Noticias del mercado

-

21:00

Dow -0.11% 17,831.00 -20.51 Nasdaq +0.17% 4,903.29 +8.40 S&P +0.03% 2,091.13 +0.59

-

18:00

European stocks closed: FTSE 100 6,265.65 +2.80 +0.04% CAC 40 4,512.64 +31.00 +0.69% DAX 10,272.71 +67.50 +0.66%

-

16:58

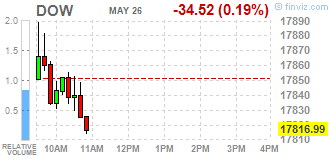

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday, taking a breather from their robust two-day run, as investors keenly await a speech from Fed Chair Janet Yellen on Friday. Comments from policymakers in recent days and upbeat U.S. economic data have raised expectations that the Federal Reserve could pull the trigger on a rate increase much sooner than previously thought.

Dow stocks mixed (17in negative, 13 in positive area). Top looser - Microsoft Corporation (MSFT, -1,01%). Top gainer - Wal-Mart Stores Inc. (WMT, +0,68%).

S&P sectors also mixed. Top looser - Basic Materials (-0,4%). Top gainer - Utilities (+0,6%).

At the moment:

Dow 17806.00 -11.00 -0.06%

S&P 500 2086.75 -0.50 -0.02%

Nasdaq 100 4481.25 +6.50 +0.15%

Oil 49.51 -0.05 -0.10%

Gold 1226.60 +2.80 +0.23%

U.S. 10yr 1.85 -0.02

-

15:33

U.S. Stocks open: Dow +0.19%, Nasdaq +0.15%, S&P +0.17%

-

15:26

Before the bell: S&P futures +0.12%, NASDAQ futures +0.14%

U.S. stock-index futures edged higher.

Global Stocks:

Nikkei 16,772.46 +15.11 +0.09%

Hang Seng 20,397.11 +29.06 +0.14%

Shanghai Composite 2,822.57 +7.49 +0.27%

FTSE 6,254.25 -8.60 -0.14%

CAC 4,505.08 +23.44 +0.52%

DAX 10,274.56 +69.35 +0.68%

Crude $50.08 (+1.05%)

Gold $1228.10 (+0.35%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.78

0.18(1.875%)

82410

Amazon.com Inc., NASDAQ

AMZN

708.6

0.25(0.0353%)

14441

Apple Inc.

AAPL

99.46

-0.16(-0.1606%)

179026

Barrick Gold Corporation, NYSE

ABX

17.43

0.17(0.9849%)

81594

Caterpillar Inc

CAT

73.28

0.71(0.9784%)

28615

Chevron Corp

CVX

102.08

0.31(0.3046%)

3493

Cisco Systems Inc

CSCO

29

0.08(0.2766%)

4250

Citigroup Inc., NYSE

C

47.09

0.15(0.3196%)

55617

Exxon Mobil Corp

XOM

90.55

0.29(0.3213%)

3136

Facebook, Inc.

FB

118.06

0.17(0.1442%)

68395

Ford Motor Co.

F

13.58

0.06(0.4438%)

11475

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.92

0.27(2.3176%)

224742

General Electric Co

GE

30.12

0.03(0.0997%)

5705

Goldman Sachs

GS

162.48

1.23(0.7628%)

875

Hewlett-Packard Co.

HPQ

12.32

0.12(0.9836%)

8267

Intel Corp

INTC

31.53

0.14(0.446%)

6157

International Business Machines Co...

IBM

151.51

-0.18(-0.1187%)

1767

JPMorgan Chase and Co

JPM

65.75

0.23(0.351%)

9731

McDonald's Corp

MCD

123.3

0.04(0.0325%)

100

Merck & Co Inc

MRK

56.57

-0.00(-0.00%)

1465

Microsoft Corp

MSFT

52.2

0.08(0.1535%)

2994

Nike

NKE

56.3

0.31(0.5537%)

4336

Starbucks Corporation, NASDAQ

SBUX

55.7

0.55(0.9973%)

7365

Tesla Motors, Inc., NASDAQ

TSLA

219.85

0.27(0.123%)

6275

Twitter, Inc., NYSE

TWTR

14.48

0.07(0.4858%)

31210

Verizon Communications Inc

VZ

49.78

-0.07(-0.1404%)

1178

Wal-Mart Stores Inc

WMT

70.4

-0.08(-0.1135%)

777

Walt Disney Co

DIS

100

0.14(0.1402%)

2623

Yahoo! Inc., NASDAQ

YHOO

36.27

0.68(1.9107%)

124609

Yandex N.V., NASDAQ

YNDX

20.08

0.31(1.568%)

7430

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

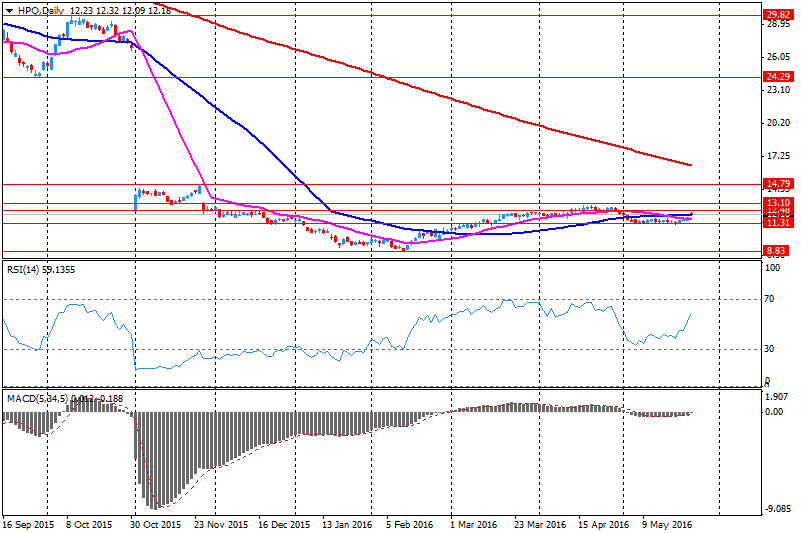

Other:HP Inc. (HPQ) reiterated with a Hold at Needham Research

HP Inc. (HPQ) reiterated with a Neutral at Mizuho Securities

-

13:46

Company News: HP Inc. (HPQ) Q2 earnings beat analysts’ expectations

HP Inc. reported Q2 FY 2016 earnings of $0.41 per share (versus $0.87 in Q2 FY 2015), beating analysts' consensus of $0.38.

The company's quarterly revenues amounted to $11.588 bln (-10.7% y/y), missing consensus estimate of $11.709 bln.

HP Inc. also issued guidance for Q3 and FY2016, projecting Q3 EPS of $0.37-0.40 (versus analysts' consensus estimate of $0.41) and FY2016 EPS of $1.59-1.65 (versus analysts' consensus estimate of $1.58).

HPQ was traded at $12.20 (0%) in pre-market trading.

-

10:12

Minneapolis Fed President Neel Kashkari: negative interest rates would only be a last resort for the Fed

Minneapolis Fed President Neel Kashkari said on Wednesday that negative interest rates would only be a last resort for the Fed, noting that negative interest rates were "perverse". He added that the Fed had other tools to stimulate the economy.

Minneapolis Fed president also said that he expected the U.S. economy to expand moderately.

Kashkari is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:05

Standard & Poor’s: Britain’s exit from the European Union could have a negative impact on the pound as an international reserve currency

Ratings agency Standard & Poor's (S&P) said on Wednesday that Britain's exit from the European Union (Brexit) could have a negative impact on the pound as an international reserve currency, adding that Brexit could also have a negative impact on the country's credit rating.

S&P analyst Frank Gill said that Brexit could weigh on foreign direct investment and other capital inflows.

-

10:02

Dallas Fed President Robert Kaplan would support an interest rate hike in the “near future”

Dallas Fed President Robert Kaplan said on Wednesday that he would support an interest rate hike in the "near future" if the U.S. economy continued to improve.

"That may not be June or July," he added.

Kaplan noted that the referendum on Britain's membership in the European Union may weigh on the Fed's interest rate decision in June.

-

09:51

Fitch Ratings: the slowdown in emerging economies and adjustments to energy sector spending continue to weigh on global growth

Ratings agency Fitch Ratings said in its latest Global Economic Outlook (GEO) on Wednesday that the slowdown in emerging economies and adjustments to energy sector spending continued to weigh on global growth. Fitch Chief Economist Brian Coulton said that near-term risks to the growth of emerging economies eased.

The agency expects the U.S. economy to expand 1.8% in 2016. It is the first sub-2% growth since 2013. Fitch upgraded its growth forecasts for China to 6.3% in 2016 from the previous estimate of 6.2% and to 6.3% in 2017 from the previous estimate of 6.0%.

The agency raised its growth forecasts for the Eurozone. The economy in the Eurozone is expected to expand 1.6% in 2016, up by 0.1% from the previous estimate.

The growth forecast for the U.K. was downgraded. The economy is expected to grow 1.9% in 2016, down by 0.2% from the previous estimate.

Fitch expects the global economy (based on an aggregate of 20 large developed and emerging economies) to expand 2.5% in 2016, unchanged from 2015 and from the previous estimate in March, and around 3% in 2017.

-

06:27

Global Stocks

European stocks closed with strong gains Wednesday, as international creditors reached a deal to unlock more bailout funds for Greece and oil prices gained. Greece is now in line to receive 10.3 billion euros ($11.48 billion) in new loans, if a deal struck early Wednesday is signed off by the 19 countries comprising the eurozone.

U.S. stocks advanced for a second straight session on Wednesday, with the S&P 500 posting its highest close in nearly a month on the back of a rally in energy and materials shares.

Asian stocks rose to a one-week high and the currencies of oil-exporting nations strengthened as Brent crude traded above $50 a barrel for the first time since November. Gold rebounded from a seven-week low as the dollar lost ground versus most of its major peers.

Based on MarketWatch materials

-

04:04

Nikkei 225 16,815.43 +58.08 +0.35 %, Hang Seng 20,265.24 -102.81 -0.50 %, Shanghai Composite 2,788.62 -26.47 -0.94 %

-

00:29

Stocks. Daily history for Sep Apr May 25’2016:

(index / closing price / change items /% change)

Nikkei 225 16,757.35 +258.59 +1.57 %

Hang Seng 20,368.05 +537.62 +2.71 %

S&P/ASX 200 5,372.51 +76.94 +1.45 %

Shanghai Composite 2,815.28 -6.39 -0.23 %

FTSE 100 6,262.85 +43.59 +0.70 %

CAC 40 4,481.64 +50.12 +1.13 %

Xetra DAX 10,205.21 +147.90 +1.47 %

S&P 500 2,090.54 +14.48 +0.70 %

NASDAQ Composite 4,894.89 +33.84 +0.70 %

Dow Jones 17,851.51 +145.46 +0.82 %

-