

Orders

EUR/USD

Offers 1.0685-90 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0600 1.0580-85 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5135 1.5150-55 1.5170 1.5180-85 1.5200 1.5300

Bids 1.5075-80 1.5065 1.5050 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7050 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7015-20 0.7000 0.6980-85 0.6965 0.6950

EUR/JPY

Offers 130.50 130.80 131.00131.20 131.50 131.85 132.00 132.50 132.75 133.00

Bids 130.00 129.85 129.50 129.35 129.00

USD/JPY

Offers 122.85-95 123.00 123.20-25 123.35 123.50 123.65.70 123.85 124.00

Bids 122.20-25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7260 0.7280-85 0.7300 0.7325-30 0.7350 0.7375 0.7400

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100-05

-

11:21

Private capital expenditure in Australia plunges 9.2% in the third quarter

The Australian Bureau of Statistics released its private capital expenditure data on Thursday. Private capital expenditure in Australia dropped 9.2% in the third quarter, missing expectations for a 3.0% decline, after a 4.4% fall in the second quarter.

The second quarter's figure was revised down from a 4.0% decrease.

Capex for buildings and structures plunged 9.8% in the third quarter, while capital spending for equipment, plants and machinery fell 8.2%.

On a yearly basis, private capital expenditure in Australia declined 20.0% in the third quarter.

-

10:52

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 40.9 in in the week ended November 22

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 40.9 in in the week ended November 22 from 41.2 the prior week. The decline was driven by a less favourable assessment of the current economy.

The measure of views of the economy declined to 30.5 from 32.2. It was the highest reading since early May.

The buying climate and the personal finances indexes slightly rose last week.

-

10:29

M3 money supply in the Eurozone rises 5.3% in October from last year

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.3% in October from last year, exceeding expectations for a 4.9% gain, after a 4.9 % increase in September.

Loans to the private sector in the Eurozone climbed 1.2% in October from the last year, in line with expectations, after a 1.1% gain in September.

-

10:08

Spain’s economy expands 0.8% the third quarter

The Spanish statistical office INE released its final gross domestic product (GDP) for Spain. Spain's economy expanded 0.8% the third quarter, in line with the preliminary reading, after a 1.0% growth in the second quarter. It was the ninth consecutive increase.

On a yearly, GDP grew 3.4% in the third quarter, in line with the preliminary reading, after a 3.1% in the second quarter. It was the fastest growth since the fourth quarter of 2007.

Household spending climbed 1% in the third quarter, general government spending rose by 0.9%, while investment increased 1.1%.

Exports were up 2.8% in the third quarter, while imports jumped 4%.

-

10:01

Eurozone: Private Loans, Y/Y, October 1.2% (forecast 1.2%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, October 5.3% (forecast 4.9%)

-

09:12

New Zealand’s trade deficit narrows to NZ$963 million in October

Statistics New Zealand released its trade data on late Wednesday evening. New Zealand's trade deficit narrowed to NZ$963 million in October from NZ$1,140 million in September. September's figure was revised up from a deficit of NZ$1,222 million.

Analysts had expected the deficit to decline to NZ$937 million.

Exports dropped 4.5% year-on-year in October, while imports decreased by 2.2%.

"Since annual exports to China fell from their peak in 2014, exports to China and Australia have been around $8.4 billion each. Annual exports to Australia peaked in January 2012 but have been generally falling since, due to lower crude oil exports," Statistics NZ international statistics senior manager Jason Attewell said.

-

08:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.65 (USD 436m) 123.00 (213m)

EUR/USD 1.0500 (EUR 1.3bln) 1.0590-1.0600 (558m) 1.0690-1.0700 (2bln)

GBP/USD 1.5090 (GBP 193m)

AUD/USD 0.7110 (AUD 329m) 0.7150 (339m) 0.7300 (255m)

-

08:19

Foreign exchange market. Asian session: the U.S. dollar edged down

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Private Capital Expenditure Quarter III -4.4% Revised From -4.0% -3% -9.2%

The U.S. dollar declined slightly against the yen after yesterday's gains, which were driven by strong data. The final reading of Reuters/Michigan Consumer Sentiment Index came in at 91.3 in November compared to 90 in October. Investors took this report for a sign that the Federal Reserve will raise interest rates in December.

Weekly data from the Labor Department also came in better than expected. The number of initial jobless claims fell by 12,000, while analysts had expected this index to remain at 271,000.

The Australian dollar declined amid private capital expenditure data. The index fell by 9.2% in the third quarter compared to the second quarter. Analysts had expected a moderate 3.0% drop. The previous reading was revised to -4.4% from -4.0%. Spending in mining investment fell 10.4%. Spending on buildings and structures declined 9.8%, while equipment, plant and machinery investment fell 8.2%.

EUR/USD: the pair fluctuated within $1.0615-25 in Asian trade

USD/JPY: the pair fell to Y122.55

GBP/USD: the pair traded within $1.5110-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Private Loans, Y/Y October 1.1% 1.2%

09:00 Eurozone M3 money supply, adjusted y/y October 4.9% 4.9%

12:00 Germany Gfk Consumer Confidence Survey December 9.4

23:30 Japan Unemployment Rate October 3.4% 3.4%

23:30 Japan Household spending Y/Y October -0.4% 0.1%

23:30 Japan Tokyo Consumer Price Index, y/y November 0.1% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November -0.2% -0.1%

23:30 Japan National Consumer Price Index, y/y October 0.0% 0%

23:30 Japan National CPI Ex-Fresh Food, y/y October -0.1% -0.1%

-

07:19

Options levels on thursday, November 26, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0742 (1122)

$1.0716 (1482)

$1.0675 (740)

Price at time of writing this review: $1.0620

Support levels (open interest**, contracts):

$1.0577 (5203)

$1.0547 (7439)

$1.0503 (6094)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 96864 contracts, with the maximum number of contracts with strike price $1,1100 (6091);

- Overall open interest on the PUT options with the expiration date December, 4 is 122018 contracts, with the maximum number of contracts with strike price $1,0500 (10669);

- The ratio of PUT/CALL was 1.26 versus 1.26 from the previous trading day according to data from November, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (1907)

$1.5302 (2549)

$1.5204 (1078)

Price at time of writing this review: $1.5122

Support levels (open interest**, contracts):

$1.5094 (2470)

$1.4997 (2659)

$1.4899 (2660)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28291 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 32325 contracts, with the maximum number of contracts with strike price $1,5050 (4945);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from November, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Currencies. Daily history for Nov 25’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0624 -0,17%

GBP/USD $1,5128 +0,31%

USD/CHF Chf1,0216 +0,50%

USD/JPY Y122,69 +0,13%

EUR/JPY Y130,34 -0,05%

GBP/JPY Y185,7 +0,50%

AUD/USD $0,7249 -0,06%

NZD/USD $0,6577 +0,36%

USD/CAD C$1,3287 -0,13%

-

01:59

Schedule for today, Thursday, Nov 26’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Private Capital Expenditure Quarter III -4.4% Revised From -4.0% -3% -9.2%

09:00 Eurozone Private Loans, Y/Y October 1.1% 1.2%

09:00 Eurozone M3 money supply, adjusted y/y October 4.9% 4.9%

12:00 Germany Gfk Consumer Confidence Survey December 9.4

13:00 Canada Bank holiday

13:00 U.S. Bank holiday

23:30 Japan Unemployment Rate October 3.4% 3.4%

23:30 Japan Household spending Y/Y October -0.4% 0.1%

23:30 Japan Tokyo Consumer Price Index, y/y November 0.1% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November -0.2% -0.1%

23:30 Japan National Consumer Price Index, y/y October 0.0% 0%

23:30 Japan National CPI Ex-Fresh Food, y/y October -0.1% -0.1%

-

01:30

Australia: Private Capital Expenditure, Quarter III -9.2% (forecast -3%)

-