Noticias del mercado

-

22:11

The major US stock indices showed multidirectional dynamics

Major US stock indexes ended the session mixed after earlier in the course of trading updated their record highs in response to a sharp increase in quarterly earnings of several companies, in particular Facebook and Verizon (VZ).

Considering that almost half of the companies from the S & P 500 reported on the financial results for the second quarter, the total profit of the companies in this index probably increased by 9%, according to FactSet. Recall that in the 1st quarter total profit grew at the fastest pace in almost six years.

A small influence on the dynamics of trading was provided by statistical data for the United States. As it became known, the number of Americans applying for unemployment benefits rose in late July, but remained almost at the lowest level in recent decades, reflecting a strong labor market. Initial applications for unemployment benefits in the period from July 16 to July 22 increased by 10 000 to 244 000, taking into account seasonal fluctuations. It was predicted that the number of hits will be 241,000.

Meanwhile, the US Department of Commerce said that orders for durable goods soared in June to a three-year high. Orders for durable goods increased by 6.5%. Expected to increase by 3%. However, except for aircraft and cars, orders rose by 0.2%, and the key indicator of investment in business fell for the first time in 2017. A key measure of business investment fell for the first time since December - the basic orders for capital goods fell by 0.1%. However, the main orders for the last 12 months increased by 5.6%, which is the fastest indicator since 2012.

The components of the DOW index finished the trades in different directions (14 in negative territory, 16 in positive territory). Leader of growth were the shares of Verizon Communications Inc. (VZ, + 7.43%). Outsider were shares Apple Inc. (AAPL, -2.10%).

Most sectors of the S & P index showed a decline. The largest drop was shown by the sector of conglomerates (-1.3%). The industrial goods sector grew most (+ 0.2%).

At closing:

DJIA + 0.39% 21.796.55 +85.54

Nasdaq -0.63% 6.382.19 -40.56

S & P -0.10% 2,475.42 -2.41

-

21:00

DJIA +0.10% 21,733.75 +22.74 Nasdaq -0.99% 6,359.44 -63.31 S&P -0.43% 2,467.17 -10.66

-

18:00

European stocks closed: FTSE 100 -9.31 7443.01 -0.12% DAX -93.07 12212.04 -0.76% CAC 40 -3.22 5186.95 -0.06%

-

16:12

Chicago Fed national activity index points to a pickup in economic growth in June

The Chicago Federal Reserve reported the Chicago Fed national activity index (CFNAI), a weighted average of 85 different economic indicators, rose to +0.13 in June from a revised -0.30 in May (originally +0.35), pointing to a pickup in economic growth in June. According to the report, three of the four broad categories made positive contributions to the index last month. The index's three-month moving average increased to +0.06 in June from -0.04 in May. The contribution from production-related indicators to the CFNAI increased to +0.09 in June from -0.16 in May. Employment-related indicators contributed +0.06 to the CFNAI in June, up from -0.15 in the previous month. The sales, orders, and inventories category made a contribution of +0.02 to the CFNAI in June, up slightly from a neutral contribution in May. Meanwhile, the contribution of the personal consumption and housing category to the index edged up to -0.04 last month from -0.09 in the prior month.

-

15:34

U.S. Stocks open: Dow +0.25%, Nasdaq +0.48%, S&P +0.13%

-

15:26

Before the bell: S&P futures +0.22%, NASDAQ futures +0.69%

U.S. stock-index futures were higher as investors assessed another batch of earnings and yesterdays' statement by the Fed on its latest policy decision.

Global Stocks:

Nikkei 20,079.64 +29.48 +0.15%

Hang Seng 27,131.17 +190.15 +0.71%

Shanghai 3,249.29 +1.62 +0.05%

S&P/ASX 5,785.01 +8.39 +0.15%

FTSE 7,438.58 -13.74 -0.18%

CAC 5,185.78 -4.39 -0.08%

DAX 12,228.24 -76.87 -0.62%

Crude $48.50 (-0.51%)

Gold $1,263.10 (+1.10%)

-

15:05

U.S. durable goods orders surge 6.5 percent in June

The Commerce Department reported that new orders for U.S. durable goods rose 6.5 percent m-o-m in June after a revised 0.1 percent decrease in the prior month (originally a 1.1 percent fall). That was the biggest surge since July of 2014. Economists had expected a gain of 3 percent. Meanwhile, non-defense capital goods orders excluding aircraft, a closely watched proxy for business investment, fell 0.1 percent last month, after an upwardly revised 0.7 percent drop in May, representing the first drop since December. Economists had forecast core capital goods orders growing 0.2 percent in June. Shipments of those so-called core capital goods rose 0.2 percent in June after increasing 0.4 percent in May. Meanwhile, orders for durable goods excluding the transportation category edged up 0.2 percent in June after a revised 0.6 percent gain in the previous month (originally a 0.1 percent increase), while orders excluding defense boosted 6.7 percent last month after a revised 0.4 percent advance in May (originally a 0.6 percent decline).

-

14:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

200

0.97(0.49%)

910

ALCOA INC.

AA

36.8

0.17(0.46%)

2346

ALTRIA GROUP INC.

MO

71.4

-0.33(-0.46%)

6466

Amazon.com Inc., NASDAQ

AMZN

1,068.00

15.20(1.44%)

68018

Apple Inc.

AAPL

154.25

0.79(0.51%)

102848

AT&T Inc

T

38.1

0.07(0.18%)

41926

Barrick Gold Corporation, NYSE

ABX

16.65

0.41(2.52%)

61756

Boeing Co

BA

235.9

2.45(1.05%)

93811

Caterpillar Inc

CAT

113.7

0.18(0.16%)

253

Chevron Corp

CVX

105.5

0.38(0.36%)

1425

Cisco Systems Inc

CSCO

31.76

0.10(0.32%)

51963

Citigroup Inc., NYSE

C

68.2

0.22(0.32%)

3781

E. I. du Pont de Nemours and Co

DD

85.58

1.15(1.36%)

1610

Exxon Mobil Corp

XOM

80.34

-0.03(-0.04%)

20228

Facebook, Inc.

FB

177.09

11.48(6.93%)

2867390

Ford Motor Co.

F

11.03

-0.03(-0.27%)

68522

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15

-0.06(-0.40%)

155004

General Electric Co

GE

25.68

0.09(0.35%)

6687

General Motors Company, NYSE

GM

35.42

-0.20(-0.56%)

1600

Google Inc.

GOOG

950.25

2.45(0.26%)

6098

Hewlett-Packard Co.

HPQ

19.29

0.03(0.16%)

169

Home Depot Inc

HD

146.1

-0.59(-0.40%)

815

Intel Corp

INTC

34.69

-0.06(-0.17%)

46780

International Business Machines Co...

IBM

144.87

-0.49(-0.34%)

1719

Johnson & Johnson

JNJ

131.75

0.80(0.61%)

939

JPMorgan Chase and Co

JPM

92

0.07(0.08%)

621

McDonald's Corp

MCD

156.75

0.24(0.15%)

1221

Merck & Co Inc

MRK

64.6

2.80(4.53%)

605113

Microsoft Corp

MSFT

73.8

-0.25(-0.34%)

63881

Nike

NKE

58.59

0.23(0.39%)

573

Pfizer Inc

PFE

32.85

-0.04(-0.12%)

48200

Procter & Gamble Co

PG

91.2

1.90(2.13%)

160361

Starbucks Corporation, NASDAQ

SBUX

57.9

-0.04(-0.07%)

9051

Tesla Motors, Inc., NASDAQ

TSLA

345.53

1.68(0.49%)

39653

Twitter, Inc., NYSE

TWTR

17.57

-2.04(-10.40%)

5131395

Verizon Communications Inc

VZ

45.87

1.47(3.31%)

386857

Visa

V

101.28

0.43(0.43%)

1288

Walt Disney Co

DIS

107.25

0.31(0.29%)

4092

Yandex N.V., NASDAQ

YNDX

32.2

0.36(1.13%)

6300

-

14:48

Target price changes before the market open

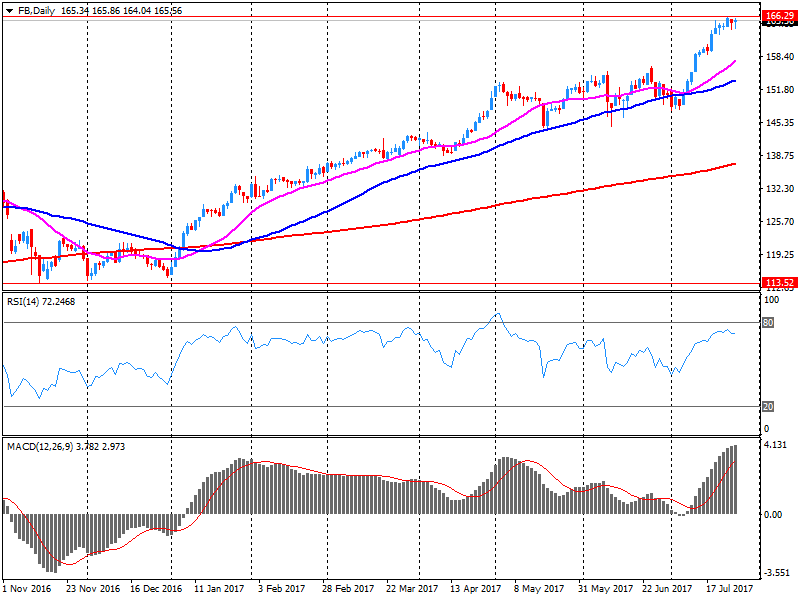

Facebook (FB) target raised to $200 from $185 at Aegis Capital

Facebook (FB) target raised to $200 from $170 at Stifel Research

Facebook (FB) target raised to $195 from $185 at RBC Capital

Freeport-McMoRan (FCX) target raised to $22 from $20 at Cowen

-

14:46

Upgrades before the market open

Boeing (BA) upgraded to Sector Perform at RBC Capital Mkts; target raised to $235

Boeing (BA) upgraded to Outperform from Neutral at Credit Suisse

Boeing (BA) upgraded to Neutral from Sell at Goldman

-

14:46

U.S. jobless claims rise more than expected

The data from the Labor Department revealed the number of applications for unemployment benefits rose more than expected last week but continued to point to a tightening labor market. According to the report, the initial claims for unemployment benefits increased by 10,000 to a seasonally adjusted 244,000 for the week ended July 22. Economists had expected 241,000 new claims last week. Claims for the prior week were revised upwardly to 234,000 from the initial estimate of 233,000. Meanwhile, the four-week moving average was unchanged at 244,000 last week. It was the 125th straight week that claims remained below the 300,000 threshold, the longest streak since 1970.

-

13:43

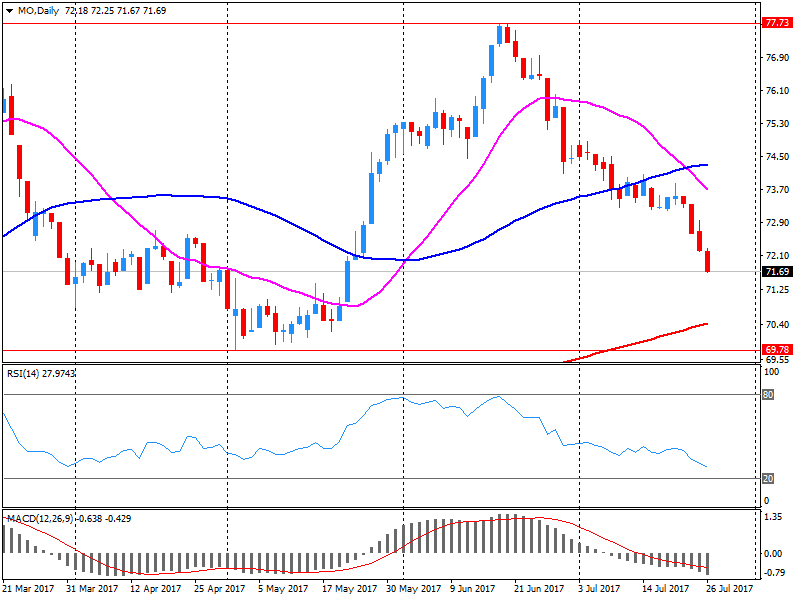

Company News: Altria (MO) quarterly results miss analysts’ forecasts

Altria (MO) reported Q2 FY 2017 earnings of $0.85 per share (versus $0.81 in Q2 FY 2016), missing analysts' consensus estimate of $0.86.

The company's quarterly revenues amounted to $4.366 bln (+3.2% y/y), missing analysts' consensus estimate of $5.021 bln.

The company also reaffirmed its FY 2017 adjusted diluted EPS growth guidance of 7.5% to 9.5%.

MO fell to $71.70. (-0.04%) in pre-market trading.

-

13:34

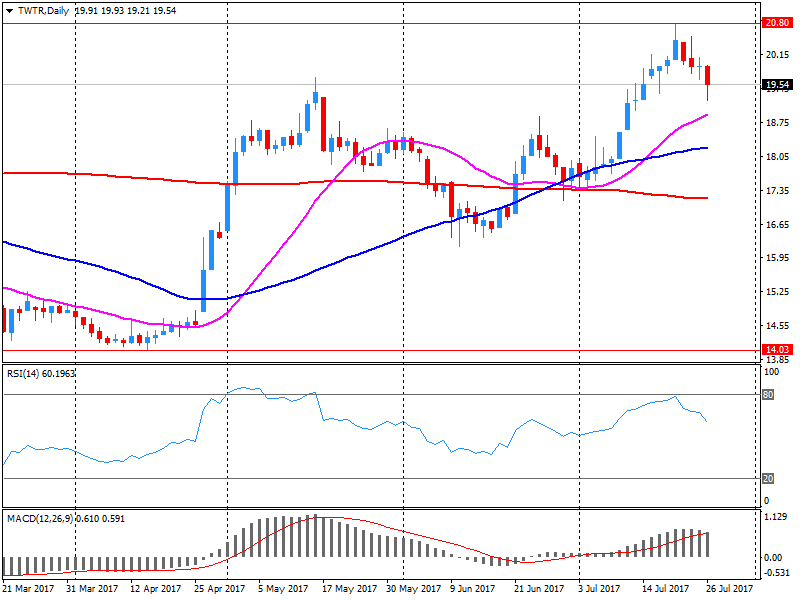

Company News: Twitter (TWTR) quarterly results beat analysts’ expectations

Twitter (TWTR) reported Q2 FY 2017 earnings of $0.08 per share (versus $0.13 in Q2 FY 2016), beating analysts' consensus estimate of $0.05.

The company's quarterly revenues amounted to $0.574 bln (-4.7% y/y), beating analysts' consensus estimate of $0.537 bln.

TWTR fell to $17.95 (-8.47%) in pre-market trading.

-

13:26

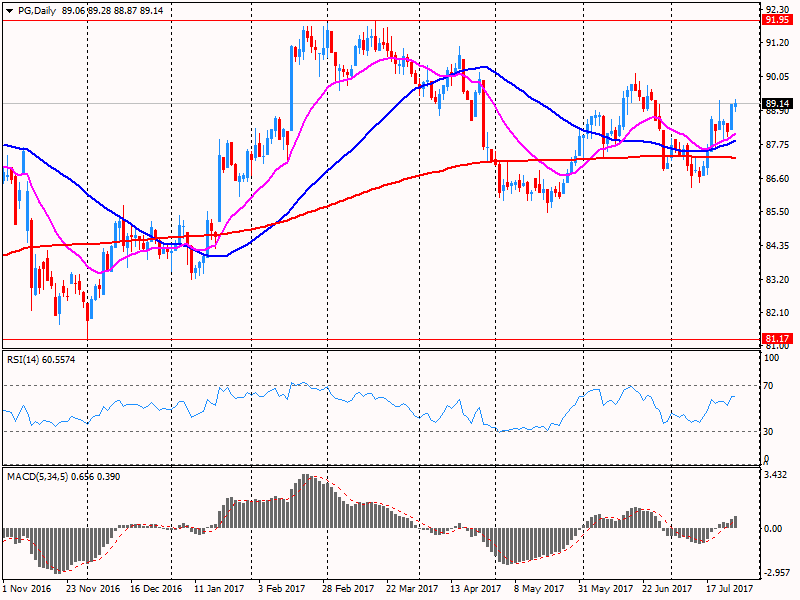

Company News: Procter & Gamble (PG) quarterly earnings beat analysts’ estimate

Procter & Gamble (PG) reported Q4 FY 2017 earnings of $0.85 per share (versus $0.79 in Q4 FY 2016), beating analysts' consensus estimate of $0.78.

The company's quarterly revenues amounted to $16.079 bln (-0.1% y/y), generally in-line with analysts' consensus estimate of $16.005 bln.

The company also issued upside guidance for FY 2018, projecting core EPS growth of +5-7% to est. $4.12-4.19 (versus analysts' consensus estimate of $4.12) and revenue growth of +3% to appr. $67.00 bln (versus analysts' consensus estimate of $66.69 bln).

PG rose to $90.00 (+0.78%) in pre-market trading.

-

13:11

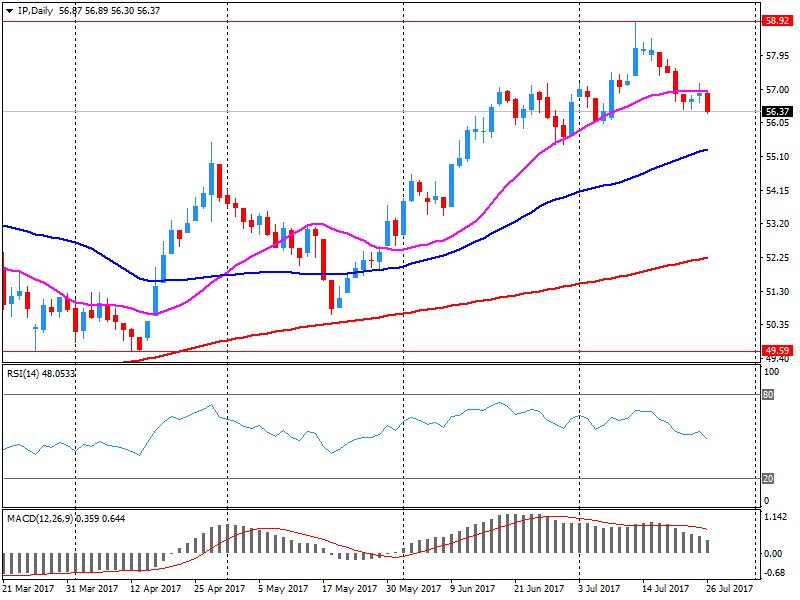

Company News: Intl Paper (IP) posts Q2 financials in line with analysts' estimates

Intl Paper (IP) reported Q2 FY 2017 earnings of $0.65 per share (versus $0.92 in Q2 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.772 bln (+8.5% y/y), generally in-line with analysts' consensus estimate of $5.720 bln.

IP closed Wednesday's trading session at $56.39 (-0.9%).

-

13:01

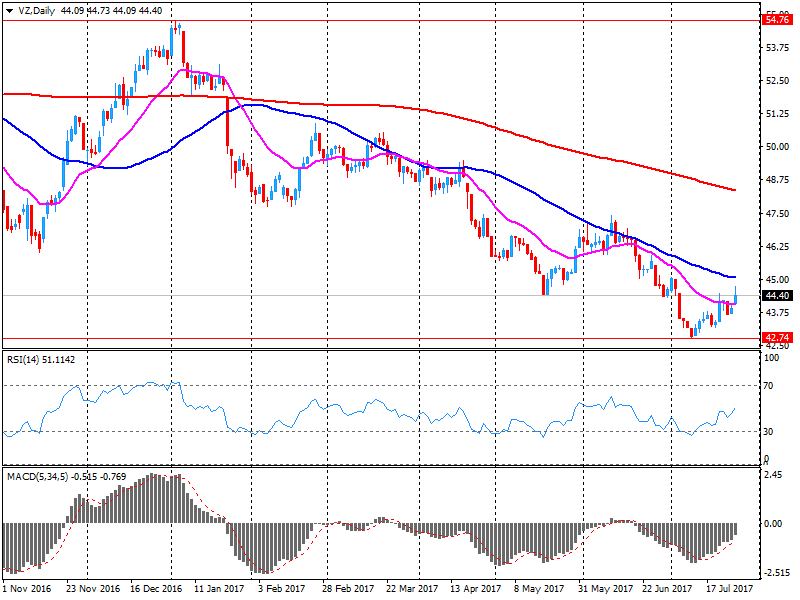

Company News: Verizon (VZ) posts Q2 EPS in line with analysts' estimates

Verizon (VZ) reported Q2 FY 2017 earnings of $0.96 per share (versus $0.94 in Q2 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $30548. bln (+0.1% y/y), beating analysts' consensus estimate of $29.840 bln.

VZ closed Wednesday's trading session at $44.40 (+0.95%).

-

12:40

UK retail sales expand in July

The latest Distributive Trades Survey by the Confederation of British Industry (CBI) showed that UK's retail sales growth picked up in July, exceeding expectations.

According to the survey, 48 percent of retailers said that sales volumes were up in July on a year ago, while 26 percent said they were lower. As a result, monthly retail sales balance stood at +22 in July, up from +12 in June, hitting a three-month high. Economists had forecast a balance of +10.

The retail sales growth was boosted by grocery and clothing sales in particular, while orders placed on suppliers rose at a solid pace for a second consecutive month.

Looking ahead, retailers expect steady expansions in both sales and orders in the year to August, at paces similar to those seen this month, the survey said.

Anna Leach, CBI Head of Economic Intelligence, noted: "The warm summer has added a sizzle to our high streets as shoppers defied expectations, with sales growth in clothing shops and grocers driving overall performance. But while retailers expect a similar pace of growth next month, the factors underpinning their sales growth are more shaky. Although employment is strong, real incomes are falling in the wake of higher inflation, and that's expected to feed slower consumer spending growth ahead."

-

11:59

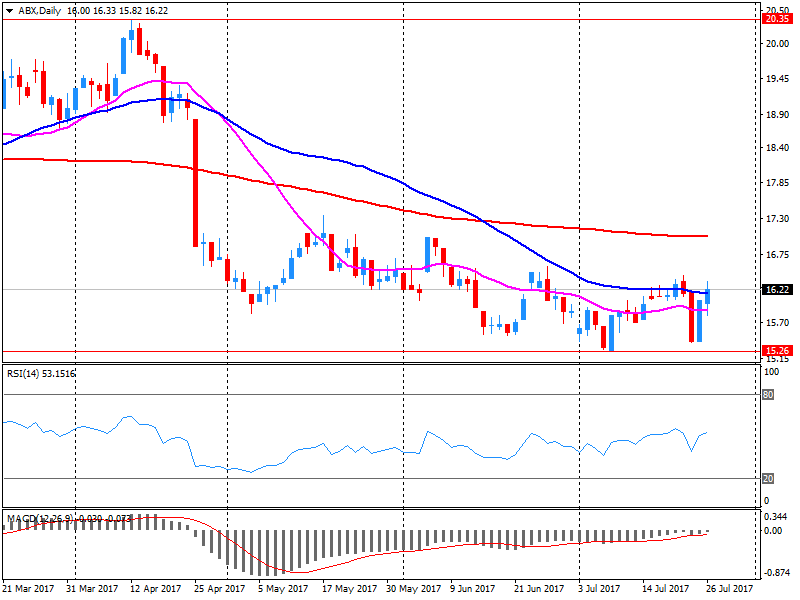

Company News: Barrick Gold (ABX) quarterly results beat analysts’ expectations

Barrick Gold (ABX) reported Q2 FY 2017 earnings of $0.22 per share (versus $0.14 in Q2 FY 2016), beating analysts' consensus estimate of $0.17.

The company's quarterly revenues amounted to $2.160 bln (+7.4% y/y), beating analysts' consensus estimate of $2.031 bln.

The company also confirmed its FY 2017 production forecasts for gold of 5.3-5.6 million ounces and for copper of 400-450 million pounds.

ABX rose to $$16.62 (+2.34%) in pre-market trading.

-

11:56

Company News: Facebook (FB) quarterly results beat analysts’ estimates

Facebook (FB) reported Q2 FY 2017 earnings of $1.32 per share (versus $0.97 in Q2 FY 2016), beating analysts' consensus estimate of $1.12.

The company's quarterly revenues amounted to $9.321 bln (+44.8% y/y), beating analysts' consensus estimate of $9.194 bln.

FB rose to $171.85 (+3.77%) in pre-market trading.

-

10:46

Eurozone private loans growth holds steady in June

The European Central Bank (ECB) revealed that the annual growth rate of total credit to euro area residents stood at 4.4 percent in June 2017, compared with 4.5 percent in the previous month. Meanwhile, the annual growth rate of credit to general government dropped to 8.1 percent from 9.5 percent, while the annual growth rate of credit to the private sector rose to 3.1 percent from 2.9 percent.

The annual growth rate of adjusted loans to the private sector decreased to 2.5 percent in June, from 2.7 percent in May. In particular, the annual growth rate of adjusted loans to households stood at 2.6 percent in the reviewed period, unchanged from the previous month, and the annual growth rate of adjusted loans to nonfinancial corporations reduced to 2.1 percent from 2.5 percent.

-

10:45

Eurozone M3 money supply growth improves slightly in June

The European Central Bank (ECB) reported that the annual growth rate of the broad monetary aggregate M3 came in at 5 percent in June after 4.9 percent in May (revised from initially reported 5 percent). Meanwhile, the annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits as well, rose to 9.7 percent in June, up from 9.3 percent in May. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was more negative at -3 percent in the reviewed period compared to -2.8 percent in the prior month. The annual growth rate of marketable instruments (M3-M2) fell to -0.8 percent, from 1.2 percent.

Within M3, the annual growth rate of deposits placed by households declined to 4.9 percent in June, from 5.1 percent in May, while the annual growth rate of deposits placed by non-financial corporations rose to 8.4 percent from 7.5%. Elsewhere, the annual growth rate of deposits placed by non-monetary financial corporations grew to 3.7 percent from 2.7 percent.

-

08:31

German consumer sentiment set to continue improving in August

The GfK Group's survey revealed the consumer confidence in German is set to continue improving in August, reflecting Germans' positive view of the economy and their own finances.

According to the survey, GfK's consumer confidence index registered a slight increase in the consumer climate forecast for August to 10.8 points from a level of 10.6 in July. That was the highest reading since October 2001. Economists had forecast the reading to stay at 10.6 points.

"Consumers are expecting that the domestic economy can even pick up a notch over the course of the remaining year," the survey said.

-

08:02

Fed says balance sheet normalization will start “relatively soon”

Federal Open Market Committee (FOMC) released its latest monetary policy decisions on Wednesday afternoon, following the July meeting. As widely expected, the U.S. regulator did not make any changes to the policy stance, maintaining the target range for the federal funds rate at between 1.00 percent and 1.25 percent. While policy did not change, the FOMC changed the language on its plans on balance-sheet normalization. Instead of saying that it would start shrinking its balance sheet "this year" it said it would begin this process "relatively soon." Regarding the Fed's view on inflation, the FOMC members noted that inflation was expected to remain somewhat below the Fed's 2 percent target in the near term but to stabilize around this level over the medium term. "Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely," said the Fed statement.

-

07:28

Global Stocks

Stocks across Europe finished higher Wednesday, as investors sifted through the latest round of corporate earnings reports ahead of the Federal Reserve's policy decision. The Stoxx Europe 600 SXXP, +0.52% gained 0.5% to end at 382.74, after the benchmark on Tuesday advanced 0.4%.

U.S. stock-market benchmarks on Wednesday finished modestly higher, with all three gauges recording all-time highs, supported by better-than-expected corporate results, and as the Federal Reserve offered an update to its monetary-policy outlook. The Dow Jones Industrial Average DJIA, +0.45% advanced 97.58 points, or 0.5%, to close at a record of 21,711.01. Boeing Co. BA, +9.88% shares surged nearly 10% to its own all-time high, logging its best daily climb on a percentage basis since Oct. 28, 2008, according to WSJ Market Data Group.

Asian shares gave up earlier gains Wednesday, though Japanese and Australian stocks outperformed, helped by an improvement in appetite for risk, which pushed the U.S. dollar and commodity prices higher overnight. Commodities led the charge in European and U.S. trading on Tuesday, with copper prices jumping 4% and oil rising more than 3%. That's particularly good for Australian stocks, where a big market segment is mining and energy companies.

-

07:02

Australia export prices fall less than expected in Q2

The report from the Australian Bureau of Statistics (ABS) showed that import prices in Australia unexpectedly fell by 0.1 percent q-o-q in the second quarter of 2017, following an unrevised 1.2 percent rise in the prior quarter, while economists estimated a 0.7 percent gain. The main contributor to this fall was a decrease in prices paid for mineral fuels, lubricants and related materials (-4.8 percent q-o-q) and machinery and transport equipment (-0.3 percent q-o-q). Offsetting these price drops were rises in manufactured goods classified chiefly by material (+1.9 percent q-o-q), chemicals and related products (+1.7 percent q-o-q), and miscellaneous manufactured articles (+1.0 percent q-o-q). Through the year to the June quarter, the import prices rose 0.3 percent, boosted by higher prices paid for mineral fuels, lubricants, and related materials (+13.9 percent).

Meanwhile, export prices declined by 5.7 percent q-o-q in the second quarter of 2017, compared to a downwardly revised 8.8 percent q-o-q surge in the prior quarter (originally a 9.4 percent advance) and economists' forecast for a decline of 6.3 percent q-o-q. The drop was driven by lower prices received for crude materials, inedible, except fuels (-13.1 percent q-o-q) and mineral fuels, lubricants, and related materials (-4.8 percent q-o-q). Offsetting these price falls were rises in food and live animals (+1.8 percent q-o-q) and commodities and transactions (+3.1 percent q-o-q). Through the year to the June quarter, the export prices climbed 22.5 percent, driven by mineral fuels, lubricants, and related materials (+68.3 percent).

-

00:28

Stocks. Daily history for Jul 26’2017:

(index / closing price / change items /% change)

Nikkei +94.96 20050.16 +0.48%

TOPIX +3.81 1620.88 +0.24%

Hang Seng +88.97 26941.02 +0.33%

CSI 300 -14.17 3705.39 -0.38%

Euro Stoxx 50 +17.65 3491.19 +0.51%

FTSE 100 +17.50 7452.32 +0.24%

DAX +40.80 12305.11 +0.33%

CAC 40 +29.09 5190.17 +0.56%

DJIA +97.58 21711.01 +0.45%

S&P 500 +0.70 2477.83 +0.03%

NASDAQ +10.57 6422.75 +0.16%

S&P/TSX -30.98 15171.39 -0.20%

-