Noticias del mercado

-

21:00

Dow +2.41% 16,043.28 +376.84 Nasdaq +2.56% 4,621.64 +115.15 S&P +2.38% 1,912.07 +44.46

-

19:03

WSE: Session Results

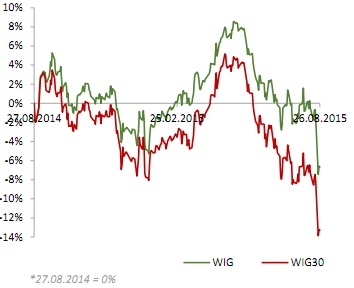

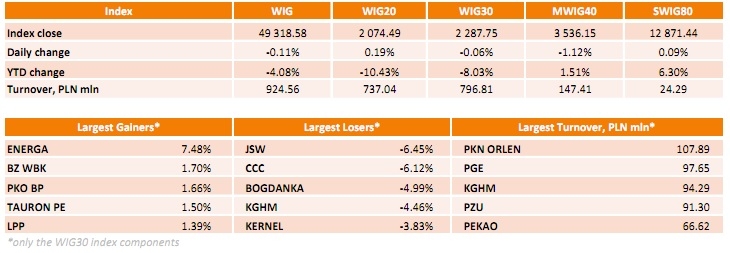

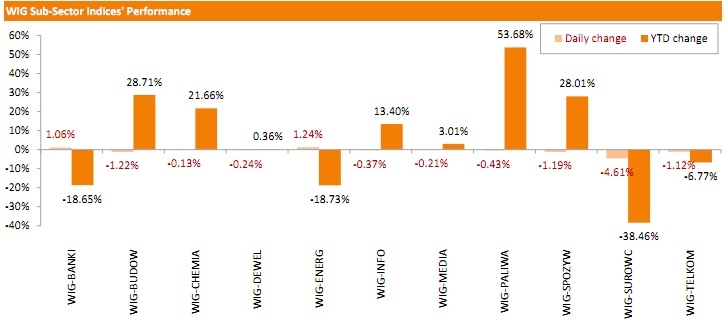

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, slid down 0.11%. Sector-wise, utilities (+1.24%) and banks (+1.06%) were the only sectors, which posted positive results. At the same time, materials (-4.61%) recorded the sharpest drop.

The large-cap stocks' measure, the WIG30 Index, edged down 0.06%. Within the WIG30 Index components, JSW (WSE: JSW) was hit the hardest, tumbling 6.45% after the company announced it would take a PLN 211.2 mln writedown on one of its coal mines. It was followed by CCC (WSE: CCC), BOGDANKA (WSE: LWB), KGHM (WSE: KGH) and KERNEL (WSE: KER), declining by 3.83%-6.12%. On the plus side, ENERGA (WSE: ENG) was the standout performer of the day, skyrocketing by 7.48%.

-

18:24

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday, helped by stronger-than-expected durable goods data, raising hopes that Wall Street will snap its six-day losing streak. Durable goods orders rose 2% in July, compared with analysts' average forecast of a 4% fall. Orders for core capital goods, a proxy for business investment, rose 2.2% - their biggest gain in 13 months. The data suggested U.S. economy was in good shape. Wednesday's gains followed a dramatic day of trading on Tuesday, when the three main indexes reversed course suddenly to close sharply lower amid lingering worries about slowing growth in China.

Almost all of Dow stocks in positive area (29 of 30). Top looser - The Boeing Company (BA, -0.06%). Top gainer - Merck & Co. Inc. (MRK, +3.22).

Almost all S&P index sectors in positive area. Top looser - Conglomerates (-0.3%). Top gainer - Technology (+1,1%).

At the moment:

Dow 15821.00 +102.00 +0.65%

S&P 500 1885.50 +12.75 +0.68%

Nasdaq 100 4077.00 +48.50 +1.20%

10 Year yield 2,14% +0,01

Oil 39.05 -0.26 -0.66%

Gold 1123.30 -15.00 -1.32%

-

18:00

European stocks closed: FTSE 100 5,979.2 -102.14 -1.68% CAC 40 4,501.05 -63.81 -1.40% DAX 9,997.43 -130.69 -1.29%

-

18:00

European stocks close: stocks closed lower as concerns over a slowdown in the Chinese economy turned in focus again

Stock indices closed lower as concerns over a slowdown in the Chinese economy turned in focus again. The People's Bank of China (PBoC) lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

The European Central Bank (ECB) Executive Board Member Peter Praet said on Wednesday that the downside risk of achieving the central bank's 2% inflation target are increased. He added that the ECB will add further stimulus measures if needed.

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Wednesday. Real GDP of 34 OECD member countries rose 0.4% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up 0.6% in the second quarter, real GDP of Germany rose to 0.4%, while Britain's economy climbed to 0.7%.

GDP of France remained flat in the second quarter, Italy's economy increased 0.2%, while Japan's GDP was down 0.4%.

Eurozone's economic growth remained unchanged at 0.4% in the second quarter.

On yearly basis, GDP of 34 OECD member countries remained unchanged at 2.0% in the second quarter.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance increased to +24% in August from +21% in July.

The increase was driven by a rise in sales in clothing stores.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,979.2 -102.14 -1.68 %

DAX 9,997.43 -130.69 -1.29 %

CAC 40 4,501.05 -63.81 -1.40 %

-

17:10

Federal Reserve Bank of New York President William Dudley: the interest rate hike in September seems less compelling

Federal Reserve Bank of New York President William Dudley said Wednesday that the interest rate hike in September seems less compelling.

"From my perspective, at this moment, the decision to begin the normalization process at the September FOMC meeting seems less compelling to me than it was a few weeks ago. But normalization could become more compelling by the time of the meeting as we get additional information on how the U.S. economy is performing and more information on international and financial market developments, all of which are important in shaping the U.S. economic outlook," he noted.

Dudley pointed out that the interest rate hike remains data depended, and the developments abroad could affect the economic outlook.

He also said that low oil prices weigh on the inflation.

Dudley is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:35

European Central Bank Executive Board Member Peter Praet: the downside risk of achieving the central bank’s 2% inflation target are increased

The European Central Bank (ECB) Executive Board Member Peter Praet said on Wednesday that the downside risk of achieving the central bank's 2% inflation target are increased. He added that the ECB will add further stimulus measures if needed.

"Recent developments in the world economy and in commodity markets have increased the downside risk of achieving the sustainable inflation path toward 2 percent. There should be no ambiguity on the willingness and ability of the Governing Council to act if needed," Praet said.

The ECB will release its inflation and growth forecasts on September 3.

-

16:04

Volume of global trade declines 0.5% in the second quarter

The Netherlands Bureau for Economic Policy Analysis release the world trade data on Tuesday. The volume of global trade declined 0.5% in the second quarter, after a 1.5% drop in the first quarter.

Global trade in the first half of the year showed the worst performance since the 2009 collapse in global trade.

"We have had a miserable first six months of 2015," chief economist of the World Trade Organisation, Robert Koopman, said. He pointed out that a faltering recovery in Europe and a slowdown in the Chinese economy weighed on global trade.

-

15:31

U.S. Stocks open: Dow +0.83%, Nasdaq +2.83%, S&P +1.15%

-

15:27

Before the bell: S&P futures +2.36%, NASDAQ futures +2.67%

U.S. index futures extended gains after a report showed orders for capital goods increased in July by the most in more than a year, showing corporate spending was finding its footing prior to the turmoil in financial markets.

Global Stocks:

Nikkei 18,376.83 +570.13 +3.20%

Hang Seng 21,080.39 -324.57 -1.52%

Shanghai Composite 2,926.38 -38.59 -1.30%

FTSE 6,082.13 +0.79 +0.01%

CAC 4,566.93 +2.07 +0.05%

DAX 10,121.83 -6.29 -0.06%

Crude oil $39.69 (+0.94%)

Gold $1125.30 (-1.11%)

-

15:12

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

64.01

+1.44%

9.4K

McDonald's Corp

MCD

93.00

+1.96%

0.3K

Caterpillar Inc

CAT

73.60

+2.14%

17.6K

United Technologies Corp

UTX

90.70

+2.14%

0.9K

Yahoo! Inc., NASDAQ

YHOO

32.42

+2.14%

11.0K

AT&T Inc

T

32.49

+2.17%

51.8K

Cisco Systems Inc

CSCO

25.16

+2.19%

28.0K

HONEYWELL INTERNATIONAL INC.

HON

96.00

+2.20%

0.3K

Johnson & Johnson

JNJ

92.75

+2.23%

6.9K

E. I. du Pont de Nemours and Co

DD

50.20

+2.32%

1.1K

International Business Machines Co...

IBM

144.30

+2.37%

4.7K

Verizon Communications Inc

VZ

44.54

+2.39%

18.6K

Exxon Mobil Corp

XOM

70.37

+2.42%

46.0K

Procter & Gamble Co

PG

70.10

+2.46%

7.7K

Walt Disney Co

DIS

98.30

+2.51%

28.6K

Yandex N.V., NASDAQ

YNDX

10.83

+2.51%

14.7K

General Motors Company, NYSE

GM

27.97

+2.53%

35.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.45

+2.55%

64.1K

Merck & Co Inc

MRK

52.50

+2.61%

1.5K

The Coca-Cola Co

KO

38.99

+2.63%

10.4K

Ford Motor Co.

F

13.24

+2.64%

45.1K

ALTRIA GROUP INC.

MO

53.20

+2.66%

0.2K

Intel Corp

INTC

26.56

+2.67%

29.5K

Pfizer Inc

PFE

32.19

+2.71%

6.6K

Deere & Company, NYSE

DE

81.23

+2.71%

2.5K

UnitedHealth Group Inc

UNH

113.00

+2.75%

0.9K

Boeing Co

BA

129.00

+2.80%

5.5K

ALCOA INC.

AA

8.34

+2.84%

48.7K

Apple Inc.

AAPL

106.70

+2.85%

808.7K

General Electric Co

GE

23.95

+2.92%

98.3K

Home Depot Inc

HD

114.30

+3.00%

4.0K

Visa

V

69.00

+3.03%

2.5K

Goldman Sachs

GS

183.75

+3.10%

4.1K

Microsoft Corp

MSFT

41.75

+3.16%

101.8K

Nike

NKE

106.89

+3.24%

0.8K

JPMorgan Chase and Co

JPM

61.85

+3.24%

11.9K

AMERICAN INTERNATIONAL GROUP

AIG

58.49

+3.27%

2.7K

Chevron Corp

CVX

72.32

+3.28%

7.5K

Citigroup Inc., NYSE

C

51.54

+3.33%

40.9K

American Express Co

AXP

75.98

+3.35%

1.2K

Twitter, Inc., NYSE

TWTR

25.20

+3.36%

55.2K

Tesla Motors, Inc., NASDAQ

TSLA

227.50

+3.39%

29.4K

3M Co

MMM

142.60

+3.60%

19.1K

Starbucks Corporation, NASDAQ

SBUX

52.96

+3.66%

3.9K

Facebook, Inc.

FB

86.12

+3.76%

229.2K

Amazon.com Inc., NASDAQ

AMZN

485.00

+3.99%

22.7K

Google Inc.

GOOG

610.00

+4.80%

15.8K

Barrick Gold Corporation, NYSE

ABX

6.91

-1.14%

46.2K

-

15:03

Upgrades and downgrades before the market open

Upgrades:

Google (GOOG, GOOGL) upgraded to Buy from Neutral at Goldman, target raised to $800 from $660

IBM upgraded to Buy from Hold at Argus, target $175

NIKE (NKE) upgraded to Positive from Neutral at Susquehanna

Downgrades:

Other:

-

14:55

U.S. durable goods orders soar 2.0% in July

The U.S. Commerce Department released durable goods orders data on Wednesday. The U.S. durable goods orders increased 2.0% in July, beating expectations for a 0.4% decrease, after a 4.1% gain in June. June's figure was revised up from a 3.4% rise.

The increase was partly driven by rises in new machinery, electronics and other goods.

Transportation orders climbed 4.7% in July.

The U.S. durable goods orders excluding transportation rose 0.6% in July, exceeding expectations for a 0.4% gain, after a 0.8% increase in June.

The U.S. durable goods orders excluding defence climbed 1.0 % in July, after a 4.2% gain in June. June's figure was revised up from a 3.8% increase.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

14:43

Real GDP in the OECD area climbs 0.4% in the second quarter

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Wednesday. Real GDP of 34 OECD member countries rose 0.4% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up 0.6% in the second quarter, real GDP of Germany rose to 0.4%, while Britain's economy climbed to 0.7%.

GDP of France remained flat in the second quarter, Italy's economy increased 0.2%, while Japan's GDP was down 0.4%.

Eurozone's economic growth remained unchanged at 0.4% in the second quarter.

On yearly basis, GDP of 34 OECD member countries remained unchanged at 2.0% in the second quarter.

-

14:32

CBI retail sales balance rises to +24% in August

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance increased to +24% in August from +21% in July.

The increase was driven by a rise in sales in clothing stores.

Sales expectations for next month were up to +35%.

"Household spending seems to have remained firm going into the second half of this year, so the outlook for the retail sector looks upbeat," CBI Director of Economics, Rain Newton-Smith, said.

-

14:23

The People's Bank of China injects 140 billion yuan into the financial system

The People's Bank of China (PBoC) injected 140 billion yuan (about €19 billion) into the financial system via a short-term liquidity operation on Wednesday. The central bank wants to support the country's economy and to calm down the markets.

The PBoC lowered the one-year benchmark bank lending rate by 25 basis points to 4.6% on Tuesday. One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

-

12:03

European stock markets mid session: stocks traded lower as concerns over a slowdown in the Chinese economy turned in focus again

Stock indices traded lower as concerns over a slowdown in the Chinese economy turned in focus again. The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets. The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

Current figures:

Name Price Change Change %

FTSE 100 6,005.38 -75.96 -1.25 %

DAX 10,014.42 -113.70 -1.12 %

CAC 40 4,506.4 -58.46 -1.28 %

-

11:35

Fed Chairwoman Janet Yellen is asked to testify on bank supervision matters before the House Financial Services Committee

The Fed Chairwoman Janet Yellen was asked to testify on bank supervision matters before the House Financial Services Committee in September. No date has been finalized for Yellen's testimony.

-

11:23

UBS consumption index rises to 1.64 in July

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.64 in July from 1.61 in June. June's figure was revised down from 1.68.

Retailer sentiment remained pessimistic due to the weak outlook for the development of prices and sales.

Consumer sentiment continued to worsen.

-

11:07

Number of mortgage approvals in the U.K. is up to 46,033 in July, the highest reading since February 2014

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

-

10:48

New Zealand’s trade deficit widens to NZ$649 million in July

Statistics New Zealand released its trade data on late Tuesday evening. New Zealand's trade deficit widened to NZ$649 million in July from NZ$194 million in June. June's figure was revised down from a deficit of NZ$60 million.

The increase in deficit was driven by higher exports. Exports rose 1.5% in July, while imports increased by 11.9%.

Dairy exports were up 0.1% in July, the first increase in dairy exports since August 2014.

"The small rise in dairy export values combined with the falling New Zealand dollar contributed to the rise in total exports value this month. A weaker dollar means that exporters receive more New Zealand dollars for transactions in foreign currencies while imports cost more," Statistics NZ international statistics senior manager Jason Attewell said.

-

10:35

The U.S. budget deficit could decline by $60 billion in 2015

The U.S: Congressional Budget Office (CBO) said on Tuesday that the U.S. budget deficit could decline by $60 billion in 2015 due to higher revenue gains. The CBO expects a $426 billion deficit for fiscal year 2015, down from its previous $486 billion estimate, a $414 billion deficit for fiscal year 2016, a reduction of $41 billion from the previous estimate.

The new forecast may mean that the deficit for fiscal year 2015 could be the lowest since 2007, and there will be likely no need to raise a debt limit in December.

-

10:17

Construction work done in Australia climbs 1.6% in the second quarter

The Australian Bureau of Statistics released its construction work done figures on Wednesday. Construction work done in Australia climbed 1.6% in the second quarter, beating forecasts of a 1.5% drop, after a 0.8% decrease in the previous quarter. The first quarter's figure was revised up from a 2.4% decline.

The seasonally adjusted estimate of total building work done fell 2.6% in the second quarter.

On a yearly basis, total construction work plunged 3.3%.

-

10:12

Chinese Premier Li Keqiang: there is no basis for the further yuan devaluation

Chinese Premier Li Keqiang said on Tuesday that there is no basis for the further yuan devaluation.

"Currently, there is no basis for continued depreciation in the renminbi (yuan), which is able to stay at a reasonable and balanced level," he said.

Li added that the Chinese government could achieve main economic targets for this year.

-

08:33

Global Stocks: Chinese stocks rebounded amid PBOC actions

U.S. stock indices fell at the end of Tuesday session losing gains accumulated at the session's beginning.

The People's Bank of China cut its key lending and deposit rates by 0.25% to 4.6% and 1.75% respectively. This information supported equities at the beginning of the session.

The Dow Jones Industrial Average dropped 204.91 points, or 1.3%, to 15,666.44. The S&P 500 fell 25.59 points, or 1.4%, to 1,867.61. The Nasdaq Composite lost 19.76 points, or 0.4% to 4,506.49.

Meanwhile a report from the Conference Board showed that the index of consumer confidence in the U.S. rose to 101.5 in August from 91.0 in July (revised from 90.9). Economists expected the index to come in at 93.4. The index of expectations improved to 92.5 in August from 82.3 in July, while the current situation index advanced to 115.1 from 104.0.

This morning in Asia Hong Kong Hang Seng recovered 1.11%, or 236.60 points, to 21,641.56. China Shanghai Composite Index rose 2.72%, or 80.56 points, to 3,045.53. The Nikkei added 2.57%, or 457.08 points, to 18,263.78.

Chinese stocks revived and helped other Asian markets rebound amid new supportive measures from the government. On Tuesday the People's Bank of China cut its key lending and deposit rates by 0.25% to 4.6% and 1.75% respectively.

The PBOC also said it would require large banks to keep less money in reserve, making it easier for banks to lend money (effective from September 6).

-

04:03

Nikkei 225 17,941.79 +135.09 +0.76%, Hang Seng 21,418.02 +13.06 +0.06%, Shanghai Composite 2,992.42 +27.45 +0.93%

-

00:30

Stocks. Daily history for Aug 25’2015:

(index / closing price / change items /% change)

Nikkei 22517,806.7 -733.98 -3.96%

Hang Seng 21,404.96 +153.39 +0.72%

S&P/ASX 200 5,137.25 +135.97 +2.72%

Shanghai Composite 2,965.15 -244.76 -7.63%

FTSE 100 6,081.34 +182.47 +3.09%

CAC 40 4,564.86 +181.40 +4.14%

Xetra DAX 10,128.12 +479.69 +4.97%

S&P 500 1,867.61 -25.60 -1.35%

NASDAQ Composite 4,506.49 -19.76 -0.44%

Dow Jones 15,666.44 -204.91 -1.29%

-