Noticias del mercado

-

19:03

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes posted their sharpest rally of the year on Tuesday, as investors sought out bargains a day after Wall Street's worst performance in four years on fears China's economy was slowing. Markets also got a shot of good news with China's second interest rate cut in two months. Analysts were cautious, however, and even with Tuesday's gains, the Dow and the S&P were on track for the their worst monthly losses since February 2009, while the Nasdaq was poised for its steepest monthly fall since November 2008.

Almost all of Dow stocks in positive area (28 of 30). Top looser - Merck & Co. Inc. (MRK, -0.44%). Top gainer - Apple Inc. (AAPL, +5.64).

All S&P index sectors in positive area. Top gainer - Conglomerates (+4,4%).At the moment:

Dow 16197.00 +488.00 +3.11%

S&P 500 1933.25 +62.00 +3.31%

Nasdaq 100 4186.50 +183.25 +4.58%

10 Year yield 2,11% +0,12

Oil 39.43 +1.19 +3.11%

Gold 1137.00 -16.60 -1.44%

-

18:46

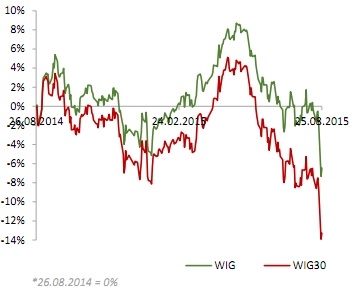

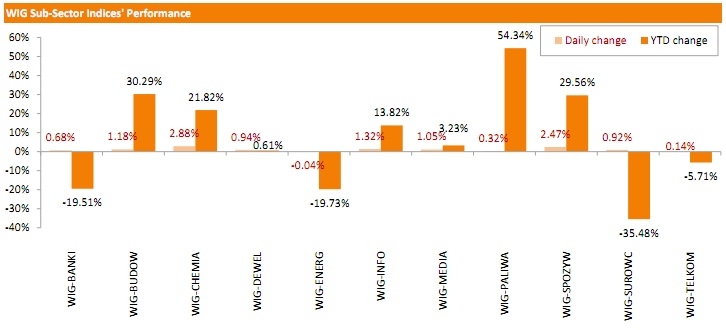

WSE: Session Results

Polish equity markets rebounded on Tuesday. The broad market measure, the WIG Index, advanced by 0.93%. Almost all sectors in the WIG generated positive returns. Utilities sector (-0.04%) was the only exception. At the same time, chemicals (+2.88%) and food sector (+2.47%) posed the best gains.

The large-cap stocks' measure, the WIG30 Index, returned 0.73% for the day. Within the WIG30 Index components, EUROCASH (WSE: EUR) became the session's best performer, as it stocks skyrocketed by 7.29%, recuperating from yesterday plunge. It was followed by GRUPA AZOTY (WSE: ATT) and HANDLOWY (WSE: BHW), which gained 5.29% and 4.17% respectively. On the other side of the ledger, coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW) continued to slump, losing 5.67% and 4.64% respectively. ING BSK (WSE: ING) and ENERGA (WSE: ENG) also fell noticeably, down 3.63% and 3.35% respectively.

-

18:00

European stocks closed: FTSE 100 6,081.34 +182.47 +3.09% CAC 40 4,564.86 +181.40 +4.14% DAX 10,128.12 +479.69 +4.97%

-

18:00

European stocks close: stocks closed higher as concerns over a slowdown in the Chinese economy eased

Stock indices closed higher as concerns over a slowdown in the Chinese economy eased. The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

Meanwhile, the economic data from the Eurozone was positive. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,081.34 +182.47 +3.09 %

DAX 10,128.12 +479.69 +4.97 %

CAC 40 4,564.86 +181.40 +4.14 %

-

17:33

European Central Bank Vice President Vitor Constancio: the central bank will add further measures if there is a significant risk to the outlook for inflation in the Eurozone

The European Central Bank (ECB) Vice President Vitor Constancio said on Tuesday that the central bank will add further measures if there is a significant risk to the outlook for inflation in the Eurozone.

I am confident that full implementation of the private and public-sector asset purchase programs, as announced, will lead to a sustained return of inflation rates toward levels consistent with our definition of price stability. As always, the Governing Council stands ready to use all the instruments available within its mandate to respond to any material change to the outlook for price stability," he said.

Constancio pointed out that the recent decline in oil prices is affecting the inflation, "but there is nothing monetary policy can do about that." He added that this effect "will disappear one day".

-

17:04

Japan’s Finance Minister Taro Aso expresses worries about a recent increase in yen

Japan's Finance Minister Taro Aso on Tuesday expressed worries about a recent increase in yen.

"For the economy to grow stably, it's better for (currency and stock price) moves to be gradual and steady, rather than rough," he said.

-

16:50

U.S. consumer confidence index jumps to 101.5 in August

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 101.5 in August from 91.0 in July, exceeding expectations for a rise to 93.4. July's figure was revised up from 90.9.

The increase was mainly driven by the better outlook for current conditions. The present conditions index climbed to 115.1 in August from 104.0 in July. It was the highest level since November 2007.

The Conference Board's consumer expectations index for the next six months increased to 92.5 in August from 82.3 in July.

"Consumers' assessment of current conditions was considerably more upbeat, primarily due to a more favourable appraisal of the labour market," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 14.6% in August from 13.7% in July.

-

16:34

New home sales rise 5.7% in July

The U.S. Commerce Department released new home sales data on Tuesday. New home sales increased 5.7% to a seasonally adjusted annual rate of 507,000 units in July from 481,000 units in June. June's figure was revised down from 482,000 units.

Analysts had expected new home sales to reach 510,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast climbed 23.1% in July.

The median sales price of new house increased by 2% from a year ago to $285,900.

-

16:18

Richmond Fed Manufacturing Index drops to 0 in August

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to 0 in August from 13 in July.

The decline was driven by decreases in shipments and order backlog. Shipments subindex fell 20 points to -4 in August, while new orders subindex was down 16 points to 1.

-

16:04

U.S. house price index rise 0.2% in June

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.2% on a seasonally adjusted basis in June, missing expectations for a 0.4% increase, after a 0.5% gain in May. May's figure was revised up from 0.4% rise.

The house price index climbed 1.2% in the second quarter.

"Home price growth in the second quarter once again far exceeded the pace of overall inflation, even as mortgage rates drifted upwards. Although too early to tell whether it's a sign of a slowdown, the monthly appreciation rate in June was more modest than we have seen in a while," FHFA Principal Economist Andrew Leventis said.

-

15:55

U.S. preliminary services purchasing managers' index declines to 55.2 in August

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) declined to 55.2 in August from 55.7 in July, missing expectations for an increase to 56.0.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a weak new business growth.

"Service providers' new business volumes expanded at the slowest pace since January, suggesting that underlying momentum within the U.S. economy had shifted down a gear even before the recent global market turmoil and escalating worries about China's growth outlook gathered on the horizon.," Markit Senior Economist Tim Moore.

-

15:39

NBB business climate declines to -5.1 in August

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate rose to -5.1 in August from -4.1 in July, missing forecasts for a rise to -3.5.

The decline was driven by a drop in the manufacturing industry.

The business climate index for the manufacturing sector dropped to -8.0 in August from -5.2 in July due to downward revision of demand forecasts.

The business climate index for the services sector was up to 11.8 in August from 7.2 in July due to more optimistic outlook about current levels of activity.

The business climate index for the building sector increased to -8.3 in August from -9.8 in July due to more favourable assessments of demand outlook.

The business climate index for the trade sector dropped to -8.0 in August from -6.7 in July due to downward revision of forecasts for orders and for employment.

-

15:34

U.S. Stocks open: Dow +2.04%, Nasdaq +3.22%, S&P +1.95%

-

15:24

Before the bell: S&P futures +3.42%, NASDAQ futures +3.82%

U.S. index futures extended gains after China cut interest rates. Risk appetite made a comeback.

Global Stocks:

Nikkei 17,806.7 -733.98 -3.96%

Hang Seng 21,404.96 +153.39 +0.72%

Shanghai Composite 2,965.15 -244.76 -7.63%

FTSE 6,081.47 +182.60 +3.10%

CAC 4,586.33 +202.87 +4.63%

DAX 10,098.68 +450.25 +4.67%

Crude oil $39.43 (+3.06%)

Gold $1151.30 (-0.18%)

-

15:18

S&P/Case-Shiller home price index rises 5.0% in June

The S&P/Case-Shiller home price index increased 5.0% in June, missing expectations for a 5.1% rise, after a 4.9% gain in May.

Denver, San Francisco and Dallas were the largest contributors to the rise, where prices climbed by 10.2%, 9.5% and 8.2%, respectively.

"The price gains have been consistent as the unemployment rate declined with steady inflation and an unchanged Fed policy," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index climbed by a seasonally adjusted 0.1% rate in June.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

94.67

+1.94%

6.0K

HONEYWELL INTERNATIONAL INC.

HON

97.13

+1.94%

0.3K

ALTRIA GROUP INC.

MO

53.15

+1.94%

4.1K

Johnson & Johnson

JNJ

94.75

+2.08%

7.5K

Merck & Co Inc

MRK

55.13

+2.11%

7.0K

Procter & Gamble Co

PG

70.61

+2.13%

14.5K

AT&T Inc

T

33.09

+2.22%

64.7K

Hewlett-Packard Co.

HPQ

27.20

+2.26%

2.6K

The Coca-Cola Co

KO

39.25

+2.27%

14.9K

Microsoft Corp

MSFT

42.65

+2.33%

72.5K

Home Depot Inc

HD

115.20

+2.36%

8.1K

3M Co

MMM

141.88

+2.38%

4.2K

Wal-Mart Stores Inc

WMT

65.49

+2.40%

4.7K

FedEx Corporation, NYSE

FDX

152.02

+2.46%

2.1K

International Business Machines Co...

IBM

147.01

+2.47%

7.9K

E. I. du Pont de Nemours and Co

DD

51.23

+2.50%

7.4K

Boeing Co

BA

130.51

+2.61%

7.2K

Chevron Corp

CVX

74.04

+2.66%

19.7K

Cisco Systems Inc

CSCO

25.86

+2.66%

40.2K

Verizon Communications Inc

VZ

46.00

+2.82%

34.0K

Nike

NKE

106.86

+2.88%

5.3K

AMERICAN INTERNATIONAL GROUP

AIG

58.58

+2.88%

14.3K

American Express Co

AXP

76.83

+2.92%

15.3K

Intel Corp

INTC

27.02

+2.93%

108.6K

Travelers Companies Inc

TRV

101.68

+2.94%

3.5K

UnitedHealth Group Inc

UNH

113.72

+2.98%

9.5K

United Technologies Corp

UTX

93.62

+3.03%

5.4K

Pfizer Inc

PFE

33.11

+3.05%

13.6K

Visa

V

70.50

+3.13%

16.5K

Caterpillar Inc

CAT

75.10

+3.13%

18.4K

Exxon Mobil Corp

XOM

70.90

+3.17%

50.2K

Goldman Sachs

GS

185.25

+3.23%

23.1K

Deere & Company, NYSE

DE

83.40

+3.26%

0.4K

General Electric Co

GE

24.65

+3.27%

64.3K

Google Inc.

GOOG

609.10

+3.31%

29.7K

General Motors Company, NYSE

GM

28.75

+3.43%

27.5K

Twitter, Inc., NYSE

TWTR

26.05

+3.50%

101.8K

Ford Motor Co.

F

13.70

+3.87%

55.9K

Citigroup Inc., NYSE

C

52.31

+3.91%

71.1K

Tesla Motors, Inc., NASDAQ

TSLA

227.44

+3.92%

51.2K

JPMorgan Chase and Co

JPM

62.64

+3.97%

177.2K

Amazon.com Inc., NASDAQ

AMZN

481.99

+4.02%

37.1K

Barrick Gold Corporation, NYSE

ABX

7.53

+4.15%

11.8K

Walt Disney Co

DIS

99.47

+4.31%

51.3K

ALCOA INC.

AA

8.58

+4.63%

60.9K

Facebook, Inc.

FB

85.90

+4.64%

459.4K

Apple Inc.

AAPL

108.15

+4.88%

1.1M

Starbucks Corporation, NASDAQ

SBUX

52.80

+4.89%

12.7K

Yahoo! Inc., NASDAQ

YHOO

32.86

+4.95%

76.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.16

+5.53%

59.8K

Yandex N.V., NASDAQ

YNDX

10.84

+6.48%

1.4K

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Neutral from Underperform at Macquarie

Apple (AAPL) upgraded to Outperform from Market Perform at Wells Fargo

JPMorgan Chase (JPM) upgraded to Buy from Outperform at Credit Agricole, target $78

Downgrades:

Other:

-

14:41

The People's Bank of China (PBoC) lowers its interest rates

The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

-

12:00

European stock markets mid session: stocks recover after the yesterday’s selloff

Stock indices recovered after the yesterday's selloff. Concerns over a slowdown in the Chinese economy remain in focus.

Meanwhile, the economic data from the Eurozone was positive. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

Current figures:

Name Price Change Change %

FTSE 100 6,064.12 +165.25 +2.80 %

DAX 9,960.78 +312.35 +3.24 %

CAC 40 4,527.09 +143.63 +3.28 %

-

11:51

Federal Reserve Bank of Atlanta President Dennis Lockhart still expects the Fed to raise its interest rate this year

Federal Reserve Bank of Atlanta President Dennis Lockhart said on Monday that he still expects the Fed to raise its interest rate this year.

"I expect the normalization of monetary policy-that is, interest rates-to begin sometime this year. I expect normalization to proceed gradually, the implication being an environment of rather low rates for quite some time," he said.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

11:42

Employment in Switzerland increases by 1.2% year-on-year in the second quarter

The Swiss Federal Statistical Office (FSO) released its employment data on Tuesday. The employment in Switzerland increased by 1.2% year-on-year in the second quarter, after a 0.4% gain in the first quarter.

The tertiary sector expanded at an annual rate of 1.6% in annual comparison), while the secondary sector declined -0.1%.

The number of job vacancies dropped by 8.3% year-on-year, while the employment outlook indicator fell 1.4%.

-

11:20

Spanish producer prices increase 0.1% in July

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Tuesday. The Spanish producer prices rose 0.1% in July, after a 0.9% increase in June.

On a yearly basis, producer price inflation in Spain fell 1.3% in July, after a 1.3% decline in June. Producer prices have been declining since July 2014.

Producer prices excluding energy climbed 0.7% year-on-year in July, after a 0.7% rise in June.

Energy prices dropped 7.0% in July.

-

11:02

German final GDP increases 0.4% in the second quarter

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

-

10:47

German business confidence index climbs to 108.3 in August

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

-

10:34

Britain’s Finance Minister George Osborne: the U.K. economy could be hurt by international shocks

Chancellor of the Exchequer George Osborne said on Monday that the U.K. economy could be hurt by international shocks.

"Everyone is concerned about the situation on the Asian financial markets. I would take it as a reminder that we are not immune from what happens in the world," he said.

Osborne pointed out that it is necessary to keep "own house in order".

"You don't know where the next crisis is coming from, where the next shock is going to come from in the world. Britain is a very open economy, probably the most open of the largest economies, and we are affected by what happens, whether it is problems in the euro zone, problems in Asian financial markets," he noted.

-

10:18

The People’s Bank of China injects 150 billion yuan in the financial system

The People's Bank of China (PBoC) injected 150 billion yuan ($23.4 billion) in the financial system on Tuesday, increasing efforts to combat capital flight from the country's economy and stock markets. The central bank used seven-day reverse-repurchase agreements.

The PBoC already injected 150 billion yuan in the financial system last week.

-

10:12

National Association for Business Economics survey: only 37% of the economists expect that the Fed will raise its interest rate in September

According to a National Association for Business Economics (NABE) survey, only 37% of the economists expect that the Fed will raise its interest rate next month. Nearly a quarter of the economists said the central bank is likely to start hiking rates in late October, 17% expect the first interest rate hike would come in December, while 17% said that the Fed would wait until next year or later.

NABE surveyed 331 economists between July 27 and August 4.

-

08:14

Global Stocks: U.S. indices declined further

Fears of a slowdown in world economic growth persisted, driving U.S. stock indices sharply lower on Monday. The Dow dropped as much as 1,089 points in the first six minutes of trading, but it partly recovered later.

Experts from the Deutsche Bank said that the global collapse of equity markets is serious and we should expect revisions of economic forecasts. The experts also said that low oil prices and changes in forecasts would lead to another round of cuts in corporate earnings forecasts worldwide.

The Dow Jones Industrial Average dropped 588.4 points, or 3.57%, to 15,871.4. The S&P 500 fell 77.68 points, or 3.94%, to 1,970.89. The Nasdaq Composite lost 179.79 points, or 3.82%, to 4,526.25.

This morning in Asia Hong Kong Hang Seng recovered 1.62%, or 344.17 points, to 21,595.74. China Shanghai Composite Index tumbled 4.33%, or 138.84 points, to 3,071.06. The Nikkei fell 0.59%, or 110.25 points, to 18,430.43.

Chinese stocks continued declining. Analysts said that panic remained in the market after Monday drop.

Japanese and Hong Kong shares also dropped at the beginning of the session, but recovered later and moved into the green zone.

-

04:04

Nikkei 225 18,486.44 -54.24 -0.3 %, Hang Seng 21,550.83 +299.26 +1.4 %, Shanghai Composite 3,042.08 -167.83 -5.2 %

-

00:33

Stocks. Daily history for Aug 24’2015:

(index / closing price / change items /% change)

HANG SENG 21,258.89 -1,150.73 -5.13%

S&P/ASX 200 5,001.3 -213.30 -4.09%

TOPIX 1,480.87 -92.14 -5.86%

SHANGHAI COMP 3,231.88 -275.86 -7.86%

FTSE 100 5,898.87 -288.78 -4.67 %

CAC 40 4,383.46 -247.53 -5.35 %

Xetra DAX 9,648.43 -476.09 -4.70 %

S&P 500 1,893.21 -77.68 -3.94 %

NASDAQ Composite 4,526.25 -179.79 -3.82 %

Dow Jones 15,871.35 -588.40 -3.57 %

-