Noticias del mercado

-

21:00

Dow +0.75% 16,408.44 +122.93 Nasdaq +1.11% 4,749.76 +52.22 S&P +1.03% 1,960.56 +20.05

-

18:41

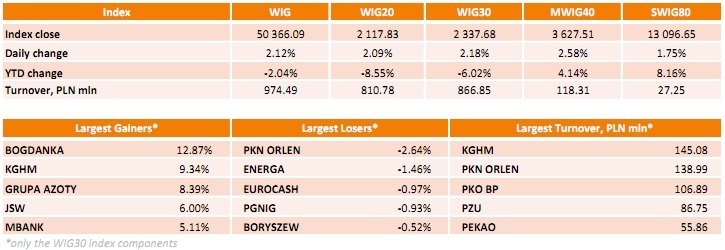

WSE: Session Results

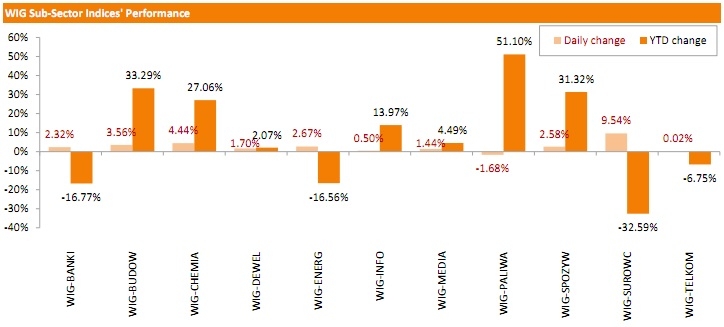

Polish equity market appreciated on Thursday. The broad market measure, the WIG index, added 2.12%. Sector-wise, oil and gas sector (-1.68%) was the only group that suffered a loss. At the same time, materials (+9.54%) fared the best.

The large-cap stocks' measure, the WIG30 Index, advanced 2.18%. BOGDANKA (WSE: LWB) recorded the strongest daily performance in the WIG30, soaring by 12.87%. The news, that the company's key client ENEA (WSE: ENA; +0.9%) may return to negotiations on terminated coal supply contract, helped the stock to bounce back from its historical lows. KGHM (WSE: KGH) emerged as the second best-performing stock, adding 9.34%, supported by higher copper prices. GRUPA AZOTY (WSE: ATT) and JSW (WSE: JSW) also posted strong gains, boosting by 8.39% and 6% respectively. On the other side of the ledger, PKN ORLEN (WSE: PKN) and ENERGA (WSE: ENG) were the major laggards, losing 2.64% and 1.46% respectively.

-

18:19

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes extended their rally on Thursday, raising hopes that the worst was behind the market, after further evidence that the U.S. economy was on a solid footing. Data showed annual U.S. gross domestic product grew 3.7% in the second quarter - much faster than the previous estimate of 2.3%. Other data showed jobless claims fell more than expected last week, pointing to a steadily firming labor market.

All Dow stocks in positive area (30 of 30). Top gainer - Chevron Corporation (CVX, +5.29).

All S&P index sectors in positive area. Top gainer - Basic materials (+4,5%).

At the moment:

Dow 16541.00 +292.00 +1.80%

S&P 500 1976.25 +38.25 +1.97%

Nasdaq 100 4302.75 +88.25 +2.09%

10 Year yield 2,19% +0,02

Oil 41.87 +3.27 +8.47%

Gold 1123.20 -1.40 -0.12%

-

18:05

Federal Reserve Bank of Kansas City President Esther George: the Fed should be careful making its interest rate decision

Federal Reserve Bank of Kansas City President Esther George said in an interview with FOX Business Network on Thursday that the Fed should be careful making its interest rate decision.

"Given what we've seen recently, I think we just have to wait and see. I don't want to take too much signal from something that could turn out to be noise. I don't want to overreact to short-term data that may not in the long term really turn out to be significant for that kind of a decision," she said.

George noted that it's important to understand this week's stock market volatility.

Federal Reserve Bank of Kansas City president pointed out that the normalization process should begin.

"So after a disappointing first quarter, it looks like we're back on track. We'll probably do another two percent growth. The labour markets continue to show great health, I think. We've had over 200,000 jobs per month for 15 of the last 17 months. That is great sign, I think. And so as consumers spend, as they gain more confidence, as low oil prices seed through to them, my outlook is for continued growth. And I think in that context, it's time for us to talk about normalization," George said.

George is not a voting member of the Federal Open Market Committee this year.

-

18:00

European stocks closed: FTSE 100 6,192.03 +212.83 +3.56% CAC 40 4,658.18 +157.13 +3.49% DAX 10,315.62 +318.19 +3.18%

-

18:00

European stocks close: stocks closed higher as concerns over a slowdown in the Chinese economy eased and the Chinese stock market stabilised

Stock indices closed higher as concerns over a slowdown in the Chinese economy eased and the Chinese stock market stabilised.

Meanwhile, the economic data from the Eurozone was mostly positive. M3 money supply rose 5.3% in July from last year, beating expectations for a 4.9% gain, after a 5.0 % increase in June.

Loans to the private sector in the Eurozone climbed 0.9% in July from the last year, exceeding expectations for a 0.8% rise, after a 0.6% gain in June.

German import prices declined by 1.7% in July from last year, after a 1.4% fall in June. On a monthly base, import prices decreased 0.7% in July, after a 0.5% fall in June.

Export prices in Germany climbed 1.2% year-on-year in July, after a 1.3% increase in June. On a monthly base, export prices were up 0.1% in July, after a 0.1% decline in June.

Spain's economy expanded 1.0% the second quarter, after a 0.9% growth in the first quarter. It was the fastest growth since the first quarter of 2007.

It was the eighth consecutive increase.

On a yearly, GDP grew 3.1% in the second quarter, after a 2.7% in the first quarter. It was the fastest growth since the fourth quarter of 2007.

The French manufacturing confidence index increased to 103 in August from 102 in July.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.3% in August, missing expectations for a 0.4% rise, after a 0.4% increase in July.

On a yearly basis, house prices fell to 3.2% in August from 3.5% in July, beating expectations for a fall to 3.1%. It was the lowest increase since June 2013.

"However, with UK house building running well below the expected rate of household formation in recent years and with demand for homes rising, a significant increase in construction activity is required if affordability is not to become stretched in the years ahead," Nationwide's chief economist, Robert Gardner, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,192.03 +212.83 +3.56 %

DAX 10,315.62 +318.19 +3.18 %

CAC 40 4,658.18 +157.13 +3.49 %

-

16:58

U.S. pending home sales climbs 0.5% in July

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. rose 0.5% in July, after a 1.7% drop in June. June's figure was revised down up a 1.8% decline.

The increase was partly lead by gains gain in the Northeast.

"Homeowners looking to sell this spring appear to be in the driver's seat, as there are more buyers competing for a limited number of homes available for sale. As a result, home prices are up and accelerating in many markets," the NAR's chief economist Lawrence Yun said.

He pointed out that the U.S. housing market can handle interest rates well above 4%.

"The housing market can handle interest rates well above 4 percent as long as inventory improves to slow price growth and underwriting standards ease to normal levels so that qualified buyers - especially first-time buyers - are able to obtain a mortgage," Yun noted.

-

16:41

European Central Bank Executive Board Member Benoit Coeure: the Eurozone is irreversible project

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Thursday that the Eurozone is irreversible project.

"The exit of a member country would inevitably lead economic actors to wonder who would be next, with all the potential destabilising effects that such speculation could entail. The genie will not be put back in its bottle once and for all until it is clear that such a risk will not rear its head again," he said.

Coeure also said that low energy prices and an accommodative monetary policy alone will not be enough to boost the economic growth and to combat unemployment.

"Monetary policy can support growth but it cannot create it in a lasting way. And the effectiveness and legitimacy of euro area governance will not be increased by placing excessive demands on the central bank-quite the opposite," he said.

-

16:18

Head of the European Stability Mechanism Klaus Regling: a Greek exit from the Eurozone is possible if Greece does not fulfil the conditions

The head of the European Stability Mechanism (ESM), Klaus Regling, said on Thursday that a Greek exit from the Eurozone is possible if Greece does not fulfil the conditions of its third bailout programme.

"This threat as a possibility must always be there and is still there," he said.

Regling ruled out the debt "haircut", but noted that talks about debt relief in autumn are possible.

He also said that he expects the International Monetary Fund (IMF) to participate in the third Greek bailout programme.

-

16:02

Moody's Investors Service: the latest policy action by the People's Bank of China will add liquidity to the financial system

Moody's Investors Service said on Thursday that the latest policy action by the People's Bank of China (PBoC) will add liquidity to the financial system, but it also points to the weakness in the domestic economy.

"On balance, we expect the latest policy action to be positive for Chinese banks from a liquidity perspective," Frank Wu, a Moody's analyst, said.

"This will alleviate upward pressure on interbank borrowing rates and ease interbank rate volatility. But the latest policy move is symptomatic of further weakness in the domestic economy and the challenging operating environment for banks," he added.

-

15:35

U.S. Stocks open: Dow +1.11%, Nasdaq +1.36%, S&P +1.23%

-

15:35

China relaxes its real estate investment rules for foreigners

China's Commerce Ministry said on Thursday that the country has relaxed its real estate investment rules for foreigners. Foreign individuals and companies can buy as many properties as they want, as long as it is within the limits of local housing purchase.

Foreign investors should not pay their registered capital in full before borrowing local loans anymore.

-

15:27

Before the bell: S&P futures +1.21%, NASDAQ futures +1.33%

U.S. stock-index futures rose after data showed the economy grew more than previously estimated, with equities poised to advance amid a rebound throughout global markets.

Global Stocks:

Nikkei 18,574.44 +197.61 +1.08%

Hang Seng 21,838.54 +758.15 +3.60%

Shanghai Composite 3,085.42 +158.13 +5.40%

FTSE 6,146.99 +167.79 +2.81%

CAC 4,650.29 +149.24 +3.32%

DAX 10,330.11 +332.68 +3.33%

Crude oil $40.10 (+3.89%)

Gold $1121.50 (-0.27%)

-

15:12

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

95.85

+0.74%

5.6K

United Technologies Corp

UTX

92.26

+0.76%

2.1K

Travelers Companies Inc

TRV

100.88

+0.88%

0.7K

Microsoft Corp

MSFT

43.09

+0.89%

24.4K

ALTRIA GROUP INC.

MO

53.75

+1.01%

2.4K

American Express Co

AXP

76.41

+1.03%

11.1K

Wal-Mart Stores Inc

WMT

65.50

+1.03%

68.0K

FedEx Corporation, NYSE

FDX

149.98

+1.04%

0.9K

E. I. du Pont de Nemours and Co

DD

51.20

+1.07%

2.7K

Merck & Co Inc

MRK

55.00

+1.07%

1.6K

Barrick Gold Corporation, NYSE

ABX

6.60

+1.07%

42.8K

Procter & Gamble Co

PG

71.70

+1.13%

12.8K

Cisco Systems Inc

CSCO

25.98

+1.17%

15.9K

3M Co

MMM

144.40

+1.18%

0.5K

International Business Machines Co...

IBM

148.43

+1.18%

2.3K

Johnson & Johnson

JNJ

96.24

+1.19%

0.8K

Intel Corp

INTC

27.64

+1.23%

22.9K

Deere & Company, NYSE

DE

82.25

+1.26%

0.4K

General Electric Co

GE

24.32

+1.29%

12.0K

Hewlett-Packard Co.

HPQ

27.45

+1.29%

14.1K

Goldman Sachs

GS

186.80

+1.30%

7.6K

UnitedHealth Group Inc

UNH

115.00

+1.36%

0.7K

Twitter, Inc., NYSE

TWTR

25.37

+1.36%

111.8K

Nike

NKE

110.25

+1.37%

0.7K

Caterpillar Inc

CAT

74.90

+1.39%

24.4K

Verizon Communications Inc

VZ

45.79

+1.40%

8.1K

JPMorgan Chase and Co

JPM

63.80

+1.41%

10.5K

Starbucks Corporation, NASDAQ

SBUX

54.72

+1.41%

18.5K

Pfizer Inc

PFE

32.89

+1.42%

8.7K

AMERICAN INTERNATIONAL GROUP

AIG

60.00

+1.42%

5.7K

Walt Disney Co

DIS

100.65

+1.43%

18.4K

Boeing Co

BA

131.25

+1.48%

2.5K

Exxon Mobil Corp

XOM

73.60

+1.52%

19.7K

AT&T Inc

T

33.19

+1.53%

20.1K

ALCOA INC.

AA

8.39

+1.57%

19.5K

General Motors Company, NYSE

GM

28.54

+1.57%

6.3K

The Coca-Cola Co

KO

39.34

+1.58%

14.1K

Citigroup Inc., NYSE

C

53.11

+1.59%

38.5K

Google Inc.

GOOG

638.74

+1.61%

6.5K

Visa

V

71.89

+1.70%

15.4K

Ford Motor Co.

F

13.44

+1.74%

19.7K

Home Depot Inc

HD

118.00

+1.79%

5.2K

Facebook, Inc.

FB

89.02

+2.10%

375.9K

Apple Inc.

AAPL

112.00

+2.11%

915.2K

Chevron Corp

CVX

74.75

+2.27%

8.3K

Amazon.com Inc., NASDAQ

AMZN

512.40

+2.32%

64.3K

Yahoo! Inc., NASDAQ

YHOO

33.43

+2.80%

6.5K

Tesla Motors, Inc., NASDAQ

TSLA

232.20

+3.27%

55.4K

Yandex N.V., NASDAQ

YNDX

11.32

+4.43%

39.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.37

+5.68%

162.8K

-

15:12

U.S. revised GDP soars 3.7% in the second quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Thursday. The U.S. revised GDP climbed 3.7% in the second quarter, exceeding expectations for a 3.2% increase, up from the preliminary estimate of a 2.3% rise.

The upward revision was partly driven by an upward revision to inventories.

Consumer spending rose by 3.1% in the second quarter, up from the previous estimate of a 2.9% increase.

Business investment increased 3.2% in second quarter, up from the preliminary estimate of a 0.6% decline.

Exports climbed 5.2%, while imports were up 2.8%.

The Personal consumer expenditures (PCE) price index rose 2.2% in the second quarter, in line with expectations, after a 2.0% drop in the first quarter. The PCE price index excluding food and energy costs increased 1.8%, in line with expectations, after a 1.0% rise in the first quarter.

The PCE price index is the Fed's preferred gauge for inflation.

These figures could mean that the interest rate hike by the Fed this year is still possible.

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded to Strong Buy from Outperform at Raymond James

Downgrades:

Other:

-

14:45

Initial jobless claims decline by 6,000 to 271,000 in the week ending August 22

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 22 in the U.S. fell by 6,000 to 271,000 from 277,000 in the previous week.

Analysts had expected the number of initial jobless claims to be 274,000.

Jobless claims remained below 300,000 the 17th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 13,000 to 2,269,000 in the week ended August 15.

-

12:01

European stock markets mid session: stocks traded higher as concerns over a slowdown in the Chinese economy eased and the Chinese stock market stabilised

Stock indices traded higher as concerns over a slowdown in the Chinese economy eased and the Chinese stock market stabilised.

Meanwhile, the economic data from the Eurozone was mostly positive. M3 money supply rose 5.3% in July from last year, beating expectations for a 4.9% gain, after a 5.0 % increase in June.

Loans to the private sector in the Eurozone climbed 0.9% in July from the last year, exceeding expectations for a 0.8% rise, after a 0.6% gain in June.

German import prices declined by 1.7% in July from last year, after a 1.4% fall in June. On a monthly base, import prices decreased 0.7% in July, after a 0.5% fall in June.

Export prices in Germany climbed 1.2% year-on-year in July, after a 1.3% increase in June. On a monthly base, export prices were up 0.1% in July, after a 0.1% decline in June.

Spain's economy expanded 1.0% the second quarter, after a 0.9% growth in the first quarter. It was the fastest growth since the first quarter of 2007.

It was the eighth consecutive increase.

On a yearly, GDP grew 3.1% in the second quarter, after a 2.7% in the first quarter. It was the fastest growth since the fourth quarter of 2007.

The French manufacturing confidence index increased to 103 in August from 102 in July.

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.3% in August, missing expectations for a 0.4% rise, after a 0.4% increase in July.

On a yearly basis, house prices fell to 3.2% in August from 3.5% in July, beating expectations for a fall to 3.1%. It was the lowest increase since June 2013.

"However, with UK house building running well below the expected rate of household formation in recent years and with demand for homes rising, a significant increase in construction activity is required if affordability is not to become stretched in the years ahead," Nationwide's chief economist, Robert Gardner, said.

Current figures:

Name Price Change Change %

FTSE 100 6,109.36 +130.16 +2.18 %

DAX 10,298.34 +300.91 +3.01 %

CAC 40 4,630.22 +129.17 +2.87 %

-

11:50

Bank of Japan Governor Haruhiko Kuroda: there is no need for further easing of monetary policy to achieve the 2% inflation target

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that a slowdown in Chinese economy should not have a negative impact on Japan's exports. He added that China's economy is likely to slow further.

Kuroda also said that there is no need for further easing of monetary policy to achieve the 2% inflation target, but the central bank could add further stimulus measures if needed.

"At this stage, we have no concrete proposal for further accommodation. But if necessary, we will certainly make necessary adjustment," the BoJ governor said.

Kuroda noted that an interest rate hike by the Fed would have a positive impact on the global and Japanese economies.

-

11:35

Spain’s economy expands 1.0% the second quarter, the fastest growth since 2007

The Spanish statistical office INE released its final gross domestic product (GDP) for Spain. Spain's economy expanded 1.0% the second quarter, after a 0.9% growth in the first quarter. It was the fastest growth since the first quarter of 2007.

It was the eighth consecutive increase.

On a yearly, GDP grew 3.1% in the second quarter, after a 2.7% in the first quarter. It was the fastest growth since the fourth quarter of 2007.

-

11:15

Swiss industrial production drops 2.5% in the second quarter

The Swiss Federal Statistical Office released its industrial production data for Switzerland on Thursday. Swiss industrial production dropped 2.5% in the second quarter from a year earlier, after a 0.5% fall in the first quarter.

The output in manufacturing plunged 3.0% in the second quarter, energy output climbed 1.5%, and the production in the construction sector was down 2.5%, while the output in mining and quarrying dropped 5.5%.

-

11:10

French manufacturing confidence index rises to 103 in August

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 103 in August from 102 in July.

Past change in production index plunged to 6 in August from 9 in July.

Personal production expectations index rose to 7 in August from 5 in July, while general production outlook index climbed to 3 in August from 0 in July.

-

11:03

Nationwide: UK house prices rise 0.3% in August

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.3% in August, missing expectations for a 0.4% rise, after a 0.4% increase in July.

On a yearly basis, house prices fell to 3.2% in August from 3.5% in July, beating expectations for a fall to 3.1%. It was the lowest increase since June 2013.

"However, with UK house building running well below the expected rate of household formation in recent years and with demand for homes rising, a significant increase in construction activity is required if affordability is not to become stretched in the years ahead," Nationwide's chief economist, Robert Gardner, said.

-

10:49

M3 money supply in the Eurozone rises 5.3% in July from last year

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.3% in July from last year, beating expectations for a 4.9% gain, after a 5.0 % increase in June.

Loans to the private sector in the Eurozone climbed 0.9% in July from the last year, exceeding expectations for a 0.8% rise, after a 0.6% gain in June.

The lending to households jumped 1.9% year-on-year in July from 1.7% in June.

-

10:39

German import prices decline 0.7% in July

Destatis released its import prices data for Germany on Thursday. German import prices declined by 1.7% in July from last year, after a 1.4% fall in June.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.7% in July, after a 0.5% fall in June.

On a yearly base, import prices excluding crude oil and mineral oil products climbed by 2.5% in July.

Export prices climbed 1.2% year-on-year in July, after a 1.3% increase in June.

On a monthly base, export prices were up 0.1% in July, after a 0.1% decline in June.

-

10:32

European Central Bank Governing Council Member Ardo Hansson: Greece's outlook is slightly brighter now and the volume of ELA may decline

The European Central Bank (ECB) Governing Council Member Ardo Hansson said on Wednesday that Greece's outlook is slightly brighter now and the volume of ELA (Emergency Liquidity Assistance) may decline.

"The agreement negotiated during the Eurozone summit in mid-July, restart of negotiations and reasonable easing of capital controls helped to increase the confidence of depositors so that the deposits' outflow from Greece was replaced with a small inflow, and the volume of ELA has slightly decreased. The development is fragile, but nevertheless positive. One could predict a further small decrease of ELA, if news from Greece will remain positive," he said.

-

10:18

U.S. building permits plunge 15.5% in July

The U.S. Commerce Department's Bureau of the Census revised the number of building permits on Wednesday. U.S. building permits in July fell 15.5% to a 1.130 million unit annual rate, up from a preliminary estimate of a 16.3% fall to a 1.119 million unit rate.

Building permits for single-family homes declined 1.7% to a 680,000 unit rate, down from a preliminary estimate of a 1.9% decrease to a 679,000 unit rate, while permits for multi-unit buildings dropped 30.2% to a 450,000 unit rate, down from a preliminary estimate of a 31.8% decline to a 440,000 unit rate.

-

10:12

Number of unemployed people in France declines 0.1% in July

The French Labour Ministry released its labour market data on Wednesday. The number of unemployed people in France - registered job seekers who are fully unemployed - decreased 0.1% in July from June to 3,551,600. It was the first decline since January.

The unemployment in France has continued to increase since French President Francois Hollande took office in 2012.

The number of jobseekers is 3.9% higher than in July last year.

-

08:22

Global Stocks: U.S. and Asian indices rebounded

U.S. stock indices posted significant gains on Wednesday amid strong macroeconomic data and signs of stabilization. Seasonally adjusted durable goods orders rose by 2% in July compared to June. This is the second straight monthly increase and it suggests greater business confidence.

Meanwhile recent sharp declines in markets across the globe lowered expectations for a Fed rate hike in September, when the central bank meets next. Traders believe that there is a 25% chance of a rate increase next month. FOMC member Dudley said Wednesday that a rate increase in September seems to be less likely than a few weeks ago. Nevertheless Dudley said that he hopes that this event will take place this year.

The Dow Jones Industrial Average gained 619.91 points, or 4%, to 16,285.51. The S&P 500 rose 72.90 points, or 3.9%, to 1,940.51 (all of its 10 sectors gained). The Nasdaq Composite surged 191.05 points, or 4.2% to 4,697.54.

This morning in Asia Hong Kong Hang Seng advanced 2.30%, or 484.39 points, to 21,564.78. China Shanghai Composite Index rose 1.78%, or 51.98 points, to 2,979.27. The Nikkei added 0.69%, or 127.57 points, to 18,504.40.

Analysts say that Chinese stocks' gains are related to the government's efforts to restore investor trust.

Japanese stocks advanced as investors bought crashed shares. High market volatility is likely to persist in the coming months, because market participants are extra cautious about China's economy and prospects of Fed rates. A weaker yen also supported stocks.

-

04:03

Nikkei 225 18,700.17 +323.34 +1.8 %, Hang Seng 21,610.02 +529.63 +2.5 %, Shanghai Composite 2,995.45 +68.16 +2.3 %

-

00:31

Stocks. Daily history for Aug 26’2015:

(index / closing price / change items /% change)

Nikkei 225 18,376.83 +570.13 +3.20 %

Hang Seng 21,080.39 -324.57 -1.52 %

S&P/ASX 200 5,172.78 +35.52 +0.69 %

FTSE 100 5,979.2 -102.14 -1.68 %

CAC 40 4,501.05 -63.81 -1.40 %

Xetra DAX 9,997.43 -130.69 -1.29 %

S&P 500 1,940.51 +72.90 +3.90 %

NASDAQ Composite 4,697.54 +191.05 +4.24 %

Dow Jones 16,285.51 +619.07 +3.95 %

-