Noticias del mercado

-

22:12

Major US stock indexes completed the session in different directions

The major US stock indexes ended the trading mixed, since the decline in the shares of the technology sector was opposed by the growth of the conglomerate sector.

In addition, the negative impact on the mood of investors had weak data on orders for durable goods and sluggish dynamics of oil quotes.

As it became known today, orders for non-military capital goods, with the exception of aircraft carefully monitored by the sensor for business expenses, fell by 0.2%. These so-called basic orders for capital goods were revised, and showed an increase of 0.2% in April. Earlier it was reported that they grew by 0.1%. At the same time, the supply of capital goods used to calculate equipment costs in the national GDP measurement decreased by 0.2% last month after rising 0.1% in April. Economists predicted that major orders for capital goods in May will grow by 0.3%. General orders for durable goods, goods from toasters to aircraft, which are designed for a lifetime of three years or longer, fell 1.1% after a decline of 0.9% in April.

Most components of the DOW index closed in positive territory (17 out of 30). Most fell shares of The Boeing Company (BA, -1.03%). The leader of growth was the shares of The Goldman Sachs Group (GS, + 1.66%).

Most sectors of the S & P index showed an increase. The technological sector fell most (-0.4%). The growth leader was the conglomerate sector (+ 0.9%).

At closing:

DJIA + 0.07% 21.405.55 +14.79

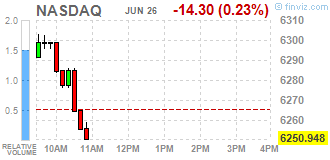

Nasdaq -0.29% 6.247.15 -18.10

S & P + 0.03% 2.439.07 + 0.77

-

21:00

DJIA +0.19% 21,435.03 +40.27 Nasdaq -0.17% 6,254.75 -10.50 S&P +0.16% 2,442.16 +3.86

-

18:00

European stocks closed: FTSE 100 +22.67 7446.80 +0.31% DAX +37.42 12770.83 +0.29% CAC 40 +29.63 5295.75 +0.56%

-

17:34

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes demonstrated mixed dynamics on Monday. Declines in technology and health-care sectors were the major drivers of the market's sharp downward move after positive opening. Investors' sentiment was also impacted by weaker-than-expected data on durable goods orders for May and stalled oil prices.

A majority of Dow stocks in positive area (17 of 30). Top loser - Exxon Mobil Corp. (XOM, -0.65%). Top gainer - The Goldman Sachs Group (GS, +1.04%).

Most of S&P sectors in positive area.Top loser - Technology (-0.2%) и Healthcare (-0.2%). Top gainer - Utilities (+0.8%).

At the moment:

Dow 21347.00 +8.00 +0.04%

S&P 500 2438.00 +3.00 +0.12%

Nasdaq 100 5800.25 -12.00 -0.21%

Oil 42.65 -0.36 -0.84%

Gold 1245.30 -11.10 -0.88%

U.S. 10yr 2.13 -0.01

-

15:31

U.S. Stocks open: +0.25%, Nasdaq +0.44%, S&P +0.29%

-

15:20

Before the bell: S&P futures +0.26%, NASDAQ futures +0.47%

U.S. stock-index futures rose moderately, as oil prices continued to rebound, while investors assessed the May data on durable goods orders.

Stocks:

Nikkei 20,153.35 +20.68 +0.10%

Hang Seng 25,871.89 +201.84 +0.79%

Shanghai 3,186.05 +28.17 +0.89%

S&P/ASX 5,720.16 +4.29 +0.08%

FTSE 7,471.97 +47.84 +0.64%

CAC 5,318.50 +52.38 +0.99%

DAX 12,818.73 +85.32 +0.67%

Crude $43.12 (+0.26%)

Gold $1,239.70 (-1.33%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.9

-0.19(-0.61%)

1200

Amazon.com Inc., NASDAQ

AMZN

1,009.90

6.16(0.61%)

31733

American Express Co

AXP

82.5

0.28(0.34%)

100

Apple Inc.

AAPL

147.15

0.87(0.59%)

127284

AT&T Inc

T

38

0.05(0.13%)

1700

Barrick Gold Corporation, NYSE

ABX

16.19

-0.29(-1.76%)

50013

Caterpillar Inc

CAT

104.3

0.19(0.18%)

1623

Cisco Systems Inc

CSCO

32.4

0.31(0.97%)

25493

Citigroup Inc., NYSE

C

63.8

0.39(0.62%)

17664

Deere & Company, NYSE

DE

124.65

1.05(0.85%)

501

Exxon Mobil Corp

XOM

81.71

0.10(0.12%)

3596

Facebook, Inc.

FB

155.95

0.88(0.57%)

150617

FedEx Corporation, NYSE

FDX

216

0.65(0.30%)

106

Ford Motor Co.

F

11.06

0.02(0.18%)

22151

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.84

0.08(0.68%)

10982

General Electric Co

GE

27.67

0.10(0.36%)

8629

Goldman Sachs

GS

218.1

0.91(0.42%)

6466

Google Inc.

GOOG

972.5

6.91(0.72%)

4227

Hewlett-Packard Co.

HPQ

17.84

0.04(0.22%)

410

Home Depot Inc

HD

151.98

0.67(0.44%)

5708

Intel Corp

INTC

34.25

0.06(0.18%)

4393

Johnson & Johnson

JNJ

136.25

-0.18(-0.13%)

547

JPMorgan Chase and Co

JPM

87.15

0.29(0.33%)

9426

McDonald's Corp

MCD

154.75

0.11(0.07%)

1301

Microsoft Corp

MSFT

71.55

0.34(0.48%)

16545

Nike

NKE

52.93

0.08(0.15%)

891

Pfizer Inc

PFE

34.3

0.13(0.38%)

1120

Tesla Motors, Inc., NASDAQ

TSLA

386.6

3.15(0.82%)

66853

Twitter, Inc., NYSE

TWTR

18.61

0.11(0.59%)

87799

UnitedHealth Group Inc

UNH

186.88

1.63(0.88%)

130

Verizon Communications Inc

VZ

45.44

0.05(0.11%)

2760

Visa

V

95.8

0.22(0.23%)

1928

Wal-Mart Stores Inc

WMT

74.95

0.11(0.15%)

2130

Walt Disney Co

DIS

104.75

0.39(0.37%)

2087

-

14:48

Analyst coverage resumption before the market open

Credit Suisse (CS) resumed with a Overweight at JP Morgan

-

14:39

Target price changes before the market open

McDonald's (MCD) target raised to $175 from $165 at Wells Fargo

-

09:39

Major stock markets in Europe trading in the green zone: FTSE + 0.3%, DAX + 0.4%, CAC40 + 0.6%, FTMIB + 0.7%, IBEX + 0.3%

-

08:38

Positive start of trading expected on the main European stock markets: DAX + 0.2%, CAC 40 + 0.2%, FTSE 100 + 0.1%

-

07:33

Global Stocks

Equities in Europe lost ground on Friday, as energy shares extended losses in what's been a dreadful week for oil prices, while investors assessed mixed signals about the eurozone economy. Stocks remained in the red as the first, or flash, reading of growth in the eurozone's manufacturing and services sector slowed for June, although the region is undergoing its best quarter of growth in six years. Markit's flash eurozone PMI composite output index came in at 55.7 in June, a five-month low.

U.S. stocks closed mostly higher on Friday, as energy shares staged a modest rebound after a recent selloff, while technology stocks extended their advance. The Nasdaq Composite COMP, +0.46% outperformed other indexes, rising 28.56 points, or 0.5%, to 6,265.25 on Friday and booking a 1.9% gain over the week, the largest in a month. The gains on the tech-heavy index were driven by a jump in biotechnology shares earlier in the week.

Tech stocks and stabilizing commodity prices helped stocks in Asia start the week on an up note amid a lack of major data releases or other market catalysts. Stabilization in commodities is helping beaten-down Australian stocks, noted Michael McCarthy chief market strategist at CMC. The S&P/ASX 200 fell 1% last week amid weakness in commodity stocks, with Australian equities notably lagging others in the region.

-

00:27

Stocks. Daily history for Jun 23’2017:

(index / closing price / change items /% change)

Nikkei +22.16 20132.67 +0.11%

TOPIX +0.96 1611.34 +0.06%

Hang Seng -4.48 25670.05 -0.02%

CSI 300 +32.54 3622.88 +0.91%

Euro Stoxx 50 -12.08 3543.68 -0.34%

FTSE 100 -15.16 7424.13 -0.20%

DAX -60.59 12733.41 -0.47%

CAC 40 -15.81 5266.12 -0.30%

DJIA -2.53 21394.76 -0.01%

S&P 500 +3.80 2438.30 +0.16%

NASDAQ +28.57 6265.25 +0.46%

S&P/TSX +99.66 15319.56 +0.65%

-