Noticias del mercado

-

22:07

The main US stock indices rose as a result of today's trading

The main stock indexes of Wall Street finished the session above the zero mark, receiving a boost from confident corporate profits.

In addition, some influence on the dynamics of trading was provided by data on the US housing market and the results of a two-day meeting of the Federal Reserve.

The Commerce Department reported that in June, sales of new homes in the US rose for the second consecutive month, as purchases in the West rose to nearly a 10-year high, but a serious shortage of real estate remains an obstacle to a robust recovery in the housing market. Sales of new buildings rose by 0.8% to a seasonally adjusted annual level of 610,000 units. The pace of sales for May was revised to 605,000 units from 610,000 units.

As for the Fed meeting, as expected, the Central Bank left the range of interest rates on federal funds unchanged, between 1.00% and 1.25%. This decision was taken unanimously (9 members of the FOMC voted "for"). The FOMC Accompanying Statement reported that the process of reducing the balance will begin "pretty soon." In general, the Fed management did not make it clear that weak inflation data changed their plans for another rate increase this year. "The situation on the labor market continued to improve. The growth of jobs is "strong", the unemployment rate has declined, "the FOMC statement said. - Economic activity "is growing at a moderate pace." The costs of households and companies also continued to grow. Short-term risks for the economy, in general, are "balanced". "

Oil prices rose by more than 1.5%, reaching an almost 8-week high, as a significant drop in US oil inventories reinforced expectations that the long-oversaturated market is moving toward a balance of supply and demand. The US Energy Ministry reported that US oil inventories fell sharply last week, as refineries increased their workload. In addition, there was a reduction in gasoline stocks and distillate stocks.

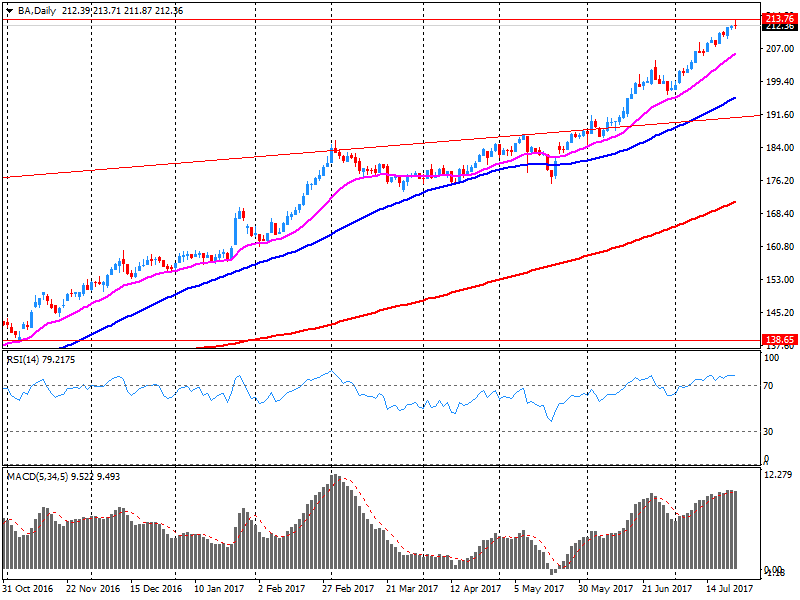

Components of the DOW index finished trades in different directions (17 in negative territory, 13 in positive territory). The leader of growth was the shares of The Boeing Company (BA, + 9.56%). Outsider were the shares of Cisco Systems, Inc. (CSCO, -1.75%).

Most sectors of the S & P recorded a rise. The utilities sector grew most (+ 0.5%). The health sector showed the greatest decline (-0.3%).

At closing:

DJIA + 0.45% 21,710.12 +96.69

Nasdaq + 0.16% 6,422.75 +10.58

S & P + 0.03% 2.477.83 + 0.70

-

21:00

DJIA +0.39% 21,696.87 +83.44 Nasdaq +0.11% 6,419.44 +7.27 S&P +0.05% 2,478.43 +1.30

-

18:00

European stocks closed: FTSE 100 +17.50 7452.32 +0.24% DAX +40.80 12305.11 +0.33% CAC 40 +29.09 5190.17 +0.56%

-

15:31

U.S. Stocks open: Dow +0.36%, Nasdaq +0.21%, S&P +0.14%

-

15:12

Before the bell: S&P futures +0.19%, NASDAQ futures +0.23%

U.S. stock-index futures were higher as investors digested another batch of earnings and awaited the Fed's latest policy decision.

Global Stocks:

Nikkei 20,050.16 +94.96 +0.48%

Hang Seng 26,941.02 +88.97 +0.33%

Shanghai 3,247.58 +3.89 +0.12%

S&P/ASX 5,776.63 +50.03 +0.87%

FTSE 7,466.44 +31.62 +0.43%

CAC 5,188.24 +27.16 +0.53%

DAX 12,299.68 +35.37 +0.29%

Crude $48.38 (+1.02%)

Gold $1,247.10 (-0.40%)

-

14:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

200.8

1.41(0.71%)

2117

ALCOA INC.

AA

37.42

0.12(0.32%)

212

Amazon.com Inc., NASDAQ

AMZN

1,045.00

5.13(0.49%)

11717

Apple Inc.

AAPL

153.35

0.61(0.40%)

38884

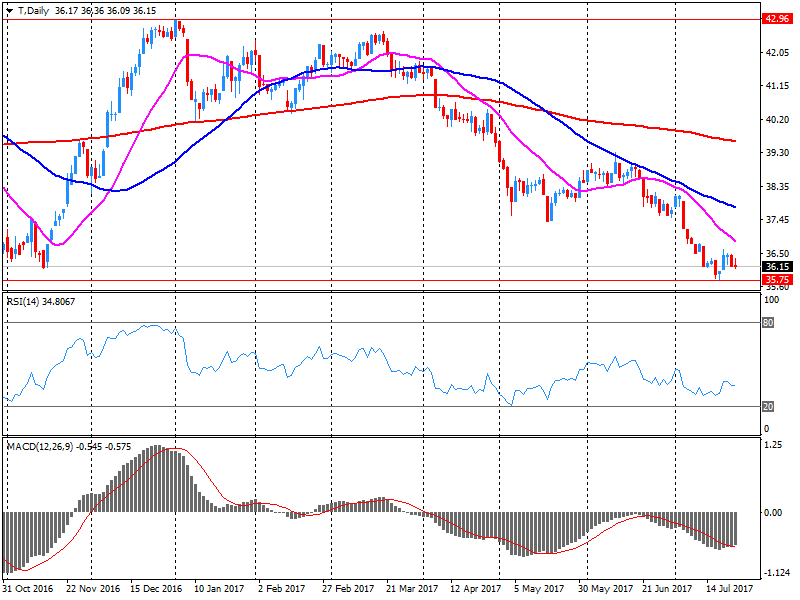

AT&T Inc

T

37.48

1.26(3.48%)

734345

Barrick Gold Corporation, NYSE

ABX

15.94

-0.10(-0.62%)

67443

Boeing Co

BA

219.85

7.39(3.48%)

123088

Caterpillar Inc

CAT

114.23

-0.31(-0.27%)

4568

Chevron Corp

CVX

104.79

0.40(0.38%)

553

Cisco Systems Inc

CSCO

32.1

-0.02(-0.06%)

1755

Citigroup Inc., NYSE

C

68.25

0.22(0.32%)

18531

Deere & Company, NYSE

DE

128.45

0.55(0.43%)

2503

Exxon Mobil Corp

XOM

80.68

0.41(0.51%)

2727

Facebook, Inc.

FB

165.85

0.57(0.34%)

98195

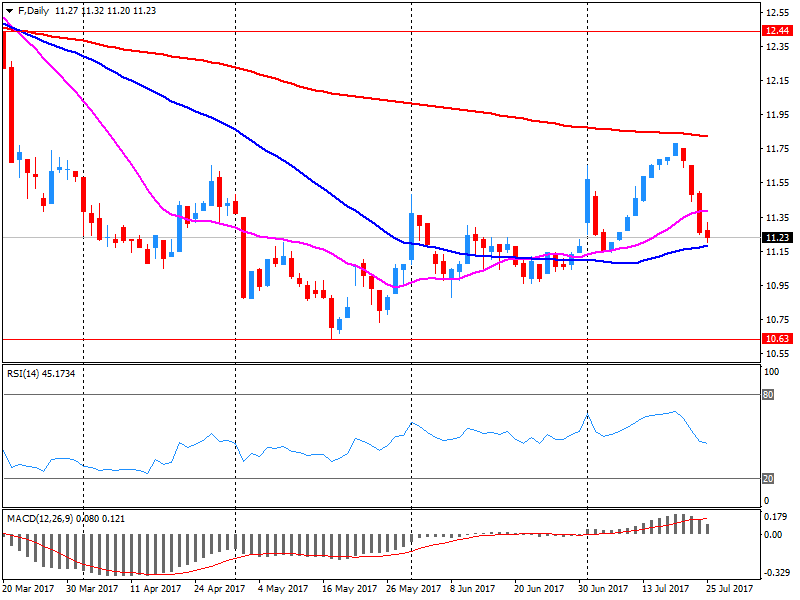

Ford Motor Co.

F

11.11

-0.16(-1.42%)

2541142

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.61

-0.26(-1.75%)

127164

General Electric Co

GE

25.55

0.11(0.43%)

20711

General Motors Company, NYSE

GM

35.5

-0.07(-0.20%)

2680

Goldman Sachs

GS

222.24

0.66(0.30%)

1253

Google Inc.

GOOG

952.78

2.08(0.22%)

2773

Home Depot Inc

HD

146.72

-0.25(-0.17%)

555

Intel Corp

INTC

34.73

0.06(0.17%)

1949

International Business Machines Co...

IBM

147

0.81(0.55%)

342

JPMorgan Chase and Co

JPM

93

0.20(0.22%)

4228

McDonald's Corp

MCD

158.92

-0.15(-0.09%)

1788

Microsoft Corp

MSFT

74.31

0.12(0.16%)

13722

Starbucks Corporation, NASDAQ

SBUX

58.85

0.30(0.51%)

1206

Tesla Motors, Inc., NASDAQ

TSLA

340.91

1.31(0.39%)

29093

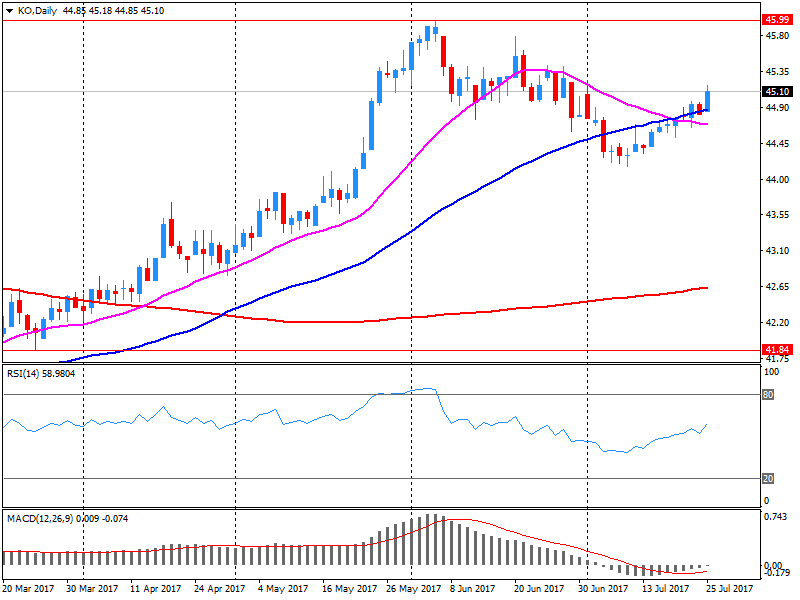

The Coca-Cola Co

KO

45.2

-0.04(-0.09%)

22763

Twitter, Inc., NYSE

TWTR

19.9

-0.07(-0.35%)

25788

United Technologies Corp

UTX

120.5

0.08(0.07%)

655

Verizon Communications Inc

VZ

44.89

0.91(2.07%)

205317

Wal-Mart Stores Inc

WMT

78.54

0.02(0.03%)

801

-

14:02

Company News: Boeing (BA) Q2 EPS beat analysts’ estimate

Boeing (BA) reported Q2 FY 2017 earnings of $2.55 per share (versus -$0.44 in Q2 FY 2016), beating analysts' consensus estimate of $2.31.

The company's quarterly revenues amounted to $22.739 bln (-8.1% y/y), missing analysts' consensus estimate of $22.972 bln.

The company also issued guidance for FY 2017, raising EPS to $9.80-10.00 from $9.20-9.40 (versus analysts' consensus estimate of $9.40) and reaffirming FY 2017 revenues of $90.5-92.5 bln (versus analysts' consensus estimate of $92 bln).

BA rose to $219.47 (+3.30%) in pre-market trading.

-

13:21

Company News: Coca-Cola (KO) Q2 EPS beat analysts’ estimate

Coca-Cola (KO) reported Q2 FY 2017 earnings of $0.59 per share (versus $0.60 in Q2 FY 2016), beating analysts' consensus estimate of $0.57.

The company's quarterly revenues amounted to $9.702 bln (-15.9% y/y), generally in-line with analysts' consensus estimate of $9.618 bln.

KO rose to $45.50 (+0.57%) in pre-market trading.

-

13:15

Company News: Ford Motor (F) Q2 EPS beat analysts’ forecast

Ford Motor (F) reported Q2 FY 2017 earnings of $0.51 per share (versus $0.52 in Q2 FY 2016), beating analysts' consensus estimate of $0.43.

The company's quarterly revenues amounted to $36.932 bln (-0.5% y/y), generally in-line with analysts' consensus estimate of $37.219 bln.

The company also issued upside guidance for FY 2017, projecting EPS of $1.65-1.85 versus analysts' consensus estimate of $1.51.

F fell to $11.25 (-0.18%) in pre-market trading.

-

12:45

Company News: AT&T (T) Q2 EPS beat analysts’ estimate

AT&T (T) reported Q2 FY 2017 earnings of $0.79 per share (versus $0.72 in Q2 FY 2016), beating analysts' consensus estimate of $0.74.

The company's quarterly revenues amounted to $39.837 bln (-1.6% y/y), in-line with analysts' consensus estimate of $39.838 bln.

The company also said it continued to expect the Time Warner (TWX) deal to close by year-end and further transform the company.

T rose to $37.25 (+2.84%) in pre-market trading.

-

10:22

Major European stock exchanges trading in the green zone: FTSE 7466.92 +32.10 + 0.43%, DAX 12286.18 +21.87 + 0.18%, CAC 5178.00 +16.92 + 0.33%

-

08:37

Negative start of trading expected on the main European stock markets: DAX -0.1%, CAC 40 -0.1%, FTSE 100 -0.1%

-

07:33

Global Stocks

European stocks closed higher Tuesday, with bank stocks gaining ground as investors assessed upbeat developments from Germany and Greece. The Stoxx Europe 600 SXXP, +0.41% tacked on 0.4% to finish at 380.77, rebounding after the benchmark on Monday closed lower by 0.2%. In Frankfurt, the DAX 30 DAX, +0.45% was higher by 0.5% at 12,264.31, holding to gains after the closely watched Ifo Institute described German companies as "euphoric". The widely watched Ifo index of business sentiment in Europe's largest economy surged to a record high of 116.0 in July.

Asian shares gave up earlier gains Wednesday, though Japanese and Australian stocks outperformed, helped by an improvement in appetite for risk, which pushed the U.S. dollar and commodity prices higher overnight. Commodities led the charge in European and U.S. trading on Tuesday, with copper prices jumping 4% and oil rising more than 3%. That's particularly good for Australian stocks, where a big market segment is mining and energy companies.

The S&P 500 and Nasdaq on Tuesday notched fresh all-time highs as Wall digested an array of better-than-expected corporate-results. The Dow Jones Industrial Average DJIA, +0.47% closed up 100 points, or 0.5%, but the blue-chip average's advance was limited by a plunge in shares of component 3M Co. MMM, -5.05% which marked its sharpest-ever net drop on a dollar-basis on record, off $10.61, or down 5.1%, according to WSJ Market Data Group, tracking data going back to 1972.

-

00:18

Stocks. Daily history for Jul 25’2017:

(index / closing price / change items /% change)

Nikkei -20.47 19955.20 -0.10%

TOPIX -4.50 1617.07 -0.28%

Hang Seng +5.22 26852.05 +0.02%

CSI 300 -23.91 3719.56 -0.64%

Euro Stoxx 50 +20.37 3473.54 +0.59%

FTSE 100 +57.09 7434.82 +0.77%

DAX +55.36 12264.31 +0.45%

CAC 40 +33.38 5161.08 +0.65%

DJIA +100.26 21613.43 +0.47%

S&P 500 +7.22 2477.13 +0.29%

NASDAQ +1.36 6412.17 +0.02%

S&P/TSX +73.68 15202.37 +0.49%

-