Noticias del mercado

-

22:10

Major US stock indexes ended the session in negative territory

The main US stock indices fell noticeably. Pressure on the market provided sales in the technological segment and conglomerate sector, while some support was provided by the market from the growth of shares of banks, as well as securities of the energy sector.

In addition, investors reacted to the message that the confidence of consumers unexpectedly improved. The Conference Board said that the consumer confidence index rose to 118.9 in June. It was expected to decline to 116 from 117.6 in May. The index of the current situation increased by 5.3 points to 146.3, while the index of expectations fell by 1.7, to 100.6. At the same time, the S & P / Case-Shiller report showed that prices for single-family homes in the US accelerated at a slower pace than expected in April. According to the report, the composite index for 20 megacities rose in April at 5.7% per annum after an increase of 5.9% in March. The growth was forecasted at 5.9%.

Attention of market participants was also attracted by reports that the IMF worsened the outlook for the US economy due to doubts about the effectiveness of measures promised by Tramp to reduce taxes and increase spending on infrastructure. The IMF expects US GDP growth by 2.1% in 2018 against the previous forecast of + 2.5%, and predicts a slowdown in growth to 1.7% in the next 5 years. The IMF also believes that the US dollar rate is 10% -20% higher than the level justified in terms of economic fundamentals. In addition, the IMF said that the Fed should continue to raise interest rates "depending on the incoming data."

Most components of the DOW index finished trading in the red (22 of 30). Most fell shares of Verizon Communications Inc. (VZ, -1.76%). Leader of the growth were JPMorgan Chase & Co. shares. (JPM, + 1.18%).

Most sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-2.0%). The leader of growth was the financial sector (+ 0.3%).

At closing:

DJIA -0.45% 21.313.54 -96.01

Nasdaq -1.61% 6,146.62 -100.53

S & P -0.80% 2.419.45 -19.62

-

21:00

DJIA -0.18% 21,370.64 -38.91 Nasdaq -1.10% 6,178.47 -68.68 S&P -0.43% 2,428.59 -10.48

-

18:00

European stocks closed: FTSE 100 -12.44 7434.36 -0.17% DAX -99.81 12671.02 -0.78% CAC 40 -37.17 5258.58 -0.70%

-

17:58

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes were little changed, as equities managed to retrace a good portion of their opening losses. The investors' sentiment remained subdued due to continuing selloff in technology shares and ahead of the speech by Federal Reserve Chair Janet Yellen. On the contrary, names, belonging to financial and energy sectors, helped to keep the broader market afloat. Better-than-expected consumer confidence data also provided some support to the market.

A majority of Dow stocks in negative area (16 of 30). Top loser - Verizon Communications Inc. (VZ, -1.84%). Top gainer - JPMorgan Chase & Co. (JPM, +1.50%).

Most of S&P sectors in negative area.Top loser - Utilities (-0.7%). Top gainer - Basic Materials (+0.8%).

At the moment:

Dow 21381.00 +13.00 +0.06%

S&P 500 2436.75 +0.75 +0.03%

Nasdaq 100 5763.00 -15.25 -0.26%

Crude Oil 44.41 +1.03 +2.37%

Gold 1247.80 +1.40 +0.11%

U.S. 10yr 2.20 +0.06

-

15:32

U.S. Stocks open: Dow -0.10%, Nasdaq -0.50%, S&P -0.19%

-

15:28

Before the bell: S&P futures -0.06%, NASDAQ futures -0.40%

U.S. stock-index futures slipped, as a selloff in technology shares continued, while investors awaited the speech by Federal Reserve Chair Janet Yellen.

Stocks:

Nikkei 20,225.09 +71.74 +0.36%

Hang Seng 25,839.99 -31.90 -0.12%

Shanghai 3,191.51 +6.07 +0.19%

S&P/ASX 5,714.19 -5.97 -0.10%

FTSE 7,433.86 -12.94 -0.17%

CAC 5,259.10 -36.65 -0.69%

DAX 12,689.72 -81.11 -0.64%

Crude $43.98 (+1.38%)

Gold $1,249.80 (+0.27%)

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.45

0.27(0.87%)

11474

Amazon.com Inc., NASDAQ

AMZN

989.3

-4.68(-0.47%)

25566

Apple Inc.

AAPL

145.23

-0.59(-0.40%)

109456

AT&T Inc

T

37.94

-0.21(-0.55%)

51686

Barrick Gold Corporation, NYSE

ABX

16.49

0.15(0.92%)

16061

Boeing Co

BA

200

0.02(0.01%)

592

Caterpillar Inc

CAT

104.2

-0.05(-0.05%)

300

Cisco Systems Inc

CSCO

32.2

-0.04(-0.12%)

1681

Citigroup Inc., NYSE

C

64.01

0.23(0.36%)

6098

Exxon Mobil Corp

XOM

81.27

0.03(0.04%)

1423

Facebook, Inc.

FB

153

-0.59(-0.38%)

45356

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.91

0.09(0.76%)

5237

General Electric Co

GE

27.66

0.05(0.18%)

6701

General Motors Company, NYSE

GM

34.34

-0.18(-0.52%)

5618

Goldman Sachs

GS

221.8

1.36(0.62%)

3113

Google Inc.

GOOG

940.01

-12.26(-1.29%)

18761

Hewlett-Packard Co.

HPQ

18.17

0.01(0.06%)

100

Intel Corp

INTC

34

-0.07(-0.21%)

43267

Johnson & Johnson

JNJ

136.88

0.54(0.40%)

734

JPMorgan Chase and Co

JPM

87.6

0.36(0.41%)

4898

Merck & Co Inc

MRK

66.5

0.58(0.88%)

231683

Microsoft Corp

MSFT

70.16

-0.37(-0.52%)

9559

Nike

NKE

53.2

-0.08(-0.15%)

1615

Procter & Gamble Co

PG

89.28

-0.08(-0.09%)

701

Starbucks Corporation, NASDAQ

SBUX

59.59

-0.05(-0.08%)

622

Tesla Motors, Inc., NASDAQ

TSLA

374.41

-3.08(-0.82%)

51387

The Coca-Cola Co

KO

45.42

-0.01(-0.02%)

2296

Twitter, Inc., NYSE

TWTR

18.34

0.05(0.27%)

37148

Verizon Communications Inc

VZ

45.23

-0.52(-1.14%)

89196

Yandex N.V., NASDAQ

YNDX

27.26

0.09(0.33%)

910

-

09:36

Major stock exchanges in Europe trading in the red zone: FTSE 7444.50 -2.30 -0.03%, DAX 12706.46 -64.37 -0.50%, CAC 5273.56 -22.19 -0.42%

-

08:20

Negative start of trading expected on the main European stock markets: DAX -0.2%, CAC 40 -0.1%, FTSE 100 flat

-

07:33

Global Stocks

European stocks finished with gains on Monday, helped by Italian banks after that country's government stepped in to shut down two failed lenders, and as Nestlé SA rallied after a hedge fund snapped up a big stake in the consumer-products giant.

The Dow industrials on Monday ended a string of daily losses at four, but the Nasdaq Composite faltered, putting pressure on the broader market. For the first half of 2017, the benchmark S&P 500 is on track to advance about 9%, with some analysts suggesting that the second half will likely be positive as well.

Global shares were higher in Asia-Pacific trade Tuesday, lifted in part by a stronger U.S. dollar, though markets in Australia bucked the trend due to declines in utility and mining stocks. Spot gold prices were recently down 0.2%, extending losses after Monday's flash crash, which was caused by suspected human error. It plunged 1% shortly after the opening call in London on Monday and traded about 1.8 million troy ounces in a minute, "which is more than the volumes traded seen during recent global risk events," noted ANZ Research.

-

00:18

Stocks. Daily history for Jun 26’2017:

(index / closing price / change items /% change)

Nikkei +20.68 20153.35 +0.10%

TOPIX +0.87 1612.21 +0.05%

Hang Seng +201.84 25871.89 +0.79%

CSI 300 +45.21 3668.09 +1.25%

Euro Stoxx 50 +18.08 3561.76 +0.51%

FTSE 100 +22.67 7446.80 +0.31%

DAX +37.42 12770.83 +0.29%

CAC 40 +29.63 5295.75 +0.56%

DJIA +14.79 21409.55 +0.07%

S&P 500 +0.77 2439.07 +0.03%

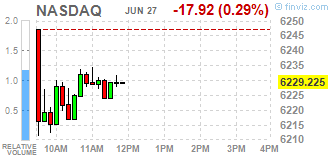

NASDAQ -18.10 6247.15 -0.29%

S&P/TSX -3.54 15316.02 -0.02%

-