Noticias del mercado

-

23:56

Schedule for today, Wednesday, Aug 26’2015:

(time / country / index / period / previous value / forecast)

00:05 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Construction Work Done Quarter II -2.4% -1.5%

06:00 Switzerland UBS Consumption Indicator July 1.68

08:30 United Kingdom BBA Mortgage Approvals July 44.5

11:00 U.S. MBA Mortgage Applications August 3.6%

12:30 U.S. Durable Goods Orders July 3.4% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation July 0.8% 0.4%

12:30 U.S. Durable goods orders ex defense 3.8%

14:00 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August 2.62 2.2

-

21:00

Dow +1.95% 16,181.37 +310.02 Nasdaq +2.56% 4,641.98 +115.73 S&P +1.80% 1,927.33 +34.12

-

19:03

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes posted their sharpest rally of the year on Tuesday, as investors sought out bargains a day after Wall Street's worst performance in four years on fears China's economy was slowing. Markets also got a shot of good news with China's second interest rate cut in two months. Analysts were cautious, however, and even with Tuesday's gains, the Dow and the S&P were on track for the their worst monthly losses since February 2009, while the Nasdaq was poised for its steepest monthly fall since November 2008.

Almost all of Dow stocks in positive area (28 of 30). Top looser - Merck & Co. Inc. (MRK, -0.44%). Top gainer - Apple Inc. (AAPL, +5.64).

All S&P index sectors in positive area. Top gainer - Conglomerates (+4,4%).At the moment:

Dow 16197.00 +488.00 +3.11%

S&P 500 1933.25 +62.00 +3.31%

Nasdaq 100 4186.50 +183.25 +4.58%

10 Year yield 2,11% +0,12

Oil 39.43 +1.19 +3.11%

Gold 1137.00 -16.60 -1.44%

-

18:46

WSE: Session Results

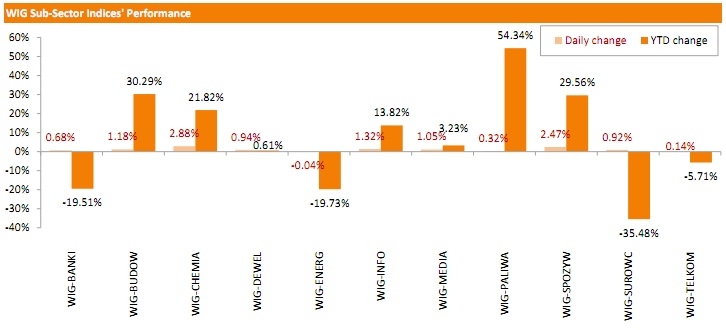

Polish equity markets rebounded on Tuesday. The broad market measure, the WIG Index, advanced by 0.93%. Almost all sectors in the WIG generated positive returns. Utilities sector (-0.04%) was the only exception. At the same time, chemicals (+2.88%) and food sector (+2.47%) posed the best gains.

The large-cap stocks' measure, the WIG30 Index, returned 0.73% for the day. Within the WIG30 Index components, EUROCASH (WSE: EUR) became the session's best performer, as it stocks skyrocketed by 7.29%, recuperating from yesterday plunge. It was followed by GRUPA AZOTY (WSE: ATT) and HANDLOWY (WSE: BHW), which gained 5.29% and 4.17% respectively. On the other side of the ledger, coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW) continued to slump, losing 5.67% and 4.64% respectively. ING BSK (WSE: ING) and ENERGA (WSE: ENG) also fell noticeably, down 3.63% and 3.35% respectively.

-

18:00

European stocks closed: FTSE 100 6,081.34 +182.47 +3.09% CAC 40 4,564.86 +181.40 +4.14% DAX 10,128.12 +479.69 +4.97%

-

18:00

European stocks close: stocks closed higher as concerns over a slowdown in the Chinese economy eased

Stock indices closed higher as concerns over a slowdown in the Chinese economy eased. The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

Meanwhile, the economic data from the Eurozone was positive. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,081.34 +182.47 +3.09 %

DAX 10,128.12 +479.69 +4.97 %

CAC 40 4,564.86 +181.40 +4.14 %

-

17:43

Oil prices rise more than 2%

Oil prices rose more than 2% today but remained near 6-1/2-year lows as concerns over the global oil oversupply and worries over a slowdown in the Chinese economy continued to weigh. The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

Comments by Iran's oil minister Bijan Zanganeh. He said that Iran plans to raise output by 500,000 barrels a day as soon as restrictions are lifted, and a further barrels a day in the coming months after the lift-off.

Zanganeh also said that the country wants to sell its oil whether the price declines or rises.

"We should sell our oil whether the price falls or goes to $100 (a barrel). Even though we would like to sell our oil more expensively, the price is determined by the market," he noted

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for October delivery rose to $39.52 a barrel on the New York Mercantile Exchange.

Brent crude oil for October increased to $43.35 a barrel on ICE Futures Europe.

-

17:33

European Central Bank Vice President Vitor Constancio: the central bank will add further measures if there is a significant risk to the outlook for inflation in the Eurozone

The European Central Bank (ECB) Vice President Vitor Constancio said on Tuesday that the central bank will add further measures if there is a significant risk to the outlook for inflation in the Eurozone.

I am confident that full implementation of the private and public-sector asset purchase programs, as announced, will lead to a sustained return of inflation rates toward levels consistent with our definition of price stability. As always, the Governing Council stands ready to use all the instruments available within its mandate to respond to any material change to the outlook for price stability," he said.

Constancio pointed out that the recent decline in oil prices is affecting the inflation, "but there is nothing monetary policy can do about that." He added that this effect "will disappear one day".

-

17:24

Gold price declines on a decision by China’s central bank and on a stronger U.S. dollar

Gold price declined on a decision by China's central bank and on a stronger U.S. dollar. The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

The greenback rose against other currencies after the release of the better-than-expected U.S. consumer confidence index. The index rose to 101.5 in August from 91.0 in July, exceeding expectations for a rise to 93.4. July's figure was revised up from 90.9.

The increase was mainly driven by the better outlook for current conditions. The present conditions index climbed to 115.1 in August from 104.0 in July. It was the highest level since November 2007.

Gains were limited as it is unclear if the Fed will start raising its interest rate in September.

September futures for gold on the COMEX today decreased to 1133.60 dollars per ounce.

-

17:04

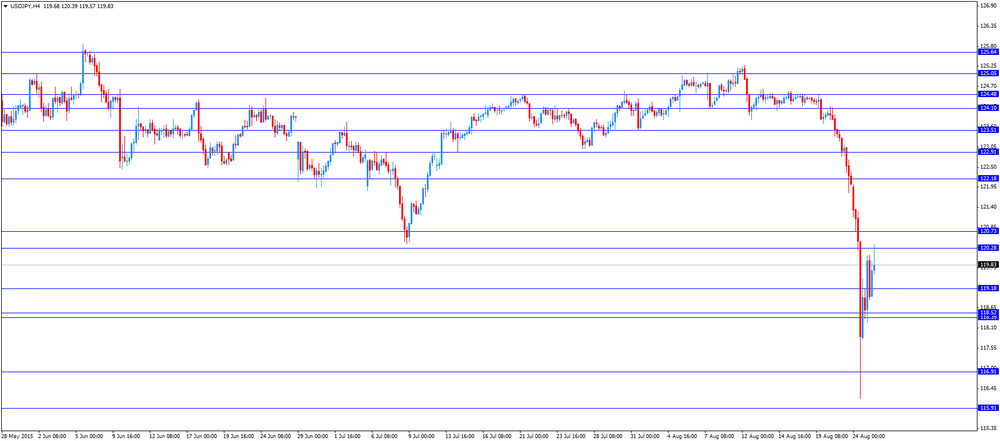

Japan’s Finance Minister Taro Aso expresses worries about a recent increase in yen

Japan's Finance Minister Taro Aso on Tuesday expressed worries about a recent increase in yen.

"For the economy to grow stably, it's better for (currency and stock price) moves to be gradual and steady, rather than rough," he said.

-

16:50

U.S. consumer confidence index jumps to 101.5 in August

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 101.5 in August from 91.0 in July, exceeding expectations for a rise to 93.4. July's figure was revised up from 90.9.

The increase was mainly driven by the better outlook for current conditions. The present conditions index climbed to 115.1 in August from 104.0 in July. It was the highest level since November 2007.

The Conference Board's consumer expectations index for the next six months increased to 92.5 in August from 82.3 in July.

"Consumers' assessment of current conditions was considerably more upbeat, primarily due to a more favourable appraisal of the labour market," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 14.6% in August from 13.7% in July.

-

16:34

New home sales rise 5.7% in July

The U.S. Commerce Department released new home sales data on Tuesday. New home sales increased 5.7% to a seasonally adjusted annual rate of 507,000 units in July from 481,000 units in June. June's figure was revised down from 482,000 units.

Analysts had expected new home sales to reach 510,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast climbed 23.1% in July.

The median sales price of new house increased by 2% from a year ago to $285,900.

-

16:18

Richmond Fed Manufacturing Index drops to 0 in August

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to 0 in August from 13 in July.

The decline was driven by decreases in shipments and order backlog. Shipments subindex fell 20 points to -4 in August, while new orders subindex was down 16 points to 1.

-

16:04

U.S. house price index rise 0.2% in June

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.2% on a seasonally adjusted basis in June, missing expectations for a 0.4% increase, after a 0.5% gain in May. May's figure was revised up from 0.4% rise.

The house price index climbed 1.2% in the second quarter.

"Home price growth in the second quarter once again far exceeded the pace of overall inflation, even as mortgage rates drifted upwards. Although too early to tell whether it's a sign of a slowdown, the monthly appreciation rate in June was more modest than we have seen in a while," FHFA Principal Economist Andrew Leventis said.

-

16:00

U.S.: Consumer confidence , August 101.5 (forecast 93.4)

-

16:00

U.S.: New Home Sales, July 507 (forecast 510)

-

15:55

U.S. preliminary services purchasing managers' index declines to 55.2 in August

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) declined to 55.2 in August from 55.7 in July, missing expectations for an increase to 56.0.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a weak new business growth.

"Service providers' new business volumes expanded at the slowest pace since January, suggesting that underlying momentum within the U.S. economy had shifted down a gear even before the recent global market turmoil and escalating worries about China's growth outlook gathered on the horizon.," Markit Senior Economist Tim Moore.

-

15:45

U.S.: Services PMI, August 55.2 (forecast 56)

-

15:39

NBB business climate declines to -5.1 in August

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate rose to -5.1 in August from -4.1 in July, missing forecasts for a rise to -3.5.

The decline was driven by a drop in the manufacturing industry.

The business climate index for the manufacturing sector dropped to -8.0 in August from -5.2 in July due to downward revision of demand forecasts.

The business climate index for the services sector was up to 11.8 in August from 7.2 in July due to more optimistic outlook about current levels of activity.

The business climate index for the building sector increased to -8.3 in August from -9.8 in July due to more favourable assessments of demand outlook.

The business climate index for the trade sector dropped to -8.0 in August from -6.7 in July due to downward revision of forecasts for orders and for employment.

-

15:34

U.S. Stocks open: Dow +2.04%, Nasdaq +3.22%, S&P +1.95%

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1325(E227mn)

USD/JPY: Y121.50($380mn), Y122.00($666mn), Y123.00($1.0bn)

EUR/GBP: Gbp0.7160(E223mn)

USD/CAD: C$1.3125($190mn), C$1.3250($413mn)

-

15:24

Before the bell: S&P futures +3.42%, NASDAQ futures +3.82%

U.S. index futures extended gains after China cut interest rates. Risk appetite made a comeback.

Global Stocks:

Nikkei 17,806.7 -733.98 -3.96%

Hang Seng 21,404.96 +153.39 +0.72%

Shanghai Composite 2,965.15 -244.76 -7.63%

FTSE 6,081.47 +182.60 +3.10%

CAC 4,586.33 +202.87 +4.63%

DAX 10,098.68 +450.25 +4.67%

Crude oil $39.43 (+3.06%)

Gold $1151.30 (-0.18%)

-

15:18

S&P/Case-Shiller home price index rises 5.0% in June

The S&P/Case-Shiller home price index increased 5.0% in June, missing expectations for a 5.1% rise, after a 4.9% gain in May.

Denver, San Francisco and Dallas were the largest contributors to the rise, where prices climbed by 10.2%, 9.5% and 8.2%, respectively.

"The price gains have been consistent as the unemployment rate declined with steady inflation and an unchanged Fed policy," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index climbed by a seasonally adjusted 0.1% rate in June.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

94.67

+1.94%

6.0K

HONEYWELL INTERNATIONAL INC.

HON

97.13

+1.94%

0.3K

ALTRIA GROUP INC.

MO

53.15

+1.94%

4.1K

Johnson & Johnson

JNJ

94.75

+2.08%

7.5K

Merck & Co Inc

MRK

55.13

+2.11%

7.0K

Procter & Gamble Co

PG

70.61

+2.13%

14.5K

AT&T Inc

T

33.09

+2.22%

64.7K

Hewlett-Packard Co.

HPQ

27.20

+2.26%

2.6K

The Coca-Cola Co

KO

39.25

+2.27%

14.9K

Microsoft Corp

MSFT

42.65

+2.33%

72.5K

Home Depot Inc

HD

115.20

+2.36%

8.1K

3M Co

MMM

141.88

+2.38%

4.2K

Wal-Mart Stores Inc

WMT

65.49

+2.40%

4.7K

FedEx Corporation, NYSE

FDX

152.02

+2.46%

2.1K

International Business Machines Co...

IBM

147.01

+2.47%

7.9K

E. I. du Pont de Nemours and Co

DD

51.23

+2.50%

7.4K

Boeing Co

BA

130.51

+2.61%

7.2K

Chevron Corp

CVX

74.04

+2.66%

19.7K

Cisco Systems Inc

CSCO

25.86

+2.66%

40.2K

Verizon Communications Inc

VZ

46.00

+2.82%

34.0K

Nike

NKE

106.86

+2.88%

5.3K

AMERICAN INTERNATIONAL GROUP

AIG

58.58

+2.88%

14.3K

American Express Co

AXP

76.83

+2.92%

15.3K

Intel Corp

INTC

27.02

+2.93%

108.6K

Travelers Companies Inc

TRV

101.68

+2.94%

3.5K

UnitedHealth Group Inc

UNH

113.72

+2.98%

9.5K

United Technologies Corp

UTX

93.62

+3.03%

5.4K

Pfizer Inc

PFE

33.11

+3.05%

13.6K

Visa

V

70.50

+3.13%

16.5K

Caterpillar Inc

CAT

75.10

+3.13%

18.4K

Exxon Mobil Corp

XOM

70.90

+3.17%

50.2K

Goldman Sachs

GS

185.25

+3.23%

23.1K

Deere & Company, NYSE

DE

83.40

+3.26%

0.4K

General Electric Co

GE

24.65

+3.27%

64.3K

Google Inc.

GOOG

609.10

+3.31%

29.7K

General Motors Company, NYSE

GM

28.75

+3.43%

27.5K

Twitter, Inc., NYSE

TWTR

26.05

+3.50%

101.8K

Ford Motor Co.

F

13.70

+3.87%

55.9K

Citigroup Inc., NYSE

C

52.31

+3.91%

71.1K

Tesla Motors, Inc., NASDAQ

TSLA

227.44

+3.92%

51.2K

JPMorgan Chase and Co

JPM

62.64

+3.97%

177.2K

Amazon.com Inc., NASDAQ

AMZN

481.99

+4.02%

37.1K

Barrick Gold Corporation, NYSE

ABX

7.53

+4.15%

11.8K

Walt Disney Co

DIS

99.47

+4.31%

51.3K

ALCOA INC.

AA

8.58

+4.63%

60.9K

Facebook, Inc.

FB

85.90

+4.64%

459.4K

Apple Inc.

AAPL

108.15

+4.88%

1.1M

Starbucks Corporation, NASDAQ

SBUX

52.80

+4.89%

12.7K

Yahoo! Inc., NASDAQ

YHOO

32.86

+4.95%

76.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.16

+5.53%

59.8K

Yandex N.V., NASDAQ

YNDX

10.84

+6.48%

1.4K

-

15:01

U.S.: Housing Price Index, m/m, June 0.2% (forecast 0.4%)

-

15:01

Belgium: Business Climate, August -5.1 (forecast -3.5)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, June 5.0% (forecast 5.1%)

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Neutral from Underperform at Macquarie

Apple (AAPL) upgraded to Outperform from Market Perform at Wells Fargo

JPMorgan Chase (JPM) upgraded to Buy from Outperform at Credit Agricole, target $78

Downgrades:

Other:

-

14:41

The People's Bank of China (PBoC) lowers its interest rates

The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

-

14:15

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index June 0.2% -0.2%

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III 1.9% 1.9%

06:00 Germany GDP (YoY) (Finally) Quarter II 1.2% Revised From 1.1% 1.6% 1.6%

06:00 Germany GDP (QoQ) (Finally) Quarter II 0.3% 0.4% 0.4%

07:15 Switzerland Employment Level Quarter II 4.23 4.24 4.24

08:00 Germany IFO - Business Climate August 108 107.7 108.3

08:00 Germany IFO - Current Assessment August 113.9 113.9 114.8

08:00 Germany IFO - Expectations August 102.3 Revised From 102.4 102 102.2

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 5.1% in June, after a 4.9% gain in May.

The U.S. consumer confidence is expected to climb to 93.4 in August from 90.9 from July.

New home sales in the U.S. are expected to rise to 510,000 units in July from 482,000 units in June.

Concerns over a slowdown in the Chinese economy still weighed on the greenback.

The euro traded lower against the U.S. dollar despite the positive economic data from Germany. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

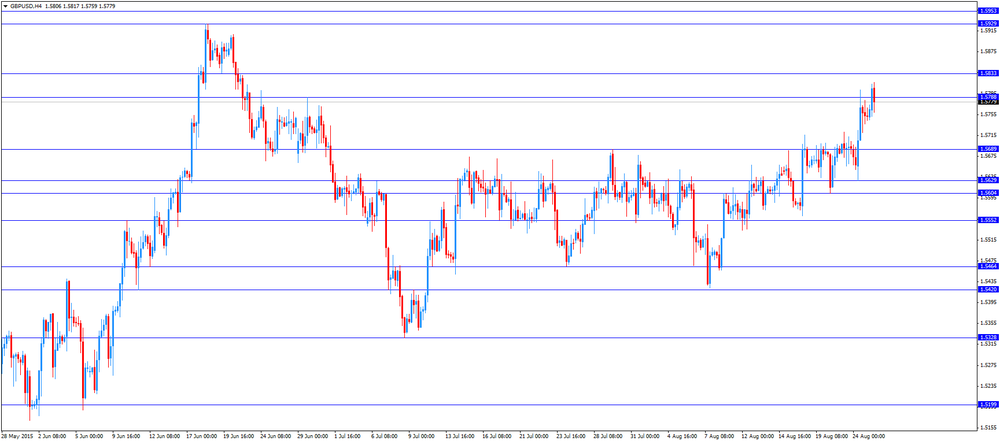

The British pound traded mixed against the U.S. dollar in the absence of any major economic report from the Eurozone.

The Swiss franc traded lower against the U.S. dollar. The employment in Switzerland increased by 1.2% year-on-year in the second quarter, after a 0.4% gain in the first quarter.

The tertiary sector expanded at an annual rate of 1.6% in annual comparison), while the secondary sector declined -0.1%.

The number of job vacancies dropped by 8.3% year-on-year, while the employment outlook indicator fell 1.4%.

EUR/USD: the currency pair declined to $1.1455

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y120.39

The most important news that are expected (GMT0):

13:00 Belgium Business Climate August -4.1 -3.5

13:00 U.S. Housing Price Index, m/m June 0.4% 0.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June 4.9% 5.1%

13:45 U.S. Services PMI (Preliminary) August 55.7 56

14:00 U.S. Richmond Fed Manufacturing Index August 13

14:00 U.S. New Home Sales July 482 510

14:00 U.S. Consumer confidence August 90.9 93.4

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

22:45 New Zealand Trade Balance, mln July -60

-

12:00

European stock markets mid session: stocks recover after the yesterday’s selloff

Stock indices recovered after the yesterday's selloff. Concerns over a slowdown in the Chinese economy remain in focus.

Meanwhile, the economic data from the Eurozone was positive. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

Current figures:

Name Price Change Change %

FTSE 100 6,064.12 +165.25 +2.80 %

DAX 9,960.78 +312.35 +3.24 %

CAC 40 4,527.09 +143.63 +3.28 %

-

11:51

Federal Reserve Bank of Atlanta President Dennis Lockhart still expects the Fed to raise its interest rate this year

Federal Reserve Bank of Atlanta President Dennis Lockhart said on Monday that he still expects the Fed to raise its interest rate this year.

"I expect the normalization of monetary policy-that is, interest rates-to begin sometime this year. I expect normalization to proceed gradually, the implication being an environment of rather low rates for quite some time," he said.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

11:42

Employment in Switzerland increases by 1.2% year-on-year in the second quarter

The Swiss Federal Statistical Office (FSO) released its employment data on Tuesday. The employment in Switzerland increased by 1.2% year-on-year in the second quarter, after a 0.4% gain in the first quarter.

The tertiary sector expanded at an annual rate of 1.6% in annual comparison), while the secondary sector declined -0.1%.

The number of job vacancies dropped by 8.3% year-on-year, while the employment outlook indicator fell 1.4%.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1325(E227mn)

USD/JPY: Y121.50($380mn), Y122.00($666mn), Y123.00($1.0bn)

EUR/GBP: Gbp0.7160(E223mn)

USD/CAD: C$1.3125($190mn), C$1.3250($413mn)

-

11:20

Spanish producer prices increase 0.1% in July

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Tuesday. The Spanish producer prices rose 0.1% in July, after a 0.9% increase in June.

On a yearly basis, producer price inflation in Spain fell 1.3% in July, after a 1.3% decline in June. Producer prices have been declining since July 2014.

Producer prices excluding energy climbed 0.7% year-on-year in July, after a 0.7% rise in June.

Energy prices dropped 7.0% in July.

-

11:02

German final GDP increases 0.4% in the second quarter

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.4% in the second quarter, in line with the preliminary reading, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's final GDP rose to 1.6% in the second quarter from 1.2% in the first quarter, in line with the preliminary reading.

-

10:47

German business confidence index climbs to 108.3 in August

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rose to 108.3 in August from 108.0 in July, beating expectations for a decline to 107.7.

"Satisfaction with the current situation has again increased significantly. However, the companies were somewhat less optimistic regarding future business. The German economy continues to be a rock in turbulent waters," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index climbed to 114.8 from 113.9. Analysts had expected the index to remain unchanged at 113.9.

The Ifo expectations index declined to 102.2 from 102.3. Analysts had expected the index to decrease to 102.0.

-

10:34

Britain’s Finance Minister George Osborne: the U.K. economy could be hurt by international shocks

Chancellor of the Exchequer George Osborne said on Monday that the U.K. economy could be hurt by international shocks.

"Everyone is concerned about the situation on the Asian financial markets. I would take it as a reminder that we are not immune from what happens in the world," he said.

Osborne pointed out that it is necessary to keep "own house in order".

"You don't know where the next crisis is coming from, where the next shock is going to come from in the world. Britain is a very open economy, probably the most open of the largest economies, and we are affected by what happens, whether it is problems in the euro zone, problems in Asian financial markets," he noted.

-

10:18

The People’s Bank of China injects 150 billion yuan in the financial system

The People's Bank of China (PBoC) injected 150 billion yuan ($23.4 billion) in the financial system on Tuesday, increasing efforts to combat capital flight from the country's economy and stock markets. The central bank used seven-day reverse-repurchase agreements.

The PBoC already injected 150 billion yuan in the financial system last week.

-

10:12

National Association for Business Economics survey: only 37% of the economists expect that the Fed will raise its interest rate in September

According to a National Association for Business Economics (NABE) survey, only 37% of the economists expect that the Fed will raise its interest rate next month. Nearly a quarter of the economists said the central bank is likely to start hiking rates in late October, 17% expect the first interest rate hike would come in December, while 17% said that the Fed would wait until next year or later.

NABE surveyed 331 economists between July 27 and August 4.

-

10:00

Germany: IFO - Business Climate, August 108.3 (forecast 107.7)

-

10:00

Germany: IFO - Current Assessment , August 114.8 (forecast 113.9)

-

10:00

Germany: IFO - Expectations , August 102.2 (forecast 102)

-

08:47

Oil prices climbed

West Texas Intermediate futures for October delivery advanced to $38.81 (+1.49%), while Brent crude rebounded to $43.00 (+0.73%) after sharp losses amid ongoing collapse in China's equity markets in the previous session. Nevertheless continued declines in Chinese stocks kept investors concerned and both crudes stayed close to Monday's lows of $37.75 and $42.23, respectively, weakest since early 2009.

Meanwhile oversupply and robust production persisted. At the same time weak economic data from China (one of the key consumers of oil) and signs of capital outflows may harm demand.

-

08:29

Options levels on tuesday, August 25, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1717 (3447)

$1.1674 (2458)

$1.1645 (3797)

Price at time of writing this review: $1.1569

Support levels (open interest**, contracts):

$1.1486 (594)

$1.1429 (1737)

$1.1358 (1863)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84746 contracts, with the maximum number of contracts with strike price $1,1300 (7727);

- Overall open interest on the PUT options with the expiration date September, 4 is 123486 contracts, with the maximum number of contracts with strike price $1,0500 (7811);

- The ratio of PUT/CALL was 1.46 versus 1.38 from the previous trading day according to data from August, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6002 (1640)

$1.5904 (2251)

$1.5808 (2550)

Price at time of writing this review: $1.5760

Support levels (open interest**, contracts):

$1.5694 (356)

$1.5597 (970)

$1.5499 (2771)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30395 contracts, with the maximum number of contracts with strike price $1,5600 (2723);

- Overall open interest on the PUT options with the expiration date September, 4 is 35190 contracts, with the maximum number of contracts with strike price $1,5500 (2771);

- The ratio of PUT/CALL was 1.16 versus 1.15 from the previous trading day according to data from August, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

Gold declined slightly

Gold is currently below a seven-week high at $1,151.40 (-0.19%). It posted a decline on Monday after five sessions of gains, which were generated by a collapse in equity markets worldwide and concerns over China's economy. However today some Asian stock indices rebounded, although U.S. indices dropped sharply.

"Gold should continue to hold its value during the current market turbulence, however a material surge higher is unlikely as participants find liquidity by selling all asset classes, including precious metals," MKS Group trader James Gardiner said. However expectations of a rate hike in the U.S. still weigh on bullion. Atlanta Fed President Dennis Lockhart said Monday that he still believes that the central bank will raise its benchmark rate this year.

-

08:14

Global Stocks: U.S. indices declined further

Fears of a slowdown in world economic growth persisted, driving U.S. stock indices sharply lower on Monday. The Dow dropped as much as 1,089 points in the first six minutes of trading, but it partly recovered later.

Experts from the Deutsche Bank said that the global collapse of equity markets is serious and we should expect revisions of economic forecasts. The experts also said that low oil prices and changes in forecasts would lead to another round of cuts in corporate earnings forecasts worldwide.

The Dow Jones Industrial Average dropped 588.4 points, or 3.57%, to 15,871.4. The S&P 500 fell 77.68 points, or 3.94%, to 1,970.89. The Nasdaq Composite lost 179.79 points, or 3.82%, to 4,526.25.

This morning in Asia Hong Kong Hang Seng recovered 1.62%, or 344.17 points, to 21,595.74. China Shanghai Composite Index tumbled 4.33%, or 138.84 points, to 3,071.06. The Nikkei fell 0.59%, or 110.25 points, to 18,430.43.

Chinese stocks continued declining. Analysts said that panic remained in the market after Monday drop.

Japanese and Hong Kong shares also dropped at the beginning of the session, but recovered later and moved into the green zone.

-

08:10

Foreign exchange market. Asian session: the Australian dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Conference Board Australia Leading Index June 0.2% -0.2%

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III 1.9% 1.9%

06:00 Germany GDP (YoY) (Finally) Quarter II 1.1% 1.6% 1.6%

06:00 Germany GDP (QoQ) (Finally) Quarter II 0.3% 0.4% 0.4%

The Australian dollar strengthened against the U.S. dollar amid positive statistics from China. The country's Leading indicators index from the Conference Board rose to 0.9% in July from 0.6% reported previously. In May the index was above 1.1%. "July's gain in the Leading Economic Index for China was driven mainly by bank loans, while consumer sentiment, manufacturing, and exports were all weak," Said Jing Sima, senior economist at The Conference Board. He also noted that China's economy is likely to face increasing downside risks in the coming months. China is Australia's major trading partner.

The yen fell against the greenback amid correction in Japanese stocks. The Nikkei stepped into the green area. Yesterday the yen rose sharply amid lower expectations for global economic growth and inflation and uncertainties related to monetary policy tightening in the U.S. Now investors expect the Federal Reserve to raise its benchmark rate in December or in 2016.

EUR/USD: the pair fell to $1.1525 in Asian trade

USD/JPY: the pair rose to Y120.10

GBP/USD: the pair traded within $1.5745-75

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Employment Level Quarter II 4.23 4.24

08:00 Germany IFO - Business Climate August 108 107.7

08:00 Germany IFO - Current Assessment August 113.9 113.9

08:00 Germany IFO - Expectations August 102.4 102

13:00 Belgium Business Climate August -4.1 -3.5

13:00 U.S. Housing Price Index, m/m June 0.4% 0.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June 4.9% 5.1%

13:45 U.S. Services PMI (Preliminary) August 55.7 56

14:00 U.S. Richmond Fed Manufacturing Index August 13

14:00 U.S. New Home Sales July 482 510

14:00 U.S. Consumer confidence August 90.9 93.4

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

20:30 U.S. API Crude Oil Inventories August -2.3

22:45 New Zealand Trade Balance, mln July -60

-

08:00

Germany: GDP (YoY), Quarter II 1.6% (forecast 1.6%)

-

08:00

Germany: GDP (QoQ), Quarter II 0.4% (forecast 0.4%)

-

05:01

New Zealand: Expected Annual Inflation 2y from now, Quarter III 1.9%

-

04:04

Nikkei 225 18,486.44 -54.24 -0.3 %, Hang Seng 21,550.83 +299.26 +1.4 %, Shanghai Composite 3,042.08 -167.83 -5.2 %

-

02:01

Australia: Conference Board Australia Leading Index, June -0.2%

-

00:34

Commodities. Daily history for Aug 24’2015:

(raw materials / closing price /% change)

Oil 38.06 -0.47%

Gold 1,154.40 +0.07%

-

00:33

Stocks. Daily history for Aug 24’2015:

(index / closing price / change items /% change)

HANG SENG 21,258.89 -1,150.73 -5.13%

S&P/ASX 200 5,001.3 -213.30 -4.09%

TOPIX 1,480.87 -92.14 -5.86%

SHANGHAI COMP 3,231.88 -275.86 -7.86%

FTSE 100 5,898.87 -288.78 -4.67 %

CAC 40 4,383.46 -247.53 -5.35 %

Xetra DAX 9,648.43 -476.09 -4.70 %

S&P 500 1,893.21 -77.68 -3.94 %

NASDAQ Composite 4,526.25 -179.79 -3.82 %

Dow Jones 15,871.35 -588.40 -3.57 %

-

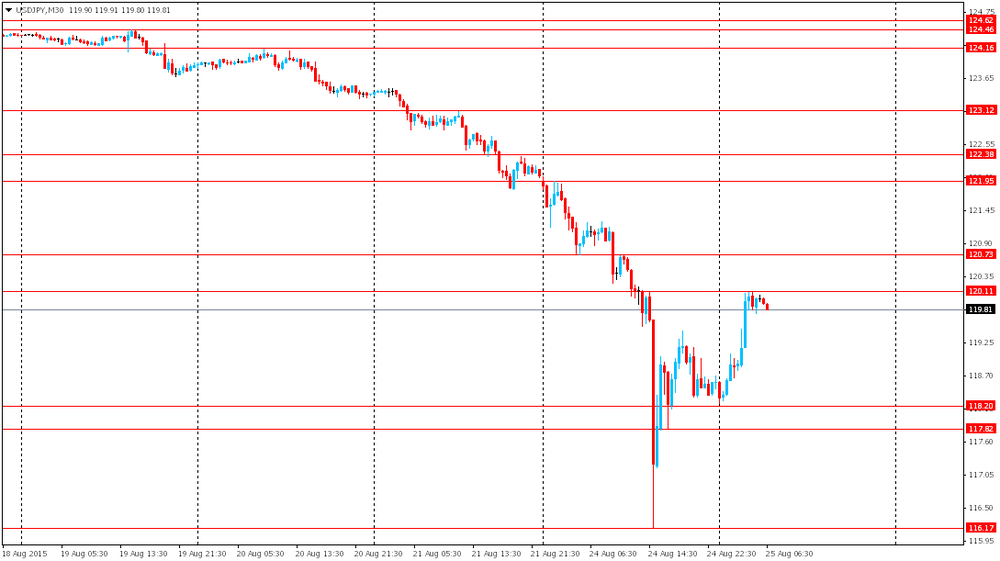

00:32

Currencies. Daily history for Aug 24’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1579 +1,67%

GBP/USD $1,5752 +0,39%

USD/CHF Chf0,9327 -1,43%

USD/JPY Y118,60 -2,90%

EUR/JPY Y137,32 -1,19%

GBP/JPY Y186,65 -2,57%

AUD/USD $0,7137 -2,45%

NZD/USD $0,6444 -3,72%

USD/CAD C$1,3386 +1,49%

-