Noticias del mercado

-

17:10

Federal Reserve Bank of New York President William Dudley: the interest rate hike in September seems less compelling

Federal Reserve Bank of New York President William Dudley said Wednesday that the interest rate hike in September seems less compelling.

"From my perspective, at this moment, the decision to begin the normalization process at the September FOMC meeting seems less compelling to me than it was a few weeks ago. But normalization could become more compelling by the time of the meeting as we get additional information on how the U.S. economy is performing and more information on international and financial market developments, all of which are important in shaping the U.S. economic outlook," he noted.

Dudley pointed out that the interest rate hike remains data depended, and the developments abroad could affect the economic outlook.

He also said that low oil prices weigh on the inflation.

Dudley is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:35

European Central Bank Executive Board Member Peter Praet: the downside risk of achieving the central bank’s 2% inflation target are increased

The European Central Bank (ECB) Executive Board Member Peter Praet said on Wednesday that the downside risk of achieving the central bank's 2% inflation target are increased. He added that the ECB will add further stimulus measures if needed.

"Recent developments in the world economy and in commodity markets have increased the downside risk of achieving the sustainable inflation path toward 2 percent. There should be no ambiguity on the willingness and ability of the Governing Council to act if needed," Praet said.

The ECB will release its inflation and growth forecasts on September 3.

-

16:30

U.S.: Crude Oil Inventories, August -5.452 (forecast 2)

-

16:04

Volume of global trade declines 0.5% in the second quarter

The Netherlands Bureau for Economic Policy Analysis release the world trade data on Tuesday. The volume of global trade declined 0.5% in the second quarter, after a 1.5% drop in the first quarter.

Global trade in the first half of the year showed the worst performance since the 2009 collapse in global trade.

"We have had a miserable first six months of 2015," chief economist of the World Trade Organisation, Robert Koopman, said. He pointed out that a faltering recovery in Europe and a slowdown in the Chinese economy weighed on global trade.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E653mn)

USD/JPY: Y117.00($377mn), Y120.00($300mn), Y122.00($579mn)

EUR/GBP: Gbp0.7070(E289mn)

AUD/USD: $0.6950(A$403mn), $0.7300(A$286mn)

USD/CAD: C$1.3100($305mn)

-

14:55

U.S. durable goods orders soar 2.0% in July

The U.S. Commerce Department released durable goods orders data on Wednesday. The U.S. durable goods orders increased 2.0% in July, beating expectations for a 0.4% decrease, after a 4.1% gain in June. June's figure was revised up from a 3.4% rise.

The increase was partly driven by rises in new machinery, electronics and other goods.

Transportation orders climbed 4.7% in July.

The U.S. durable goods orders excluding transportation rose 0.6% in July, exceeding expectations for a 0.4% gain, after a 0.8% increase in June.

The U.S. durable goods orders excluding defence climbed 1.0 % in July, after a 4.2% gain in June. June's figure was revised up from a 3.8% increase.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

14:43

Real GDP in the OECD area climbs 0.4% in the second quarter

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Wednesday. Real GDP of 34 OECD member countries rose 0.4% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up 0.6% in the second quarter, real GDP of Germany rose to 0.4%, while Britain's economy climbed to 0.7%.

GDP of France remained flat in the second quarter, Italy's economy increased 0.2%, while Japan's GDP was down 0.4%.

Eurozone's economic growth remained unchanged at 0.4% in the second quarter.

On yearly basis, GDP of 34 OECD member countries remained unchanged at 2.0% in the second quarter.

-

14:32

CBI retail sales balance rises to +24% in August

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance increased to +24% in August from +21% in July.

The increase was driven by a rise in sales in clothing stores.

Sales expectations for next month were up to +35%.

"Household spending seems to have remained firm going into the second half of this year, so the outlook for the retail sector looks upbeat," CBI Director of Economics, Rain Newton-Smith, said.

-

14:30

U.S.: Durable Goods Orders , July 2.0% (forecast -0.4%)

-

14:30

U.S.: Durable goods orders ex defense, 1.0%

-

14:30

U.S.: Durable Goods Orders ex Transportation , July 0.6% (forecast 0.4%)

-

14:23

The People's Bank of China injects 140 billion yuan into the financial system

The People's Bank of China (PBoC) injected 140 billion yuan (about €19 billion) into the financial system via a short-term liquidity operation on Wednesday. The central bank wants to support the country's economy and to calm down the markets.

The PBoC lowered the one-year benchmark bank lending rate by 25 basis points to 4.6% on Tuesday. One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

-

14:14

Foreign exchange market. European session: the euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Construction Work Done Quarter II -0.8% Revised From -2.4% -1.5% 1.6%

06:00 Switzerland UBS Consumption Indicator July 1.61 Revised From 1.68 1.64

08:30 United Kingdom BBA Mortgage Approvals July 44.8 Revised From 44.5 46.0

11:00 U.S. MBA Mortgage Applications August 3.6% 0.2%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. durable goods orders data. The U.S. durable goods orders are expected to decrease 0.4% in July, after a 3.4% gain in June.

The U.S. durable goods orders excluding transportation are expected to rise 0.4% in July, after a 0.8% gain in June.

The greenback remained supported by yesterday's U.S. consumer confidence data. The index rose to 101.5 in August from 91.0 in July, exceeding expectations for a rise to 93.4.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

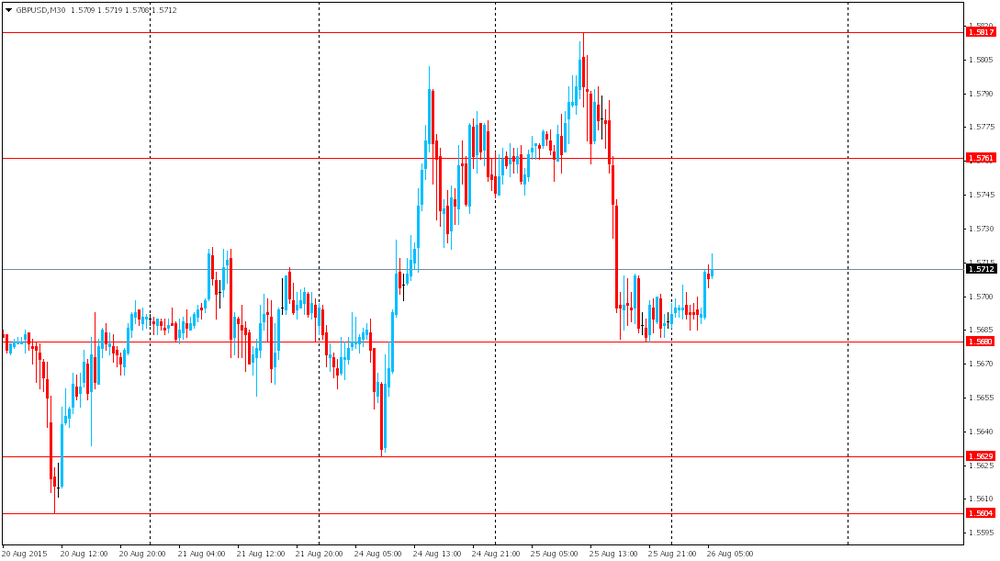

The British pound traded lower against the U.S. dollar in the absence of any major economic report from the U.K.

The Swiss franc traded lower against the U.S. dollar. The UBS consumption index increased to 1.64 in July from 1.61 in June. June's figure was revised down from 1.68.

Retailer sentiment remained pessimistic due to the weak outlook for the development of prices and sales.

Consumer sentiment continued to worsen.

EUR/USD: the currency pair declined to $1.1401

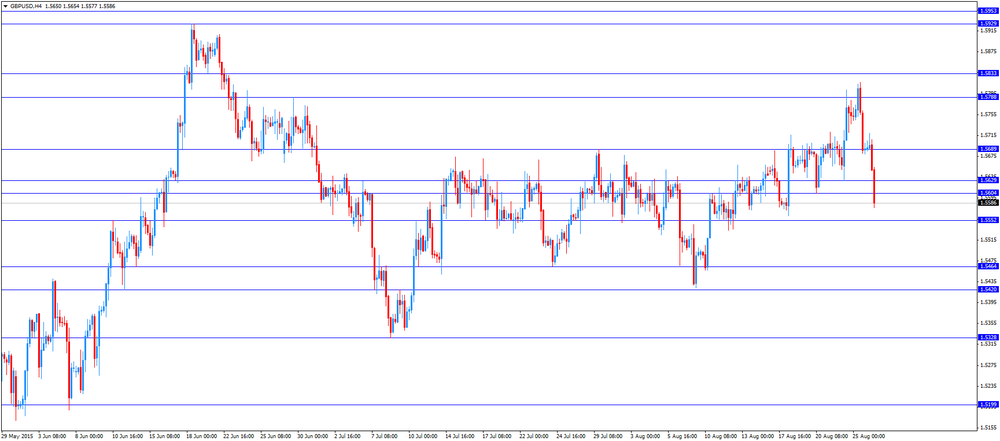

GBP/USD: the currency pair fell to $1.5577

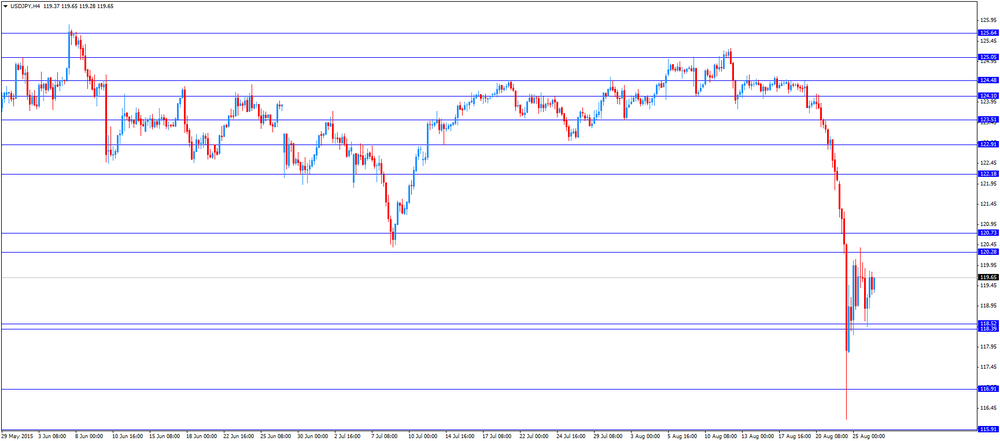

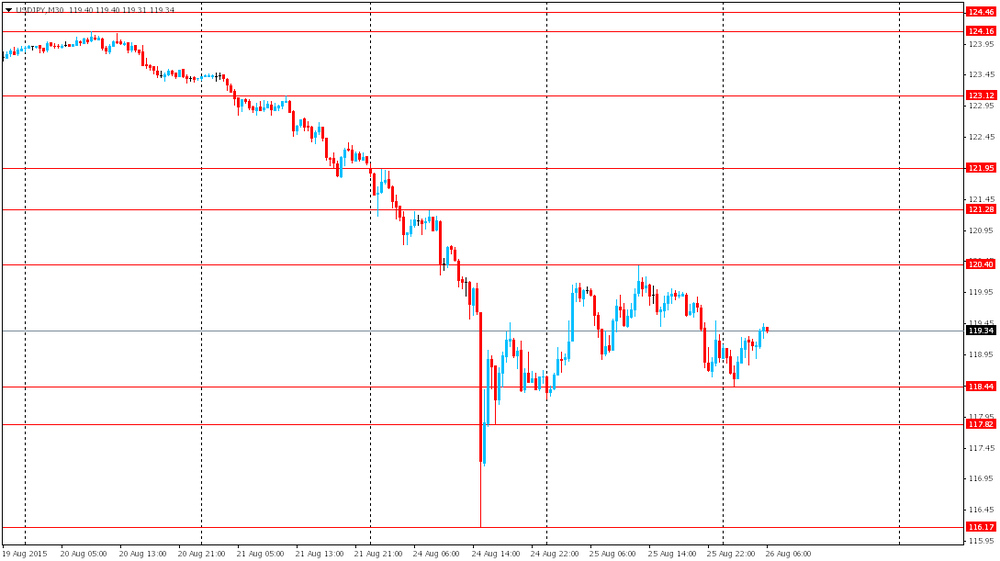

USD/JPY: the currency pair rose to Y119.65

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders July 3.4% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation July 0.8% 0.4%

12:30 U.S. Durable goods orders ex defense July 3.8%

14:00 U.S. FOMC Member Dudley Speak

-

14:00

Orders

EUR/USD

Offers 1.1520-25 1.1550 1.1565 1.1580 1.1600 1.1620 1.1650 1.1680 1.1700 1.1720

Bids 1.1500 1.1485 1.1470 1.1450 1.1420-25 1.1400 1.1385 1.1350

GBP/USD

Offers 1.5700 1.5720-25 1.5745-50 1.5780-85 1.5800 1.5830 1.5850

Bids 1.5650-55 1.5630-35 1.5625 1.5600 1.5585 1.5565 1.5550

EUR/GBP

Offers 0.7340-50 0.7365 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7300 0.7285 0.7265-70 0.7250 0.7230 0.7200

EUR/JPY

Offers 137.80 138.00 138.25 138.50 138.85 139.00 139.35 139.50

Bids 137.00 136.80 136.50 136.20 136.00 135.50 135.20

USD/JPY

Offers 119.65 119.85 120.00 120.20 120.45-50 120.80 121.00 121.25-30

Bids 119.25-30 119.00 118.85 118.50 118.35 118.20 118.00

AUD/USD

Offers 0.7150-55 0.7175 0.7200 0.7220-25 0.7250 0.7265 0.7285 0.7300

Bids 0.7100 0.7075-80 0.7050 0.7000 0.6950

-

13:00

U.S.: MBA Mortgage Applications, August 0.2%

-

11:35

Fed Chairwoman Janet Yellen is asked to testify on bank supervision matters before the House Financial Services Committee

The Fed Chairwoman Janet Yellen was asked to testify on bank supervision matters before the House Financial Services Committee in September. No date has been finalized for Yellen's testimony.

-

11:23

UBS consumption index rises to 1.64 in July

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.64 in July from 1.61 in June. June's figure was revised down from 1.68.

Retailer sentiment remained pessimistic due to the weak outlook for the development of prices and sales.

Consumer sentiment continued to worsen.

-

11:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E653mn)

USD/JPY: Y117.00($377mn), Y120.00($300mn), Y122.00($579mn)

EUR/GBP: Gbp0.7070(E289mn)

AUD/USD: $0.6950(A$403mn), $0.7300(A$286mn)

USD/CAD: C$1.3100($305mn)

-

11:07

Number of mortgage approvals in the U.K. is up to 46,033 in July, the highest reading since February 2014

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

-

10:48

New Zealand’s trade deficit widens to NZ$649 million in July

Statistics New Zealand released its trade data on late Tuesday evening. New Zealand's trade deficit widened to NZ$649 million in July from NZ$194 million in June. June's figure was revised down from a deficit of NZ$60 million.

The increase in deficit was driven by higher exports. Exports rose 1.5% in July, while imports increased by 11.9%.

Dairy exports were up 0.1% in July, the first increase in dairy exports since August 2014.

"The small rise in dairy export values combined with the falling New Zealand dollar contributed to the rise in total exports value this month. A weaker dollar means that exporters receive more New Zealand dollars for transactions in foreign currencies while imports cost more," Statistics NZ international statistics senior manager Jason Attewell said.

-

10:35

The U.S. budget deficit could decline by $60 billion in 2015

The U.S: Congressional Budget Office (CBO) said on Tuesday that the U.S. budget deficit could decline by $60 billion in 2015 due to higher revenue gains. The CBO expects a $426 billion deficit for fiscal year 2015, down from its previous $486 billion estimate, a $414 billion deficit for fiscal year 2016, a reduction of $41 billion from the previous estimate.

The new forecast may mean that the deficit for fiscal year 2015 could be the lowest since 2007, and there will be likely no need to raise a debt limit in December.

-

10:30

United Kingdom: BBA Mortgage Approvals, July 46.0

-

10:17

Construction work done in Australia climbs 1.6% in the second quarter

The Australian Bureau of Statistics released its construction work done figures on Wednesday. Construction work done in Australia climbed 1.6% in the second quarter, beating forecasts of a 1.5% drop, after a 0.8% decrease in the previous quarter. The first quarter's figure was revised up from a 2.4% decline.

The seasonally adjusted estimate of total building work done fell 2.6% in the second quarter.

On a yearly basis, total construction work plunged 3.3%.

-

10:12

Chinese Premier Li Keqiang: there is no basis for the further yuan devaluation

Chinese Premier Li Keqiang said on Tuesday that there is no basis for the further yuan devaluation.

"Currently, there is no basis for continued depreciation in the renminbi (yuan), which is able to stay at a reasonable and balanced level," he said.

Li added that the Chinese government could achieve main economic targets for this year.

-

08:36

Options levels on wednesday, August 26, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1681 (1560)

$1.1606 (3855)

$1.1543 (1968)

Price at time of writing this review: $1.1481

Support levels (open interest**, contracts):

$1.1406 (405)

$1.1356 (1560)

$1.1311 (1837)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 82441 contracts, with the maximum number of contracts with strike price $1,1350 (5249);

- Overall open interest on the PUT options with the expiration date September, 4 is 124321 contracts, with the maximum number of contracts with strike price $1,0500 (7791);

- The ratio of PUT/CALL was 1.51 versus 1.46 from the previous trading day according to data from August, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1650)

$1.5902 (2266)

$1.5804 (2527)

Price at time of writing this review: $1.5698

Support levels (open interest**, contracts):

$1.5595 (1001)

$1.5498 (2757)

$1.5399 (2132)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30385 contracts, with the maximum number of contracts with strike price $1,5600 (2725);

- Overall open interest on the PUT options with the expiration date September, 4 is 35323 contracts, with the maximum number of contracts with strike price $1,5500 (2757);

- The ratio of PUT/CALL was 1.16 versus 1.16 from the previous trading day according to data from August, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

Foreign exchange market. Asian session: the U.S. dollar little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Construction Work Done Quarter II -0.8% Revised From -2.4% -1.5% 1.6%

06:00 Switzerland UBS Consumption Indicator July 1.61 Revised From 1.68 1.64

The U.S. dollar fluctuated with modest changes to the euro and the yen. It's worth to remember that concerns over China's economic growth triggered massive declines in stocks worldwide on Monday. This also made the greenback very volatile. Investors are still cautious about short-term outlook of the dollar. They are waiting for signs of stabilization in China and strong data on the U.S. economy, which would suggest that the Federal Reserve is still on track to raise rates in 2015.

At the beginning of today's session the Australian dollar declined against the U.S. dollar. However later economic data supported the AUD. The seasonally adjusted Construction Work Done index rose by 1.6% in the second quarter. Economists expected the index to rise by 1.5%.

The New Zealand dollar is under pressure. Statistics showed that the country's trade balance came in at -Nz649 in July missing expectations for -NZ600. The deficit expanded as imports continued rising. Exports of dairy products have picked up for the first time in nearly a year.

EUR/USD: the pair fluctuated within $1.1500-60 in Asian trade

USD/JPY: the pair traded around Y119.00

GBP/USD: the pair rose to $1.5720

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals July 44.5

11:00 U.S. MBA Mortgage Applications August 3.6%

12:30 U.S. Durable Goods Orders July 3.4% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation July 0.8% 0.4%

12:30 U.S. Durable goods orders ex defense 3.8%

14:00 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August 2.62 2

-

08:00

Switzerland: UBS Consumption Indicator, July 1.64

-

03:30

Australia: Construction Work Done, Quarter II 1.6% (forecast -1.5%)

-

00:45

New Zealand: Trade Balance, mln, July -649

-

00:29

Currencies. Daily history for Aug 25’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1516 -0,55%

GBP/USD $1,5689 -0,40%

USD/CHF Chf0,9397 +0,74%

USD/JPY Y118,90 +0,25%

EUR/JPY Y136,96 -0,26%

GBP/JPY Y186,54 -0,06%

AUD/USD $0,7141 +0,06%

NZD/USD $0,6488 +0,68%

USD/CAD C$1,3329 -0,43%

-