Noticias del mercado

-

19:00

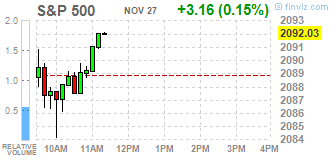

DJIA 17802.70 -10.69 -0.06%, NASDAQ 5128.47 12.33 0.24%, S&P 500 2090.62 1.75 0.08%

-

18:14

WSE: Session Results

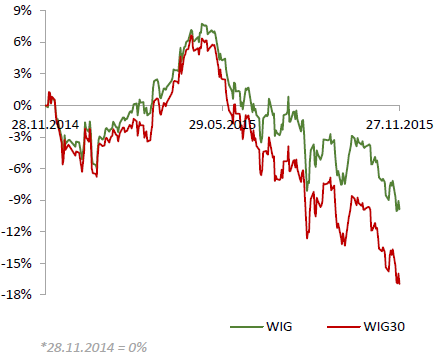

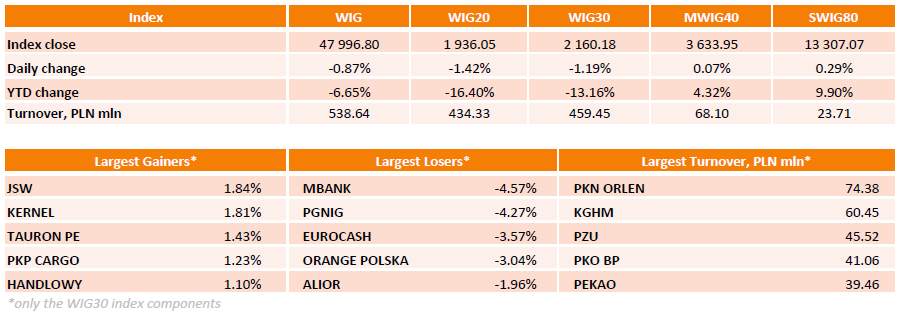

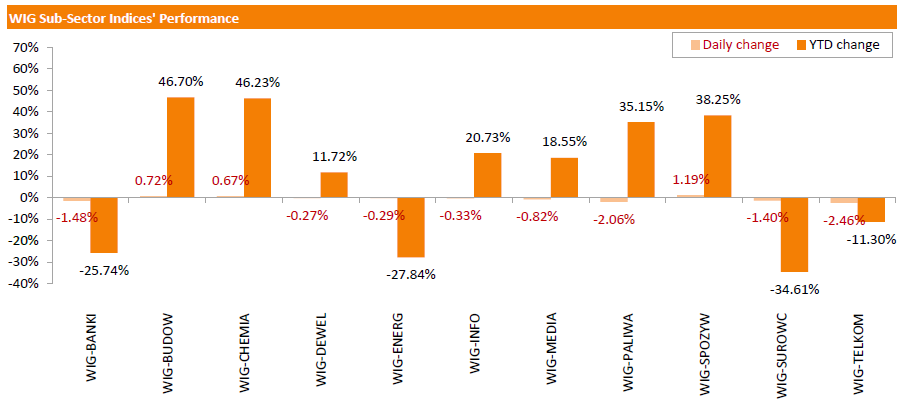

Polish equity market declined on Friday. The broad market measure, the WIG Index, slumped by 0.87%. Sector-wise, telecoms stocks (-2.46%) lagged behind, while food sector names (+1.19%) were the strongest group.

The large-cap stocks fell by 1.19%, as measured by the WIG30 Index. In the index basket, banking name MBANK (WSE: MBK) and oil and gas sector name PGNIG (WSE: PGN) led the decliners, tumbling by 4.57% and 4.27% respectively. Other prominent losers were FMCG distributor EUROCASH (WSE: EUR) and telecoms name ORANGE POLSKE (WSE: OPL), plummeting by 3.57% and 3.04% respectively. On the other side of the ledger, coal miner JSW (WSE: JSW) and agricultural producer KERNEL (WSE: KER) were the best-performing names, advancing by 1.84% and 1.81% respectively. They were followed by genco TAURON PE (WSE: TPE) and railway freight operator PKP CARGO (WSE: PKP), which quotations went up by 1.43% and 1.23% respectively.

-

18:00

European stocks close: stocks closed lower on a drop in Chinese stock markets

Stock indices closed lower on a drop in Chinese stock markets. Chinese stock markets slid due to investigations by the Chinese securities regulatory body.

Meanwhile, the economic data from the Eurozone was mixed. The European Commission released its economic sentiment index for the Eurozone on Friday. The index remained unchanged at 106.1 in November. October's figure was revised up from 105.9. Analysts had expected the index to decline to 105.9.

The increase was driven by stronger confidence among consumers.

The industrial confidence index dropped to -3.2 in November from -2.0 in October, missing expectations for a decline to -2.1.

The final consumer confidence index was up to -5.9 in November from -7.5 in October, beating expectations for a fall to -7.7. October's figure was revised up from -7.6.

The business climate index decreased to 0.36 in November from 0.44 in October. Analysts had expected the index to rise to 0.45.

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index fell to 1 in November from 2 in October. Analysts had expected the index to remain unchanged at 2.

"Overall, despite the good news agenda of rock-bottom inflation, falling fuel prices and higher wage growth boosting spending power, confidence appears to be depressed by a combination of wider economic, political and social events. However, one area that continues to hold up is our expectation for our personal financial situation for the next 12 months," Joe Staton, Head of Market Dynamics at GfK, said.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Friday. The revised U.K. GDP expanded at 0.5% in the third quarter, in line with the preliminary reading, after a 0.7% rise in the second quarter.

The growth was driven by a rise in household spending. Household spending rose 0.8% in the third quarter, after a 0.7% increase in the second quarter.

Exports climbed 0.9% in the third quarter, while imports were up 5.5%.

Business investment jumped 2.2% in the third quarter.

The service sector climbed 0.7% in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.3% in the third quarter, in line with the preliminary reading, after a 2.4% gain in the second quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,375.15 -17.98 -0.28 %

DAX 11,293.76 -27.01 -0.24 %

CAC 40 4,930.14 -15.88 -0.32 %

-

18:00

European stocks closed: FTSE 6375.15 -17.98 -0.28%, DAX 11293.76 -27.01 -0.24%, CAC 40 4930.14 -15.88 -0.32%

-

17:24

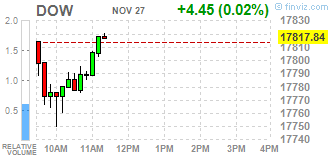

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes was little changed on Friday, a shortened trading day, as investors turn their focus to the crucial U.S. holiday shopping season and Disney weighed on indexes. The shopping season spanning November and December is crucial for many retailers because the two months can account for anywhere between 20 percent and 40 percent of annual sales. The National Retail Federation is expecting holiday sales to rise 3.7 percent, slower than last year's 4.1 percent increase.

Crude oil futures were lower on Friday, bringing losses this month to over 8 percent as disappointing Chinese data and worries over a supply glut overshadowed geopolitical concerns.

Dow stocks mixed (15 vs 15). Top looser - The Walt Disney Company (DIS, -3.88%). Top gainer - UnitedHealth Group Incorporated (UNH. +0.87%).

S&P index sectors also mixed. Top looser - Basic materials (-1.2%). Top gainer - Conglomerates (+0,8%).

At the moment:

Dow 17783.00 -19.00 -0.11%

S&P 500 2088.75 +0.75 +0.04%

Nasdaq 100 4680.00 +2.75 +0.06%

Oil 42.04 -1.00 -2.32%

Gold 1057.00 -12.70 -1.19%

U.S. 10yr 2.22 -0.02

-

16:52

Profits of industrial companies in China drop 4.6% in October

China's National Bureau of Statistics (NBS) said on Friday that profits of industrial companies in China declined 4.6% in October from a year earlier, after a 0.1% fall in September.

For the first ten months of 2015, industrial profits fell 2.0% from a year earlier.

Profits in the mining sector dropped 56.3% in the first ten months of the year from a year earlier, while manufacturing profits rose 3.8%.

-

16:41

Greek revised GDP falls at a seasonally-and-calendar adjusted 0.9% in the third quarter

The Hellenic Statistical Authority released its revised gross domestic product (GDP) data for Greece on Friday. The Greek revised GDP fall at a seasonally-and-calendar adjusted 0.9% rate in the third quarter, down from the preliminary reading of a 0.5% decline, after a 0.3% growth in the second quarter.

The second quarter's figure was revised down to a 0.4% rise.

On a yearly unadjusted basis, Greek final GDP slid 0.9% rate in the third quarter, down from the preliminary reading of a 0.1% decrease, after a 1.3% increase in the second quarter.

Total consumption expenditure dropped 1.0% year-on-year in the third quarter.

Exports dropped 7.1% in the third quarter, while imports declined 16.9%.

-

16:26

Preliminary consumer price inflation in Spain rises 0.3% in November

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.3% in November, after a 0.6% rise in October.

On a yearly basis, consumer prices fell by 0.3% in November, after a 0.7% decrease in October.

The annual decline was mainly driven by the decline in the prices of fuels and lubricants (gas and diesel oil).

-

16:12

Nationwide: UK house prices rise 0.1% in November

The Nationwide Building Society released its house prices data for the U.K. on Friday. UK house prices were up 0.1% in November, missing expectations for a 0.5% rise, after a 0.5% increase in October. October's figure was revised down from a 0.6% gain.

On a yearly basis, house prices fell to 3.7% in November from 3.9% in October. Analysts had expected house prices to rise by 4.2%.

"While this bodes well for a sustainable increase in housing market activity in the period ahead, much will depend on whether building activity can keep pace with increasing demand," Nationwide's chief economist, Robert Gardner, said.

-

15:38

Italian consumer confidence index climbs to 118.4 in November

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. The Italian consumer confidence index climbed to 118.4 in November from 117.0 in October. October's figure was revised up from 116.9.

The increase was driven by rises in all components: economic, personal, current and future.

The business confidence index fell to 104.6 in November from 105.7 in October. October's figure was revised down from 105.9.

-

15:34

U.S. Stocks open: Dow -0.04%, Nasdaq +0.17%, S&P +0.06%

-

15:26

Before the bell: S&P futures 0%, NASDAQ futures +0.22%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 19,883.94 -60.47 -0.30%

Hang Seng 22,068.32 -420.62 -1.87%

Shanghai Composite 3,436.38 -199.17 -5.48%

FTSE 6,378.75 -14.38 -0.22%

CAC 4,944.7 -1.32 -0.03%

DAX 11,311.4 -9.37 -0.08%

Crude oil $42.18 (-2%)

Gold $1054.30 (-1.47%)

-

15:22

GfK’s U.K. consumer confidence index declines to 1 in November

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index fell to 1 in November from 2 in October. Analysts had expected the index to remain unchanged at 2.

3 of 5 measures decreased, 1 rose and 1 was unchanged.

"Overall, despite the good news agenda of rock-bottom inflation, falling fuel prices and higher wage growth boosting spending power, confidence appears to be depressed by a combination of wider economic, political and social events. However, one area that continues to hold up is our expectation for our personal financial situation for the next 12 months," Joe Staton, Head of Market Dynamics at GfK, said.

-

15:00

Greek producer prices decrease 0.6% in October

The Hellenic Statistical Authority released its producer price index (PPI) data on Friday. Greek producer prices decreased 0.6% in October.

Domestic market prices fell by 0.5% in October, while foreign market prices slid 0.6%.

On a yearly basis, Greek PPI plunged 9.6% in October, after a 10.4% drop in September.

Domestic market prices slid 8.1% year-on-year in October, while foreign market prices dropped 14.1%.

Energy prices plunged 23.0% year-on-year in October, while non-durable consumer goods industrial prices were up 0.3% year-on-year.

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Amazon.com Inc., NASDAQ

AMZN

680.59

0.78%

29.4K

Pfizer Inc

PFE

33.10

0.70%

11.6K

AMERICAN INTERNATIONAL GROUP

AIG

63.55

0.63%

0.4K

Nike

NKE

134.96

0.62%

1.9K

Google Inc.

GOOG

752.75

0.61%

0.7K

Twitter, Inc., NYSE

TWTR

26.19

0.50%

24.6K

Home Depot Inc

HD

135.30

0.48%

0.5K

General Motors Company, NYSE

GM

36.50

0.44%

2.1K

Wal-Mart Stores Inc

WMT

60.49

0.42%

1.5K

Tesla Motors, Inc., NASDAQ

TSLA

230.49

0.37%

3.4K

Starbucks Corporation, NASDAQ

SBUX

62.40

0.34%

1.7K

Microsoft Corp

MSFT

53.85

0.30%

7.6K

Intel Corp

INTC

34.55

0.29%

2.7K

Apple Inc.

AAPL

118.37

0.29%

85.3K

Visa

V

79.77

0.26%

0.1K

American Express Co

AXP

71.85

0.22%

0.2K

McDonald's Corp

MCD

113.75

0.21%

1.3K

ALCOA INC.

AA

9.43

0.21%

2.9K

AT&T Inc

T

33.50

0.15%

4.0K

Facebook, Inc.

FB

105.56

0.14%

32.4K

JPMorgan Chase and Co

JPM

66.90

0.06%

3.9K

The Coca-Cola Co

KO

43.05

0.05%

0.2K

Cisco Systems Inc

CSCO

27.25

0.04%

7.5K

Verizon Communications Inc

VZ

44.92

0.00%

3.1K

Ford Motor Co.

F

14.55

0.00%

2.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.10

0.00%

130.8K

Hewlett-Packard Co.

HPQ

12.64

0.00%

2.3K

Citigroup Inc., NYSE

C

54.00

-0.15%

3.0K

General Electric Co

GE

30.28

-0.26%

7.0K

Caterpillar Inc

CAT

71.19

-0.42%

0.2K

Chevron Corp

CVX

90.41

-0.51%

0.9K

Exxon Mobil Corp

XOM

80.75

-0.62%

4.1K

Yahoo! Inc., NASDAQ

YHOO

32.80

-1.09%

6.1K

Yandex N.V., NASDAQ

YNDX

16.74

-1.65%

6.1K

Walt Disney Co

DIS

116.17

-2.11%

35.4K

Barrick Gold Corporation, NYSE

ABX

7.19

-2.31%

34.6K

-

14:43

Canadian industrial product prices decline in October, while raw materials prices climb

Statistics Canada released its industrial product and raw materials price indexes on Friday. The Industrial Product Price Index (IPPI) fell 0.5% in October, missing forecasts for a 0.1% drop, after a 0.4% decline in September. September's figure was revised down from 0.3% decrease.

The decrease was mainly driven by lower prices for motorized and recreational vehicles, which slid 1.1% in October.

2 of the 21 commodity groups increased, 18 declined and 1 was unchanged.

The Raw Materials Price Index (RMPI) climbed 0.4% in October, after a 2.4% gain in September. September's figure was revised down from a 3.0% rise.

The rise was driven by higher prices for crude energy products. Crude energy products rose by 2.4% in September.

3 of the 6 commodity groups rose and 3 decreased.

-

14:29

German Gfk consumer confidence index declines to 9.3 in December

Market research group GfK released its consumer confidence index for Germany on Friday. German Gfk consumer confidence index fell to 9.3 in December from 9.4 in November, beating expectations for a drop to 9.2.

The decrease was driven by declines in 2 of 3 indicators.

The economic expectations index plunged by 2.4 points to -5.3 points in November, while the willingness to buy index increased 3.0 points to 48.9.

The income expectations index fell by 3.3 points to 44.4 in November.

"German consumer confidence is continuing to wane, while economic expectations are maintaining their downward trend. The persistently high influx of asylum seekers has seen economic optimism fall further, and has also had a detrimental effect on the income expectations indicator, which has also experienced losses. In contrast, the propensity to consume is currently bucking this trend and, despite the general economic downturn, actually increased this month," Gfk noted.

-

12:01

European stock markets mid session: stocks traded mixed on a drop in Chinese stock markets

Stock indices traded mixed on a drop in Chinese stock markets. Chinese stock markets slid due to investigations by the Chinese securities regulatory body.

Meanwhile, the economic data from the Eurozone was mixed. The European Commission released its economic sentiment index for the Eurozone on Friday. The index remained unchanged at 106.1 in November. October's figure was revised up from 105.9. Analysts had expected the index to decline to 105.9.

The increase was driven by stronger confidence among consumers.

The industrial confidence index dropped to -3.2 in November from -2.0 in October, missing expectations for a decline to -2.1.

The final consumer confidence index was up to -5.9 in November from -7.5 in October, beating expectations for a fall to -7.7. October's figure was revised up from -7.6.

The business climate index decreased to 0.36 in November from 0.44 in October. Analysts had expected the index to rise to 0.45.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Friday. The revised U.K. GDP expanded at 0.5% in the third quarter, in line with the preliminary reading, after a 0.7% rise in the second quarter.

The growth was driven by a rise in household spending. Household spending rose 0.8% in the third quarter, after a 0.7% increase in the second quarter.

Exports climbed 0.9% in the third quarter, while imports were up 5.5%.

Business investment jumped 2.2% in the third quarter.

The service sector climbed 0.7% in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.3% in the third quarter, in line with the preliminary reading, after a 2.4% gain in the second quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,383.23 -9.90 -0.15 %

DAX 11,339.81 +19.04 +0.17 %

CAC 40 4,950.24 +4.22 +0.09 %

-

11:46

Eurozone’s economic sentiment index remains unchanged at 106.1 in November

The European Commission released its economic sentiment index for the Eurozone on Friday. The index remained unchanged at 106.1 in November. October's figure was revised up from 105.9. Analysts had expected the index to decline to 105.9.

The increase was driven by stronger confidence among consumers.

The industrial confidence index dropped to -3.2 in November from -2.0 in October, missing expectations for a decline to -2.1.

The final consumer confidence index was up to -5.9 in November from -7.5 in October, beating expectations for a fall to -7.7. October's figure was revised up from -7.6.

The business climate index decreased to 0.36 in November from 0.44 in October. Analysts had expected the index to rise to 0.45.

-

11:32

Revised U.K. GDP grows at 0.5% in the third quarter

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Friday. The revised U.K. GDP expanded at 0.5% in the third quarter, in line with the preliminary reading, after a 0.7% rise in the second quarter.

The growth was driven by a rise in household spending. Household spending rose 0.8% in the third quarter, after a 0.7% increase in the second quarter.

Exports climbed 0.9% in the third quarter, while imports were up 5.5%.

Business investment jumped 2.2% in the third quarter.

The service sector climbed 0.7% in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.3% in the third quarter, in line with the preliminary reading, after a 2.4% gain in the second quarter.

-

11:22

French producer prices increase 0.2% in October

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.2% in October, after a 0.1% rise in September.

The increase was driven a rise in prices for mining and quarrying products, energy and water, which were up 1.9% in October.

On a yearly basis, French PPI fell 2.5% in October, after a 2.6% drop in September.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 32.0 year-on-year in October.

Import prices decreased 0.4% in October, after a 0.6% fall in September.

-

11:15

French consumer spending drops 0.7% in October

French statistical office INSEE released its consumer spending data on Friday. French consumer spending slid 0.7% in October, after a 0.1% gain in September. It was the first drop since March.

The drop was mainly driven by a decline in purchases of durable goods. Spending on durable goods plunged by 1.8% in October, driven by lower car purchases.

Spending on food was flat in October, while spending on energy fell 1.1%.

On a yearly basis, consumer spending climbed 2.1% in October.

-

11:02

German import prices decline 0.3% in October

Destatis released its import prices data for Germany on Friday. German import prices declined by 4.1% in October from last year, after a 4.0% fall in September.

The decline was driven by a drop in energy prices, which plunged 30.0% year-on-year in October.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.3% in October, after a 0.7% fall in September.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 0.5% in October.

Export prices increased 0.2% year-on-year in October, after a 0.3% rise in September.

On a monthly base, export prices were down 0.2% in October.

-

10:52

Japan's national CPI rises to an annual rate of 0.3% in October

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) rose to an annual rate of 0.3% in October from 0.0% in September. Analysts had expected the index to remain unchanged at 0.0%.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of -0.1% in October, in line with expectations.

The decline was mainly driven by low energy prices.

Household spending in Japan fell 2.4% year-on-year in October, after a 0.4% decline in September, missing expectations of a 0.1% gain.

The unemployment rate dropped to 3.1% in October from 3.4% in September. Analysts had expected the index to remain unchanged at 3.4%.

The Bank of Japan released its own inflation figures. Japan's core national CPI climbed an annual rate of 1.2% in October. The central bank's calculation does not include fresh food products and energy, but it includes prices for imported food products.

-

10:42

The number of registered job seekers without any employment activity in France rises 1.2% in October

The French labour ministry said on Thursday that the number of registered job seekers without any employment activity rose 1.2% in October, after a 0.7% decline in September.

The total number of fully unemployed was 3.589 million people. It was the highest level since April 2013.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012. The French government is struggling to bring down unemployment.

-

10:20

The Swiss National Bank President Thomas Jordan: the central bank closely monitors the exchange rate of the Swiss currency

The Swiss National Bank (SNB) President Thomas Jordan said in an interview with Swiss newspaper Handelszeitung on Thursday that the central bank closely monitors the exchange rate of the Swiss currency.

"Our monetary policy is clear. It is based on two pillars: the negative interest rates and the willingness to intervene in the currency market if necessary," he said.

Jordan added that there was no limit to how much the central bank could increase its balance sheet.

-

10:09

French Finance Minister Michel Sapin: the country plans to meet its budget deficit targets next year

French Finance Minister Michel Sapin said on Thursday that the country plans to meet its budget deficit targets next year, despite the additional spending for the security after the terrorist attacks in Paris.

"I won't put any budgetary hurdles in the way of assuring the internal or external security of the French people, but France will not abandon this necessary goal of reducing our deficit," he said.

-

07:06

Global Stocks: Asian stock indices declined amid weak data

U.S. stock indices were closed on Thursday due to Thanksgiving Day.

This morning in Asia Hong Kong Hang Seng lost 1.23%, or 277.13, to 22,211.81. China Shanghai Composite Index fell 1.52%, or 55.37, to 3.580.18. The Nikkei declined 0.41%, or 82.12, to 19,862.29.

Asian indices fell weighed by Chinese data. According to government data Chinese industrial profits fell by 4.6% in October, intensifying investors' concerns over the country's slowing economic growth.

At the beginning of the session Japanese stocks advanced amid positive employment data released late Friday. The unemployment rate came in at 3.1% in October compared to 3.4% in September. Economists had expected the index to remain unchanged.

However less favorable October inflation data showed that the core consumer price index declined by 0.1% y/y in line with expectations. This is the third months of declines in a row.

Household spending fell by 2.4% y/y in October as consumers spent less on clothing, health care and education.

-

03:01

Nikkei 225 19,874.5 -69.91 -0.35 %, Hang Seng 22,425.93 -63.01 -0.28 %, Shanghai Composite 3,616.54 -19.01 -0.52 %

-

02:32

Stocks. Daily history for Sep Nov 26’2015:

(index / closing price / change items /% change)

HANG SENG 22,480.12 -17.88 -0.08%

S&P/ASX 200 5,210.7 +17.02 +0.33%

TOPIX 1,602.32 +7.65 +0.48%

SHANGHAI COMP 3,635.67 -12.26 -0.34%

FTSE 100 6,393.13 +55.49 +0.88 %

CAC 40 4,946.02 +53.03 +1.08 %

Xetra DAX 11,320.77 +151.23 +1.35 %

-