Noticias del mercado

-

17:42

Oil prices decline on concerns over the global oil oversupply

Oil prices declined on concerns over the global oil oversupply. The U.S. crude oil inventories data had only a moderate impact on oil prices. The U.S. Energy Information Administration (EIA) said on Wednesday that U.S. crude inventories dropped by 5.45 million barrels to 450.8 million in the week to August 21.

Analysts had expected U.S. crude oil inventories to decline by 2.0 million barrels.

Gasoline inventories increased by 1.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 256,000 barrels.

U.S. crude oil imports decreased by 839,000 barrels per day.

Refineries in the U.S. were running at 94.5% of capacity, down from 95.1% the previous week.

Yesterday's interest rate cut by the Chinese central bank slightly supported oil prices.

WTI crude oil for October delivery declined to $39.24 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $43.00 a barrel on ICE Futures Europe.

-

17:24

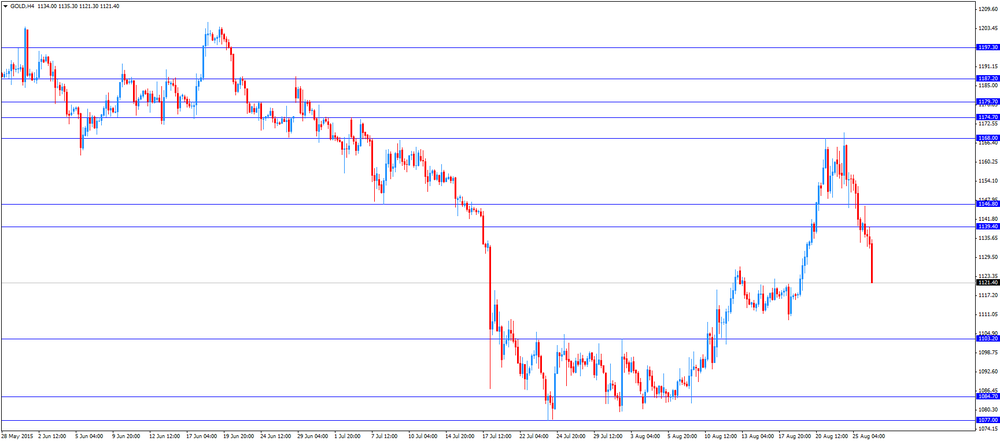

Gold price falls on a stronger U.S. dollar and as stock markets seem to stabilise

Gold price declined on a stronger U.S. dollar and as stock markets seem to stabilise. The U.S. dollar rose against other currencies as the U.S. durable goods orders were better than expected. The U.S. durable goods orders increased 2.0% in July, beating expectations for a 0.4% decrease, after a 4.1% gain in June. June's figure was revised up from a 3.4% rise.

The increase was partly driven by rises in new machinery, electronics and other goods.

The U.S. durable goods orders excluding transportation rose 0.6% in July, exceeding expectations for a 0.4% gain, after a 0.8% increase in June.

The U.S. durable goods orders excluding defence climbed 1.0 % in July, after a 4.2% gain in June. June's figure was revised up from a 3.8% increase.

Comments by Federal Reserve Bank of New York President William Dudley supported gold price. Dudley said on Wednesday that the interest rate hike in September seems less compelling.

September futures for gold on the COMEX today decreased to 1122.30 dollars per ounce.

-

16:49

U.S. crude inventories fall by 5.45 million barrels to 450.8 million in the week to August 21

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories dropped by 5.45 million barrels to 450.8 million in the week to August 21.

Analysts had expected U.S. crude oil inventories to decline by 2.0 million barrels.

Gasoline inventories increased by 1.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 256,000 barrels.

U.S. crude oil imports decreased by 839,000 barrels per day.

Refineries in the U.S. were running at 94.5% of capacity, down from 95.1% the previous week.

-

15:48

-

14:23

The People's Bank of China injects 140 billion yuan into the financial system

The People's Bank of China (PBoC) injected 140 billion yuan (about €19 billion) into the financial system via a short-term liquidity operation on Wednesday. The central bank wants to support the country's economy and to calm down the markets.

The PBoC lowered the one-year benchmark bank lending rate by 25 basis points to 4.6% on Tuesday. One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

-

10:12

Chinese Premier Li Keqiang: there is no basis for the further yuan devaluation

Chinese Premier Li Keqiang said on Tuesday that there is no basis for the further yuan devaluation.

"Currently, there is no basis for continued depreciation in the renminbi (yuan), which is able to stay at a reasonable and balanced level," he said.

Li added that the Chinese government could achieve main economic targets for this year.

-

09:34

Oil prices rose moderately

West Texas Intermediate futures for October delivery advanced to $39.61 (+0.76%), while Brent crude rebounded to $43.51 (+0.69%) after China's central bank stepped in to support the country's economy. However both crudes remained not far from 6-1/2 year lows as concerns over ongoing supply glut limited gains. At the same time some investors believe that a rate cut, which was conducted by the People's Bank of China on Tuesday, will not be enough to stabilize China's slowing economic growth.

Meanwhile data from the American Petroleum Institute showed on Tuesday that U.S. crude inventories fell by 7.3 million barrels last week to 449.3 million, compared with analysts' expectations for a 1 million barrels rise. Energy Information Administration data is due 14:30 GMT today.

-

09:05

Gold declined for a third sesion

Gold fell to $1,136.30 (-1.50%) after Chinese stocks rebounded amid actions of the country's central bank and pushed equities in other countries up. On Tuesday the People's Bank of China cut its key lending and deposit rates by 0.25% to 4.6% and 1.75% respectively.

Stronger stocks raise a question of probability of an interest rate hike by the Federal Reserve this year thus putting pressure on bullion.

-

00:31

Commodities. Daily history for Aug 25’2015:

(raw materials / closing price /% change)

Oil 39.62 +0.79%

Gold 1,140.10 +0.16%

-